I apologize for the lag between articles. I’ve been scouring the junior landscape in search of a new entry, a new addition for the Highballer shortlist portfolio—a list that currently reads eleven.

I’m reviewing several potential candidates. All strike me as intriguing speculations. All boast the fundamentals I require in a Junior ExploreCo: solid management, mining-friendly jurisdiction, tight cap structure, geological merit, etc. I’ll trot one out today. The others, I’m still reviewing—not quite decided if they’re ‘shortlist’ worthy.

I’m breaking my own rules with this new addition. This company checks all of my boxes, except one—it does NOT have a 43-101 compliant resource base, nor does it have a fat JV with a deep-pocketed Sr. Producer. What it does have is a geologically prospective flagship project run by a management team with a solid track record of discovery, and value creation.

If you bothered to check out who I am via the ABOUT link on this website, you’ll know that I had a rather remarkable two-year run with André Gaumond’s Virginia Gold during the last bull cycle in precious metals:

An excerpt:

One such trade was Virginia Gold, a stock purchased in the summer of 2004 at $1.12. Virginia, on the strength of its Eleonoré gold discovery in the James Bay region of Quebec, went on to trade north of $15.00 a little over one year later after a solid uptrend in gold—and a fat takeover offer from a Sr. Producer—sent the shares flying. Though Nolan’s initial entry was $1.12, he averaged up multiple times as the Virginia story continued to demonstrate a world-class gold discovery. Nolan was convinced the company would get taken out by a resource-hungry predator, at a significant premium. He was right.

André Gaumond was at the helm of Virginia Gold during that spectacular run. He now Chairs Harfang Exploration.

Harfang Exploration (HAR.V)

August 2020 Corporate Presentation

- 48.79 million shares outstanding

- $14.64M market cap based on its recent $0.30 close

Gaumond is one of the main reasons I’m here:

André Gaumond is currently a director of Altius Minerals. Until November 2016, Mr. Gaumond had been acting as Senior Vice President, Northern Development and Exploration and until May 2019, as Director of Osisko Gold Royalties. Mr. Gaumond had been President and Chief Executive Officer and Director of Virginia Mines Inc. from March 2006 to February 2015 and was President and Chief Executive Officer and Director of Virginia Gold Mines Inc. from June 1996 to February 2006. Mr. Gaumond is a geological engineer with a master’s degree in geological economics. He worked as a geological engineer for several organizations and as a mining analyst for several institutions. During his career, Mr. Gaumond received, on behalf of Virginia, no less than 16 awards such as Québec Prospector of the Year (twice) bestowed upon important work carried out in the James Bay region.

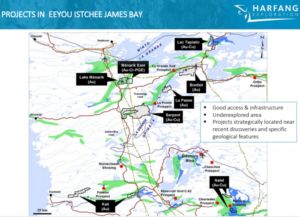

I count twelve, the number of properties in Harfang’s project portfolio.

The company’s main focus is the highly prospective James Bay region of Quebec, an area that Gaumond knows like the back of his hand.

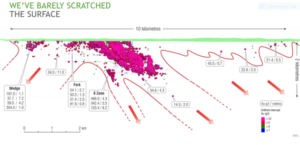

Harfang’s Serpent Project currently bears flagship status.

Project highlights:

- 28,565 hectares, 100% owned by Harfang;

- No underlying royalties;

- Accessible by ground, air, or by boat from lake Sakami;

- Located 80 kilometers southeast of Radisson and 60 kilometers from the La Grande airport;

- Adjacent to the paved James Bay road;

- Two powerlines run through the property;

- The eastern limit of the property is next to the Sakami Gold Project (Quebec Precious Metals Corporation);

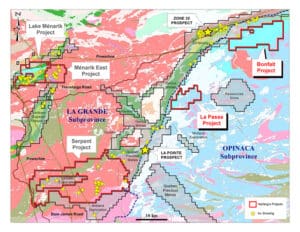

- The project is located in an under-explored area outside the known greenstone belts, near the contact between the La Grande and Opinaca subprovinces;

- Archean basement intruded by felsic to ultramafic magmas, minor discontinuous highly-deformed and metamorphosed volcano-sedimentary horizons (including the Apple Formation);

- Elongated mafic and ultramafic dykes intruded into a major pluri-kilometric East-West deformation corridor.

The Serpent Project boasts the discovery of at least 15 orogenic gold and intrusion-related Cu-Au-Ag mineralized occurrences, including 14 gold-rich occurrences hosted in quartz veins…

The Lawr and Langelier prospects:

- Up to 186 g/t Au and 200 g/t Ag (grab sample);

- 79 g/t Au over 1.25 meters (channel sample);

- 91.48 g/t Au over 0.45 meters (channel sample);

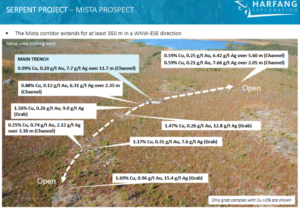

And one Cu-Au-Ag prospect traced over at least 350 meters laterally…

The Mista prospect:

- Up to 0.99% Cu, 0.20 g/t Au and 7.7 g/t Ag over 11.7 meters (channel sample);

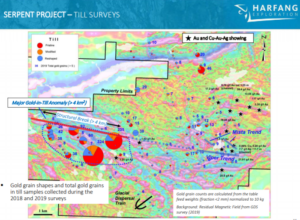

What I find particularly intriguing here is a 4 square kilometer (plus) gold-in-till anomaly—one of the largest of its kind in Canada—in an unexplored corner of the property.

Within these till samples, gold grain counts as high as 324 (grains) have been encountered.

Earlier this year, an Induced Polarization (IP) survey completed over the Mista Trend successfully detected an 800-meter+ long chargeability axis superposed over the Mista Cu-Au-Ag prospect (0.99% Cu, 0.20 g/t Au and 7.7 g/t Ag over 11.7 m in trenching).

A sulfide-bearing, quartz-rich vein zone has already traced along surface for over 350 meters. The IP axis suggests the continuation of the mineralization in the subsurface layers to the west.

“The result of the survey confirms the relevance of Harfang’s method to identify mineralized rocks by mapping conductivity (resistivity) and chargeability of metallic minerals in the bedrock.”

The company is currently extending the IP survey over the 4 square kilometer (plus) gold-in-till anomaly highlighted above.

“Harfang considers that this unexplored portion of the Property represents a high-priority prospective target and warrants a serious exploration effort. High-grade gold occurrences at Serpent are mainly associated with shear zone-hosted quartz veins. The major East-West structural break extending over more than 4 km, which is interpreted from magnetic discontinuities, represents a prime target up-ice of the gold-in-till anomaly.”

According to a May 12th press release, activities on the Serpent property this summer will also include extensive prospecting, soil/till sampling, and mechanical trenching over the gold-in-till anomaly and structural break.

“A drilling program could be designed following detection of IP anomalies and associated gold mineralization.”

The company likes what it sees at Serpent—enough to tie up more ground in the area. On June 9th, the company dropped the following headline:

HARFANG ACQUIRES TWO GOLD PROJECTS IN JAMES BAY (QUÉBEC)

These claims, grouped into two blocks, refer to the new Bonfait and La Passe projects located along the regional contact separating the La Grande and Opinaca subprovinces in the James Bay area.

“This contact is known to be highly prospective due to the discovery of many spatially-associated gold occurrences. Moreover, this acquisition strenghtens Harfang’s strategic position near its Serpent gold and copper project which is considered as the flagship asset of the Corporation.”

“This contact is known to be highly prospective due to the discovery of many spatially-associated gold occurrences. Moreover, this acquisition strenghtens Harfang’s strategic position near its Serpent gold and copper project which is considered as the flagship asset of the Corporation.”

Bonfait and La Passe projects highlights:

- Located along the La Grande-Opinaca limit which is known to be spatially-associated with substantial gold mineralizations, including the Éléonore gold mine operated by Newmont (246,000 ounces of gold produced in 2019 and 1.3 million ounces of gold reserves at December 31, 2019), the Zone 32 (4.2 million metric tons @ 2.1 g/t Au and 0.2% Cu, O3 Mining), and the La Pointe prospects (Quebec Precious Metals Corporation);

- Rocks identified on both properties are variably altered, mineralized, and metamorphosed wacke, paragneiss, and conglomerate similar to those in the Low Formation hosting the Éléonore deposit;

- The metamorphic gradient, ranging from greenschist to lower amphibolite facies, is similar to that found in most worldwide orogenic gold deposits.

The company is stacking good science, both geochemical and geophysical, as it homes in on potential drill targets.

The company recently stoked its treasury to the tune of $2.5M via a non-brokered PP—a combination of hard dollar and FT shares (note the half warrant):

Harfang Completes a $2.5M Private Placement

This may be a signal that management is teeing-up a more aggressive push along the exploration curve.

The following vid lays it all out in just under a minute and a half (nice soundtrack fellas).

Harfang is a prospect generator (PG) by design. But like Virginia Gold during the previous cycle, Harfang may elect to drop the PG business model if the Serpent Project continues to demonstrate world-class potential.

My best guess is that Harfang is onto something big at Serpent.

Updating several other companies in Highballer shortlist portfolio

Once again, I apologize for not covering these developments earlier. These companies deserve far more attention than what I’m about to dole out.

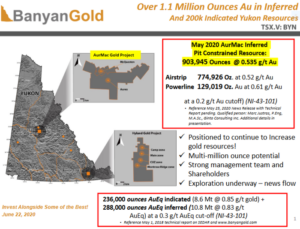

Banyan (BYN.V) delivered solid drill hole assays from their AurMac project on August 17th:

Airstrip zone highlights:

- 0.63 g/t Au over 46.0 meters from 88.1 meters in MQ-20-66;

- 0.75 g/t Au over 116.4 meters from 20.2 meters in MQ-20-71;

- 0.52 g/t Au over 38.7 meters from 37.5 meters in MQ-20-75;

- 0.75 g/t Au over 32.5 meters from 32.5 meters in MQ-20-76;

- 0.82 g/t Au over 20.5 meters from 84.5 meters in MQ-20-77;

- 0.64 g/t Au over 65.2 meters from 5.8 meters in MQ-20-78.

Higher-grade assays from the Airstrip zone are as follows (most of these values represent the higher-grade ‘included’ intervals in the holes featured above):

- 8.33 g/t Au over 1.4 meters in Hole MQ-20-66;

- 3.22 g/t Au over 0.9 meters in Hole MQ-20-70;

- 19.5 g/t Au over 0.7 meters in Hole MQ-20-71;

- 3.13 g/t Au over 1.6 meters in Hole MQ-20-71;

- 19.4 g/t Au over 0.2 meters in Hole MQ-20-71;

- 3.94 g/t Au over 1.0 meter in Hole MQ-20-71;

- 7.93 g/t Au over 1.1 meters in Hole MQ-20-71;

- 3.07 g/t Au over 0.3 meters in Hole MQ-20-74;

- 4.35 g/t Au over 0.8 meters in Hole MQ-20-75;

- 4.16 g/t Au over 0.3 meters in Hole MQ-20-75;

- 8.64 /t Au over 1.5 meters in Hole MQ-20-76;

- 7.11 g/t Au over 1.0 meter in Hole MQ-20-77;

- 3.40 g/t Au over 1.5 meters in Hole MQ-20-78.

The 2020 phase-one Airstrip drilling campaign included 3,578 meters in 18 holes—results are pending for over half of the holes drilled to date.

Banyan was first brought to your attention here back in mid-February, 2020, at a mere $0.06 per share. Today’s $0.37 share price represents a > 500% gain, if you were successful in positioning yourself at those lowly mid-Feb levels.

It goes without saying that taking some money off the table—at least your initial investment—would be a wise move, if you haven’t already done so.

Defense Metals (DEFN.V) released additional (flotation) pilot plant results on August 13th:

Defense Metals Announces Additional Positive Flotation Pilot Plant Results

I covered this development over at Equity Guru on August 16th via the following piece:

An REE supply crunch and an undervalued development play—Defense Metals (DEFN.V)

Here’s an excerpt:

Getting back to the REE supply farce, on July 27th, Lynas Corp (LYC.AX) inked a deal with the US Department of Defense, one where the Pentagon will fund initial design work for a heavy rare earth separation facility in Texas.

This REE refining facility will be built in Texas… to process material from an REE deposit 16,600 kilometers away, in Western Australia (Lynas’ flagship Mount Weld deposit).

With China’s grip on the global REE refining market, this stratagem exemplifies just how precarious the REE supply chain truly is.

You gotta wonder who else might be in the crosshairs of the Pentagon.

Cartier (ECR.V) closed an upsized PP on August 11th:

Cartier Closes Private Placement for Total Proceeds of C$9.3M

Pursuant to the Investor Rights Agreement between Cartier and Agnico Eagle Mines Limited, Agnico Eagle elected to maintain its pro-rata 16.4% interest in Cartier.

The gross proceeds from the Offering will be used by the Company to advance and explore respectively the Company’s Chimo Mine and Benoist projects.

The company’s current cash position now stands at $13.8 million+.

This development sets the stage for a flurry of press releases that are expected to drop over the coming weeks.

An updated resource estimate for the Chimo Mine project is expected in Q4 of this year. Expectations for said estimate run as high as 2 million ounces.

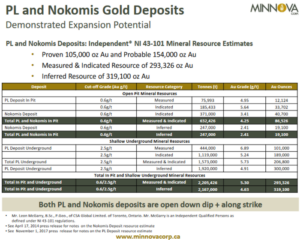

Minnova (MCI.V) dropped the following headline on August 10th:

Minnova Corp. Wide Interval of High-Grade Gold Mineralization Confirmed in Hole M-20-01

Highlighted intercepts within this single hole include:

- 6.33 g/t over 1.00 meter;

- 5.40 g/t over 1.00 meter;

- 5.37 g/t over 1.00 meter;

- 19.20 g/t over 1.00 meter (duplicate – quarter split of above 5.37g/t half split);

- 7.86 g/t over 1.00 meter

This is an interesting development.

“Assay results from hole M-20-01 reconcile with the visible gold initially observed in core. See Table 1 below which presents continuous assay results over a core length of 8.0 meters from 102.3 meters to 110.3 meters that defines the new footwall tonalite structure. Based on these initial positive results our geological team re-logged past hole M-17-56, located over 200 meters, along strike, to the northwest of M-20-01 to determine if the footwall tonalite structure was present. M-17-56 was relatively short hole (EOH 80 meters) that did not report any meaningful structures or gold mineralization. Hole M-17-56 was re-logged and visible gold was observed along a microfracture in a quartz vein at 76.87 meters. The visible gold was associated with arsenopyrite near the margin of a quartz vein starting at approximately 76.5 meters and extending to the EOH at 80 meters. It is believed that this mineralized vein marks the beginning of the footwall tonalite structure and the drill hole was stopped prematurely and the footwall tonalite structure was not recognized at that time. If this is the case the footwall tonalite mineralized structure can be traced over 200 meters along strike to the northwest. These positive assay results, combined with previous drilling suggest we have identified a new, wide zone of gold mineralization occurring within the footwall tonalite.”

In previous drilling campaigns, the footwall tonalite was thought to be barren. This could change everything. If the footwall tonalite structure can be traced over 200 meters along strike to the northwest, and it’s mineralized throughout, there are significant ounces to be added to the current count.

Drilling has been paused as the company has core to re-sample.

Drilling is expected to resume next month.

My friend Vince Marciano published a solid Minnova write-up on August 19th (follow the link below):

Minnova Corp. August 19, 2020 – Gold Juniors to Overshoot to the Upside

Vince explores these recent assays in some detail.

Pure Gold (PGM.V) temporarily suspended operations at its Red Lake Mine project on August 10th as a forest fire raged through the Red Lake area. The event was short-lived. On August 17th, they were back on site.

Both surface and underground inspections have been completed and confirm that there is no damage to infrastructure or equipment at the mine site. The temporary shut down had no material impact on our development schedule with first gold pour expected in Q4 2020.

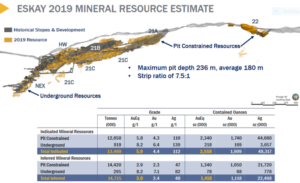

On August 20th, Skeena (SKE.T) received final approval to list the company’s common shares on the Toronto Stock Exchange.

Walter Coles Jr., Skeena CEO:

“Skeena’s graduation to the TSX senior exchange is a natural evolution in the growth of the Company. We’ve demonstrated a very robust project at Eskay Creek while at the same time have managed to sign a deal to acquire 100% ownership of the mine. We currently have six drills turning at Eskay with more on the way. Assay results are expected shortly. The timing to improve our access to capital markets with the new TSX listing could not be better.”

That’s it for this one.

Greg Nolan

Full disclosure: Of the companies featured above, Cartier Resources and Defense Metals are Highballer marketing clients.

A lot of interest is being generated about Harfang. First heard about on Mining Education in an Interview with a investor he also talked about Cartier. Interested in your newsletter.

My commentary is 100% free of charge Ronald. Just click on the subscriber link. I will NOT share your personal info. Period.