Highballerstocks is getting a lot of positive feedback from readers. I appreciate the emails. I’m working hard to identify undervalued, under-appreciated plays in the junior exploration arena—plays that offer discovery and resource-expansion potential. I see significant shareholder value creation ahead as we ride the next bull cycle in mining stocks… a cycle I believe has just begun.

In answer to your numerous queries regarding how I plan to continue my reporting. No major changes. I plan to continue coverage of companies I hold in the highest regard, passing along my insights to you free of charge (I have no plans to establish a paid subscription type newsletter). I will, however, begin taking on corporate sponsors, but only those I know, trust, and value.

As I stated early in the going, “wealth creation” is my goal here.

Today, I’m welcoming Forum Energy Metals to the Highballer shortlist, and as a client.

Forum Energy Metals (FMC.V)

- 114.09 million shares outstanding

- $10.27M market cap based on its recent $0.09 close

Major shareholders:

- Institutional—10%

- Holystone Energy—8%

- Transition Metals—7%

- Management—7%

- Lumina Capital—3%

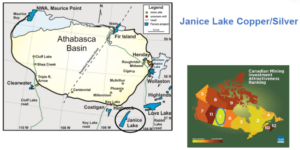

Forum operates in Saskatchewan. According to the venerable Fraser Institute, Saskatchewan is the highest-ranked mining destination in Canada, and it’s held this ‘top-spot’ designation for the past 15 years.

Of the 76 regions covered worldwide in the Institute’s most recent “investment attractiveness” survey, Saskatchewan ranks 11.

Forum’s flagship project is all about copper. First, some of the more weighty fundamentals underpinning this ‘green metal’:

Copper, a malleable metal with excellent thermal and electrical conductivity properties, has some extremely compelling supply-demand dynamics.

Electric vehicles (EVs), for example, require roughly 183 lbs of copper (electric buses require between 500 and 800 lbs).

Even the charging stations that keep these vehicles in motion require copper—heaps of it:

EV sector will need 250% more copper by 2030 just for charging stations

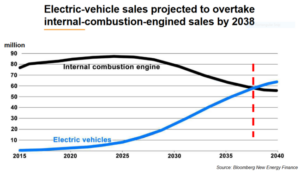

The pace at which EVs are rolling off the assembly line increases with each passing day.

As our species attempts to sustain the urbanization of our planet—there will be eight billion of us tripping over one another in a few short years—the demand for green metals, like copper, will go through the roof.

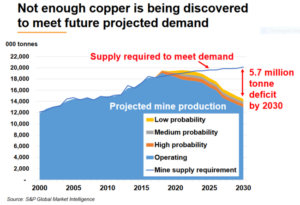

The fact is, we have less than 20 years worth of (economic) copper reserves remaining with nearly half of the world’s primary copper supply coming from only 20 mines.

The 14 largest producers show an average reserve grade of 0.62% (large deposits running grades north of 1% are exceedingly rare this day and age).

Future copper projects—the 19 largest development projects currently on deck—run grades averaging roughly 0.5%. These deposits are barely economic at current Cu prices, but we need this supply.

Further down the food chain, the next group of large development projects run grades in the range of 0.4%. These deposits are NOT economic at current Cu prices, and again, we need this supply.

It’s estimated that a 50% lift in the price of copper is required to incentivize new mine development—to dust off these 0.4% and 0.5% Cu deposits and push them further along the development curve.

On Friday, Reuters dropped the following headline…

Janice Lake, Forum’s flagship

Janice Lake’s 38,250 hectares are located in north-central Saskatchewan within the Wollaston Domain, “a northeasterly-trending belt of metamorphosed lower Proterozoic supracrustal rocks deposited upon Archean granitoid basement.”

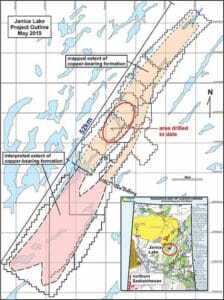

Forum controls the entire Wollaston Copper belt—the entire 52 kilometers.

The property boasts over 20 sediment-hosted copper showings.

These sedimentary settings hold the potential for multiple layers of copper mineralization.

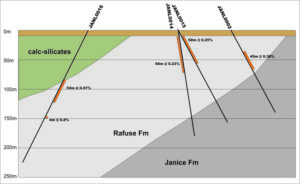

Though largely unexplored, a 1993 drilling campaign by Noranda tagged an interval of 0.77% Cu over 33.0 meters (including 1.6% Cu over 6 meters) within 35 meters of surface.

A modest drilling program by Phelps Dodge tagged 0.72% Cu over 26.0 meters (including 1.33% Cu over 5.83 meters) in a separate zone.

More recently, a surface sampling campaign by Transition Metals (XTM.V) yielded grab sample values ranging from 0.34 to 9.35% copper, and 0.7 to 61.7 g/t silver.

This historic work confirms the presence of high-grade mineralization at surface, and the potential for multiple sediment-hosted copper deposits.

A first pass drilling campaign by Forum in the summer of 2018 encountered copper mineralization in all four holes within 80 meters of surface. The highlight interval: 18.5 meters grading 0.94% Cu and 6.7 g/t Ag (including 5.2 meters grading 2.22% Cu and 16.5 g/t Ag).

Nice hit.

Forum employs the classic prospect generator business model with their project portfolio: acquire an early stage (under-appreciated) asset for a song, drill a few holes to establish geological merit and value, and then joint venture (JV) the project out to a deep-pocketed Senior partner to do most of the heavy lifting.

The JV

Things got really interesting when the company entered into a $30 million JV with mining giant Rio Tinto Exploration Canada (RTEC) roughly one year ago.

The terms of the JV are as follows:

- RTEC commits $3 million to exploration spending over the first 18 months;

- RTEC is granted a four year option to acquire a 51% interest in the Janice Lake Project by spending $10 million in exploration, making $490,000 in cash payments, and servicing the remaining $200,000 in underlying cash payments to Transition Metals as per the terms of the Forum/Transition Option Agreement dated February 5, 2018;

- RTEC has a second option to earn a further 29% interest (total 80% interest) by spending a further $20 million in exploration over a three year period (total $30 million) and making further cash payments of $150,000 (total $640,000).

This $30M JV is a big deal. The work commitments spelled out in the JV agreement are substantial.

This puts Forum, and its shareholders, in an enviable position.

The participation of mining behemoth Rio Tinto adds tremendous validity to the geological merit and scale of Janice Lake. Rio doesn’t mess around with the small stuff. They’re only interested in projects that hold world-class (Tier-1) potential.

Both Forum and Rio have their sights set on a large Cu deposit similar to other sedimentary hosted Cu deposits around the world.

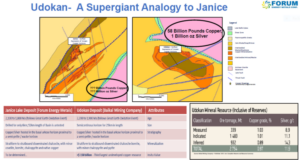

The Udokan Copper Project, located in the Zabaikalye region of Kalar District in Russia—the third largest Cu deposit on the planet—is the analog for Janice Lake.

(if difficult to read, refer to slide 8 on Forum’s corporate presentation)

The geological similarities are certainly there (red box bottom left). If Rio and Forum delineate even a fraction of what Udokan holds in its subsurface layers, current shareholders are in for a wild ride.

Hitting the ground running

Rio Tinto (‘Rio’ from here on) did not waste any time putting boots to the ground at Janice Lake. After performing an airborne magnetic survey over the property, they mobilized a drill rig less than three months after entering into the JV with Forum.

Rio’s first probe with the drill bit generated the following headlines:

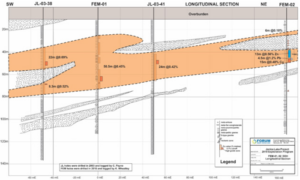

Drill holes assays from the Jamsen target…

- Strike: 650 meters

- Dip: 200 meters

- Thickness: 45 to 60 meters

- Open in all directions

- To be drilled in January

Drill hole assays from the Janice target…

- Strike: 1200 meters

- Dip: 400 meters

- Thickness: up to 57 meters

- Multiple horizons

- Open in all directions

- To be drilled in January

Rio tagged some nice grades with this first pass.

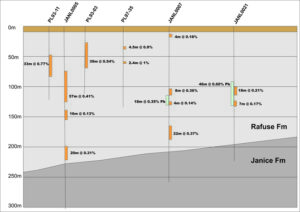

- 0.41% Cu and 4.2 g/t Ag over 57.1 meters (from 78.9 meters to 136 meters), including 0.95% Cu and 9.7 g/t Ag over 13 meters (from 89 meters to 102 meters);

- 0.57% Cu and 1.50 g/t Ag over 51.8 meters (from 116.2 meters to 168 meters), including 1.09% Cu and 1.39 g/t Ag over 9.1 meters (from 118.9 meters to 128 meters) AND 1.32% Cu and 3.42 g/t Ag over 5.0 meters (139.0 meters to 144.0 meters).

Rio likes what they see. The mining colossus spent $3.7 million at Janice Lake in 2019, and is accelerating work on the property projecting to spend $7 million during a multiple phase drilling campaign.

That’ll earn them 51% in Janice Lake in < two years, rather than the four years outlined in the May 9, 2019 joint venture agreement.

Rio was actually in the process of mobilizing equipment to Janice Lake back in March when the C-19 crisis hit.

The shutdown is near an end. On May 20, Forum dropped the following headline:

Drilling over the next year will be carried out in two phases (summer 2020 and winter 2021). The first phase will take on a regional approach (Rio will drill multiple targets spread out across the 52-kilometer long sedimentary basin).

Rio’s proposed 2020/2021 exploration program details:

- A 110 kilometer winter haul road was completed to the site of the Burbidge Lake Drill Camp on the Janice Lake property in March. Permits are in hand for construction of a 50 person drill camp this summer.

- The 2020 exploration program will commence as soon as practical and will be based out of the same camp as in the 2019 program.

- A 2,000 meter diamond drill program this summer will test regional drill targets prioritized by the permitted Mapping and Orientation programs. The permit application for the 2020/2021 RAB and diamond drilling program has been submitted to the Saskatchewan Ministry of Environment.

- A Rotary Air Blast (RAB) drill rig will be used as a prospecting tool to drill short holes into the bedrock on copper showings, structural, geophysical, geochemical and boulder train targets developed by the mapping and prospecting program.

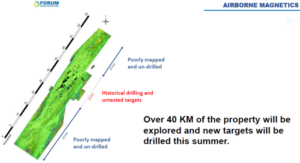

- A mapping and prospecting team will systematically map the 52km extent of the property (see map below) initially on 2km wide traverse lines this summer with more detailed follow-up in prospective areas.

- Orientation surveys over the Jansem and Janice targets will be completed this summer including downhole logging of the 2019 holes, an Induced Polarization survey, vegetation and soil surveys and a regional AMT survey to understand basin architecture.

- Engagement with local communities is well advanced and ongoing.

Geophysical surveys (IP and AMT), vegetation and soil surveys, using a RAB rig to probe the immediate subsurface layers before a dd rig is hauled in… Rio is stacking good science to prioritize drill targets at Janice.

The focus on regional targets opens up the potential for a new discovery(s). This back to back multiple phase approach should generate considerable newsflow.

Rick Mazur, Forum CEO:

“Rio Tinto intends to commence operations as soon as possible by adjusting its planning while remaining committed to the original program to explore Janice Lake. They have an industry leading health and safety protocol and will undertake this program with the utmost in care for the employees, contractors and communities engaged in this project. I am particularly looking forward to the regional focus of copper mineralization at Janice which has never been undertaken before on this property.”

More irons in the fire

Forum has two more irons in the fire worth commenting on—Fir Island and Love Lake.

Fir Island

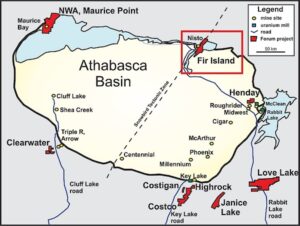

The 14,205 hectare Fir Island uranium project is located along the northeast edge of the prolific Athabasca Basin.

The Athabasca Basin is to uranium what the Carlin Trend is to gold.

Here, another Senior entity, Orano Canada, is earning a 51% interest in the project by spending $3,000,000 on or before December 31, 2021. Orano can increase its stake in the project and earn a 70% interest by spending an additional $3,000,000 (a total of $6,000,000 on or before December 31, 2023).

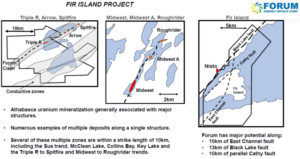

“The regionally important Black Lake fault, part of the major Snowbird Tectonic Zone, transects the entire Athabasca Basin, and is highly prospective for unconformity-type uranium deposits. The sandstone cover varies from 0 to 200m above the unconformity. The possibility of uranium mineralization below the unconformity at the base of the thrust fault (similar to McArthur River) or in the hanging wall of the Cathy Fault in the basement (similar to Millennium or Eagle Point) demonstrates the highly prospective nature of the Fir Island project.”

Cameco’s (CCO.T) Centennial deposit is located near the south boundary of the property. The historic Nisto uranium mine (96 tonnes mined at a grade of 1.38%) occurs in basement rocks on the northwest side of the Black Lake fault, directly adjacent to the property.

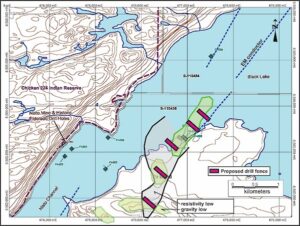

In early March of this year, the JV partners commenced a diamond drill program at Fir Island—Forum operated the program, Orano funded it as per the option agreement.

In the above map, the grey shaded area represents a resistivity low, the green areas are gravity lows, and the dashed blue lines are EM conductors. Note the drill hole fences and the scale on this map.

On May 27, Forum dropped the following headline:

Forum Announces Drill Results from its Fir Island Uranium Project in Saskatchewan’s Athabasca Basin

A total of six holes were drilled for 1,819 meters.

With these additional holes (Forum completed a 10 hole reconnaissance drill program totaling 2,435 meters in early 2015), the JV partners confirmed the continuity of the target structure a further one-kilometer to the south.

“Six holes (FI-011 to FI-016) were drilled in an area of low resistivity combined with a series of gravity lows and associated boron soil anomalies of up to 3,350 ppm at the north end of Fir Island. The program was successful in locating the prospective host structure, the East Channel Fault, for uranium mineralization with similar features as the 2015 drilling; a 50 metre offset of the unconformity, strong tectonization of the overlying sandstones and quartz remobilization. Elevated geochemistry with uranium up to 283ppm in a hematized structure in the basement, boron up to 2,160ppm from dravite clays in the basement, plus copper and nickel (314ppm and 2140ppm respectively) was intersected in holes FI-15 and 16 which intersected the East Channel Fault.”

Vectoring in on a potential U308 orebody is not an easy task. It’s important to understand that uranium deposits are often needles in a haystack, even in a prolific setting like the Athabasca Basin.

It can take dozens and dozens of holes to tag a U308 discovery. McArthur River, an Athabasca standout, took 210 pokes with the drill bit to crack.

Further drilling on a much larger scale has been proposed by Orano for next winter.

Ken Wheatley, Forum’s VP, Exploration:

“I am looking forward to following up on this drill program next winter as we have a much better handle on the East Channel structure that has all the characteristics of hosting a major uranium deposit.”

Love Lake

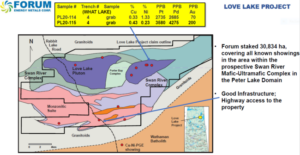

Love Lake is a wholly-owned early-stage Ni-Cu-PGM project encompassing some 27,896 hectares located 60 kilometers northeast of the company’s Janice Lake project in north-eastern Saskatchewan.

“The Ni-Cu-PGM occurrences are associated with the 2.5 billion year old Swan River mafic complex and the Love Lake felsic pluton in the Peter Lake Domain. Forum has now staked a 30 km by 15 km area of historic copper- nickel- platinum group metal showings which returned up to 0.31% Cu over 5.2m in a trench, with visible sulphides occurring in outcrop along a 1.5km east-west trend of “reef type” layered intrusive that was not properly tested by historical drilling. Grab samples in Trench #4 in the Korvin Lake area returned 0.33% Cu, 1.33% Ni, 2735 ppb platinum, 2685 ppb palladium, 70 ppb gold and 0.43%Cu, 0.23% Ni, 3580 ppb platinum, 4275 ppb palladium, 200 ppb gold. (Saskatchewan Geological Survey – Maxeiner and Rayner, 2005).”

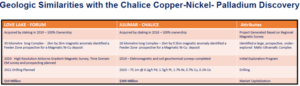

Love Lake bears geological similarities to North American Palladium’s (PDL.T) Lac Des Isle deposit in the Thunder Bay region of Ontario, and Chalice Gold’s (CHL.AX) Julimar discovery in Western Australia.

Viewed as being one year behind Chalice Gold’s $300M-plus Julimar project, CEO Mazur intends to put a field crew on Love Lake later this summer or fall, funds permitting.

Speaking of CEO Mazur, the man has an impressive resume, as does the rest of the Forum team:

“Mr. Mazur, P. Geo, MBA is a geoscientist who has held positions in the international exploration and mining industry for over 30 years as a project geologist, financial analyst and senior executive on uranium, gold, base metals, coal and industrial minerals projects around the world. Mr. Mazur worked as an analyst for Canamax Resources Inc. from 1985 to 1991 during the development of three Canadian gold mines. Two of these mines – Bell Creek in Timmins, Ontario and the Island Mine in Wawa, Ontario are still in production. Mr. Mazur also served as a Director of Roxgold when it was named the top company on the TSX Venture 50 in 2012. Currently, he is a Director of Alto Ventures (ATV.V), Impact Silver (IPT.V), and Midnight Sun Mining (MMA.V), which just completed a $51M option with Rio Tinto on its Solwezi copper project in Zambia.

Final thoughts

Forum has a number of prospective irons in the fire.

The company’s project portfolio commands the respect of Senior mining companies.

Janice Lake has Company Maker potential. Ground crews and drill rigs are waiting for the green light to mobilize to the project, perhaps by the end of this month—that’ll be the next catalyst for the company.

With a $7 million multiple phase drilling campaign beginning this summer, expect strong newsflow. Fir Island and Love Lake news could add volume to the flow.

END

—Greg Nolan

Full disclosure: Forum is a Highballer marketing client. That makes me biased. It’s important that you perform your own due diligence. I do not own Forum stock, but I may initiate purchases in the coming days/weeks.