The price strength in precious metals continues with gold closing out last week’s session at the highest level in some eight months.

A flight to safety—mounting tensions along the Russia-Ukraine border and recession fears—underpin this recent price strength.

I follow a good number of companies in the junior space, some of which have been presented here in these pages.

The following updates capture recent news events among several companies I track more closely than others.

Banyan Gold (BYN.V) – (BYAGF.OTC)

- 226.59 million shares outstanding

- $80.44M market cap based on its recent $0.355 close

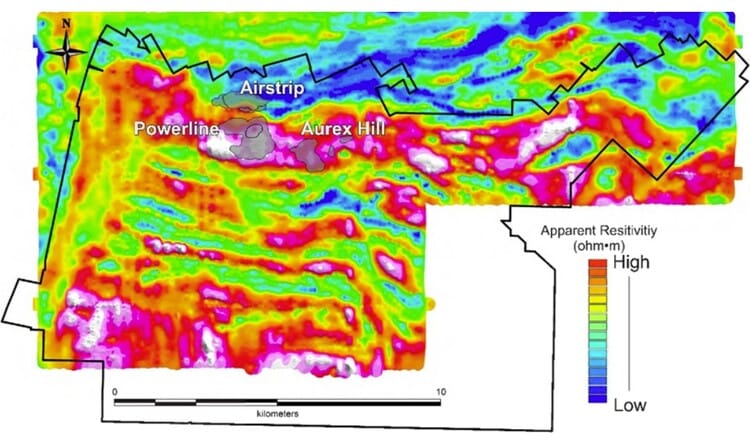

Yukon based Banyan continues to push its flagship AurMac Gold Project aggressively along the curve.

Recent assays from the Company’s flagship AurMac Gold Project—the Powerline Deposit zone specifically—continue to demonstrate continuity and scale. The Company is cranking out results about as fast as the lab will allow.

Drill hole highlights released in mid-December from the Company’s Phase-2 2021 drill campaign include:

- 72.9 meters of 0.51 g/t Au from 29.0 meters in DDH AX-21-134;

- 57.9 meters of 0.61 g/t Au from 35.1 meters in DDH AX-21-135;

- 118.4 meters of 0.44 g/t Au from 21.3 meters in DDH AX-21-137;

- 72.4 meters of 1.73 g/t Au from 8.2 meters in DDH AX-21-139;

- 58.0 meters of 0.47 g/t Au from 15.2 meters in DDH AX-21-141;

- 41.7 meters of 0.66 g/t Au from 9.1 meters in DDH AX-21-150.

Drill hole highlights released on Jan. 10th include:

- 84.5 meters of 1.32 g/t Au from surface in DDH AX-21-151

- Including 72.5 meters of 1.53 g/t Au from 22 meters;

- Including 3.1 meters of 19.5 g/t Au from 76.2 meters;

- 79.7 meters of 0.43 g/t Au from 43.3 meters in DDH AX-21-136;

- 51.8 meters of 0.60 g/t Au from surface in DDH AX-21-159.

In continuing its rapid push along the exploration/development curve, Banyan dropped the following headline on February 2nd:

Banyan Commences 2022 Aurmac Drill Program

The primary objective of this 30,000-meter drill campaign is to continue expanding the Powerline Deposit, and advance the Aurex Hill Zone.

Tara Christie, President & CEO:

“Exploration at the AurMac Property has now resumed with three diamond drill rigs on the AurMac Property. The initial focus is the expansion of the Powerline Deposit and, late summer, on the Aurex Hill target. We continue to receive assay results from our 2021 drill program which concluded in late December and expect to receive those through April. We are excited with our planned 30,000 m drill program for 2022 all of which will target to add ounces at AurMac.”

There aren’t too many projects this far north that can be drilled in the dead of winter. Expect strong newsflow out of this one over the balance of 2022.

Defense Metals (DEFN.V) – (DFMTF.OTC) – (35D.FSE)

- 160.59 million shares outstanding

- $40.95M market cap based on its recent $0.255 close

Defense recently announced a new hire.

This new advisor adds additional depth to the Defense crew.

John Goode (P.Eng.), an internationally recognized rare earth element processing expert, “has been responsible for design, monitoring, and interpretation of several programs of beneficiation and hydrometallurgical testwork, engineering and economic evaluations of new and existing processing operations for the recovery of rare earth element (REE), gold, base metals, uranium, and other elements from ore and other sources.”

Goode has over 50 years of experience as a metallurgist having worked on numerous rare earth projects around the globe.

This new hire makes a good deal of sense.

Most recently John worked as a special consultant to SRK Canada Inc. providing design and capital and operating expenditure estimates for metallurgical processes in the recent positive Wicheeda REE Project preliminary economic assessment (PEA)***. John was instrumental in identifying potential simplified alternative hydrometallurgical processes for Wicheeda mill feed that have the potential to yield future process-cost savings.

Luisa Moreno, President and Director :

“We are extremely pleased to add John Goode, an internationally recognized rare earth element processing expert, to the Defense Metals advisory board. John has already contributed significantly to metallurgical process development of the Wicheeda REE Project, and we expect him to continue to bring his considerable expertise to bear in adding value to the Project as we advance towards a Pre-Feasibility Study.”

If you’re a current Defense Metals shareholder or are pondering putting a position on, you need to watch this YouTube vid featuring Defense’s Luisa Moreno.

Moreno estimates that China’s rare earth production accounted for 95% of the market ten years ago. Today, she estimates that China’s dominance has been pared down to 60% by the likes of MP Materials in the U.S., Lynas out of Australia, and other operators around the globe.

Once in production, it’s estimated that the Company’s Wicheeda deposit could deliver REEs equal to roughly 10% of the world’s current production.

As it currently stands, Wicheeda has a 5.0 million tonne Indicated resource averaging 2.95% TREO and a 29.5 million tonne Inferred resource averaging 1.83% TREO (at a cut-off grade of 0.5% TREO).

On deck

Wicheeda drill hole assays are on deck from a 2021 drill program designed to expand the existing resource base and upgrade the Inferred tonnage to the higher confidence M&A resource categories.

This 5,349-meter program should generate significant assay-related newsflow over the next few months. The first batch of assays is due to drop any day now.

Forum Energy Metals (FMC.V) – (FDCFF.OTC)

- 170.03 million shares outstanding

- $34.01M market cap based on its recent $0.20 close

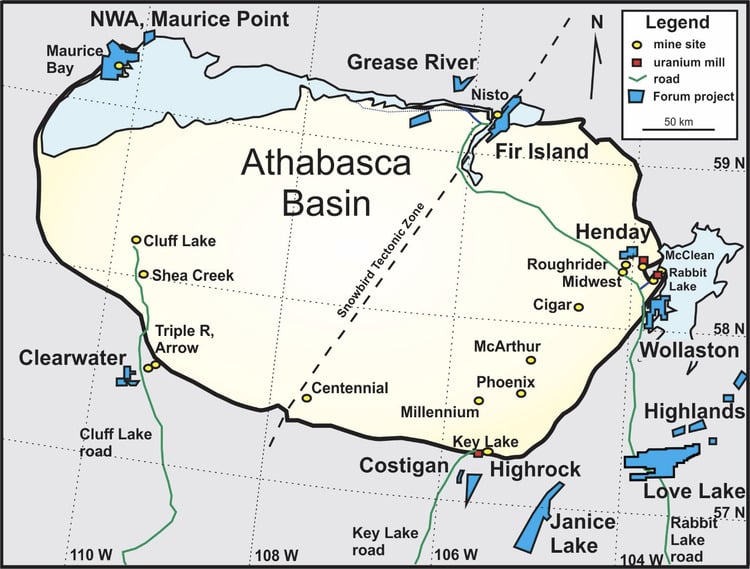

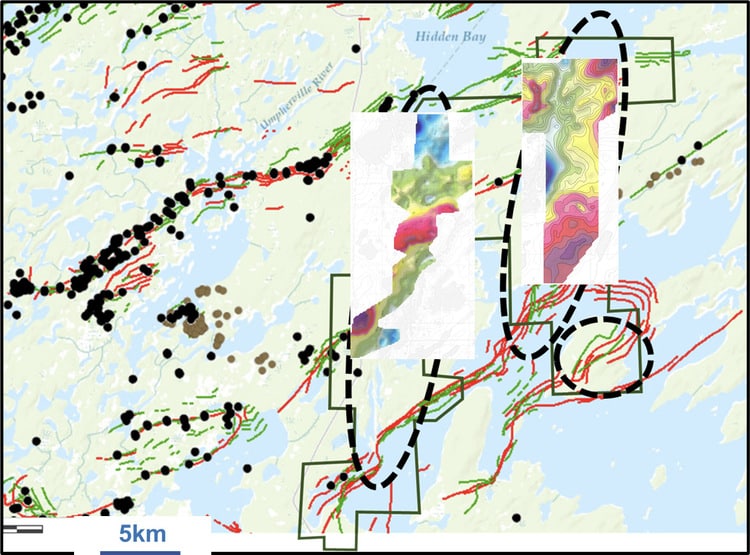

Last week Forum announced receipt of drill permits for its wholly-owned Wollaston Uranium Project, located 10 kilometers southeast of Cameco’s Rabbit Lake mill (and 30kms southeast of Orano/Denison’s McClean Lake mill) along the eastern edge of the prolific Athabasca Basin.

This announcement lays to rest any concerns that the Company was encountering challenges on the permitting front.

Forum Receives Drill Permit at Wollaston Uranium Project, Athabasca Basin, Saskatchewan

The Company is now on the cusp of a 3,000 meter drill program at Wollaston. An announcement regarding the start of drilling at its Highrock Uranium Project—under option to Sassy Resources—is also in the offing.

Drill crews have been mobilized to the Wollaston property. Drilling is expected to commence this week.

The Wollaston project is located just outside the margin of the overlying Athabasca sandstone and is prospective for basement-hosted unconformity style uranium deposits (Eagle Point, Arrow). The northeastern area of the Athabasca Basin is well endowed with uranium deposits that have been discovered and mined since the original discovery of the Rabbit Lake mine in 1968 (See Figure 2). Gravity crews have completed surveys on the main target areas to be drill tested (Map below). These surveys detect alteration halos surrounding potential uranium deposits associated with structures outlined by electromagnetic (EM) conductors.

The Company is using good science in prioritizing drill targets at Wollaston.

Ken Wheatley, VP of Exploration:

“We are quite excited about this drill program, bringing new techniques and models to an older project in an area that is prolific for uranium deposits. We will be testing targets that exhibit a combination of structurally offset graphitic conductors with associated gravity lows. Any mineralization found would provide the nearby Cameco and Orano/Denison uranium mills with easy access to mill feed.”

Rick Mazur, President & CEO:

“We commend the Hatchet Lake Denesuline First Nation for their input on the project parameters during the engagement process and their collaboration in providing services to Forum for execution of this drill program.”

For those looking for exposure to a potential new uranium discovery in one of the most mining-friendly regions on the planet, current prices may represent a good entry point.

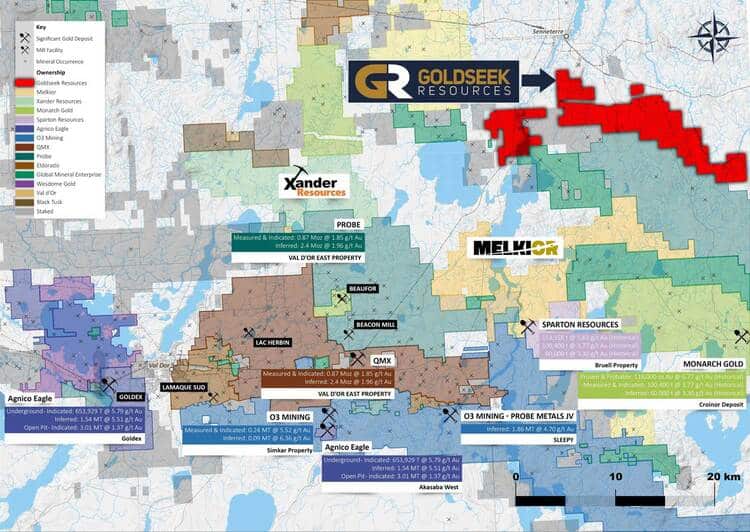

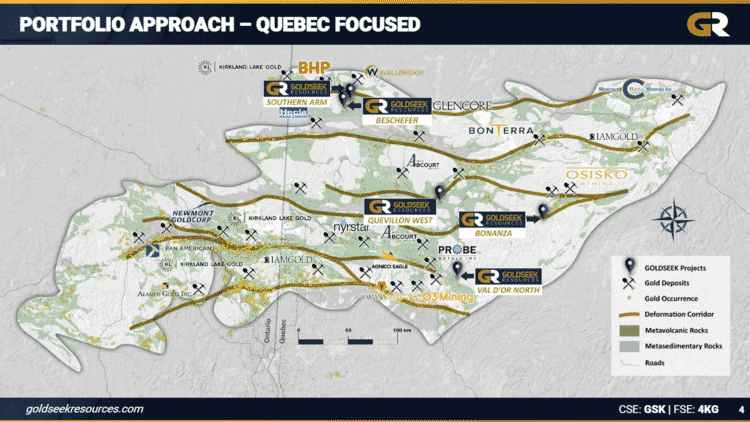

Goldseek Resources (GSK.C) – (GSKKF.OTC) – (4KG.FSE)

- 36.93 million shares outstanding

- $3.88M market cap based on its recent $0.105 close

Last week Goldseek gave us an update on its Val-d’Or North Property located 38 kilometers northeast of Val d’Or Quebec.

Goldseek Announces Update at its Val-D’or North Property

The Company now has five targets in its crosshairs at Val-d’Or North—targets based on polymetallic soil anomalies (soil samples showing consistent values in till). The Company plans a follow-up ground campaign this summer to better define and characterize these targets.

The Targets:

Multi-element assays on HMC and fine fraction of the 2020-2021 samples were used to define anomalous samples for precious metals (gold, silver) and base metals (copper, zinc, lead, etc) in heavy mineral concentrate and in fine fraction. The best response for targeting purposes was provided from the gold and silver content in HMC, associated with gold in the fine fraction.

Target 1 is located north of the Mogul showing, which has been described as a VMS system hosted at the contact between felsic tuffs and basalts. The Mogul showing presents copper, silver and zinc anomalies in grab samples: 1365ppm Cu, 0.9g/t Ag; 7670 ppm Cu, 1245 ppm Zn and 468ppm Au, which were associated with a massive sulphide lens in felsic tuff and basalt (Roberstson, D., et al., 1988).

Target 2 is south of the Lavoie-Simard showing, which has been described as a Mo-Cu-Au-Zn showing, returning up to 3.32% Mo, 0.2% Cu, 2.06% Zn, 1.03g/t Au and 5.14g/t Ag (Ingham, 1953). Target 2 could be the down-ice manifestation of this showing as it presents a very narrow dispersion trail in a NNE-SSW direction. It is also possible that new mineralization is the source of Target 2.

Target 3 is a dense cluster of the highest calculated ppb Au values (295ppb, 380ppb, and 1747ppb Au); highest total gold grain count (125 and 165 total grains); highest gold value in HMC assays (1.485ppm and >25ppm Au) and high values in the fine fraction assays (0.107ppm Au) indicating a probable proximal source to the NNE of the defined anomaly.

Target 4 is a small cluster of medium to high total gold grains count (10, 19, 19 and 30 total grains) with medium values of 4.9ppm Zn in the HMC and 38ppm Zn in the fine fraction. The source of the anomaly could be in the continuity of the Dollard showing about 1km west of Target 4. The Dollard showing was sampled in sheared and carbonatized andesite with massive sulphide zones mineralized in 2200ppm to 2.52% Cu (Cote, R., and al., 1976). The contact between the felsic and mafic units is a good target.

Target 5 is a less defined cluster of HMC assays anomalous in gold, silver, copper and zinc (1.765ppm Au, 2.6ppm Au, 0.275ppm Ag, 0.432ppm Ag, 37.3ppm Cu and 139.5ppm Zn), while the fine fraction returned anomalous values in silver, copper and zinc (0.135 ppm Ag, 0.182ppm Ag, 16.65ppm Cu, 15.5ppm Cu, 38.5ppm Zn, 33.0ppm Zn and 40.1ppm Zn). The HMC and fine fraction assays are slightly separated and result from the glacial remobilization of the different fractions during the various glacial ages (and subsequent remobilization of anterior glacial deposits).

Jon Deluce, CEO:

“We are excited to announce the continued development of our targets at the Val D’Or North Property. The presence of high gold grain counts, especially at our Target 3 supports the potential of this grassroots project in a camp that has seen lots of recent M&A. We continue to deliver on our overall plan by developing our grassroots portfolio systematically while being open to partnerships while focusing on our near-resource flagship Beschefer on the Detour Gold Trend.”

The Company is set to launch a 4,000-meter Phase-2 drill campaign at its flagship Beschefer Project —located along the Detour Gold Trend roughly 30 kilometers southwest of Wallbridge’s Fenelon Gold project—any day now. This Phase-2 program is designed to infill and extend historical zones of high-grade mineralization.

Goldseek has a current market cap of < $4M. Current prices may represent an attractive entry point for those looking to speculate on a well-run junior with a robust project pipeline in some of Canada’s more prolific mining camps.

HighGold Mining (HIGH.V) – (HGGOF.OTC)

- 73.02 million shares outstanding

- $105.88M market cap based on its recent $1.45 close

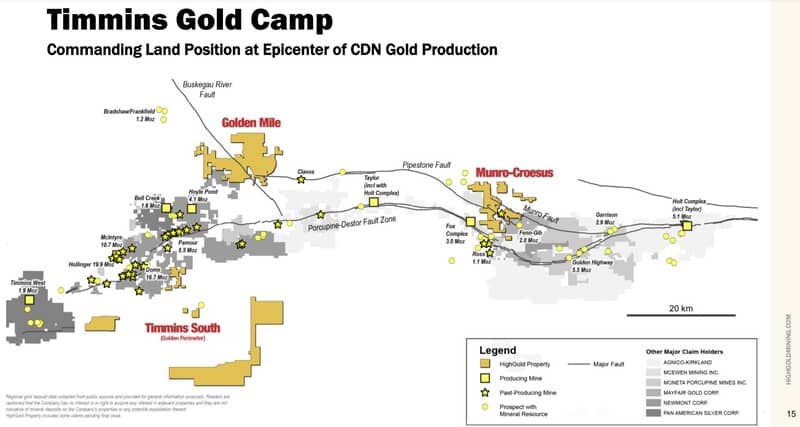

While we anxiously await for the snow levels to rise at the Company’s flagship high-grade Johnson Tract Project in Southcentral Alaska, management has shifted its focus to its wholly-owned assets in the Timmins gold camp of northeast Ontario—projects proximal to the Porcupine-Destor and Pipestone Faults where multiple multi-million ounce deposits are located directly on either side.

The Munro-Croesus Project is located along Highway 101 in the heart of the Abitibi greenstone belt, Canada’s premier gold mining jurisdiction (Figure 1). The Project now covers 47 km2 (18.1 mi2) of highly prospective geology situated between the Black Fox Mine Complex operated by McEwen Mining Inc. and the Fenn-Gib gold deposit being developed by Mayfair Gold Corp. This property is also proximal to major gold-bearing breaks. Extensive land consolidation by the Company in 2020-2021 has now unified the patchwork of patented and unpatented mining claims surrounding the Croesus Gold Mine into one contiguous package and has enhanced the exploration potential of the Project.

A recent headline concerning these Timmins assets…

HighGold Commences 8,000-meter Phase 2 Drill Program at Munro-Croesus Project, Timmins Area, Ontario

The Company is now in the midst of an 8,000 meter Phase-2 drill program at its Munro-Croesus Project.

Phase-2 is designed to follow up on a Phase 1 campaign that systematically tested the strike and down-dip/down-plunge potential of the #2 and #4 Veins located immediately south and southwest of the past-producing Croesus Gold Mine and the Croesus Vein (this consolidated Munro-Croesus land position is being explored for the first time in nearly a century under the banner of one Company).

Aside from targets located near the Croesus Gold Mine, several new priority targets on the property will see a first pass with the drill bit.

New priority targets to be tested during Phase-2 will include:

- Croesus-style vein targets within the Croesus pillowed mafic flow and its favourable sulphidic flow-top breccia;

- Structural and vein targets within the #4 variolitic mafic flow;

- Pipestone Fault and associated splays with focus on mafic/ultramafic contacts, volcanic/sediment contacts, and intrusive-hosted gold targets;

- Ultramafic rocks (green carbonate zones) in association with the northerly Munro Fault;

A portion of the planned meterage will also be reserved for potential follow-up drilling on the #2 and #4 Vein prospects that were tested during the Phase 1 program. The Phase 1 program was completed in November-December 2021 and totaled 4,321 meters in 24 holes, with initial assay results from the program expected in the later half of Q1/2022.

The Company is also carrying out a (100 line-km) IP survey over the central portion of the Project.

Regarding the regional potential of their flagship JT property in Alaska, a pending resource update for the JT Deposit, and the condition of the Company’s treasury, CEO Darwin Green from a January 25th press release:

“We are seeing encouraging results across the length and breadth of the property and believe that systematic exploration will continue to generate new discoveries at Johnson Tract. The geological setting that was permissive in developing exceptional precious metal grades at the JT Deposit appears to extend across the greater property. This thesis is supported by HighGold’s DC discovery hole which ranked #3 on the Opaxe* global list of Top 10 Drill Holes of the Year (577.9 g/t Au and 2,023 g/t Ag over 6.4 m in drill hole DC21-010; See Company press release dated October 6, 2021). This is the second time in three years that Johnson Tract has made the Top 10 best drill intersections list, placing #7 in 2019 in the Company’s first drill program and only narrowly missing the list in 2020.”

Click HERE for additional video commentary regarding the above referenced high-grade hit at their Difficult Creek target.

“With approximately $23M in the treasury, HighGold is well funded to drill these new discovery-stage targets in 2022 while also following up on the highly successful 2021 drill program at Middle DC. We also look forward to completion of an updated mineral resource estimate for the JT Deposit that is due within the next three months and continuing with deposit expansion drilling as part of the greater 2022 exploration program.”

Prime Mining (PRYM.V) – PRMNF F.V) – (04V3.FRA)

- 112.69 million shares outstanding

- $429.36M market cap based on its recent $3.81 close

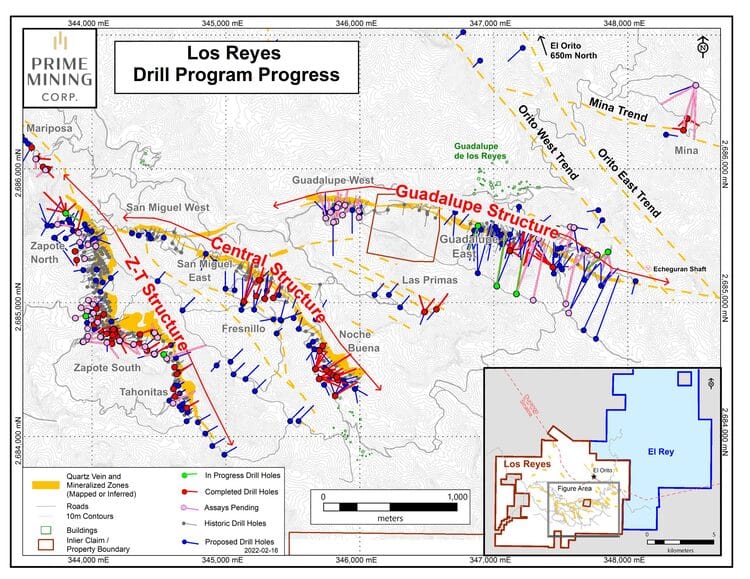

On February 17th, Prime dropped a new batch of drill hole assays from its wholly-owned Los Reyes Gold-Silver Project in Sinaloa State, Mexico.

Drilling Intercepts 35 Metres of 4.9 gpt Gold Extending Los Reyes Z-T Structure 450 Metres

As the text in the above headline asserts, these new results continue to expand known mineralized structures.

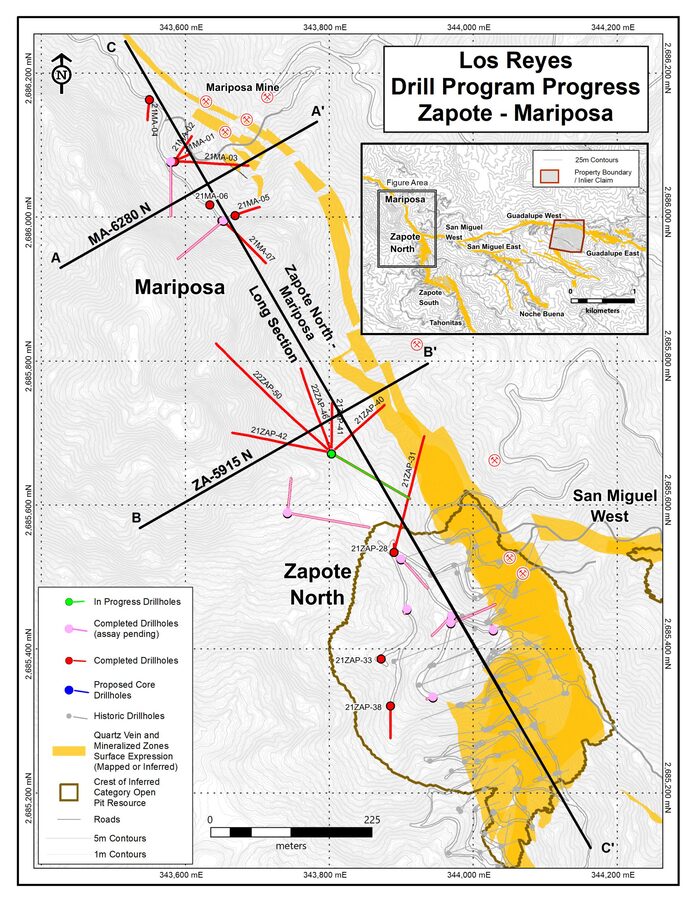

The assays reported in this press release cover 17 new holes targeting the northern extension of the Zapote-Tahonitas structure (Z-T Structure).

Seven of the 17 holes probed ground near the historical underground Mariposa Mine. The other ten holes probed a previously untested mineralized gap between Zapote North and Mariposa.

We now have confirmation that the gold-silver mineralization extends from Zapote North to Mariposa, increasing the total length of the mineralized Z-T Structure by 450 meters to roughly 3.0 kilometers.

Holes reported today are from Phase 1 drilling through October 30, 2021, and Phase 2 drilling that began November 1, 2021. Approximately 15,000 m of the planned 50,000 m Phase 2 drill program are targeting the Mariposa, Zapote North, Zapote South and Tahonitas gold-silver mineral deposits that make up the Z-T Structure (see Figure 2). There are currently 3 drill rigs working on the west side of the property at the Z-T Structure and 5-rigs working on the east side of the property at the Guadalupe and El Orito structures. The Company continues to work with the assay laboratory to resolve, and where possible accelerate, the previously reported current backlog of drill hole samples requiring assaying. The assay turnaround time is now 6-8 weeks, including completion of QA/QC procedures. Despite the assay delays, the efficient ramp up of drilling and mobilization of a reverse circulation drill rig has kept Phase 2 progress on target with 21,530 m, comprising 69 holes, already drilled including approximately 5,440 m in November, 4,550 m in December and 6,850 m in January.

Mariposa stepout drilling highlights:

- 4.89 grams per tonne (“gpt”) gold (“Au”) and 22.2 gpt silver (“Ag”) over 35.3 m (34.7 m estimated true width (“etw”) including 23.13 g/t Au and 61.4 g/t Ag over 2.9 m (2.9 m etw) and 41.50 g/t Au and 40.4 g/t Ag over 1.5 m (1.5 m etw) plus 1.08 gpt Au and 18.4 gpt Ag over 2.4 m (2.3 m etw) (21MA-06);

- 1.34 gpt Au and 24.5 gpt Ag over 16.7 m (12.8 m etw) including 3.22 g/t Au and 36.2 g/t Ag over 2.5 m (1.9 m etw) and 1.27 g/t Au and 5.8 g/t Ag over 1.4 m (1.0 m etw) (21MA-01); and,

- 3.06 gpt Au and 30.2 gpt Ag over 1.5 m (1.5 m etw) (21MA-03).

Zapote North stepout drilling highlights:

- 1.29 gpt Au and 25.7 gpt Ag over 10.5 m (7.4 m etw), including 4.93 gpt Au and 42.3 gpt Ag over 0.8 m (0.5 m etw) and 2.74 gpt Au and 40.5 gpt Ag over 1.9 m (1.3 m etw) (21ZAP-28); and,

- 1.00 gpt Au and 5.6 gpt Ag over 12.0 m (10.4 m etw) (21ZAP-39).

Daniel Kunz, CEO:

“Connecting Mariposa to Zapote North is an important development for the evolving Z-T Structure. Drilling on the Z-T Structure continues to target Zapote North to further evaluate the new Mariposa extension and Zapote South and Tahonitas to better define and expand the higher-grade, potentially open-pit mineable material identified to date. Drilling is also focused on exploring the down dip, potentially underground mineable extensions that are below the current depths of known boiling zone mineralization. To-date for Phase 1 and 2 combined, Prime already drilled 191 holes totalling 47,200 metres.”

END

—Greg Nolan

Postscript… a BBC headline: Putin orders troops into eastern Ukraine

***Independent Preliminary Economic Assessment for the Wicheeda Rare Earth Element Project, British Columbia, Canada, dated January 6, 2022, with an effective date of November 7, 2021, and prepared by SRK Consulting (Canada) Inc. is filed under Defense Metals Corp.’s Issuer Profile on SEDAR (www.sedar.com)

Full disclosure: Defense Metals, Forum Energy Metals and Goldseek Resources are Highballer clients.