The following is a brief update related to two of the companies we follow closely here at Highballer. Brief, because it’s currently pushing 41C (107F) as I tap away on my keyboard, beads of sweat colonizing my forehead and the nape of my neck. I’ve consumed 8 liters of H2O and my day is barely half done.

B.C. sets new Canadian record for hottest temperature ever recorded

Moving along…

Forum Energy Metals (FMC.V)

- 151.02 million shares outstanding

- $57.39M market cap based on its recent $0.38 close

I covered recent developments at Forum’s flagship Janice Lake Copper/Silver Project on June 17th in an offering titled Forum Energy Metals (FMC.V) tags high grade Cu at Janice Lake Project in mining-friendly Saskatchewan

The one piece of information we lacked on June 17th was Rio Tinto Exploration Canada’s (RTEC’s) intentions concerning Janice Lake this summer. We got our answer on June 24th.

Rio Tinto Commences Drilling at Forum’s Janice Lake Copper/Silver Project, Saskatchewan

The drills are turning at Janice Lake.

Following a successful winter drill season of high grade copper intersections on the 2.8 kilometre long Rafuse target, RTEC will follow up drilling on the structurally controlled mineralization encountered in Hole JANL00028 grading 0.86% copper and 8.02 g/t silver over 14 metres, including 6m of 1.67% copper and 13.6 g/t silver and stratabound mineralization encountered in Hole JANL0023 grading 0.325% copper and 2.04 g/t silver over 48 metres, including 1.78% copper and 9.25 g/t silver over 3.15 metres (see news releases dated May 25 and June 9, 2021).

The limited drilling by RTEC to date has shown that multiple occurrences of shallow copper mineralization amenable to open pit mining are present and are working to find more.

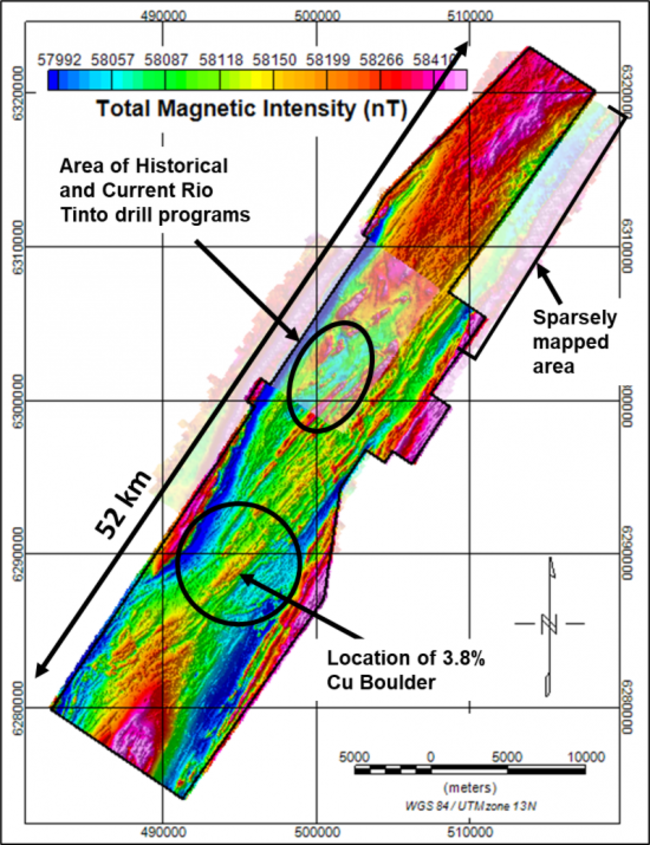

Note the mag high circled on the bottom of the above map and the proximity of a boulder grading 3.8% Cu—the upshot of a 2020 ground campaign (RTEC will be hitting the ground hard this summer with an aggressive prospecting campaign, one designed to cover the full extent of this 52-kilometer trend).

All told, RTEC has the following planned for Janice Lake this summer:

- Estimated ten holes for a total of 2,800 meters on the Rafuse target.

- A LIDAR survey over the full extent of the property to locate outcrop through the forest canopy and interpret glacial geology to aid in geochemical prospecting.

- RTEC has assembled a larger team of geologists and prospectors to continue the initial mapping and prospecting undertaken in 2020. The focus will be to increase the density of mapping and prospecting in prospective areas already identified by mapping and to map/prospect in areas that were not reached in 2020.

Forum is not a one-trick pony. We should also have news concerning the Company’s wholly-owned Love Lake Ni-Cu-Pt-Pd Project in the coming days/weeks. Management has plans to drill Love Lake this summer in a program that will likely overlap the Janice Lake campaign.

To that end, the Company dropped the following headline on June 24th:

Forum Announces Non-Brokered Flow Through Private Placement of up to C$2.5 Million

These are flow-through units priced at $0.45.

Each FT Unit will consist of one flow-through share and one-half of a 2-year warrant exercisable at $0.57.

There’s an appetite for high-quality base metal and U3O8 plays in the junior arena. Only hours after tabling this raise, Rick Mazur, Forum’s CEO, upsized the PP…

Forum Announces Upsize of Non-Brokered Private Placement of up to C$3.5 Million

Forum Energy Metals Corp. (TSXV: FMC) has three 100% owned energy metal projects being drilled in 2021 by the Company and its major mining company partners Rio Tinto and Orano for copper/silver, uranium and nickel/platinum/palladium in Saskatchewan, Canada’s Number One Rated mining province for exploration and development. In addition, Forum has a portfolio of seven drill ready uranium projects and a strategic land position in the Idaho Cobalt Belt. For further information: www.forumenergymetals.com

HighGold Mining (HIGH.V)

- 59.34 million shares outstanding

- $83.67M market cap based on its recent $1.41 close

In what might be one of the more closely watched drill campaigns this summer, HighGold recently commenced drilling at its flagship Johnson Tract Project in Southcentral Alaska, adding 4k meters to the previously announced program.

The June 23rd headline…

HighGold Mining Increases Johnson Tract (Alaska) Drill Program to 20,000 meters – Drills Now Turning

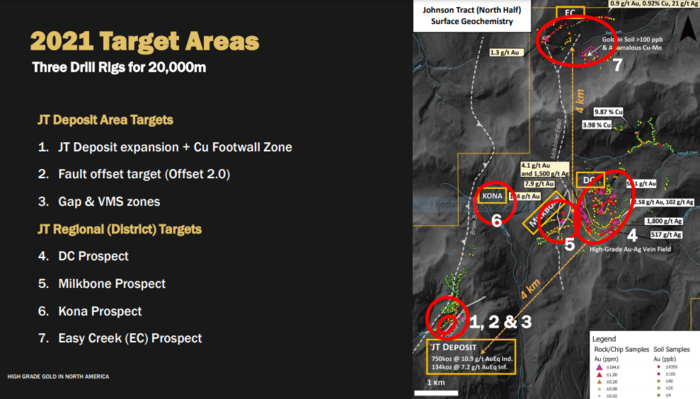

Drilling began during the week of June 23rd with three rigs—two at the JT Deposit and one at the DC Prospect (a regional target).

50-70% of the program’s meterage will be directed at the JT Deposit area where the current resource stands at 834k high-grade AuEq ounces (Indicated and Inferred). 30-50% will be directed at regional prospects.

At the JT Deposit area, priority drill targets include:

- JT Deposit – Expansion along strike and down-plunge in nominal 100-meter step-outs from the 750koz at 10.9 g/t gold equivalent (“AuEq”) indicated mineral resource;

- Footwall Copper Zone – Step-outs at depth from the copper-rich mineralized ‘feeder’ zone first discovered in 2019 (20.7 meters at 32 g/t Ag, 2.4% Cu, 4.9% Zn) in hole JT19-089, including 7.0 meters at 66 g/t Ag, 4.7% Cu, 9.7% Zn;

- Revised Fault Offset Target – testing the new interpretation of the JT Deposit fault displacement;

- GAP Target – widely-spaced fans of holes to test the poorly drilled area immediately along strike to the northeast from the JT Deposit and the inferred source of mineralized boulders grading up to 26 g/t Au, 4.1% Cu and 4.0% Zn; and

- New 2020 VMS zone – follow-up on the 2020 intercept, which returned 7.8 meters at 6.1% Zn, 1.6% Pb, 0.2% Cu, 0.7 g/t Au, 36 g/t Ag in hole JT20-114, including 3.9 meters at 9.1% Zn, 2.3% Pb, 0.3% Cu, 0.8 g/t Au, 47 g/t Ag.

There’s excellent potential to grow the current AuEq ounce count in the immediate vicinity of the JT deposit.

This 2021 program will also include definition drilling and metallurgical test work with a future resource update and potential engineering studies in mind.

Johnson Tract District regional prospects to be tested with the drill bit include:

- DC Prospect – characterized by a series of large gossan alteration zones similar in style to the JT Deposit and including a 500 x 1000 meter silver-rich New Vein Field discovered by HighGold geologists last season that consists of multiple sets of low-sulphidation epithermal crustiform quartz veins, vein swarms, and siliceous breccias;

- Milkbone Prospect – located 400m west of the silver-rich New Vein Field at the DC Prospect, this prospect is defined by a strong gold-in-soil anomaly (70 to 4,390 ppb Au) with supporting high-grade rock sample results from near-source boulders and subcrop (up to 184 g/t Au); and

- Kona Prospect – a large-scale alteration zone associated with a strong IP chargeability geophysical anomaly.

The Company laid a foundation for this regional potential in 2020 via a vigorous campaign of mapping, prospecting, soil sampling… and a round of geophysics.

The upshot of this groundwork—DC, Milkbone, Kona, Easy Creek… multiple high-priority regional targets along a 12-kilometer trend characterized by pervasive alteration. This adds an interesting speculative dynamic to the 2021 field season.

Darwin Green, HighGold’s CEO:

“It feels great to have the drills turning again at Johnson. During the off-season, our geological team developed and refined a large number of high-quality drill targets that we are eager to pursue. The upsized program allows us to more aggressively test these target areas, particularly amongst the regional prospects, most of which are being drill-tested for the very first time.”

20k meters will generate significant newsflow for the balance of 2021.

END

—Greg Nolan

Full disclosure: Forum is a Highballer marketing client (color me biased).

Hi Greg, have you taken a look at the recent results for Metalstech and their Sturtec mine in Slovakia? 70odd meters at over 9gpt AU…also they just sold their lithium assets for around $18m so are cashed up for new drill program starting this week. Current mkt cap is below 40m Aud… BIG resource at a tiny price. May be worth a look…I’m trying to accumulate at 22-24cents range. All the best, tony

Hi Tony. I’m not familiar with the project but I like that 70 meter hit. I’ll take a look.