In US dollar terms, Gold is currently flirting with all-time highs. Actually, the metal has already carved out fresh all-time highs in most other currencies. Take the Cdn dollar, for example…

With this recent price strength, one would expect the juniors to be under intense accumulation, but that’s simply not the case. Those of us who have been around the junior arena for a while believe that an across-the-board re-rating is overdue. Long overdue. Especially among the better-run, higher-quality names operating geologically prospective projects in mining-friendly climes.

Before I rattle off a list of junior gold, silver, and copper juniors that intrigue me, I’ll update an expertly helmed (client) company aggressively exploring a region where “a generational uranium mining district” may be unfolding.

>>>Note that the first installment of this report is in collaboration with Forum Energy Metals (Highballer is compensated by the company for this effort)<<<

Forum Energy Metals (FMC.V)

- 309.35 million shares outstanding

- $20.11M market cap based on its recent $0.065 close

- FMC website

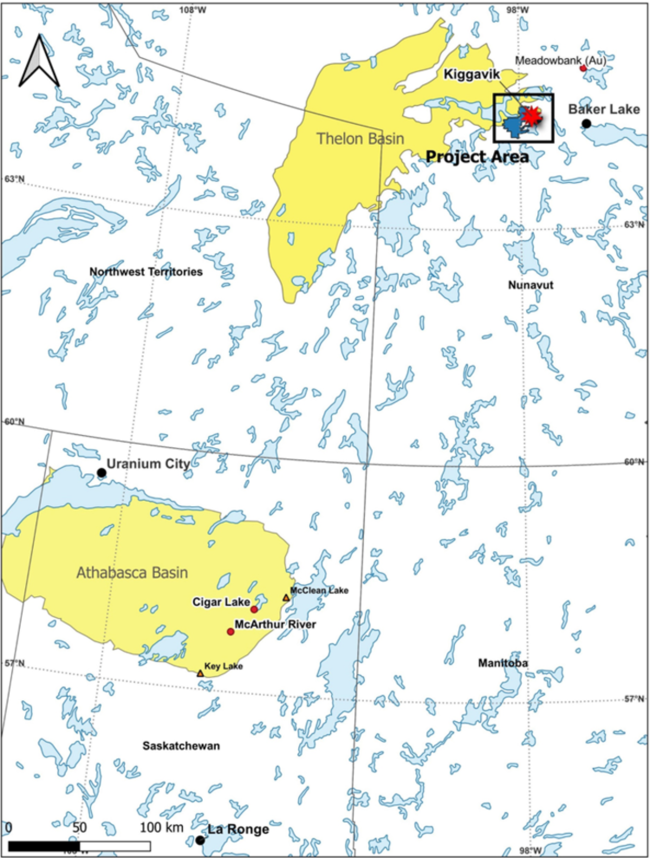

Forum Energy Metals is rigorously exploring its 95k-hectare Aberdeen Project in the Thelon Basin of Nunavut, a vastly under-explored piece of highly prospective terra firma management characterizes as the closest geological analog we have to the prolific Athabasca Basin further south…

We’ll kick off this update with a quote from Forum’s CEO concerning the significance of recent assays reported from Aberdeen.

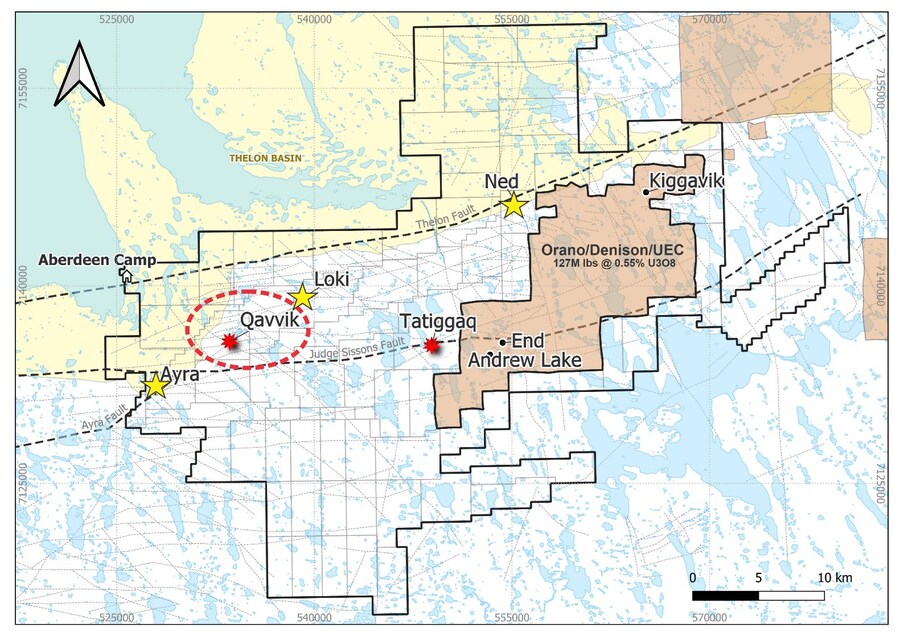

CEO Rick Mazur: “Forum has the most advanced exploration property in the Thelon Basin right next door to an economically viable uranium deposit. This year’s drill program successfully expanded the footprint of our two basement-hosted discoveries, Tatiggaq and Qavvik and initiated our search for large unconformity contact-type deposits with drilling at the Ned, Ayra and Loki targets. With continued drilling of our numerous blue sky target areas and further resource delineation on the Aberdeen Project, we believe that a generational uranium mining district is unfolding.”

An interesting bit of recent history concerning this flagship project: CEO Mazur snagged 58 claims (80,659 hectares) in the region in a real heads-up move before anyone else noticed that U3O8 mining giant Cameco Corp allowed them to lapse (the company held 14,860 hectares prior). The cost to the company? $150k.

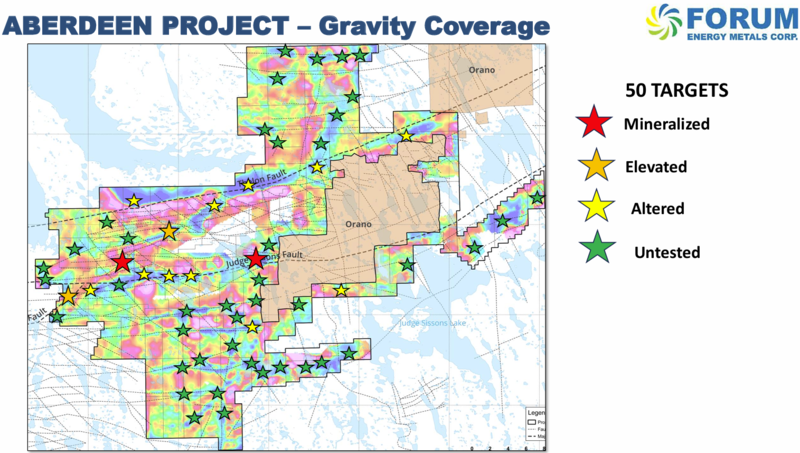

The company is employing a disciplined approach to expanding three known zones of basement-hosted U3O8 mineralization (Tatiggaq, Tatiggaq West and Qavvik), stepping out along parallel structures, and systematically probing high-priority targets on a regional scale. In its crosshairs: additional basement-hosted zones of mineralization and the elusive uber high-grade unconformity type deposits found further to the south in the Athabasca Basin. The company has no shortage of targets teed up for a proper probe with the drill bit (slide #17 from Forum’s deck)...

The Mid-January Aberdeen Assays

Forum delivered two assay-related press releases since the calendar flipped over to 2025 to follow up on results released in late November (covered in these pages here).

Januray 13, 2025: Forum Announces Final Assay Results from Tatiggaq; Drill Intercept Identifies Potential New Zone 300 Metres North of the Tatiggaq Deposit.

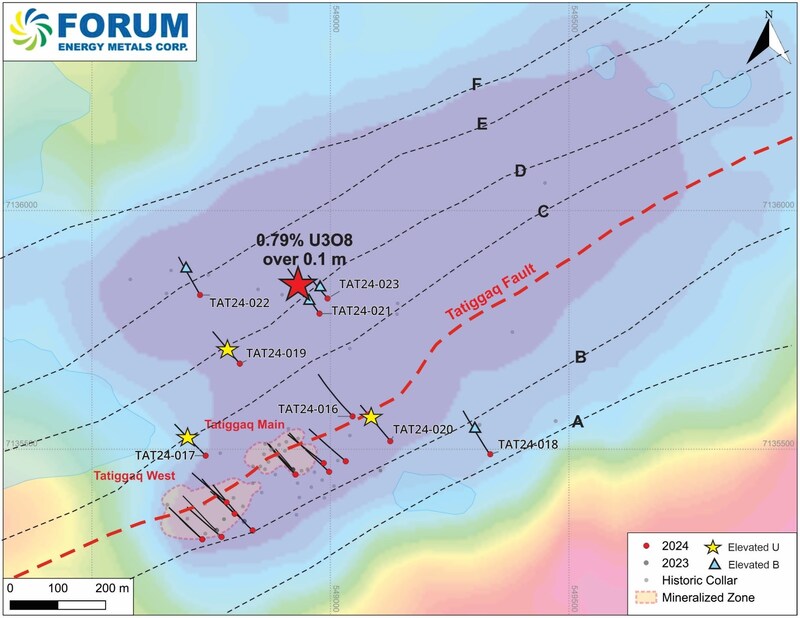

The first round of drill holes released in late November were designed to infill the main zones and stepout along strike at Tatigaq and Tatigaq West. This next round was designed to step out from the main zones and test prospective targets along additional and sub-parallel faults within a large gravity anomaly measuring 1.5 x 0.7 kilometers.

Quoting the press release: Forum completed eight drill holes testing along the Tatiggaq Fault and subsidiary ENE-trending faults (A-F) to determine if there are additional mineralized zones or evidence of potential zones (Drill holes: TAT24-016 to TAT24-023). All eight drill holes intersected clay alteration and fault structures as well as elevated Boron, which is an important pathfinder element for uranium mineralization in the Thelon Basin.

The highlight interval from this January 13 release was in drill hole TAT24-021, which tagged 0.38% U3O8 over 0.3 meters from 220.8 to 221.1 meters (including 0.79% U3O8 over 0.1 meters). Yes, this is a narrow intercept, but when you consider the steep dipping nature of this mineralization, there’s reason for excitement—it’s possible the company caught the very edge of a new lens. Some might characterize this narrow hit as ‘in-your-face’ evidence of a new mineralized zone.

Dr. Rebecca Hunter, Forum’s VP: “The objectives we had for the 2024 drilling at Tatiggaq were to expand within the proximal footprint but also to step out at significant intervals to identify potential new uranium zones. With this last series of holes, we intersected uranium mineralization outside of the current Tatiggaq deposit area. While the uranium intercept is small, this is significant as results from the other holes in the series included elevated levels of uranium and boron, an important pathfinder element for uranium mineralization in the Thelon Basin. We are encouraged for the potential of the area to host more zones of uranium mineralization to build the scale of the Tatiggaq deposit given half of the anomaly remains untested.”

A summary of the progress realized thus far via the biz end of the drill bit, verbatim as per the guts of this Jan 13 release:

- Tatiggaq Main – Another parallel lense of high-grade uranium was intersected extending the width to 35 metres and remains open to a greater thickness.

- Tatiggaq West – Drilling demonstrated lateral continuity and thickness to the west and remains open along strike and at depth.

- Tatiggaq North – A potential new zone 300 metres north of the Main Tatiggaq deposit with an intersection of 0.79% U3O8 over 0.1 m at 221 m depth. The northern part of the Tatiggaq anomaly has shown that it is highly anomalous in both uranium and boron. The entire northeast part of the anomaly is prospective along the fertile structures to the northeast, in particular the Tatiggaq Fault and the D Fault.

- Tatiggaq West Resampling – Forum resampled six historical uranium mineralized drill holes from the Tatiggaq West zone as these drill results were not filed publicly by the previous operator. These results now provide Forum with a complete mineralized assay database of the Tatiggaq West zone, and in concert with the public historical drill data and the drilling data from Forum’s 2023 and 2024 exploration programs, form the foundation for the development of an in-house resource at Tatiggaq.

The January 21 Aberdeen Assays

The next round of assays dropped roughly one week later via the following headline…

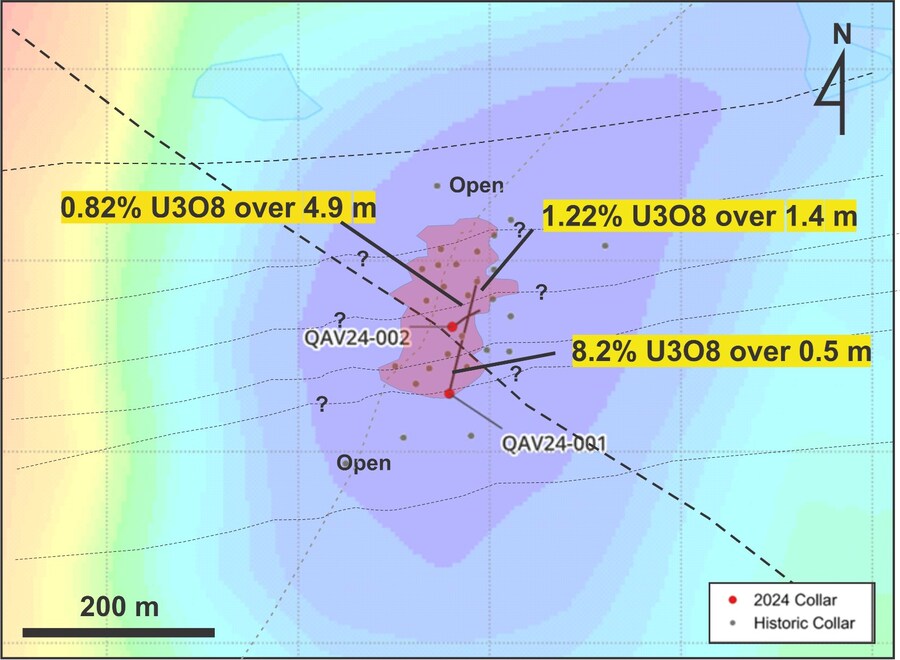

This assay-rich press release was all about the Qavvik zone, roughly 16 kilometers west of Tatiggaq. Qavvik, discovered back in 2009 when Cameco owned the property, was Dr. Hunter’s first U3O8 discovery in the Thelon Basin.

In a recent interview (linked further down the page), Dr. Hunter compared Qavvik to the Andrew Lake deposit, the largest of the three deposits comprising Orano’s Kiggavik Uranium Project further to the west (a basement-hosted U3O8 endowment of some 133 million pounds grading 0.54%). According to Hunter, Qavvik has the same style of mineralization as Andrew Lake.

Qavvik was generally considered lower grade than Tatiggaq next door, but the higher grades (8.17% U3O8 over 0.5 meters) encountered during this phase of drilling are challenging that thinking.

Quoting the January 21 news: This highly successful program intersected a 296-metre-wide zone of uranium mineralization with grades up to 8.2% U3O8 in a newly identified lense and resulted in more than 20 assays with grades greater than 1% U3O8. Mineralization is open to the northeast and southwest, and the shallow depths along with the thick overall uranium intercepts demonstrates the open pit potential of this deposit.

Highlights from the two holes drilled at Qavvik in 2024 (QAV24-001 and QAV24-002):

- QAV24-001 intersected a 296 m wide zone of uranium mineralization consisting of numerous discreet lenses from 36 meters to 332 meters, and QAV24-002 intersected over 190 merters of discreet mineralized lenses from 192 metrers to 384 metrers. On the Qavvik Grid, uranium mineralization has been intersected over a 150 meter northeast-southwest trend and is open for extension of the deposit.

- The highest mineralization intervals from QAV24-001 are as follows:

-

- 1.49% U3O8 over 3.30 m (171.9 – 175.2 m)

- Max. of 8.17% U3O8 over 0.5 m at 172.0 m

- 1.49% U3O8 over 3.30 m (171.9 – 175.2 m)

-

- 1.99% U3O8 over 0.3 m (205.3 – 205.6 m)

-

- 0.82% U3O8 over 4.9 m (291.4 – 296.3 m)

- Max. grade of 7.92% U3O8 over 0.1 m at 292.3 m

- 0.82% U3O8 over 4.9 m (291.4 – 296.3 m)

-

- 0.64% U3O8 over 2.7 m (317.1 – 319.8 m)

- Including 1.22% U3O8 over 1.4 m at 318.1 m

- Max. grade of 6.3% U3O8 over 0.2 m at 318.8 m

- 0.64% U3O8 over 2.7 m (317.1 – 319.8 m)

- The highest mineralization intervals fromQAV24-002 are as follows:

-

- 0.40% U3O8 over 3.5 m from 192.9 to 196.4 m including:

- 1.69% U3O8 over 0.6 m at 195.9 m

- Max. grade of 2.44% U3O8 over 0.2 m at 196.2 m

- 0.40% U3O8 over 3.5 m from 192.9 to 196.4 m including:

-

- 0.66% U3O8 over 1.7 m from 197.0 to 198.7 m including:

- Max. grade of 3.08% U3O8 over 0.2 m at 197.4 m

- 0.66% U3O8 over 1.7 m from 197.0 to 198.7 m including:

The structural setting of Qavvik is still being interpreted but the main controls on mineralization appear to be east-northeast subsidiary faults, and potentially a northeast fault that transects the area. The mineralization is open throughout the anomaly but in particular, to the northeast and southwest along these fertile east-northeast trending fault zones.

Dr. Hunter: “Going into 2024, it was our first opportunity as a company to showcase the size and grade potential of the Qavvik deposit. Our objective to drill at a shallower angle in order to intersect multiple lenses was highly successful both in terms of grade and size. The thick intersection in our first drill hole of several hundred metres of uranium mineralization is quite prolific. In addition, the high grades demonstrate tremendous potential for increasing the resource at Qavvik. We are very encouraged by these results and look forward to conducting more infill and expansion drilling at Qavvik.”

Results generated to date from both zones—Tatiggaq and Qavvik—serve as a solid foundation from which Forum can begin calculating a global maiden resource for the project.

On deck are assays from regional targets—Ned, Ayra and Loki—where the quarry is unconformity (Athabasca Basin) type mineralization.

In this very recent interview, Dr. Rebecca Hunter explains it all:

Elsewhere in the Junior Arena

This next installment highlights a handful of the companies I consider good value—companies grounded in fundamentals that encompass one or more of the following: 1) a 43-101 compliant resource that appears attractive in this lofty metals price environment, 2) a prospective project at the pre-resource stage, 3) a new discovery underpinned by either high-grade or broad intervals of consistent mineralization, and 4) an asset that has attracted a deep-pocketed senior partner with an aggressive spending commitment. The competence of management and the mining friendliness of the jurisdiction are also essential factors. Put simply, I’m attempting to pare down my list to companies that may land in the crosshairs of a resource-hungry predator.

The following list offers a snapshot. The serious DD is up to you…

AbraSilver Resource Corp. (ABRA.V) – (ABBRF.OTC)

- 1259.51 million shares outstanding

- $360.04M market cap based on its recent $2.78 close

- ABRA website

AbraSilver is a high-grade silver play in Salta Province, Argentina, where the company is aggressively drilling off its wholly-owned Diablillos Project.

Recent newsflow includes assay results and a PFS from their flagship Diablillos project.

Dec 3 – AbraSilver Announces Updated Diablillos PFS With CAD$1,046M (USD$747M) After-Tax Base-Case NPV

Abitibi Metals Corp. (AMQ.C) (AMQFF.OTC)

- 117.76 million shares outstanding

- $31.21M market cap based on its recent $0.265 close

- AMQ website

AMQ is methodically pushing its flagship B26 Polymetallic Deposit along the exploration and development curve. The resource at B26 currently stands at 11.3MT grading 2.13% CuEq (Indicated) & 7.2MT grading 2.21% CuEq (Inferred).

Recent newsflow includes:

Amarc Resources (AHR.V) – (AXREF.OTC)

- 220.8 million shares outstanding

- $139.10M market cap based on its recent $0.63 close

- AHR website

Amarc is advancing its JOY (under JV with Freeport-McMoRan), DUKE (under JV with Boliden), and IKE (100%-owned) projects in prolific porphyry regions of northern, central and southern BC. The company made waves in recent sessions via two rapid-fire (discovery-related) headlines:

American Eagle Gold Corp. (AE.V) – (AMEGF.OTC)

- 167.85 million shares outstanding

- $73.01M market cap based on its recent $0.435 close

- AE website

With two mining giants on its registry (Teck owns 19.9% – South32 owns 19.9%), American Eagle is drilling off multiple zones of porphyry mineralization at its flagship NAK Project in the Babine Copper-Gold Porphyry district of central British Columbia.

Recent newsflow includes:

Dec 18 – American Eagle Gold Delivers Multiple High-Grade Copper Equivalent Intercepts at NAK

Apollo Silver Corp. (APGO.V) – (APGOF.OTC)

- 242.19 million shares outstanding

- $53.28M market cap based on its recent $0.22 close

- APGO website

Apollo boasts two weighty (resource-rich) silver assets in its project portfolio: the Calico Silver Project in San Bernardino County, California, and the Cinco De Mayo Project in Chihuahua State, Mexico.

Recent newsflow:

Dec 2 – Apollo Silver Provides Corporate Update

Amerigo Resources Ltd. (ARG.TO) – (ARREF.OTC)

- 165.96 million shares outstanding

- $277.15M market cap based on its recent $1.67 close

- ARG website

Amerigo is a profitable producer that dividends a healthy chunk of its profits to shareholders. The company produces copper and molybdenum concentrate at its Minera Valle Central operation by processing fresh and historic tailings from Codelco’s El Teniente mine, the world’s largest underground copper mine.

Recent newsflow:

Nov 28 – Amerigo Renews Normal Course Issuer Bid

Jan 14 – Amerigo Reports 2024 Operational Results & Provides 2025 Guidance

ATEX Resources (ATX.V)

- 275.93 million shares outstanding

- $524.26M market cap based on its recent $1.90 close

- ATX website

ATEX is exploring its Valeriano Copper Gold Project in Chile. The project is located within an emerging copper gold porphyry mineral belt that links the prolific El Indio High-Sulphidation Belt to the south with the Maricunga Gold Porphyry Belt to the north. This emerging belt hosts several copper gold porphyry deposits at various stages of development including, Filo del Sol (BHP / Lundin Mining), Lunahausi (NGEx Minerals), Josemaria (Lundin Mining), La Fortuna (Teck Resources/Newmont) and El Encierro (Antofagasta/Barrick Gold).

Recent newsflow:

Aurion Resources (AU.V) – (AIRRF.OTC)

- 148.89 million shares outstanding

- $93.80M market cap based on its recent $0.63 close

- AU website

Aurion has exposure to mineral tenements that cover roughly 75,000 hectares of the Central Lapland Greenstone Belt (CLGB) along the Fennoscandian Shield—a vastly under-explored region some say holds similar potential to the Timmins region of Ontario. The company’s wholly-owned Risti project is the company’s main focus currently.

Recent (assay-related) newsflow:

Borealis Mining (BOGO.V)

- 83.22 million shares outstanding

- $51.60M market cap based on its recent $0.62 close

- BOGO website

Borealis’s assertion that it can go from the “drillbit to doré bars faster than 99% of our competitors” is grounded in the considerable exploration upside surrounding its historically productive Borealis Mine in Nevada—a fully permitted mine site equipped with active heap leach pads, an ADR facility, and all necessary infrastructure to support a heap leach gold mining operation.

Recent newsflow:

Dec 10 – Borealis Mining Announces Acquisition of Gold Bull Resources

Jan 22 – Borealis Announces Production of Approximately 550 oz of Gold from the Borealis Mine

Collective Mining (CNL.TO) – (CNL.NYSE)

- 77.6 million shares outstanding

- $567.27M market cap based on its recent $7.31 close

- CNL website

Collective, founded by the same team that developed and sold Continental Gold to Zijin Mining for roughly $2 billion in enterprise value, appears to be onto another world-class deposit(s) at its Guayabales Project in Caldas, Colombia. Collective has been one of the better performers since I featured the company in these pages last October.

Recent (assay-rich) newsflow:

Goliath Resources Limited (GOT.V) – (GOTRF.OTC)

- 137.34 million shares outstanding

- $230.73M market cap based on its recent $1.68 close

- GOT website

Another solid performer since it was last featured in October, Goliath is drilling off what appears to be an expansive high-grade gold system at its Golddigger Property in the prolific Golden Triangle of northwestern BC (significant shareholders include Crescat Capital, Eric Sprott, Mr. Rob McEwen and a Global Commodity Group based out of Singapore).

Recent (assay-related) newsflow:

Kenorland Minerals (KLD.V) – (KLDCF.OTC)

- 76.6 million shares outstanding

- $97.28M market cap based on its recent $1.27 close

- KLD website

Kenorland is a hybrid prospect generator that successfully deploys this often underappreciated biz model. The company boasts C$25.6 million in working capital, a highly prospective portfolio of projects with strategic JV’s, and a fat 4% NSR covering the high-grade Frotet gold discovery.

Recent newsflow:

Dec 9 – Kenorland Reports Regional Exploration Results from Northwestern Ontario Projects

Dec 17 – Kenorland Minerals Provides an Exploration Update and Grants Stock Options

Dec 20 – Kenorland Completes Top-Up Right from Sumitomo and Centerra

Mayfair Gold Corp. (MFG.V) – (MFGCF.OTC)

- 109.28 million shares outstanding

- $2187.97M market cap based on its recent $1.72 close

- MFG website

With the dust finally settled after a control-related brouhaha with this Timmins-based exploration and development play, Mayfair can now focus on generating shareholder value via its wholly-owned Fenn-Gib gold project where the current ounce-count stands at 4.313 million ozs Indicated (181.3M tonnes grading 0.74 g/t Au) and 140k ozs Inferred (8.92M tonnes grading 0.49 g/t Au).

Newsflow has been on the lean side since I last highlighted the company back in October:

Oct – 28 – Mayfair Announces the Appointment of Vice President of Corporate Development

Nov 14 – Mayfair Gold Q3 2024 Financial and Operating Results

Northern Superior Resources (SUP.V) – (NSUPF.OTC)

- 165.19 million shares outstanding

- $82.60M market cap based on its revcent $0.50 close

- SUP website

Viewed by some as one of the more obvious takeover candidates in the junior arena, Northern Superior is currently in the early innings of a 20k meter drill program designed to expand the mineralized footprint of its Philibert gold project. Philbert is a nine-kilometer hop from IAMGOLD’s Nelligan project in the Chibougamau Gold Camp of Quebec (SOQUEM currently owns 25% of the project).

Recent newsflow:

ONGold Resources (ONAU.V) – (ONGRF.OTC)

- 63.28 million shares outstanding

- $49.99M market cap based on its recent $0.79 close

- ONAU website

One of the better movers since it was highlighted in these pages last October, ONGold holds a portfolio of exploration assets in Northern Ontario, including the district-scale TPK and October gold projects. TPK hosts one of the largest unsourced gold-in-till anomalies in North America at 6 km x 11 kilometers.

Recent (acquisition-related) newsflow:

Nov 25 – Ongold Announces Agreement to Acquire the Monument Bay and Domain Projects in Manitoba

Dec 23 – AGNICO EAGLE ANNOUNCES ACQUISITION OF COMMON SHARES OF ONGOLD RESOURCES LTD

Orogen Royalties (OGN.V) – (OGNRF.OTC)

- 201.65 million shares outstanding

- $308.52M market cap based on its recent $1.53 close

- OGN website

Orogen Royalties is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The company’s expansive portfolio of royalties includes a 2.0% NSR on First Majestic’s Ermitaño gold and silver mine in Sonora, Mexico, and significantly, a 1% NSR on AngloGold Ashanti’s Expanded Silicon gold project in Nevada.

Recent newsflow:

Nov 26 – Orogen Royalties Announces Another Strong Quarter in Royalty Revenue

Jan 6 – Orogen Royalties Participates in BHP’s 2025 Xplor Accelerator Program

Jan 16 – Orogen Royalties Creates a New Royalty on the Si2 Gold Project

Probe Gold (PRB.V) – (PROBF.OTC)

- 182.19 million shares outstanding

- $357.10M market cap based on its recent $1.96 close

- PRB website

Probe blew away expectations last September when it dropped a world-class resource from its Val-d’Or East properties in Quebec—6,728,600 ounces (M&I) and 3,277,100 ounces (Inferred). The company is now in the midst of a 50,000-metre infill drill campaign to support a PFS due later this year.

Recent newsflow:

Jan 7 – Probe Gold Completes Acquisition of Stella Property in Val-d’Or, Quebec

Jan 14 – Probe Gold Establishes Community Integration Committee

Prime Mining (PRYM.V) – (PRMNF.OTC)

- 148.69 million shares outstanding

- $251.29M market cap based on its recent $1.69 close

- PRYM website

Prime Mining, which is no stranger to these pages, continues to advance its wholly-owned Los Reyes Gold-Silver Project in Sinaloa, Mexico where the ounce-count currently stands at 2.2 AuEq ozs (Indicated) and 800k AuEq ozs (Inferred).

Recent newsflow:

Dec 10 – Prime Intersects 42 g/t Gold Equivalent over 1 m at Guadalupe

Radisson Mining Resources (RDS.V) – (RMRDF.OTC)

- 345.74 million shares outstanding

- $112.37M market cap based on its recent $0.325 close

- RDS website

RDS is focused on advancing its wholly-owned O’Brien project located in the heart of one of the most productive gold mining camps along the Abitibi Greenstone Belt, the Cadillac Mining Camp. The past-producing O’Brien Mine, with its current ounce-count of 501,000 ounces Au Indicated (1,517,000 tonnes grading 10.26 Au) and 449,000 ozs Inferred ( 1,616,000 tonnes grading 8.64 g/t Au), was once crowned as the highest-grade Au producer in the province of Quebec.

Recent (assay-rich) newsflow:

Jan 13 – Radisson Provides 2025 Outlook and Exploration & Development Plans for the O’Brien Gold Project

Red Pine Exploration (RPX.V) – (RDEXF.OTC)

- 292.3 million shares outstanding

- $32.15M market cap based on its recent $0.11 close

- RPX website

Red Pine is giving its Wawa Gold Project (842k ozs Indicated + 843k ozs Inferred) along the Michipicoten Greenstone Belt of Ontario an aggressive push along the exploration/development curve. A fully funded 25k meter drill campaign is currently underway.

Recent newsflow:

Nov 12 – Red Pine Commences 2024-25 Drilling Program at the Wawa Gold Project

Ridgeline Minerals Corp. (RDG.V) – (RDGMF.OTC)

- 109.73 million shares outstanding

- $16.46M market cap based on its recent $0.15 close

- RDG website

Ridgeline is a hybrid prospect generator with multiple projects along the Carlin Trend, the Battle Mtn–Eureka Trend, and the ‘Emerging Porphyry/CRD Trend’ in mining-friendly Nevada. On the JV side of its project portfolio, its Swift and Black Ridge projects have been optioned to Nevada Gold Mines (a JV between Barrick & Newmont). Its Selena project has been dealt out to South32.

Recent newsflow:

Dec 18 – Ridgeline Minerals Provides Year-End Exploration Update for its Nevada Portfolio

Jan 7 – Ridgeline Minerals Stakes High-Grade, Carlin-Type Gold Project in Nevada

Riley Gold Corp. (RLYG.V) – (RLYGF.OTC)

- 42.18 million shares outstanding

- $5.06M market cap based on its recent $0.12 close

- RYLG website

Riley Gold is another Nevada-focused exploreco with a project portfolio centered on established gold trends (Battle Mountain–Cortez–Eureka and Walker Lane). The company’s Pipeline West/Clipper (PWC) project, optioned to Kinross, grants the producer the right to earn up to 75% via a minimum spending commitment of US$20 million.

Newsflow out of Riley has been a tad lean in recent months:

Summa Silver (SSVR.V) – (SSVRF.OTC)

- 118.06 million shares outstanding

- $43.09M market cap based on its recent $0.365 close

- SSVR website

Summa Silver is focused on two key past-producing assets: the Hughes Project in central Nevada and the Mogollon Project in southwestern New Mexico. Either project could serve as the company’s flagship.

Recent newsflow:

Teuton Resources (TUO.V)

- 57.75 million shares outstanding

- $58.32M market cap based on its recent $1.01 close

- TUO website

Treaty Creek, ranked in the Top Ten (undeveloped) gold deposits globally, boasts an ounce-count of 27.87 million AuEq ozs in the Indicated category (21.66 Moz of Au at 0.92 g/t, 128.73 Moz of Ag at 5.48 g/t, and 2.87 billion pounds of Cu at 0.18%) and 6.03 million AuEq ozs in the Inferred category. The company holds a 20% (carried) interest in Treaty Creek, along with an extensive portfolio of properties and royalties in the prolific Golden Triangle of northwestern BC.

Recent newsflow:

Jan 23 – Teuton Announces Spin-Out of Luxor Project

West Point Gold (WPG.V) – (WPGCF.OTC)

- 65.86 million shares outstanding

- $21.73M market cap based on its recent $0.33 close

- WPG website

Boasting a highly prospective project portfolio, West Point is currently focused on delivering a maiden (high-grade) near-surface resource at its Gold Chain Project in Arizona. Management believes Gold Chain holds multi-million oz potential in its immediate subsurface layers. Values flowing from a recently completed 1,264-meter drill campaign are beginning to validate that belief.

Recent (assay-related) newsflow:

Other companies worthy of your due diligence include names like Anton Resources (AAN.V), Aldebaran Resources (ALDE.V), Azimut Exploration (AZM.V), Hercules Metals (BIG.V), Dolly Varden Silver (DV.V), GFG Resources (GFG.V), Kuya Silver (KUYA.C), Hannan Metals (HAN.V), Lavras Gold (LGC.V), Ramp Metals (RAMP.V), Rio2 Limited (RIO.V), Skeena Resources (SKE.TO), Western Alaska Minerals (WAM.V), and West Vault Mining (WVM.V).

END

Greg Nolan

Full disclosure: the author owns shares of Forum Energy Metals (FMC.V), OnGold Resources (ONAU.V), Radisson Mining (RDS.V), Red Pine Exploration (RPX.V) and Amarc Resources (AHR.V). Consider the author especially biased where these names are concerned.