At Jackson Hole late last week, Fed chair Jerome Powell stated that the U.S. economy would need tight monetary policy “for some time” before inflation is reined in. Translation: expect more Fed bullying tactics, which means slower growth, a weaker job market, and “some pain” for many Americans.

The duration of the Fed’s aggressive rate hike cycle is now in question. And the broader market reacted like it wasn’t expecting this hawkish stance.

A year-to-date chart of the S&P 500…

Note how the 200-period SMA (blue line) has kept this bear market rally in check. The 200 SMA also held back (sucker) rallies during Tech and Housing crashes earlier this century.

Gold had a similar reaction to Powell’s hawkish talk and now chops around the neutral $1750 level…

With the global economy struggling at every level, sustaining this oppressive rate hike cycle during a recession will only push us deeper into the red.

So, when will Powell pivot?

Clearly, these are uncharted H2Os.

One bright spot in the market is uranium and certain battery metal stocks.

The firmness in uranium equities is due, in part, to governments in Japan and South Korea removing their anti-nuclear policies. China and India are looking to build more reactors. The U.S., France, Belgium… even Germany are easing their concerns over this energy-dense metal.

Buoyancy in the battery metals arena can largely be explained by super tight supply chain issues vs. increasing global demand from car makers looking to make good on their promised future capacity.

Updating some of the companies we follow

Apollo Silver (APGO.V) – (APGOF.OTC) – (6ZF0.FRA)

- 174.46 million shares outstanding

- $33.15M market cap based on its recent $0.19 close

Last week, Apollo dropped additional assays from its mothership Calico Silver Project located in the mining-friendly county of San Bernardino, California. The ounce count at Calico currently stands at 166 million ounces of silver contained in 58.1 million tonnes at an average grade of 89 grams per tonne.

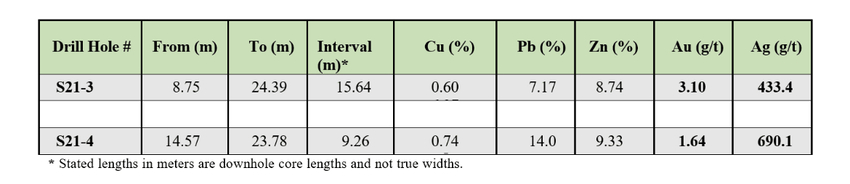

The August 23 press release…

Infill drilling at the Waterloo deposit continues to demonstrate results consistent with the 2022 Calico mineral resource estimate block model (MRE).

This reverse circulation (RC) campaign is designed to upgrade and expand the above-noted MRE.

Highlights from this latest batch of (12) RC drill holes:

SILVER HIGHLIGHTS

- Hole W22-RC-014

- 139 g/t Ag over 103.5 m from 1.0 m depth down hole;

- including 662 g/t Ag over 1.5 m from 79.0 m depth down hole;

- 139 g/t Ag over 103.5 m from 1.0 m depth down hole;

- Hole W22-RC-018

- 133 g/t Ag over 66.0 m from 4.0 m depth down hole;

- Hole W22-RC-019

- 104 g/t Ag over 105.0 m from 2.5 m depth down hole; and

- Hole W22-RC-025

- 135 g/t Ag over 91.5 m from 1.0 m depth down hole;

- including 908 g/t Ag over 1.5 m from 55.0 m depth down hole;

- 135 g/t Ag over 91.5 m from 1.0 m depth down hole;

- Hole W22-RC-033

- 66 g/t Ag over 12.0 m from 134.5 m down hole; and

- 95 g/t Ag over 25.5 m from 154.0 m depth down hole.

In addition, the drill bit tagged significant silver mineralization beneath the MRE resource block (the MRE has a max depth of 125 meters).

Drill hole W22-RC-033 reported silver grades above the MRE cut-off grade (“COG”) of 50 g/t to at least 180 meters depth down hole and indicates possible stacking of silver mineralized horizons in the Barstow sediments. This is encouraging as it illustrates the opportunity to expand the mineral resource at depth. In addition, these latest results show 11 of 12 holes intersected shallow silver mineralization above the COG and two holes intersected silver grades in excess of 500 g/t.

Apollo’s CEO Tom Peregoodoff: “The Calico silver resource is already one of the largest undeveloped silver resources in the world. We have always believed that the resource had the potential to grow beyond what is currently shown in our 2022 resource declaration. These latest results confirm that silver mineralization above the 50 g/t COG extends well below the current base of the resource model. Further, the latest results again demonstrate the consistent and predictable nature of the near-surface silver mineralization within the current resource which adds further support to our goal of achieving upgraded confidence of silver ounces in our pending updated resource. Continued positive results will greatly reduce future development and mining risks for the Project, which is a clear advantage over more structurally complex and narrow silver resources. We look forward to discussing these results, and all results received to date in the context of our pending 2022 revised resource declaration and encourage all interested investors to attend our previously announced webinar to be held on Thursday, September 8, 2022.”

INVESTOR WEBINAR

As announced August 18, 2022, the Company will host a corporate update webinar for shareholders, investors, and analysts on Thursday, September 8, 2022, at 9:00 a.m. PT / 12:00 p.m. ET. The webinar will be facilitated by Tom Peregoodoff, President & CEO, and Cathy Fitzgerald, VP Exploration and Resource Development and will focus on Company’s Calico Silver Project, located in San Bernardino County, California. Specifically, the Company will provide an update on the 2022 Technical Program drilling results to date, the commencement of Phase 2 of the drill program, and the timing of the Company’s planned Mineral Resource Estimate update. Please see www.apollosilver.com for more information and to pre-register to attend the webinar.

Forum Energy Metals (FMC.V) – (FDCFF.OTC)

- $170.82 million shares outstanding

- $28.18M market cap based on its recent $0.165 close

Forum is on the hunt for a significant uranium discovery in the prolific Athabasca Basin of northern Saskatchewan. If successful, positive sector sentiment, along with headlines like this—Global Energy Crisis Spurs a Revival of Nuclear Power in Asia—will likely trigger significant (upside) trajectory on Forum’s price chart.

On August 22, the Company dropped the following headline…

Forum Commences Airborne Geophysical Survey on the Wollaston Uranium Project

The Company recently commenced an airborne electromagnetic (EM) and magnetic survey at its Wollaston Uranium Project located 10 kilometers south of Cameco’s Rabbit Lake Uranium Mill and 30 kilometers south of Orano/Denison’s McClean Lake Uranium Mill in the northeastern Athabasca Basin.

The Axiom Exploration Group Ltd. Is flying a Time Domain Electromagnetic survey (Xcite TDEM) and coincident magnetic survey over the whole project area (Figure 1). The lines will be completed at 100m spacing for an approximate total of 1650 line kilometres (Figure 2). Results from this survey will be available in September and will allow for the development of further drill targets on the project.

Figure 1: The Axiom Xcite TDEM airborne system in action.

Figure 2: Airborne EM and Magnetic Survey over the Wollaston Project.

The survey area is outlined in red. The two areas of current gravity coverage are shown, with the Gizmo showing located.

The Gizmo showing was discovered from last winters’ drill program with five holes defining a very strong zone of alteration with uranium mineralization up to 0.21% U3O8 and boron (an indicator element) up to 2,200 ppm (see June 29 news release for details). A number of gravity lows are evident further to the south that have not been investigated by historic drill programs, and the EM/Magnetic survey will aid in prioritizing these targets.

The Company believes they’re onto something significant at Wollaston even though their first drill campaign barely scratched the surface (difficult ground conditions thwarted forward progress). Four out of five holes from this limited campaign encountered extreme alteration along with anomalous geochemistry. The above-noted uranium whiff (0.21% U3O8)—plus elevated boron, nickel, copper, and cobalt values—are indicative of a mineralizing event in Wollaston’s shallow subsurface layers.

As I keep citing (it’s worth repeating as vectoring in on these elusive high-grade orebodies requires a geological sleuth), Forum’s VP of Exploration, Ken Wheatley, is no stranger to the complex geology underpinning the prolific Athabasca Basin. He boasts an enviable track record of eight uranium (deposit) discoveries, four of which became producing mines.

Ken Wheatley (P.GEO., M.SC.): “Drilling in the winter of 2022 demonstrated the uranium potential of the property with the discovery of the Gizmo zone. The airborne survey will aid with structural interpretations and precisely locate the EM conductors for identification of continuing gravity surveys. This will set the project up for investigating numerous high-priority targets with future drill programs, starting in 2023.”

Forum is active on multiple fronts. Aside from Wollaston, which is quickly rising to mothership status, the Company’s Northwest Athabasca Joint Venture—a JV with NexGen, Cameco, and Orano (Forum holds a 39.25% interest)—will be generating newsflow soon. We should also hear something concerning the 105,000-hectare Thelon Basin Uranium Project in Canada’s Nunavut Territory and the Company’s extensive energy metal project pipeline in Saskatchewan and Idaho.

Teuton Resources (TUO.V) – (TEUTF.OTC) – (TFE.FRA)

- 56.22 million shares outstanding

- $81.51M market cap based on its recent $1.45 close

Optimum Ventures (OPV.V)

- 39.89 million shares outstanding

- $13.76M market cap based on its recent $0.345 close

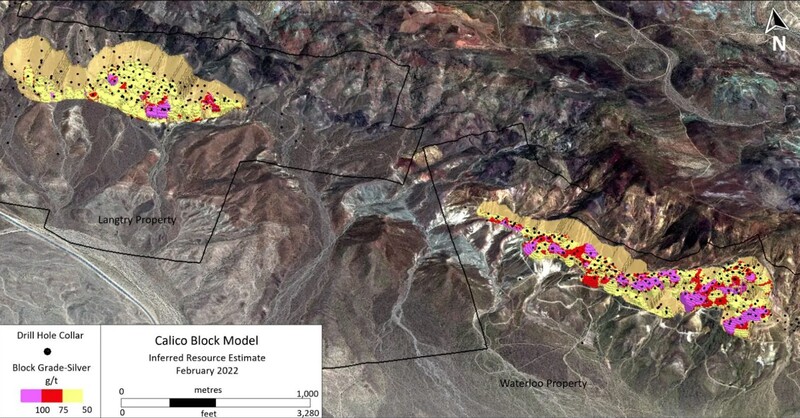

Teuton and Optimum are focused on the discovery potential of the prolific Golden Triangle region of northwestern British Columbia.

With Teuton having optioned out its Harry Project to Optimum, the latter can earn up to 80% in the project via exploration expenditures totaling $9 million spread over five years. Over the option period, $1.5 million in cash and 4,000,000 Optimum common shares are also due. Teuton will retain a 2.0% NSR and a 20% interest after the option is exercised.

Though Optimum has been quiet on the newsfront in recent weeks, they’ve been busy with boots on the ground, teeing up high-priority targets for an upcoming drill campaign.

On August 18, the JV partners dropped the following headline…

More Mineralized Zones Discovered on Teuton’s Harry Property, Golden Triangle, BC

The map below highlights several new zones of mineralization Optimum has identified this field season. Recent mapping has indicated a sequence of volcanic rocks along the property’s northeast section and thick units of mudstone to the southwest, both of which are intensely altered. These alteration zones have revealed abundant sericite, pyrite, quartz veins, breccias, and semi-massive sulphides.

Most of the zones highlighted below will see the business end of the drill bit before the snow flies.

The following details are mostly verbatim as per the guts of Optimum’s August 18 press release (note where the highly anticipated Swan zone follow-up drilling falls into place)...

Summit

Located in the northwest corner of the claim group, it consists of a quartz breccia zone 1-2 m wide, part of a 50m wide alteration corridor which carries pockets and stringers of tetrahedrite, green sphalerite (similar to that of the Swann zone 1km SE) and galena along with minor pyrite. In the footwall region of the zone, several parallel zones of quartz breccia with sulphides occur. Drill pads are presently being constructed for drilling in early September, consisting of short holes to test the width and tenor of gold-silver-lead-zinc mineralization.

Milestone

This mineralized zone is located within quartz breccias; a 2020 chip sample taken across 2 metres averaged 7.86 oz/ton gold (269.5 g/t), with the full width of this new zone not being truly defined due to overburden cover. Optimum Ventures plans to complete Shaw shallow drilling on the area of coarse gold and an eastern extension.

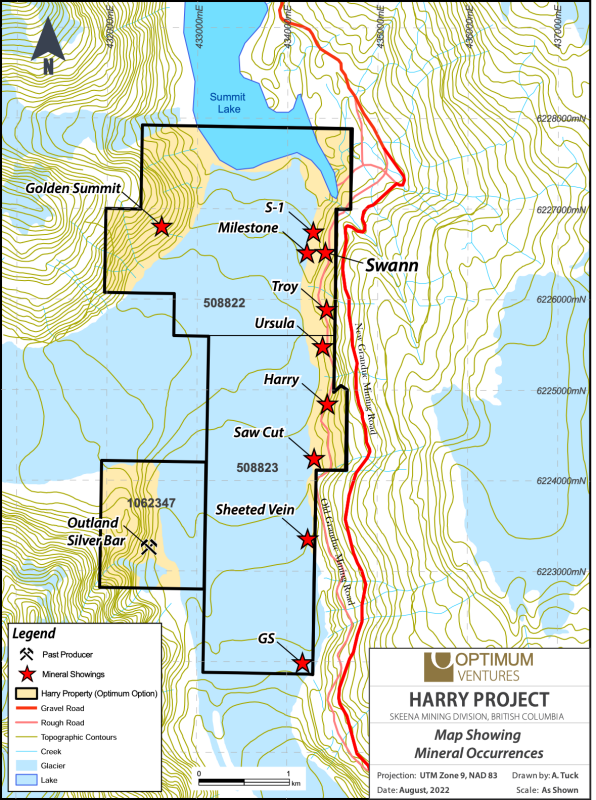

Swann

Work completed in late 2021 indicated the occurrence of semi-massive to massive sulphides consisting of sphalerite, galena, tetrahedrite, chalcopyrite, and pyrite in sub-outcrop. Fine visible gold occurs within the sulphides (particularly within green sphalerite). In 2021, 22 samples were collected from a boulder train located near the new Swann discovery; assay values ran from 0.76 to 286.2 g/t Au, 246 to 2,202 g/t Ag, 21.5 to 57.33 % Pb, 0.07 to 2.87 % Cu and 0.41 to 32.11 % Zn. Two drill holes into the Swann zone in 2021 returned the following encouraging silver results over appreciable widths:

Optimum Ventures plans to expose an area of sub-crop to determine the zone’s strike and dip before the upcoming drilling. Drilling on the Swann will be the last area tested as its close proximity to roads is not hampered by bad weather.

BR (new zone)

Located near the Swann zone, BR is approximately 100 m higher in elevation. The zone consists of massive galena with minor sphalerite veinlets in a stockwork zone. The zone is poorly exposed in an overburden-covered area and further work is required to determine if it is part of the Swann zone or a separate system. Several drill holes are planned in this highly accessible zone.

Ursula (new zone)

The zone consists of massive pyrite with minor galena and sphalerite exposed over a 10 m width. Galena-rich boulders (up to 1 m in diameter) located down ice from an overburden-covered area in the zone indicate the possibility of strike extension. Chip sampling and Shaw drill testing are planned for this zone.

Saw Cut (new zone)

Pyrite and sphalerite in mudstones were located along the edge of the Salmon Glacier in an area of glacial meltback. This new zone features abundant hydrozincite on surface with coarse pyrite and fine sphalerite occurring along layers of fine beds. This mineralization type appears to have some affinities with the Eskay Creek mineralization found about 30km to the northwest. Further sampling is planned to be followed by drilling.

GS (new zone)

A new discovery features galena and sphalerite mineralization in a stockwork zone hosted within north-trending sediments. Additional sampling is planned as the Company continues to define this new discovery.

Expect robust assay-related newsflow out of the Optimum camp in the weeks and months to come.

Tyler Ross, CEO of Optimum Ventures: “We were excited to begin this seasons’ exploration at Swann on the back of last year’s successful drilling. Glacial ice crews have outlined several new zones from which we are awaiting assay results from over 700 samples taken” to confirm the zone’s potential The discovery of this mineralized corridor solidifies our belief in the robust potential of The Harry Project.”

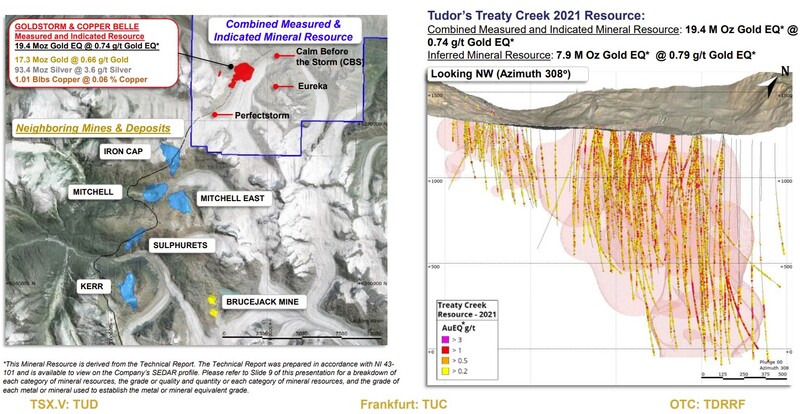

Treaty Creek

Then, on August 23, Teuton updated progress at its mothership Treaty Creek Project where the current ounce count stands at 19.4M AuEq ozs (M&I) and 7.22M AuEq ozs (Inferred).

Treaty Creek, a JV between Tudor (60%), Teuton (20%), and American Creek (20%), borders Seabridge Gold’s KSM property to the southwest and Newcrest Mining’s Brucejack property to the southeast.

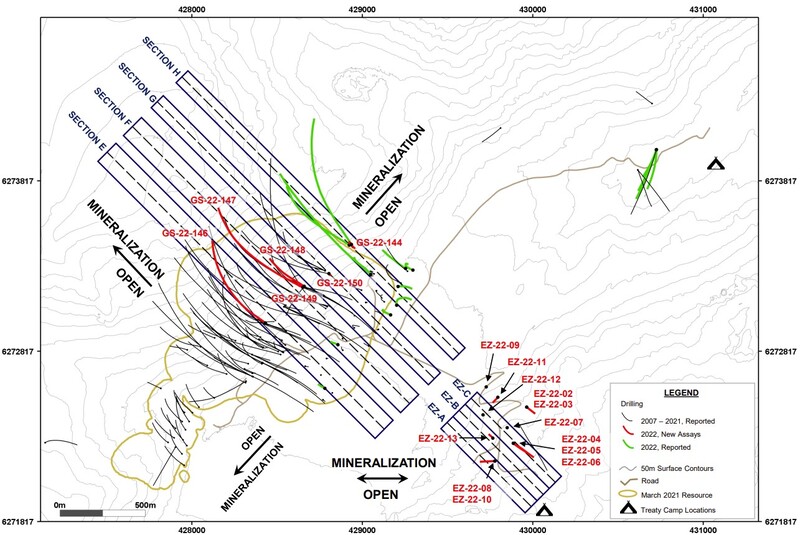

(click on the image below to amplify)

The August 23rd headline…

Teuton announced receiving the fifth batch of drill results from JV partner Tudor Gold. The drill program at Treaty Creek is an aggressive one. I lost count of the rigs they’ve mobilized to the project (8?) as they have yet to determine the limits to Goldstorm and Eureka’s mineralized footprint. The 2022 campaign is targeting resource expansion and upgrades for several areas, including the Goldstorm Deposit, the Eureka zone, and the Calm Before the Storm zone (above map).

Treaty Creek drill hole results (verbatim as per the Aug. 23 press release):

Goldstorm Deposit

SECTION E

- GS-22-146 was drilled to target the northwest extension of CS600. The successful CS600 intercept was spaced 125 m down-dip from previous drilling. The hole first drilled through an exceptional intercept of the 300H domain which returned 517.5 m grading 1.10 g/t AuEQ (1.02 g/t Au, 4.17 g/t Ag, 0.03 % Cu) which included a 10.5 m interval of 9.55 g/t AuEQ (8.77 g/t Au, 62.44 g/t Ag, 0.04 % Cu). The CS600 domain intercept reported 24.0 m grading 4.72 g/t AuEQ (4.50 g/t Au, 1.10 g/t Ag, 0.17 % Cu) within 88.5 m grading 2.10 g/t AuEQ (1.85 g/t Au, 2.39 g/t Ag, 0.18 % Cu).

SECTION F

- GS-22-147 was also drilled as a northwest extension of CS600 with the hole landing 125 m from previous drilling, extending the CS600 down-dip. The 300H domain was intercepted prior to reaching the CS600 domain and reported several high-grade intervals, including 22.79 g/t AuEQ (13.4 g/t Au, 801.00 g/t Ag, 2.83 % Cu) over 1.10 m, and 11.25 g/t AuEQ (4.00 g/t Au, 335.00 g/t Ag, 2.83% Cu) over 1.05 m. The CS600 intercept reported 87.0 m grading 1.01 g/t AuEQ (0.45 g/t Au, 6.86 g/t Ag, 0.41 % Cu).

- GS-22-148 was drilled as an infill hole within the 300H domain. The hole successfully intercepted 141.0 m grading 0.97 g/t AuEQ (0.91 g/t Au, 3.37 g/t Ag, 0.02 % Cu).

SECTION G

- GS-22-150 targeted the CS600 along the north-western boundary of the domain to improve the understanding of continuity along the uppermost portion of the domain. The hole intercepted 52.5 m grading 1.09 g/t AuEQ (0.66 g/t Au, 15.91 g/t Ag, 0.21 % Cu) and was spaced 90 m to the southwest from previous drilling.

SECTION H

- GS-22-144 stepped out 175 m to the northwest from the 2021 drilling and targeted the CS600 and DS5 domains which were both successfully intercepted. The CS600 intercept returned 90.0 meters grading 1.35 g/t AuEQ (0.73 g/t Au, 16.3 g/t Ag, 0.36 % Cu) within a broader envelope of 220.5 m grading 1.02 g/t AuEQ (0.62 g/t Au, 11.43 g/t Ag, 0.22 % Cu). Below this, the DS5 intercept reported 258.0 m grading 1.00 g/t AuEQ (0.95 g/t Au, 3.22 g/t Ag, 0.01 % Cu).

EUREKA ZONE

A total of twelve diamond drill holes were drilled in the Eureka Zone, partly to gain a better understanding of the geological controls underpinning these mineralized structures. Several holes hit favorable mineralized intercepts, including:

- EZ-22-04: 0.50 g/t AuEQ (0.32 g/t Au, 6.01 g/t Ag, 0.09 % Cu) over 81.0 m.

- EZ-22-07: 0.51 g/t AuEQ (0.45 g/t Au, 3.75 g/t Ag, 0.01 % Cu) over 81.0 m.

- EZ-22-08: 0.60 g/t AuEQ (0.50 g/t Au, 4.86 g/t Ag, 0.04 % Cu) over 152.7 m.

- EZ-22-10: 0.54 g/t AuEQ (0.43 g/t Au, 5.43 g/t Ag, 0.04 % Cu) over 135.0 m.

- EZ-22-12: 1.05 g/t AuEQ (0.89 g/t Au, 6.41 g/t Ag, 0.07 % Cu) over 46.0 m.

- EZ-22-13: 0.58 g/t AuEQ (0.49 g/t Au, 4.78 g/t Ag, 0.03 % Cu) over 142.05 m.

(click on the image below to amplify)

Section Areas – Plan View

Ken Konkin, President and CEO: “We are extremely pleased with the 5th set of results for the 2022 Treaty Creek drill hole program. Not only do we see continued success in the step-out drilling of the large Goldstorm Deposit and its various domains, but we also see the continuation of hitting high-grades within pulses of gold and silver as a late-stage, over-printed style of mineralization. Notably, much higher silver mineralization is associated with these late-stage features as supported by a 1.5 meter (m) interval within the 300H domain which yielded 24.11 g/t AuEQ (20.40 g/t Au, 311 g/t Ag and 648 ppm Cu) within GS-22-146 as part of a 10.5 m composite that averaged 9.55 g/t AuEQ (8.77 g/t Au, 62.44 g/t Ag and 410 ppm Cu). Similarly, within hole GS-22-147, a 1.10 m intercept yielded 22.79 g/t AuEQ (13.4 g/t Au, 801 g/t Ag and 196 ppm Cu). These two high-grade precious metal intercepts occur deeper within the 300H domain and are 285 m apart from each other. Three of the six reported Goldstorm holes were step-out drill holes that were drilled outside the 2021 Resource Estimate area; the other drill holes were targeted to infill large blocks that represent significant tonnages within the resource model. Within the 300H domain, we continue to recover long intercepts of gold-silver mineralization that contains a core of gold-silver enrichment: GS-22-146 cut 517.5 m of 1.10 g/t AuEQ (1.02 g/t Au, 4.17 g/t Ag, 285 ppm Cu) with an enriched, deeper portion averaging 2.64 g/t AuEQ over 102 m (2.48 g/t Au, 8.88 g/t Ag and 491 ppm Cu). Step-out drill holes into the CS600 domain continue to produce strong copper grades associated with gold-sliver mineralization. GS-22-147 cut 0.41 % Cu over 87.0 m that averaged 1.01 g/t AuEQ (0.45 g/t Au, 6.86 g/t Ag, 0.41 % Cu).

Drilling at the Eureka Zone revealed gold-silver mineralization similar to the DS5 Domain of Goldstorm. Geologic similarities include the occurrence of post-mineral intrusive dykes as observed throughout the Goldstorm Deposit as well as fault off-sets. The best drilling results of the season so far were obtained from EZ-22-12 which intersected 46.0 m of 1.05 g/t AuEQ (0.89 g/t Au, 6.41 g/t Ag and 697 ppm Cu). Drilling continues as we have yet to determine any limits to the Goldstorm or Eureka systems.”

Stay tuned—lots more to come.

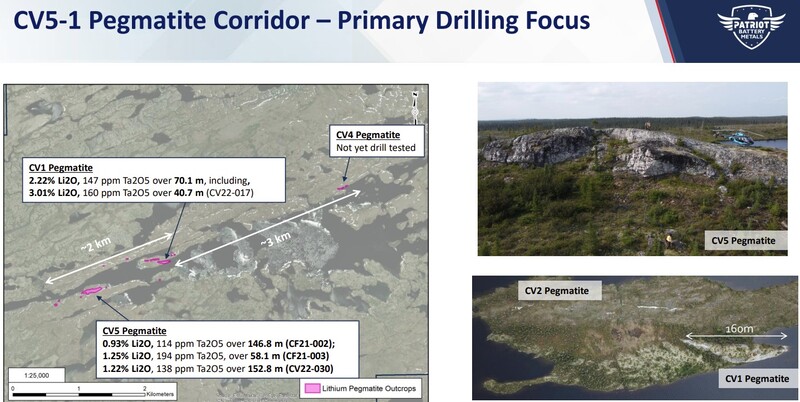

Patriot Battery Metals (PMET.V) – (PMETF.OTC) – (R9GA.FRA)

- 88.32 million shares outstanding

- $543.18M market cap based on its recent $6.15 close

Where lithium is concerned, I found this article amusing – MinRes boss wants to know what Goldman Sachs was smoking when it called the end of the lithium boom.

I first trotted out Patriot Battery Metals back in mid-April when the stock was trading in the $1.60 range and have offered several updates since then, most recently on August 2nd – A Highballer update for August 2, 2022 – Is It Go Time?

I took a modest-sized position back then—averaging up in early June—and with the recent price appreciation, PMET now represents my largest holding. I haven’t taken profits as I suspect it has an endgame. With the waaaay outta whack supply/demand dynamics bolstering the lithium space, PMET’s 100% owned Corvette Property is a sitting duck, IMO.

(this wholly-owned Corvette Property is located proximal to the Trans-Taiga Road and powerline infrastructural corridor in the James Bay region of Québec)

Weighty developments out of the Company in recent weeks have firmed my ‘be right – sit tight’ resolve.

(click on the image below to amplify)

After reporting impressive drill hole results, positive metallurgy, and the discovery of a new spodumene pegmatite outcrop cluster earlier this summer, the stock found a whole new gear. Then, just last week, the Company dropped the following headline...

The terms of Mr. Brinsden’s stock options speak volumes.

The Company has granted to Mr. Brinsden 1,000,000 stock options exercisable at CAD $7.00 and 1,000,000 stock options exercisable at CAD $9.20, vesting immediately with a 4 year term. The stock options are granted and governed in accordance with the Company’s Stock Option Plan.

There’s a lot more to this story.

The following is a comment sent this way from a mining-savvy poster that goes by the handle @Teevee (from the CEO.CA PMET Channel):

Giant high grade spodumene pegmatites are uncommon. Corvette is a superlative and singular deposit in the making. Although PMET can stand on its own merit, as it becomes more widely known, I expect some of the market capitalization of the more widely held market leaders in the lithium sector will migrate to PMET. It is still early days with much more share price upside to come on a results driven basis…. also not sure if you are aware, but control is held by only a handful of large Australian and Canadian shareholders. Assuming insiders don’t want to put Corvette into production themselves, when consolidation in the lithium sector arrives, PMET won’t go cheap and will be amongst the first to go.

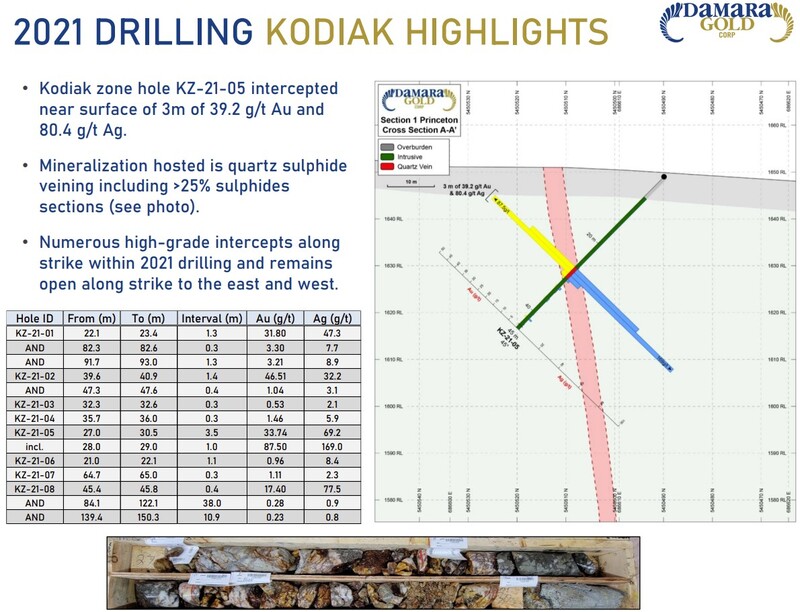

Damara Gold (DMR.V)

- 69.52 million shares outstanding

- $2.43M market cap based on its recent $0.035 close

Damara is a company I’ve been following since it put boots on the ground in the British Columbia interior.

Damara is focused on the Princeton region of southern BC, an area that played host to one of the more spectacular gold rushes in the province’s history—a boom sparked by John Chance’s Granite Creek discovery in 1885.

At the 7:35 mark on the video below, there’s an extraordinary story about a man named ‘Johansen’ who reportedly stashed several hundred ounces of platinum nuggets in a pail. Johansen buried the bucket in the vicinity of his cabin on Granite Creek, intending to retrieve it after returning from a trip to the Kootenays. He never returned. The platinum may still be buried there. Somewhere.

Using good science—a combination of geochem and geophysics—Damara is taking a disciplined, systematic approach to target definition at its flagship 17,519-hectare Placer Mountain Project.

Early stage drilling tagged the following values at the Kodiak Zone—a zone underpinned by a largely untested 1.5 km long x 600-meter wide high-grade soil anomaly (the anomaly remains open to the east).

Kodiak Zone drill hole highlights include:

- KZ-21-01 intersected 1.30 meters at 31.80 g/t gold and 47.3 g/t silver;

- KZ-21-02 intersected 1.35 meters at 46.51 g/t gold and 32.2 g/t silver;

- KZ-21-05 intersected 3.5 meters at 33.74 g/t Au and 69.2 g/t Ag;

- KZ-21-05 intersected 3.00 meters at 39.20 g/t gold and 80.4 g/t silver.

(click on the image below to amplify)

Though the Company has gone silent since dropping its last headline on April 7, I suspect we’ll see an exploration update in the not-too-distant future.

The Company is chaired by one Larry Nagy, a veteran mine finder with an impressive resume.

Quoting Nagy from that April 7 press release: “We are pleased to continue intersecting high-grade gold and silver veining at the Kodiak Zone. The snow is melting rapidly and our crews are gearing up for another productive season of exploration at Placer Mountain. Due to the successful drilling results, we decided to expand our land position even further along strike in both directions, and added several new targets identified from the analysis of satellite imagery. Field evaluation of these targets will begin soon. Our modern systematic approach to exploration has been very successful at generating new targets which are returning very strong drill results. It is exciting to be generating new orogenic gold discoveries so close to the producing Copper Mountain Mine in Southern BC. We look forward to further extending our currently defined mineralization with drilling this summer as we work toward our ultimate goal of defining a future mineral resource at Placer Mountain.”

I expect a modest raise before the Company mobilizes a drill rig to the property later this summer or fall.

That’s all I got for this episode of Highballer.

END

—Greg Nolan

Full disclosure: the author was compensated for the above Apollo Silver, Forum, and Teuton content. The author owns shares in all of the companies featured above (color Greg Nolan biased).