When the Fed began a hiking cycle way back in 1975, the Dollar soared and Gold got cut in half (from $200 to $100). Towards the end of 75, as higher rates and a soaring Greenback weighed heavily on the U.S. economy, the Fed blinked and backed away from its hawkish ways. That move served as the foundation for a powerful trend that saw Gold go on a six-year tear, from $100 to $850.

A similar scenario developed in late 2001/early 2002 when the Fed reversed course amid a rate hike campaign, triggering a move that saw the metal soar to a surreal $1900 per oz.

There are parallels between then and now. You don’t need to be a high-browed mastermind to see the (potential) setup. The question is: How much damage is the U.S. Fed willing to inflict on the global economy before it pivots and backs away from its bullying (rate hike) tactics?

The next question on investors’ minds: when the Fed blinks—which is a near certainty—will the past serve as a prolog… will Gold rip as it did at the turn of the century?

I sift through a lot of economic commentary each week. One piece I can’t recommend enough—an interview with some cold hard facts concerning where we are in this debt-burdened society—is a Mining Stock Daily conversation with Rick Rule. His take on the U.S.’s $140T in unfunded liabilities and its budget of $2T in deficit is particularly sobering, and informative—Rick Rule: “Eventually Arithmetic Triumphs Over Narrative.”

To put things into a proper context (while pondering this $140T numeral): What does one TRILLION dollars look like?

While on the subject of Rule, he figures there are between 50 and 200 junior exploration companies worldwide that might be considered viable out of the 3,000 that pretend to be. And many of these companies are amidst a capital-raising crisis. Keep this in mind when scouring the sector for value. Companies that stoked their treasuries at higher prices are in an enviable position compared to those that need to raise capital to fund future exploration and development.

There’s also a recent interview with mining legend Pierre Lassonde that’s worth a listen. Linked here is his take on where Gold and the underlying equities are headed in the short to medium term. To paraphrase Lassonde: ‘the current price of a stock doesn’t necessarily reflect its intrinsic value.’ Of course, we already know that, but it’s a good reminder as we (hesitantly) deploy sidelined capital.

A few of the companies we follow

(click on the images below to amplify)

Forum Energy Metals (FMC.V) – (FDCFF.OTC)

- 172.17 million shares outstanding

- $20.66M market cap based on its October 7 $0.12 close

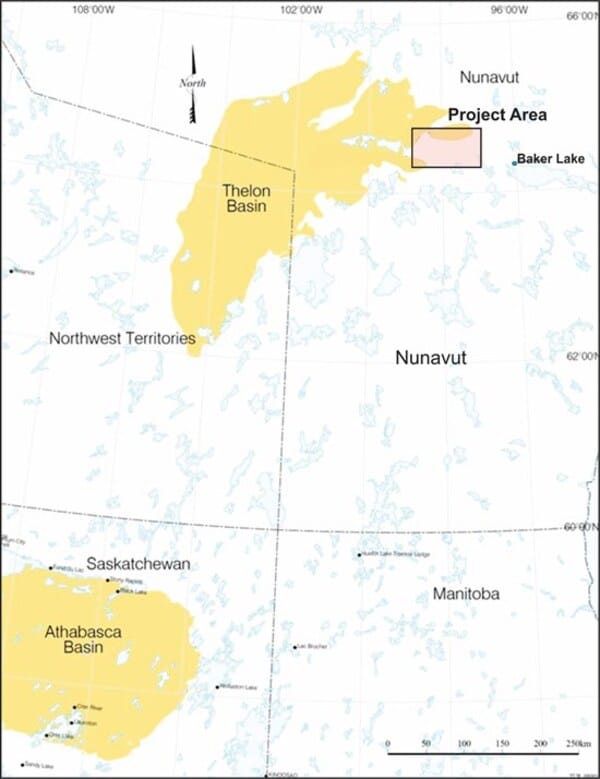

Aside from their Wollaston Uranium Project and the Northwest Athabasca Joint Venture in the prolific Athabasca Basin of Saskatchewan, Forum is on the hunt for economic uranium deposits in the Thelon Basin of Nunavut, Canada.

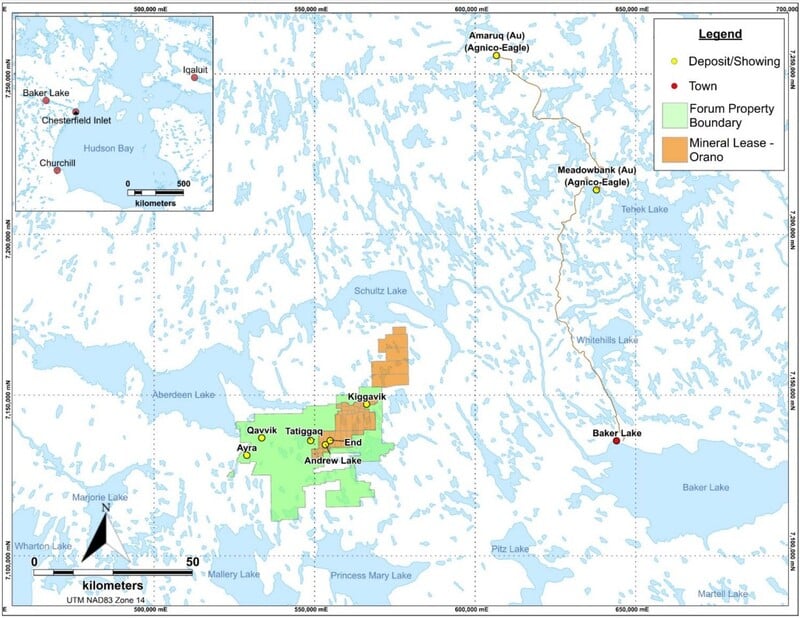

There are three deposits at the development stage in this basin—the Kiggavik, Andrew Lake, and the End deposits representing 133 million pounds of uranium at the Orano/Denison/UEX Kiggavik Uranium Mine Development Project (average head grade = 0.46% U).

Forum controls 105,000 hectares within this highly prospective setting. The Thelon Basin Uranium Project is located 100 kilometers west of the community of Baker Lake, Nunavut.

The Thelon Basin is the closest geological analog we have to the prolific Athabasca Basin further south. And it’s a region that remains vastly unexplored.

This dominant land position includes ground recently dropped by Cameco—ground that includes two unconformity-style uranium deposits: the Tatiggaq deposit and the Qavvik deposit, both located in close proximity to Orano’s Andrew Lake deposit.

Quoting Forum’s CEO, Rick Mazur, from a previous press release: “The Thelon Basin is an important unconformity-type uranium district that represents the closest geological analogue in the world to the prolific Athabasca Basin. We believe that our ground hosts major high grade uranium deposits with similar potential and grades as the Athabasca. Forum is formulating plans to aggressively explore this project in 2023.”

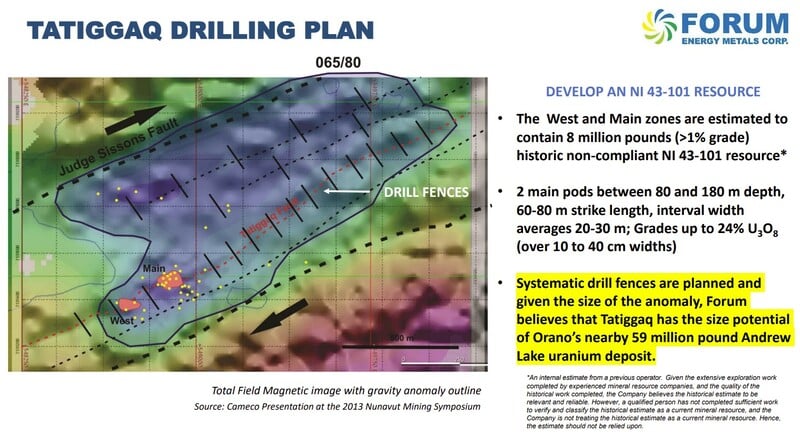

The Tatiggaq deposit consists of two shallow zones—Main and West. Both zones average 30 meters with a strike length of 60 and 80 meters, respectively.

Highlights from historical drilling include:

- TUR-026 – 1.0% U3O8 over 14.9 meters from 177.6 to 192.5 meters;

- TUR-040 – 0.92% U3O8 over 11.3 meters from 159.1 to 170.4 meters;

- TUR-042 – 2.69% U3O8 over 7.9 meters from 200.2 to 208.1 meters (including 24.8% U3O8 over 0.4 meters from 202.9 to 203.3 meters);

- TUR-052B – 0.43% U3O8 over 54.2 meters from 115.4 to 169.6 meters;

- TUR-056 – 0.93% U3O8 over 9 meters from 126 to 135 meters;

- TUR-058 – 1.17% U3O8 over 6.1 meters from 88.2 to 94.3 meters.

Forum is currently in the process of prioritizing targets as it prepares to launch an aggressive drilling campaign next summer.

To step up their efforts to open up the discovery and resource expansion potential at this far north project, on October 3, Forum announced a new addition to an already impressive team, along with an update on the geophysical front.

Dr. Rebecca Hunter Joins Forum Exploration Team; Gravity Survey Completed on Nunavut Uranium Project

This new hire was a heads-up move on management’s part. Rebecca Hunter was on the ground, leading Cameco’s exploration team to the discovery of the Tatiggaq and Qavvik deposits during her work with the senior entity. Forum’s CEO Rick Mazur characterized Rebecca as a “brilliant geologist” during a recent, highly informative interview over on StockBox (link below). Topics discussed here range from the (unconformity-style uranium deposit) discovery process to the potential economics of a 1%-plus orebody.

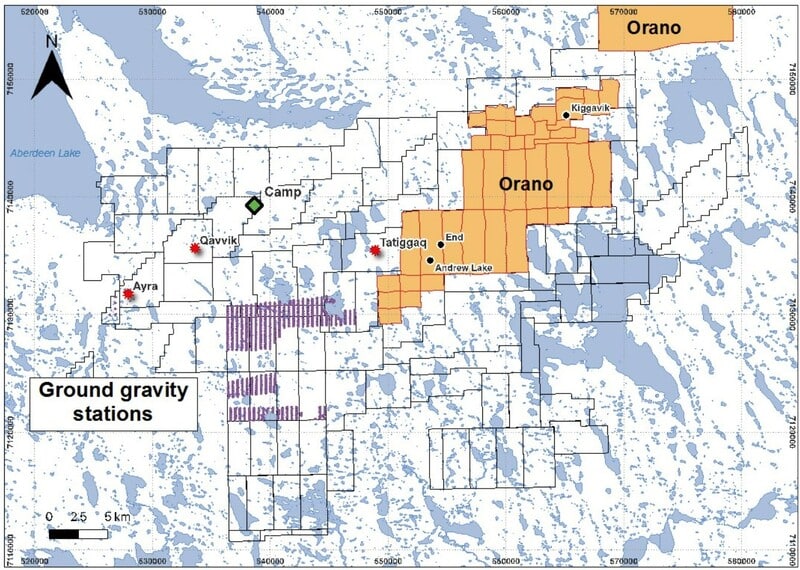

Forum also offered an update regarding a recently initiated round of geophysics at its Nunavut Uranium Project:

MWH Geo-Surveys completed a ground gravity survey over four grids within the project area, filling in gaps along trends previously covered by Cameco and along parallel trends prospective for uranium mineralization (map below).

Gravity surveys have proven to be an effective exploration tool in the Thelon Basin, layered with other geophysical methods for identifying alteration systems associated with basement-hosted, unconformity-style uranium deposits.

This summer, 1141 ground gravity stations were collected largely at a station spacing of 100 m, along lines 400 m apart. Interpretation of the survey results are expected later in the fall and will help to delineate additional targets on the project.

If you’re wondering how Forum intends to finance its planned summer-of-2023 drill campaign at Thelon, the above StockBox interview explores the available options. Hint: we may see the project spun out to existing shareholders (I love spin-out scenarios and the potential to unlock shareholder value).

The next headline to drop may concern the company’s Northwest Athabasca Joint Venture in the Athabasca Basin, where the current JV split = Forum 39.25%; NexGen 28.25%; Cameco 20%: Orano 12.5%.

I spoke too soon.

This just in…

Forum Acquires Fisher Copper Claims, Saskatchewan

100k FMC shares and a 1% NSR (one-half of which may be pulled back for $500k), buys Forum certain claims—the Fisher Property—located 40 kilometers west of Pelican Narrows, Saskatchewan. Fisher is “in a volcanic arc assemblage and associated sedimentary rocks of the Glennie Domain. The property hosts a stratabound, volcanogenic massive sulphide deposit measuring 650,000 tons grading 0.5% copper and 3.0% zinc.** Forum’s geological team has identified further targets for extension of the mineralization and will be conducting a prospecting and sampling program this month.”

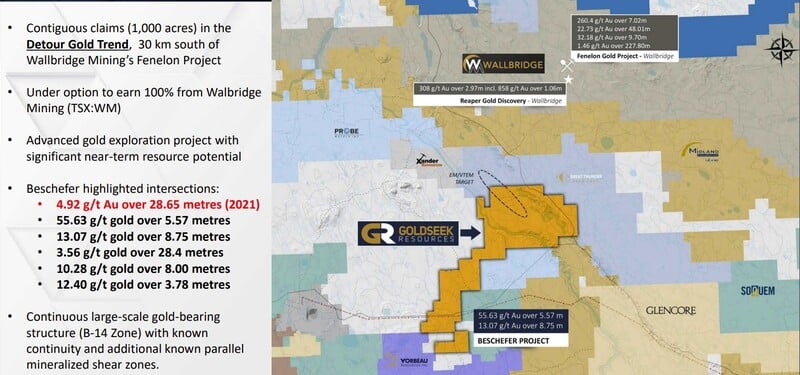

Goldseek Resources (GSK.C) – (4KG.FRA)

- 37.68 million shares outstanding

- $1.13M market cap based on its October 7 $0.03 close

Though we haven’t heard much out of the Goldseek camp in recent weeks, Management is putting together a plan to push their flagship Beschefer Project further along the resource definition and exploration curve in 2023. Beschefer is located along the northern Abitibi Greenstone Belt, some 30 kilometers southwest of Wallbridge’s Fenelon Gold Project.

The company’s share structure remains tight. With management and insider ownership riding at just over 50% (according to my last count), the company is motivated to keep things tight as they explore its financing options. My best guess is we’ll see a very modest PP, one that will get taken up (in large part) by insiders. And it will be (just) enough to fund 2023 operations and mobilize a drill rig to their flagship project. When market conditions improve, expect a more substantial raise.

We should hear something on the financing front, along with a project update, in the not-too-distant future.

HighGold Mining (HIGH.V) – (HGGOF.OTC)

- 73.1 million shares outstanding

- $48.25M market cap based on its October 7 $0.66 close

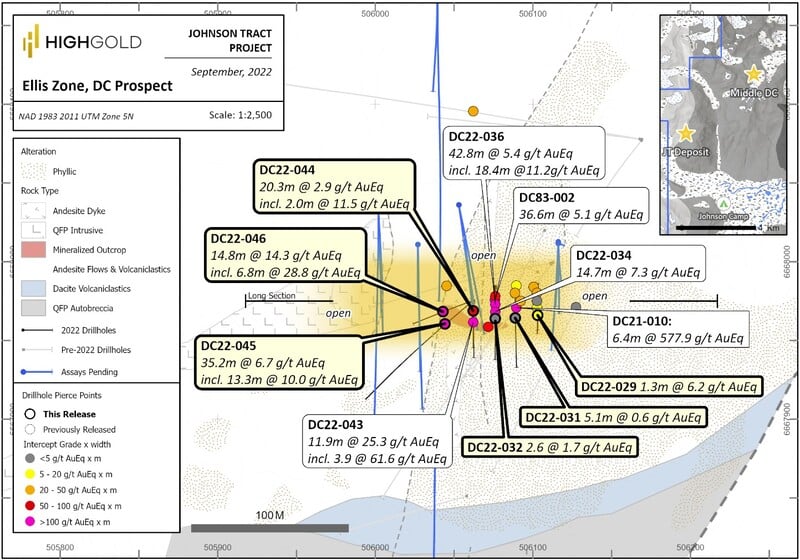

With the company zeroing in on what’s shaping up as a second deposit at its mothership Johnson Tract Project (JT) in southcentral Alaska, HighGold dropped the following headline on October 3:

This second-deposit-in-the-making involves diamond drilling at the Ellis Zone where the company recently tagged 21.68 g/t Au, 30 g/t Ag, 0.61% Cu, 4.20% Zn over 11.9 meters in a 25-meter grid a stepout campaign. (See HighGold press release dated September 12, 2022).

(JT currently boasts a high-grade MRE of 1.05 Moz @ 9.4 g/t AuEq (Indicated) and 0.11 Moz @ 4.8 g/t AuEq (Inferred))

The intervals presented in this September 28 press release show an expanded mineralized footprint to the tune of nearly 50% (Ellis remains open in all directions).

Drill Highlights of the Ellis Zone

Drillhole DC22-046

- 14.8m @ 10.14 g/t Au, 13.8 g/t Ag, 0.28% Cu, 5.97% Zn (14.3 g/t AuEq) including

- 6.8m @ 21.29 g/t Au, 25.1 g/t Ag, 0.55% Cu, 0.61% Pb, 10.70% Zn (28.7 g/t AuEq) including

- 1.5m @ 62.50 g/t Au, 10.5 g/t Ag, 0.77% Cu, 0.59% Pb, 10.59% Zn (70.0 g/t AuEq)

Drillhole DC22-045

- 35.2m @ 4.2 g/t Au, 6.1 g/t Ag, 0.12% Cu, 1.40% Pb, 3.19% Zn (6.7 g/t AuEq) including

- 1.9m @ 12.95 g/t Au, 37.7 g/t Ag, 13.51% Pb, 31.42% Zn (36.2 g/t AuEq), and

- 13.3m @ 7.81 g/t Au, 6.4 g/t Ag, 0.23% Cu, 1.31% Pb, 2.35% Zn (10.0 g/t AuEq)

Drillhole DC22-044

- 20.3m @ 1.72 g/t Au, 5.6 g/t Ag, 0.14% Cu, 1.46% Zn (2.9 g/t AuEq), in hole DC22-044, including

- 2.0m @ 8.34 g/t Au, 8.9 g/t Ag, 0.41% Cu, 4.00% Zn (11.5 g/t AuEq)

2022 Exploration Program Update

The 2022 Drilling and Exploration Program includes diamond drilling (two rigs), geological mapping, geochemical sampling, airborne drone-magnetic geophysical surveying, preliminary environmental and engineering baseline studies, and general JT camp improvements. Drilling is expected to wrap up in mid to late-October with a total of 10,000 to 11,000 meters completed. To September 23rd, a total of 8,230 meters have been completed in 47 holes (36 at the DC prospect, six (6) at the Milkbone prospect, one (1) at the Kona prospect, and four (4) at the JT Deposit area). For the remainder of the drill program one drill rig will continue to focus on expanding the Ellis Zone while the second drill rig will test important resource growth targets at the main JT Deposit, one of the other core priorities for the 2022 drill season. Assays results will be released on an ongoing basis pending review and meeting Company quality assurance-quality control protocols.

Darwin Green, CEO: “The Ellis Zone discovery continues to deliver excellent results with some of the strongest and widest intersections to date coming from the western limit of our drilling. We are very encouraged by the persistence of the Ellis Zone mineralization along strike and plan to keep stepping out in all directions as we continue expanding the known extents of the zone. While still very early days, it appears we are well on our way to defining a second deposit at Johnson Tract to compliment the existing high-grade +1Moz JT Deposit mineral resource that is also open to expansion.”

Teuton Resources (TUO.V) – (TEUTF.OTC) – (TFE.FRA)

- 57.35 million shares outstanding

- $59.07M market cap based on its October 7 $1.03 close

On October 5, Teuton dropped the following headline…

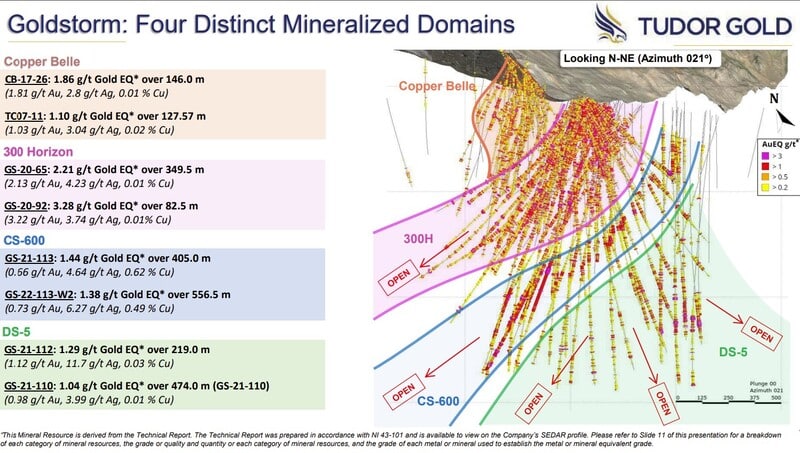

Teuton is now in receipt of the seventh set of drill results from Treaty Creek (TC), a project located in the heart of the prolific Golden Triangle of northwestern British Columbia.

For those new to the name, TC adjoins and is on trend with Seabridge Gold’s KSM property and Newcrest Mining’s Brucejack property. The ounce count at TC currently stands at 19.4 million ounces at 0.74 g/t AuEq (M&I) and 7.9 million ounces at 0.79 g/t AuEq (Inferred). Teuton’s 20% interest is carried (until a production decision is made), with JV partner Tudor Gold doing all the heavy lifting.

Something to consider when sizing up the potential of Teuton’s 20% carried interest: the current 27.3M AuEq mineral resource estimate (MRE) is based on drill hole data up to the end of the 2020 drill season only. Since then, there have been two seasons of aggressive infill and step-out drilling at the project where the mineralization remains open in all directions and at depth. After the 2022 campaign is complete, Tudor will incorporate these past two years’ worth of results into an updated MRE. We should see those numbers drop in H1, perhaps as early as Q1 2023. We should also get our first look at TC’s economics via a PEA.

Further heightening the potential for a dramatic increase in TC’s ounce count, four of the five holes presented in this Oct 5 press release were drilled partially or completely outside the main 2021 MRE block (map below).

Drill hole highlights

SECTION 114+00 NE

- GS-22-155 was drilled to target the footwall of the Treaty Thrust Fault 1 (TTF1) where the March 2021 NI 43-101 Mineral Resource Estimate classified the area largely as Inferred Mineral Resource. The drill hole successfully intercepted mineralization in close proximity to TTF1, below which intercepted 136.5 m grading 1.62 g/t AuEq (1.54 g/t Au, 3.49 g/t Ag, 0.04 % Cu) within a broader envelope of 1.28 g/t AuEq (1.20 g/t Au, 3.39 g/t Ag, 0.04 % Cu) over 222.0 m.

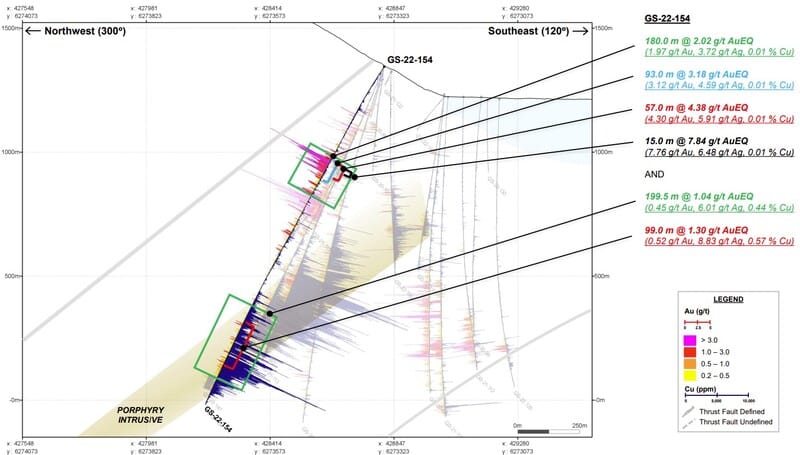

SECTION 116+50 NE

- GS-22-154 was drilled to target an area down-plunge of the CS600 domain, which exists outside of the March 2021 Mineral Resource area. Preliminary results were released on September 12, 2022 to a depth of 1236.0, with an initial interpretation of a higher-grade zone being attributed to the 300H domain. An interval consisting of steeply dipping, north-trending quartz stockwork veins and veinlets bearing sulphosalt minerals, pyrite, and sphalerite returned 57.0 m grading 4.38 g/t AuEq (4.30 g/t Au, 5.91 g/t Ag, 0.01 % Cu) with an enriched interval of 15.0 m grading 7.84 g/t AuEq (7.76 g/t Au, 6.58 g/t Ag, 0.01 % Cu).

At depth, the CS600 domain was intercepted and reported 199.5 m grading 1.04 g/t AuEq (0.45 g/t Au, 3.01 g/t Ag, 0.44 % Cu) in the intrusive hosted Gold-Copper porphyry system.

SECTION J

- GS-22-145 was drilled to target a deep intercept of CS600, however, was terminated due to unfavorable deviation and was then used as a parent hole for wedging. However, this drill hole intercepted a mineralized system that graded 0.90 g/t AuEq (0.77 g/t Au, 9.27 g/t Ag, 0.02 % Cu) over 127.0 m before it was stopped.

- GS-22-145-W1 was drilled as a wedge daughter hole from GS-22-145 and was designed to target the CS600 domain. The hole intercepted strong sulphide mineralization which correlated well to that intercepted in GS-22-154, within a quartz stockwork system. The intercept averaged 2.00 g/t AuEq (1.86 g/t Au, 10.54 g/t Ag, 0.01 % Cu) over 66.0 m. An enriched portion of the interval returned 8.22 g/t AuEq (8.16 g/t Au, 4.80 g/t Ag) over 5.0 m This stockwork interval was located 400 m from the high-grade interval intercepted in GS-22-154.

Minor CS600 style mineralization was noted at depth, however, the drill hole experienced excessive lift at depth and the hole intercepted peripheral CS600 mineralization.

- GS-22-151-W1 continued from its parent drill hole GS-22-151 to intersect the northwest extent of CS600. Preliminary results were reported in the September 12, 2022 press release to a depth of 946.5 m. In addition to the preliminary results, the CS600 domain was intercepted with a total of 300.0 m grading 1.27 g/t AuEq (0.95 g/t Au, 2.43 g/t Ag, 0.25 % Cu). Intervals of stronger mineralization were also recorded, such as 7.5 m grading 4.10 g/t AuEq (3.96 g/t Au, 3.85 g/t Ag, 0.08 % Cu).

Ken Konkin, President and CEO of Tudor Gold: “We are very pleased to confirm that our step-out and in-fill drilling is progressing extremely well. We continue to intersect higher gold values within broad mineralized envelopes within the northern aspect of the Goldstorm Deposit. Both 300H and CS600 domains yield very consistent gold mineralization with continued strong copper grades observed throughout the CS600 domain. Our geological team was delighted to observe a similar pulse of enriched gold mineralization within the 300H domain with holes GS-22-145-W1 (2.00 g/t AuEq over 66.0 m) and GS-22-154 (4.38 g/t AuEq over 57.0 m) which are approximately 400 m apart. These holes also share the similar characteristic of containing a higher-grade core of 8.22 g/t AuEq over 5.0 m (GS-22-145-W1) and 7.84 g/t AuEq over 15.0 m (GS-22-151-W1). Exploration for the high-grade gold potential in the northern region of the Goldstorm Deposit will be a priority for the 2023 exploration season. Additionally, the CS600 domain continues to demonstrate very strong and consistent copper mineralization with obvious disseminated and veinlet chalcopyrite throughout the CS600 domain with notable addition of disseminated bornite in the deeper portions of the domain. There is also a distinct higher-grade of copper mineralization of 0.57% Cu over 99.0 m within a 199.0 m envelope of 0.44% Cu (GS-22-154) in the CS600 domain. Drilling is expected to continue well into October as the Goldstorm Deposit remains open in all directions and at depth.”

Harry Property

Teuton received gold and silver assays for select samples from the BR, Usrula, and Golden Summit zones located on the Harry property—a project optioned to Optimum Ventures (OPV.V) who stands to earn up to 80% in the project by carrying out $9 million in exploration expenditures over five years. Optimum must also pay Teuton $1.5 million in cash and issue 4,000,000 shares over the option period (Teuton will retain a 2.0% NSR and a 20% interest after the option is exercised).

Highlights from this recent sampling campaign include:

- 1.8 to 26.60 g/t Au and 282.9 to 1003.2 g/t Ag from 5 samples on the BR zone;

- 0.8 to 6.5 g/t gold and 131.3 to 208.1 g/t silver on the Ursula zone;

- 0.1 to 2.30 g/t Au and 470.3 to 5477.4 g/t Ag on the Golden Summit zone.

Shaw drilling of 1 m holes on the Saw Cut zone has intersected abundant sphalerite (ZnS) over at least 10 m within an overall zone that is up to 40 m wide. Grab sample assaying of this zone produced results ranging from 0.1 to 5.4 g/t Au and 10.2 to 158.4 g/t Ag (from 3 samples) associated with the strong sphalerite mineralization.

The new zone, Ursula South, consists of mineralization in a stockwork of galena-sphalerite veins up to 0.8 m wide over a width of 5 m. This new zone is located in an overburden area approximately 75 m south of the Ursula zone.

Big Gold & Eskay Rift Properties

Prospecting and sampling over ground covered by, or in the vicinity of, several large geophysical anomalies detected by a 2018 airborne ZTEM survey conducted by Geotech has now been completed. About 85% of samples taken have now been sent for assay.

On the Big Gold property certain samples sent in early during the season have been received and show an area containing anomalous copper values.

On the Eskay Rift property, prospecting and sampling of black mudstone horizons (up to 10m thick) capped by basalts and extending along strike for hundreds of meters have been completed. Samples from many of these horizons have shown occasional chalcopyrite mineralization along with pyrite, pyrrhotite and possibly magnetite. The mineralization in the horizons is often very fine-grained and laminar. One of the horizons carrying chalcopyrite was very cherty.

Samples taken below the horizons on the ice from two prominent boulder trains have also shown occasional chalcopyrite sometimes associated with an unidentified, fine-grained blue mineral. Further exploration will depend on assay results, expected within two to three months because of a backlog at the assay lab.

Teuton will continue to generate significant newsflow over the balance of 2022 and beyond. There are a number of (potential) catalysts in the offing. An updated Treaty Creek MRE is the clear standout in my mind.

Defense Metals (DEFN.V) – (DFMTF.OTC) – (35D.FRA)

- 183.37 million shares outstanding

- $44.92M market cap based on its October 7 $0.245

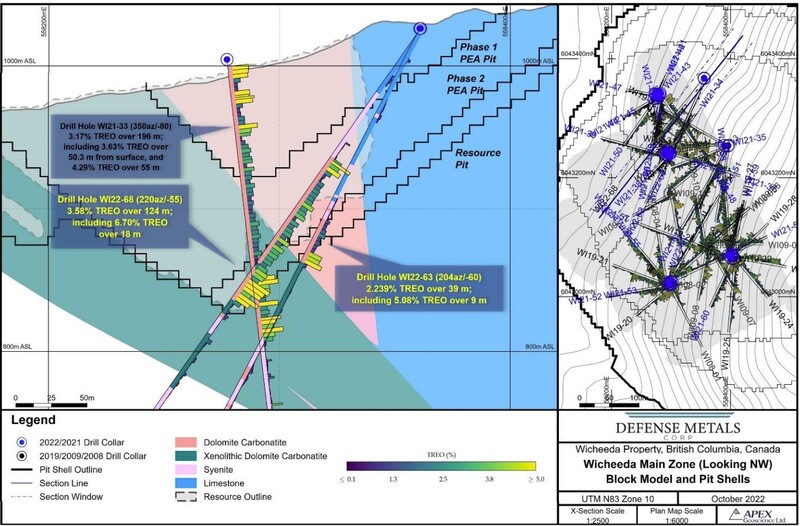

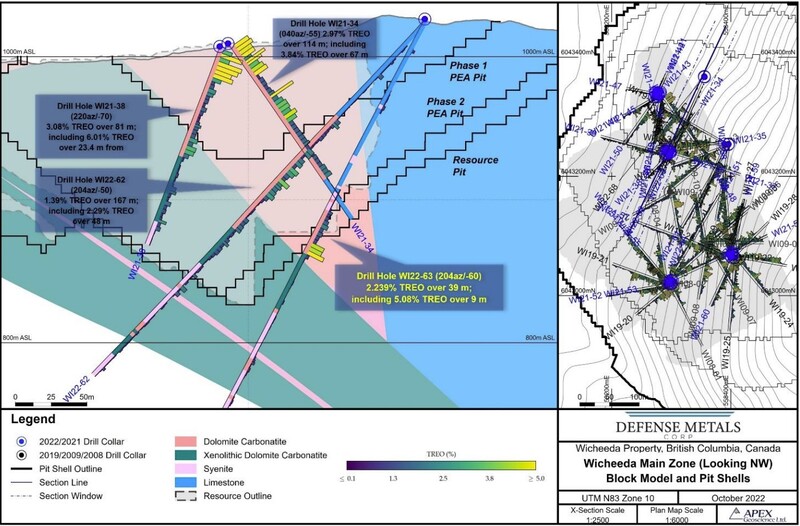

Today, October 11, Defense announced assay results for two additional drill holes from the northern area of the company’s wholly-owned Wicheeda REE Project in the Prince George region of British Columbia.

Defense Metals Drills High-Grades at Wicheeda including 124 metres of 3.58% Total Rare Earth Oxide

Infill drill hole WI22-68, the deepest hole drilled to date, tagged an impressive 3.58% total rare earth oxide (“TREO”) over 124 meters; including an exceptionally high-grade zone of 6.70% TREO over 18 meters which also included a 3-meter interval yielding 8.58% TREO.

Drill hole WI22-63, collared from the same pad, tested the interpreted eastern contact of the carbonatite body at depth and returned 2.29% TREO over 39 meters, including 5.08% TREO over 9 meters.

Luisa Moreno, President, and Director: “These two core drill holes, in particular WI22-68, once again demonstrate the potential for high REE grades over significant widths within the northern Wicheeda Deposit. Assays for WI22-68 were prioritized based on readily visible, coarse-grained REE mineralization. We look forward to receiving additional assay results of other resource infill drill holes from the northern and central Wicheeda Deposit that appear similar in terms of visually estimated REE mineralization percentage.”

Nice hits. I’ll be talking more about this one shortly.

Prime Mining (PRYM.V) – (PRMNF.OTC) – (04V3.FRA)

- 112.7 million shares outstanding

- $180.32M market cap based on its October 7 $1.60 close

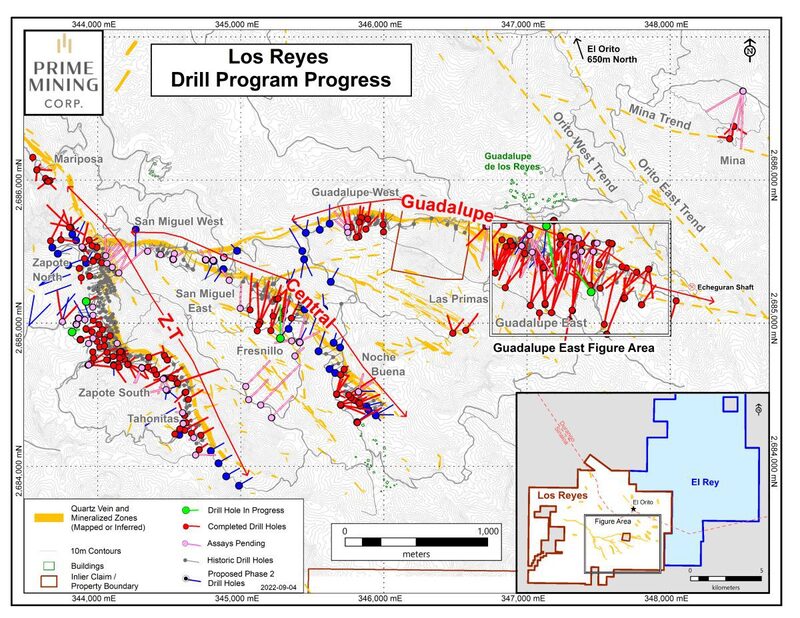

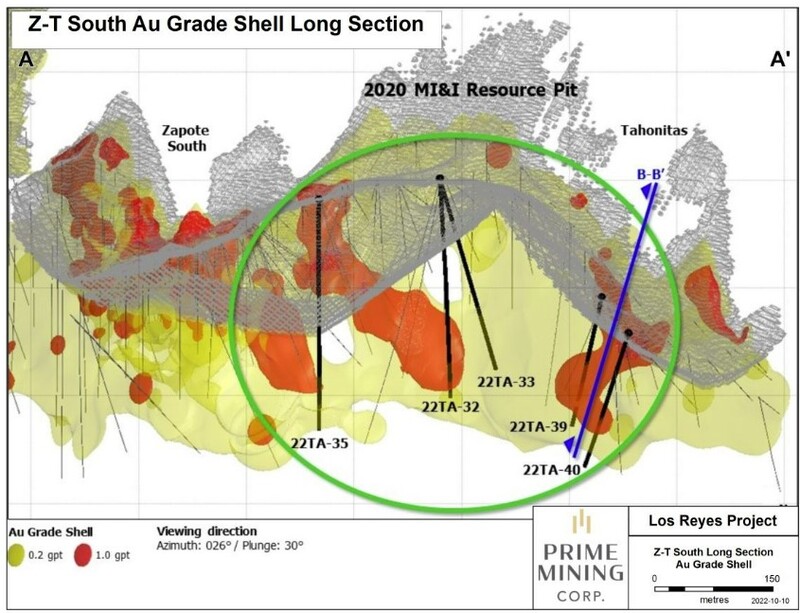

Prime just dropped results from what it characterizes as ‘five key drill holes in the Z-T area‘ as the company continues to push its mothership (multi-million-ounce) Los Reyes Project further along the curve.

Prime Intercepts 2.36 gpt Au and 178 gpt Ag over 20.5 Metres in Step-out Drilling at Z-T

Los Reyes—with a mineralized footprint of over 15 square kilometers—covers the subsurface stratum of an underexplored, 500-year-old mining district in Sinaloa State, Mexico. The company’s current drill programs are focused on expanding the Guadalupe, Central, and Z-T deposit areas that comprise this district’s core.

Five stepout holes at the southern end of the Z-T deposit are the focus of this press release—stepouts designed to demonstrate the mineralized continuity between Zapote South and Tahonitas.

Drilling continues to successfully delineate and expand open-pit resources and has identified additional potential for underground resources. Two new high-grade mineralized chutes have been discovered between the previously reported Zapote South and Tahonitas pit shells outlined in the Technical Report dated April 2, 2020. Both mineralized chutes are open for expansion down plunge.

Highlighted Intercepts

Z-T Deposit Area

- 2.36 g/t Au and 177.8 g/t Ag over 20.5 meters (13.2 m estimated true width (“etw”) and 0.91 g/t Au and 139.0 g/t Ag over 11.5 m (7.4 m etw) and 1.39 g/t Au and 12.7 g/t Ag over 6.0 m (3.9 m etw) (22TA-39);

- 3.86 g/t Au and 88.5 g/t Ag over 11.2 m (5.6 m etw), including 9.24 g/t Au and 223.0 g/t Ag over 4.25 m (2.1 m etw), and 2.70 g/t Au and 333.04 g/t Ag over 1.5 m (0.8 m etw) (22TA-32);

- 1.17 g/t Au and 207.4 g/t Ag over 8.3 m (5.3 m etw) (22TA-40);

- 0.97 g/t Au and 30.3 g/t Ag over 10.5 m (5.2 m etw) (22TA-35); and,

- 0.72 g/t Au and 61.0 g/t Ag over 5.8 m (4.3 m etw), including 1.35 g/t Au and 119.3 g/t Ag over 1.4 m (1.0 m etw) (22TA-33).

CEO Daniel Kunz: “The drill results reported today continue to increase the known strike length of the Z-T structure and have extended mineralization 200 metres deeper (vertically, from 700 to 500 metres above sea level) at the southern end of Z-T. We will continue to aggressively target these previously undrilled zones between the known pit shells. Connecting the pits along the Z-T structure would have a material impact on our mineral resource estimate. We also highlight that the high-grade gold and silver mineralization in these newly discovered chutes, especially those with materially increased silver grades, is an exciting development and provides new, significant resource expansion potential in the Z-T structure at Los Reyes.”

Five drills have continued to operate during the current rainy season successfully completing 70,590 metres to date with Phase 2 drilling planned to continue until the end of October. To date, 243 Phase 2 drill holes have been completed including the drilling results herein while results from 93 holes remain pending.

Before I wrap this one up, a note on Freeman Gold (FMAN.V):

Freeman, a company I’ve touched on here in the past, got dealt some serious What-For last week, perhaps (partly) due to delays in releasing assays from its flagship Lemhi Gold Project, and perhaps (mostly) due to an influential newsletter writer’s recommendation to exit the stock (this is all speculation on my part).

A few comments from the Freeman channel over at CEO.CA shortly after the selling pressure was triggered...

END

—Greg Nolan

Full disclosure: Greg Nolan has been compensated for the above content concerning Forum Energy Metals, Teuton Resources, Goldseek Resources, and Defense Metals. Nolan owns shares in these companies that were purchased on the open market. Nolan does not hold options on these client companies. Based on the above, consider Nolan biased and conduct your own due diligence.

** Concerning Forum Energy Metals’ Fisher property: The project’s historical resource estimate has not been calculated or classified under National Instrument 43-101 specifications and should not be relied upon.

Greg do any of these companies pay you either in cash, stock or options? Thank you.

Hi Hugh. My client base is charged a fee for my coverage. Of (potential) interest, I turn away more potential clients than I engage (I need to believe in a cos underlying fundamentals, otherwise, I’m not interested). I take no stock or options as compensation. All of my stock holdings were purchased on the open market.