I suspect the recent merger of Agnico Eagle and Kirkland Lake—a transaction valued at $13.4B—will mark an acceleration in M&A activity from hereon. A wise junior exec echoed similar sentiment during an enlightening conversation last week.

Junior companies with significant resources—those with meaningful ounce-counts in mining-friendly jurisdictions—will find themselves encircled by resource-hungry predators (Producers looking to bulk up their project pipelines rendered lean by a brutal bear market last decade).

With that prospect in mind, in my last Highballer report, I pointed out:

Though we’re not at the (extreme) levels registered in early 2019, some of the companies I track are getting close—there are a number of high-quality entities trading at sub-$10M, even sub-$5M valuations… valuations that strike me as absurdly low.

In my next report, I plan to highlight one such company.

The company I hinted at is Goldseek.

- 32.96 million shares outstanding

- $5.6M market cap based on its recent $0.17 close

- Corporate presentation

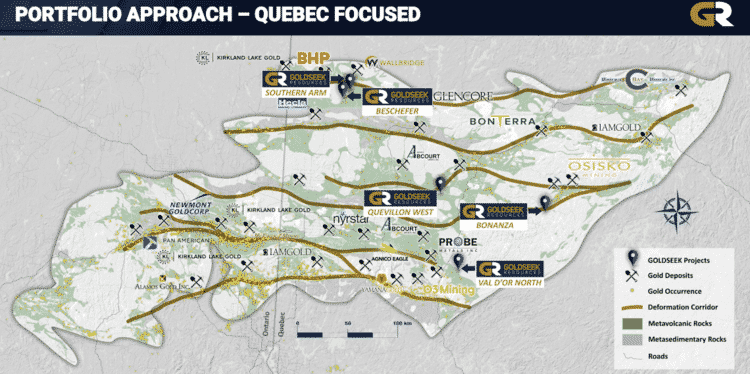

Goldseek Resources (GSK.C) holds an extensive project pipeline in some of Canadas most prolific gold camps: Hemlo, Urban Barry, Quevillon, Val D’Or North, and Detour.

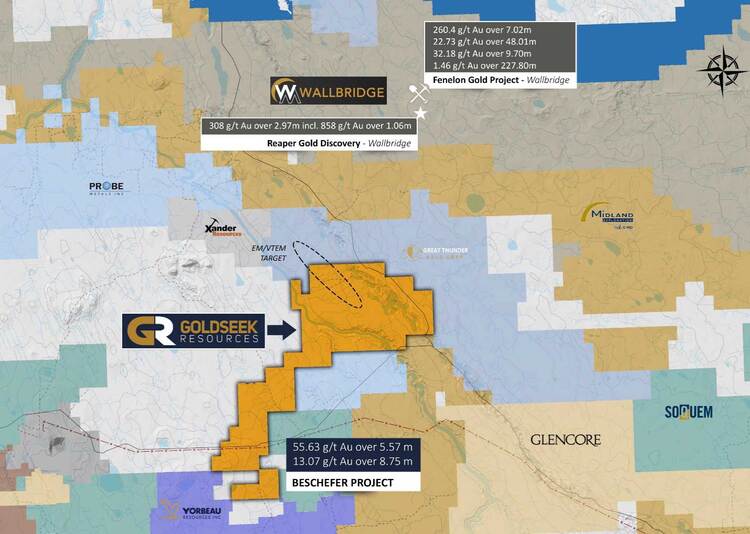

A deal struck back in March of this year—an option to earn a 100% interest in the Beschefer property from Wallbridge Mining—meets a long list of management objectives. The acquisition of an advanced stage project with significant near-term resource and discovery potential also fulfills a promise made to shareholders.

Located roughly 30 kilometers southwest of Wallbridge’s Fenelon Gold Project, Beschefer now bears flagship status and is a welcome addition to the Company’s (largely grassroots) project pipeline.

The option to acquire Beschefer can be satisfied by incurring exploration expenditures totaling $3,000,000 and issuing 4,283,672 common shares to Wallbridge over four years.

These are very friendly terms. Wallbridge obviously sees the potential in Beschefer’s geology and the expertise of management, betting on Goldseek paper. There is no cash component in this deal (rare).

The Company may accelerate Expenditures and the Option will be effectively exercised when the Company has funded and incurred Expenditures which total C$3,000,000 and issued to Wallbridge 4,283,672 Common Shares.

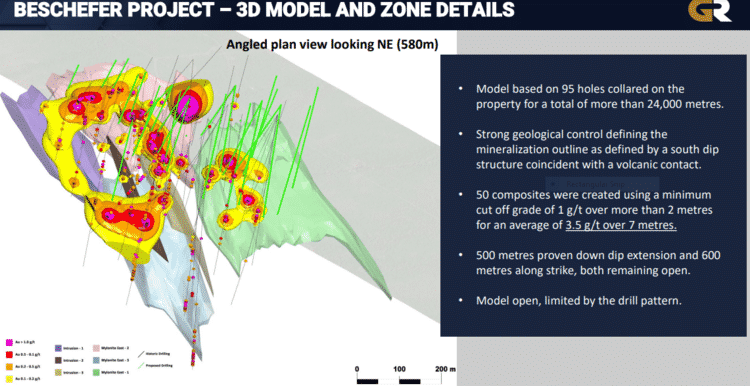

Located in a favorable orogenic gold setting, Beschefer boasts a continuous large-scale gold-bearing structure—the B-14 Zone—a structure with good continuity and a number of (known) mineralized shear zones running parallel.

“The Beschefer Project covers approximately 962 acres and is located in the Northern Abitibi Greenstone Belt, 14 km east of the past-producing polymetallic Selbaie Mine, 45 km northeast of the Casa Berardi Mine, and 30 kilometers from Wallbridge’s Fenelon Gold property. Historically, the area has mainly been explored for volcanogenic massive sulfide deposits similar to the Matagami camp and the Selbaie Mine.

Gold mineralization wa discovered in the B-14 Zone in 1995 by Billiton Canada Inc. and the Beschefer Project saw very limited exploration before the involvement by Excellon in 2011, which completed approximately 17,000 meters of drilling up to 2013. There has been limited exploration at Beschefer since 2013 with the exception of 1,600 meters drilled by Wallbridge in 2018.”

Beschefer historical drill hole highlights:

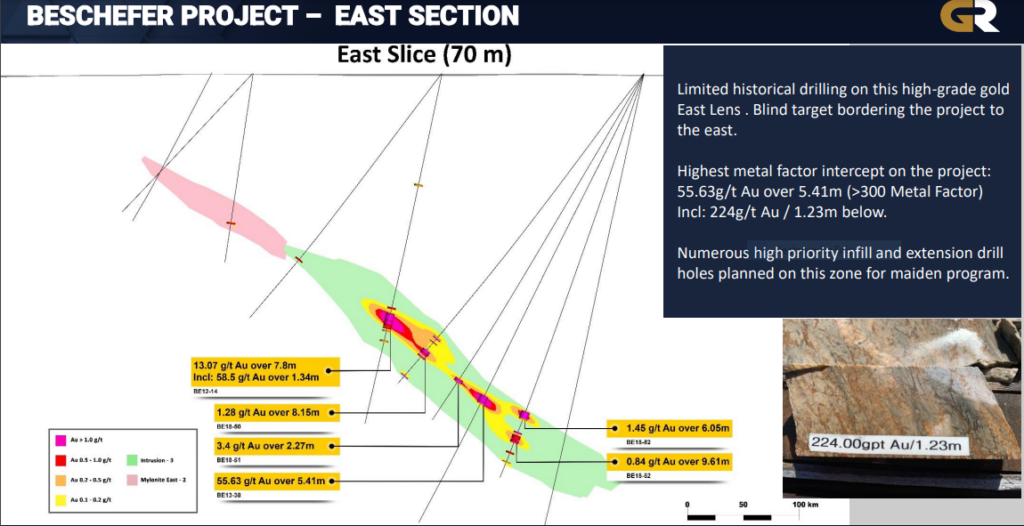

- 55.63 g/t gold over 5.57 metres in hole BE13-038 (including 224 g/t over 1.23m);

- 13.07 g/t gold over 8.75 metres in hole B12-014 (including 58.5 g/t over 1.5m);

- 3.56 g/t gold over 28.4 metres in hole B14-006 (including 7.42 g/t over 5.5m);

- 10.28 g/t gold over 8.00 metres in hole B14-35 (including 86.74 g/t over 0.60m);

- 12.40 g/t gold over 3.78 metres in hole B11-003.

Solid hits. True widths vary between 89% and 99%.

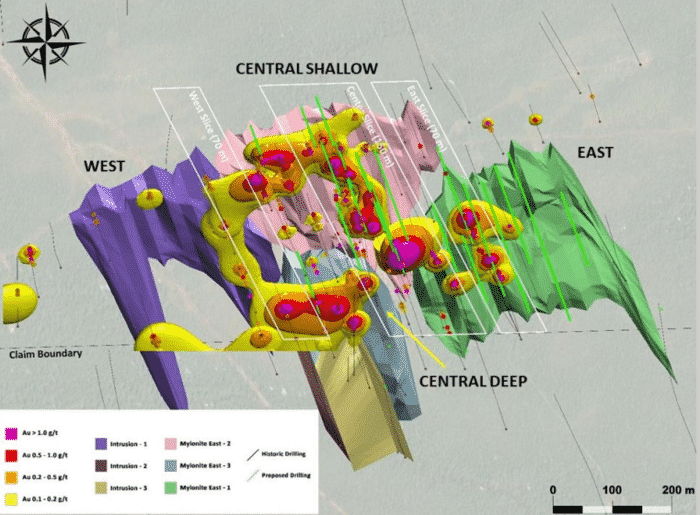

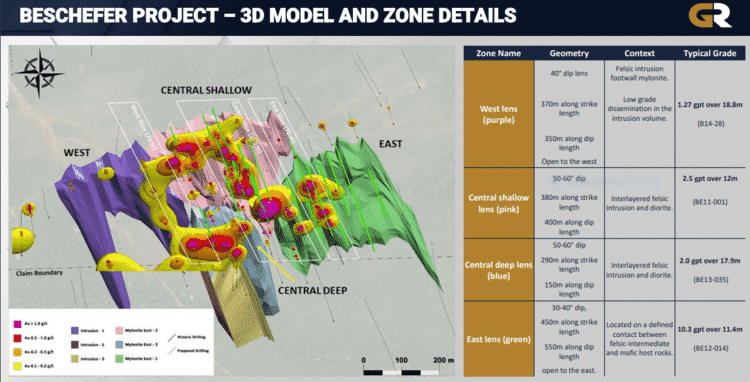

This next slide depicts Beschefer in 3D and outlines the (known) mineralized zones.

Eager to hit the ground running, the Company mobilized a drill rig to the project in early August with a 5,000 meter Phase-1 campaign.

Ducking the usual multiple-month delay in getting assays back from the lab, Goldseek dropped the following headline on October 7th:

(to be fair, no special treatment here—these assays were rushed)

Goldseek Intersects 4.92 g/t Gold Over 28.65 Meters at Beschefer

This was a weighty press release—it opened the door to all kinds of potential in Beschefer’s subsurface stratum.

As featured in the text of the headline, the highlight interval from the first seven holes of this eighteen-hole 5,000-meter campaign is an impressive 4.92 g/t Gold Over 28.65 meters (including 11.39 g/t Au over 9.1 meters) in Hole BE-21-02.

Centered at a vertical depth of 100 meters, BE-21-02 was drilled with the aim of extending strong historical results at 30 meter and 45-meter spacings off of historical holes (BE12-006 & BE18-049).

BE-21-02 “corresponds to a strong feldspar-sericite affected by tectonic brecciation. Pyrite is unevenly distributed in a brecciated structure with concentration reaching locally 10% volume. The highest individual assays reached 50.5 g/t over 0.6m from 163.8 to 164.4 metres along the hole.”

Jon Deluce, Goldseek’s CEO:

“We are very excited to announce this exceptional intercept (BE-21-02) supporting the potential of a strong maiden resource targeted for 2022. We believe these first infill-focused holes were a success hitting gold in each hole, proving the continuity and predictability of the B-14 structure. Additionally, results obtained from hole BE-21-04 represent expansion potential through extending the Central Shallow Zone to the east in an area with limited historical drilling.

We look forward to the remainder of the results, including three 100–200-meter extension/step-out holes on the East Zone, which continue to hit the mineralized zone with favorable indicators observed over intervals similar to previous holes. As we continue to process and report results, we are starting to plan our follow-up winter drill program.”

Hole BE-21-02 (4.92 g/t Gold Over 28.65 meters) is a fat hit. The elevated grade and width will augment the ‘typical grade’ in the block model of the Central Shallow Zone—currently 2.5 g/t Au over 12 meters as per the above slide on the Company’s deck—and will have a positive impact on future resource calculations.

What I find particularly compelling is the resource expansion potential as the company probes its ground further to the east.

Hole BE-21-04 (1.25 g/t over 5.2m) is one of several holes—the first to step out on the eastern edge of the Central Shallow Zone. The remaining holes drilled in this area hold the potential to extend the Shallow Central Zone further to the east, with the possibility of establishing a link with the under-explored East Zone (above map).

A total of five holes tested the subsurface potential along the East Zone—a zone that has seen limited drilling but has demonstrated the highest metal factor values (grade X thickness) on the project to date.

An example of this potential for high-grade is in historic drill hole BE13-38—a weighty 5.6 meters grading 53 g/t Au.

The three 100 to 200-meter extension holes referenced in the above quote represent larger stepouts to the east.

All three of these big stepouts were collared in the vicinity of this impressive high-grade historical hit (5.6 meters grading 53 g/t Au), tagging the shear zone in 30 to 50-meter widths. As CEO Deluce affirms, these holes “continue to hit the mineralized zone with favorable indicators observed over intervals similar to previous holes.” This crew knows when they’re in the right rock.

This is a very encouraging development. They now have confirmation that the favorable geology extends significantly to the east. Of course, the lab will generate the ultimate level of encouragement.

If these stepouts make the grade, Beschefer’s resource potential blows wide open and the next round of drilling will likely see an aggressive push further into the East zone.

It’s important to understand that the East Zone does not start at surface and is one of the reasons why previous operators failed to recognize its potential.

The Central Shallow Zone may have open-pit potential. The entire zone is mineralized—a low grade Au envelope with higher-grade pockets distributed throughout (management believes it’s getting a good handle on these high-grade pockets).

Goldseek management sees multi-million-ounce upside here. Yes… all companies see similar upside in their flagship projects, but this top-shelf crew examined dozens of projects before settling on Beschefer.

Noteworthy: Beschefer borders Goldseek’s 4,000-plus-hectare Southern Arm project where multiple geochemical anomalies were discovered directly down-ice from the property. Management believes the source of these anomalies lies on its Southern Arm ground.

On the subject of management

Management is a hugely important consideration when sizing up and shortlisting investment candidates in this high-risk/high-reward arena. You can have a fantastic (company-maker) project in a mining-friendly jurisdiction, but without the right team in place—a combination of gifted rock kickers and competent capital market types—things can fly apart at the seams.

Operational inefficiencies often create a processional effect that can lead to an erosion in shareholder value via reckless spending and an endless cycle of heavily dilutive raises.

Goldseek has been on my watch list since the summer of 2020. The Company’s CEO, Jonathon Deluce, is a young face in a new generation of junior exploration executives—highly skilled, highly motivated individuals in pursuit of the next world-class orebody. It’s a lofty goal few can attain.

Evidence that CEO Deluce is on the right track is in the cap structure of the Company, the % of common shares owned by management, the low G & A, and management’s reluctance to blow out its share structure via lowball private placements.

Goldseek’s checklist:

- 32.96 million shares outstanding (super tight);

- 58% of the outstanding common owned by management and insiders (and this wasn’t all cheap pre-IPO paper);

- G&A (consulting fees across the entire crew) = approx. $70,000 per year—one of the lowest burn rates in the sector by my reckoning;

- Only two modest private placements—July 30th 2020 and November 13th 2020—since the company began trading on the CSE in March 2020.

In this era of blown-out cap structures, recycled projects from gold bulls past, low-ball private placements, and greedy (waaaay) overcompensated management teams, the above stats are a refreshing change.

Management is NOT interested in raising funds at current levels.

I’ve had numerous conversations with CEO Deluce over the past year. Rarely have I seen this level of commitment to effective capital management.

There’s a clear alignment of values between management and shareholders here. The low G&A and large insider ownership demonstrate management’s intent—its payday will come when it succeeds in delivering a significant re-rating event.

CEO Deluce has also surrounded himself with a crew boasting impressive resumes.

Martin Demers is one example:

Demers, Goldseek’s Senior Geo, played a significant role in the acquisition of Beschefer.

With over two decades of experience in the region, this is his turf.

As a shareholder of Aurizon Mines back in the day, the Demers name strikes as a chord as he was fully engaged when the Casa Berardi Mine was pushed along the development curve—from discovery to buyout.

After a heated takeover battle between Hecla Mining and Alamos Gold, Aurizon was acquired by Hecla in a deal worth $796 million.

The Casa Berardi mine, with geologic similarities to Beschefer, is only 45 kilometers down the road. Casa Berardi is still in production today and offers a nearby mill.

Demers’ understanding of the region’s geology, and his expertise in assessing projects in the area, made him the lead when the Company set out to review various advanced-stage acquisition projects.

According to CEO Deluce, Demers’ offered the “honest truth” when sizing up Beschefer’s potential.

If Goldseek has an endgame—if it succeeds in delineating a resource that draws the attention of a resource-hungry predator (producer), Demers will help maximize the ultimate exit for Goldseek shareholders.

Steven Lauzier is another name that stands out on the roster.

According to the Company’s management page:

Steven Lauzier operates a consulting company named SL Exploration Inc since 2010, which provides services to the exploration companies of Quebec. Over the years, the Company developed a specialization in soil sampling and is associated with multiple recent soil discoveries in James Bay and the Abitibi area. Steven is also well versed in claim management, stakeholder relations (citizens, municipalities, MRC, first nations, CPTAQ, and land owners), and the permitting process of the different Quebec ministries related to mineral exploration and project development. Multiple years ago, using his financing and geological knowledge, he was generating properties and exploration targets that were sold to other parties.

Wesley Hanson also has an impressive resume and was involved in projects I was invested in back in the day.

“Mr. Hanson, a professional geologist, brings over 35 years of mining and geological experience to the Company. Mr. Hanson’s early career focused on exploration for Archean lode gold deposits, where he was a member of the exploration teams that discovered and advanced the Shear Lake (NWT), Tartan Lake (MB), Tangiers (NS), Rosebud (US) and Brewery Creek (YT) discoveries to commercial production. With SNC-Lavalin, Mr. Hanson provided technical input on numerous global mining projects including the Dukat Silver (Russia) and Diavik Diamond (NWT) projects. As VP Technical Services for Kinross Gold and VP Mine Development for Western Goldfields, Mr. Hanson supervised technical teams rehabilitating the Refugio Mine (Chile) and the Mesquite Mine (US), as well as the expansion of gold production at the Round Mountain and Fort Knox mines (US), and the Paracatu mine (Brazil).”

The Treasury

The Company has roughly $900k in the treasury, enough to launch another modest drill campaign.

The Company will need to raise funds to push exploration further along the curve, but as stated above, CEO Deluce is NOT interested in raising funds at current levels. If market forces are not aligned in the Company’s favor, expect only a modest raise, one backed by the “family” (just an educated guess on my part), and only enough to kick start a winter drill program.

For a more substantial raise, the price needs to be right, and the goal is to put the paper in strong hands where the threat of a high turnover is limited. Ultimately, a well-heeled strategic investor would satisfy that condition.

Final thoughts

CEO Deluce sees Goldseek in a similar position to that of its neighbor, Wallbridge Mining, early in the going. Wallbridge attained a market cap of $440-plus million on the strength of its 100%‒owned Fenelon Gold Project next door. The Company is scheduled to complete a highly anticipated (maiden) resource estimate this month. Expectations surrounding this impending ounce count are high.

With M&A likely to heat up in the region, Wallbridge could see a takeover bid from this recent “Merger of Equals” between Agnico Eagle and Kirkland Lake—an event that would cast a spotlight on the likes of Goldseek (all speculation on my part, of course).

Newsflow is expected to be steady over the balance of 2021. Eleven holes, including the highly anticipated stepouts along the East Zone, are on deck.

We stand to watch.

END

—Greg Nolan

Full disclosure: Goldseek is a Highballer client. Though I do not currently hold a position, I plan to purchase the stock after the customary 3-day hold after a maiden article is published (hit the ABOUT Link at the top of the page). After I establish an initial position, I may decide to add additional stock, or sell, without notice. Please be advised that I’m biased here. Use my insights as fodder, but do your own due diligence.