The year was 1988. The discovery was tucked away in the Unuk and Iskut River area along the rugged coastal mountains of northwestern British Columbia—a region known as the Golden Triangle.

The discovery, marked by ‘Hole 109’, tagged a jaw-dropping 208 meters of 27.2 grams per tonne gold and 30.2 grams per tonne silver.

The discovery was called Eskay Creek.

Hole 109 sparked an epic staking rush into the Golden Triangle. It also triggered a wave of claim jumping, forcing BC’s chief gold commissioner to invoke a staking freeze until the disputes, some of which were stacked seven deep, could be sorted out.

Hole 109 lit up the Vancouver stock exchange like the 4th of July. Howe Street brokers’ were pushed to the brink of physical and mental exhaustion as a deluge of buy orders poured in.

The shares of Consolidated Stikine Silver—stock that traded sub-nickel only two years prior—soared to $67.00 in the wake of an intense bidding war.

At its peak, Eskay Creek was THE highest-grade gold producer on the planet. It had no equal. It produced 3.3 million ounces of gold at 45 g/t Au, and 160 million ounces of silver at 2,224 g/t Ag (plus significant lead and zinc credits). It produced for the better part of 14 years, finally winding down operations in 2008.

That was my first real foray into the junior exploration arena. I was barely in my twenties. Having positioned myself in the early innings of the Eskay Creek discovery cycle, I watched my modest investment grow into a tidy sum.

The Golden Triangle made quite an impression on me back in the day.

The history of the Golden Triangle dates back much further than Hole 109, back to an era predating Canada’s recognition as a sovereign nation.

A brief Golden Triangle history lesson

In 1861 Alexander ‘Buck’ Choquette triggered a rush into the region when he struck gold at the confluence of the Stikine and Anuk Rivers.

The Premier Gold Mine, a landmark mine in its own right, went into production in 1918, hitting its peak during the Great Depression. Premier produced roughly 2 million ounces of gold and 45 million ounces of silver during its 34-year run.

Discovered in the mid-1960s, the Snip Gold Mine produced roughly one million ounces of high-grade gold between 1991 and 1999.

Beginning in 1994, as highlighted above, Eskay Creek dominated the Triangle’s mining scene during its 14-year run.

It’s important to note that all three of these past-producing mines—Premier, Snip, Eskay Creek—still hold significant resources in their subsurface layers. Example: Eskay Creek, currently being explored and developed by Skeena Resources, has a resource of 5.28 AuEq ounces of primarily open-pit material at the high end of the (open-pit) grade range. Using $1,550 gold and $22.00 silver price inputs, a 2021 PFS demonstrates an after-tax NPV(5%) of C$1.4B and an IRR of 56%. The ounce count at Eskay Creek is destined to grow, perhaps significantly so.

Fast forward to more modern times, in 2015, Imperial metals put the Red Chris Mine into production (1.2 billion tonnes containing roughly 14.9 million ounces of gold and 4.3 million tonnes of copper in all resource categories).

In 2017, Pretium Resources put the uber-rich Brucejack Mine into production.

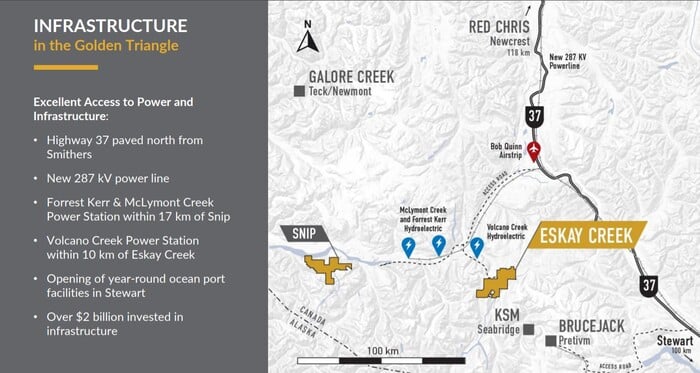

Infrastructure upgrades in the region

Infrastructure upgrades in recent years—high-voltage transmission lines, ice-free deep-water ports, the recently paved Stewart-Cassiar highway, a vast network of gravel roads crisscrossing the region—have opened up many areas within the Triangle that were once only accessible with heli-support.

Rapidly evolving ounce counts

The Golden Triangle is now recognized as a world-class destination for precious and base metals—recent newsflow out of this rapidly evolving region fortifies that lofty designation.

Gold-copper porphyry deposits, epithermal vein deposits, volcanogenic massive sulphide (VMS) deposits, intrusion-related deposits… the region boasts a broad range of geological settings and deposit types.

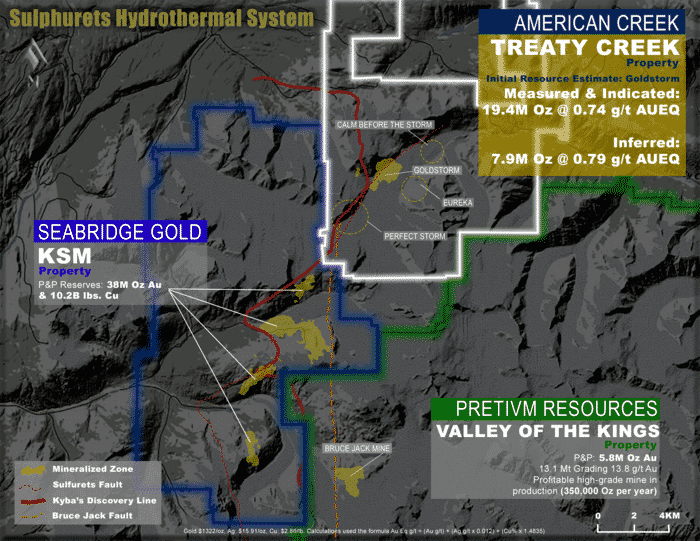

The Triangle is host to one of the largest hydrothermal systems on Earth—the Sulphurets Hydrothermal System (SHS).

The southern half of the SHS is host to 185 million ounces of gold, 739 million ounces of silver, and 50 billion pounds copper. This represents one of the densest concentrations of metal values on the planet.

The southern half of the SHS is host to the Brucejack Mine and the KSM Project.

Brucejack, operated by Pretium Resources, has M&I resources totaling 7.2 million ounces of gold at 10 g/t and 48.8 million ounces of silver at 67.5 g/t.

KSM, operated by Seabridge Gold, represents one of the largest undeveloped polymetallic deposits in the world—current M&I resources stand at 76.4 million ounces of gold and > 17.1 billion pounds of copper. 65.9 million ounces of gold and >33.2 billion pounds of copper round out the Inferred category. If my arithmetic is correct, that works out to 142.3 million ounces of gold and 50.3 billion pounds of copper. KSM also boasts 728 million ounces of silver and substantial moly credits.

Most mine plans are measured in years. KSM is measured in decades (53 years) according to a 2016 PFS, which captures P&P reserves of 38.8M ozs Au and 10.2B lbs Cu.

Here’s the thing… this global resource is destined to grow as significant discovery potential remains across vast stretches of virgin ground.

The northern extension of the Sulphurets Hydrothermal System

The Treaty Creek Project—owned by Tudor Gold (60%), Teuton Resources (20%), and American Creek (20%)—lies along the northern extension of the SHS.

On March 9th, 2021, the Treaty Creek JV partners dropped a maiden resource for the project, one that blew away my expectations…

Teuton Resources (TUO.V) – (TEUTF.OTC) – (TFE.FRA)

There are prospect generators, and then there are prospect generators. Teuton was one of the pioneers in prospect generation.

For those unfamiliar with the biz model, companies with extensive project pipelines, like Teuton, bring in strategic partners who make staged cash/share payments and commit to exploration expenditures for a majority stake in the project.

In 2021, Teuton took in just over $2,700,000 in cash and shares from its partner companies.

The prospect generation model is a win-win—it activates multiple exploration projects while generating revenue, preserving capital, and minimizing dilution. The more irons in the fire, the greater the odds of tagging a significant new discovery.

Teuton has had remarkable success deploying the model—the proof is in its carried 20% interest in Treaty Creek’s 27.3M AuEq ounce count, its cash position (>$5 million in cash and $14 million in marketable securities), and its tight cap structure.

Teuton was the original staker of Treaty Creek, having assembled a core position in the project in 1985.

Under the terms of the Treaty Creek joint venture agreement, Teuton’s 20% interest is carried. Tudor must do ALL the heavy lifting—it’s required to cover all exploration expenses until a production decision is made. (Tudor has spent more than $50 million on the property to date).

Simple arithmetic shows Teuton’s 20% of the 27.3M AuEq resource equal to 5.46M AuEq ounces.

Teuton is in an enviable position here.

But the Company’s slice of the Treaty Creek pie is richer, fatter—Teuton also holds a .98% NSR on the entire 27.3M AuEq ounce resource base (see Area 1, map below).

It also holds a 0.49% NSR on the claims peripheral to the current resource (Area 2). Suppose the Treaty Creek mineralization extends into Area 2, which many believe will. In that case, the Company holds a buy-back option to acquire an additional 1% NSR, which would bump its royalty interest in Area 2 up to 1.49%. The cost for the extra 1%? $1 million, exercisable up to 6 months from the start of commercial production.

Again… Teuton is in an enviable position here.

In my mind, these strategic NSRs are potential company-maker assets in their own right.

The above map plots the location of all ten royalty assets. For greater detail, click here.

The current Treaty Creek resource (the potential to grow the ounce count)

After acquiring its 60% option in 2016, Tudor, the project operator, launched multiple drill campaigns designed to test and expand the known zones of mineralization at Treaty Creek.

After recognizing the potential for a deep system at the Goldstorm zone, Tudor launched a 20k meter drill campaign in 2020—a program that was accelerated to 40k-plus meters via the deployment of six rigs.

The shares in all three companies went on a serious tear that spring (Teuton had 10-bagger-plus potential in only a few short months).

Drill hole highlights from the 2020 campaign:

- GS-20-57 returned a near surface intercept of 1.400 g/t AuEq over 217.5 meters within 973 meters of 0.845 g/t AuEq;

- GS-20-65 returned a near surface intercept of 2.120 g/t AuEq over 348 meters within 930 meters of 1.161 g/t AuEq;

- GS-20-75 returned a near surface intercept of 1.561 g/t AuEq over 121.5 meters within 1152.0 meters of 0.741 g/t AuEq;

- GS-20-73 returned a near surface intercept of 1.506 g/t AuEq over 229.5 meters within 775.5 meters of 0.932 g/t AuEq;

- GS-20-94 returned a near surface intercept of 1.215 g/t AuEq over 354 meters within 1225.5 meters of 0.702 AuEq;

- GS-20-92 returned a near surface intercept of 3.286 g/t AuEq over 82.5 meters within 531.0 meters of 0.999 AuEq.

With repeated hits like this, the ounces pile up fast.

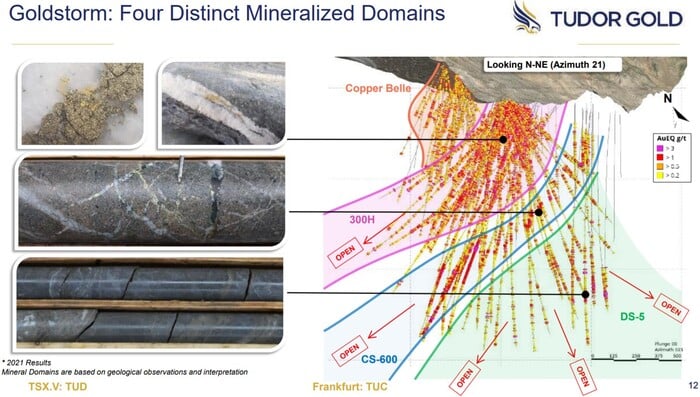

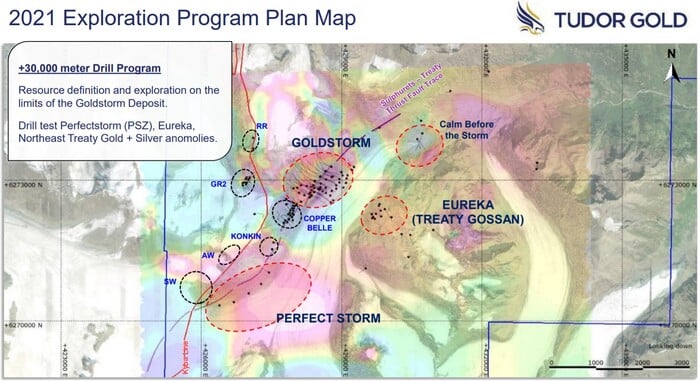

In 2021, Tudor drilled roughly 30k-plus meters at Treaty Creek, a combination of infill and stepouts that tested the limits of the main mineralized zones. The following slide shows the four mineralized domains—Copper Belle, 300H, CS-600, and DS-5—that comprise the 27.3M AuEq ounce resource base (note the extent to which Goldstorm is open in multiple directions, including depth).

A few selected highlights recently released from the 2021 campaign (note the mineralized domains – refer to the map above):

- GS-20-91 returned 0.856 g/t AuEq over 1033.5 meters (including 1.112 g/t AuEq over 532.5 meters) in the 300H domain;

- GS-20-92 returned 0.999 g/t AuEq over 531 meters (including 3.286 g/t AuEq over 82.5 meters) in the 300H domain;

- GS-21-103 returned 0.704 g/t AuEq over 801 meters (including 2.025 g/t AuEq over 75.0 meters) in the 300H domain;

- GS-21-110 returned 1.039 g/t AuEq over 474 meters (including 2.389 g/t AuEq over 130.5 meters) in the DS-5 domain;

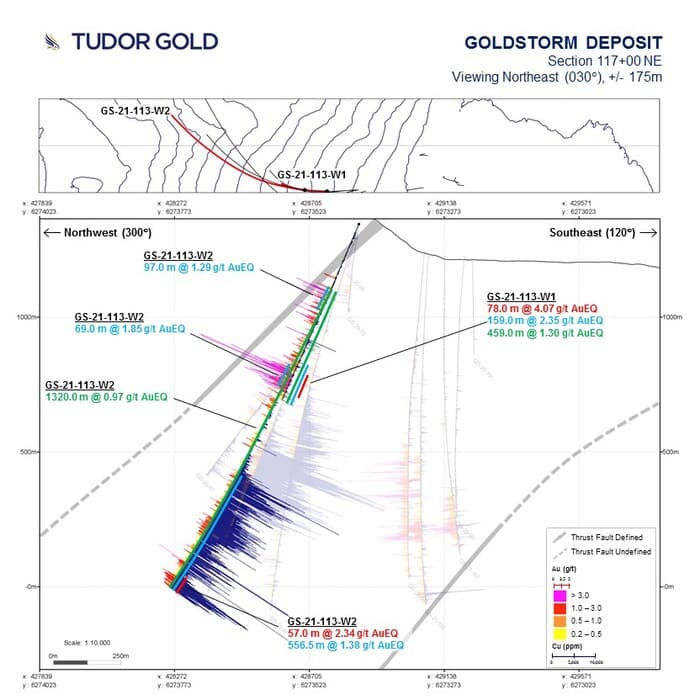

- GS-21-113 returned 1.265 g/t AuEq over 972.0 meters (including 1.352 g/t AuEq over 456 meters) in the 300H domain AND 1.439 g/t AuEq over 405 meters in the CS-600 domain – this was another exceptional extension of both 300H and CS-600 domains;

- GS-21-112 returned 1.287 g/t AuEq 219 meters (including 2.079 g/t AuEq over 79.5 meters) extending the DS-5 domain further to the northwest;

- GS-21-111 returned 0.869 g/t AuEq over 613.5 meters (including 1.974 g/t AuEq over 120 meters) in the 300H domain.

- GS-21-113 returned strong Cu values – 0.618% over 405 meters (including 0.845% Cu over 273 meters) in the CS-600 domain;

- GS-21-119 returned 1.09 g/t AuEq over 564 meters (including 1.76 g/t AuEq over 196.5 meters) extending the DS-5 domain 100 meters further to the north.

- GS-21-113-W1 returned 1.30 g/t AuEq over 459 meters (including 4.07 g/t AuEq over 78 meters) cutting the northernmost section of the 300H domain;

- GS-21-122 returned 1.22 g/t AuEq over 355.15 meters (including 1.45 g/t AuEq over 247.5 meters) in the CS-600 domain.

One hole that stands out—a deep stepout to the northwest:

- Drill hole GS-21-113-W2 tagged significant mineralization along the 300H and CS600 domains. Within a broad interval of 0.97 g/t AuEq over 1,320.0 meters (from 255 meters to 1,575 meters), the CS-600 domain was pushed dramatically deeper with a sub-interval of 1.38 g/t AuEq over 556.5 meters (from 1018.50 meters to 1,575 meters), including 2.34 g/t AuEq over the last 57.0 meters of the hole. GS-21-113-W2 was abandoned at 1,575.0 meters—the drill was pushed to its max limit.

Now that the company has demonstrated the mineralized potential at depth, the next round of drilling will see bigger rigs mobilized to the project—rigs that go deeper.

Interesting note: rock dynamics for Block Cave Mining improve at depth. Block caving would likely be the preferred mining scenario at Treaty Creek.

The 2021 campaign also tested the regional potential of recent discoveries at the Calm Before the Storm (CBS), Perfect Storm, and Eureka zones.

Near-surface gold mineralization continues along the SW trend for over a kilometer at the Perfect Storm zone:

- PS-21-06 returned .0721 g/t AuEq over 118.6 meters (including 0.927 g/t AuEq over 59.9 meters) – mineralization appears to be gaining strength towards the Iron Cap Deposit (Seabridge Gold) approximately three kilometers to the southwest.

Gold-silver mineralization is getting stronger at depth at the Calm Before the Storm zone:

- CBS-21-02 returned 0.82 g/t AuEq over 155.50 meters (including 1.30 g/t AuEq over 53.9 meters).

At the Eureka zone…

- EK-21-01 returned 0.76 g/t AuEq over 217.5 meters (including 1.13 g/t AuEq over 67.5 meters).

The geological sleuths at Tudor believe the Eureka zone represents the upper reaches of the DS-5 domain. If true—if they’re able to connect the dots between the two zones (refer to the map above and note the scale (bottom right))—Treaty Creek’s ounce count could be on its way to doubling… tripling even.

Even without the benefit of connecting said dots, the 30k-plus meters drilled in 2021—with broad intervals of mineralization, some exceeding one kilometer one length—will undoubtedly upgrade and add bulk to the current resource base.

The project pipeline

Outside the 20% Treaty Creek carried interest and related NSRs, the Company holds a robust project pipeline of Golden Triangle-based projects—more than 30 properties—ten of which are currently under option to third parties.

Eskay Rift (Z1 Anomaly): No partner company on this one. Teuton is going it alone. Identified during a 2018 airborne ZTEM survey, the Company plans to mobilize a drill rig to the highly prospective Z1 Anomaly as soon as conditions permit.

Del Norte and Lord Nelson: These two adjoining properties are optioned to Decade Resources. Recent exploration efforts delineated multiple high-grade zones. Final assays from a 2021 drill campaign are expected in the coming days (visible gold, silver, and acanthite were observed in the core of these pending holes).

Decade is drawing up plans for an active exploration program this season.

Harry: Optioned to Optimum Ventures, this 1,333-hectare project lies within a 3 kilometer wide by a 15-plus kilometer-long prospective corridor. Harry has excellent potential for high-grade gold-silver mineralization, large-scale bulk-tonnage Au-Ag zones, and VMS-type mineralization.

Optimum will be giving Harry an aggressive push along the exploration curve in 2022. Expect strong newsflow out of this one.

We’ll take a closer look at these projects in a future Highballer installment as they all hold the potential to deliver a significant discovery in 2022.

The team

Teuton is a tightly run operation. Dino Cremonese, a pioneer in prospect generation, recognized the geological potential in the Triangle’s subsurface stratum back in the early 1980s.

Ken Konkin, a name that requires no introduction, serves on the board of Teuton and is the VP of Exploration at Tudor. Quoting CEO Cremonese from an April 28th, 2021 press release:

“Ken Konkin, Vice President of Exploration at Tudor Gold, has done a superb job at Treaty Creek since taking the reins two years ago. During his tenure, nearly every hole in the Goldstorm zone has intersected lengthy grades of gold mineralization, some up to 1,000 metres.”

This link—a Commodity Tv Interview—will take you to a Ken Konkin interview where he talks about recent drill hole results and how he intends to approach the 2022 drilling season, which should see an early start. Konkin’s excitement is apparent. And it sounds like he wants to go hard in 2022.

M&A activity and significant investment in the region

The brutal bear market of the past decade forced many producing companies to slash their exploration budgets. This has led to depleted mineral inventories and lean project pipelines (a robust pipeline of development projects is the key to a producer’s long-term survival).

Many of these producing companies are now on the hunt.

An acceleration in M&A activity in the Golden Triangle began in mid-2019 when Australian-based Newcrest Mining paid $804 million for a majority stake in Imperial Metals‘ Red Chris Mine (located in the northern portion of the Triangle). In early 2021, Newcrest announced its intention to invest an additional C$135M in the project.

In the same area, in Q1 of 2021, Newmont acquired GT Gold’s Tatogga Project, a copper-gold porphyry deposit, for $393M.

More recently, on Nov 9th, 2021, Newcrest took out Pretium Resources in a deal valued at $3.5 billion.

Newcrest’s total investment in the Golden Triangle is now close to $4.5 billion.

In April of 2021, Yamana Gold took a $20.6M equity position in Ascot Resources.

In December of 2021, Franco-Nevada took a $31M equity position in Skeena Resources.

Well-heeled investors have also developed an appetite here. Canadian billionaire Eric Sprott has taken a significant position in Treaty Creek via multiple private placements in Tudor, Teuton, and American Creek. He took his last position in Teuton at $3 per share. No warrant. After the close of that transaction, Sprott held control of 9,611,000 shares and 3,500,000 warrants representing approximately 19.2% on a non-diluted basis and 24.5% on a partially diluted basis.

Here’s an interesting headline, one that speaks volumes…

The pace of M&A in the Golden Triangle appears to be accelerating. Golden Triangle companies with significant discoveries/resources on their books may have a target on their back.

Final thoughts

Looking under the hood, Teuton has:

- 56.22 million shares outstanding

- a $109.62M market cap based on its recent $1.95 close

Teuton’s 20% share of Treaty Creek’s 27.3M AuEq resource equates to 5.46M AuEq ounces. The Company holds a .98% NSR on the entire 27.3M AuEq resource plus an additional 0.49% NSR, which can easily increase to 1.49%, on the surrounding property. What are these assets worth right now? What will they be worth if (when) drilling blocks out a fatter resource base? What will they be worth if (when) gold pushes significantly higher to keep pace with inflation (and the compounding layers of economic and political uncertainty)?

What will they be worth if a resource-hungry predator takes a run at Treaty Creek?

I don’t believe the market has caught on to the intrinsic (real) value here. I believe it’s only a matter of time before it does.

END

—Greg Nolan

Full disclosure: Teuton has recently come on as a Highballer client. Though I do not hold a position in the company, I intend to accumulate shares after this report is given sufficient time to disseminate.