Having bookended the month of March with a Double Bottom and smashing through stubborn resistance at $1800 last week (a hard-fought 10-week high), Gold is holding on to its gains, settling in above that critical $1,800 line.

The next stop for the precious metal is the 200 SMA at roughly $1856. Once that level falls, $1900 should be easy peasy…

Last Friday’s jobs numbers registered the second biggest miss in the report’s history—266,000 vs analysts’ estimates of 990,000 (some economists’ were expecting to see more than 2 million jobs created). This dramatic miss buoyed the precious metal to some degree as it removed the threat of the Fed tapering anytime soon.

Regarding the very real threat of inflation, we stated the following recently…

Rising inflation—a phenomenon known to trigger powerful and sustainable moves in the metal—is now a reality. This sudden loss of purchasing power could mark the beginning of a destructive trend. The Fed was expecting it, but believes the outbreak will be transitory.

You don’t need a degree in economics to see what’s happening here in North America—everything is more expensive today than it was only months back… everything we use and consume in our everyday lives.

After some surprisingly strong Producer Price Index (PPI) numbers released on April 13th—the U.S. PPI popped 1% month-on-month pushing its annual headline rate to 4.2% (the highest in nearly a decade)—the U.S. Labor Department reported a 0.6% rise in its U.S. Consumer Price Index (CPI) for March. This follows a 0.4% rise in February. Consensus forecasts anticipated a 0.5% pop.

The report stated: “The March 1-month increase was the largest rise since a 0.6-percent increase in August 2012”

Gold’s reaction in the minutes following these higher-than-expected inflation numbers shows that the market is beginning to suspect that this price pressure may not be as ” transitory” as the Fed hopes (hope is a weak prayer).

The Fed is in the mother of all binds here. It can’t pull the trigger on higher rates. To do so would kill whatever momentum the U.S. economy can generate.

It would appear that no matter what the Fed does, it’ll be behind the (inflation) curve.

You can feel the shift in sentiment taking place. The market senses this inflation threat is real.

Rising inflation and low interest rates almost guarantee real rates are going to remain deep in negative territory for the foreseeable future.

Gold is a no-brainer in this environment.

Looking at copper—if you believe we’re in a structural bull market that will rage on for years (decades?) as the global economy accelerates its push to electrify—its recent price action, taking out all-time historic highs, will have come as no surprise.

There will be no decarbonization without this soft, malleable, red-orange metal—a red-orange metal with superior thermal and electrical conductivity properties, I might add.

Electric vehicles (EVs) require roughly 183 lbs of Cu (electric buses require between 500 and 800 lbs).

Even the charging stations that keep these vehicles in motion require copper—heaps of it:

EV sector will need 250% more copper by 2030 just for charging stations

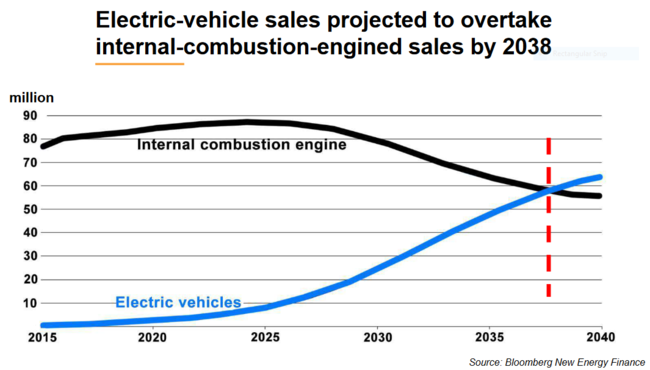

The pace at which EVs are rolling off the assembly line is best characterized visually…

More examples of the role copper will play in a greener world:

- Flywheels (pumped hydro) will require .3 to 4 tonnes of Cu per megawatt (MW).

- Wind turbines will require 3.6 tonnes of Cu per MW.

- Solar panels will require 4 to 5 tonnes of Cu per MW.

According to the International Energy Agency, worldwide demand for air conditioning is expected to triple over the next 30 years:

- 52 lbs of Cu will go into each cool air unit.

- 8 billion cool air units are expected to be in use worldwide by 2050.

- China, India, and Indonesia will account for roughly half of this global increase in electric power demand.

19% of today’s energy is electricity. Over the next 30 years, that number is expected to reach 50%.

Due diligence I performed for Equity Guru a few months back uncovered the following stats regarding supply:

- The lion’s share of the world’s primary Cu supply comes from only 20 mines.

- The world has less than 20 years’ worth of (economic) copper reserves remaining.

- The 14 largest producers show an average reserve grade of .62% (large deposits running grades north of 1% are exceedingly rare).

- Future copper projects – the 19 largest development projects on deck – run grades averaging roughly 0.5%.

- Further down the foodchain, for the next group of large development projects, 0.4% will be the average.

- The Cu sector is suffering from years of underinvestment – massive sums will be required to bring these lower-grade deposits online.

Where could Cu prices ultimately peak over the next decade?

Goehring & Rozencwajg in its recent Natural Resource Market Commentary:

“We would not be surprised to see copper prices again advance a minimum of seven-fold before this bull market is over. Using $1.95 as our starting point, we expect copper prices to potentially peak near $15 per pound by the latter part of this decade.”

While on the subject of copper…

Forum Energy Metals (FMC.V)

- 148.23 million shares outstanding

- $54.85M market cap based on its recent $0.37 close

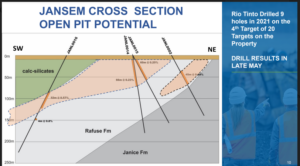

We’re currently waiting on assays from the flagship Janice Lake Copper-Silver Project where Forum and Rio Tinto (RTEC) have their sights set on a large sedimentary hosted Cu deposit (RTEC can earn up to 80% in the project by spending $30M).

Nine holes for a total of 2,330 meters were drilled along the Rafuse Target, a 2.8-kilometer long corridor characterized by surface copper mineralization developed during RTEC’s mapping, prospecting, and geophysical campaign last summer.

According to Forum’s CEO, Rick Mazur, the labs are currently “inundated and slow”. Par for the course, but we should see our first Janice Lake assays by the end of May.

Mazur anticipates a continuation of Janice Lake drilling this summer.

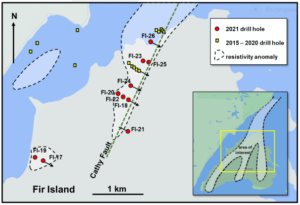

We’re also waiting on results from a winter drilling campaign at the Fir Island Uranium Project located along the northeast edge of the prolific Athabasca Basin.

Operated by Forum, Orano Canada can earn up to 70% in the project by spending up to $6 million. Ten holes for 3,051 meters were drilled testing the Cathy Fault/resistivity anomaly and a smaller resistivity low in the southwest corner of the project (map below).

Yesterday, the Company dropped the following headline concerning its wholly-owned Love Lake Nickel-Copper-PGM Project located approximately 60 kilometers northeast of the Janice Lake JV.

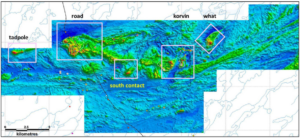

A 588 line-km airborne electromagnetic (EM) survey is in the works at Love Lake.

The HeliSAM system (a Time Domain Electromagnetic system) will focus on five areas at 100m line spacings – the Tadpole, Road, South Contact, Korvin and What Grids (map below). The HeliSam survey is capable of detecting magmatic nickel-copper-PGM deposits to significant depths and will bring the project to a drill-ready state. Forum is currently making arrangements for a drill program in the late summer, the scale of which will be dependent upon the results of the EM survey.

Forum currently has roughly $3.7M in the till of which $1.3M is flow-through. In-the-money option and warrant exercises continue to top-up up the treasury.

This summer’s drilling campaign at Love Lake is fully funded, but if this latest round of geophysics turns up additional targets, another raise may be necessary later this year.

But during a recent interview, Mazur was emphatic that he’s NOT interested in raising additional funds at current prices.

Janice Lake is what has my undivided attention here, not to dis the discovery potential at Fir Isle and Love Lake (both could be game-changers). The world needs large copper deposits and Janice Lake has world-class potential. RTEC is only interested in top-shelf orebodies.

FYI, CEO Mazur will be attending the upcoming London 121 (virtual) EMEA from May 25 to May 27.

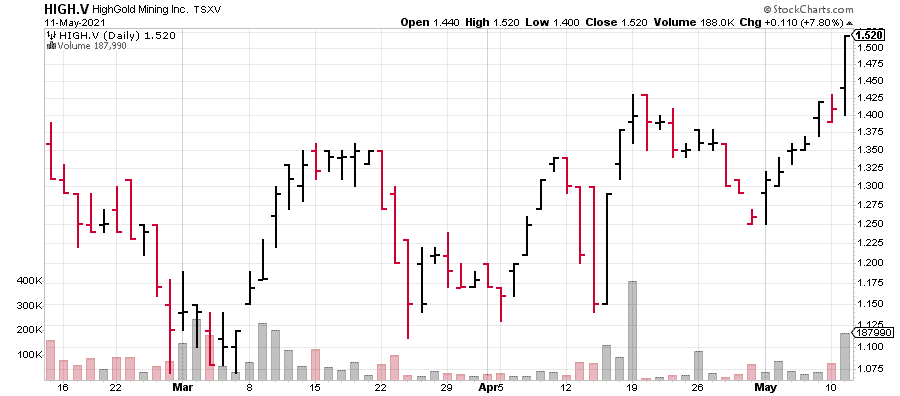

HighGold Mining (HIGH.V)

- 54.19 million shares outstanding

- $82.37M market cap based on its recent $1.52 close

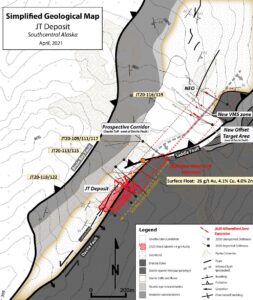

On May 5th, HighGold tabled an initial C$10 million exploration budget for its 21,000-acre (0.75 million ounce, 10.9 g/t gold AuEq) Johnson Tract polymetallic Gold Project in Southcentral Alaska, USA.

HighGold Mining Announces $10 Million Alaska Johnson Tract 2021 Exploration Program

Plans & strategy for this 2021 exploration campaign:

- Minimum 16,000 meters of drilling with three drill rigs

- Drilling to target both:

- Expansion and infill to upgrade of the JT Deposit plus adjacent target areas;

- First-time testing of other Johnson District prospects, including the new 1 km x 0.5 km High-Grade Ag-Au Vein Field discovered by prospecting in 2020 at the DC Prospect 4 km northeast of the JT Deposit;

- Property-wide magnetic-electromagnetic (“VTEM”) airborne geophysical survey totalling 1,100 line-km to identify major fault structures and prospective areas of subsurface mineralization;

- Detailed IP-Resistivity (“DCIP”) ground geophysical surveys over several Johnson District regional prospects to detect prospective mineralized trends;

- Geological mapping, prospecting, and soil & rock sampling programs to follow-up and expand on the positive results generated from the 2020 program and refine drill targets.

Darwin Green, HighGold’s CEO:

“Our exploration team’s mandate in 2021 includes both establishing critical mass at the JT Deposit and making new discoveries. The JT Deposit is open to expansion and a priority for this program is to continue tracking and expanding the deposit farther down-plunge. We have high conviction in the potential to define a multi-deposit district at Johnson Tract and are excited to be drill testing several of the priority regional prospects for the first time ever. With C$17 million in working capital, HighGold is fully funded for the planned program.”

The following video link details and highlights the Company’s plans for 2021…

HighGold Mining releases aggressive 2021 exploration program at Johnson Tract

The market will be watching HighGold closely this summer.

Slide #14 from the Company’s pitch deck offers a good reminder of the extraordinary subsurface values JT is capable of generating—thick intervals of high-grade mineralization like 107.8 meters grading 19.6 g/t AuEq.

The Company’s shares have seen positive price appreciation in recent sessions in what some characterize as a “stealth share price recovery“.

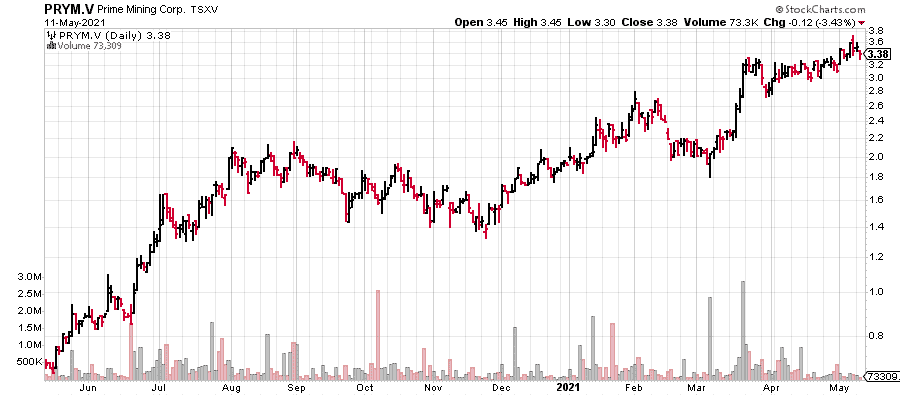

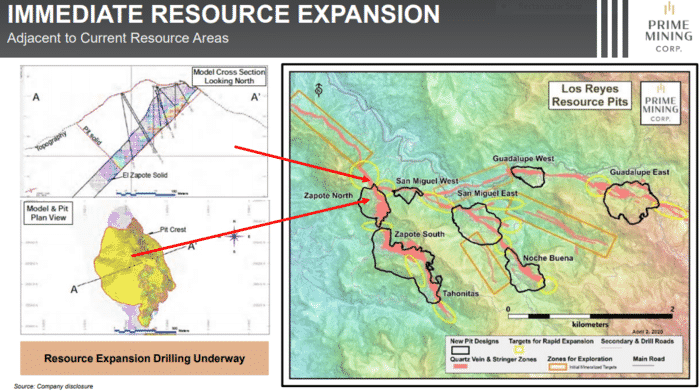

Prime Mining (PRYM.V)

- 98.69 million shares outstanding

- $333.59M market cap based on its recent $3.38 close

Prime has demonstrated some powerful price trajectory since its market debut in September of 2019…

On April 27th, the Company dropped the following headline…

Prime Mining Announces Closing of C$28.8 Million Bought Deal Private Placement Financing

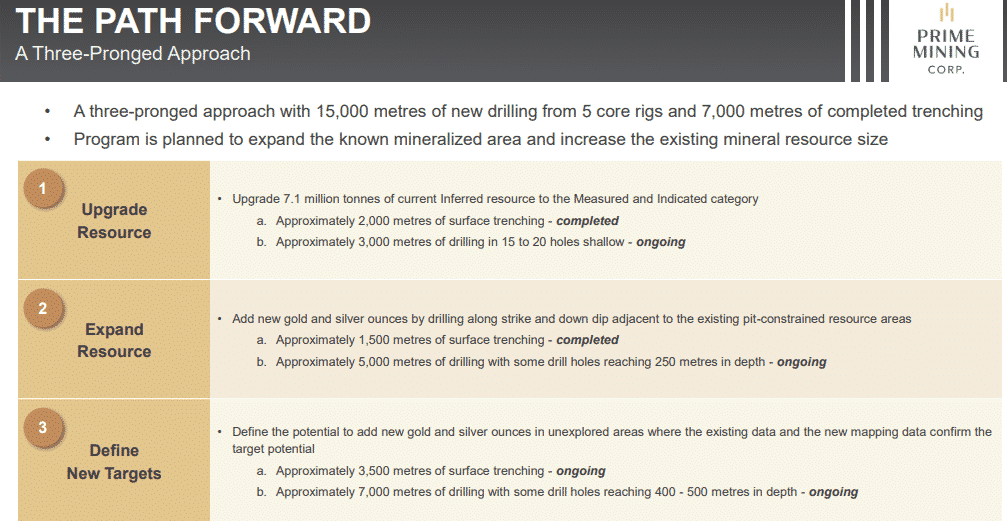

$29M will go a long way towards pushing its flagship Los Reyes Project further along the development curve.

A total of 9,746,250 units, including the full exercise of the over-allotment option, were sold at $2.95 for gross proceeds of roughly $28,751,438.

Each unit consists of one Prime common share and one-half of a 3-year $5.00 warrant. I like these terms. The half warrant with a significant out-of-the-money strike price speaks to the quality and confidence behind this crew, and its flagship asset.

Desjardins Capital Markets acted as sole bookrunner and co-lead underwriter along with TD Securities Inc., on behalf of a syndicate of underwriters including Clarus Securities Inc., BMO Capital Markets, Stifel GMP, and PI Financial Corp., in connection with completion of the Offering. The net proceeds from the Offering will be used by the Prime for exploration and development of the Company’s Los Reyes mineral property and for general corporate purposes.

The Offering included a subscription from an insider of the Company for an aggregate of 770,978 Units.

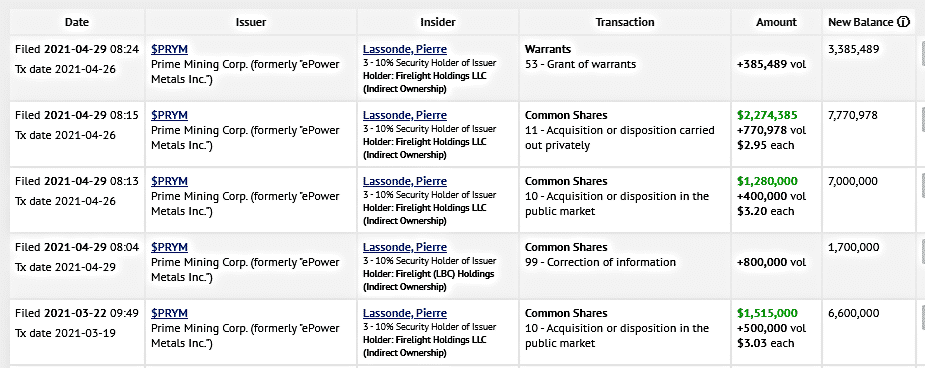

Pierre Lassonde is a name that often pops up when Prime is discussed. Lassonde already owns a significant chunk of Prime’s outstanding common—slide #5 from the Company’s pitch deck shows him with a 12.5% stake in the Company.

Recent insider filings show a man who can’t seem to get enough of the stock, even after its extraordinary multi-bagger run (click on the image to gain clarity)…

Additional assays from Los Reyes should be released shortly and will continue to flow over the balance of 2021.

Banyan Gold (BYN.V)

- 180.45 million shares outstanding

- $43.31M market cap based on its recent $0.24 close

Over the past two weeks, Banyan has generated significant newsflow.

An April 27th headline – Banyan Gold Reports 0.88 g/t Gold Over 54.6 Metres in the First Holes from 2021 Powerline Drilling, Aurmac Property, Yukon

Highlights from the first three 2021 Powerline zone drill holes:

- 0.88 g/t Au over 54.6 metres from 80 m in AX-21-66;

- 0.56 g/t Au over 67.5 metres from 60.5 m in AX-21-68;

- 0.38 g/t Au over 177.9 metres from surface m in AX-21-67.

Tara Christie, President and CEO:

“The 2020 drill program established a larger footprint for Powerline gold mineralization and these first three drill holes of 2021 continue to build on that success to demonstrate the size potential of the near/on-surface Powerline target. With 23 holes completed so far in 2021, Banyan is well-positioned to meet our 2021 objectives with continued and steady news flow throughout the spring, summer and into the fall”.

A May 3rd headline – Banyan Gold Reports 90% Leachable Gold and Rapid Recoveries From Metalurgical Test Work of Airstrip and Powerline Zones, Aurmac Property, Yukon

This May 3rd press release is all about recovery rates (metallurgy).

Ask any mining man (or woman) and they’ll tell you that metallurgy—the science of extracting valuable metals from their ores and modifying said metals for their intended use—trumps all other considerations.

Highlights:

- Gold recoveries from this work demonstrate strong heap leach kinetics and there appears to be no correlation between sulphide content and gold recovery;

- Bottle roll test work indicates rapid leach kinetics and favorable recoveries in the oxide and sulfide zones of the AurMac Deposits;

- Ultimate extraction recoveries for gold were generally greater than 80%, and as high as 96%

- Ten (10) Airstrip Zone samples achieved extraction for gold that ranged from 80% to 96% and averaged 90%;

- Five (5) Powerline Zone samples achieved extraction for gold that ranged from 86% to 92% and averaged 89%.

CEO Christie:

“We are very pleased with these metallurgical results from AurMac which have exceeded our expectations with an average recovery of 90%. The results validate the potential for an open-pit, heap leach operation, with high recoveries from oxide and sulphide ore. Drilling is ongoing, rapidly expanding the mineralized footprint at Powerline“.

A May 11th headline – Banyan Gold Powerline Mineralization Expansion Continues, Including 0.75 G/T Gold Over 45.2 Metres, Aurmac Property, Yukon

Here, we have additional assays from the Powerline zone.

Powerline zone highlights:

- 0.75 g/t Au over 46.6 metres from 52.5 m in AX-21-70;

- 0.55 g/t Au over 51.9 metres from surface 115.8 m in AX-21-71;

- 0.48 g/t Au over 45.2 metres from 67.0 m in AX-21-69.

CEO Christie again:

“We have continued to expand the drill grid around the Powerline, building upon the known mineralization rapidly and efficiently; and importantly, have intersected gold mineralization in all directions. With over 6,300 m of drilling completed as of today’s date and the highly encouraging metallurgical results announced last week (90% average recoveries from all ore types) Banyan continues to rapidly advance AurMac“.

This very recent interview with CEO Christie offers additional insights worth noting…

Skeena Resources (SKE.T)

- 222.24 million shares outstanding

- $748.96M market cap based on its recent $3.37 close

Skeena has also been active on the news front with three headlines in recent sessions.

An April 27th headline – Skeena Intersects 45.76 g/t Au over 5.60 metres at Snip Gold Project

Here, the Company reported assays from a 2020-2021 campaign of exploration drilling at its Snip gold Project, next door to its flagship Eskay Creek Project in the Golden Triangle of British Columbia.

The program was focused on resource expansion and exploration drilling along previously unexplored areas of the near-mine environment. The surface-based program was comprised of ten drill holes for a total of 5,366 metres.

Snip Drilling Highlights:

- 45.40 g/t Au over 0.50 m (S20-047);

- 45.76 g/t Au over 5.60 m (S20-049);

- 29.52 g/t Au over 4.03 m (S20-049);

- 37.78 g/t Au over 2.86 m (S20-049).

A May 4th headline – Skeena Intersects 4.94 g/t AuEq over 8.20 metres at Eskay Creek in New Mineralized Corridor

Here, the Company reported assays from its 2021 exploration campaign at Eskay Creek testing both in-pit and near-mine targets for a total of 4,375 meters across twenty surface-based drill holes.

Eskay Creek 2021 Drilling Highlights:

- 1.01 g/t Au, 6 g/t Ag (1.09 g/t AuEq) over 9.46 m (SK-21-703);

- 1.92 g/t Au, 25 g/t Ag (2.25 g/t AuEq) over 7.50 m (SK-21-810);

- 1.54 g/t Au, 27 g/t Ag (1.90 g/t AuEq) over 13.70 m (SK-21-821);

- 1.54 g/t Au, 10 g/t Ag (1.68 g/t AuEq) over 15.68 m (SK-21-824);

- 2.22 g/t Au, 9 g/t Ag (2.33 g/t AuEq) over 15.20 m (SK-21-824);

- 1.17 g/t Au, 6 g/t Ag (1.25 g/t AuEq) over 19.70 m (SK-21-824);

- 1.31 g/t Au, 14 g/t Ag (1.50 g/t AuEq) over 33.00 m (SK-21-824);

- 1.08 g/t Au, 10 g/t Ag (1.22 g/t AuEq) over 16.56 m (SK-21-829);

- 3.99 g/t Au, 71 g/t Ag (4.94 g/t AuEq) over 8.20 m (SK-21-838).

A May 10th headline – Skeena Resources Announces C$50.0 Million Bought Deal Public Offering

Here, the Company announced a bought deal raise with a syndicate of underwriters led by Raymond James and Canaccord Genuity Corp.

The underwriters have agreed to buy 16,129,033 common shares at a price of C$3.10 for gross proceeds of approximately C$50.0 million.

Having traded as high as $3.75 in recent weeks, the offering price strikes me as low. But there are no dilutive bells n whistles attached to this raise (no warrants).

The Company states that net proceeds from this offering will be used “to fund exploration and development activities at the Eskay Creek Project and Snip Gold Project and for general administration and corporate purposes.”

White Gold (WGO.V)

- 131.9 million shares outstanding

- $89.69M market cap based on its recent $0.68 close

A May 6th headline – White Gold Corp. Outlines Significant Gold Anomalies at the Nolan Property, Yukon, Canada

It’s been a good stretch between press releases, the last tabled on March 25th.

One would think that with such a vast project pipeline, we’d see headlines drop every other week or so.

Here, the Company summarized recent activity across its district-scale landholdings—some 420,000 hectares—in the prolific White Gold District of Canada’s Yukon. It also offered a peek at what’s in store this field season.

Highlights:

- The Nolan property is located in the active Sixtymile placer gold camp of west Yukon, which has produced over 500,000 ounces of placer gold to date.

- The property hosts multiple large targets with the potential for several mineral deposit types including orogenic gold, epithermal precious and base metal veins and porphyry Cu-Mo-Au.

- 2020 Exploration work included ground magnetics, VLF-EM surveys and 1,648 infill soil geochemistry samples in the Mount Hart area, with values of up to 1120 ppb Au, which has further enhanced several multi-element anomalies within a large (5km N-S x 3.5km E-W) anomalous area that will be further evaluated this coming season.

- The Company also announces its participation in several upcoming virtual conferences and invites interested parties to register to learn more about the Company’s unique district-scale gold exploration opportunity with significant defined resources, recent discoveries and new discovery potential in the prolific White Gold District, Yukon, Canada.

David D’Onofrio, CEO:

“We are very pleased with the delineation of these targets in this area of significant placer mineralization. It is further evidence of the expansiveness of gold mineralization in the White Gold District, and the effectiveness of our exploration methodologies. The exploration methodologies and results to date are encouraging based on the similarities to those that have led to the discovery of significant deposits within the White Gold District. We are excited to advance these targets with additional testing and first ever diamond drilling in the coming months.”

Unless I’ve missed something, follow-up drill results from the highly prospective Titan target (72.81 g/t Au over 6.09 meters including 136.36 g/t Au over 3.05 meters) have yet to drop. Titan was drilled last summer in a follow-up campaign. Sup with the assay delay fellas?

Valuation-wise, with a global ounce-count of 1,139,900 ounces Indicated and 632,1000 ounces Inferred, White Gold’s current $90M market cap strikes me as very reasonable (high-quality ozs, these).

That’ll be all for this episode of Highballer.

END

—Greg Nolan

Of the companies featured above, only Forum Energy Metals is a Highballer client.