$1,850 (blue line, chart below) is turning into a front line in the brawl between gold bulls and bears.

After breaking through this key support level last week, the snap-back from the $1,767 low, anchored by a surfeit of compelling fundamentals, coincided with the U.S Dollar printing 2.5 year lows.

Short term, the market is eyeing the potential of a fat stimulus package at the behest of U.S. policymakers.

The lack of any real progress on that front is the reason for the recent breakdown and volatility. But short term see-saw swings aside, the medium to long term fundamentals underpinning gold remain intact.

On the upside, the $1,881 level—the 50 period SMA—is likely being surveilled by a whole universe of traders.

The recent price strength in base metals, particularly copper, is also being watched closely.

The reddish, ductile, and superior conductor of electricity and heat is on a tear, taking out multi-year highs.

A host of fundamental factors—tight supplies (low above-ground inventories), policy-driven demand (the EV revolution), and a falling dollar—are conspiring to push prices higher.

Highballer shortlist updates

Cartier Resources (ECR.V)

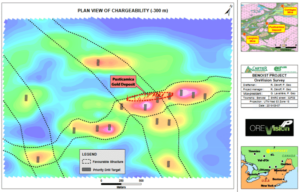

Though Cartier’s Chimo Mine Project currently bears flagship status, their Benoist Property, located along the prolific Windfall belt of mining-friendly Quebec, holds significant resource expansion potential.

An upcoming exploration campaign will consist of three diamond drill rigs and roughly 30k meters of drilling.

The program will center on the deposit itself, and potential extensions.

Approaching land-use negotiations in a spirit of fairness and cooperation needs to be at the top of every ExplorerCo’s To-Do list before a drill rig is mobilized.

On December 9th, Cartier dropped the following headline:

Cartier Resources Signs Mineral Exploration Agreement With The Cree First Nation of Waswanipi

As the headline suggests, Cartier and the Cree First Nation entered into a Mineral Exploration Agreement, laying the foundation for an aggressive drilling campaign at Benoist.

Chief Marcel Happyjack:

“The Paix des Braves agreement established a proper consultation process for forestry activities which allows for the protection and mitigation of sites of special wildlife interests essential to the sustainability of our Cree way of life. The MEA defines a simple framework, based on trust and communication, facilitating consultation and sharing of traditional knowledge with Cartier before, during and after the exploration activities are completed. A big step forward in meaningful consultation during the prospection and exploration stages of mining. I thank Mr. Cloutier for his genuine approach and understanding of our social and cultural reality.”

Philippe Cloutier, Cartier CEO:

“This framework agreement is part of our company’s approach to sound governance and underlines the respect we have for the Cree First Nation of Waswanipi. Communication of the progress of exploration activities of the Benoist project will be shared in real time with CFNW. I thank Chief Happyjack as well as the council for his support in this process.”

Forum Energy Metals (FMC.V)

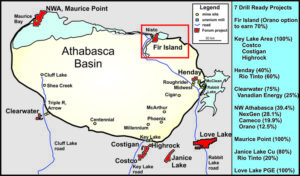

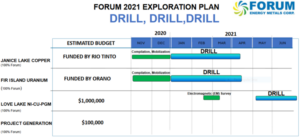

Forum’s 38,250 hectare Janice Lake Copper-Silver project, located in north-central Saskatchewan, is the Company’s flagship asset.

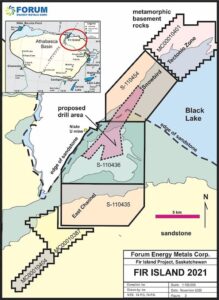

Fir Island, another property in the Company’s project portfolio is a 14,205 hectare chunk of highly prospective terra firm located in the Athabasca Basin.

Fir Island is all about uranium.

Uranium stocks went on a tear in recent sessions. Bellwether Cameco (CCO.T) is a good example of the trajectory many stocks in the sector have experienced of late.

Fir Island flanks the northeast edge of the prolific Athabasca Basin.

The Athabasca Basin is to uranium what the Carlin Trend is to gold.

Senior entity, Orano Canada, is earning a 51% interest in the project by spending $3,000,000 on or before December 31, 2021.

Orano can increase its stake in the project to 70% by spending an additional $3,000,000 (a total of $6,000,000 on or before December 31, 2023).

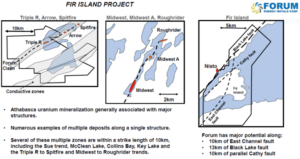

“The regionally important Black Lake fault, part of the major Snowbird Tectonic Zone, transects the entire Athabasca Basin, and is highly prospective for unconformity-type uranium deposits. The sandstone cover varies from 0 to 200m above the unconformity. The possibility of uranium mineralization below the unconformity at the base of the thrust fault (similar to McArthur River) or in the hanging wall of the Cathy Fault in the basement (similar to Millennium or Eagle Point) demonstrates the highly prospective nature of the Fir Island project.”

Cameco’s Centennial deposit is located near the south boundary of the property. The historic Nisto uranium mine (96 tonnes mined at a grade of 1.38%) occurs in basement rocks on the northwest side of the Black Lake fault, directly adjacent to the property.

In early March of this year, the JV partners commenced a diamond drill program at Fir Island—Forum operated the program, Orano funded it as per the option agreement.

Later on, in May, Forum announced results from the modest six hole, 1,819 meter program.

Forum Announces Drill Results from its Fir Island Uranium Project in Saskatchewan’s Athabasca Basin

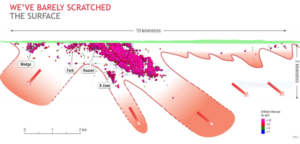

With these holes (Forum also completed a 10 hole reconnaissance drilling campaign totaling 2,435 meters back in 2015), the JV partners confirmed the continuity of the target structure a further one-kilometer to the south.

“Six holes (FI-011 to FI-016) were drilled in an area of low resistivity combined with a series of gravity lows and associated boron soil anomalies of up to 3,350 ppm at the north end of Fir Island. The program was successful in locating the prospective host structure, the East Channel Fault, for uranium mineralization with similar features as the 2015 drilling; a 50 metre offset of the unconformity, strong tectonization of the overlying sandstones and quartz remobilization. Elevated geochemistry with uranium up to 283ppm in a hematized structure in the basement, boron up to 2,160ppm from dravite clays in the basement, plus copper and nickel (314ppm and 2140ppm respectively) was intersected in holes FI-15 and 16 which intersected the East Channel Fault.”

Vectoring in on a potential U308 orebody is not an easy task. It’s important to understand that uranium deposits are often needles in a haystack, even in a prolific setting like the Athabasca Basin.

It can take dozens and dozens of holes to tag a U308 discovery. McArthur River, an Athabasca standout, took 210 pokes with the drill bit.

Further drilling—on a much larger scale—was proposed for Fir Island after those May 2020 results were published.

Ken Wheatley, Forum’s VP, Exploration:

“I am looking forward to following up on this drill program next winter as we have a much better handle on the East Channel structure that has all the characteristics of hosting a major uranium deposit.”

More recently, on December 3rd, the JV partners laid down their next steps for the project.

Here, Forum announced that Orano will be funding a 6,000 meter drill program budgeted at $1.63 million. Two drills will be mobilized to Fir Isle for a 24 hole campaign set to commence next month.

At the end of this Q1 2021 campaign, Orano will have earned a 51% interest in the project and will become operator.

Fir Island is within trucking distance of Orano’s McClean Lake uranium processing facility. Uranium mineralization is associated with the major Snowbird Tectonic Zone. Cameco’s Centennial deposit occurs along the fault at the south margin of the Athabasca Basin and the Nisto deposit, is located near the fault on the north margin of the Athabasca Basin on the border of the Fir Island project. The Nisto deposit produced 96 tonnes grading 1.38% uranium. The Snowbird Tectonic Zone transects the Fir Island project.

Forum has completed two drill programs, two gravity surveys, a resistivity survey and a soil survey over the last five years. The results from these programs are positive, with a series of gravity lows (interpreted to be related to alteration) overlapping a large resistivity low that marks a substantial offset (30 to 50 m) of the unconformity, the Cathy Fault. Drilling has confirmed that the Cathy Fault has associated quartz dissolution and remobilization, tectonization in the sandstone and basement rocks, and dravite/sudoite clay alteration; all excellent indicators for discovering potential shallow uranium mineralization. This year’s drill program is designed to investigate a number of targets defined by these surveys, past drilling, and structural studies completed by Forum and Orano.

In other news, due to popular demand, Forum announced an upsizing to a previously announced financing.

Forum Announces Increase in Financing to $1,500,000

Forum is about to find a whole new gear between Janice Lake and Fir Island drilling-related newsflow. The following slide on the Company’s i-deck lays it all out…

Pure Gold (PGM.V)

I introduced Pure Gold in these pages back in early April of this year at $0.64. It was a no-brainer—gold was consolidating its gains after a powerful push higher off its March 16th crash day lows, and the market had yet to consider the Company’s near-term production potential.

The Company’s upside share price trajectory has been, at times, a bit of a thrill ride…

The message on Pure Gold’s home page reads…

The first million ounces from our Stage One mine will start pouring by Christmas. On plan. On schedule. Generating over $2.3 billion in revenue, with an operating margin of over $1,350 per ounce.

Unwilling to cruise along cautiously after all its recent development, resource expansion, and exploration success, the Company continues to aggressively drill its Red Lake property, churning out one outstanding headline after another.

The Company dropped its latest batch of high-grade values on December 7th.

According to this press release, recent drilling continues to identify extensions to design stopes providing an opportunity to add high-grade tonnes to existing or planned development—high-grade gold was encountered near the main access ramp.

Highlights:

- 23.4 g/t gold over 2.9 meters from drill hole PGU-0143 (including

50.1 g/t gold over 1.0 meter); - 10.3 g/t gold over 6.0 meters from drill hole PGU-0150 (including

27.7 g/t gold over 1.0 meter); - 13.7 g/t gold over 2.2 meters and 13.9 g/t gold over 1.0 meter from drill hole PGU-0144;

- 14.3 g/t gold over 1.5 meters from drill hole PGB-0179;

- 11.6 g/t gold over 1.9 meters from drill hole PGB-0183.

The Company also discovered new gold zones that are currently being integrated into the mine plan.

Darin Labrenz, PureGold CEO:

“These latest high-grade gold intercepts continue to bolster our belief that continued high grade growth will add to the mine plan as we open up new zones. Our continued underground drilling success in concert with our ongoing surface exploration program, forms the foundation of our near-term and extended growth plan for the PureGold Mine. The PureGold Mine will be one of the highest grade gold mines globally, and newly discovered gold zones show potential to add near-term tonnes to our mine plan, with expected lower development costs owing to close proximity to existing development. In addition to ongoing underground drilling, we are actively drilling from surface on several new discovery targets across our seven kilometre gold corridor. With initial gold production imminent, we will continue to deliver exploration success, demonstrate the scalability of our PureGold Mine, and deliver on our objective of building a multigenerational mine in Red Lake, Canada.”

This Company holds an impressive discovery and growth engine in its subsurface stratum. As per the Company’s project page, “We believe this is just the tip of the iceberg.”

Skeena Resources (SKE.T)

I first featured Skeena back in early February of this year at $1.11. Since then, and especially since the March 16th crash day lows, it’s price trajectory has been very satisfactory (note how the 50 period SMA has kept a lid on prices over the past few months).

Recent trading activity represents a breakout. A test of multiple year highs may be in the offing.

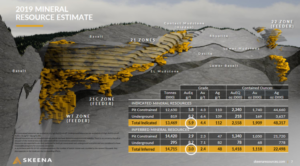

Skeena is aggressively pursuing resource expansion/conversion and exploration growth at its Eskay Creek Project.

Even though the Golden Triangle is in winter lock-down for the vast majority of participants, Skeena is probing Eskay Creek’s subsurface layers with tremendous conviction.

The December 8th headline:

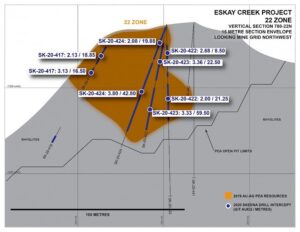

Here, the Company reports additional drill results from a phase-1 (combined) definition and exploration campaign at Eskay Creek.

22 Zone phase-1 infill drilling highlights:

- 1.73 g/t Au, 155 g/t Ag (3.80 g/t AuEq) over 42.80 meters (SK-20-424);

- 3.02 g/t Au, 11 g/t Ag (3.16 g/t AuEq) over 31.50 meters (SK-20-444);

- 1.37 g/t Au, 80 g/t Ag (2.44 g/t AuEq) over 48.00 meters (SK-20-448);

- 1.53 g/t Au, 68 g/t Ag (2.43 g/t AuEq) over 47.50 meters (SK-20-452);

- 20.68 g/t Au, 5 g/t Ag (20.75 g/t AuEq) over 11.78 meters (SK-20-456).

The phase-2 infill program, focused on resource category conversions for an ongoing Pre-Feasibility Study, is currently active with twelve drill rigs.

22 Zone phase-1 infill drilling intersects predicted mineralization:

The 2020 Phase 1 infill program at Eskay Creek continues to verify the expected grades, thickness and continuity of mineralization modelled in the 22 Zone as demonstrated by 1.73 g/t Au, 155 g/t Ag (3.80 g/t AuEq) over 42.80 m (SK-20-424). This intercept correlates well with two intervals of 3.36 g/t AuEq over 22.50 m and 3.33 g/t AuEq over 59.50 m (SK-20-423) positioned 15 m down-dip.

An additional, near surface zone of high-grade mineralization analogous to the 22 Zone lies 200 m to the northeast. This zone is parallel to the 22 Zone and averaged 20.68 g/t Au, 5 g/t Ag (20.75 g/t AuEq) over 11.78 m (SK-20-456) and 6.18 g/t Au, 5 g/t Ag (6.24 g/t AuEq) over 7.56 m (SK-20-468). This area has potential for expansion with further drilling.

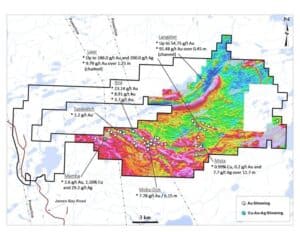

Harfang Exploration (HAR.V)

Harfang’s flagship project—the Serpent Property—is located in the James Bay region of Quebec.

Over the past year, multiple rounds of exploration, both geochemical and geophysical, have led to the discovery of more than 35 orogenic gold and intrusion-related Cu-Au-Ag mineralized occurrences.

With an induced polarization survey and a maiden 4,000 maiden drilling program planned for this winter, the Company tabled the following raise on December 9th:

Harfang Completes a $ 4.2M Private Placement

$4.2M will go a long way in Quebec where the government refunds roughly 40% of all exploration expenditures—a huge incentive for companies like Harfang to push their projects further along the curve.

The private placement of $ 4,238,350 (the “Offering”) consists of:

- 9,208,142 units (the “Units”) at a price of $0.35 per unit, for an amount of $3,222,850, each Unit being comprised of one (1) common share of Harfang and one half (1/2) common share purchase warrant, each whole warrant entitling its holder to subscribe for one (1) common share at a price of $0.55 per share during a 24-month period;

- 2,031,000 flow-through common shares (the “FT Shares”) at a price of $0.50 per FT Share for an amount of $1,015,500.

And, this just in…

HighGold Mining (HIGH.V)

As most here already know, HighGold’s Johnson Tract Gold Project (JT) in Southcentral Alaska is the flagship project.

We’re expecting drill results from JT at any time, and assays will continue to flow well into Q1 of 2021.

The Company is also active in the prolific Timmins camp of Ontario.

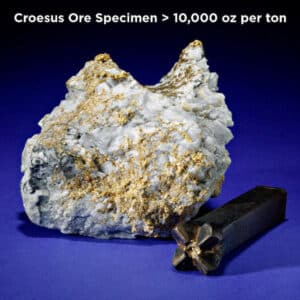

The Company’s Munro-Croesus Gold Project includes a past-producing mine that yielded some of the highest-grade gold ever mined in Ontario.

Just moments ago, in the early morning hours of this December 14th, HighGold dropped the following headline:

Here, the Company announced the acquisition of three mineral properties surrounding its Munro-Croesus project.

This is a significant acquisition.

These new property acquisitions increase the size of Munro-Croesus by more than 40%, creating a single contiguous property with an area of 28 km2 (2,787 ha).

Consolidation Activities in 2020

In the past 12 months, the Company has completed seven separate transactions to consolidate a patchwork of mining claims held by many different landowners. Most are patented mining claims that were originally established in the early to mid-1900s and have seen no modern exploration work. HighGold’s historic Croesus mine property, renowned for its high-grade gold mineralization has been the nucleus to the land consolidation effort and HighGold is the first company to assemble the surrounding claims under single ownership. The Royal Ontario Museum (ROM) holds five Croesus ore specimen samples that collectively weigh 85 pounds and contain 480.7 ounces of gold or 11,310 oz. gold per short ton (387,727 g/tonne). In addition to the past producing Croesus mine, the Project hosts numerous other gold prospects that include pits, trenches and exploration shafts developed early in the last century. Several +1,000,000-ounce gold deposits are located within a 2-to-7-kilometer radius of the Project, including the currently operating Black Fox Mine complex, the former producing Ross Mine, and the development stage Fenn-Gib deposit.

(Readers are cautioned that the Company has no interest in or right to acquire any interest in the Black Fox Mine complex, the Ross Mine or the Fenn-Gib deposit, and that mineral deposits, and the results of any mining thereof, on adjacent or similar properties are not indicative of mineral deposits on the Company’s properties or any potential exploitation thereof)

Darwin Green, HighGold CEO:

“Consolidation of Munro-Croesus has created a single large property package in a highly prospective region of the greater Timmins gold camp; this strategic land position has received almost no contemporary exploration due to the historically fractured land ownership. This represents a rare opportunity in a mature and productive gold jurisdiction and we are excited to initiate the first modern, systematic exploration of the greater Project area. Central to our exploration thesis is a high conviction that the exceptional tenor of gold grades produced from the Croesus mine near the turn of the last century does not occur in isolation and is indicative of a highly fertile gold environment.”

This press release goes on to state that the Company has completed its fall drill program in the Timmins camp.

Four holes totaling 1,179 meters were completed at the Golden Mile property and 31 shallow holes totaling 2,645 meters were completed at Munro-Croesus. Assay results will be reported in batches as they are received.

Currently, the Company is in the midst of a detailed airborne magnetic-EM geophysical survey over the project area with plans to have drills turning again in February.

That’s it for this episode of Highballer.

Between now and the end of the year I’ll be rounding up all of the companies on the Highballer shortlist.

I’ll also be sizing up candidates for my Top-3 picks for 2021.

END

—Greg Nolan

Full disclosure: Of the companies featured in this report, HighGold, Cartier, and Forum are Highballer clients. The author owns shares of HighGold, Cartier, Forum, Harfang, and Skeena. Color me biased.