Highballer client, Teuton Resources, received some welcome news last week from its JV partner, Tudor Gold: a fully funded 30k meter drill program is currently underway at Treaty Creek (TC) in the prolific Golden Triangle of northwestern British Columbia.

This first 30k meters represents Phase-1.

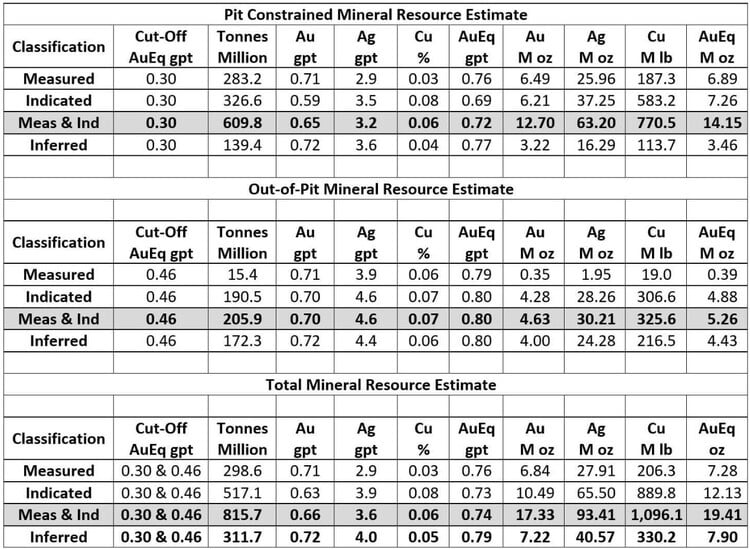

Tudor mobilized multiple rigs to get an early jump on the 2022 exploration season. The goal is to augment an already weighty resource base in Treaty Creek’s subsurface stratum – a resource that currently stands at 19.4 million ounces at 0.74 g/t AuEq (Measured and Indicated) and 7.9 Million Ounces of 0.79 g/t AuEq (Inferred).

Treaty Creek’s ‘Pit Constrained’ and ‘Out-of-Pit’ components are broken down in the table below.

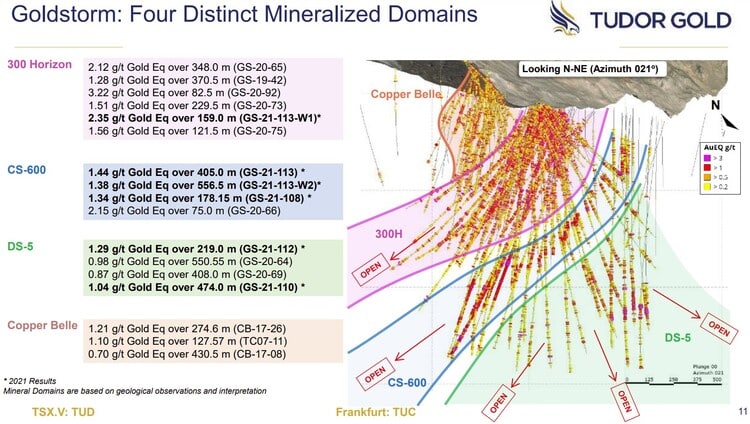

The potential to unlock additional resources at Treaty Creek exists along Goldstorm’s four distinct domains (note how all four zones are open at depth)…

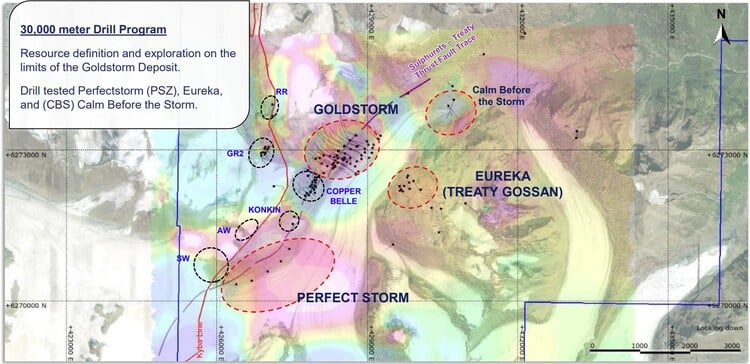

There’s further potential to add to Treaty Creek’s ounce count along multiple global targets that have already demonstrated significant mineralization (note the scale on the map below (bottom right)).

For a deeper delve into Teuton’s many moving parts, my maiden piece published earlier this year will bring you up to speed – A new addition to the Highballer list – Teuton Resources Corp. (TUO.V)

The May 10 headline:

As noted above, this fully-funded Phase-1 program consists of 30,000 meters to systematically test for extensions of the Goldstorm deposit beyond the limits of the primary resource base. The Calm Before the Storm (CBS) and Eureka zones (EZ) will also see the business end of the drill bit during this Phase-1 campaign.

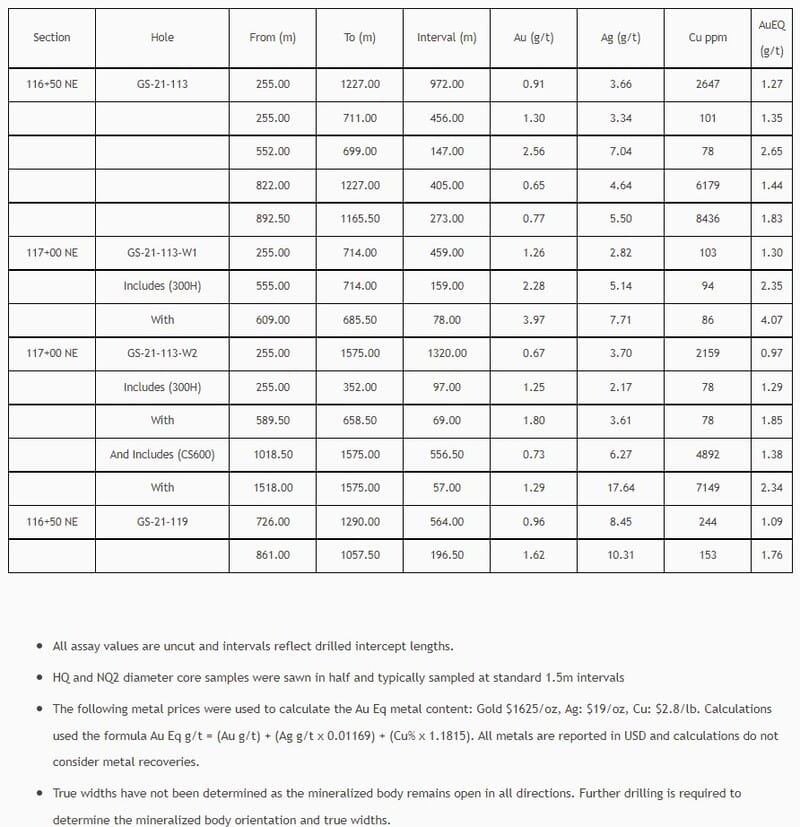

The program is a follow-up to the 2021 exploration drilling campaign which successfully infilled key areas of the 2021 Mineral Resource with reported gold and copper grades that were significantly higher than grades outlined in the 2021 Mineral Resource Estimate. The 2022 exploration program will test the Goldstorm System for an additional 500 metres along the northeastern axis. (see Goldstorm Phase One Drill Program, Plan Map: URL is here). The primary goal of the Program is to expand the size of the initial mineral resource and to define the limits of the mineralized domains.

Three drill rigs are currently stepping out along the northern aspects of the Goldstorm deposit. One rig is turning on a newly discovered gold-silver system located 2.5 kilometers northeast of Goldstorm – Calm Before The Storm (see above map). Four additional rigs are currently being mobilized to the site to ‘fast-track’ this Phase-1 campaign.

This crew isn’t messing around. The rigs Tudor has tasked for this aggressive 2022 campaign are formidable, powerful, and capable of drilling down some two kilometers.

Ken Konkin, President and CEO of Tudor Gold:

“This year we have planned a very robust drilling campaign that will focus 80% of the exploration as continued step-out drilling from the latest impressive 2021 results obtained from holes GS-21-113, GS-21-113-W1, GS-21-113-W2 and GS-21-119 in the northern sector of the Goldstorm Deposit (Table 1). The remaining 20% of planned holes will include Goldstorm resource definition drilling as well as exploration drill holes for CBS and Eureka gold systems. Our exceptional start-up team has done a superb job safely dealing with challenging conditions to mobilize drills and supplies utilizing the Brucejack Lake road to access our winter-haul route. We wish to thank Newcrest Mining for their assistance in allowing us to share the Brucejack access road so we could complete the mobilization of our equipment in a timely and cost-efficient manner. Our Phase Two plans will be contingent on the success of the Phase One drilling; we plan to concentrate our drilling in the areas that contain the strongest mineralization throughout the 300H, CS-600 and DS-5 domains. We also plan to test the hypothesis that the Eureka Zone may be the continuation of the DS-5 domain. The Goldstorm Deposit continues to amaze our geological team as it remains open in all directions and to depth with some of the most impressive and strongest gold-copper mineralization obtained late last year within the northern areas of this deposit.”

This May 10 press release went on to detail stepout drilling highlights from last year’s campaign.

Dino Cremonese, P. Eng., President and CEO of Teuton:

“This is a very exciting program aimed at testing the continuity to depth of the robust copper and gold values reported in last year’s drilling. The new drills can apparently reach down to 2km which is very impressive from a technical standpoint. Magnetotelluric geophysical surveys indicate a major anomaly lies around this depth, possibly implying an extensive copper-gold porphyry deposit. As they say, there is only one way to test this hypothesis and that it is to put a drill into it.”

Final thoughts

Teuton’s (carried) 20% interest in Treaty Creek’s 27.3M AuEq resource base works out to 5.46M AuEq ounces. The Company also holds a .98% NSR on the entire TC resource plus an additional NSR on claims peripheral to the deposit.

Worth noting as a potential value creation event, Teuton is contemplating spinning off its non-Treaty Creek assets consisting of 30+ mineral properties and royalty interests. We should hear more on that front in the not-too-distant future.

As the Great Rotation continues – funds fleeing the big-cap growth / mega-cap tech space – companies like Teuton, those boasting significant ounce counts in mining-friendly jurisdictions, will stand out and attract these retreating funds (this author’s humble opinion).

The Company is being carried along another aggressive exploration campaign that will likely unlock more ounces of gold-silver and more pounds of copper at Treaty Creek. What’s not to like here?

Expect strong newsflow over the balance of the year.

END

– Greg Nolan

Full disclosure: Teuton is a Highballer client. The author owns in the company.