I’ve been following the HighGold story since January of this year when I penned a piece titled A high-grade gold and base metal play with Tier-1 potential – HighGold Mining (HIGH.V)

HighGold is all about its flagship Johnson Tract Project (JT), a phenomenal high-grade deposit that was, until very recently, buried from sight for over a quarter-century.

HighGold acquired JT through a lease agreement with CIRI, an Alaskan Native Regional Corporation, one of the largest private landowners in the Cook Inlet region.

Read: About CIRI & Johnson Tract

HighGold has a good, business-minded partner in CIRI.

“The lease agreement between HighGold and CIRI has an “Initial Term” of 10-years, followed by a 5-year “Development Term” to achieve a mine construction decision, and then a “Production Term” that will continue for so long as operations and commercial production are maintained. Minimum exploration expenditure and annual lease payments are required to maintain the lease until production. CIRI maintains certain NSR royalty rights and a back-in right for up to a 25% participating interest.”

Note that the back-in right represents a participating interest… not a carried interest, as one might expect.

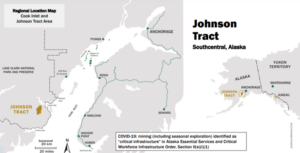

Johnson Tract is located in a very accessible part of Alaska, near tidewater (above map).

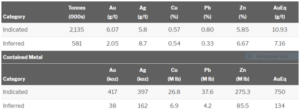

The project boasts a high-grade resource just shy of 900k gold equivalent (AuEq) ounces.

But what sets JT apart from most high-grade deposits is a rare combination of grade and thickness. JT boasts (narrow) vein-type grades with widths you normally associate with low-grade bulk-tonnage deposits (between 20 and 50-plus meters true thickness).

Obviously, the wider the high-grade zone, the more robust the economics.

Select Johnson Tract drill intersections…

(we’ll talk about the first interval on the above list a little further down the page)

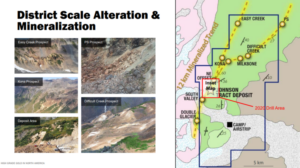

Geologically, JT is an epithermal setting with submarine volcanogenic attributes. It’s a ‘district-scale’ project in every sense of the word.

The following pic gives you a nice visual read of the pervasive hydrothermal alteration dominating the landscape at Johnson Tract.

Here, HighGold CEO Darwin Green is standing on a heli pad just above the JT deposit looking up at the alteration—the light brown material—that runs oblique to the main deposit in a northerly direction.

The company has multiple high-priority targets in its crosshairs as the vast majority of this hydrothermal system—some 10 to 12 kilometers in length—has never been probed with the drill bit.

JT Deposit Expansion

- The edges of the JT deposit are open to expansion along strike, particularly the deeper portions of the deposit where the thickest and highest-grade mineralization has been intersected (more details on this bit of geological sleuthing further down the page). Immediate plans include incremental step-outs (i.e.) northeast of hole JT19-090 that tagged 75.1 meters of 10.0 g/t Au, 9.4% Zn, and 0.6% Cu.

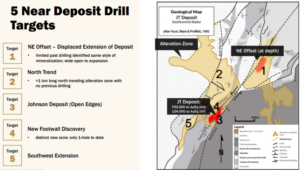

Northeast Offset

- This is a fat target. Located approximately 500 to 800 meters to the northeast of the JT deposit, it represents the interpreted fault-displaced continuation of the 900k AuEq resource. Significantly, limited wide-spaced historic drilling has documented the same distinct alteration and metal signature that is associated with mineralization at the main deposit. Holes drilled into this high-priority target will go deeper than most—some may exceed 500 meters in length.

North Trend

- A new exploration model developed by the HighGold technical team suggests a north-south structural control that holds the potential for multiple mineralized zones along this one kilometer-plus hydrothermal alteration trend.

Footwall Discovery

- Follow-up drilling is planned on this new discovery made during the 2019 confirmation and resource definition drill program. Only one (deep) drill hole tested this distinct zone of mineralization to date. Located in the footwall to the JT deposit, the discovery hole tagged 20.7 meters grading 32 g/t Ag, 2.4% Cu, and 4.9% Zn (Hole JT19-089).

Southwest Extension

- This is a zone of previously undrilled alteration and mineralization that lies to the immediate southwest of the JT deposit.

The small red box on the following slide represents the area—an 800-meter radius from the main JT deposit—that will be systematically probed with the drill bit during the 2020 field season.

Still on the above slide, the property boundaries are outlined in blue—the yellow Y formation represents the extent and length of the hydrothermal system.

Though this year’s drilling will be confined to the area within the red box, ground crews are out prospecting, mapping, running geochemical (rock and soil), and geophysical surveys deeper afield to prioritize targets for future drilling campaigns.

One example: the Difficult Creek target, located roughly 4.5 kilometers northeast from the main deposit, will likely occupy a spot on the 2021 ‘To-Drill’ list.

Note the (new) high-grade channel sample of 23.3 g/t Au over 1.5 meters.

For a deeper delve, the following video opens JT right up—nice visuals folks…

Watch: On Location at Johnson Tract – 2020 Drill Targets

The setup—the fundamentals all lined up

The company is run by an experienced and driven team with multiple discoveries under their collective belts.

Their flagship project has an exceptional 900k AuEq resource, with excellent resource expansion potential (more on this below).

The company has multiple high-grade targets in its crosshairs within 800 meters of its high-grade resource, including one which represents a fault-displaced continuation of said resource.

With hydrothermal alteration stretching from one valley to the next, over some 12 kilometers in length, the company boasts genuine district-scale potential.

After closing a recent $13.8 Million Upsized Bought Deal Financing (no dilutive bells n whistles), the company has $21M in its coffers.

After launching a two rig, 7,000-meter diamond drilling campaign back in June, the company added a third rig and aggressively expanded its 2020 program to 15,000 meters (minimum).

And… after watching the 2020 exploration season evolve over a period of months, the company dropped its first assays last week.

Results exceeded even my lofty expectations…

I try to refrain from hyperbole when covering assay related news events, but these headline values represent one boomer of a hit.

The significance of this hit on the outer edge of the JT deposit wasn’t lost on the market either (Friday’s dip was shortlived):

Drill hole JT20-092 tested an area below the last hole of the 2019 season with the objective of better defining the down-dip extent of the JT Deposit and confirming a subzone of very high-grade gold. JT20-092 tagged 74.1 meters grading 17.89 g/t gold, 7.1 g/t silver, 0.48% copper, 7.28% zinc and 1.31% lead (23.8 g/t AuEq; estimated true width = 37.1 meters).

The gold grade of this interval (17.89 g/t) is 79% higher than JT19-90 (located approximately 15 to 20 meters up-dip) which returned 75.1 meters grading 10.01 g/t gold, 6.0 g/t silver, 0.57% copper, 9.36% zinc and 1.11% lead (estimated true width 40.6 meters). This zone of thick high-grade mineralization is open to expansion and remains the focus of ongoing drilling.

Hole JT20-093 intersected strong base metal grades along the open northeast edge of the JT Deposit, including 43.5 meters grading 1.98% copper, 8.45% zinc, and 1.35 g/t gold (9.9 g/t AuEq; estimated true width of 28.0 meters). This drill intersection expanded both the width and up-dip extent of the mineralized zone tested.

The following map shows the location of these two new intersections—the two red dots—relative to previously drilled holes. These two hits qualify as both infill and stepout holes—they should increase the grade of the surrounding resource blocks while opening up the JT deposit for further expansion. The green dots represent recently drilled holes where assays are pending.

CEO Darwin Green:

“HighGold’s 2020 drill program has started right where we left off last season with the intersection of exceptional widths of high-grade mineralization. These intersections continue to confirm and expand the mineralized zone and, more importantly, include higher-grade mineralization than the closest neighboring drill holes. The results also support our exploration model which suggests that the lower part of the known JT Deposit, the thickest and highest-grade portion, is open to expansion. One drill rig continues to systematically test this resource expansion target, while two other drill rigs remain focused on surrounding targets including the high-priority NE Offset area.”

Drilling related newsflow out of Johnson Tract will be steady for the balance of 2020 and into Q1 of 2021.

The Timmins assets

The company also has three highly prospective projects in the prolific Timmins Gold Camp of Ontario—Munro-Croesus, Golden Mile, and Golden Perimeter.

After recently consolidating its land position around Munro-Croesus, the Timmins camp drilling will begin shortly and will tie in nicely with the cessation of drilling at Johnson Tract. This should sustain drilling-related newsflow right into the 2021 JT field season.

This portfolio of projects in the Timmins camp, though overshadowed by the enormity of Johnson Tract, could easily garner flagship status with any other company in this sector.

Final thoughts

HighGold has a current valuation of $147.5M based on its 50 million shares outstanding and recent close at $2.95.

I’m reluctant to dole out price targets on the stocks I shortlist here at Highballer, but if pressed, “Higher” would be my best guess re HighGold.

I suspect there are a number of resource-hungry predators—Producers looking to bulk up their project pipelines—watching developments out of the JT camp closely.

I believe HighGold has an endgame.

END

—Greg Nolan

Full disclosure: HighGold is a Highballer marketing client. The author owns shares.