Everything in the junior exploration arena, with few exceptions, has taken it on the chin in recent weeks.

High-quality gold and silver stocks have been tossed with little regard for their underlying fundamental value.

To paraphrase my thinking in a recent Equity Guru article…

If your convictions regarding the precious metals are weak, you’ve likely been stoking the negative price pressure, dumping your positions wholesale (fear is a powerful motivator).

If your convictions are firm and unwavering, you likely view this current price weakness as a necessary unpleasantness that will ultimately be resolved with a powerful push to the upside. And you’re likely shortlisting some of the better values that are beginning to emerge, looking to deploy some of your sidelined capital.

Entering buy orders during periods of excessive weakness should never feel ‘right’ IMO. It’s a counterintuitive kinda thing—you’re going against the herd and for most, that’s contrary to our better nature. But personally, some of my very best trades were initiated during periods of such weakness… when I approached my trading platform with great trepidation.

It’s possible that by the time this rout is over, volatility will hath made its masterpiece.

But then again, we could be on the cusp of that powerful push to the upside.

Corrections and protracted price weakness aside, many of the companies on the Highballer shortlist have dropped headlines since I last checked in. Let’s examine a few…

Banyan Gold (BYN.V)

Here, additional diamond drilling results were received from the Airstrip Zone on the company’s AurMac Property in Canada’s Yukon.

Highlights include:

- 1.02 g/t Au over 47.7 meters from 84.8 meters in hole MQ-20-67;

- 0.53 g/t Au over 16.5 meters from surface in hole MQ-20-79;

- 0.55 g/t Au over 12.0 meters from 29.0 meters in hole MQ-20-79;

- 0.51 g/t Au over 49.5 meters from 140.5 meters in hole MQ-20-80;

- 0.59 g/t Au over 114.8 meters from 161.0 meters in hole MQ-20-82.

High-grade intervals include:

- 2.38 g/t Au over 10.6 meters in hole MQ-20-67;

- 1.73 g/t Au over 7.4 meters in hole MQ-20-67;

- 4.82 g/t Au over 3.4 meters in hole MQ-20-67;

- 22 g/t Au over 0.4 meters in hole MQ-20-67;

- 18.4 g/t Au over 2.1 meters in hole MQ-20-73;

- 2.62 g/t Au over 6.0 meters in hole MQ-20-80;

- 4.13 g/t Au over 1.8 meters in hole MQ-20-80;

- 27.7 g/t Au over 1.5 meters in hole MQ-20-81;

- 3.88 g/t Au over 1.5 meters in hole MQ-20-81;

- 4.27 g/t Au over 1.5 meters in hole MQ-20-82.

It’s important to note that drill hole MQ-20-67 is a 100-meter step-out to the west of hole MQ-20-66 which tagged 0.63 g/t Au over 46 meters from 88.1 meters depth.

Those two holes add over 200 meters of strike to the AurMac deposit on previously untested ground.

It’s also important to note that drill hole MQ-20-82 is a 125-meter step-out to the south of hole MQ-18-34 which tagged 0.74 g/t Au over 113.0 meters from 63.5 meters depth.

The resource at AurMac (Airstrip + Powerline zones) currently stands at 52,576,520 tonnes grading 0.535 g/t Au for 903,945 ounces of Au.

With these results, the current AurMac ounce count appears destined to grow.

HighGold Mining (HIGH.V)

Though the headline act here is the flagship Johnson Tract Project (JT) in Southcentral Alaska, the company has just begun a 3,500-meter drilling campaign in the prolific Timmins gold camp of Ontario.

The company controls three highly prospective projects in the Timmins camp—Munro-Croesus, Golden Mile, and Golden Perimeter.

These Timmins projects, though overshadowed by the sheer scale of Johnson Tract, would attain flagship status anywhere else, with any other company in the junior arena.

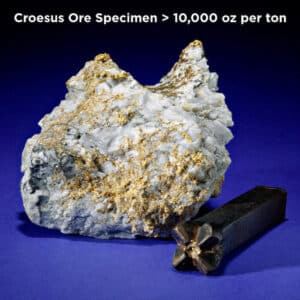

At Munro-Croesus, historic small-scale mining tagged some of the highest grade gold ever encountered in the Timmins camp.

The property, only three kilometers northwest and along trend of Pan American Silver’s (PAAS.T) multi-million ounce Fenn-Gib gold deposit, boasts over a kilometer of untested parallel vein structures.

The Golden Mile property is located nine kilometers northeast of Newmont-Goldcorp’s (NGT.T) multi-million-ounce Hoyle Pond deposit.

Getting back to the September 22nd headline, this 3,500-meter program follows-up and expands on a drill program that was suspended in mid-March (in response to COVID-19 issues).

At Munro-Croesus, the company recently completed a prospecting and mapping campaign followed by mechanical stripping, power washing, and channel sampling on the project’s gold-bearing (quartz) vein systems.

Highlights from the first batch of assayed channel samples include:

- 11.24 g/t Au over 1.85 meters;

- 17.05 g/t Au over 0.8 meters;

- 8.42 g/t Au over 1.5 meters.

“Several of these vein prospects, which are developed in areas outside the historic Croesus mine environment, will be drill tested for the first time during the current drill program.”

According to this press release, HighGold continued to expand its Munro-Croesus land position with recent property purchases and claim staking, increasing the size of the property fivefold to 20 square kilometers (1,968 hectares).

“The acquisitions have consolidated a previously fragmented and underexplored package of highly prospective ground within the influence of the Pipestone Break, a regional fault system that is host to gold deposits throughout the Timmins gold camp.”

On deck are muchly anticipated assays out of Johnson Tract where drilling-related newsflow will be steady for the balance of 2020 and into Q1 of 2021

3 drills are currently turning at JT.

This Timmins drilling campaign will tie in nicely with the cessation of drilling at Johnson Tract, sustaining drilling-related newsflow right into the 2021 JT field season.

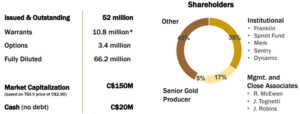

The company’s superior cap structure is another reason we’re here…

Cartier Resources (ECR.V)

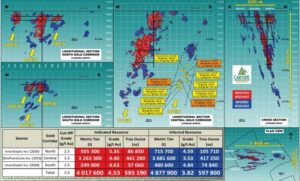

This press release featured results from an engineering study highlighting the hoisting capacity of the underground mining infrastructure at Cartier’s 100% owned Chimo Mine Project located 45 kilometers east of the Val-d’Or mining camp.

As a reminder, the current resource at Chimo stands at 585,190 ounces of gold in the Indicated category (4,017,600 tonnes @ 4.53 g/t Au) and 597,800 ounces of gold in the Inferred category (4,877,900 tonnes @ 3.82 g/t Au).

Highlights of this current study:

- With simple adjustments, the shaft on the Chimo Mine Property could extract 1.7 million metric tons per year (4,921 mt/day);

- This is one of four engineering studies being carried out in conjunction with a preparatory study for a new mineral resource estimate designed to reveal Chimo’s ultimate value.

To date, two internal engineering studies have been completed with positive conclusions.

Two additional internal engineering studies are currently underway.

The positive conclusions reached in these engineering studies should augment Chimo’s global ounce count.

This upcoming resource estimate—a potentially significant near term catalyst—is expected in Q4 of 2020.

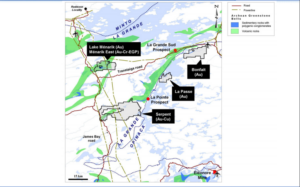

Harfang Exploration (HAR.V)

Harfang is our most recent addition to the Highballer shortlist.

In this press release, the company reports results from mechanical trenching and prospecting at its flagship Serpent Property in the James Bay region of Quebec.

An aggressive 2020 summer exploration campaign at Serpent focused on an unexplored part of the property highlighted by a >4 square kilometer gold-in-till anomaly.

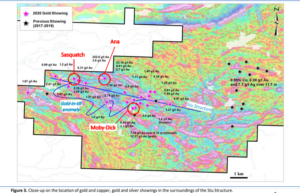

Work included an induced polarization survey (34 linear kilometers), 14 mechanical trenches in three specific areas (Moby-Dick, Ana, and Sasquatch), and the collection of 855 grab, 458 channel, 90 till, and 50 soil (B-Horizon) samples.

This recent fieldwork revealed more than 20 new gold showings (>1 g/t Au).

When combined with previously discovered showings, gold occurrences now cover an East-West strike length of at least 12 kilometers.

Quoting this September 22nd press release…

Located 100 meters from the exploration camp, the Moby-Dick structure was channelled and returned up to 7.78 g/t Au over 6.15 meters, including 24.06 g/t Au over 1.80 meters and 2.00 g/t Au over 2.25 meters (Figs. 4 and 5). Visible gold was observed in one sample along this channel (61.06 g/t Au over 0.50 meters). Trenching conducted on this structure exposed the vein over more than 350 meters. The easternmost part of the structure returned 8.95 g/t Au over 0.45 meters (TR-SER-20-005). Gold content in other channels is limited to anomalous values showing its coarse nature (nugget effect). Grab samples returned up to 12.27 g/t Au (TR-SER-20-001), and 8.85 g/t and 2.10 g/t Au (TR-SER-20-007). The Moby-Dick structure is characterized by shear zone-hosted quartz veins up to 10 meters wide. It stretches over a strike length of at least 350 m in a N250° direction, dipping moderately to abruptly to the northwest.

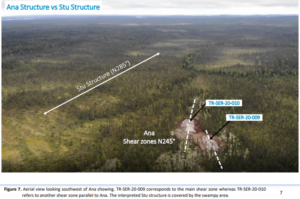

The Ana structure is characterized by a 4-meter wide shear zone filled with quartz veins exposed over 25 meters long (Figs. 6 and 7). The shear zone strikes into a N245° direction and dips abruptly to the northwest. It is developed in the old Archean tonalitic basement (Langelier Complex) and pyroxenite and gabbro dykes. The shear zone appears to continue to the northeast. Grab samples reached up to 23.14 g/t Au in the most mineralized part of the shear zone where visible gold was observed (Fig. 6). Channel sampling results are pending. Sulfide content (pyrite, ± pyrrhotite) reaches up to 5% locally. Calc-silicate and potassic alterations are described together with intense silicification. A parallel structure is located 25 meters to the southwest.

The Sasquatch structure is located 3.8 kilometers northwest of Moby-Dick. It is characterized by an 8-meter wide shear zone filled with quartz veins striking into a N245° direction, dipping abruptly to the northwest (Figs. 8 and 9). Its lateral extension is at least 80 meters and remains open at both extremities. A grab sample collected in a portion of the vein with 3-5% pyrite returned 1.20 g/t Au. Channel sampling results are pending. Sheared pyrite-bearing gabbro and several smaller quartz veins, which graded 3.50, 5.31, 9.29 and 222.58 g/t Au, were found southeast of Sasquatch along potential parallel structures.

The company has identified an important East-West structure—the “Stu Structure—and secondary structures (affecting the geological units in the gold-in-till anomaly area) that represent a high-priority target for additional exploration.

“Field evidences such as gold anomalies in bedrock and till, structural features and mapped alterations support this interpretation. Fieldwork has outlined a strong gold potential along various structures.”

Click here for a detailed view of these highly prospective structures (great pics Harfang).

The fall program, already underway, consists of surface prospecting and an important (B-Horizon) soil sampling campaign around a swampy area which partially covers the first priority target (above image). A heli-portable excavator will be used to carve out test pits and trenches in specific areas in and around the swamp.

This is still an early stage play, but Harfang is stacking good science as it continues to home in on high-priority drill targets at Serpent.

Pervasive mineralization spread out across 12 kilometers of strike—you gotta know this crew is onto something.

Defense Metals (DEFN.V)

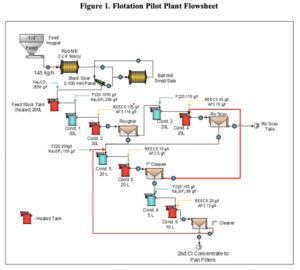

September 23rd news: Defense Metals Receives Final Wicheeda REE Pilot Plant Report From SGS

My friend and colleague, Lukas Kane, covered this important development over at Chris Parry’s Equity Guru just a few days back.

Read: Defense Metals’ (DEFN.V) pilot plant metallurgy validates REE extraction plan

END

—Greg Nolan

Full disclosure: Of the companies featured in this article, HighGold and Cartier are Highballer clients. The author owns shares of HighGold, Cartier, Harfang, and Defense.