Just as Gold appeared to be in the process of breaking major support last week, it staged a dramatic reversal after tagging a fresh 52-week low. On the weekly chart, it staged an outside reversal (taking out the previous week’s low and closing above the previous week’s high). Interesting price action.

As has been the case since March of this year, the US Dollar has kept the Gold price in check, but it may be in the process of breaking down. A substantial break below the 50 period SMA (blue line chart below) should telegraph a trend change, and if a top is in for the Greenback, Gold can go on its merry way.

Where the Gold equities are concerned, the GDXJ was the standout last Friday, printing a 10% gain to the upside accompanied by big volume.

These are all positive indications that it’s game-on for the precious metal (silver inc) and the underlying equities.

Positive supportive fundamentals include a recent report out of the World Gold Council that shows increased central bank appetites for the metal—Record central bank buying lifts global gold demand, WGC says.

Central banks bought a record 399 tons in the third quarter of 2022. Year-to-date, they bought 673 tons worth, a binge not witnessed since 1967 (when the metal still backed the Dollar). And it would appear that some of these central bankers would prefer to remain nameless—Who Are The Mystery Buyers Responsible For Central Bank Gold Boom?

We’re all now wondering, is this the real deal? Or is this ANOTHER bull trap, a head fake, another sucker’s rally?

For those holding back funds that would otherwise be invested in this sector, we now need to consider the possibility that the Gold train is leaving the station. The rest of this week’s trading action will be watched by a whole universe of traders wondering the same damn thing.

The stocks

First, I’ll update the companies covered in these pages in the past. Closer to the end of this piece, I’ll trot out a few new names that strike me as good value at current levels.

(click on the images below to amplify)

Teuton Resources (TUO.V) – (TFE.FRA)

- 57.35 million shares outstanding

- $69.39M market cap based on its recent $1.21 close

Teuton states that it has received the eighth set of drill results from Treaty Creek (TC), its flagship project located in the heart of the prolific Golden Triangle of northwestern British Columbia.

TC’s 27.3 million AuEq ounces adjoin and are on trend with Seabridge Gold’s KSM property and Newcrest Mining’s Brucejack property. Teuton’s 20% interest is carried (until a production decision is made), with its JV partner Tudor Gold paying all the bills (drilling in the Golden Triangle is an expensive proposition).

From my Oct. 11 offering:

Something to consider when sizing up the potential of Teuton’s 20% carried interest: the current 27.3M AuEq mineral resource estimate (MRE) is based on drill hole data up to the end of the 2020 drill season only. Since then, there have been two seasons of aggressive infill and step-out drilling at the project where the mineralization remains open in all directions and at depth. After the 2022 campaign is complete, Tudor will incorporate these past two years’ worth of results into an updated MRE. We should see those numbers drop in H1, perhaps as early as Q1 2023. We should also get our first look at TC’s economics via a PEA.

The November 1 headline: Teuton Resources Reports 8th set of Drill Results from Treaty Creek; Strong Gold-Copper Porphyry Mineralization Intersected in Northernmost Step-Out; 1.82 g/t AuEq over 114.0 Metres within 592.5 Metres of 1.16 g/t AuEq.

Results reported in this press release include five holes drilled into the Goldstorm Deposit, the Copper Belle Deposit, and the Konkin Zones.

The highlight hit in the text of the headline targeted the CS600 domain within the main TC deposit resource area (Goldstorm).

Drill hole GS-22-158, collared 250 meters north of the 2021 mineral resource estimate, tagged an impressive 592.5 meters averaging 1.16 g/t AuEQ (0.73 g/t Au, 3.17 g/t Ag, 0.34% Cu) with an enriched zone of 1.82 g/t AuEQ (1.04 g/t Au, 5.17 Ag, 0.61% Cu) over 114.0 meters.

Tudor notes that GS-22-158 “confirms the consistency of mineralization throughout the porphyry system where no boundary on the northern side of the system has been encountered. Future exploration will target the northerly extension of this system.”

Additional drill hole assays reported in this November 1 press release include:

GOLDSTORM DEPOSIT

SECTION K

GS-22-156 was drilled as an infill hole within the 300H domain in the area of the footwall of the Treaty Thrust Fault 1 (TTF1). An intercept of 294.0 m grading 1.0 g/t AuEQ (0.92 g/t Au, 4.38 g/t Ag, 0.02% Cu) was returned with a high-grade segment with 13.5 m grading 5.16 g/t AuEQ (4.99 g/t Au, 5.17 g/t Ag, 0.09% Cu).

COPPER BELLE DEPOSIT

SECTION 98+50 NE

CB-22-01 was drilled as a 100 m southeastern step-out hole on the Copper Belle deposit. An interval of 168.0 m returned 0.68 g/t AuEQ (0.65 g/t Au, 1.97 g/t Ag, 0.01 % Cu) with a high-grade segment of 4.5 m grading 4.44 g/t AuEQ (4.31 g/t Au, 10.78 g/t Ag). This hole confirms the continuity of mineralization to the south of Copper Belle and that the deposit remains open.

CB-22-02 was drilled as a 100 m northwestern step-out hole one the Copper Belle deposit. An interval of 39.0 m grading 0.65 g/t AuEQ (0.62 g/t Au, 0.72 g/t Ag, 0.02 % Cu). This hole confirms the continuity of mineralization to the south of Copper Belle and that the deposit remains open.

KONKIN ZONE

SECTION 94+50 NE

KZ-22-01 was drilled as an exploration hole to follow up on anomalous gold surface samples. The hole encountered 46.5 m of 0.53 g/t AuEQ (0.51 g/t Au, 1.36 g/t Ag, 0.01% Cu) as well as a significant gold interval over 9.0 m of 3.60 g/t AuEQ (3.54 g/t Au, 5.32 g/t Ag). The hole intercepted propylitic and phyllic alteration which could be associated with the Goldstorm porphyry system or may be related to a separate intrusive event.

Harry Property

In late October, Teuton received a report from JV partner Optimum Ventures stating that drilling has commenced on the Harry property—Drilling is Proceeding at The Harry Property, Golden Triangle, BC.

The Harry property is situated within a 200 kilometer long northwest trending corridor hosting numerous high-grade gold occurrences and discoveries. It is just 30 km southwest of the Eskay Creek Mine and located between Ascot Resources Ltd.’s Premier Mine and Newcrest Mining’s Brucejack Mine.

This late season drill campaign will test “several new zones discovered earlier this year during prospecting, mapping and, in some instances, Shaw shallow surface drilling. Priority is being given to the Swann, BR, Ursula, Ursula South, Saw Cut, and GS zones, where to date over 1000 surface talus fines, chip samples, grab samples, saw cut samples and Shaw drill core has been sent for assay.”

Dino Cremonese, P. Eng., President of Teuton: “I am pleased that Optimum Ventures’ methodical approach to exploration at the Harry property has led to a drill program testing multiple targets. Particularly intriguing is the suggestion that some of the zones may contain volcanogenic massive sulfide mineralization.”

Goldseek Resources (GSK.C) – (4KG.FRA)

- 37.68 million shares outstanding

- $753,521 market cap based on its recent $0.02 close

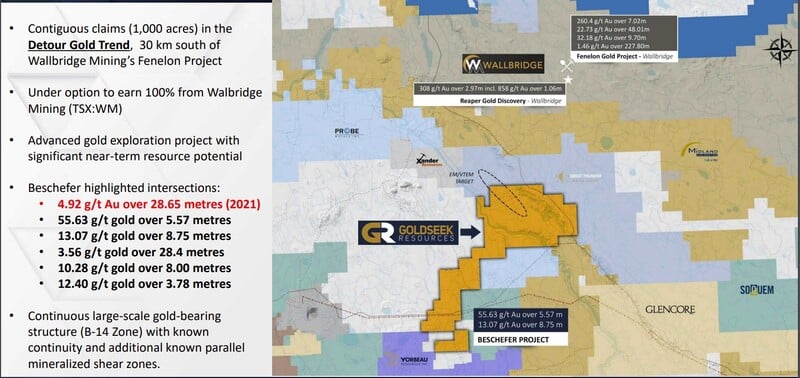

Goldseek has seen its valuation beaten down by the across-the-board selling pressure that has blindsided the junior sector in recent weeks/months. Despite an extensive project pipeline in some of Canada’s most prolific gold camps (Hemlo, Urban Barry, Quevillon, Val D’Or North, and Detour), its market cap has been reduced to sub-$1M status.

There may be an opportunity here as management is shrugging off the dismal market sentiment and pressing forward with its flagship Beschefer Project located along the northern Abitibi Greenstone Belt, some 30 kilometers southwest of Wallbridge’s Fenelon Gold Project.

I had a chance to catch up with the company’s CEO, Jonathon Deluce recently.

Nolan: Your flagship asset is Beschefer. After two rounds of drilling, you believe you’ve barely scratched the project’s surface. Of the multiple zones you’ve tested with the drill bit, where do you see the greatest potential?

CEO Deluce: We see the greatest potential in the Central Shallow and East Zone each for varying reasons:

1. Central Shallow

This zone has the most historical drilling so this will be the bulk of a maiden resource. This zone has delivered high-metal factor intercepts, including 4.92 g/t over 28.65 meters by Goldseek in 2021. In 2022 we demonstrated the step-out potential of the zone to the northeast intercepting 3.20 g/t over 9.05 meters providing support that this zone is open in all directions while targeting the next higher-grade shoot.

2. East Zone

The east zone has the least drilling historically but hosts the highest metal factor

intercept of 55.63 g/t Au over 5.57 meters. Since optioning the project, we have

expanded the strike length of this zone to over 300 meters, and in 2022 through a

western step-out hole which intercepted 3.1 g/t over 6.5 meters are getting closer to

our goal of connecting this zone with the Central Shallow.

These two objectives are our top priority and a potential major rerating opportunity for shareholders. Our first objective is to find the next high-grade shoot because that is required to get the market excited during these harsh market conditions and will contribute to increasing the grade of our current block model of the deposit. Both Zones have the potential to deliver high-grade results, so every step-out hole has the potential to be our next high-grade hit while continuing to demonstrate the continuity of the zones.

Nolan: Are you planning any big stepouts at Beschefer, and if so, where?

CEO Deluce: We are planning larger step-out holes focused on expanding both the Central Shallow and East Zones to the north-east where we have over 1.5 km’s of potential strike length.

Nolan: Do your 2023 plans include a maiden resource estimate?

CEO Deluce: We continue to update our internal resource model to ensure it is delivered when we will create value for shareholders. This is an ongoing assessment based on our current estimated resource numbers, market conditions, our market cap and other strategic items we are working on. As it stands now, with those factors considered, we are moving our maiden MRE target towards the second half of 2023.

Nolan: I see you just announced a modest private placement?

CEO Deluce: We have announced a financing entirely with our management team proposed at a premium to market to show our commitment to the Company and address any funding concerns for 2023. Additionally, we are currently planning a winter 2023 drill program to target the next high grade shoot.

I also believe that given the current very challenging market conditions where the majority of companies are trading at 52-week lows, a shift in market conditions will be a catalyst of its own for Goldseek. As of today, with a market cap of under $1M we are essentially trading at shell value giving no value for what we believe is a very strong near-resource asset at Beschefer. This is an issue across the industry where I am seeing companies with over a million ounces in resources trading for less than $10M market cap.

However, I believe the economic conditions are present for a strong rerating and safe haven shift into gold once the narrative shifts away from the Federal Reserve being able to get inflation under control. I believe when that happens Companies like Goldseek with an asset like Beschefer with a tight cap structure and large insider ownership will be early to benefit from interest coming back into the space.

Nolan: You and your team are taking down the entire PP?

CEO Deluce: We as a management team and family office are confident in the prospects of Beschefer and also in explosive market conditions over the medium term. To show our confidence, we will be subscribing for our entire next PP to ensure we keep our share structure tight so that our shareholders and we get the rerating deserved on further successes at Beschefer and/or market conditions improve. This will put my management team and family office as 60%+ owners of Goldseek while having one of the lowest G&A burns in the business, which is a very rare combination that I challenge you to find amongst our competitors.

The financing CEO Deluce referenced above via a November 4 press release: GOLDSEEK Announces Private Placement.

With a sub-$1M market cap and a winter drill program on deck at its highly prospective flagship project, the company’s current valuation may represent a low-risk entry point with significant upside potential.

Defense Metals (DEFN.V) – (DFMTF.OTC)

- 183.37 million shares outstanding

- $47.68M market cap based on its recent $0.26 close

Defense Metals continues to systematically de-risk its flagship Wicheeda Rare-Earth Project where current resources stand at 5,031,000 tonnes averaging 2.95% total rare-earth oxide (TREO) Indicated and 29,467,000 tonnes averaging 1.83% TREO Inferred.

I covered the fundamentals underpinning the company in a recent report titled Defense Metals (DEFN.V) continues its push along the REE development curve.

With a recently concluded 5,000-meter program designed to upgrade Inferred rock to the higher confidence M&I categories, Defense continues to confirm its flagship asset’s robust grade and scale.

An October 26 press release: Defense Metals Drills 113 metres of 2.50% Total Rare Earth Oxide at Wicheeda; Completes 2022 Resource Delineation and Pit Geotechnical Drilling of 5,500 metres.

The values highlighted in the text of the above headline belong to infill hole WI22-70, drilled in the northern area of the deposit. Here, the drill bit tagged a broad zone of mineralization averaging 2.50% total rare earth oxide (TREO) over 113 meters.

The Company is also pleased to report the completion of the Wicheeda REE Deposit resource delineation and pit geotechnical diamond drilling campaign for the 2022 exploration season. This year a total of 5,500 metres of diamond drilling was completed in 18 holes. The 2022 drilling included completion of five (5) pit slope geotechnical and hydrogeologic holes totalling 1,150 metres, which were designed in part to support a Preliminary Feasibility Study (PFS) expected to commence Q4 2022.

Kristopher Raffle, P.Geo. and Director and QP of Defense Metals stated: “The 2022 Wicheeda drilling continues to meet or exceed expectations, yielding broad zones of mineralized dolomite-carbonatite that in the case of WI22-70 announced today serves to support, and refine confidence in, our PEA mineralized volumes.”

Future (potential) catalysts for this advanced-stage REE development play:

- Continued assay flow from the recently concluded 5,000-meter drill campaign;

- Additional metallurgical test results;

- News regarding progress on the company’s Pilot Plant;

- Initiation of a PFS;

- An updated resource estimate;

- News regarding potential suitors or JV partners that need to bulk up their REE inventory.

Apollo Silver (APGO.V) – (APGOF.OTC) – (6ZF0.FRA)

- 174.46 million shares outstanding

- $20.06M market cap based on its recent $0.12 close

Apollo is another exploration/development play that has seen its valuation beaten down by the relentless selling pressure that has gripped the junior sector in recent weeks/months.

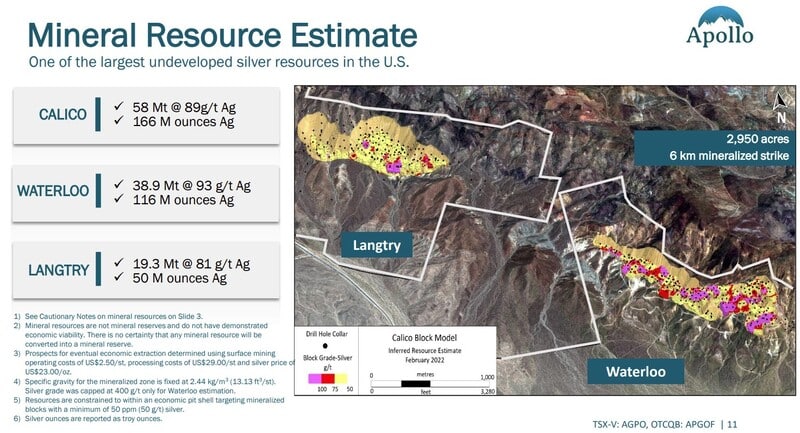

On October 17, the company provided an update for its flagship Calico Silver Project located in the mining-friendly county of San Bernardino, California. Calico’s Inferred ounce count currently stands at 166 million ounces of silver contained within 58.1 million tonnes at an average grade of 89 grams per tonne (there’s gold and barite in Calico’s subsurface stratum too).

The Oct. 17 headline: Apollo Provides Update on Phase 2 Drill Program at Calico Silver Project

Here, the company reported that drilling—one component of a multi-component 2022 Calico technical program—is well underway. Thirteen RC drill holes were completed at the time the above headline dropped. This campaign is designed to upgrade Calico’s Inferred ounces into the higher confidence M&I categories.

Additionally, Apollo has commenced initial groundwater assessment work, which is designed to assess groundwater quality, depth, and well pumping capacity. The program will utilize existing wells and will involve the addition of a new monitoring well on its Waterloo Property which was recently permitted by the County of San Bernardino.

Apollo’s CEO Tom Peregoodoff: “Phase 2 of the 2022 drill program is progressing on schedule and on budget. The commencement of the groundwater monitoring program is an important milestone as we advance the Calico Project. Understanding the nature and availability of groundwater in the Calico Project area will be a critical component of our strategy to secure water resources required to support future development. As has been our previous experience with obtaining permits for the drill program, we received the permit to drill a new water well in a very timely fashion from the County of San Bernardino.”

Phase-2 drilling is expected to wind down in late November 2022. After all drill hole data is in hand, the company will begin working on an updated resource estimate, expected in Q1 of 2023.

Groundwater Assessment

In the late 1970s, a previous operator of the Waterloo Property (ASARCO) completed both a groundwater monitoring well and a pumping well on unpatented mill site claims. Apollo has determined that these wells are accessible and has commenced test work. ASARCO also completed a monitoring well on the Waterloo Property near the historic Burcham mine, approximately 800 m to the south of the Waterloo resource area. Apollo has determined that this monitoring well is sealed off and inaccessible and plans to complete a new monitoring well in this same area to test groundwater near the Waterloo resource. At the Langtry Property, one groundwater monitoring well exists, and Apollo is working to determine is it is accessible and can be used for testing. The groundwater test work and drilling of the new monitoring well will be executed by Desert Empire Drilling of Barstow, California, and is scheduled for completion in October 2022.

With a 166M oz resource and a market cap of a mere $20.94M (based on its recent $0.12 close), the downside risk has to be considered limited. Current prices may represent a low-risk buying opp if you’re looking for silver exposure in a mining-friendly US jurisdiction.

Patriot Battery Metals (PMET.V) – (PMETF.OTC) – (R9GA.FRA)

- 91.55 million shares outstanding

- $464.18M market cap based on its recent $5.07 close

Patriot Battery Metals now appears to be in a holding pattern as it awaits entry into the Australian arena—the ASX —where lithium companies are held in the highest regard. The timing looks to be early December.

With the company coffers now stoked—Patriot Announces Closing of $20M Flow-Through Financing—shareholders can look forward to an aggressive multi-rig winter drill program at its flagship Corvette Project in the James Bay region of Quebec.

The last results on the exploration front dropped on October 12: Patriot Drills 104.5 m of 0.97% Li2O and 61.9 m of 1.42% Li2O, and Extends Strike Length of Mineralization to 2.2 km at the CV5 Pegmatite, Corvette Property, Quebec

On November 2, the company updated shareholders on its recently concluded summer/fall drill campaign and plans for an aggressive five-rig program due to commence in January. It also updated progress on the ASX listing front and announced the adoption of what’s proving to be a highly contentious ‘Omnibus Equity Incentive Plan’—Patriot Battery Metals Provides Exploration and Corporate Update.

Prime Mining (PRYM.V) – (PRMNF.OTC) – (04V3.FRA)

- 112.8 million shares outstanding

- $128.59M market cap based on its recent $1.14 close

After reporting bonanza grade hits including 27.9 g/t Au and 509 g/t Ag over 2.3 meters from its flagship Los Reyes Project in the mining-friendly state of Sinaloa, Mexico in late October, Prime began testing two-year lows on weak volume.

Los Reyes boasts a mineralized footprint of over 15 square kilometers covering the subsurface stratum of three known gold-silver deposit areas (Guadalupe, Z-T, and Central).

In tracking the trading activity of ‘smart money’ types, it appears that Pierre Lassonde has an appetite for the stock (hit the SEDI Insider Filings link, middle left on this page).

Previous Prime Mining Highballer coverage can be accessed here.

Current prices may represent a low risk entry point.

Skeena Resources (SKE.T) – (SKE.NYSE)

- 75.77 million shares outstanding

- $490.98M market cap based on its recent $6.48 close

For all of the reasons discussed here in the past, Skeena might be considered solid value for those looking for more of an advanced-stage project boasting compelling economics.

The following slide reflects the current ounce count at Skeena’s flagship Eskay Creek project.

The economics underpinning Eskay Creek, via a Feasibility study released on September 8, shows an after-tax NPV5% of C$1.4B, 50% IRR, and a 1-year payback using fairly aggressive price inputs (US$1,700/oz Au and US$19/oz Ag).

Price sensitivity to higher/lower metal price inputs…

The company continues to push Eskay Creek along the exploration curve. A November 1 headline: Skeena Extends Eskay Creek Rift with New Discovery Intersecting 4.46 g/t AuEq over 32.19 metres.

And this just in (added post publication): Skeena Intersects High-Grade In-Pit Mineralization in 21A West Zone Averaging 22.38 g/t AuEq over 24.00 metres.

Fat hit.

Banyan Gold (BYN.V) – (BYAGF.OTC)

- 258.4 million shares outstanding

- $100.78M market cap based on its recent $0.39 close

Banyan continues to generate shareholder value via the business end of the drill bit.

Banyon’s flagship AurMac Gold Project currently boasts a global resource of some 4 million ounces @ 0.6 g/t Au.

AurMac appears destined for Tier-1 status (a five million-plus ounce count). Case in point: This just in…

Banyan Intersects 1.13 g/t Gold over 84.4 Metres at Aurex Hill Deposit, Aurmac Property, Yukon

2022 Exploration Program Update

Banyan started its 2022 exploration program on January 26th and the last drill hole was completed on November 5th, with a total of two-hundred-eleven (211) drill holes culminating in over 50,000 metres (“m”) of drilling designed to expand the mineralization around the Powerline and Aurex Hill Deposits. Core logging, processing and on-site sample preparatory lab activities will continue through November.

Arizona Metals (AMC.T) – (AZMCF.OTC)

- 112.17 million shares outstanding

- $491.31M market cap based on its recent $4.38 close

The Company’s flagship Kay Project in Yavapai County, characterized as one of the (very) few large precious-metals-rich VMS deposits not yet mined, is positioned along the southern end of a mineralized trend boasting sixty 60 past-producing Cu-Au-Zn VMS mines and nearly 4 billion pounds of historical copper production. The average grade mined = 3% Cu (plus significant gold, zinc, and silver credits).

A historic estimate by Exxon Minerals in 1982 reported a “proven and probable reserve of 6.4 million short tons at a grade of 2.2% copper, 2.8 g/t gold, 3.03% zinc, and 55 g/t silver.”***

A recent exploration-related press release dated October 31: Arizona Metals Corp Announces Receipt of Western Target Drill Permits; Fully Permitted and Funded for Upcoming 76,000 m Phase 3 Drill Program.

This is an exciting development. These new pads located roughly 1.2 kilometers west of the Kay Mine Deposit—W1 and W2—will allow the company to probe the subsurface stratum of the Western Target, as well as additional coincident anomalies located between the Central and Western target areas.

The Central and Western targets were delineated via extensive ground mapping, electromagnetic and gravity surveys).

With an aggressive program expected to commence in Q1 of 2023, there will be a lot of eyes on this new phase of drilling.

Marc Pais, CEO: “We are very pleased to announce the receipt of a permit for two new drill pads, W1 and W2, located approximately 1,200 metres west of the Kay Mine Deposit. These pads will allow drill testing of the Western Target, as well as anomalies located between the Central and Western Targets. This drilling is part of the larger Phase 3 program, which will total at least 76,000 m and cover the western extent of the Kay Mine Project. Drilling will continue at the Kay Mine Deposit, with concurrent goals of further discovery and resource definition. The Company is fully-funded to continue drilling at the Kay Mine Deposit, while also undertaking the first detailed exploration of the Central and Western Targets in the known history of the property.”

Lion One Metals (LIO.V) – (LOMLF.OTC) – (LLO.ASX)

- 173.77 million shares outstanding

- $130.33M market cap based on it recent $0.75 close

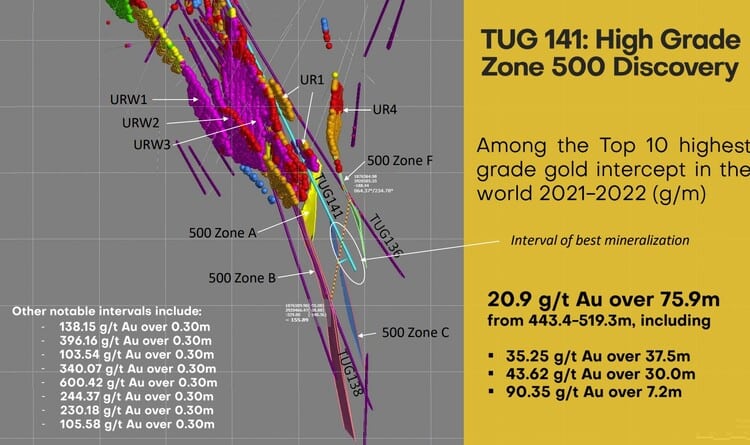

Lion One’s flagship asset is its wholly-owned Tuvatu Alkaline Gold Project, located on the island of Viti Levu in Fiji. The project covers the entire Navilawa Caldera, an underexplored yet highly prospective 7-kilometer-in-diameter alkaline gold system.

Despite a September 20 lowball raise that saw the stock careen down to its current levels, the company’s high-grade ounce count, along with a compelling series of recent high-grade hits, makes this one worth a closer look.

Lion One envisions a low-cost, high-grade underground mining scenario at Tuvatu.

These alkaline gold systems are known for their exceptional high grades and scale…

A recent exploration-related press release dated October 4: Lion One Drills Exceptional High-Grade Intersections as Part of Metallurgical Drill Program

Sokoman Minerals (SIC.V) – (SICNF.OTC)

- 214.28 million shares outstanding

- $45M market cap based on its recent $0.21 close

Back in September, Sokoman reported results from an ongoing 100,000-meter Phase 6 drilling campaign at their flagship Moosehead Project in north-central Newfoundland. Said results included an impressive 39.6-meter (core length) intercept grading 12.50 g/t Au (including a higher-grade interval of 10.25 meters @ 41.97 g/t Au) from the Lower Eastern Trend.

The most recent exploration-related press release, involving its Kraken Lithium Prospect JV with Benton Resources, dropped on October 18: Benton and Sokoman – Kraken Lithium Prospect Phase 2 Drill Results Exploration Update.

The highlight interval from this Phase-2 program was in hole GH-22-15: 0.60% Li2O over 20.82 meters (46.00 m – 66.82 m), incl. 1.16% Li2O over 5.50 meters.

A few new names that strike me as good value

There’s a whole universe of companies in the junior exploration arena trading at depressed levels, in some cases multi-year lows. Some stand out more than others.

Briefly…

I-80 Gold (IAU.TO) – (IAUX.NYSE)

- 240.37 million shares outstanding

- $586.5M market cap based on its recent $2.44 close

I have yet to talk about this Ewan Downie-run vehicle in these pages, but the company ranks high on my list as one of the sector’s better-run resource expansion, development, and exploration plays. Management is targeting production of 400k ounces of gold via a 5-year plan.

In recent press releases, you’ll note a number of headlines highlighting high-grade drill hole results flowing from its Nevada-based portfolio where multiple high-grade zones and new discoveries are a common theme.

This one is worth your due diligence if you’re looking to build a portfolio of advanced-stage, high-quality stocks in the junior arena.

A recent exploration-related press release dated November 1: i-80 Gold Intersects High-Grade Gold in Granite Creek Underground Drill Program

Ridgeline Minerals (RDG.V) – (RDGMF.OTC)

- 68.47 million shares outstanding

- $14.72M market cap based on its recent $0.215 close

Ridgeline is an expertly helmed gold-silver exploreco boasting a 163 km² exploration portfolio across five projects in Nevada and Idaho.

A recent exploration-related press release dated October 18: Ridgeline Minerals Commences Drill Program at the Selena Project, Nevada.

Radisson Mining Resources (RDS.V) – (RMRDF.OTC)

- 275.96 million shares outstanding

- $35.87M market cap based on its recent $0.13 close

Having recently completed a 127k meter drill program at its flagship O’Brien project in the Bousquet-Cadillac mining camp—a program designed to expand the geological footprint of the deposit along a 1.2 km corridor—Radisson is delivering a steady stream of high-grade results.

With its location along the Abitibi Greenstone Belt (Quebec) and its proximity to high-profile neighbors such as Agnico-Eagle (LaRonde, LZ5, and Lapa), IAMGOLD (Westwood), Wesdome (Kiena) and Eldorado (Lamaque), Radisson’s high-grade ounce count may represent one of the more obvious takeover targets in the junior arena.

A recent exploration-related press release dated October 20: Radisson reports several high-grade intercepts above 15 g/t Au from expansion drilling along Trend #1 at the O’Brien gold project.

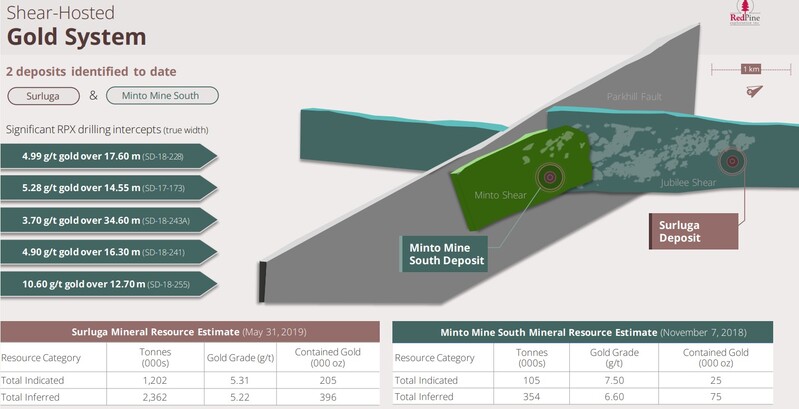

Ridge Pine Exploration (RPX.V) – (RDEXF.OTC)

- 136.86 million shares outstanding

- $26M market cap based on its recent $0.19 close

Red Pine’s Wawa Gold Project is located along the Michipicoten greenstone belt of Ontario, a region that has seen significant investment by several producers in the last five years.

In the company’s crosshairs: a corridor hosting multiple centers of mineralization and deposits extending over six kilometers in strike length.

A recent exploration-related press release dated September 6: Red Pine Intersects High Grade Gold Mineralization in the Extensions of the Surluga Deposit; Intersects 42.95 g/t gold over 1.92 metres in the Jubilee Shear Zone south of the Parkhill Fault

Timberline Resources (TBR.V) – (TLRS.OTC)

- 159.68 million shares outstanding

- $25.55M market cap based on its recent $0.16 close

Timberline is focused on high-grade Carlin-Type gold discoveries at its district-scale (62 square kilometer) Eureka Project in Nevada, a property host to the historic Lookout Mountain and Windfall mines.

A recent exploration-related press release dated September 14: Timberline Intersects 22.8m at 4.29 g/t Gold in Southern Extension of Water Well Zone at Eureka Project

Thesis Gold (TAU.V) – (THSGF.OTC)

- 64.89 million shares outstanding

- $55.15M market cap based on its recent $0.85 close

Thesis is focused on developing the resource potential of its Ranch Gold Project in the “Golden Horseshoe” area of northern British Columbia (roughly 300 kilometers north of Smithers, BC).

This recently in: Thesis Gold Drills 91.00 m of 1.92 g/t AuEq, Including 35.00 m of 3.06 g/t AuEq at Bonanza.

Nice headline hit.

Snowline Gold (SGD.C) – (SNWGF.OTC)

- 131.88 million shares outstanding

- $346.83M market cap based on its recent $2.63 close

This one isn’t exactly cheap for what it’s able to show thus far, but the geological model and recent drill results flowing from its flagship Rogue and Einarson projects in the Selwyn Basin of the Yukon Territory could ultimately prove the current $2.63 a decent entry price.

A recent exploration-related press release dated October 12: Snowline Gold Intersects 318.8 Metres Of 2.5 Grams Per Tonne Gold Including 108.0 Metres Of 4.1 Grams Per Tonne Gold from Surface at Its Valley Zone, Rogue Project, Yukon.

END

—Greg Nolan

Full disclosure: Greg Nolan was compensated for the content concerning Teuton, Goldseek, Apollo, and Defense. Greg Nolan owns shares of Teuton, Defense, and Patriot.

*** The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a “qualified person” (as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects) before the historic estimate can be verified and upgraded to be a current mineral resource. A qualified person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.