The summer doldrums are in full force across much of the junior exploration sector. Though there are a few notable exceptions—Snowline (SGD.V) and Mayfair (MFG), highlighted here in recent months—the bargains crossing my screen are taking on a surreal quality.

Forum Energy Metals (FMC.V) – (FDCFF.OTC)

- 224.02 million shares outstanding

- $12.32M market cap based on its recent $0.055 close

- Corp pitch deck

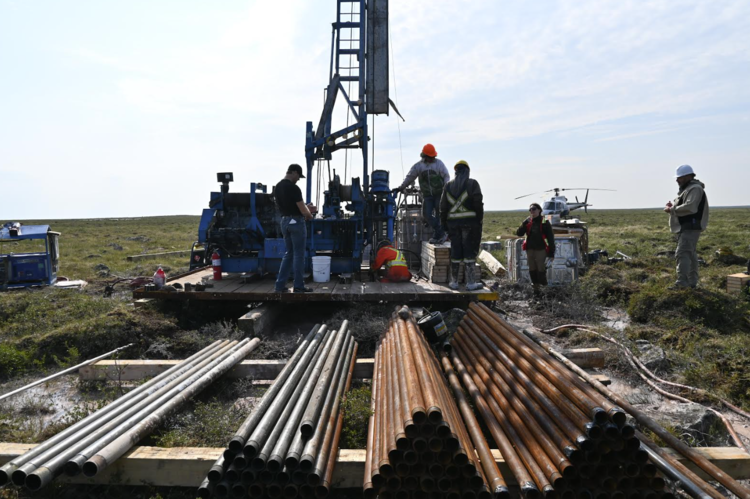

Forum recently dropped a headline announcing the commencement of drilling at its Thelon Basin Project in Canada’s Nunavut Territory.

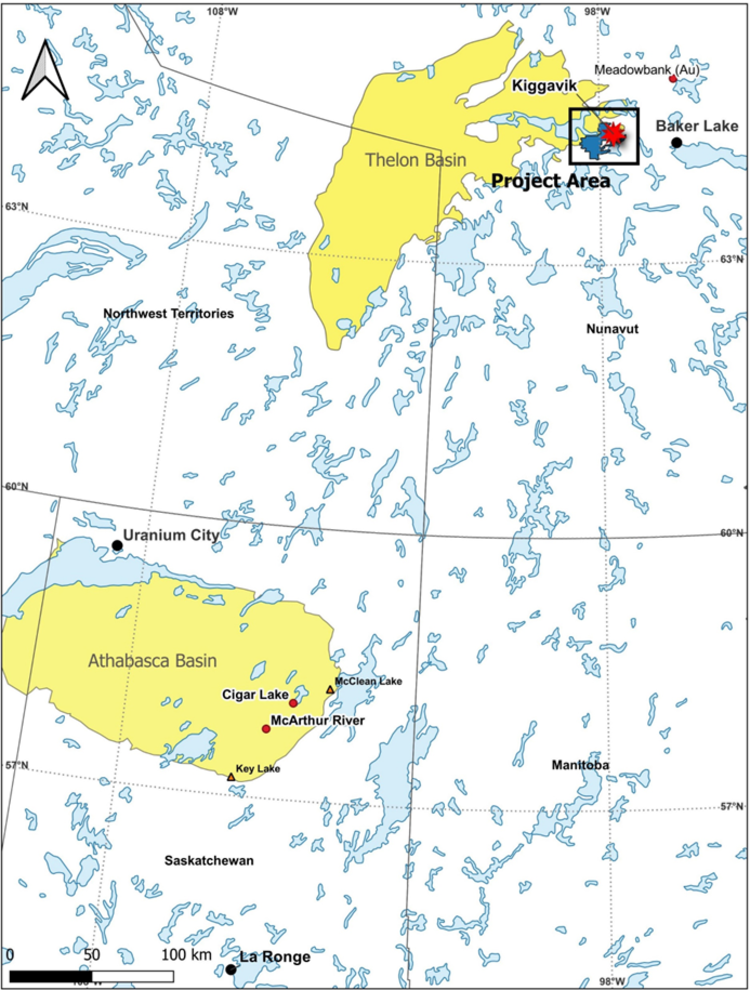

The Thelon Basin is a vastly underexplored region Forum characterizes as the closest geological analog we have to the prolific Athabasca Basin further south. Due to a lack of systematic exploration, Thelon’s discovery cycle is in its infancy—it may be where the Athabasca Basin was a half-century ago, before Cigar Lake and McArthur River lit up Canada’s U3O8 map. Forum believes the region holds considerable potential for unconformity-type uranium mineralization in its subsurface stratum.

Both the Athabasca and Thelon basins are similar in the following ways:

age (~1.7 billion years old)

size in square kilometres (~150,000 km 2 )

composition (basins largely made of well-sorted sandstone)

overlie similar older metamorphosed basement rock (that acts as a good reductant)

both areas have undergone fault reactivation events during the same, which ultimately led to

the uranium mineralization events in both basins

both basins host high-grade unconformity-related uranium mineralization

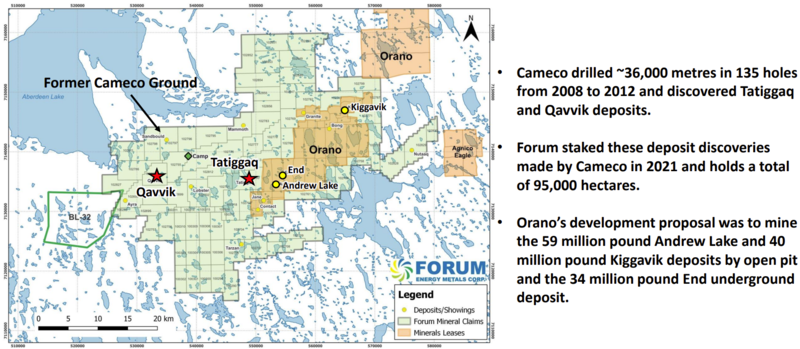

A dominant land position

Forum’s wholly-owned land position in the Thelon Basin is a commanding one. It captures 95,500 hectares of highly prospective ground, including claims formerly held by U3O8 colossus Cameco Corp—ground the mining giant drilled extensively (135 holes for over 36,000 meters between 2008 to 2012). When Cameco dropped its claims in the region, CEO Mazur snagged them in a real heads-up move (see Forum press release dated Feb. 1, 2022).

There are three deposits at the development stage in this basin—the Kiggavik, Andrew Lake, and End deposits, aka the Kiggavik Uranium Project, pounds-in-the-ground that represent 133 million pounds of uranium owned by Orano and Uranium Energy. Kiggavik’s average head grade = 0.54%.

Forum’s ground surrounds this massive deposit.

Mazur and his team have a high-grade U3O8 resource in their crosshairs—they’re already part way there. And now, with its recently closed $3M financing—a PP that saw a single strategic investor take down the entire offering—the company is on the move.

As noted above, Cameco drilled 135 holes for over 36,000 meters on ground that now belongs to Forum – ground to the west of Orano’s 133 million pound U3O8 deposit. Forum’s VP of Exploration, Dr. Rebecca Hunter, knows this project like the back of her hand having guided Cameco’s exploration campaign—the Turqavik-Aberdeen exploration project—while working as a project geologist from 2005 to 2016. Her sleuthing along the region’s subsurface layers led to the discovery of two unconformity-style uranium deposits: the Tatiggaq deposit and the Qavvik deposit (Dr. Hunter’s efforts also tagged what’s called the Ayra showing).

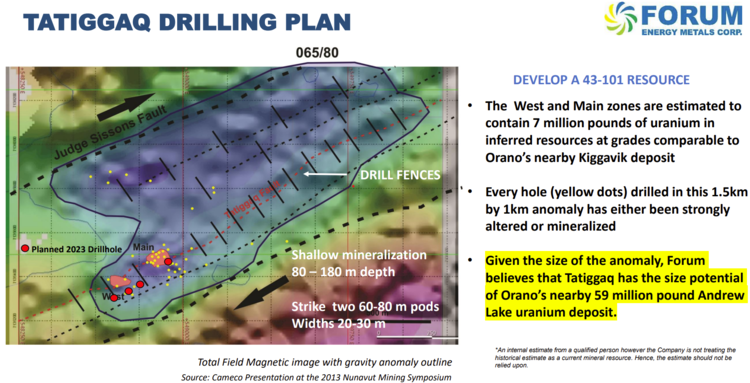

Tatiggaq holds a historical resource (non-NI 43-101 compliant) of some 7 million pounds of U3O8 grading 0.61%.*

These historical pounds-in-the-ground now belong to Forum.

Tatiggaq lies roughly five kilometers west of Orano’s Andrew Lake deposit.

Forum’s Tatiggaq discovery consists of two zones—Main and West. Both average 30 meters in thickness at a relatively shallow depth—between 80 and 180 meters. The Main zone has a strike length of 80 meters. The West zone has a strike length of 60 meters.

Importantly, Tatiggaq remains open for extension along strike and to depth within a large gravity anomaly that measures 0.7 kilometers wide by 1.5 kilometers long.

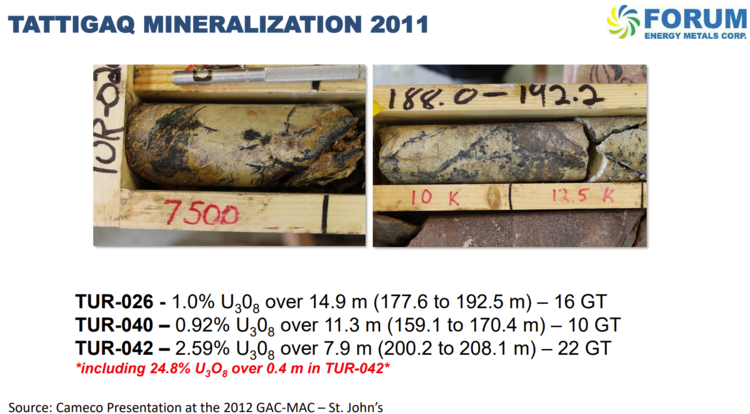

Highlights from historical Tatiggaq drilling include:

- TUR-026 – 1.0% U3O8 over 14.9 meters from 177.6 to 192.5 meters;

- TUR-040 – 0.92% U3O8 over 11.3 meters from 159.1 to 170.4 meters;

- TUR-042 – 2.69% U3O8 over 7.9 meters from 200.2 to 208.1 meters (including 24.8% U3O8 over 0.4 meters from 202.9 to 203.3 meters);

- TUR-052B – 0.43% U3O8 over 54.2 meters from 115.4 to 169.6 meters;

- TUR-056 – 0.93% U3O8 over 9 meters from 126 to 135 meters;

- TUR-058 – 1.17% U3O8 over 6.1 meters from 88.2 to 94.3 meters.

The anomaly that carries Tatiggaq’s historical resource has seen limited drilling—only 200 meters of its 1500-meter strike length has been tested with the drill bit. This is where Dr. Hunter and her team will focus their attention via a two thousand-meter drill campaign.

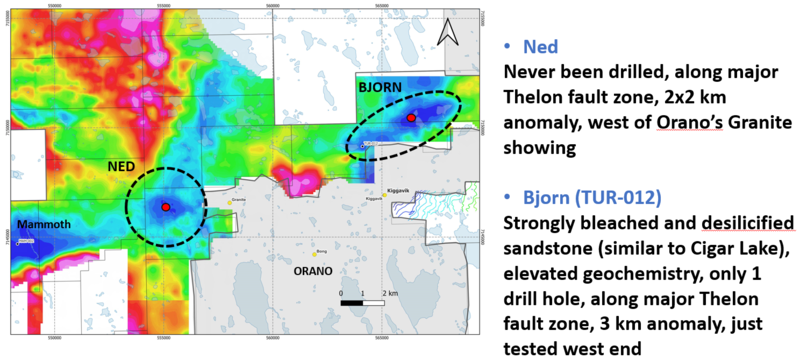

If things go by the numbers—if there’s time and a little slack left in the budget—we’ll also see the drill rig mobilized to a pair of high-priority regional targets where the discovery potential is considered excellent. The two anomalies, Bjorn and Ned, are big-ass targets.

Regarding Thelon’s regional discovery potential, Dr. Hunter from a Q&A I conducted last November:

“We plan to spend about 25% of our budget each year drilling the other 9+ high-priority anomalies on our property for ‘at the unconformity’ unconformity-related uranium mineralization. We have several anomalies that have overlying Thelon Basin sandstone that have shown significant clay alteration, desilicification, and elevated uranium values in the sandstone column. It is our belief that the Thelon Basin holds the potential to host 100+ million lbs deposits similar to the Athabasca Basin that are just waiting to be discovered. We feel that Forum Energy Metals is extremely well positioned to make one or more of these ground-breaking discoveries.”

The July 18 press release…

Forum Commences Drilling on Its Thelon Basin Uranium Project

As highlighted above, this initial 2,000-meter drill campaign will target the Tatiggaq zone to confirm and expand the historical (non-NI 43-101 compliant) resource of 7 million pounds of U3O8 grading 0.61%.*

Quoting Dr. Rebecca Hunter from this July 18 press release: “Forum’s Nunavut Uranium Project in the Thelon Basin is a geologic analogue to the prolific Athabasca Basin for large, high grade, unconformity-related uranium deposits. Forum’s initial drill program will focus on further delineation of the Tatiggaq deposit and if time permits, Forum will test one or two of over twenty other high-priority targets on the property.”

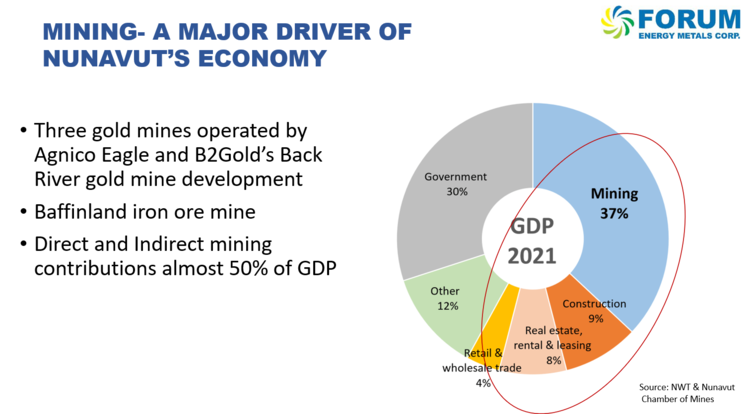

The Jurisdiction

Mining plays a critical role in this far-north community.

Nunavut is on the radar of resource-hungry producers looking to goose their production profiles. Earlier this year, B2Gold took out Sabina Gold & Silver for its district-scale Back River gold project in an all-paper deal valued at C$1.1B. BTO is fully committed to this Nunavut asset. Earlier this year, via a winter ice road, it hauled in all the critical materials necessary to complete the construction of a mill (mill completion is expected in the first quarter of 2025). My point: significant funds are being deployed, and development activity is accelerating in Nunavut.

Conclusion

Forum’s first campaign with the drill bit in the Basin, some 2k meters, is modest, but it could go a long way towards opening up and expanding the zone Dr. Hunter and her team tagged while working for the U3O8 colossus. Dr. Hunter will be to picking up where she left off with Cameco years back.

These are very early innings for Thelon’s discovery cycle. Forum’s commanding land position in the basin could yield multiple new discoveries outside its (already) highly prospective Tatiggaq zone. The company’s current share price and market cap—$0.055 and $12.4 million, respectively—might be viewed as a low-risk entry point, especially considering the compelling abovementioned fundamentals.

END

~ Greg Nolan

Full disclosure: Forum Energy Metals is a Highballer client. The author owns shares.

* An internal estimate from a qualified person however the Company is not treating the historical estimate as a current mineral resource. Hence, the estimate should not be relied upon.