As Gold consolidates after taking out $2k, there’s anticipation of an imminent assault on all-time highs. The conditions are right for a powerful, sustainable push to higher ground. Of course, much of the short-term price action will be data-driven vis-à-vis a backdrop of falling yields, a sagging Greenback, and weak US economic data—not to mention a twitchy Fed.

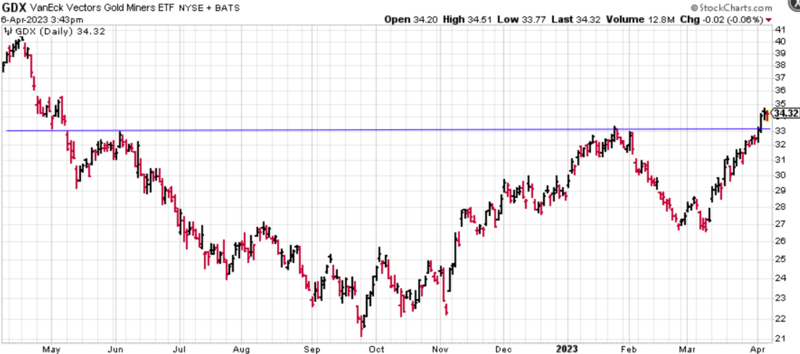

Though many of the juniors we follow are stuck in a narrow trading range, the senior entities have demonstrated considerable strength in recent sessions.

Not to dismiss this breakout to the upside, but there’s a rather substantial disconnect between gold equities and the metal itself, one that has dominated trading patterns for over a decade (the following chart courtesy of the ASA Gold and Precious Metals Chart Book).

Bottom line: gold equities will need to move substantially higher—they need to more than double in price—if they are to align with their historical average.

Lithium

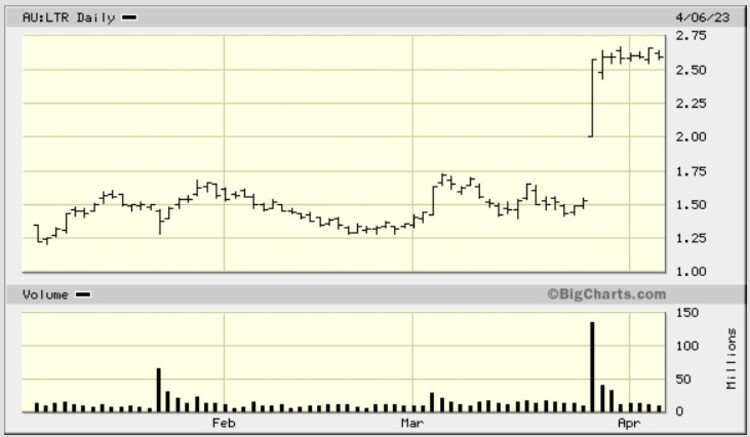

While the lithium sector remains in the grip of a correction, news of mining giant Albemarle Corp taking a run at Australian-based Liontown Resources eased a lot of the selling pressure.

The prize in Albemarle’s eyes is Liontown’s Kathleen Valley Lithium Project, a Tier-1 deposit boasting a resource of 156 million tonnes grading 1.4% Li2O and 130 ppm Ta2O5… 80% of which is deemed high confidence (Measured and Indicated).

Liontown shares are currently consolidating higher ground as the market awaits a fatter offer from Albemarle – “The Liontown board unanimously determined that (the proposal) substantially undervalues Liontown, and therefore is not in the best interests of shareholders.”

If Albermarle complies and offers a stack more in line with Liontown’s expectations, or better yet… if another resource-hungry predator enters the fray and instigates a bidding war, the entire lithium arena will light up like the 4th of July (there’s no denying the megatrends of decarbonization and electrification that are firmly in place).

Updating some of the companies we follow

Forum Energy Metals (FMC.V) * (FDCFF.OTC)

Earlier this week, Forum dropped results from a drilling campaign at their wholly-owned Wollaston Lake Project—a campaign cut short due to unseasonably mild weather and ground access challenges.

The April 3 press release…

Drilling Intersects Anomalous Uranium at Forum’s Wollaston Project, Athabasca Basin, Saskatchewan

The target mineralization is shallow, basement-hosted uranium similar to the Eagle Point-Rabbit Lake uranium deposits found on the eastern edge of the Athabasca basin within the Rabbit Lake uranium mine district, approximately 25km to the north.

Two of the seven holes drilled during this abbreviated program encountered anomalous uranium and boron values along the Gizmo trend. Additional drilling is needed to test the full extent of this highly prospective zone.

The Company also completed another round of geophysics at Wollaston. A ground gravity survey conducted over an area 67.2 km2 in size picked up fourteen new (gravity) anomalies, some of which are associated with coincident (moderate to strong) EM conductors. These new anomalies represent compelling targets and will be tested during the next phase of drilling.

Highlights from this latest round of exploration:

- Complete ground gravity coverage over prospective conductive trends.

- Anomalous uranium and boron in two drill holes along Gizmo trend requires follow-up drilling.

- Follow-up drilling required along newly identified coincident electromagnetic conductor/gravity trends and at historical uranium mineralization encountered on Burman Island.

Gizmo Trend Follow-up

New drilling along the Gizmo trend (map below) has identified a graphitic pelite with a weak brittle overprint below the main elevated radioactivity, which may be the controlling structure that led to the weak uranium mineralization up to 1960 ppm U identified earlier in 2022 (see Forum News Release dated April 19, 2022). New assay samples from the 2022/2023 winter drilling program have returned additional elevated U values between 95 and 444 ppm with coincident elevated Boron up to 900 ppm and weak to moderate clay alteration adjacent to these discreet brittle fault structures. Follow-up of this structure will be a focus in future drilling programs along trend where a newly identified strong gravity low (750 m long) to the east is coincident with this prospective and uranium fertile structure/conductor system. This anomaly was not tested this winter due to terrain challenges getting into the area and will have to drilled using a helicopter-supported program.

New Trends

Additional high-priority conductors (A1, B1, B2 and B3) with coincident gravity anomalies have been identified (above map). Along the A1 conductor historical drilling intersected several m-scale, moderately to strongly graphitic and pyritic zones with intervals of brecciation and moderate clay alteration. Weak elevated radioactivity is observed over 2.7 kilometres within and adjacent to these graphitic fault structures. Historical drill testing was largely widely spaced (~400 to 900 m) and was drilled at moderate angles to less than 100 metres depth. Additional investigation is warranted over the A1 conductor. Three additional conductive splays branch off the main A1 trend and coincide a new gravity anomaly as well.

The B1, B2 and B3 conductors are along the southern shore of Hidden Bay and along Ashley Peninsula (above map). Historical, shallow depth and widely spaced drilling identified prospective conductive stratigraphy and one drill hole along the B1 conductor intersected elevated radioactivity (400 cps).

Burman Island

Located within the southern part of the Wollaston property is a prospective area that was initially explored due to numerous radioactive graphitic pelite and pegmatitic boulders being discovered on the island (above map). Historical drilling by Wyoming Mineral Corp. intersected elevated radioactivity in 17 of 19 drillholes and returned numerous shallow drill intercepts (<50 metres) up to 477 ppm U3O8. Two sub-parallel brecciated and sheared graphitic structures transect the area and require additional testing along strike and at depth. A new gravity anomaly along a sub-parallel conductor to the south of the island also warrants additional exploration.

Rebecca Hunter, VP of Exploration: “The regional geophysical surveys and limited drilling completed by Forum coupled with historical work done on this property have elevated our expectations for an economic uranium deposit on this well-located property in the Athabasca.”

Economic orebodies in The Basin can be like needles in a haystack. They often require multiple exploration campaigns to pin down (example: it took Cameco more than 200 holes to tag McArthur River). With these new results in hand, the geo-sleuths at Forum believe they’re on to something at the Basin’s eastern edge. They have the right alteration, layers of positively correlated geophysics, and multiple large structures to follow up on (the scale of A1 has the company excited). The next round of drilling could usher in a significant new discovery.

Thelon

The next major news cycle here may stem from Forum’s Thelon Basin Project in Canada’s Nunavut Territory where the Company is looking to prove up and expand a historical resource (non NI 43-101 compliant) of some 7 million pounds of U3O8 at a grade of 0.61%. The main anomaly that carries these historical pounds-in-the-ground (the Tatiggaq zone) has seen only 200 meters of its 1500 meter strike length tested with the drill bit.

It’s important to note that the Company’s land position at Thelon—a position that includes ground recently dropped by Cameco—surrounds a 133 million pound basement hosted resource held by Orano and partners.

(management snagging these additional claims was a real heads-up move)

Thought to be the closest geological analog we have to the prolific Athabasca Basin further south, Thelon is a vastly unexplored region with significant discovery potential. There could be a potent catalyst in these subsurface layers.

Two interviews with Rick Mazur and Rebecca Hunter popped up on YouTube recently. The first offers some good background on the Company and what they’re on the hunt for in both Basin’s…

This more recent interview delves into the Wollaston update released earlier this week and touches on the Company’s plans for Thelon this summer…

Patriot Battery Metals (PMET.V) * (PMT.ASX) * (PMETF.OTC) * (R9GA.FRA)

PMET recently began releasing results from a six-rig winter drill campaign centered on its mothership Corvette Project in the James Bay region of mining-friendly Quebec.

The primary objectives of the 2023 drill campaign are to further delineate the extent of the CV5 Pegmatite culminating in an initial mineral resource estimate scheduled for Q2 2023, as well as infill drilling to refine the geological model to achieve indicated mineral resource confidence to support a Pre-Feasibility Study.

Having recently raised an additional $50M via flow through (funds that must be spent via the biz end of the drill bit), and with six rigs currently turning, newsflow promises to be especially robust over the balance of 2023.

In a press release dated Mar. 23—Patriot Extends Strike Length of the CV5 Pegmatite to 3.15 km, Corvette Property, Quebec, Canada—the Company announced having extended the CV5 Pegmatite structure eastwardly by a further 550 meters. CV5 now spans a lateral distance of at least 3.15 kilometers and remains open along strike (at both ends) and to depth.

On Mar. 29, an anxious shareholder base got their first look at the lithium values the Company is pulling out of the ground at CV5, and they didn’t disappoint.

Highlights (where exceptional lengths of high-grade core is par for the course):

- 83.7 m at 3.13% Li2O (222.7 m to 306.4 m), including 19.8 m at 5.28% Li2O and 5.1 m at 5.17% Li2O (CV23-105).

- 132.2 m at 1.22% Li2O (274.1 m to 406.3 m), including 11.2 m at 2.99% Li2O and 6.0 m at 2.92% Li2O (CV23-106).

- 65.4 m at 1.30% Li2O (293.2 m to 358.6 m), including 37.1 m at 2.09% Li2O or 3.0 m at 5.43% Li2O (CV23-107).

- 54.0 m at 1.55% Li2O (294.7 m to 348.6 m), including 26.6 m at 2.44% Li2O or 5.0 m at 4.30% Li2O (CV23-108).

- The Nova Zone has now been traced over a 750 m strike length, including a very high-grade band of greater than 5% Li2O over a minimum 200 m strike length.

Other significant intercepts include:

- 85.0 m at 1.04% Li2O (184.4 m to 269.4 m), including 39.4 m at 1.51% Li2O (CV23-110).

- 22.6 m at 2.13% Li2O (230.6 m to 253.1 m), including 6.5 m at 3.44% Li2O (CV23-115).

- 23.8 m at 1.61% Li2O (307.8 m to 331.6 m) (CV23-116).

- Several core sample assays exceeding 6% Li2O returned, including 1.3 m at 6.53% Li2O (CV23-115).

- Core samples for twenty-seven (27) additional drill holes have arrived at the analytical lab (SGS).

- Six (6) core drilling rigs currently active at the CV5 Pegmatite.

Be bold and mighty forces will come to your aid (someone once said that).

Aside from the push to step out and establish continuity along strike a further 1.5 kilometers eastward to the CV4 Pegmatite cluster, the company is also stepping out toward the CV13 Pegmatite cluster some 4.3 kilometers to the west.

Successfully establishing mineralized continuity between these multiple zones would blow the lid off Corvette’s ultimate scale and resource upside.

On the subject of scale, the following YouTube vid, featuring CEO Blair Way, explores what management and shareholders alike have in their crosshairs (fast forward to 16:51 if you wanna get right to it)…

Last word goes to Patriot’s VP of Exploration, Darren L. Smith:

“The first core sample assays of our winter drill program have confirmed the extension of the high-grade Nova Zone to the east, including a 20 m intersection at greater than 5% Li2O in CV23-105. The lithium grades found in this zone are very significant, and include a 3 – 25 m thick (core length) band of greater than 5% Li2O over a significant strike length of 200+ m. The Company continues to delineate the Nova Zone and the overall CV5 Pegmatite, which remains open along strike at both ends and to depth along most of its length. The size of the CV5 Pegmatite has grown substantially through the winter drill program completed to date, and the results announced today further affirms Corvette as a globally significant hard rock lithium pegmatite project.”

END

— Greg Nolan

Full disclosure: Forum Energy Metals is a Highballer client (the author was compensated for the above content). The author owns shares of both Forum Energy Metals and Patriot Battery Metals.