There are a number of tiny-cap ExploreCos in the junior exploration arena that have put on quite a show of late, doubling or tripling, carrying their market caps from sub-$5M to $10M-plus in the space of only a few weeks.

These bottom-of-the-food-chain stocks score heaps of appeal among retail investors: they’re cheap, they’re liquid, and they can offer the small guy a handsome return if the company can get on the herd’s radar.

But what some retail investors do not realize is that the higher-priced ExploreCos, those trading in the one-dollar/$20M-plus market cap range, may offer similar leverage due to a tighter cap structure, and an asset that is bigger, better, and further along the development curve.

Two examples that just happened to drop headlines last week:

HighGold Mining (HIGH.V)

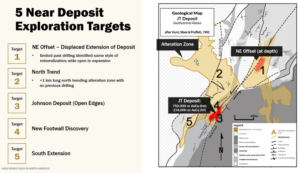

Phase one of this program calls for 7,000 to 10,000 meters of diamond drilling utilizing two rigs across five target areas surrounding the Johnson Tract (JT) deposit.

As a reminder, the JT deposit hosts an Indicated resource of 750k ounces at 10.93 g/t AuEq. There’s also an Inferred resource of 134,000 ounces at 7.16 g/t AuEq.

Priority drill targets for this 2020 campaign (as per the June 30 press release):

JT Deposit Expansion

The edges of the JT Deposit are open to expansion along strike, particularly the deeper portions of the deposit where the thickest and highest-grade mineralization has been intersected. Plans include step-out drilling northeast of drill hole JT19-090 that intersected 75.1m grading 10.0 g/t Au, 9.4% Zn, and 0.6% Cu.

Northeast Offset

This represents the interpreted fault-displaced continuation of the main Johnson Tract resource and mineralized zone, located approximately 500 to 800 meters to northeast of the JT Deposit. Significantly, limited wide-spaced historic drilling has documented the same distinct alteration and metal signature that is associated with mineralization at the main JT deposit.

North Trend

A mappable trend and footprint of hydrothermal alteration extends over 1 km north from the JT Deposit, with no previous drilling. A new exploration model developed by the HighGold technical team suggests a first order, north-south structural control to mineralization with potential for multiple mineralized zones along this trend.

Footwall Discovery

Follow-up drilling is planned on a new discovery made during a 2019 confirmation and resource definition drilling campaign. To date, only one drill hole has tested this distinct zone of mineralization located in the footwall to the JT Deposit, which intersected 20.7 meters grading 32 g/t Ag, 2.4% Cu, and 4.9% Zn in hole JT19-089.

Southwest Extension

A zone of previously undrilled alteration and mineralization that lies to the immediate southwest of the JT Deposit.

HighGold’s technical teams will also carry out geological mapping, geochemical sampling, and geophysical surveys across the 8,475 hectare property where a series of under explored regional prospects collectively define a 12-kilometer long mineral trend.

“The intent of the surface work is to advance regional prospects to the drill-ready stage. Limited reconnaissance work in 2019 at the Difficult Creek prospect included the discovery of a new vein system and chip-channel samples yielding up to 22.1 g/t Au, 1.1% Cu, and 20% Pb over 1.5 meters.”

CEO Darwin Green:

“We are excited to launch on the first serious exploration drill program in 25 years at Johnson. HighGold’s work in 2019 generated numerous quality drill targets within an 800-meter radius of the high-grade JT Deposit mineral resource, several of which will be drilled for the first time this year. Focus is on expanding the mineral resource base and discovering new zones of mineralization, with early emphasis given to the Northeast Offset target where limited drilling by previous operators identified what is believed to be the fault-displaced continuation of the deposit. Crews are on-site, COVID-19 mitigation plans are in place, and drills are in position and ready to commence coring.”

This press release states that additional drilling may be undertaken in a second phase during the latter half of the 2020 field season.

This just in…

HighGold Mining Announces C$8.0 Million Bought Deal Private Placement Common Share Offering

4,630,000 common shares priced at C$1.73 for gross proceeds of roughly C$8.0 million.

No warrants.

White Gold (WGO.V)

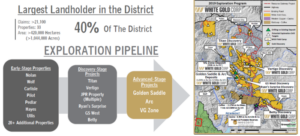

Drilling has commenced on the company’s highly prospective Titan Project. Ground work is also underway on other high priority targets including detailed soil sampling, ground geophysical surveys, GT probing, mechanical trenching and detailed geological and structural mapping.

This 2020 program has been designed to further test existing targets and recent new discoveries along the company’s White Gold, Hen, and JP Ross properties, as well as to identify and advance other targets on a regional scale.

CEO David D’Onofrio:

“We are very excited to kick off our 2020 exploration program. The fully funded program is designed to be focused and impactful starting with drilling the Titan anomaly identified late last year and to follow up on some of our other highest priority projects. The quick and accurate delineation of these targets through our disciplined and systematic exploration methodologies is a testament to our scientific and data driven approach and provides additional confidence in the prospectivity of these and our other targets”.

Final thought

Keep an eye on these two companies as the 2020 drilling season advances. Expect strong newsflow out of both companies.

END

—Greg Nolan

Full disclosure: Highballer does not currently have a marketing relationship with HighGold or White Gold. The author does not hold shares in either company, but may initiate purchases in the coming days/weeks.