Gold is currently testing support at $1,800 (lower blue line) after crashing through support at $1,850. Current prices represent multi-month lows.

If $1,800 doesn’t hold (that’s where the 200 SMA is at), $1,750 might be in the cards.

Of course, this sudden price weakness might be a big-ass Bear Trap. If so, the metal should snap back above $1,850 with tremendous force.

For the macro-view, I have my own opinions, but I like to defer to a small stable of ‘experts’—those I’ve been following over the years/decades. Serially successful types, if you will.

The next few lines are from a piece I posted over on Equity Guru piece very recently (Nov. 23rd)…

John Hathaway—portfolio manager at Sprott Hathaway Special Situations Strategy and co-portfolio manager of the Sprott Gold Equity Fund— has some good, well-considered insights regarding the metal and where it’s headed.

Hathaway believes that interest rates will need to stay low—that much is clear, considering the state of the global economy. He believes Bonds—widely used as a hedge against stock market uncertainty—can no longer be counted on. This will force large pools of capital to seek out a more effective hedge against equity risk, and gold is really the only asset that will offer such protection.

The other factor supporting gold is a weaker USD. The Fed doesn’t want a strong USD as it would put US exports further out of reach for foreign consumers. Hathaway states that many elite investors are calling for a 30% drop from here. Continued erosion in the USD would be an extremely friendly backdrop for the metal.

Hathaway estimates there’s roughly $100 trillion worth of assets currently under management—pension funds, mutual funds, sovereign wealth, private wealth—and gold does NOT factor into the equation in any meaningful way.

If a mere 1% of that total—$1 trillion—were to move into gold over the next few years, that would represent six years of new mine supply. That’s how under-owned gold is.

$1 trillion entering the gold space would push prices to levels difficult to imagine, to perhaps five times the metal’s current trading range.

There’s a lot of wisdom in this interview—it’s worth at least one go…

With the macro view in mind, and a rout that appears to have run its course, I plan on adding to my positions over the next week or so.

Moving along…

Several of the high-quality companies on our shortlist generated news in recent sessions.

HighGold Mining (HIGH.V) dropped the following headline last week:

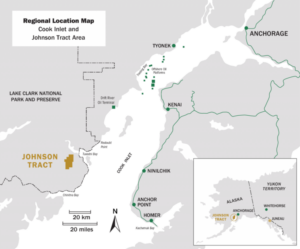

Here, the Company announced results from its flagship Johnson Tract Gold Project (JT) in Southcentral Alaska.

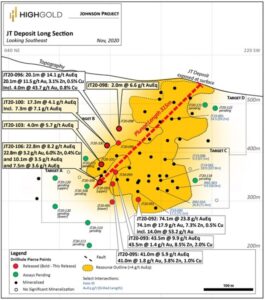

HighGold reported results from four holes, including step-outs that extend JT’s high-grade mineralization down-plunge.

Highlights

Drill hole JT20-106, designed as a 20-meter step-out from drill hole JT20-95 (41.0 meters at 5.9 g/t gold AuEq), successfully intersected three closely-spaced mineralized intervals for a cumulative width of 40.4 meters:

- 22.8 meters at 3.2 g/t Au, 4 g/t Ag, 0.4% Cu, 6.0% Zn (8.2 g/t AuEq), including 17.4 meters at 3.9 g/t Au, 5 g/t Ag, 0.6% Cu, 7.6% Zn (10.3 g/t AuEq), also including 7.4 meters at 8.6 g/t Au, 8 g/t Ag, 0.7% Cu, 10.2% Zn (17.5 g/t AuEq);

- 10.1 meters at 3.7% Zn, 0.7% Cu, 4 g/t Ag, 0.1 g/t Au (3.5 g/t AuEq);

- 7.5 meters at 0.8% Zn, 2.0% Cu, 16 g/t Ag, 0.1 g/t Au (3.6 g/t AuEq).

Drill hole JT20-100, designed as a 20-meter step-out from drill hole JT20-96 (20.1 meters at 13.8 g/t AuEq), successfully intersected 17.3 meters of zinc-rich mineralization and yielded a separate 9.0-meter interval from the deeper Footwall Copper Zone:

- 17.3 meters at 6.1% Zn, 0.1% Cu, 1 g/t Ag, 0.2 g/t Au (4.1 g/t AuEq), including 7.3 meters at 11.1% Zn, 0.1% Cu, 1 g/t Ag, 0.2 g/t Au (7.1 g/t Au Eq);

- 9.0 meters at 1.4% Cu, 2.8% Zn, 7 g/t Ag, 0.1 g/t Au (4.0 g/t AuEq -Footwall Copper Zone).

These are good results. And importantly, they significantly expand the known resource at JT, a resource that currently stands at 750k ounces AuEq @ 10.9 g/t AuEq (Indicated), and 134k ounces AuEq @ 7.2 g/t AuEq (Inferred).

Darwin Green, HighGold’s CEO:

“Today’s results further extend mineralization to depth & down-plunge of the main JT Deposit. The results also highlight the opportunity to add high-tonnage/high-value mineralization with each new step-out hole. Observations of drill core from these and subsequent holes (for which assays are still pending) suggest the JT Deposit remains open for continued expansion down-plunge and that not all of it is faulted-off at depth as was previously interpreted.”

This is an interesting development. Without a doubt, the Company broadens its understanding of what may ultimately lie in these subsurface layers with each stepout drilled.

Of the 33 drill holes drilled during this 2021 campaign, 16 probed the JT Deposit and Footwall Copper Zone, nine the NE Offset target, four the North Trend target, and four the DMZ target (located between the JT Deposit and the NE Offset target).

Results reported in this press release stem from the JT Deposit and adjacent Footwall Copper Zone.

Between last year and this, the Company released several drill holes that rank in the top-ten globally (grade x width).

The bar at JT has been set very high. Though this last batch doesn’t quite make the global top-ten, they will continue to grow JT’s ounce-count in a meaningful way.

Drilling has wrapped up for the season at JT (the exploration window opens in late May and closes in late October). A total of 16,420 meters was completed in 33 drill holes.

Assay results are still pending for 23 drill holes and will be released in batches over the next few months.

The Company needs this downtime as they are still figuring out JT’s geological controls. Between geophysics and geochemistry—aside from the 33 holes drilled, the Company collected 1,800 soil and rock samples this season—the HighGold team will be busy data-stacking, generating the highest-priority targets for the next round of drilling.

HighGold’s assets in the Timmins Camp—Munro-Croesus and Golden Mile—shouldn’t be underestimated.

A current 3,500-meter drilling campaign will test the high-grade potential along a stretch of Timmins that yielded some of the highest-grade gold ever mined in Ontario.

Munro-Croesus’ highly-prospective geology is proximal to the Porcupine-Destor Deformation Fault Zone and Pipestone Fault. It lies within three kilometers northwest and along trend of Pan American Silver’s (PAAS.T) multi-million ounce Fenn-Gib gold deposit.

This Timmins campaign will augment HighGold’s newsflow, front and center with the 23 remaining holes pending from JT.

Aside from having a super tight share structure, the Company has $17M in its coffers, enough to see it through the 2021 exploration season.

Exclusive Interview: HighGold Mining (TSX.V: HIGH) President and CEO Darwin Green

Copper has gone on a tear of late, tagging multi-year highs, currently consolidating at $3.30 resistance.

The timing for a significant new Cu discovery couldn’t be better.

Last weeks headline:

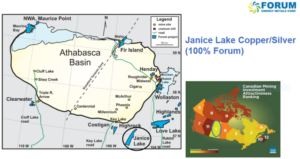

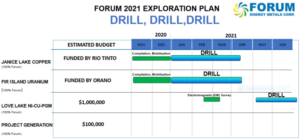

A brief overview: Janice Lake is Forum’s flagship asset. The property encompasses some 38,250 hectares in north-central Saskatchewan, within the Wollaston Domain—a northeasterly-trending belt of metamorphosed lower Proterozoic supracrustal rocks deposited upon Archean granitoid basement.

The property boasts over 20 sediment-hosted copper showings that hold the potential for multiple layers of copper mineralization.

The property boasts district-scale potential—optimism validated by a $30M JV with mining colossus Rio Tinto (RTEC).…

“Forum entered into an agreement granting Rio Tinto Canada a four-year option to acquire a 51% interest in the Janice Lake Project by spending $10 million in exploration, making $490,000 in cash payments, and servicing the remaining $200,000 in underlying cash payments to Transition Metals Corp. Rio can earn a further 29% interest (total 80%) by spending a further $20 million in exploration over three years (total $30 million) and making further cash payments of $150,000 to Forum (total $640,000).”

Back to last week’s news…

Rio Tinto released results from a rotary air blast (RAB) drilling program initiated this past summer.

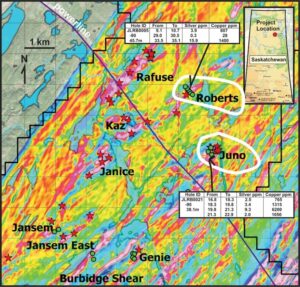

This RAB campaign was deployed as a prospecting tool to punch vertically through areas covered in overburden—short holes designed to test the immediate subsurface layers at the Roberts and Juno target areas.

Cu-Ag mineralization was intersected 4 kilometers on strike of the Jansem/Janice/Rafuse trend at Roberts, and 3 kilometers east in a parallel trend repeated by faulting at Juno.

The highlight from this program was a 6 meter intercept with a 1.5 meter section grading 0.62% copper and 9.3 g/t silver.

The Juno target lies on a parallel mineralized trend to the Jansem and Janice targets approximately 3km east of the Janice target (above map). Three RAB holes were attempted with two being completed for a total of 68.5m and one hole being abandoned at 6.1m. Hole JLRB0021 returned up to 1.5m of 0.62% copper and 9.3 g/t silver starting at a depth of 19.8m. A historic grab sample at the showing returned 1.9% copper and 32 g/t silver.

The Roberts target lies approximately 4km on strike to the northeast from the Janice target (above map). Six RAB holes were completed in one fence with the first hole being abandoned at 16.7m and the remaining holes having a total of 161.5m with a maximum depth of 45.7m. Hole JLRB0005 intersected up to 1.6m of 0.14% copper and 15.9 g/t silver at a depth of 33.5m. A historic grab sample at the showing returned 2.4% copper and 12.9 g/t silver.

In a November 11th press release, RIO, the project operator, updated its exploration plans for the project, signaling its intention to push Janice Lake further along the exploration curve.

RIO will mobilize two diamond drill rigs to the project for a planned 7,500-meter campaign in roughly 30 holes. Scheduled to kick off in January 2021, Rio has both Roberts and Juno in its crosshairs, as well as Jansem and Rafuse, two targets covered in last week’s episode of Highballer.

This could be characterized as the calm before the storm—Forum is about to get very busy on multiple fronts.

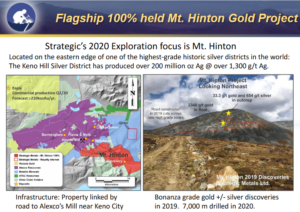

Strategic Metals (SMD.V) dropped a headline last week giving us our first look at what lies in Mt. Hinton’s subsurface layers.

Strategic Metals Announces Initial Drill Results from its Mt. Hinton Gold and Silver Project, Yukon

Mt Hinton, located in the Keno Hill District in central Yukon, lies immediately southeast of Alexco Resources‘ (AXU.T) Keno Hill property (Alexco just announced the commissioning of its mill with initial production of lead/silver/zinc concentrates underway).

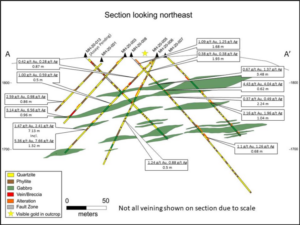

Strategic’s 2021 drilling campaign at Mt. Hinton consisted of 6,978 meters in 32 holes.

24 holes tested the Granite North Zone, 5 holes tested the Southwest Zone, 3 holes probed the Northern Structural Corridor.

The results contained within in this release represent the first six from Granite North.

“The Granite North Zone is characterized by occasional coarse visible gold in talus and localized bedrock exposures. The section line is oriented sub-parallel to foliation and layering in host rocks and crosses a number of north-northeasterly trending, 5 to 25 m wide vein/breccia/alteration bands that were mapped in talus and outcrop within the up to 400 m wide zone. All of the holes intersected abundant quartz veining of differing types.”

The highlight interval here was an underwhelming 1.47 g/t gold and 2.41 g/t silver over 7.13 meters, including 5.36 g/t gold and 7.66 g/t silver over 1.32 meters, in Hole MH-20-005.

Underwhelming, yes, for a project located in one of the highest-grade silver producing regions on the planet. Underwhelming for a project with such high-grade Au-Ag values on the surface.

But here’s the thing…

“None of the holes on this section line intersected visible gold or abundant sulphide mineralization, which were reported from later holes in the program.”

The Company may have drilled this area first as, logistically, it made the most sense at the time.

The results from a further 26 holes are pending.

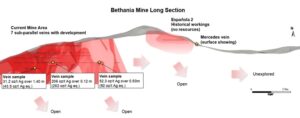

Kuya Silver (KUYA.V), a recent addition to the Highballer shortlist, continues to push its flagship Bethania Silver Mine Project further along the curve.

Aside from conducting a PEA, Mining Plus will complete detailed engineering in anticipation of a 350 tons per day production scenario.

Concurrent with this work, Kuya intends to execute a 5,000 meter drill program focused on increasing the resource confidence in zones close to the existing mine workings.

The goal of this initial program is to elevate Bethania’s resource to 43-101 compliant status. Kuya will also test extensions to the known veins along strike and at depth. The data and modeling obtained from this drill program will also be incorporated into the PEA and engineering designs.

David Stein, Kuya’s CEO:

“Kuya is very pleased to initiate this engineering partnership with Mining Plus to assist us in designing and developing the Bethania silver mine expansion project. Besides the expansion itself, Kuya expects that a professional mine design will provide many other benefits, including improvement of safety standards, ventilation, working conditions, productivity and better integration with the planned flotation process plant. We believe that by making a relatively small up-front investment to upgrade the planning and engineering design of the mine today, we will generate a stronger return when production is restarted.”

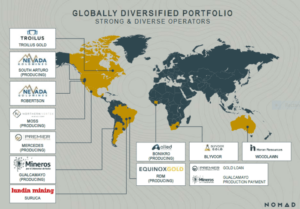

Nomad (NSR.T), as I’m sure you’re well aware, took out one of Highballer’s top three picks for 2020 – Coral Gold.

Within the next week or so, Coral shareholders will receive Nomad shares, warrants, and a nickel for each Coral share held.

A bit of background on this top-shelf royalty and streaming company:

- 524.53 million shares outstanding

- $629.43M market cap based on its recent $1.20 close

Since its debut on the TSX on May 29th, Nomad (NSR.T) management has done everything it said it would do, and in only a few months time.

From the get-go, the Company set out to acquire high-quality assets, adding to an already robust project portfolio of producing and advanced-stage assets.

A recent example of this deal making prowess is the July 27th acquisition of a 1% net smelter return royalty (NSR) on the 8.11 million gold equivalent ounce Troilus Gold Project located along the Frotet-Evans Greenstone Belt in northern Québec.

And of course, the August 24th headline announcing the acquisition of our highly prized Coral Gold:

Nomad Royalty Company to Acquire Coral Gold, Marking the Start of Its Sector Consolidation Strategy

A comment I posted regarding the Coral Gold acquisition last August…

We haven’t seen much in the way of M & A activity in the royalty space in recent years. But this is a good one. And the asset at the center of this acquisition is one I’ve studied closely (Coral Gold is one of my Top Three Picks for 2020 over at HighballerStocks).

The highlights of this important acquisition…

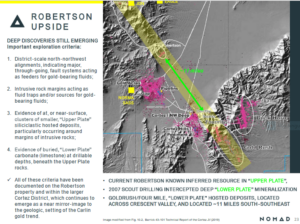

Coral holds an uncapped sliding scale NSR (1% to 2.25%) on over 2.7 million ounces at Nevada Gold Mines (NGM) Robertson Property located along the prolific Cortez Gold Trend of northern Nevada. Note: this resource is currently deemed ‘historic’.

The Robertson Property is a joint venture between mining behemoths Barrick (61.5%) and Newmont-Goldcorp (38.5%).

Based on the current US$1,850-plus spot price, the applicable NSR royalty rate on Robertson’s 2.7 million ounces of oxide material is a weighty 2.00%.

When spot gold takes out $2k, the royalty tops out at 2.25%.

The Robertson asset would garner flagship status in any ExplorerCos project pipeline.

The (deep) latent exploration potential at Robertson is compelling. With a proper, well-designed drilling campaign, we could see Robertson evolve into a world-class, Tier-1 asset.

On November 19th, Nomad completed the acquisition of Coral…

Nomad Royalty Company Completes Acquisition of Coral Gold

“Pursuant to the Transaction, Nomad acquired all of the outstanding shares of Coral (“Coral Shares”). Coral shareholders received, for each Coral Share held, consideration consisting of C$0.05 in cash and 0.80 of a unit (a “Unit”) of Nomad (collectively, the “Consideration”). Each whole Unit is comprised of one Nomad common share (a “Nomad Share) and one-half of a common share purchase warrant (a “Warrant”). Each full Warrant entitles the holder thereof to purchase one additional Nomad Share at a price of C$1.71 for a period of two years following the date hereof. If the daily volume-weighted average trading price of Nomad Shares on the Toronto Stock Exchange exceeds the Warrant exercise price by at least 25% for any period of 20 consecutive trading days after one year from the date hereof, Nomad will have the right to give notice in writing to the holders of the Warrants that the Warrants will expire 30 days following such notice, unless exercised prior thereto.”

Earlier this month, on November 9th, Nomad released its third qtr results. It was a strong quarter with record revenue of $7.6 million. Revenue from its streams and royalties rang in at $5.9 million, representing an increase of 100% quarter over quarter—a clear demonstration of the strength in Nomad’s diversified portfolio.

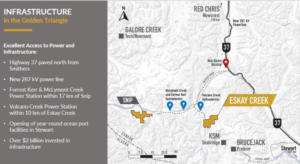

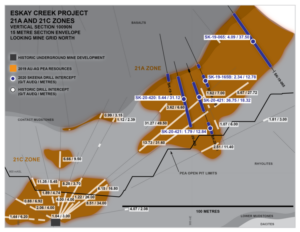

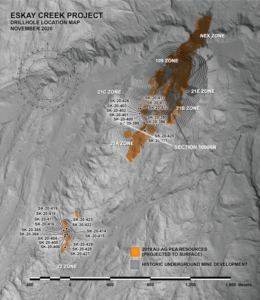

Skeena Resources (SKE.T) is in the habit of dropping stellar drill hole assays, both infill and stepout, as a matter of routine.

The Company’s flagship Eskay Creek Project is located in the prolific Golden Triangle of British Columbia.

Yesterday’s headline (November 24th) continued this tradition.

Skeena Intersects 36.75 g/t AuEq over 18.32 metres in 21A Zone Infill Drilling at Eskay Creek

That is one fat headline number.

This Phase 1 campaign is a combination of definition and exploration drilling. The Phase 2 infill program, focused on resource conversions for the open-pit constrained ounces, is on-going with eleven drill rigs currently active.

As a reminder, Eskay Creek’s open-pittable resource currently stands at four million ounces with a grade of 4.4 g/t AuEq. But these are old numbers/values. I’m expecting a substantial increase in the ounce-count when the next resource update drops.

Highlights from this press release (21A Zone):

- 5.15 g/t Au, 21 g/t Ag (5.44 g/t AuEq) over 31.12 m (SK-20-420);

- 36.66 g/t Au, 7 g/t Ag (36.75 g/t AuEq) over 18.32 m (SK-20-421).

22 Zone highlights:

- 6.89 g/t Au, 122 g/t Ag (8.52 g/t AuEq) over 48.74 metres (SK-20-389);

- 3.11 g/t Au, 106 g/t Ag (4.52 g/t AuEq) over 29.60 m (SK-20-384);

- 1.39 g/t Au, 195 g/t Ag (3.99 g/t AuEq) over 86.57 m (SK-20-406);

- 1.99 g/t Au, 127 g/t Ag (3.68 g/t AuEq) over 80.69 m (SK-20-415);

- 2.97 g/t Au, 57 g/t Ag (3.73 g/t AuEq) over 39.80 m (SK-20-416);

- 2.51 g/t Au, 62 g/t Ag (3.33 g/t AuEq) over 59.50 m (SK-20-423).

I view all of the companies featured above as interesting speculations at current price levels (a few well-placed stink bids might get hit if the metal continues to correct).

That’s it for this episode of Highballer.

My plan, if all goes well over the next few days, is to trot out a new pick—a new addition to the Highballer shortlist—within the next week. Until then, take good care.

—Greg Nolan

Full disclosure: Of the companies featured above, HighGold and Forum are Highballer clients. Nomad is an Equity Guru marketing client. The author owns shares of HighGold, Forum, Strategic, Skeena, and Nomad (by way of Coral Gold).