Janet Yellen recently stated that the U.S. wants to end its dependence on China REEs and will focus instead on “friend-shoring” (diversifying their supply chains with trusted trading partners). She recently told Reuters there’s now a push for increased trade ties with the likes of South Korea “to improve the resilience of supply chains and avert possible manipulation by geopolitical rivals.”

Finding, developing, and permitting new mines in North America will resolve some of these objectionable dependence issues. But equally important, we need to increase our refining capacity on this side of the pond. For example: if a company puts a copper deposit into production in Canada or the US, they’ll likely be producing a concentrate that will need to be shipped overseas for (further) processing… shipped overseas to China. According to Joe Mazumdar, China currently holds 60 to 70% of the world’s smelter capacity.

To keep this green revolution on track—to achieve net-zero by mid-century while limiting geopolitical risk—we need to build more smelters, but no one wants them in their backyard. I can’t imagine why…

Defense Metals (DEFN.V) – (DFMTF.OTC) – (35D.FRA)

- 183.37 million shares outstanding

- $33.92M market cap based on its recent $0.185 close

On August 9, Defense provided an update for an ongoing drilling program at its flagship Wicheeda REE deposit in the Prince George region of British Columbia:

A 3,500-meter campaign of infill and stepout drilling recently wrapped up. Pit slope geotechnical drilling is now underway.

The northern and central areas of the Wicheeda deposit—zones within the PEA mine plan—were the target for this 12-hole, 3,500 meter round. Drill hole assays should begin to flow in September.

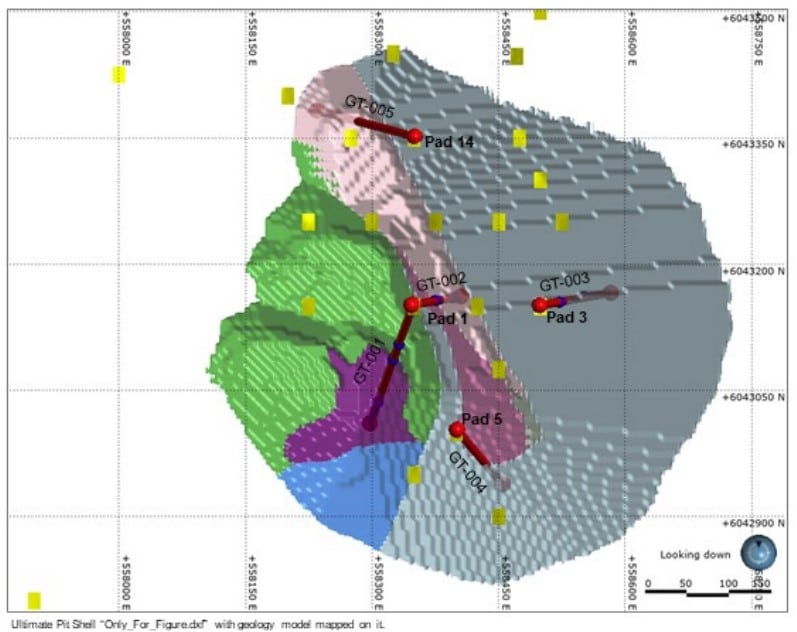

All materials, instrumentation, and technical personnel have now been mobilized to site to commence geotechnical drilling for the purpose of open pit slope design optimization. A total of 5 geotechnical drill holes targeting the north, west, south, and east high walls of the Wicheeda PEA mine plan ultimate pit are planned (map below). Data collection will include oriented drill core, field point load and laboratory-based intact rock and discontinuity strength testing, vibrating wire piezometer, and standpipe piezometer installation for hydrogeological investigations.

(click on the image to magnify)

Kristopher Raffle, P.Geo., Director and QP of Defense Metals: “Defense Metals is very pleased with the progress of the 2022 infill and exploration drilling to date, and we look forward to gathering important pit slope geotechnical data to support future Wicheeda REE Deposit advanced economic studies.”

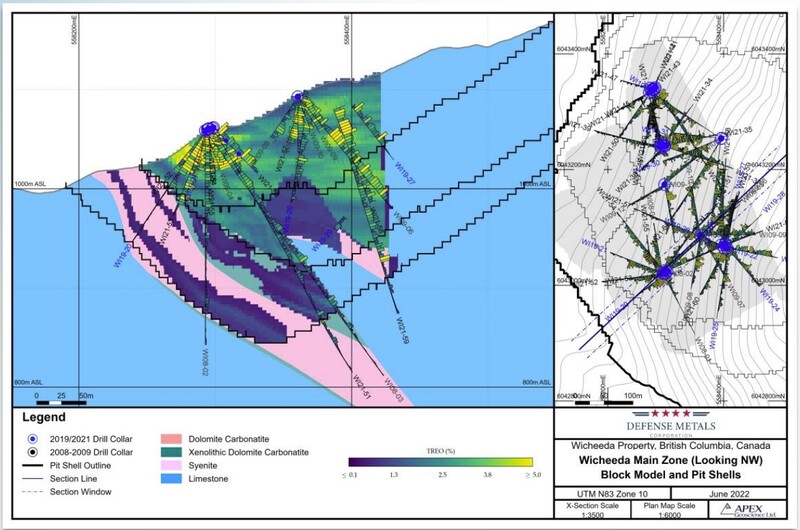

Applying a 0.5% cut-off, the total rare-earth oxide (TREO) resource at Wicheeda currently stands at 5.0 million tonnes averaging 2.95% TREO (Indicated) and 29.5 million tonnes averaging 1.83% TREO (Inferred).

(click on the image to magnify)

A short video interview featuring CEO Craig Taylor went live shortly after the August 9th press release dropped – Defense Metals (TSXV:DEFN) updates diamond drill program at Wicheeda. Here, CEO Taylor suggests that recent drilling, combined with the 5,300 meters drilled last season, carries the potential to grow the size and grade of Wicheeda. This amplification could positively impact the economics and mine life outlined in the 2021 PEA. We should also see a successful conversion of the Inferred material into the higher confidence (M&I) categories. These upgrades will set the stage for a more advanced (PFS) economic study.

Defense has guests

This week, a Wicheeda field visit is being conducted to accommodate “strategic interested parties and capital market analysts.” In the above interview, CEO Taylor suggests that “a major strategic investor from the U.S. (in the processing space)” is taking a look and could potentially fund Wicheeda’s development through to feasibility. Not a done deal, but an intriguing detail.

I’ll have more on Defense once assays begin to flow from this recently concluded summer drill campaign.

Teuton Resources (TUO.V) – (TEUTF.OTC) – (TFE.FRA)

- 56.22 million shares outstanding

- $83.2M market cap based on its recent $1.48 close

On August 15, Teuton updated progress on multiple fronts from its robust project portfolio in the prolific Golden Triangle of northwestern British Columbia. This update included Treaty Creek after the Company received a fourth set of drill results from its JV partner, Tudor Gold (TUD.V) – Teuton Reports Progress at Many of its Properties in the Golden Triangle, BC. (Teuton holds a carried 20% interest in TC)

Treaty Creek

The 17,913-hectare Treaty Creek Project, which borders Seabridge Gold’s KSM property to the southwest and Newcrest Mining’s Brucejack property to the southeast, boasts an ounce count of 19.4 million ounces at 0.74 g/t AuEq (M&I) and 7.9 million ounces at 0.79 g/t AuEq (Inferred).

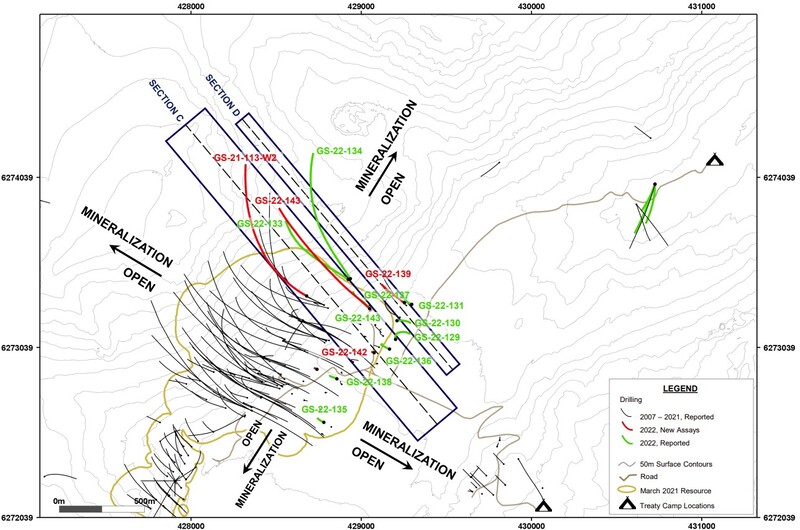

Results reported in this press release include six holes drilled into the Goldstorm deposit (from sections C and D).

(click on the image to magnify)

Five out of six holes were targeted outside the main resource block, meaning… TC continues to grow, perhaps significantly so.

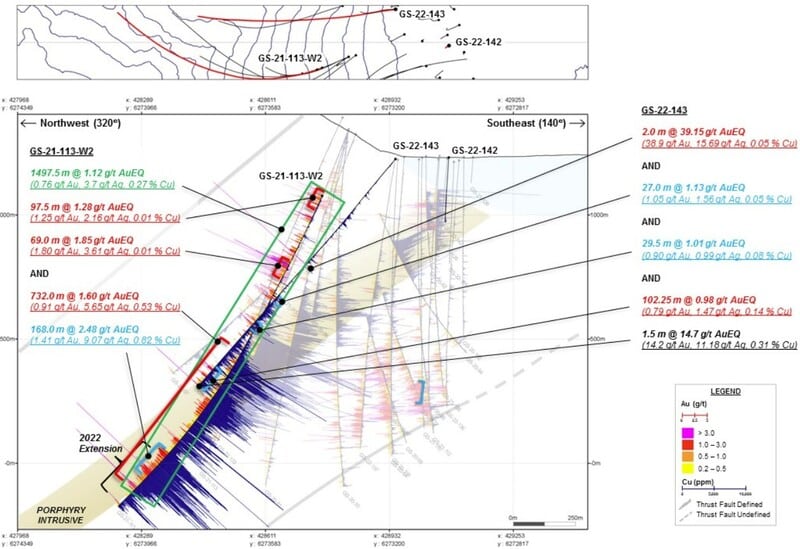

The highlight interval in this press release is from Hole GS-21-113-W2—a hole from the 2021 campaign that bottomed out in strong mineralization; a hole that couldn’t be pushed any deeper due to the depth limitations of their rig. Tudor, having mobilized bigger, more powerful rigs for this current campaign, re-entered GS-21-113-W2 and pushed the drill bit 280.1 meters deeper, tagging an impressive 2.48 g/t AuEq over 168 meters with copper values averaging 0.82 %. All told, GS-21-113-W2 hit an incredible 1,497.5 meters of 1.12 g/t AuEq material.

(click on the image to magnify)

As per the guts of this recent press release…

GOLDSTORM DEPOSIT

SECTION C

GS-21-113-W2, a 2021 drill hole (see November 30, 2021 press release), was re-entered and extended by 280.1 m to a total depth of 1855.1 m. The composited interval that includes 300H and CS600 domains, that was calculated in 2021, has been expanded from 1320.0 m of 0.97 g/t AuEQ to 1497.5 m grading 1.12 g/t AuEq. The CS600 domain intercept was expanded from 556.5 m of 1.38 g/t AuEq to 732.0 m grading 1.60 g/t AuEq. The high-grade bottom segment of CS600 originally reported 57.0 m grading 2.34 g/t AuEq which has now been extended to 168.0 m of 2.48 g/t AuEq (1.41 g/t Au, 0.82 % Cu); visible gold was noted in one core sample. The drill hole successfully exited the lower boundary of the CS600, however, a downdip boundary (northwest boundary) of the orebody has not been identified and the CS600 currently remains open at depth where gold and copper grades are the highest. Increasing grades at depth are closely correlated with increasing potassic alteration as drilling information vectors towards the magmatic source of this extensive porphyry system.

GS-22-143 stepped out 225 m to the northeast from the 2021 drilling and targeted 300H and CS600 mineralization. In addition to the high-grade interval of 39.15 g/t AuEq over 2.0 m that was previously reported (see July 26, 2022 press release) a 102.25 m interval grading 0.98 g/t AuEq in the CS600 area was intercepted which included a 1.5 m interval of 14.7 g/t AuEq. The hole skimmed the upper boundary of the CS600, however, deviation did not allow the hole to get into the core of the porphyry where higher grades have been measured. The hole was stopped short of the target due to pad conditions. Assays for this hole are fully reported in this press release.

SECTION D

GS-22-139 targeted the DS5 domain and returned 438.0 m grading 1.07 g/t AuEq. Within this, two high-grade intervals consisted of 28.4 m grading 1.95 g/t AuEq and 24.0 m grading 2.05 g/t AuEqThis hole is located 250 m to the northeast from the 2021 drill holes.

Ken Konkin, President and CEO of Tudor Gold: “During the 2021 drill program, we drilled hole GS-21-113-W2 to the maximum depth possible and noted that the strongest sulphide mineralization occurred at the bottom of this hole. A decision was made to leave the casing and HQ rods in GS-21-113-W2 with the plan of returning to re-enter the hole this year with a more powerful diamond drill rig and we succeeded! The hole was extended 280.1 meters (m) demonstrating that gold and copper grades increase with depth as the strongest mineralization occurs between 1520 m and 1688 m. This portion of the hole averages 2.48 g/t AuEq over 168 m with copper averaging 0.82 %. Silver mineralization is also becoming stronger at depth within the CS600 domain. In addition, results from targeting the DS5 domain were also successful with drill hole GS-22-139 which intersected 438 m of 1.07 g/t AuEq and included an enriched upper portion that averaged 1.36 g/t AuEQ over 172.4 m. As previously reported, high-grade visible native gold has occurred from two of three aggressive step-out holes that were 225-meter and 500-meter step-out holes from the 2021 drilling program within the northeastern sector of the Goldstorm Deposit. These high-grade gold results may add a new dimension to the exploration potential of this project and we will continue to advance and explore this rapidly expanding aspect of these well mineralized domains.”

Harry

The Harry Property is a JV with Optimum Ventures (OPV.V). Optimum can earn an 80% interest in the project by spending $9M on exploration, making a $1.5M cash payment, and issuing 4M shares over five years (Teuton will retain a 2.0% NSR once all is said and done).

Harry hosts multiple zones of intense alteration trending NW along the length of the property. Within this intense alteration, sericite along with abundant pyrite is prevalent. Quartz veins, quartz breccias and semi-massive sulphides occur within these alteration zones. This type of alteration and mineralization is also found at the nearby gold deposits being developed by Ascot Resources.

In 2020, a new zone of mineralization in quartz breccias associated with fine arsenopyrite (“Milestone”) was discovered on the Harry property averaging 7.86 oz/ton Au (269.5 g/t) across a 2 m width. The full width of this new zone has not been defined due to overburden cover (see the 43-101 report at: Sedar.com under Optimum Ventures).

In 2021, 22 samples were collected from a boulder train near the new Swan discovery which ranged in value from 0.76 to 286.2 g/t Au, 246 to 2202 g/t Ag, 21.5 to 57.33 % Pb, 0.07 to 2.87 % Cu and 0.41 to 32.11 % Zn.

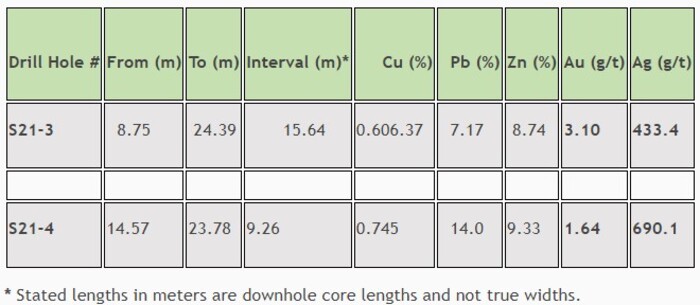

Two holes drilled into the Swan zone last year tagged the following values:

Optimum is currently prioritizing drill targets via geophysics in preparation for a summer campaign—an IP survey is in progress. Regional prospecting and sampling are ongoing. To date, 400 samples have been sent off to the lab.

Tyler Ross, President of Optimum: “We are excited to get back to work on the Harry project, unlocking the potential value for our shareholders. The priority of this exploration program is to prepare for the forthcoming drilling to test both the Swan and Milestone zones as well as to collect more data on multiple structures throughout the numerous sericite-pyrite alteration zones. Drilling will focus on extending the strike and dip of the Swan zone.”

The Harry property should begin generating significant newsflow in the not-too-distant future.

Ground Truthing Big Gold, Eskay Rift, Pearson and Tennyson

Surface sampling and prospecting began in early July in the vicinity of several large, ZTEM anomalies detected during a 2018 airborne survey found on the Big Gold, Eskay Rift, Pearson and Tennyson properties (all four properties are 100%-owned). A lingering snow apron at high altitude has limited the area available for investigation.

This work is expected to continue into September. The Company hopes that it can gather enough information this year to make a decision to drill the best targets uncovered.

That’s it for this episode of Highballer.

END

– Greg Nolan

Full disclosure: Defense Metals and Teuton Resources are Highballer clients. The author owns stock in both companies.

Coincidentally I own both companies and have for years.

What does the TUDOR spin off mean for us TUO shareholders? Yes, TUO will own shares and I should see a benefit, but what does TUO now do with their 20% of the claim? What happens to us shareholders?

Hi Randy. So, Teuton will receive its fair share of Tudor spinco paper as per the transaction details. But since the assets being spun off are non-core and do not involve the current Treaty Creek resource – plz correct me if I’m wrong on that point – there’s zero impact on Teuton’s Treaty Creek status.

That’s my understanding too.

Will Teuton do a spinco with their 20% ?

Is it worth while? I would think yes, we have so many other properties. I have zero experience with this type of situation.

RBC is a big buyer of DEFN today. But the paper just doesn’t stop coming .

We’ll have to wait n see what the company has instore Randy. From the March 1 press release: “Teuton is currently investigating a spin-out of its own, which would involve most of its non-Treaty Creek assets consisting of 30+ mineral properties and royalty interests.”