Not to downplay Gold’s recent trading action—a Golden Cross and subsequent trajectory that saw $1900 fall—but the headline event in the junior exploration arena is Patriot Battery Metals’ spectacular run. Included in the frenzy are a host of strategically positioned explorecos in proximity to the Patriot’s flagship Corvette Project in the James Bay region of Quebec.

After consolidating in the $7.00 to $8.00 range for the better part of two weeks, Patriot management halted trading on Jan. 18 in advance of a headline that generated a tsunami of buy orders across a universe of trading platforms targeting the James Bay Lithium District.

The market moving headline…

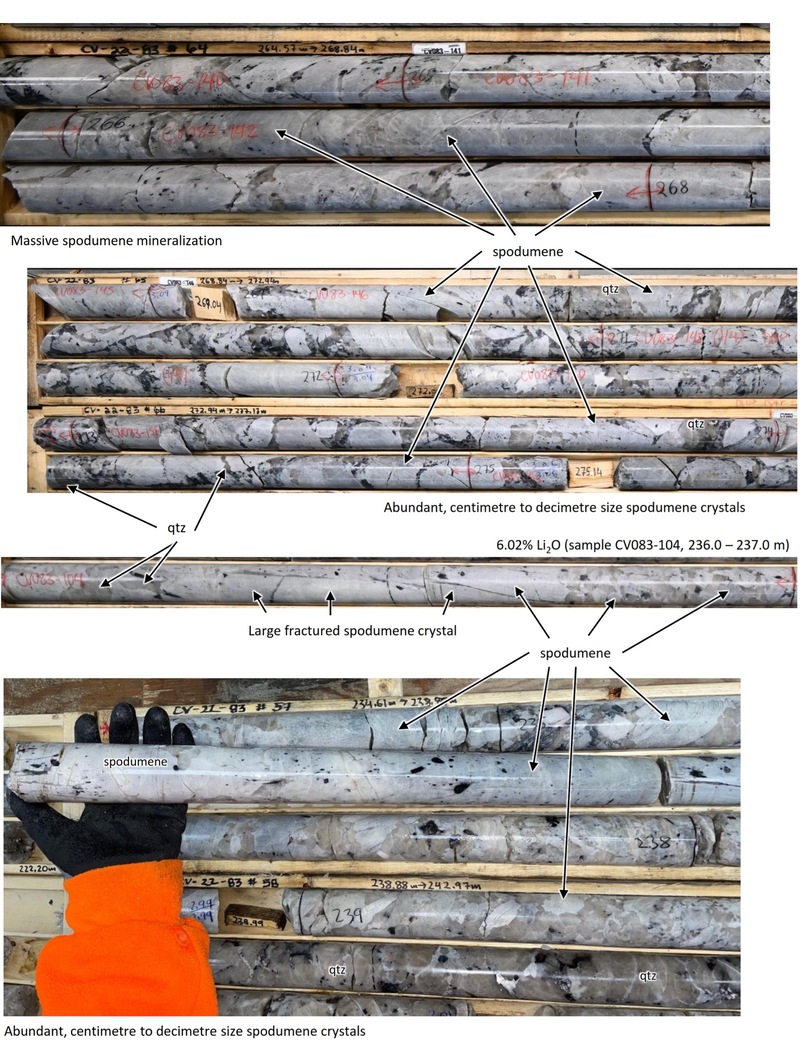

The lithium values Patriot dropped in the text of this headline—156.9 meters at 2.12% Li2O (inc 25.0 meters at 5.04% Li2O or 5.0 meters at 6.36% Li2O) in drill hole CV22-083—stand out among the best I’ve seen since I began tracking this sector. Outstanding.

And shareholders were handsomely rewarded for their ‘Patriotism’ when the halt was lifted and trading resumed Down Under, and then on the Venture exchange a short time after…

There was a valiant attempt to shake loose weak hands when the calender flipped over to the new year—a tip of my hat to those who ignored the noise and maintained their conviction to this rapidly evolving story.

Significant Drill Intercepts (verbatim as per this Jan. 19 release):

- The widest, highest grade lithium drill intercept returned to date at the CV5 Pegmatite – drill hole CV22-083;

- 156.9 meters at 2.12% Li2O (176.4 m to 333.4 m), including 25.0 meters at 5.04% Li2O or 5.0 meters at 6.36% Li2O (CV22-083);

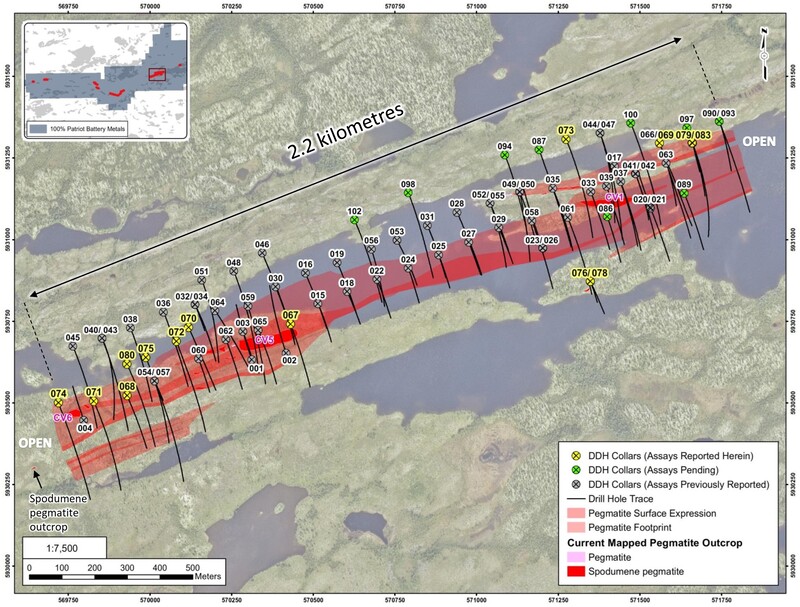

- Drill hole CV22-083 continues to extend mineralization eastwardly at the CV5 Pegmatite, and is interpreted to have intersected part of a large, high-grade ‘zone’ within the overall pegmatite that now has been defined by several drill holes, including CV22-017, 042, 066, and 083 over a strike length of at least 250 meters;

- Extension of the high-grade zone eastwardly to be tested with the first series of drill holes as part of the 2023 winter drill program;

- Additional significant drill intercepts in the most recent results follow;

- 45.3 meters at 1.72% Li2O (205.8 m to 251.0 m), including 31.0 meters at 2.11% Li2O (CV22-069);

- 31.2 meters at 1.95% Li2O (163.0 m to 194.2 m), including 9.0 meters at 2.78% Li2O (CV22-070);

- 49.5 meters at 1.33% Li2O (80.6 m to 130.1 m) (CV22-080);

- 41.3 meters at 1.01% Li2O (96.5 m to 137.7 m), including 12.0 meters at 1.59% Li2O (CV22-075);

- The spodumene mineralization at the CV5 Pegmatite has been traced over a strike length of at least 2,200 meters through the 2021 & 2022 drill programs. The mineralization remains open along strike at both ends and to depth along most of the pegmatite’s length;

- Core assay results for twenty-four (24) drill holes from the 2022 drill campaign remain to be reported – ten (10) at the CV5 Pegmatite cluster and fourteen (14) at the CV13 Pegmatite cluster;

Darren Smith, VP of Exploration: “It is hard to find words to adequately describe the impressive nature of the lithium mineralization in drill hole CV22-083. Visual estimates of spodumene abundance may give you a sense, but assays are the true measure and have certainly astounded with this hole. As we move east, we are defining a significant high-grade zone at a coarse drill spacing of 50 to 100 m. The recently commenced winter drill program will continue to probe and delineate this area ahead of an initial mineral resource estimate planned for the first half of 2023. Drill hole CV22-083 has raised the bar ever higher with respect to the considerable potential at CV5 as we continue to delineate it, and by extension, the rest of the CV lithium district held by the Company that has yet to be drill tested.”

I don’t usually heed the (management) comments attached to these press releases. But Smith’s words speak volumes. There’s genuine excitement here.

Connecting the dots

Clearly, hole 83 (CV22-083) is a banner-effing drill hole. Hole 93 (CV22-093), a 100-meter stepout along strike to the east, tagged spodumene pegmatite over a core length of 52.2 meters. Assays for this important stepout are pending.

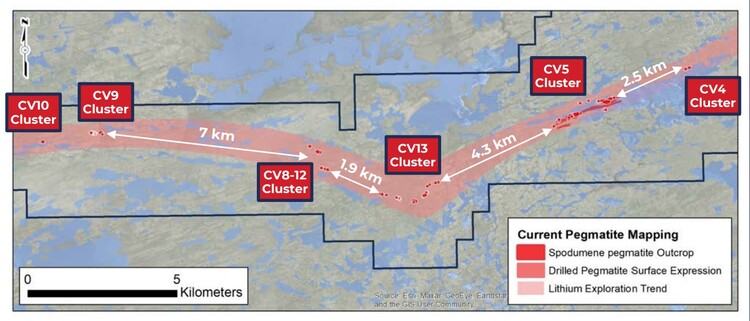

Continued success in stepping out from the CV5 pegmatite cluster is fueling speculation that Corvette’s mineralization may extend 2.5 kilometers eastward to CV4, and 4.3 kilometers westward to CV13.

If PMET can successfully tease out continuity with the biz end of the drill bit between these zones, Corvette’s resource expansion/exploration doors blow wide open.

According to a January 5th press release, the first series of holes at the recently commenced winter campaign will probe the subsurface layers of the (high-grade) CV5 zone moving eastwards.

On deck are the remaining twenty-four holes from the 2022 program—fourteen from the CV5 cluster (inc hole 93, the aforementioned easterly stepout) and a batch from the CV13 cluster 4.3 kilometers to the west southwest.

Just as people were beginning to think newsflow out of the Corvette camp was starting to dry up, with this aggressive 20,000-meter campaign now in full swing, said newsflow is about to find a whole new gear.

The James Bay Area Plays

Patriot is fast commanding the title of one of the better ‘story stocks’ of this battery metals bull cycle. In doing so, it’s mobilizing muchly needed funds from the sidelines, reinvigorating interest in the junior arena.

Aside from carving out significant price chart trajectory of its own over the past few sessions, this Jan. 18 headline lit up some of the area players in the region, drawing attention to the likes of QTWO, OPHR, BRW, VGD (and JV partner SPOD), and AZM, to name a handful of those I keep tabs on. In the same general area, initial results from an ongoing drill campaign at Winsome Resources‘ Adina project have also poured fuel on the speculative fire.

I’m not sure I’d be wading into these closeology plays after the frenzy witnessed in recent sessions, but some of these companies are bound to make discoveries during the upcoming field season.

If I were new and looking for exposure to the James Bay Li district, I’d focus on cashed-up companies with tight cap structures and experienced management teams. To start your due diligence journey, you might find this map helpful as it gives you the James Bay lay (clicking any location on the map will amplify your view). In examining recent JV deals, pay attention to the terms of the spending commitments—an aggressive year-one spend is what I’d be looking for (I’ve noted some recent JV deals with very modest (lame) year-one spending commitments).

My friend Teevee, a mining/exploration savvy poster on the PMET Channel over at CEO.CA, has been plotting PMET’s drill hole data on an Excel spreadsheet since the company began delivering results.*** His characterization of these recent results is highlighted below (note that Teevee’s comments are his opinions only and should be treated as such):

“PMET hits it out of the park with drill hole CV22-83 interval of 156.9m at 2.12% Li2O including 25m of 5.04% LiO. I have added all the latest results

to my Excel spreadsheet and report the average principle drill intervals remain remarkably consistent at about 42.6m at weighted average grades of 1.18% Li2O and 144.5ppm Ta2O5.

As previously stated by PMET, the winter drill program is underway and initially focused on the east end of the deposit. This telegraphs more spectacular results to come from drill hole assays yet to be reported from the east end of Corvette, so stand by for more shock and awe from Patriot Battery Metals.

Taking into consideration the apparent size, coarse crystalline nature of predominately spodumene mineralization, Corvette must be considered to be a tier 1 giant, singular and peerless spodumene deposit.”

If I’m coming off as more effusive than usual, it’s due to my oversized position in PMET (oversized by my modest standards). Take what I have to say with a ‘grain of salt’ and do your own due diligence. I’m biased here. Obviously. But in this era dominated by the megatrends of decarbonization and electrification, I suspect PMET has an end game. I suspect we’ll see a lithium-hungry predator—a Rio Tinto, an SQM, or an Albermarle—take a run at the company to bulk up its exposure to the battery metal.

Patriot trades via the symbols PMET on the Venture, PMT on the ASX, PMETF south of the Canadian border, and R9GA in Frankfurt.

Briefly updating a few more companies on our list

Apollo Silver (APGO.V) – (APGOF.OTC) – (6ZF0.FRA)

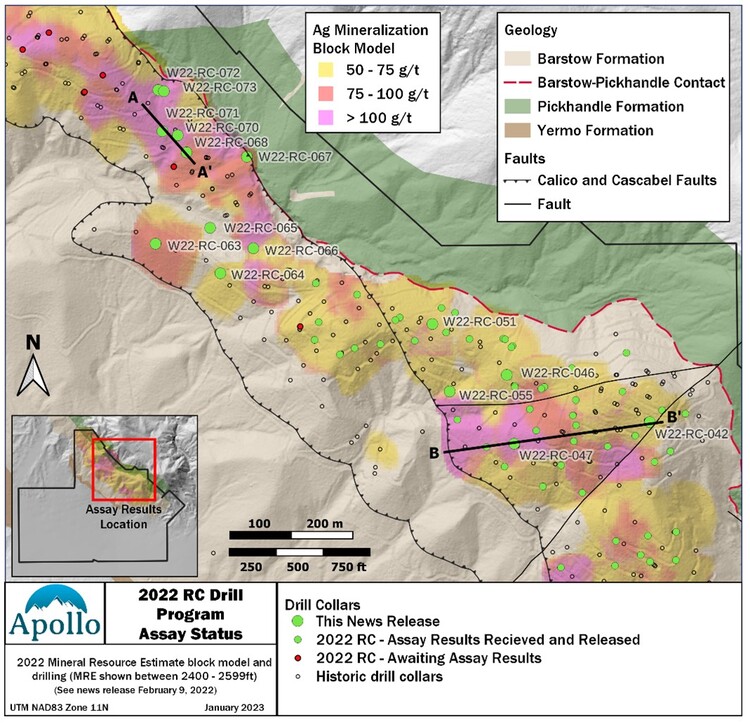

Apollo shareholders are seeing a nice lift in the stock after the company reported the highest Ag grades to date from its mothership Calico Silver Project in San Bernardino County, California—Apollo Reports Highest Silver Grades to Date from the Calico Project.

Assays continue to flow from a recently completed Phase 2 drill campaign at Calico. Highlights from this Jan. 18 press release include:

SILVER

- 189 g/t Ag over 140.5 meters from surface (W22-RC-042), including;

- 416 g/t Ag over 24.0 meters from 82.0 meters depth down hole, and including

- 528 g/t Ag over 4.5 m from 82.0 m depth down hole, and

- 658 g/t Ag over 6.0 m from 92.5 m depth down hole, which includes

- 1,610 g/t Ag over 1.5 m from 92.5 m depth down hole.

- 416 g/t Ag over 24.0 meters from 82.0 meters depth down hole, and including

- 129 g/t Ag over 58.5 m from 1.0 m depth down hole (W22-RC-046), including;

- 367 g/t Ag over 6.0 m from 19.0 m depth down hole, and including

- 421 g/t Ag over 1.5 m from 20.5 m depth down hole, and

- 597 g/t Ag over 1.5 m from 23.5 m depth down hole.

- 367 g/t Ag over 6.0 m from 19.0 m depth down hole, and including

- 138 g/t Ag over 112.0 m from surface (W22-RC-047), including;

- 539 g/t Ag over 4.5 m from 80.5 m depth down hole, and including

- 1,095 g/t Ag over 1.5 m from 82.0 m depth down hole.

- 539 g/t Ag over 4.5 m from 80.5 m depth down hole, and including

- 113 g/t Ag over 43.5 m from 8.5 m depth down hole (W22-RC-055);

- 138 g/t Ag over 57.0 m from 5.5 m depth down hole (W22-RC-068);

- 115 g/t Ag over 63.0 m from 2.5 m depth down hole (W22-RC-070);

- 141 g/t Ag over 74.5 m from surface (W22-RC-071), including;

- 311 g/t Ag over 1.5 m from 16.0 m depth down hole.

(Silver intercepts are reported at a 50 g/t silver cut-off grade (“COG”) with up to 4.5 m dilution and are uncapped. Lengths are down hole lengths and may not represent true widths unless otherwise stated)

You have to appreciate broad intervals beginning at or near surface that carry multiple-ounce values. The sub-intervals carrying values that can be measured by the kilo clearly deserve one’s approval.

Cathy Fitzgerald, Apollo’s VP Exploration: “We are delighted with the results from the 2022 drilling at Calico. The design of the 2022 drill program included not only infill drilling, but targeted drilling to define high-angle structures that may have acted as feeder zones for silver mineralization. Our drilling results to date, in combination with historical and new mapping has allowed us to more accurately model controlling structures and identify trends in high-grade silver mineralization. These outstanding results support our understanding of the geological controls on high grade silver mineralization. With the laboratory results coming in at a steady pace, we are in an excellent position to hit the ground running with the resource update work program.”

These thick high-grade intercepts, along with the mineralization tagged below the base of the current MRE—a base boasting 166 million ounces of silver contained within 58.1 million tonnes at an average grade of 89 g/t—should go a long way towards bolstering/augmenting a revised silver resource estimate due by the end of Q1 2023.

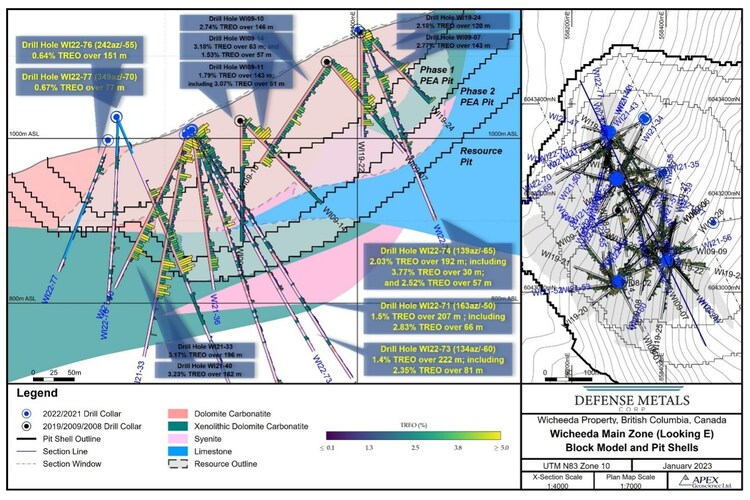

Defense Metals (DEFN.V) – (DFMTF.OTC) – (35D.FRA)

On Jan. 17, Defense dropped a round of assays from its flagship Wicheeda Rare-Earth Project where the current resource stands at 5,031,000 tonnes averaging 2.95% total rare-earth oxide (TREO) Indicated and 29,467,000 tonnes averaging 1.83% TREO Inferred—Defense Metals announces more Rare Earth Assay Results from Wicheeda Project Drilling, including 30 meters of 3.77% TREO.

This Jan. 17 press release includes results from eight core drill holes totaling 2,104 meters completed during the 2022 campaign—two exploration, three resource delineation, and three pit slope geotechnical (hole WI22-73 returned the second longest REE-mineralized intercept to date—see the drill hole table contained within).

These drill hole values follow on the heels of results released two months earlier—results that include…

Drill hole (WI22-72): a deep infill hole that tagged an impressive 3.02% TREO over 55 meters within a broader zone averaging 2.56% TREO over 122 meters.

And…

Drill hole (WI22-69): an infill hole drilled within the northern area of the deposit that tagged an even more impressive 3.52% TREO over 111 meters within a broader interval of 2.14% TREO over 221 meters.

Defense has a number of potentially positive catalysts on deck as management pushes Wicheeda aggressively along the development curve. The company is currently assembling data for a PFS—an economic study it plans to subcontract to a major mining consulting firm later this quarter—to build on the positive PEA digits released last year.

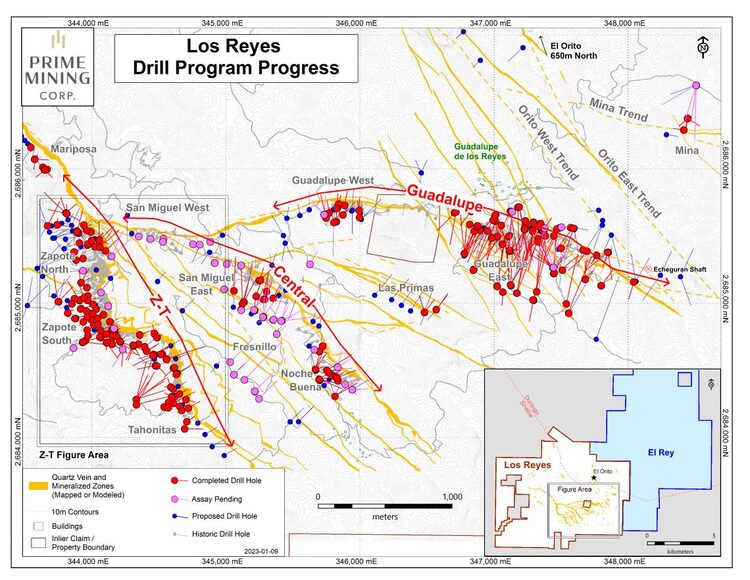

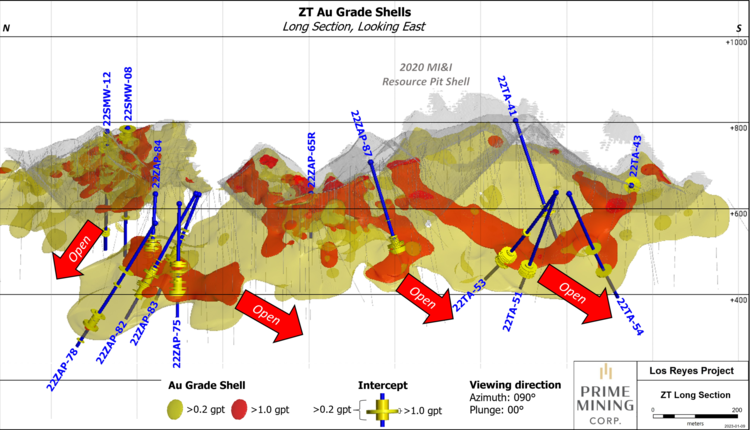

Prime Mining (PRYM.V) – (PRMNF.OTC) – (04V3.FRA)

On Jan. 11, Prime released additional assays from a recently completed Phase-2 campaign—results from 48 drill holes at Z-T where the company continues to delineate and expand the multi-million-ounce 115 square kilometer Los Reyes Project in the mining-friendly district of Sinaloa, Mexico.

The Jan. 11 headline…

Prime Drills Multiple Wide, High-Grade Intercepts in Z-T Area Including Bonanza-Grade Intervals

HIGHLIGHT Z-T DRILL INTERCEPTS:

Stepout intercepts:

- 10.0 g/t Au and 131 g/t Ag over 3.1 meters (3.1m estimated true width or “etw”) including 28.5 g/t Au and 310 g/t Ag over 1.1 meters (1.1m etw) in hole 22TA-51;

- 4.7 g/t Au and 103 g/t Ag over 11.4 meters (8.7m etw) including 39.6 g/t Au and 174 g/t Ag over 0.9 meters (0.7m etw) in hole 22ZAP-87;

- 2.7 g/t Au and 451 g/t Ag over 6.3 meters (4.8m etw) including 4.8 g/t Au and 821 g/t Ag over 3.0 meters (2.3m etw) in hole 22TA-41;

- 3.6 g/t Au and 20 g/t Ag over 16 meters (13.8m etw), including 22.2 g/t Au and 41 g/t Ag over 2.2 meters (1.9m etw) in hole 22ZAP-82.

Infill intercepts:

- 4.2 g/t Au and 59 g/t Ag over 6.0 meters (5.4m etw), including 23.6 g/t Au and 103 g/t Ag over 0.9 meters (0.8m etw) in hole 22TA-43;

- 6.9 g/t Au and 33 g/t Ag over 15.0 meters (14.8m etw), including 21 g/t Au and 55 g/t Ag over 1.5 meters (1.5m etw) in hole 22SMW-12.

This drilling campaign was designed to grow Los Reyes’ ounce count via probing for high-grade extensions along strike and down dip through step-out drilling, and to push the existing Inferred ounces into the higher confidence M&A categories.

According to Prime’s CEO, Daniel Kunz, “these results support our view that the Z-T area current resource pits are merging into a more continuous single pit.”

Scott Smith, Prime’s VP Exploration: “The Z-T area continues to reveal wide zones of potential ore well above cutoff grades with potentially low strip ratios. The stepout drilling is showing strong potential to expand the resource in a number of areas and directions. We have intercepted mineralization over 300m below the current resource pits and shown that the deposits remain open down dip and along strike.”

A five-rig Phase 3 program is well underway as the company continues to systematically advance and de-risk the project. Again, the focus is on resource expansion and delineating new ore zones.

A significant (potential) catalyst in the offing: an updated resource estimate capturing all Phase 1 and Phase 2 results (plus some initial results from the ongoing Phase 3 campaign) due to be released mid-2023.

Northern Superior (SUP.V) – (NSUPF.OTC)

While I can appreciate the progress made at the company’s Croteau Est and Lac Surprise projects in Quebec (recent headlines highlighted below)…

A Jan. 16 headline: Northern Superior Reports 1.63 G/T Gold over 45.9 Metres and 0.84 g/t Gold over 43.0 Metres from the Falcon Gold Zone at Lac Surprise

A Jan. 11 headline: Northern Superior Reports 5.96 g/t gold over 10.0 metres, 2.94 g/t gold over 14.0 metres, and 1.63 g/t gold over 20.6 metres from the Arctic Fox Zone of the Philibert Project

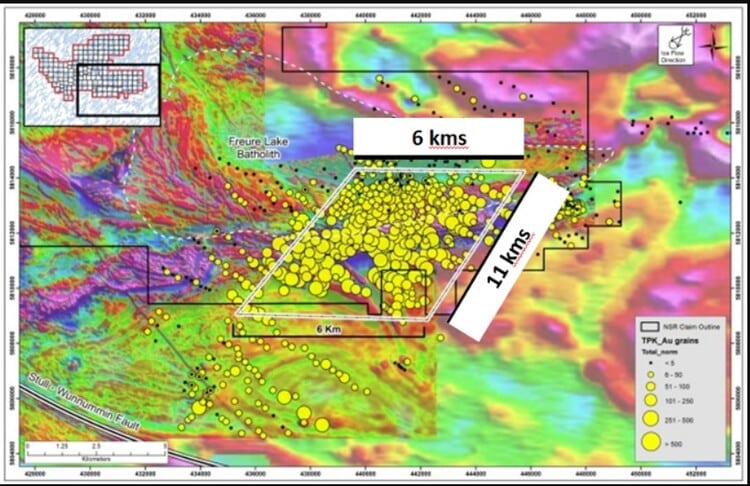

… my main interest here lies in the TPK Project in Northern Ontario—a project the company intends to spin off to existing shareholders. We’re still awaiting word on when that will happen and, equally important, when drill rigs will be mobilized to the project.

I presented a few choice details on TPK in my December 6 piece titled A Highballer Roundup for December 6 featuring a host of names – familiar and new.

(I have yet to establish a position in Northern Superior, but intend to do so in the not-too-distant future)

END

—Greg Nolan

Full disclosure: I have no current business relationship with the companies featured in this article. I do, however, own shares of Patriot Battery Metals.

***Teevee is a retired natural resource sector veteran focused on the discovery potential within the junior exploration arena, particularly porphyry Cu-Au deposits which he says “are one of the pillars of the great mining houses.”