Goldseek Resources (GSK.C) is an aggressive, tightly run exploreco with 37.68 million shares outstanding and a stock price of $0.06, which gives it a market cap of roughly $2.26M.

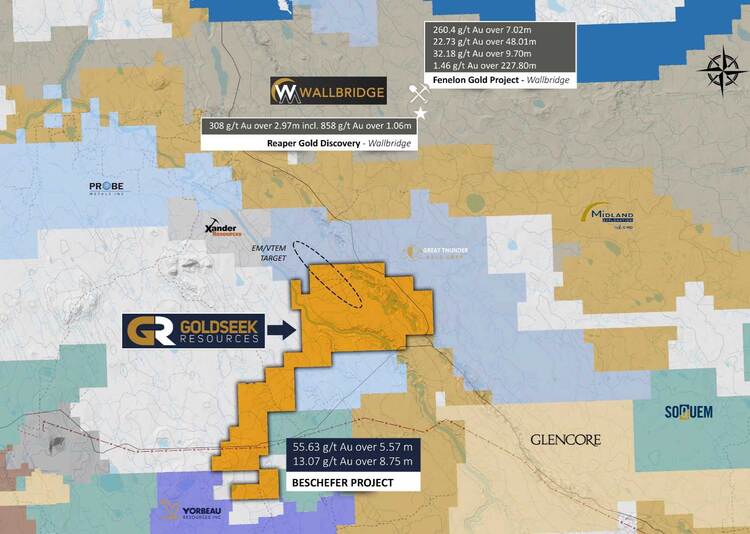

The Company holds an extensive project pipeline in some of Canada’s most prolific gold camps: Hemlo, Urban Barry, Quevillon, Val D’Or North, and Detour. Its flagship is Beschefer—a 962-acre property located along the northern Abitibi Greenstone Belt some 14 kilometers east of the past-producing Selbaie Mine, 45 kilometers northeast of the Casa Berardi Mine, and 30 kilometers southwest of Wallbridge’s Fenelon Gold Project.

The deal for Beschefer—an advanced stage project with significant near-term resource and discovery potential—was struck back in March of last year.

The option terms require Goldseek to divvy out 4,283,672 shares and spend $3,000,000 on exploration over four years. These are friendly terms. Wallbridge obviously sees the potential in Beschefer’s geology and Goldseek management expertise. Wallbridge is betting on Goldseek paper.

Located in a favorable orogenic gold setting, Beschefer boasts a continuous large-scale gold-bearing structure—the B-14 Zone—a structure with good continuity and a number of (known) mineralized shear zones running parallel.

The Beschefer Project is positioned on a kilometric section of the B14 shear system hosted in the Brouillan volcanic formation. The northeast shallow dipping structure was discovered during the nineties, 12km east of the former Selbaie Mine following a base metal targeting program. The gold-bearing structure is open to the east on the property over a strike length of approximately 2km.

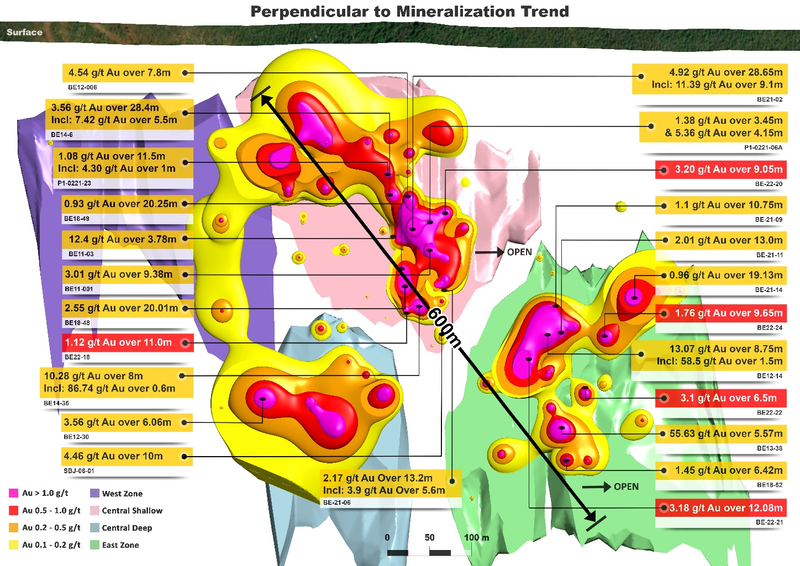

Historical drill hole highlights include:

- 55.63 g/t gold over 5.57 meters in hole BE13-038 (including 224 g/t over 1.23 meters);

- 13.07 g/t gold over 8.75 meters in hole B12-014 (including 58.5 g/t over 1.5 meters);

- 3.56 g/t gold over 28.4 meters in hole B14-006 (including 7.42 g/t over 5.5 meters);

- 10.28 g/t gold over 8.00 meters in hole B14-35 (including 86.74 g/t over 0.60m);

- 12.40 g/t gold over 3.78 meters in hole B11-003.

Solid hits. True widths vary between 89% and 99%.

The Central Shallow zone has seen the lion’s share of historical drilling (pink shaded area, map below).

Since acquiring the project, Goldseek launched two phases of drilling totaling roughly 9,000 meters.

Highlights from this recent drilling include:

- 4.92 g/t Gold Over 28.65 meters (including 11.39 g/t Au over 9.1 meters) at the – Oct 7, 2021 press release;

- 2.17 g/t gold over 13.2 meters (including 3.9 g/t gold over 5.6 meters) at the Central Shallow Zone – Nov 23, 2021 press release;

- 0.96 g/t gold over 19.9 meters (including 1.56 g/t gold over 7.0 meters) at the East Zone (green shaded area, map above) – Nov 25, 2021 press release;

- 3.18 g/t gold over 12.08 meters (including 7.24 g/t gold over 2.65 meters) at the East Zone – April 6,2022 press release;

- 3.2 g/t gold over 9.05 meters along the eastern strike extent of the Central Shallow Zone – April 6, 2022 press release.

On May 18, the Company released the final batch of assays from Phase-2 via the following headline:

GOLDSEEK Intersects 3.1 G/T Gold Over 6.5 Metres at Beschefer

Highlights from this last batch:

- 3.1 g/t gAu over 6.5 meters, including 4.92 g/t Au over 2.8 meters, which successfully confirms the continuity of the East Zone to the northeast;

- 1.76 g/t Au over 9.65 meters on the eastern strike extension of the East Zone;

- 12 of 13 holes from Phase-2 returned gold values supporting the continuity of the B14 gold-bearing structure.

These final results are not the monster high-grade hits we were hoping for, but the mineralized widths are good. And importantly, management believes that there’s excellent potential for tagging another high-grade gold lens. The East Zone has that high-grade potential—previous operators drilled 53 g/t Au over 5.6 meters back in 2013 (green shaded area, map above).

Jon Deluce, CEO: “We are very excited to announce the full gold results from our winter drill program. We continue to outline the strong continuity and expansion potential at Beschefer. At the eastern margin of our drill grid, we identified wide low-grade intervals associated with strong alteration and brecciation, which are considered proximity indicators for the next potential high-grade gold shoot.”

The East Zone is the standout from this recent campaign. It now has a strike length of >200 meters (up from the 25 meters when Goldseek first acquired the project). Geophysics will now come into play to zero in on potential (new) high-grade zones.

CEO Deluce again: “We are planning a follow-up drill program this summer and geophysics to better investigate the location of additional high-grade gold shoots cross-cutting the main northeast trend.”

Additional details regarding this last batch of Phase-2 assays (as per the guts of this May 18 press release):

East Zone

BE-22-22 was drilled at close range east of the central East Zone section at around 275 metres vertical depth. This hole intercepted 3.1 g/t Au over 6.5 metres, including 4.92 g/t Au over 2.8 metres in an albitized shear zone at the hanging wall of the B14 structure and hosted about 5% of disseminated pyrite.

BE-22-27: was drilled at close range east of the central East Zone section to intercept the up-dip extension at about 200 metres vertical depth. This hole intercepted 1.52 g/t Au over 6.45 metres, higher grades were obtained from narrow quartz-pyrite bands concordant to the strong deformation fabric.

East Zone Extension

BE-22-24 was drilled to test the eastern strike extension of the East Zone to link the Zone with BE-21-14. This hole intercepted 1.76 g/t Au over 9.65 metres, including 2.79 g/t Au over 5.2 metres hosted in a strongly feldspathized and brecciated unit. Rarely seen in the area, more than half of the mineralized interval corresponds to a brecciated gold-bearing quartz vein which ran against the alteration zone. According to the Leapfrog model, BE-22-24 reinforces a northeast mineralized trend, which can be interpreted over about 100 metres. Hole BE-22-23 was drilled more than 80 metres down dip. The low-grade interval of 0.52 g/t Au over 10.5 metres supports the down-dip extension potential of the gold system.

BE-22-17 and BE-22-25 targeted the extension of the mineralized system past historical drilling and up to 50 metres east of BE-21-14 to support a strong northeast gold trend. Both holes have intersected a strong shear zone evolving to a tectonic breccia over 30 metres. Mineralized intervals of respectively 0.6 g/t Au over 15.5 metres (including 1.1 g/t over 5m) and 0.81 g/t Au over 1.15 metres are related to massive albite-ankerite alteration overprinting integrally volcanic texture of the host rock developed against the B14 ductile shear zone. Disseminated pyrite is observed in minor amounts through the entire unit.

You’re in good hands with Goldseek. Industry low G&A and the fact that management owns 52% of the outstanding common, and will continue to support the stock in future financings, removes the risk of a major dilution event.

The Company is planning a Phase-3 drill campaign this summer. Expect management to fork out the necessary funds (via a modest PP) to mobilize a rig.

Goldseek’s $2.26 market cap is the lowest of the companies I track in this wild west sector. A solid hit in a new high-grade zone will likely trigger a significant re-rating event.

Bear in mind that Hemlo took 76 drill holes, Eskay Creek took 109 drill holes, and McArthur River took 210 drill holes before headlines were made.

Brief updates – Banyan Gold, Prime Mining, and Patriot Battery Metals

Banyan Gold (BYN.V) – (BYAGF.OTC)

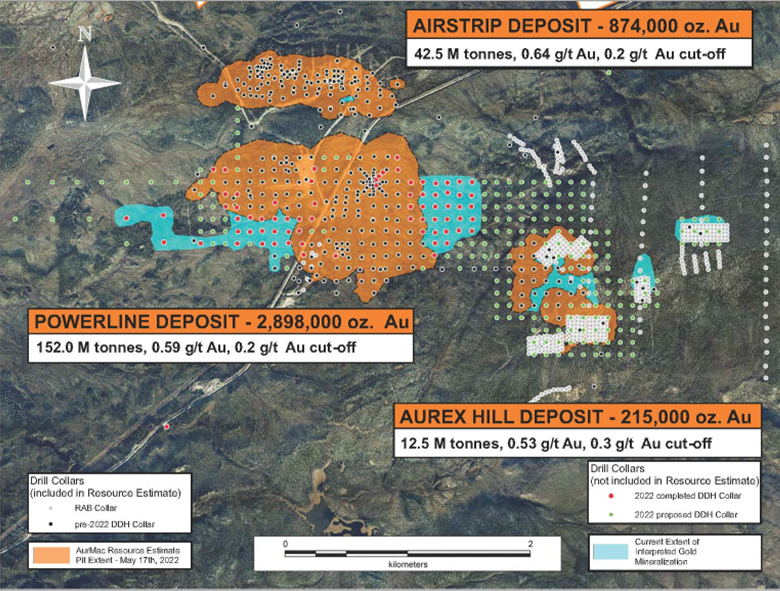

On May 17, Banyan dropped a weighty piece of news from its flagship AurMac Gold Project in the Mayo Mining District of Canada’s Yukon.

This updated global resource estimate rings in at 3,990,000 ounces of gold (Inferred). The resource is spread out across three deposits—Airstrip (874,000 ozs), Powerline (2,898,000 ozs), and Aurex Hill (215,000 ozs).

(see table one in this May 17 press release for the resource breakdown)

The Company has budgeted 35k meters of drilling this year—they’ve drilled roughly 17.5k meters thus far.

The Company has 5M ounces in its crosshairs. Based on recent drilling success, the Company should have no trouble reaching that (tier-1) milestone.

Tara Christie, CEO: “This Resource Estimate demonstrates the value generated by Banyan with 40,000 metres of drilling adding over 3 million ounces of inferred mineral resources. All three deposits are open, with mineralization known to extend beyond the current block model boundaries. Examining the Airstrip and Powerline Mineral Resource model highlights their robust nature; when the cut-off grades are increased by 50%, to 0.3g/t, just 10% of the ounces are reduced; while the grade increases by 20% to an average of 0.72 g/t. We are confident the 30,000 metres that the Company plans to drill in 2022 will meaningfully continue to build upon this Resource Estimate.”

Prime Mining (PRYM.V) – (PRMNF.OTC) – (O4V3.FRA)

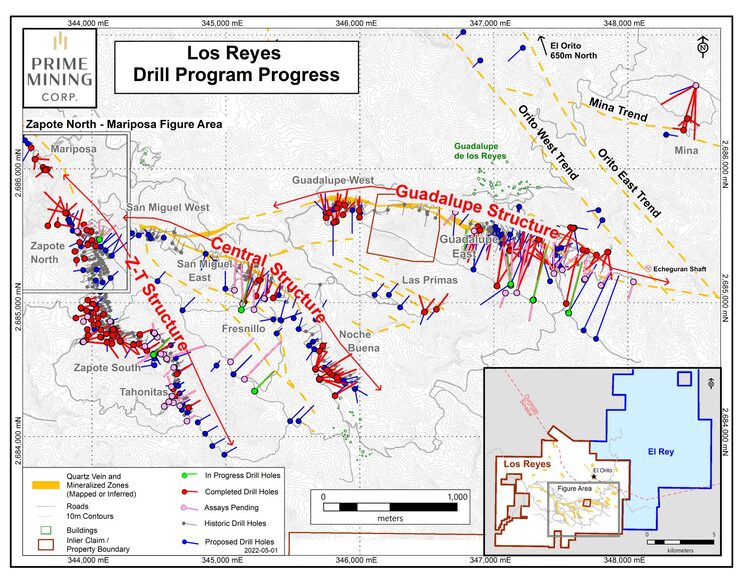

On May 2nd, Prime released additional drill results from its wholly-owned Los Reyes Au-Ag Project in Sinaloa State, Mexico:

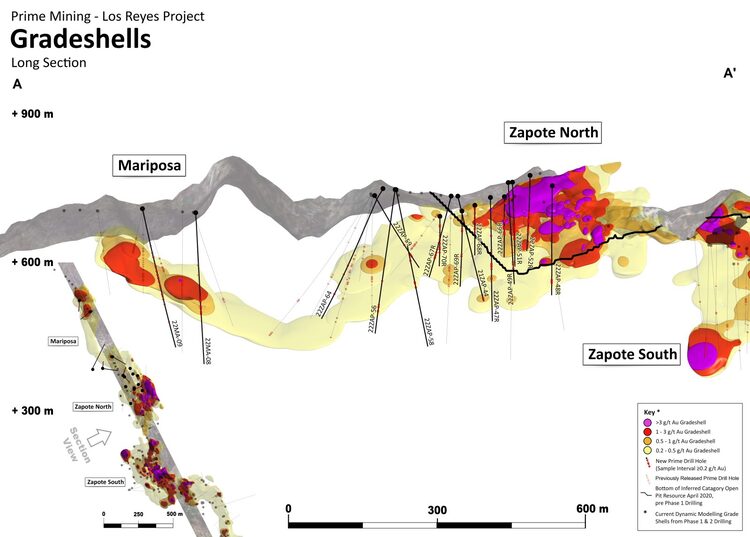

These new drill results were successful in expanding Zapote North, one of the eight known mineralized deposits at Los Reyes.

These May 2 results consisted of 17 stepout drill holes targeting the northern extension of the Zapote-Tahonitas structure.

Two of the 17 holes are the final Phase 2 results for Mariposa and the other 15 new drill holes are from Zapote North (see Figures 1 and 2). This drilling is targeting the expansion of the Zapote North deposit northwards along the structure and confirming the continuity of mineralization of Mariposa to the south. These holes confirm that gold-silver mineralization extends from Zapote North to Mariposa.

Zapote North highlights

- 4.81 g/t Au gold and 17.2 g/t Ag over 2.4 meters (1.7 meters estimated true width (etw);

- 2.42 g/t Au and 24.5 g/t Ag over 10.7 meters (9.7 meters etw);

- 3.83 g/t Au and 13.9 g/t Ag over 1.5 meters (1.4 meters etw);

- 1.40 g/t Au and 13.8 g/t Ag over 8.7 meters (8.2 meters etw);

- 1.07 g/t Au and 20.3 g/t Ag over 25.9 meters (19.9 meters etw), plus 10.7 meters (8.2 meters etw) at 0.77 g/t Au and 26.5 g/t Ag;

- 1.73 g/t Au and 17.7 g/t Ag over 9.2 meters (7.9 meters etw) plus 10.7 meters (8.2 meters etw) at 0.68 g/t Au and 13.2 g/t Ag;

- 1.42 g/t Au and 28.3 g/t Ag over 6.1 meters (5.0 meters etw).

Mariposa highlights

- 1.10 g/t Au and 11.0 g/t Ag over 11.8 meters (8.3 meters etw) plus 7.1 meters (5.4 meters etw) at 0.99 g/t Au and 9.2 g/t Ag (22MA-08);

- 1.51 g/t Au and 14.7 g/t Ag over 4.5 meters (2.9 meters etw).

These results follow an outstanding hit at Guadalupe East—52.0 g/t Au and 1,007.6 g/t Ag over 4.3 meters (4.0 m etw) plus 7.62 g/t Au and 1,970 g/t Ag over 1.5 meters (0.6 m etw)—released on April 12.

Daniel Kunz, CEO: “Connecting open pit mineralization from Zapote North to Mariposa is an important development for the evolving Z-T Structure. This drilling has identified higher grade ore shoots of potentially open-pit mineable material with a focus on exploring the down dip extensions within known boiling zone elevations. The Zapote North deposit has expansion potential directly east and may be connected to the San Miguel.”

There are currently nine drill rigs turning at Los Reyes in a campaign budgeted for 35k meters.

According to the Company’s pitch deck, they have $21M in cash and roughly $30M in ITM warrants and options.

Aside from solid assay-related newsflow, a resource update is expected in Q1 of 2023.

Patriot Battery Metals (PMET.C) – (PMETF.OTC) – (R9GA.FRA)

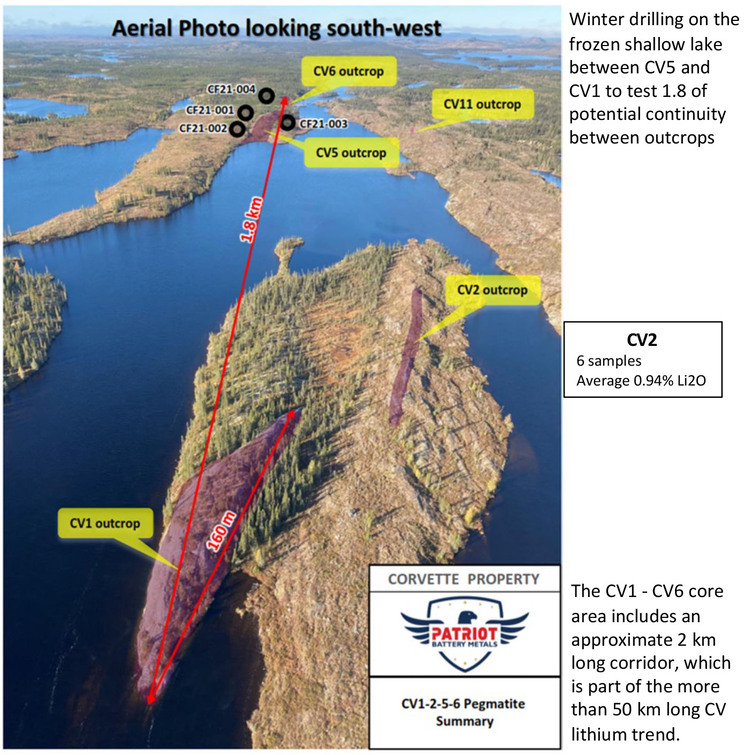

Right now, PMET is all about drilling off a potential world-class lithium-bearing pegmatite deposit, one that may form part of an entire district spread out across a 50-kilometer pegmatite trend.

On May 17, the Company dropped the following headline:

Highlights

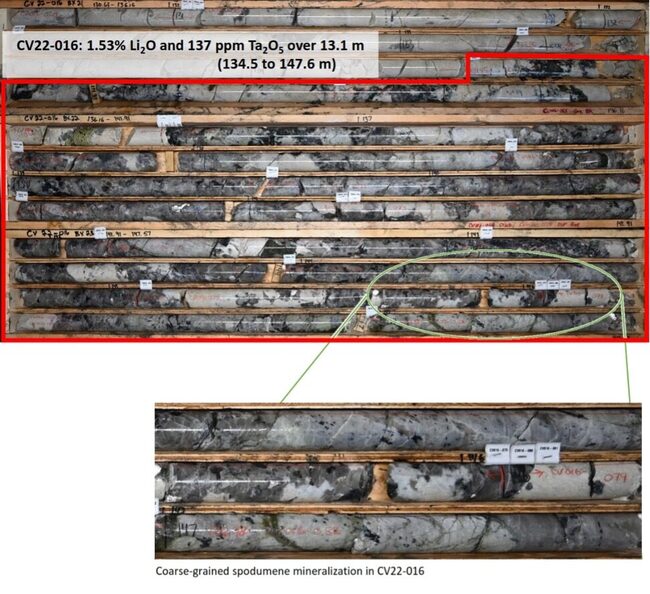

- Strong lithium and tantalum mineralization confirmed in first series of core sample assays received for drill holes CV22-015, 016, 018, and 019, including

- 1.17% Li2O and 111 ppm Ta2O5 over 33.8 m within a wider zone of 0.80% Li2O and 118 ppm Ta2O5 over 95.8 meters;

- 0.91% Li2O and 127 ppm Ta2O5 over 29.0 meters within a wider zone of 0.85% Li2O and 122 ppm Ta2O5 over 56.6 meters, and a separate zone of 1.53% Li2O and 137 ppm Ta2O5 over 13.1 meters;

- 1.01% Li2O and 100 ppm Ta2O5 over 25.8 meters;

- 1.22% Li2O and 113 ppm Ta2O5 over 6.8 meters;

- Core assays confirm the lithium-tantalum mineralization extends approximately 250 meters along trend to the northeast from drill hole CF21-002, and continues down-dip

- Lithium mineralization has been traced through drilling over a strike length of approximately 900 meters within the 2.0+ km long core area of the pegmatite trend, to a vertical depth of approximately 155 meters;

- Mineralization remains open along trend and down-dip;

- Core assays for additional sixteen (16) drill holes from the winter program remain to be reported.

There’s a lot of detail packed into this quote from the Patriot’s CEO, Blair Way:

“We are very excited to announce assays for the first series of holes of our twenty-hole winter/spring drill program and look forward to announcing further assay results as they are received from the lab in the coming weeks. These independent assays, confirming lithium and tantalum mineralization within the CV5-1 Corridor, validate the Company’s decision to add a third rig to our summer drill program, which was made after geologists in the field identified spodumene crystals in the pegmatite intercepts as part of initial core logging. After drilling only 5,100 metres, Patriot has established lithium and tantalum mineralization across an approximate 900 m strike length, which remains open at both ends and down-dip. The Patriot team is excited to commence the 15,000 metre summer/fall drill program in June and further delineate this discovery. Additionally, Patriot has identified multiple other spodumene pegmatites across the Property and we look forward to exploring these further, as well as the remainder of the more than 50 km long CV Lithium Trend the Company controls, as part of our summer 2022 program.”

END

—Greg Nolan

Full disclosure: Of the companies featured above, Goldseek is a Highballer client. The author owns shares of Goldseek and Patriot Battery Metals.