Inflation is every investor’s concern right now. It’s on everyone’s radar. Spiraling price pressure doesn’t just represent a loss in purchasing power; it’s a precursor to a lower standard of living (if wages don’t rise commensurate with the spiral). All eyes will be on the CPI numbers set for release this Tuesday (April 12).

Analyst estimates percolating under this next round are worrying. Last week the Federal Reserve Bank of Cleveland estimated the numbers could top 8.40%. When you consider that these gov’t stats are understated—just ask Ron Paul or Peter Schiff for their take on the blatant manipulation underpinning these stats—the erosion in our dollars’ purchasing power can’t be overstated. We all see it. Prices are rising across the board, and ‘shrinkflation‘ is now a thing – End the Fed and Get More Doritos.

The Fed appears to be out of moves. In a desperate attempt to rein in this price pressure, they’ll likely push interest rates up by a half-point when they meet again in May. The Bank of Canada is expected to follow suit – As inflation soars and wages stay stagnant, Bank of Canada survey signals pressure to move aggressively on rate hikes.

This hawkish attitude carries some obvious risks. ING’s chief international economist, James Knightley: “With the Fed seemingly feeling the need to ‘catch up’ to regain control of inflation and inflation expectations, a rapid-fire pace of aggressive interest rate increases heightens the chances of a policy miss-step that could be enough to topple the economy into a recession.”

Inflation is (especially) on the radar of those aggressively positioned in precious metals for what’s perceived as the most potent setup witnessed in decades.

Looking at the (daily) price chart, those in the bull camp view recent trade in the metal as a classic case of price compression—a coiled spring, if you will—and believe it’s on the verge of ripping substantially higher.

The party faithful is not only looking for a dramatic push higher, they expect the metal to carve out a higher trading range in record territory; one that will set the stage for a multi-year bull run.

Gold stocks are telegraphing such a move, outperforming the metal, trading with the expectation that a chart-defining gold breakout is looming on the horizon (this GDX stair-stepping price pattern is featured below).

For those of you with exposure to the junior sector, wondering why your high-quality/undervalued positions can’t seem to catch a meaningful bid, it’s recently been suggested that precious metals (and related equities) currently account for < 0.5% of the total value of savings and investment in the U.S. The norm—the three-decade mean—is 1.5%. If investment merely reverts back to the three-decade mean, demand will triple. This dynamic represents a (potentially) powerful catalyst from the top of the precious metals food chain on down. If investment accelerates beyond that 1.5% three-decade mean, demand will outstrip supply, and this tiny sector, able to accommodate only so much buying pressure, will go on a tear of epic proportions (I’ve seen this movie before).

Some of the companies we follow closely here at Highballer generated headlines in recent sessions. We’ll start with Goldseek.

Goldseek Resources (GSK.C) – (GSKKF.OTC) – (4KG.FRA)

- 37.68 million shares outstanding

- $4.14M market cap based on its recent $0.11 close

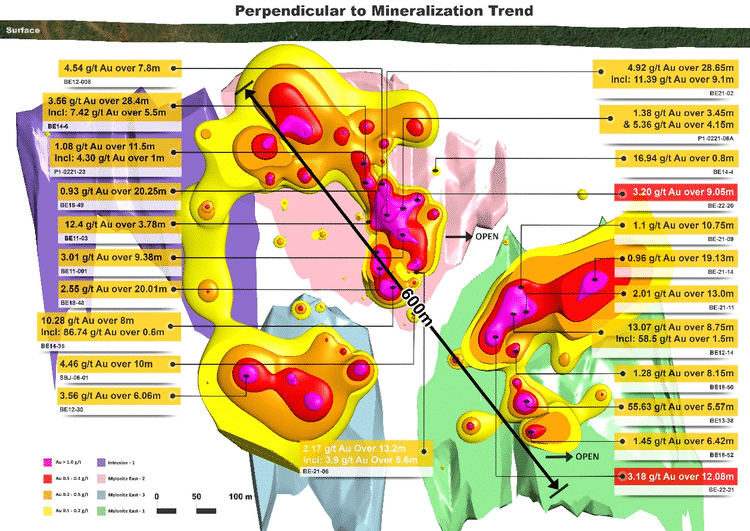

Goldseek released the first five of 13 holes from a 3,840-meter drill campaign at their flagship Beschefer Project located in the Detour Gold camp of mining-friendly Quebec.

The April 6 headline:

Goldseek Intersects 3.18 g/t Gold over 12.08 Metres at Beschefer

Beschefer, optioned from Wallbridge Mining roughly one year back, has the larger Company betting on Goldseek equity for the Project’s ultimate upside.

Highlights from these first five holes:

- 3.18 g/t gold over 12.08 meters (including 7.24 g/t gold over 2.65 meters in BE-22-21), which successfully extends the East Zone westward;

- 3.2 g/t gold over 9.05 meters in BE-22-20 on the eastern strike extent of the Central Shallow Zone;

- 4 of 5 holes reported returned gold values supporting the continuity of the B14 gold-bearing structure.

The above highlights state Goldseek is four for five with this first batch of assays, but there remains a 6.8-meter section of core from hole BE-22-19 that is still pending and could prove well mineralized, setting up a (potential) five for five hit rate from this first round.

** Assays from 6.8 metres of the rushed zone are still outstanding

The key takeaway is that with BE-22-21, a 30-meter step-out along the East Zone, it’s beginning to look like the Central Shallow and East zones are connected via the same mineralized structure.

Click on the images below to magnify

As per the guts of this April 6 press release…

East Zone

- BE-22-21 was drilled at a 30m NW strike extension of BE12-014 to extend strong historical results and the influence of the East Zone to the west. The mineralized interval of 3.18 g/t Au over 12.08 metres (including 7.24 g/t over 2.65 metres) is centred at a vertical depth of 200 metres. The mineralization is hosted in a similar alteration and mineralization style as BE-22-20. Its location creates opportunities to expand the East Zone to the west and eventually connect with the deeper part of the Central Shallow Zone.

Central Shallow Zone (CSZ)

- BE-22-20 and BE-22-28 intercepted the B14 structure between 100 and 250 metres vertical depth to validate high-grade holes, infill and extend the mineralized zones.

- BE-22-20 was drilled about 20 metres from surrounding holes to fill a gap at the eastern limit of the CSZ. The mineralized interval of 3.02 g/t Au over 9.05 metres consisted of a greyish-beige fine-grain alteration composed of feldspar, carbonate and pyrite. This result reinforces the potential of this area and is open for expansion to the northeast.

- BE-22-28, drilled about 15 metres west of historical hole SBJ-06-01 returned 3.3 g/t Au over 4 metres hosted in a high density of deformed carbonate veinlets associated with disseminated pyrite. This hole defines the down-dip limit of the CSZ in this area at about 200 metres in depth.

There are an additional eight holes with assays pending from this winter campaign: one from the Central Shallow zone and seven from the East zone.

Goldseek’s President & CEO Jon Deluce:

“We are very excited to announce this step-out hole (BE-22-21) on the East Zone, supporting the expansion potential and our goal of connecting the Central Shallow and East Zones sharing the same structure and mineralization. We believe these first 5 holes were a success hitting gold in 4 of 5 holes, proving the continuity and predictability of the B14 structure. Additionally, results obtained from BE-22-20 represent further strong infill drilling within the Central Shallow Zone, supporting our goal of a maiden resource estimate.

We look forward to the remainder of the results, including 1 hole within the Central Shallow and the majority of our drilling within the East Zone, which continue to hit the mineralized zone with favourable indicators observed over intervals similar to previous holes.”

In a recent interview, CEO Deluce discusses the significance of these first five, the remaining eight, and the timing of a maiden resource estimate. You can open the discussion here.

With a market cap of just over $4M, one or more decent hits out of the East zone (assays pending) could push these eleven-cent shares higher, perhaps substantially so.

Teuton Resources (TUO.V) – (TEUTF.OTC) – (TFE.FRA)

- 56.22 million shares outstanding

- $126.49M market cap based on its recent $2.25 close

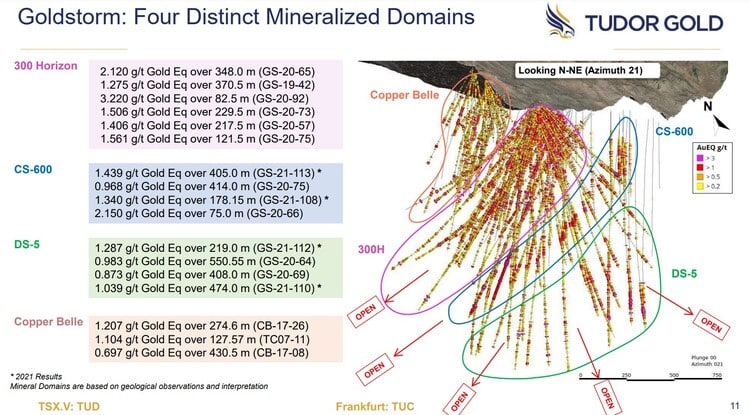

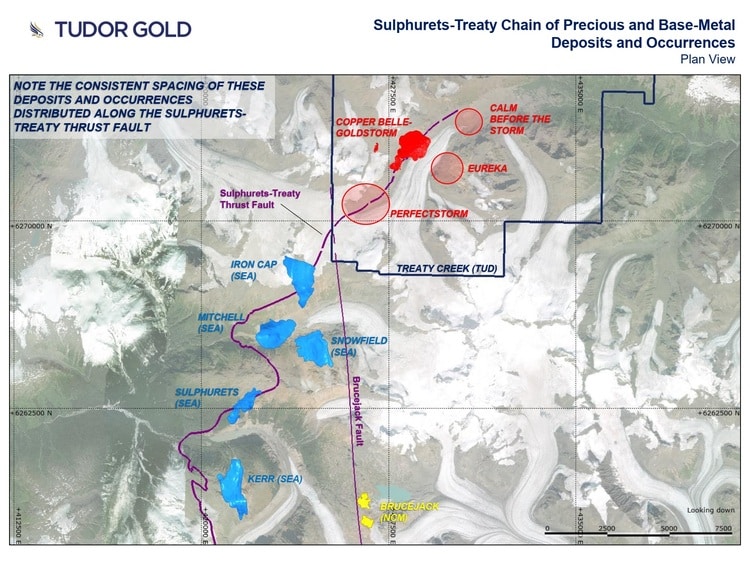

On April 7, Teuton, boasting a 20% (carried) interest in Treaty Creek’s 27.3M AuEq ounce count, dropped the following headline concerning its flagship project in the heart of the Golden Triangle of northwest British Columbia:

Teuton received word from its joint venture partner, Tudor Gold, that crews are being mobilized to Treaty Creek in advance of what promises to be an aggressive and eventful 2022 exploration campaign.

Crews are currently transporting heavy equipment and drilling supplies to site along a winter access branching from the Brucejack Lake Road. Crews will also be preparing the camps for the upcoming drill campaign set to commence early May.

Early May is just around the corner. We could see a solid six months of exploration activity at Treaty Creek in 2022.

Tudor’s President and CEO, Ken Konkin:

“As in the previous season, the priority of our upcoming exploration program will be to expand and define the limits of the Goldstorm Deposit (GS), as mineralization remains open in all directions and at depth. Ten diamond drill rigs are scheduled to be mobilized to site throughout the month of May for an aggressive diamond drilling program. While the priority remains to complete the exploration and definition of the Goldstorm Deposit, exploration drilling will follow up on several other discoveries including the Eureka Zone (EZ), located 800 meters southeast of GS, and the Company’s newest discovery, Calm Before the Storm (CBS), located two kilometres northeast of GS. Tudor’s priority is to define the limits of the GS mineralized domains in order to complete an updated resource estimate and support a Preliminary Economic Assessment (PEA). At the end of the 2021 drill program, some of our best Au-Cu-Ag results were encountered from our step-out drilling to the north within the 300H and CS-600 domains from drill holes GS-21-113 (1.44 g/t Au Eq over 405.0 meters within CS-600), GS-21-113-W1 (2.35 g/t AuEq over 159.0 meters within 300H) and GS-21-113-W2 (1.38 g/t AuEq over 556.5 meters within CS-600). To the northeast, we encountered some of strongest gold mineralization within the DS-5 domain with drill hole GS-21-119 (1.76 g/t AuEq over 196.5 meters). Not only is the size of the deposit increasing, but the values are also some of the highest that we have received within GS and these latter drill holes are those which we will be stepping out from in 2022.”

Treaty Creek, ranked among the top gold discoveries over the past thirty-some-years, is turning into an absolute monster with mineralization open in all directions and at depth.

Teuton can’t seem to satiate its appetite for this rapidly evolving exploration/development play. In this April 7 press release, the Company also reported taking down a substantial portion of Tudor’s recent $12.9 million raise – $2 million for 1,000,000 units (each unit consists of one share and a half two-year warrant exercisable at $2.80).

The last time I checked, Teuton had >$5 million in cash and $14 million in marketable securities (in 2021, they took in just over $2,700,000 in cash and shares from partner companies). The fact that they plowed an additional $2M into their own project as an investment speaks volumes.

All told, Teuton has invested $11.6 million in Tudor (Eric Sprott also participated in the Tudor PP taking down 1,250,000 units valued at $2.5 million).

Ten rigs are set to turn on defining and expanding multiple zones within the main Treaty Creek resource base area (Goldstorm). The project’s regional potential—Perfect Storm, Eureka (800 meters southeast of Goldstorm), Calm Before the Storm (two kilometers northeast of Goldstorm)—will also see the business end of the drill bit in 2022.

Teuton’s 20% of the 27.3M AuEq resource works out to 5.46M AuEq ounces. That ounce count appears destined to grow, perhaps significantly so. It also holds a .98% NSR on the entire 27.3M AuEq ounce resource base, and then some.

We’re on the cusp of a sustained period of robust newsflow with this one (We stand to watch).

Forum Energy Metals (FMC.V) – (FDCFF.OTC)

- 170.03 million shares outstanding

- $41.66M market cap based on its recent $0.245 close

On April 7, Forum dropped the following headline concerning its Love Lake Project located roughly 60 kilometers northeast of the Company’s Janice Lake Project in north-eastern Saskatchewan.

Highlights from the What Lake and Korvin Creek zones:

- LL-03 – 0.23% Cu, 0.05% Ni, 85 ppb Pt, 118 ppb Pd over 8.5 meters from 34.5 to 43 meters;

- LL-08 – 0.56% Cu, 0.06%Ni, 5 ppb Pt, 14 ppb Pd over 13.5 meters from 24.5 to 38 meters;

- LL-10 – 0.45% Cu, 0.07% Ni over 23 meters from 3 to 26 meters.

Perhaps best characterized as a technical success, there were no mic-drop assay values in this press release. That’s not to say there isn’t a significant deposit tucked away in Love Lake’s 32,135-hectare subsurface stratum. Larry Hulbert, Forum’s Cu-Ni-PGE consultant:

“The unusually high Copper/Nickel ratios associated with the magnesium-rich mafic to ultramafic host lithologies at Korvin Creek and their extreme PGE-depletion are incompatible and could suggest an unrecognized earlier sulphide-PGE segregation event. The anomalous Platinum and Palladium association at What Lake needs further investigation.”

With all of the current activity on the U3O8 front—Wollaston, Highrock, the Thelon Basin—Love Lake is barely on the radar of Forum’s investors, so it’s not surprising the market took these neutral assay values in stride.

Forum has set itself up for a solid stretch of substantial newsflow—the drills have been turning at both Wollaston and Highrock since early March. Positive results on either front should receive a rousing cheer from this buoyant market.

Cartier Resources (ECR.V)

- 218.15 million shares outstanding

- $31.63M market cap based on its recent $0.145 close

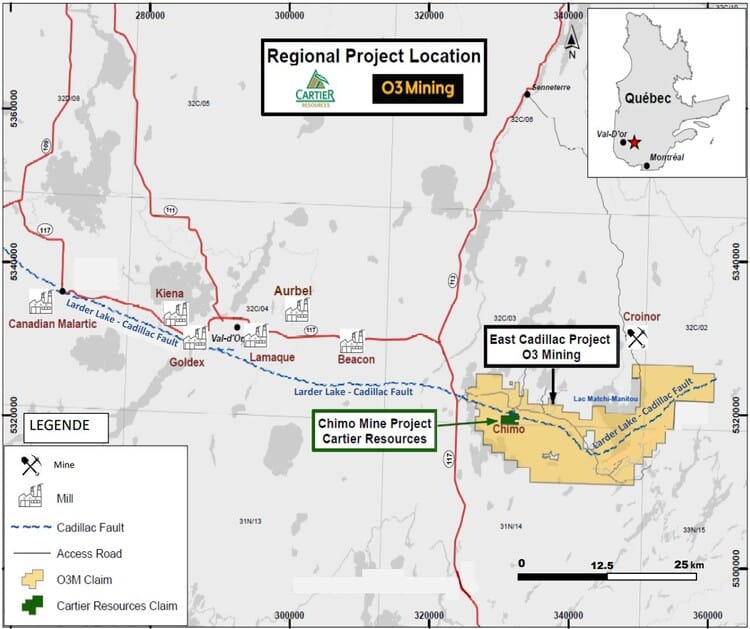

In a recent Highballer offering—Defense (DEFN.V), Cartier (ECR.V), Goldseek (GSK.C), HighGold (HIGH.V), and Prime (PRYM.V) – A Highballer Roundup—we took a fresh look at Cartier Resources on the heels of a new (potential) acquisition—O3 Mining’s East Cadillac Project located along the prolific Val-d’Or gold camp of mining-friendly Quebec.

Updating developments along this front, on April 8, Cartier dropped the following headline:

Cartier Signs Share Purchase Agreement With O3 Mining

It’s a done deal. Cartier has expanded its land position in the prolific Val-d’Or camp to 29,754 hectares…

… and the Company now reaps the following benefits (verbatim, as per the guts of this Apr 7 press release):

Advantages: Eliminates boundaries, increases resource and potential for additional ounces, Increased flexibility to strengthen project economics and favor project development and its construction:

- Cartier will hold 100% interest in largest land position east of Val-d’Or:

- Immediate increase of the resource base to 714,400 oz in the indicated category and 1,527,400 oz of gold in the inferred category;

- Initial budget designed to increase resources and explore additional potential;

- Significantly increases exploration territory and potential for new discoveries.

- Enhanced capital markets profile and exposure;

- Platform for further district consolidation;

- New partnership formed with O3 Mining.

On closing of the Transaction, Cartier and O3 Mining will enter into an investor rights agreement (the “Investor Rights Agreement”) pursuant to which O3 Mining will be entitled to designate one director for appointment to the board of directors of Cartier. The Investor Rights Agreement will also include, among other things, pre-emptive and top-up rights in favour of O3 Mining, a standstill provision for a period of 2 years and a share transfer restriction provision effective for a period of 3 years.

A technical committee will be formed and comprised of one (1) nominee of Cartier and one (1) nominee of O3 Mining with a purpose to provide strategic advice and guidance to Cartier on exploration and development activities for the Project, and provide a forum for Cartier and O3 Mining to share their views on the exploration, development and advancement of the Project.

Cartier handed over 46,273,265 common shares representing a 17.5% interest in the Company’s o/s stock to seal this deal.

Philippe Cloutier, Cartier’s CEO:

“The acquisition will provide Cartier with largest land holding along the prolific Larder Lake – Cadillac Fault east of Val-d’Or as well as a solid resource base with significant growth potential. The Simon West, Nordeau West and Nordeau deposits, immediately adjacent to the gold resources of the Chimo Mine property, will provide short term targets to significantly increase our gold resources.”

This is an interesting development for a company I had all but written off. I may look to re-establish a position once the Company tables a budget and work plan.

END

—Greg Nolan

Full disclosure: Goldseek, Forum, and Teuton are Highballer clients. The author owns shares in tall three companies.

agree with you regarding tuo, however for cartier …too many shares issued the best way for this play is gmx globex mining who have a gmr on this property,gmx has only56 millions shares issued many royalties properties , more than 20 millions in the bank and no debt.

I like Jack Stoch. I’m a big fan of Globex. Been around for decades and never once a rollback. Nice to see it trading a decade-plus highs. Still undervalued IMO.