“Be bold and mighty forces will come to your aid”—someone famous once said that. It might’ve been Francis McDormand.

I don’t need to recap what happened last week in the broader markets, cept to say the selling was across-the-board, indiscriminate.

In the resource arena, much of the price weakness we witnessed was exacerbated by the near-complete absence of buyers. If bids are pulled in sufficient numbers, even a minor measure of selling pressure will weigh heavily on a stock, particularly those with thin trading volumes.

High-quality companies, like Great Bear (GBR.V), were dealt a serious dose of what-for…

I’m shocked that Great Bear didn’t recoup at least some of that loss at the end of Friday’s session, like some of the other high-quality issues I follow in the junior exploration arena.

Note the price action in Lion One (LIO.V) – the stock was more than cut in half from where it began trading earlier in the week, ending up solidly in the green at Friday’s close…

Friday’s trade marked the second-highest volume for the company over the past year.

Last week’s trade in Irving Resources (IRV.V), a Japanese ExplorerCo I follow closely, was even more dramatic… violent if you will.

Irving tagged an all-time high a few shorts weeks ago. Friday’s session pounded it to within a chip shot of its 52-week low.

Those who possessed the boldness-to-buy near the lows at $1.75 were rewarded with an 80% gain a few hours later.

There are other high-quality issues in the junior arena with similar recent trading patters—Ely Royalties (ELY.V), for example…

One more, just to point out some of the carnage that took place in the commodity arena. I honestly can’t remember the last time I saw silver blow through its 50 and 200 period movings averages in a single session…

The Highballer list

Where our own list is concerned, there was price weakness, but not nearly the drama exhibited by the co’s featured above.

HighGold Mining (HIGH.V) took it on the chin, but managed to take back lost ground registered earlier in Friday’s session, closing unch’d.

Briefly recapping Highgold’s assets, the company’s Johnson Tract property in southcentral Alaska bears flagship status. We covered Johnson Tract in some detail late last January in A high-grade gold and base metal play with Tier-1 potential.

The company also controls three highly prospective projects in the world-class Timmins Gold Camp of Ontario—Munro-Croesus, Golden Mile, and Golden Perimeter.

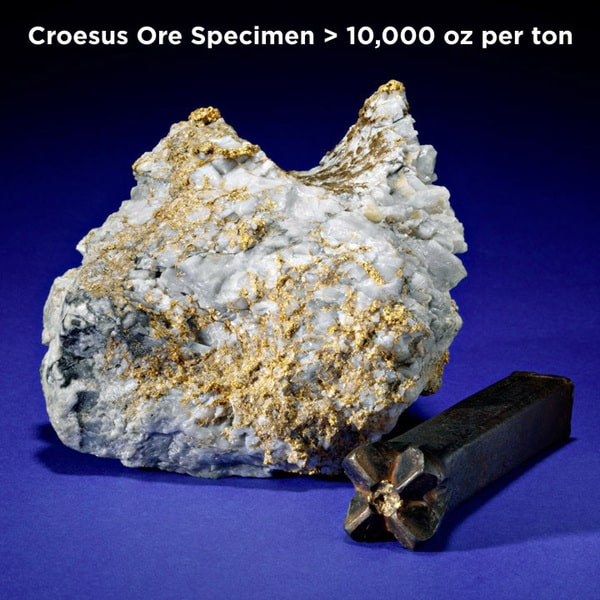

The Munro-Croesus land package includes a past-producing mine that yielded some of the highest-grade gold ever mined in the province.

On the subject of Munro-Croesus, the company dropped the following headline on Feb. 26:

HighGold Mining Commences 5000-Meter Winter Drill Program on Timmins Area Gold Projects

A two rig, 5,000-meter diamond drilling campaign is a fairly aggressive program.

This program will target:

- known zones of high-grade gold mineralization;

- areas of surface geochemical and geophysical anomalies;

- flexures along major regional structural breaks which are known to host gold within the greater Timmins gold camp;

- potential intrusive-related gold prospects.

“Particular emphasis will be given to the Munro-Croesus property and its historically mined, high-grade gold mineralization. Past diamond drilling by the previous owners in 2011 intersected 18.79 g/t Au over 4.1 meters in the hanging wall to the mined Croesus Vein and recent geological interpretative work by HighGold indicates there may be an opportunity to identify unmined portions of the historic Croesus Vein within close proximity of surface. The Company also plans to drill test other gold bearing quartz vein systems mapped on the Munro-Croesus property as it develops a property-scale exploration model. The majority of these vein systems have had no prior drilling.”

Newsflow from this campaign should tie in nicely with the beginning of the Johnson Tract field season in southcentral Alaska.

Last week, Defense Metals (DEFN.V) announced its intention to scale up the extraction/concentration process for its Wicheeda Rare Earth Element (REE) Project in the Prince George region of B.C.

Moving forward with a larger-scale pilot plant to process the remaining material from the 30-tonne bulk sample collected in January of 2019 is a significant push along the development curve.

Pilot plant testing objectives:

- confirm metallurgy in a pilot plant environment;

- generate data to support engineering;

- produce a large amount of concentrate for downstream hydrometallurgy testing.

Defense CEO Craig Taylor:

“With the decision to move forward with the flotation pilot plant, Defense Metals has achieved another key milestone towards advancement of the Wicheeda REE Project. Since announcing the option agreement to acquire the Wicheeda REE Project 14 months ago we have collected a 30 tonne bulk sample; produced a maiden mineral resource estimate; completed a highly successful 13 hole, 2,005 metre diamond drill program; and successfully developed a combined flotation and hydrometallurgical processing flowsheet for Wicheeda REE mineralization. This has allowed Defense Metals to exceed its Year 1 and Year 2 exploration spend commitments within the first 12 months.”

Wicheeda’s current resource stands at 11,370,000 tonnes averaging 1.96% LREEs. As a reminder, a grade of 1% LREE is equal to roughly 2.5 grams per tonne gold.

A resource update is on deck. Note the grades and widths from a recent Wicheeda drilling campaign:

With the above values representing both infill and stepout holes, we could see a significant improvement in both grade and scale.

We won’t have long to wait that bit of news.

Looking at Coral Gold (CLH.V), ending the week unch’d from the previous week, I found this interview with CEO David Wolfin interesting. It offers a nice recap, a reminder of why we are in this stock…

Final thoughts

The next few weeks are bound to test our mettle. Checking in on overseas market action, gold is trading up nearly $40, silver is up $0.46, and the S&P 500 is off less than 1%.

END

Greg Nolan

Postscript: the following link will take you to an Equity Guru piece covering my recent site tour of Impact Silver’s operations in Mexico – Impact Silver (IPT.V) site tour Feb. 2020

Full disclosure: I plan to initiate purchases of all three of the companies featured above in the coming days/weeks.

Disclaimer - Legal NoticeHighballerstocks.com (Greg Nolan) is not a licensed financial advisor and does not give investment advice.

The content of this report is for information purposes only.

Nothing contained herein should be construed as a recommendation or solicitation to buy or sell any security.

Always consult a licensed qualified investment advisor in your legal jurisdiction before making any investment decisions.

Though Highballerstocks.com (Greg Nolan) believes its sources to be credible, and the statements contained herein to be true, readers must conduct their own thorough due diligence, and or consult with a qualified investment advisor before important investment decisions are made.

Highballerstocks.com (Greg Nolan) accepts no responsibility or liability for the accuracy of the contents of this report.