“There will come a time when Earth sheds us like dead skin, and it will be our own fault” – John Dutton, Yellowstone (one possible scenario)

If we are to create a cleaner, greener, carbon-free world—to avoid the direst climate-related shocks gathering on the horizon—global greenhouse gas emissions need to drop 50% by 2030 and reach net-zero by mid-century. But our current green energy transition ‘plan,’ if you can call it that, is fatally flawed. It lacks vision, foresight, and coordination. Above all, we DO NOT have an adequate supply of the essential commodities—copper, nickel, lithium, REEs, etc—to make this transition possible.

The fix: we first need to reverse a multi-year declining investment trend in building new mines, and reviving (expanding) those near the end of their production cycles. Policymakers and environmentalists need to get onside to allow a viable, clean energy transition plan to take shape. More money—waaaay more money—will need to flow into the production, development, and exploration of these scarce resources if we hope to achieve net zero by mid-century.

From an investor’s point of view, specifically those looking to hedge this new era of spiraling inflation, compromised supply chains, and escalating geopolitical tension, targeting fundamentally sound producers in the resource arena makes a great deal of sense. For those with an appetite for risk, well-run exploration and development companies—those with valuable assets on their books—may also offer the potential for significant capital appreciation.

REEs

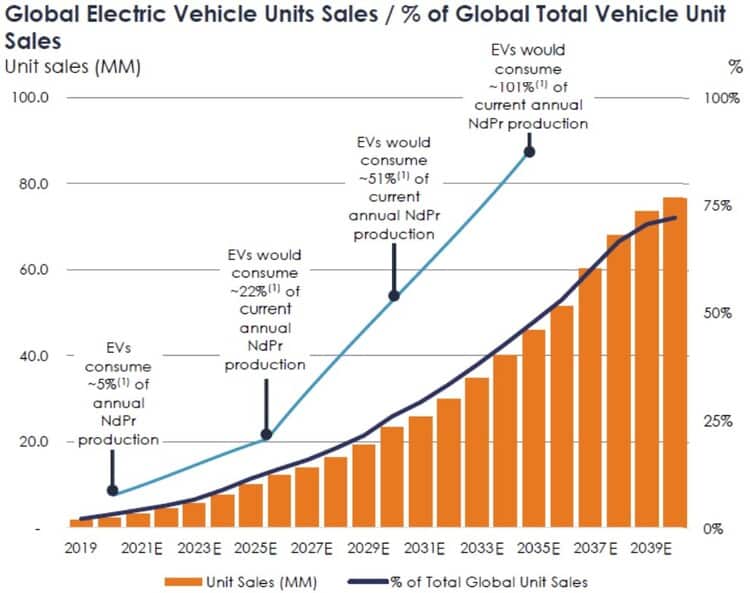

According to the chart below, EV production will consume >100% of current REE production in just over a decade. This pounds home just how unprepared we are to meet the accelerating demand (REEs go into the motors, generators, pump mechanisms, drive trains, etc., of every EV that rolls off the assembly line floor).

Defense Metals (DEFN.V) – (DFMTF.OTC) – (35D.FSE)

- 176.65 million shares outstanding

- $42.4M market cap based on its recent $0.24 close

Defense continues to de-risk its flagship Wicheeda Rare-Earth Project where current resources stand at 5,031,000 tonnes averaging 2.95% total rare-earth oxide (TREO) Indicated and 29,467,000 tonnes averaging 1.83% TREO Inferred.

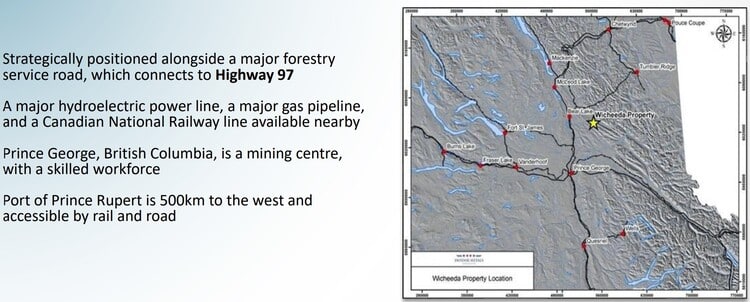

Located in mining-friendly British Columbia, Wicheeda benefits from an abundance of close-at-hand infrastructure.

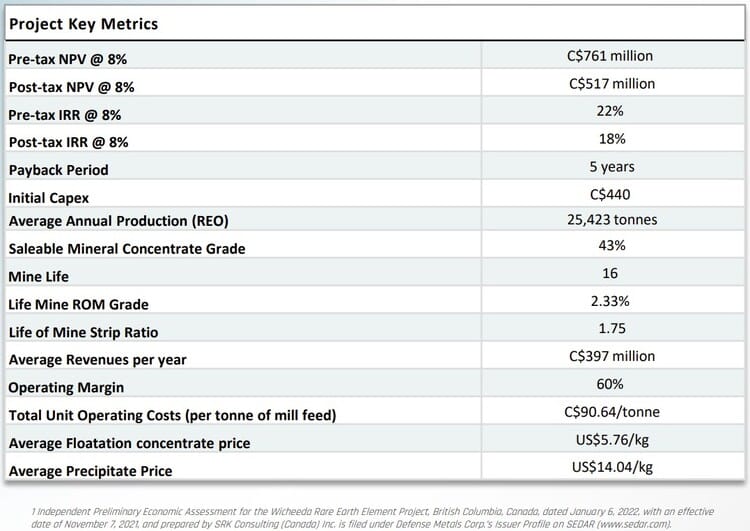

A first pass economic study of this high-grade deposit, via a November 2021 PEA, demonstrates the following values:

This PEA was generated using extremely conservative REE (Neodymium and Praseodymium) price inputs. Current Neodymium and Praseodymium spot prices are 50% higher than those applied to this first pass study.

A world-class resource

The significance of the Company’s anticipated annual production of 25,423 tonnes of REO is brought to light via the following slide:

At 140k tonnes, China continues to dominate REE production. A closer examination of the above digits reveals that other countries, including the U.S., do indeed produce significant quantities of REEs, but much of it is sent overseas to China for processing. That’s a problem in this era of extreme geopolitical tension (twitchy world leaders), compromised supply chains, etc – China’s stranglehold of the rare earths supply chain will last another decade

Wicheeda’s projected REO production—roughly 10% of current global output—may offer the West a safer, more reliable option in sourcing these critical green energy elements.

Wicheeda continues to grow

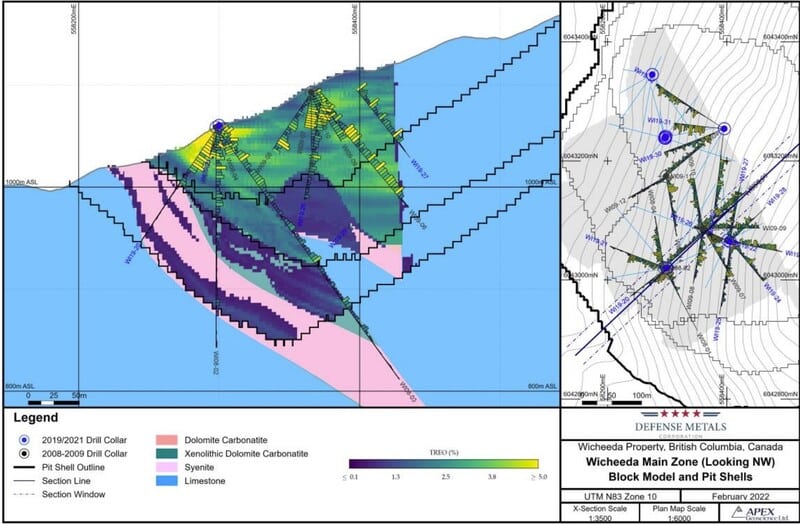

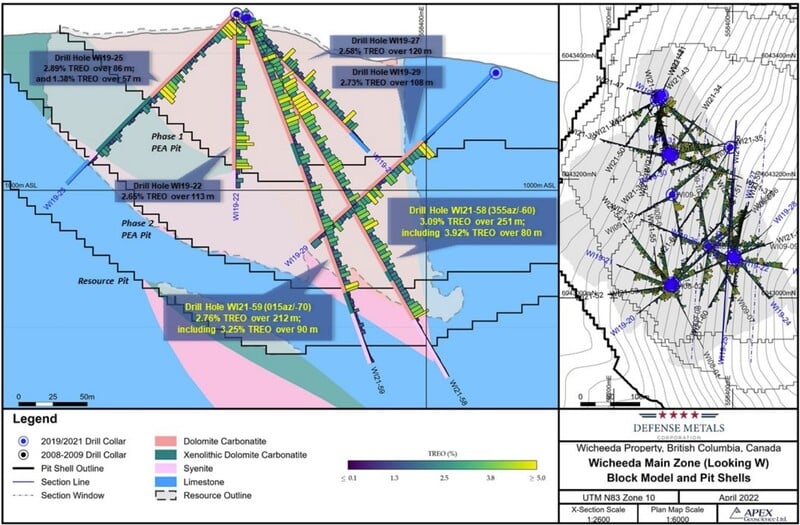

Last year, Defense completed a 5,349 meter, 29-hole drill program at Wicheeda—a campaign designed to upgrade the existing resource to the higher confidence M&I categories, and to stepout beyond the known limits of the deposit.

The effort paid off big time on both fronts (click on the images below to amplify).

Assays results from this 2021 campaign began to flow in earnest earlier this year.

Many of the holes tagged substantial widths of high-grade mineralization. Some yielded the highest-grade x width encountered on the project to date—several tagged mineralization beyond the main resource block, including a new high-grade zone at depth.

2021 drilling highlights include (note the shallow nature of these intervals):

- WI21-33 – 3.17% TREO over 196 meters including 3.63 TREO over 50.25 meters (from surface) and 4.29% TREO over 55 meters (at depth);

- WI21-34 – 2.97% TREO over 114 meters including 3.84% TREO over 67 meters (from surface);

- WI21-35 – 3.87% TREO over 119.80 meters (from surface);

- WI21-36 – 2.35% TREO over 171.90 meters including 3.45% TREO over 34.55 meters and 3.02% TREO over 38 meters (from surface);

- WI21-37 – 3.19% TREO over 137.85 meters including 4% TREO over 55 meters (from surface);

- WI21-38 – 3.08% TREO over 80.65 meters including 6.01% TREO over 23.4 meters (from surface).

- WI21-40 – 3.23% Total Rare Earth Oxide Over 162.25 meters; Including 4.21% Over 45 meters (from surface);

- WI21-48 – 2.50% TREO (total rare earth oxide) over 176 meters, including 6.14% TREO over 20 meters (near surface);

- WI21-49 – 3.79% TREO over 150 meters, including 4.77% TREO over 60 meters from 33 meters depth (this hole tagged the highest grade Neodymium-Praseodymium assay of received to date – 1.41% Neodymium-Praseodymium Oxide at 10% TREO);

- WI21-54 – 3.06% TREO over 145 meters (from surface);

- WI21-55 – 3.81% TREO over 117 meters; Including 4.87% over 38 meters (from surface);

- WI21-57 3.45% TREO over 116 meters (near surface);

- WI21-58 – 3.09% TREO over 251 meters, including 3.92% TREO over 80 meters from surface (this hole represents the longest high-grade intercept received to date);

- WI21-59 – 2.76% TREO over 212 meters, including 3.25% TREO over 90 meters (from surface);

- WI21-60 – 2.93% TREO over 154 meters, including 5.47% TREO over 39 meters (from surface);

- WI21-61 – 3.44% TREO over 114 meters from 57 meters.

Having demonstrated good continuity throughout this 5,349 meter, 29 hole campaign, the next resource update could show a significant increase in tonnage (and grade).

Newsflow from multiple fronts

Defense dropped two headlines in recent sessions as it moves towards pre-feasibility.

A May 24 headline…

SRK Consulting, highly respected and active in over 45 countries worldwide, will assist the Company in planning and implementing a (pre-feasibility level) geotechnical drill campaign to analyze and assess the technical risks associated with various open pit slope design scenarios.

The purpose of the 2022 Wicheeda REE Project’s geotechnical and hydrogeological drill program is to contribute data to the advance geotechnical characterization, and the development of comprehensive structural, hydrogeological, and rock strength models to support future advanced pre-feasibility level mine planning studies. The geotechnical and hydrological drilling is expected to include, but not be limited to, acoustic/optical televiewer downhole survey, oriented drill core, field point load and laboratory-based intact rock and discontinuity strength testing, vibrating wire piezometer, and standpipe piezometer installation for hydrogeological investigations.

Kris Raffle, P.Geo, Director of Defense Metals:

“SRK was a natural fit to assist in the continued advancement of the Wicheeda REE Deposit having worked so closely with the Defense Metals technical team during the recent PEA study. SRK is well-positioned to build on the successful PEA mine plan and guide the collection of advanced geotechnical and hydrogeological data that will contribute to an enhanced understating of geotechnical risk and refinement of future project development scenarios.”

The de-risking process continues

On May 31, Defense dropped this headline after examining an alternate processing scenario that could dramatically enhance Wicheeda’s economics…

Defense Metals Acid-Bake Process Yields Improved Rare Earth Element Recoveries At Wicheeda

Initial results from its Acid Bake Process test work on Wicheeda’s mineralized feed were presented in this press release.

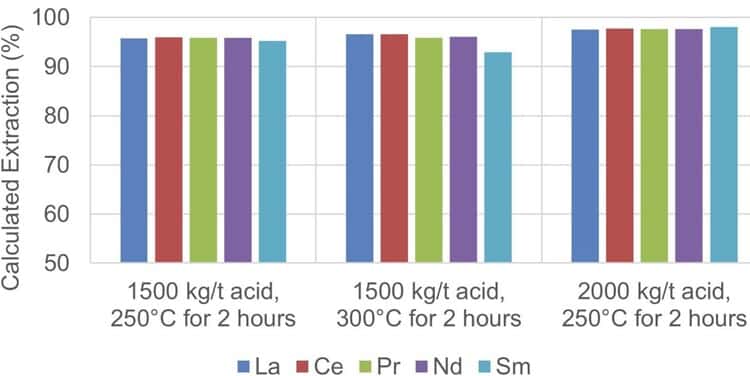

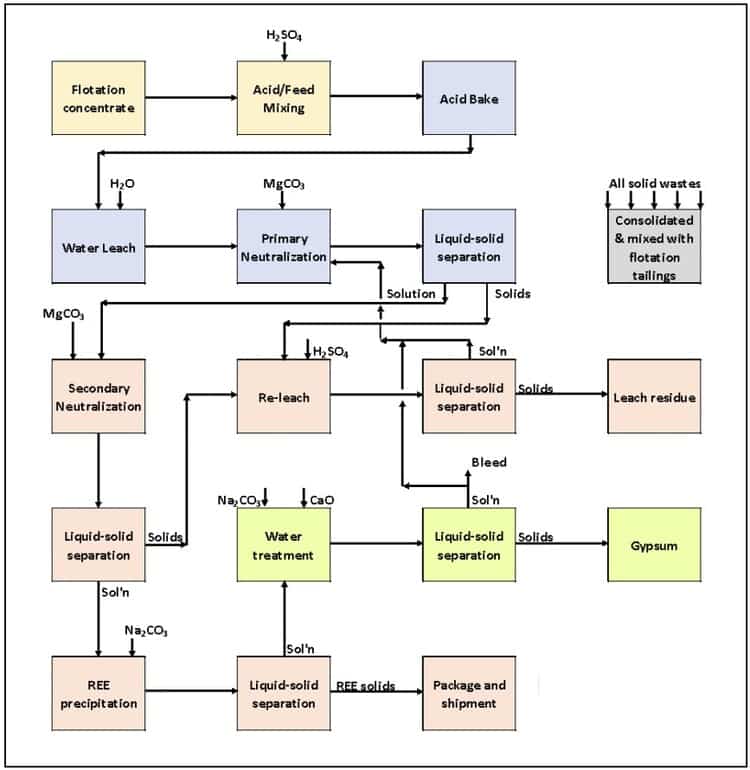

John Goode (P.Eng.), a recent addition to the Company’s advisory board, recommended testing Wicheeda’s rich rock with the (acid-bake) process. So far, results demonstrate an improvement in REE extraction. Neodymium and praseodymium recoveries >95% were achieved (from flotation concentrate into a leach solution). The hydrometallurgical flowsheet used in the PEA was based on the more costly and complex gangue-leach – caustic-crack process.

This hydrometallurgy test work, which will provide detailed design, capital, and operating-cost calculations, is expected to continue over the balance of the year.

Ongoing tests

- Testing of the acid-bake process started in late 2021, with over 20 tests on several concentrate samples completed to investigate the impact of bake conditions including acid addition, concentrate grade, and bake temperature.

- Tests continue to show that the sulphuric acid-bake approach is highly effective. Across all tests, including those under sub-optimal conditions, the neodymium/praseodymium extraction is 94% with better test results showing 97 to 99% extraction.

- Short-duration acid-bake pilot operations using the SGS Lakefield 165 mm diameter kiln are ongoing.

- Pregnant leach solution from the static acid-bake tests is now being tested for impurity removal and the precipitation of a refined rare-earth product suitable for sale.

More about the Acid-Bake-Water-Leach (AB-WL) Process:

In the AB-WL process, Wicheeda’s mineral concentrate will be treated with concentrated sulphuric acid at high temperatures (200˚C-600˚C) converting the rare earths in the minerals to water-soluble sulphates, which readily dissolve during the subsequent water leach. The leachate is then purified, and the rare-earth elements recovered by a simple precipitation process. This process requires less equipment, and involves fewer steps and circuits, as schematically presented in Figure 2 (below). Importantly, this flowsheet is the same as that used by Lynas at its Kuantan REE production facility and by Baogang at the Bayan Obo REE recovery plants (using a bastnasite and monazite ore). Most of the world’s REE are produced by the Acid-Bake process.

The Company is pulling out all the stops as it pushes Wicheeda along the development curve, methodically de-risking the project with each carefully conceived step.

Luisa Moreno, President of Defense Metals:

“We are delighted that the acid-bake process has yielded higher recoveries of rare earths and offers the potential to significantly reduce operating and capital costs, thus improving project economics and further establishing Wicheeda as a potential near-term source of rare earths.”

Notes from the above Luisa Moreno interview (near term catalysts)

- Results will continue to flow from the ‘Acid Bake’ test work program;

- Pilot plant results will begin to flow in Q4 of this year;

- A 5,000-meter drill program, designed to upgrade and expand the current resource, is on deck;

- A PFS will be initiated later this year;

- An updated resource estimate could follow on the heels of the 5k meter drill campaign (details pending).

Regarding potential suitors or JV partners approaching the Company, Luisa Moreno stated that there have been discussions (3:58 mark of the above interview).

My bet: Some large corporate entity looking for a ready-steady supply of REEs will, at some point, take a run at the Company with a fat takeover offer.

END

—Greg Nolan

Full disclosure: Defense Metals is a Highballer client. I own shares (color me biased).