As we wade into the uncharted waters of this new year, it’s beginning to look like the $1825 level in Gold, once taut resistance, is now in the rearview mirror. The metal is currently doing battle with the $1875 price level. An assault on higher ground at $1900 might be in the cards short term. As usual, short-term price action will be data-dependent.

I assume there’s a whole universe of traders watching this arena as some believe an epic rally is long overdue. Said traders will likely be watching for the aptly named Golden Cross—where the 50 SMA overtakes the 200—that may be unfolding. We’re nearly there.

Where the Producers are concerned, many are printing what looks like bull flags on their daily charts. But the breakout we’ve witnessed in recent sessions is clear and appears to be across-the-board.

The fundamental reasons for owning Gold have been emphasized repeatedly in these pages. Ad nauseam. One interesting development I came across while working on a different front concerns the voracious appetite demonstrated by central banks in recent months. Specifically, CBs are scooping up Gold at the fastest pace since 1967. A Dec. 29 Financial Post piece states that the last time we witnessed a buying binge of this intensity marked a historical turning point for the global monetary system—Central banks buy gold at fastest pace in 55 years.

These truly are uncharted H2Os. The fundamentals underpinning precious metals (and their underlying equities) have rarely been this compelling, IMO.

Homing in on a few recent headlines

Forum Energy Metals (FMC.V) – (FDCFF.OTC)

- 188.93 million shares outstanding

- $20.78M market cap based on its recent $0.11 close

After closing a private placement back in late December, Forum is sufficiently cashed up to continue probing the subsurface stratum of its Wollaston Uranium Project in the northeastern Athabasca Basin, and its district-scale Nunavut Uranium Project (Thelon Basin) later this summer.

Concerning Wollaston, the company just dropped the following headline earlier this AM…

Drilling Resumes at Forum’s Wollaston Uranium Project

Wollaston, located 10 kilometers south of Cameco’s Rabbit Lake Uranium Mill and 30 kilometers south of Orano/Denison’s McClean Lake Uranium Mill, saw three holes totaling 855.5 meters drilled before the holiday break. Ninety-five samples were collected and shipped off to the lab for assay. The Company has budgeted an additional 3000 meters for this winter drill campaign.

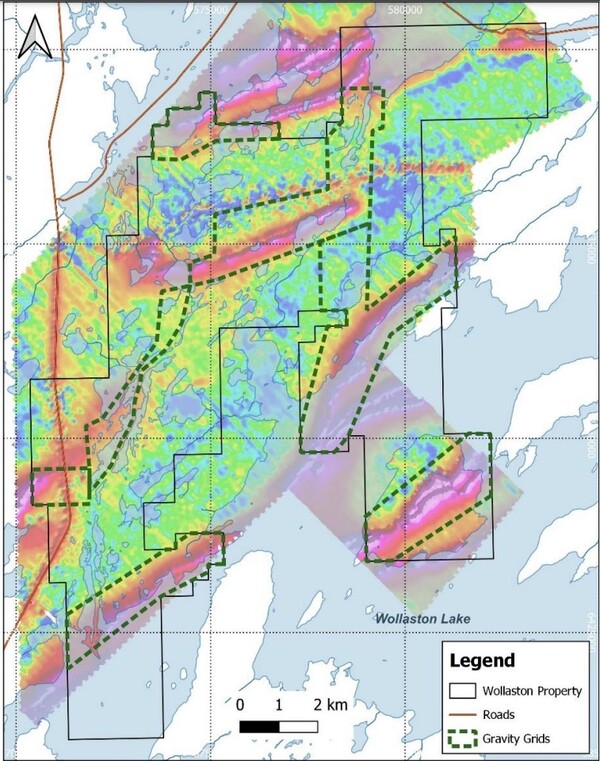

Gravity ground crews are on-site to conduct surveys over priority targets identified by an airborne time domain electromagnetic survey completed last year (image below). Approximately 3700 gravity stations will be collected over the main conductive trends at 100 x 100-meter station spacings.

For a deeper delve into the Wollaston and Thelon Basin projects, and into the thought processes of the geological sleuths running the show at ground level, you might find my Nov. 22 piece insightful—Forum Energy Metals (FMC.V) mobilizes drill rig to Athabasca Basin – a Q&A with Forum’s Wheatley and Hunter + a word on i-80 Gold (IAU.TO).

Note: Forum will be sharing booth #732 at the upcoming Vancouver Resource Investment Conference with Big Ridge Gold.

Apollo Silver (APGO.V) – (APGOF.OTC) – (6ZF0.FRA)

- 174.46 million shares outstanding

- $34.02M market cap based on its recent $0.195 close

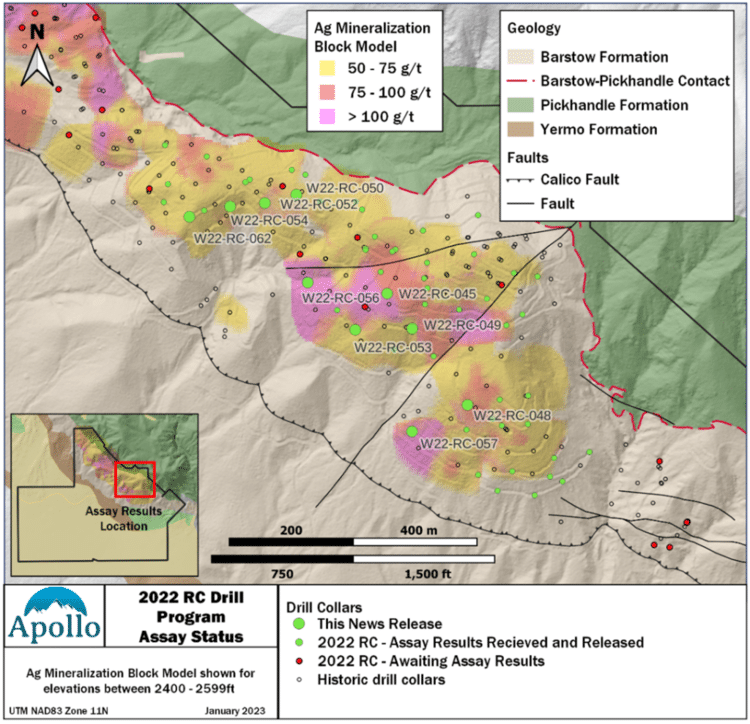

Apollo released another batch of assays from a recently completed Phase 2 drill program at its flagship Calico Silver Project in San Bernardino County, California—Apollo Reports Further Assay Results From Phase 2 Drilling.

These latest results from this infill campaign continue to expand silver mineralization below the base of a mineral resource that currently stands at 166 million ounces of silver contained within 58.1 million tonnes at an average grade of 89 grams per tonne.

The ten holes reported in this Jan. 9 press release bring the total number of holes released from this Phase 2 campaign to 16 of the 44 completed.

Highlighted values from this latest round include:

SILVER

- 109 g/t Ag over 109.0 meters from surface (W22-RC-045), including;

- 267 g/t Ag over 1.5 meters from 25.0 meters depth down hole;

- 456 g/t Ag over 1.5 meters from 29.5 meters depth down hole; and

- 307 g/t Ag over 1.5 meters from 55.0 metrers depth down hole;

- 106 g/t Ag over 45.0 meters from 11.5 meters depth down hole (W22-RC-048);

- 169 g/t Ag over 64.5 meters from 1.0 meter depth down hole (W22-RC-056), including

- 260 g/t Ag over 6.0 meters from 13.0 meters depth down hole; and

- 261 g/t Ag over 15.0 meters from 26.5 meters depth down hole;

- 101 g/t Ag over 67.0 meters from surface (W22-RC-062), including;

- 268 g/t Ag over 4.0 meters from surface.

GOLD

- 0.262 g/t Au over 19.5 meters from 134.5 meters depth down hole (W22-RC-045), including;

- 0.921 g/t Au over 3.0 meters from 140.5 meters depth down hole; and

- 1.220 g/t Au over 1.5 meters from 140.5 meters depth down hole;

- 0.921 g/t Au over 3.0 meters from 140.5 meters depth down hole; and

- 0.160 g/t Au over 21.0 meters from 134.5 meters depth down hole (W22-RC-049);

- 0.327 g/t Au over 18.0 meters from 86.5 meters depth down hole (W22-RC-050), including;

- 0.806 g/t Au over 1.5 meters from 95.5 meters depth down hole; and

- 0.774 g/t Au over 1.5 meters from 101.5 meters depth down hole.

(Silver intercepts are reported at a 50 g/t silver cut-off grade (“COG”) with up to 4.5 m dilution and are uncapped. Gold intercepts are reported at a 0.1 g/t COG with up to 4.5 m dilution and are uncapped. Lengths are down hole lengths and may not represent true widths unless otherwise stated)

Cathy Fitzgerald, Apollo’s VP Exploration & Resource Development : “I am very pleased with the technical progress the team made in 2022. The shallow, broad zones of silver mineralization above the 50 g/t cut-off grade are ubiquitous in the Waterloo deposit. Similarly, these results continue to confirm the extensive nature of the oxide gold horizon stratigraphically below the silver mineralization. This oxide gold horizon is not included in the current MRE and we will look to include this gold mineralization in the revised mineral resource estimate. Importantly, we remain on track to deliver the upcoming revised mineral resource estimate as planned in Q1 of this year.”

With the recent buoyancy in the silver arena, this upcoming MRE could represent a significant catalyst for the stock as the Company continues to aggressively de-risk Calico.

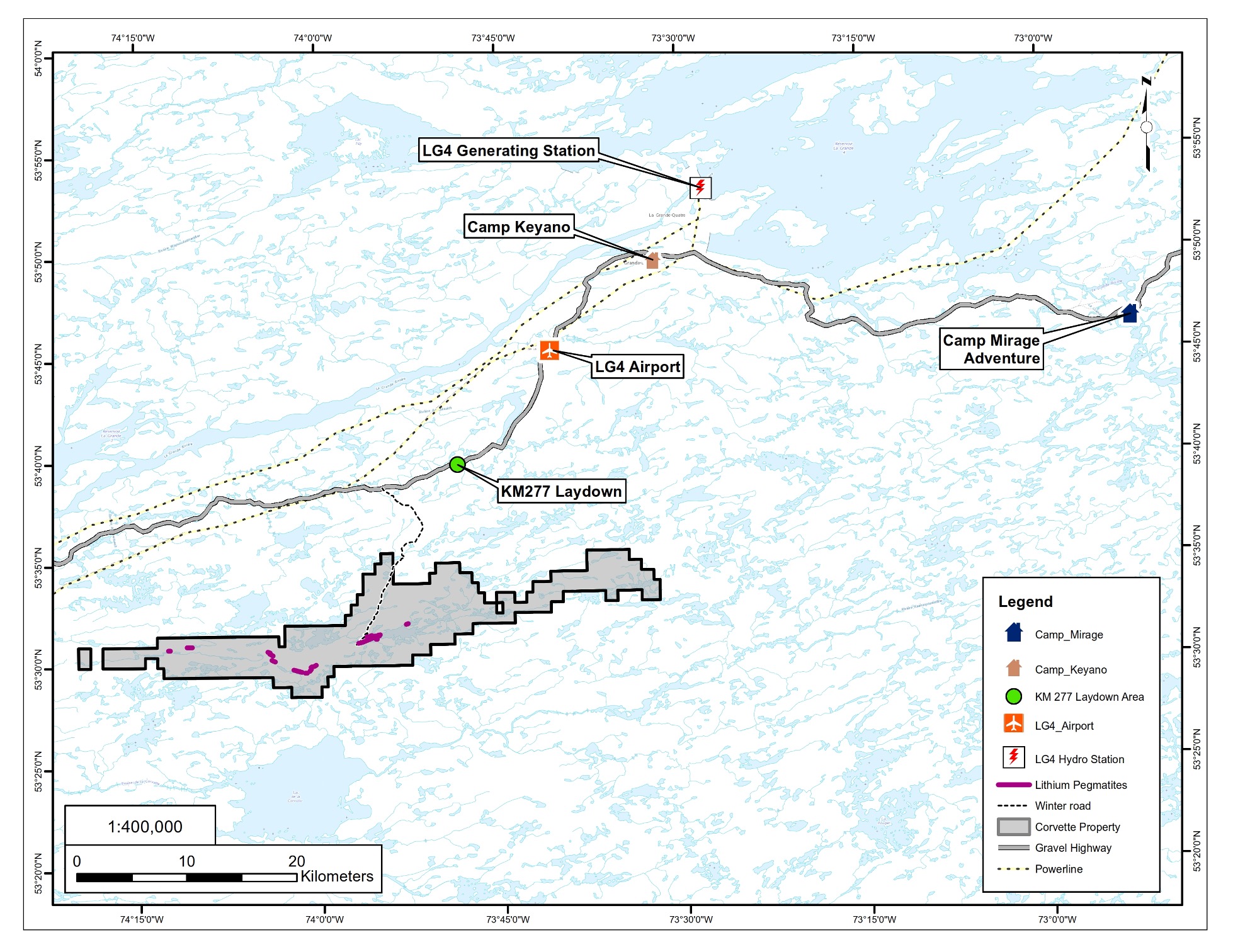

Patriot Battery Metals (PMET.V) – (PMT.ASX) – (PMETF.OTC) – (R9GA.FRA)

- 92.79 million shares outstanding

- $720.98M market cap based on its recent triple seven ($7.77) close

PMET has been subjecting shareholders to one helluva rollercoaster ride in recent sessions—a ride that has tested the loyalty of many a shareholder.

There’s been a lot of talk concerning a fat stack of cheap PP shares that have recently come free trading—a dynamic some expected to generate significant weakness as early investors locked in their gains. There’s been a lot of talk concerning those having shorted the stock in recent weeks who are now under intense pressure to cover their highly leveraged positions. There’s been a lot of talk concerning valuation. There’s been a lot of talk… But in the end, the underlying geology will have the final say as the Company aggressively pushes its flagship Corvette Property along the exploration / development curve.

I’m not fretting over the recent volatility. Not. One. Bit. I see an end game here with Rio Tinto, SQM, and Albermarle as the most likely suitors.

On the newsflow front, the Company dropped the following headline a few days back…

Patriot Commences Quebec’s Largest 2023 Lithium Focused Drill Campaign at the Corvette Property

Mobilization for an aggressive winter drill campaign is now underway.

Details as per this Jan. 6 press release:

- Mobilization for the 2023 drill campaign has commenced targeting a minimum of 20,000 m over the January to April period (the ‘winter program’);

- At least five (5) drill rigs will be utilized to complete the winter program – largest single lithium drill program undertaken in recent times in Quebec;

- Objective is to extend the 2,200 m strike length of the CV5 Pegmatite system to the east and west and to continue delineation of the recent CV13 discovery, situated ~4.3 km along geological trend to the west-southwest;

- Construction of winter road almost complete – will improve efficiency and reduce helicopter costs;

- Core assay results for thirty-eight (38) drill holes from the 2022 drill campaign remain to be reported – twenty-four (24) at the CV5 Pegmatite cluster and fourteen (14) at the CV13 Pegmatite cluster.

Further details: The primary objectives of the drill program are to further delineate the extent of the CV5 Pegmatite, as well as infill drilling to improve the geological model to achieve indicated mineral resource confidence to support a future prefeasibility study. The winter drilling will primarily target the eastern extensions of the CV5 spodumene pegmatite and secondary lenses, moving towards the CV4 Pegmatite cluster situated approximately 2.5 km along strike. An understanding of the near-surface lateral behavior of the CV5 Pegmatite is needed to refine locations of certain infrastructures required for Prefeasibility level advancement, as well as help define associated field programs planned for 2023.

Yesterday, Jan.9, the Company announced two new hires—two industry professionals with a very particular set of skills (Liam Neeson voice)…

Patriot Appoints Vice President ESG and Senior Advisor Environment and Permitting to its Team

As the Company ramps up its push along the permitting curve, Alix Drapack comes on as VP of ‘Environment, Social and Governance’ – Andrée Drolet comes on as a senior advisor for ‘Environment and Permitting.’

The final word on PMET goes to @Teevee, a mining-savvy rock kicker over at CEO.CA, who I have come to know and trust. He had this to say about the company’s recent developments (the following unedited summary is Teevee’s opinion (due your own due diligence)):

2023 Looks to be another banner year for PMET

“PMET recently announced mobilization of the 2023 winter program and that 3 drill rigs will initially focus on the east end of CV-1. This portents more exciting results yet to be reported for drill holes located there.

A maiden resource statement has been scheduled for H1, and likely that at least some of the 2023 winter drill results will be incorporated. I believe this will take Corvette well above 100 million tonnes at about 1.12% Li, officially joining a handful of the largest lithium pegmatite deposits world wide.

Two additional drill rigs will soon follow and focus on the CV-13 cluster of spodumene rich pegmatites. As this area is entirely land based, it is likely that CV-13 will be where a starter pit is located when Corvette is developed.

On the development front, important additions to the team were announced whose jobs are to advance environmental and development permitting, and First Nations relations. Assuming lithium prices remain strong, at some point, a modest off take agreement should satisfy development debt financing without need for significant further dilution.

The North American EV market requires a vertical supply chain located in North America, for both economic and strategic reasons. Both the Canadian Federal and Quebec gov’ts are solidly behind rapid buildout of the vertical battery supply chain from mining to battery manufacturers to EV car plants. Quebec also has the lowest cost electricity anywhere, so mining, milling and down stream processors and manufacturers are rapidly establishing a presence in Quebec.

There can be no doubt the worlds largest lithium producers have an eye on developments in the James Bay region, an emerging spodumene lithium district rivalling Australia. PMET’s maiden resource statement will signal to the world that Corvette is indeed a tier 1 giant spodumene deposit, and I will not be surprised if at some point in time in H2, PMET is put into play.”

Many thanks Teevee.

i-80 Gold (IAU.TO) – (IAUX.NYSE)

- 240.4 million shares outstanding

- $891.89M market cap based on its recent $3.71 close

i-80’s share price trajectory has been very satisfactory since I trotted the name out two months back in a piece titled A Nov. 8 Highballer report updating the companies on our list PLUS a few new names that may represent good value at this juncture.

An excerpt from that November 8 Highballer report:

I have yet to talk about this Ewan Downie-run vehicle in these pages, but the company ranks high on my list as one of the sector’s better-run resource expansion, development, and exploration plays. Management is targeting production of 400k ounces of gold via a 5-year plan.

This one is worth your due diligence if you’re looking to build a portfolio of advanced-stage, high-quality stocks in the junior arena.

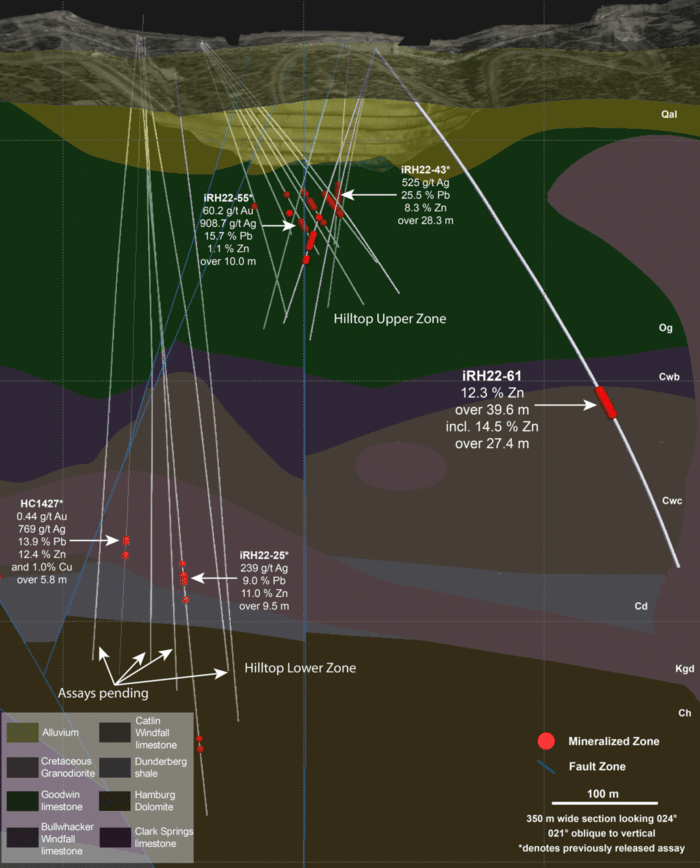

In the first hole drilled to test the “Hilltop Corridor” at its wholly owned Ruby Hill Property in Eureka County, Nevada, i-80 tagged a fat interval of high-grade zinc mineralization—i-80 Gold Discovers Additional High-Grade Mineralization at Ruby Hill.

In drill testing multiple target areas for CRD (Carbonate Replacement Deposit) mineralization, the Company encountered three new discoveries in the first dozen holes drilled. This first hole testing the Hilltop Corridor (iRH22-61) intersected high-grade mineralization grading 12.3% Zinc over 39.6 meters.

CEO Ewan Downie: “Our ongoing drill program continues to confirm the substantial upside potential of the Ruby Hill Property with our new discoveries ranking amongst the highest-grade new discoveries being made anywhere in the world. This property provides i-80 with significant optionality as it is host to oxide gold, sulphide gold, poly-metallic CRD and skarn base metal mineralization. All deposits are located in close proximity to the underground infrastructure being planned in 2023.”

If you believe we’re in the early innings of a sustainable run in precious and base metals, i-80 might serve you well as a ‘be right, sit tight’ (core) position. In the larger scheme of things, Downie and his crew are targeting production of 400k ozs of Au via a 5-year plan.

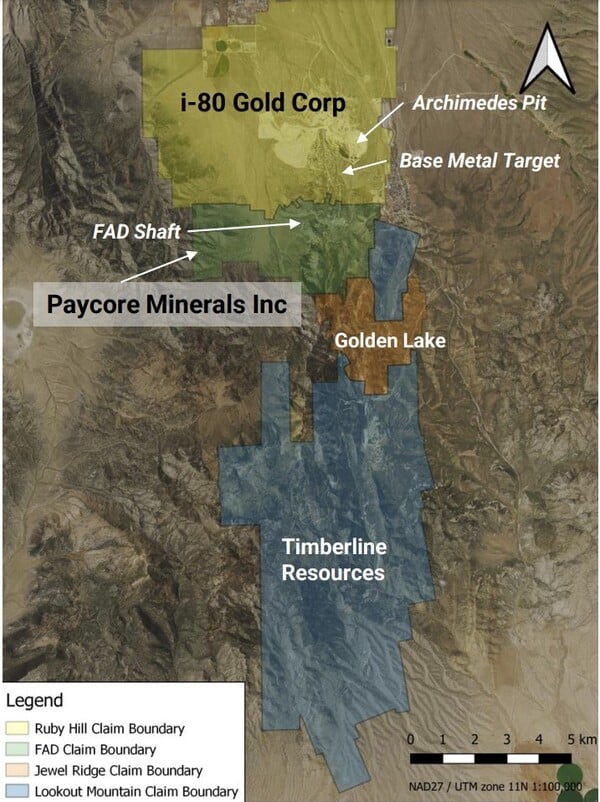

Paycore Minerals (CORE.V)

- 27.99 million shares outstanding

- $53.18M market cap based on its recent $1.90 close

I presented PayCore as a candidate for your due diligence one month ago in my piece titled A Highballer Roundup for December 6 featuring a host of names – familiar and new. The stock was trading in the $1.50 range at the time.

This might be one of the more obvious takeover targets in the junior arena. Its flagship project—the FAD Property located on the Battle Mountain-Eureka Gold Belt in Nevada—lies along the same structural corridor as i-80. In fact, both companies are helmed by common management.

The company dropped its latest round of assays on Dec. 6 via the following headline (hate the Caps Lock headlines)…

Drilled as a 200-meter step-out and down-dip from the historic resource (3,540,000 tonnes grading 8.0 % zinc, 3.80% lead, 196.46 g/t silver, and 5.14 g/t gold), the drill hole detailed in this Dec. 6 press release—Hole-10— demonstrates a lateral extension of these historic resource digits.***

FAD Main Zone—Hole PC22-10 values include:

- 27.4 meters of 10% zinc, 1% lead, 79 g/t silver and 8.0 g/t gold from 707.8 – 735.2 meter depth;

- Including 13 meters of 16% zinc, 1% lead, 110 g/t silver and 11.1 g/t gold, from 713.2 to 726.2 meter depth;

- AND 7.4 meters of 4.6% zinc, 6.1% lead, 318 g/t silver and 1.8 g/t gold, from 745.6 to 753 meter depth in hole PC22-10.

Timberline Resources and Golden Lake are also positioned along the same geological setting.

In what may spiral into a sweeping consolidation campaign to snag high-quality ounces (and pounds), all three companies—Paycore, Timberline, and Golden Lake—could fall prey to i-80 Gold. But an aggressive resource-hungry Producer looking to bulk up its project pipeline might also take a run at 1-80. It’s possible that all four have targets on their back.

Red Pine Exploration (RPX.V) – (RDEXF.OTC)

- 136.86 million shares outstanding

- $52.01M market cap based on its recent $0.38 close

Red Pine was another company introduced in these pages in my November 8 article. Just the other day they announced a fat hit outside the main resource block at their flagship Wawa Gold Project project in the mining-friendly (and mining-active) Abitibi region of Ontario.

The resource at Wawa currently stands at:

- 1,307,000 tonnes @ 5.47 g/t gold for 230,000 ounces in the Indicated category;

- 2,716,000 tonnes @ 5.39 g/t gold for 471,000 ounces in the Inferred category contained between surface to 350m depth.

The (market moving) Jan. 6 press release…

Red Pine is focused on a corridor hosting multiple centers of mineralization and deposits extending over six kilometers in strike. As noted above, this fat hit—5.13 g/t gold over 37.47 meters (including 25.20 g/t gold over 3.41 meters)—was tagged outside their main resource block and represents a new discovery.

Give this one look if you haven’t already.

END

—Greg Nolan

Full disclosure: of the companies featured above, Forum Energy Metals is a client company. The author owns shares of Forum and Patriot Battery Metals.

*** The historical drilling and estimates contained in this release have not been verified as current mineral resources defined by a national insturment 43-101. A “qualified person” (as defined in NI 43-101) has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves, and the Company is not treating the historical estimate as current mineral resources or mineral reserves.