Humble apologies for not getting this out on the weekend. I was viewing Impact Silver’s Guadalupe production center in Mexico a good part of last week and aggravated some broken ribs in the process. I also arrived back home with some kind of an intestinal thing – I’ll spare you the details on that one.

Useful travel tip though… NEVER fly economy with broken ribs, especially if you’re a big-boned kinda fella like me.

Company news

Two of our ‘top three picks for 2020‘—Cartier Resources (ECR.V) and Defense Metals (DEFN.V)—released significant news last week. Let’s have a peek.

First a look at gold…

Clearly, gold has been on a tear of late. The catalysts for the metal are many. Coronavirus is taking credit for this latest price chart trajectory.

The GDXJ, an ETF that tracks small-cap gold and silver miners, is also showing its mettle (pun intended), breaking to higher ground, taking out multi-year highs.

Whether this current rally is sustainable or not is entirely irrelevant. Gold is headed much higher in the coming weeks and months (authors humble opinion).

Cartier Resources (ECR.V)

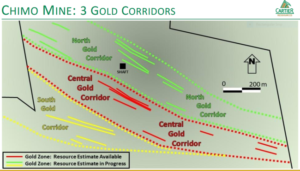

Cartier’s 100% owned Chimo Mine Project, a past producer of some 379K ounces of gold, currently bears flagship status (the company boasts a robust project pipeline).

Early last November, the company released a maiden resource for its Central Gold Corridor using a gold price of US $1,292 per ounce at a cut-off grade of 2.5 g/t Au:

- 3,263,300 tonnes at an average grade of 4.40 g/t Au for a total of 461,280 ounces of gold in the Indicated category;

- 3,681,600 tonnes at an average grade of 3.53 g/t Au for a total of 417,250 ounces of gold in the Inferred category.

This was a decent enough start, but there’s potential far beyond (and below) this zone.

Note the Central Gold Corridor outlined in red on the above map. Another resource estimate is due in the coming weeks, this time for the North Gold Corridor and South Gold Corridor, outlined in green and yellow. This will add to the ounce count.

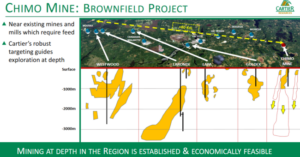

But the real potential at Chimo may lie at depth.

The above map clearly demonstrates Chimo’s depth potential relative to other mines in the region.

Just last week, we got our first indication of that potential:

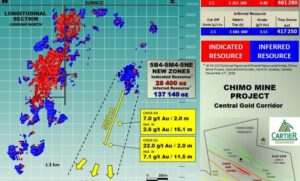

In our earlier coverage, we emphasized the importance of expanding the dimensions of multiple prioritized zones, specifically the depth potential of Zones 5B4-5M4-5NE, a zone that contains some 28,400 ounces of gold in the Indicated category and 137,140 ounces in the Inferred category.

Here, the company trotted out two exploration holes from this key target area.

- Hole CH19-54 – drilled 300 meters below Zones 5B4-5M4-5NE – assayed 2.6 g / t Au over 16.1 meters (including 7.0 g / t Au over 2.0 meters);

- Hole Ch19-55 – drilled 550 meters below Zones 5B4-5M4-5NE – assayed 7.1 g / t Au over 11.5 meters (including 22.0 g / t Au over 2.0 meters).

These results illustrate the potential for resource expansion 550 meters below the Zone 5B4-5M4-5NE resource, to a depth of 1.3 kilometers.

22 g/t Au over two meters is a solid hit.

Establishing grade continuity along this newly defined zone at depth will be key in opening up this deposit. They’re off to a good start.

Philippe Cloutier, Cartier CEO:

“The potential for resource expansion is open in all directions below the new Zones 5B4-5M4-5NE, testifying to the importance of the mineralized system and its continuity”.

We’ve talked about Cartier’s endgame potential in these pages. Agnico Eagle (AEM.TO) owns 17% of the company’s common. In previous financings over the past three years, Agnico has participated and maintained its pro-rata position in the company—a real vote of confidence by one of the best and smartest mine builders in the business.

It’s also important to note that Agnico’s nearby La Pa Mine has been shuttered, its gold reserves exhausted. For that reason alone, I suspect Agnico is watching developments at Chimo closely.

Defense Metals (DEFN.V)

Defense Metals, my go-to REE explorer and developer, is advancing its 1,708-hectare Wicheeda Rare Earth Element (REE) Project at a pace that should begin attracting a much wider audience.

In case you’re new, REEs are everywhere.

Exhibiting an extraordinary range of electronic, optical and magnetic properties, they make our TV screens glow brighter, our batteries last longer, our electronic gadgets more mesmerizing (sigh), our electric motors, generators, and appliances more efficient. They can even make our paper money less prone to forgery. They are an essential ingredient in everything from night vision camera lenses, to medical imagining technologies, to control rods in nuclear reactors.

In response to supply concerns over China’s overwhelming domination of the REE market, Canada and the U.S. are moving to secure REE supply chains in their own back yards—it’s a matter of (tech) survival.

Canada and U.S. Finalize Joint Action Plan on Critical Minerals Collaboration

“The Action Plan will guide cooperation in areas such as industry engagement; efforts to secure critical minerals supply chains for strategic industries and defence; improving information sharing on mineral resources and potential; and cooperation in multilateral fora and with other countries. This Action Plan will promote joint initiatives, including research and development cooperation, supply chain modelling and increased support for industry.”

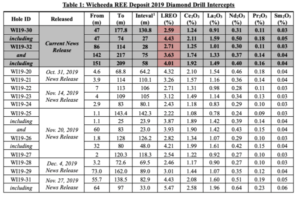

Defense’s current Wicheeda Project resource of some 11,370,000 tonnes averaging 1.96% LREEs is about to be revised and could see growth in both tonnes and grade. A recently concluded drill program produced the following results (note that a 1% LREE grade is equal to roughly 2.5 grams per tonne gold).

Currently, the company’s primary focus is de-risking the project via a series of metallurgical tests.

Metallurgy—the science (some prefer the word ‘art’) of extracting valuable metals from their ores—is everything with REE deposits.

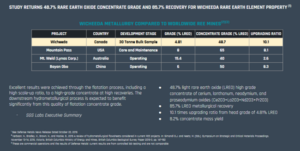

Previous metallurgical test results exceeded expectations elevating the Wicheeda deposit to among the very best in the world.

Last week, the company dropped final bench-scale hydrometallurgical test results for the Wicheeda Project:

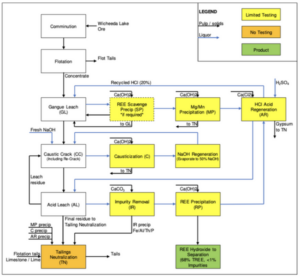

Here, samples of flotation concentrate were used in a hydrometallurgical test that led to the successful development of a flowsheet capable of producing a mixed REE hydroxide precipitate.

The overall hydrometallurgical flowsheet is chloride based and uses hydrochloric acid to dissolve gangue minerals away from the REE carrying minerals. The REE containing leach residue is subsequently processed in a caustic treatment step to convert REE phosphates and fluorides into acid soluble REE hydroxides. The REE hydroxides are leached in hydrochloric acid and the leach solution is treated to remove impurities such as iron, aluminium, phosphorous and thorium. A purified and mixed REE product suitable for further REE separation can be produced either by hydroxide or oxalate precipitation. Final filtrates from gangue leaching and REE precipitation are combined and reacted with sulphuric acid to produce 20% (w/w) hydrochloric acid for re-use.

Scaling up the process is the next step.

Once this flowsheet is optimized, the company will likely construct a pilot plant to confirm overall circuit operability, product recoveries, product grades, and reagent consumptions under continuous conditions. This should lead to the production of bulk quantities of purified mixed REE product for further separation testing.

Craig Taylor, CEO of Defense Metals:

“These hydrometallurgical test results which showed REE extractions of ~90% from flotation concentrate, in conjunction with our recently released locked cycle flotation tests that produced a high grade 48.7% TREO concentrate, conclude a very successful yearlong metallurgical flowsheet optimization process. Defense Metals believes these are exceptional results that show the Wicheeda REE Deposit mineralization is readily amenable to processing via well-established flotation, and hydrochloric acid leach / caustic crack REE extraction methods. Based on these positive results we expect to finalize our plans to commence continuous pilot plant testing in the near future.”

This just in

I was just about to close this one out when the following headline dropped:

As suspected, the company is pushing development further along the curve with the construction of a pilot plant to process the remaining material from the 30-tonne bulk sample collected last year.

From this press release:

Defense Metals has reviewed and executed the Phase 2 flotation pilot plant proposal recommended by SGS.

The objectives of pilot plant testing are to:

- Confirm metallurgy in a pilot plant environment;

- Generate data to support engineering;

- Produce a large amount of concentrate for downstream hydrometallurgy testing.

CEO Taylor again:

“With the decision to move forward with the flotation pilot plant, Defense Metals has achieved another key milestone towards advancement of the Wicheeda REE Project. Since announcing the option agreement to acquire the Wicheeda REE Project 14 months ago we have collected a 30 tonne bulk sample; produced a maiden mineral resource estimate; completed a highly successful 13 hole, 2,005 metre diamond drill program; and successfully developed a combined flotation and hydrometallurgical processing flowsheet for Wicheeda REE mineralization. This has allowed Defense Metals to exceed its Year 1 and Year 2 exploration spend commitments within the first 12 months.”

On deck is the resource update for the Wicheeda deposit. We shouldn’t have long to wait for that one.

We stand to watch.

END

—Greg Nolan

Postscript: the fade appears to be on in gold (once up $30-plus on the day, now up only $12).

Full disclosure: I do not own shares in Cartier or Defense, though I plan to initiate purchases in the near future.