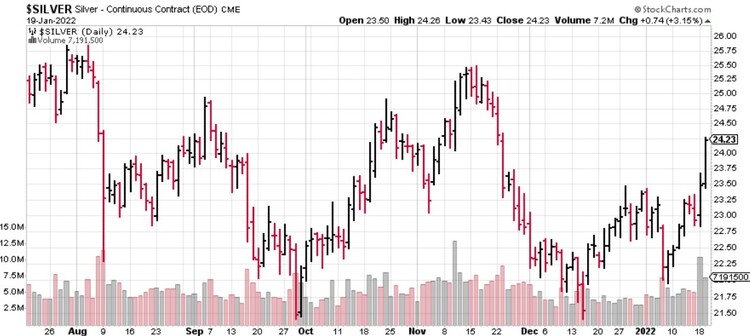

Precious metals have gone on a serious tear in recent sessions, led by silver.

This sector is marked by a seemingly endless series of bull traps. A successful test of the $25.00 level would add validity to this move.

The fundamentals underpinning firmer metals prices are obvious—debt levels that have taken on a surreal quality, negative real interest rates, increasing market volatility, geopolitical risks on multiple fronts.

And inflation is running hot around the globe.

U.K. inflation rose to a 30-year high as their CPI rose 5.4% in December, year-on-year. Canada’s CPI climbed to 4.8%, its highest level in 30 years. According to the U.S. Bureau of Labor Statistics, Headline CPI climbed to 7%—the highest level since 1982.

Steve Hanke, professor of applied economics at Johns Hopkins University, recently stated, “Contrary to what politicians have been claiming, inflation is not caused by bottlenecks in the supply chain, but rather, by increases in the money supply.”

Printing Presses Gone Wild… It’s recently been suggested that 40% of all the greenbacks currently in circulation have come into existence over the past two years.

Gold and silver—perhaps the ultimate hedge against this unbridled dollar debasement and economic uncertainty—may be on the cusp of a decisive move to the upside.

Apollo Silver (APGO.V) – APGOF.OTC) – (6ZF.FRA)

- 163.51 million shares outstanding

- $98.11M market cap based on its recent $0.60 close

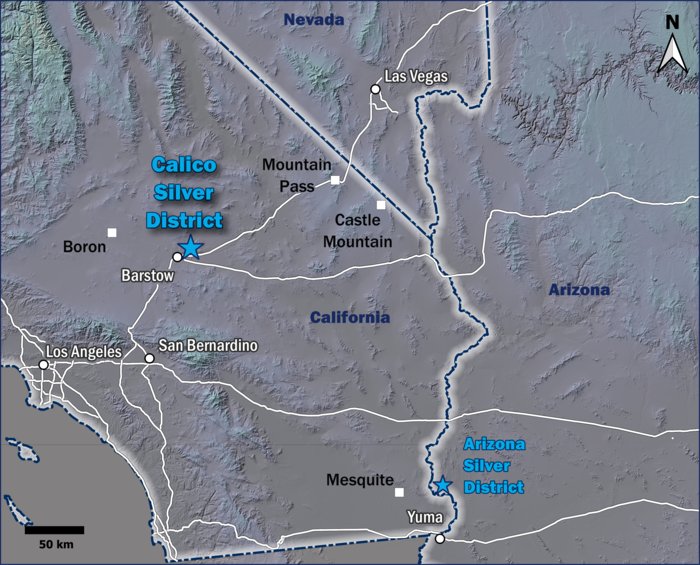

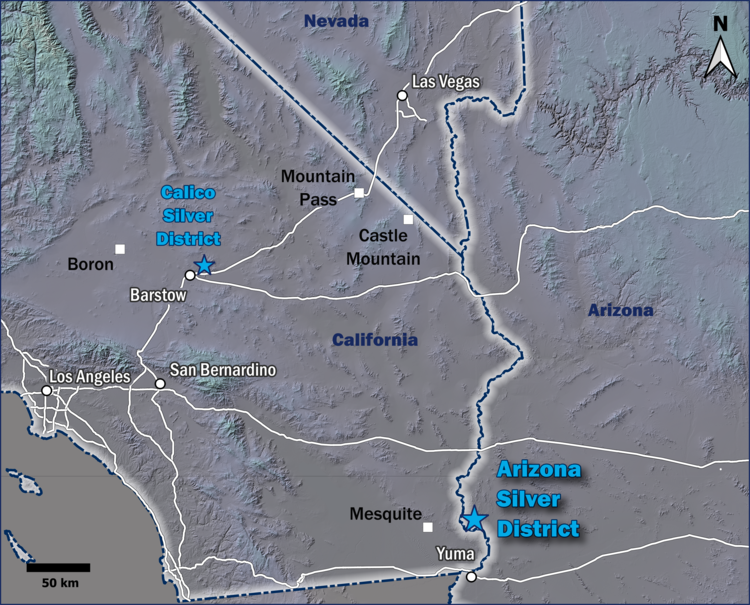

The stage was set for the Apollo story—a pure play (US-focused) silver exploration and development company—back in May of 2021 upon signing a definitive acquisition agreement for the Waterloo and Langtry assets in California and The Silver District asset in Arizona.

This is NOT an early-stage exploration story.

Investors who participated in a (well-subscribed) $52.9 Million Subscription Receipt Financing last summer are backing a significant resource development play with considerable exploration upside. They’re also backing a top-shelf management team. We’ll take a close look at the pedigree of this crew—a crew that some characterize as the A-Team—a little further down the page.

Apollo is on the cusp of pushing >164M ounces of silver—two historical resources at its Waterloo and Langtry projects—into NI 43-101 compliance.

This resource upgrade could set the stage for a significant rerating event. For now, the market appears utterly oblivious to the latent potential underpinning this silver play.

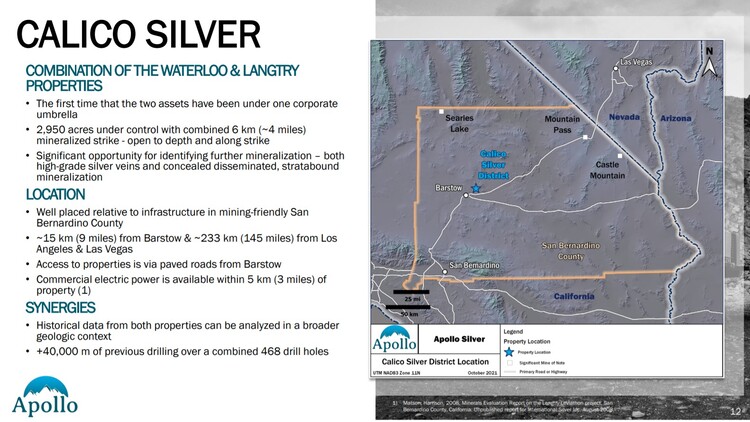

The Company’s flagship assets—Waterloo and Langtry—are located in San Bernardino County, a well-established mining-friendly district in southern California.

For those of you wary of California as a mining destination, know that the state was ranked 4th in the US for mineral production in 2020 (mining contributed US$13.6B to the state’s GDP).

At ground level, Apollo has had positive meetings with the senior leadership of San Bernardino County. The district welcomes responsible resource development and has expressed interest in examining opportunities that support the Company’s development activities.

The region is also rich in infrastructure.

A network of gravel roads cut across the projects—commercial electric power lies within five kilometers (3 miles) of the property.

Mines in the region include SV Minerals Searles Lake project, Equinox Gold’s Castle Mountain and Mesquite gold mines, and Rio Tinto’s Boron mine.

The Projects

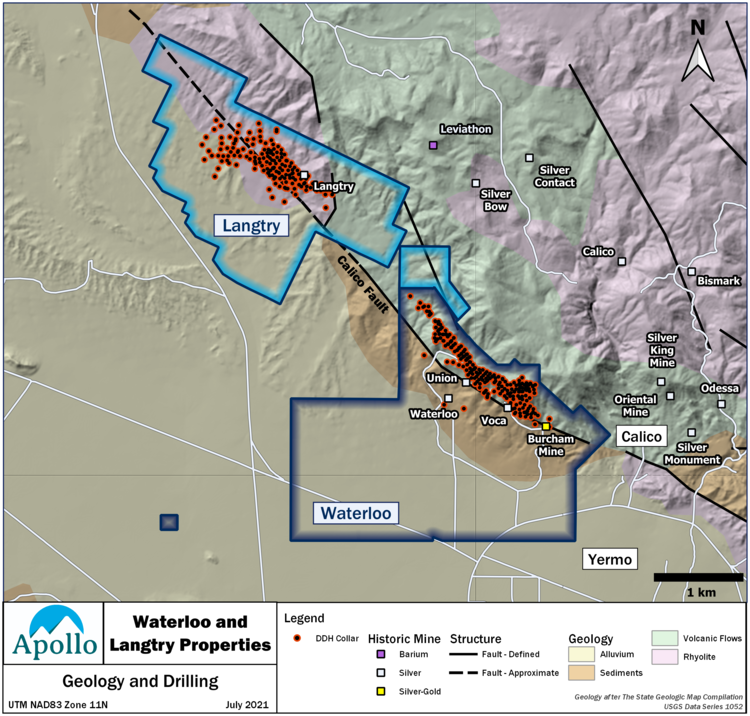

Under Apollo’s stewardship, both projects—2,950 acres in total area—are under common ownership for the first time. These 2,950 acres represent a district-scale system boasting roughly 6,000 meters (19,680 feet) of mineralized strike.

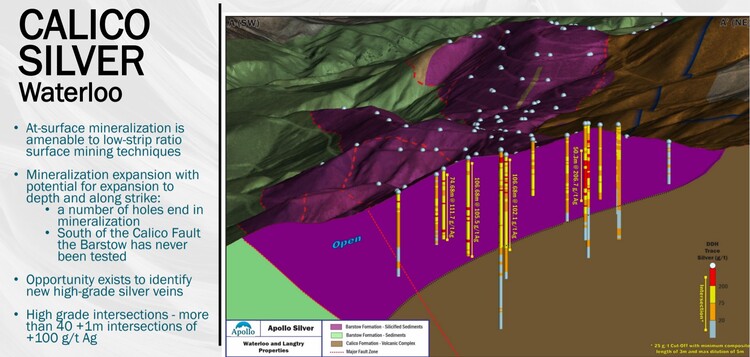

Waterloo and Langtry host low-sulfidation epithermal-vein type and disseminated-style silver-barite mineralization, which is open to depth and along strike.

Previous operators laid the foundation for the historical Waterloo and Langtry resource estimates, completing more than 40,000 meters (131,234 feet) of drilling across 468 holes.

The two clusters of red dots (map below) represent drill collars from the historical drilling that outlined these historic resources.

Waterloo

The initial historical resource estimate was calculated by Asarco in 1968, followed by a computer-calculated resource estimate in the late 1970s.

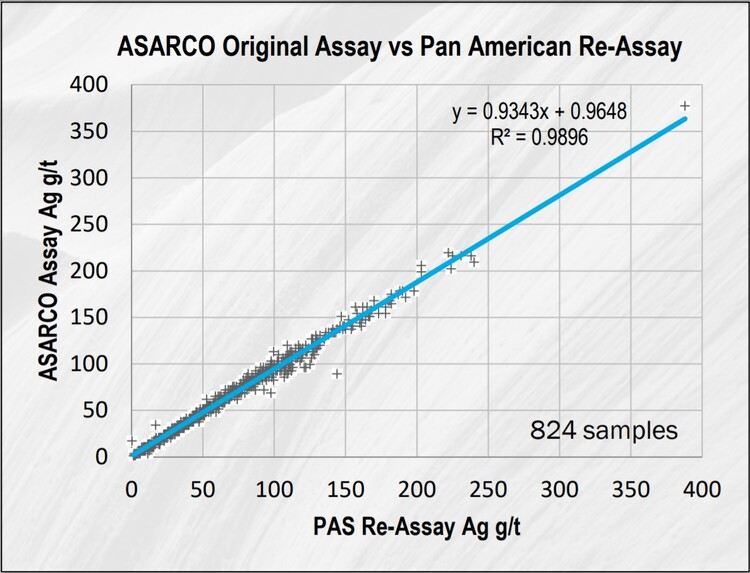

Pan American subsequently acquired the project and drilled the property in 2012. Their drill results validated the historical data from Asarco.

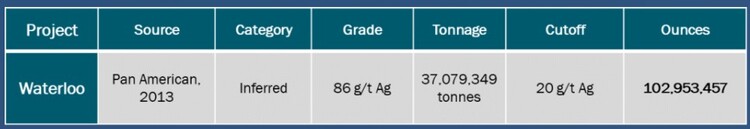

The (historical) resource at Waterloo currently stands at 37.1 million tonnes grading 86 grams/tonne for a total of 103 million ounces of contained silver.**

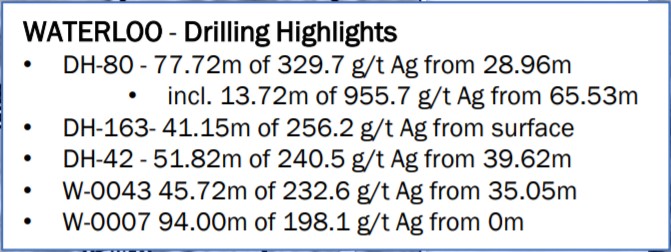

High-grade highlights from historical drilling at Waterloo (note the shallow nature of these high-grade intercepts)…

Langtry

Exploration at Langtry dates back to 1960. Between 1967 and 1984, Superior Oil conducted exploration campaigns consisting of geological mapping, geochemical sampling, surface trenching, and drilling.

Athena Silver picked up the reigns in 2010 and performed surface geological mapping, sampling, geotechnical work, and drilling.

A total of 213 drillholes (26,200 metres/86,000 feet) is reported to have been completed on the Langtry Property by the previous operators. Of these, 20,710 metres (67,946 feet) in 161 drill holes existed in the drill database for the recently released technical report “NI 43-101 Technical Report Langtry Project, California, USA” prepared by H. Samari and L. Breckenridge of Global Resource Engineering, Ltd., with an effective date of December 1, 2021 (see news release of December 2, 2021). Data for the remaining holes has been recently acquired and will be incorporated into the drill database.

An initial historical resource estimate was calculated by Superior in 1970. Subsequently, Athena calculated a resource estimate based on the results of their 2012 drilling program, along with validated historical data from Superior’s programs.

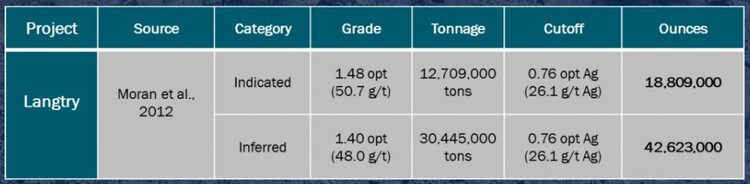

From all this historical work, SRK Consulting calculated a (historical) resource estimate of 12.7 million tons grading 1.48 ounces per tonne for 18.8 million ounces of contained silver (Indicated) and 30.4 million tons grading 1.40 ounces per tonne for 42.6 million ounces of silver (Inferred).**

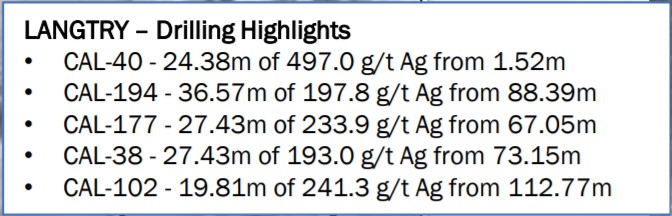

High-grade highlights from historical drilling at Langtry (again, note the shallow nature of these higher grade hits)…

Defining Waterloo and Langtry as a current mineral resource

In acquiring its flagship Calico Silver District assets, the Company inherited a massive database of historical drill hole data—all 40k-plus meters worth—across the Waterloo and Langtry project areas.

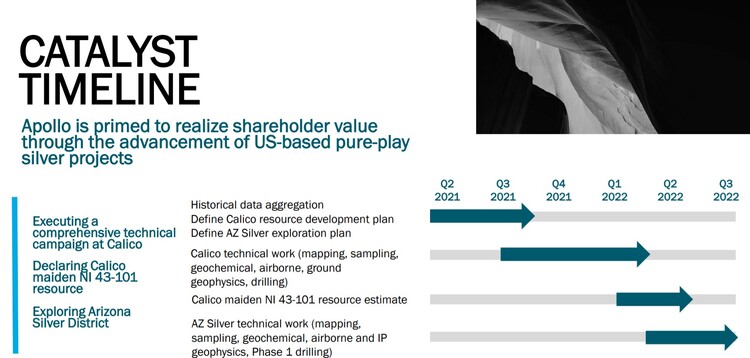

As per a December 8th, 2021 press release, Apollo engaged Stantec Inc., a company that’s been providing geological, engineering, and environmental services for over 80 years, to complete an independent maiden resource estimate for both projects.

There’s heaps of confidence in the database Apollo has inherited.

Stantec will require no further drilling to complete the resource definition work at Waterloo and Langtry.

This next slide demonstrates the excellent correlation between the older Asarco assays and the more recent Pan American assay data.

Not having to twin historic holes represents a substantial cost saving for Apollo (roughly $5M). The Company can redeploy that capital and push the projects further along the development curve.

There’s also a meaningful time saving here—a maiden Waterloo-Langtry resource was initially scheduled to drop in late Q2 or early Q3. It’s now close at hand, perhaps within the next few weeks.

The next steps

With roughly $16 mill in the till, the Company is prepared to launch an aggressive 10 to 15k meter drill campaign this year—a program that will consist of resource expansion and infill drilling (potentially upgrading the Inferred ounces to the higher confidence M&I categories).

Calico’s 2,950 acres remain under-explored. As the slide further down the page highlights, a number of the historical holes ended in mineralization. Where Waterloo is concerned, the Barstow formation south of the Calico Fault has never been tested with the drill bit. There’s ample opportunity to grow the ounce count along this untested ground.

A comprehensive metallurgical campaign is also on the agenda for 2022.

This methodical approach to resource definition and met testing may allow Apollo to skip the PEA and launch right in to a PFS. I’m sure that will be a topic for spirited discussion at future board level meetings.

On the subject of economic studies, the near-surface orientation of the mineralization and the potential for a low strip ratio will likely have a very favorable impact on the project’s economics.

The near-surface mineralization at Waterloo, along with a low-strip ratio and rising topography (above map), will likely result in significantly less disturbance, less waste rock, and perhaps… a smoother slope along the permitting curve.

On the subject of permitting, the fact that both Waterloo and Langtry’s mineralization is associated with Barite— a metal that sits on the U.S. Critical Minerals list—may help expedite the (permitting) process where Washington is concerned.

Recent news

During this ongoing technical review of historical data at Waterloo, the Company identified a 25 meter thick, gold-bearing horizon below the historical resource where the silver mineralization transitions into gold.

The details were spelled out in a January 11th press release:

Gold identified at Waterloo project in continuous near-surface horizon

Highlights:

- Potential for meaningful gold mineralization along the entire 2.2 km long contact for which the majority of historic drill holes did not test;

- Gold mineralized horizon of 25 meters (true thickness) returning 0.59 g/t Au from 132.60 meters below surface, including 1.52 meters of 5.52 g/t Au. This horizon is 60 meters wide and 110 meters in length (down-dip) and open in all directions;

- The contact represents an excellent exploration target for replacement style gold mineralization, and possibly higher-grade vein hosted gold; and

- The upcoming 2022 drill program will test for additional gold mineralization along this prospective horizon.

Tom Peregoodoff, Apollo’s CEO:

“Our systematic approach to reviewing and validating the historic data is continuing to deliver significant value. We were aware of this historic gold production at the Burcham mine, however it is only recently and through this detailed review that we have come to understand the nature and extent of the host unit, and the potential for a significant gold discovery at Waterloo. This presents an exciting opportunity in that it substantially adds to the exploration potential of the properties and testing of this prospective horizon will form part of our upcoming 2022 drill program. With our pending maiden silver resource declaration for Waterloo and Langtry on track, 2022 is shaping up to be a very exciting year for Apollo.”

The Silver District in Arizona

Though Waterloo and Langtry will see the lion’s share of spending this year, the Company’s Silver District in Arizona will likely get a solid push along the exploration curve.

An early-stage project, there’s significant discovery potential in these subsurface layers.

The Arizona Silver District Project is located in a historic silver mining district in southwestern Arizona. This represents a district-scale mineral system endowment with more than 2,000 acres. Previous operators completed a total of 19,162 metres (62,866 feet) across 465 holes on the land package. The project represents a significantly mineralized, but under-explored area in a prime jurisdiction in Arizona which is ranked #2 globally in terms of investment attractiveness in the Fraser Institute Survey (2020).

Mining in this district rarely exceeded 45 meters (150 feet) depth back in the day. Historic production between 1883 and 1893 from underground operations at the Red Cloud and Clip mines was reported at approximately 1.5 million ounces of silver and 2.3 million pounds of lead.

These 2,000-plus acres cover three major epithermal vein structures—West, Central, East—representing 13 kilometers (8 miles) of collective strike length.

Apollo’s near-term exploration plan for the Arizona Silver District project includes desktop review of historical data; surface geological investigation and compilation of all geological data into a preliminary three-dimensional geological model. This data set will form the foundation for target generation and evaluation which will guide a possible on-the ground program in 2022.

The Apollo Crew

As I’m oft heard to say, management is everything in the junior exploration arena… nearly everything. You can have a world-class company-maker of a project in the friendliest jurisdiction, but without the right team in place—a combination of gifted rock kickers and enterprising business types—things can fly apart at the seams.

Apollo has assembled an experienced and technically proficient team with an enviable track record of creating shareholder value. Management’s collective skillsets cover all the bases—capital markets, project development, and a disciplined approach to exploration using the most modern technologies and methodologies.

A sample of some of the talent running the show here:

Tom Peregoodoff, President, CEO, and Director: 30-plus years of industry leadership experience through all phases of project development and exploration. Tom was previously VP of Early Stage Exploration at BHP and CEO at Peregrine Diamonds. He’s currently on the board at Pretivm Resources (Newcrest Mining recently took over Pretivm in a deal valued at $3.5B).

Andrew Bowering, Independent Chair of the Board: A venture capitalist with 30 years experience as owner/operator of drilling companies—a leader in worldwide mineral exploration and development. Andrew built teams to pursue precious, base, and industrial metals, from exploration to production. Founder/operator of Caldera Environmental, Pinnacle Mines, ATW Gold, Cap-Ex Iron Ore, American Lithium Corp. Founded/funded Millennial Lithium (Lithium Americas took over Millennial in a deal valued at $400M).

Simon Clarke, Director: 25-plus years of capital market experience, currently the CEO for American Lithium. He founded M2 Cobalt and Osum Oil Sands Corp (Watreous Energy Fund recently acquired Osum in a series of transactions valued at approx. $400 million).

Steven Thomas, Independent Director: 30 years of international corporate experience developing and leading finance teams. Recently appointed CFO of Mountain Province Diamonds and has held similar roles in various mining companies including Torex Gold, Goldcorp (CFO, Canadian Operations), and De Beers Canada Inc.

Cathy Fitzgerald (P.Geo), VP of Exploration and Resource Development: 20 years’ experience in exploration and development of early-stage projects through to feasibility.

The list goes on.

Apollo’s entire team rooster can be viewed here.

Final thought

Best characterized as a resource development play with significant exploration upside, there are a number of potential catalysts that could trigger that rerating event I mentioned at the top of the page. First and foremost is the maiden resource estimate that could drop at any time.

END

—Greg Nolan

**The reader is cautioned that this resource estimate is historical in nature and the Company is not treating it, or any part of it, as a current mineral resource.

Full disclosure: the author, Greg Nolan, was compensated for the writing of this piece by Pacific Prime Communications Corp., a company engaged to provide investor relations services to Apollo Silver.