Gold is extending its gains, with tremendous drama, taking out all-time highs in every currency around the globe. The chart below reflects price action on the spot market (US dollar trading)…

And suddenly—finally—there appears to be life in the junior exploration arena. The breakout in the TSX Venture, aka the CDNX, looks decisive, and it could have legs. This, after chopping sideways and testing resistance multiple times over the past few months (horizontal blue line, chart below)…

Before we look at some of the junior gold, silver and copper exploreco’s highlighted in my Jan 27 report, a weighty update from Forum Energy Metals.

>>Note that the first installment of this report is in collaboration with Forum Energy Metals (Highballer is compensated by the company for this content)<<<

Forum Energy Metals (FMC.V) – (FDCFF.OTC)

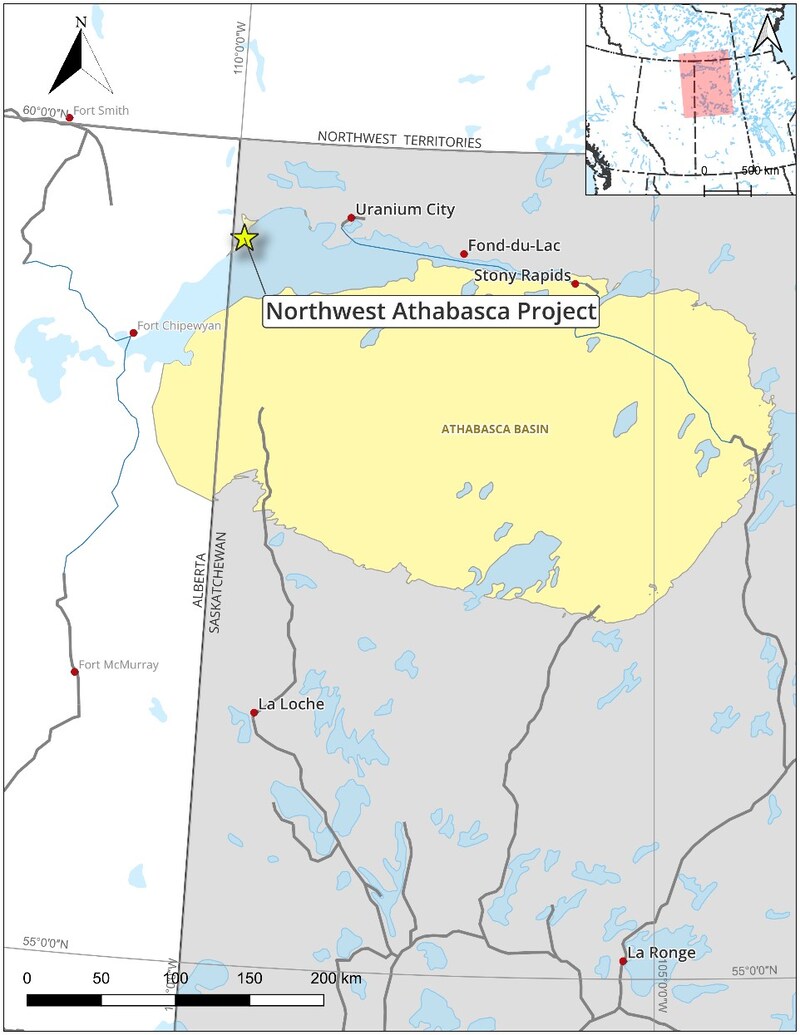

While Forum’s wholly-owned Aberdeen Project (recently updated here) garners flagship status, the company also controls a vast pipeline of projects in the prolific Athabasca Basin of Saskatchewan, nine of which are drill-ready.

The company’s Northwest Athabasca Joint Venture (NWA), where the ownership split currently stands at 45.4% Forum, 25.3% NexGen, 18.0% Cameco and 11.3% Orano, has generated some compelling newsflow in recent sessions.

The project, located along the northwest shore of Lake Athabasca, is being prepped for an imminent drilling campaign.

Forum’s VP of Exploration, Dr. Rebecca Hunter, characterizes NWA as the company’s ‘second-best’ project in the company’s project pipeline. Along with its lineup of twenty-plus high-priority drill targets, the project has a historical (non-NI 43-101 compliant) 1.5 million lb resource grading 0.6% U3O8.

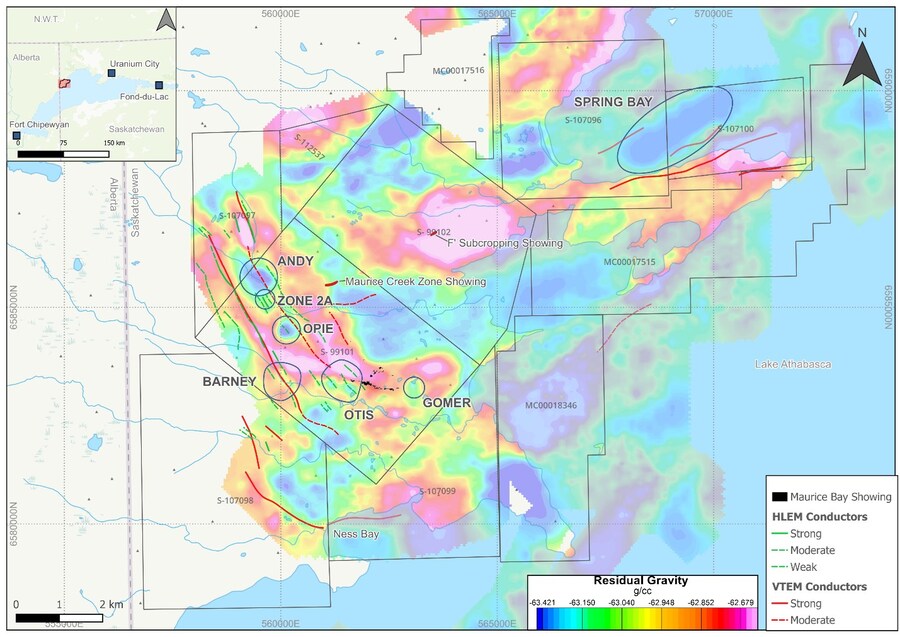

The objective for this round of exploration is to drill between 2,000 and 3,000 meters, prioritizing the Andy, Zone 2A, and Opie zones (map below). If time allows, Gomer and Spring Bay will also receive a proper probe with the drill bit.

Drilling is expected to commence by the beginning of March. In the meantime, additional geophysical surveys—gravity, resistivity and detailed magnetics—will be initiated (once the winter camp is in place).

For this decisive push along the exploration curve, Forum dealt out an option to Global Uranium (GURN.C) who can earn up to 75% of Forum’s 45.4% interest in the project by spending $20M on exploration (details of the earn-in deal can be perused here).

The two recent headlines:

Quoting the February 4th press release:

The Northwest Athabasca Project is located along the northwest shore of Lake Athabasca on the margin of the Athabasca Basin 1,000 km north-northwest of Saskatoon along the Alberta – Saskatchewan provincial border. Numerous showings that host modest-to-significant uranium mineralization have been identified on the project, including the Zone 2A area, which intersected basement-hosted mineralization grading 5.69% over 8.5 meters from drill hole Z2A-12 (Uranerz). Other areas of interest include Opie (0.14% U3O8 over 7.6 m), Maurice Creek Showing (5 to 30 ppm U in sandstone), F-Subcropping (270 ppm U in sandstone), Ness Bay (100 to 2000 ppm U), Barney (2.33% U3O8 over 0.1 m), Otis West (up to 6,250 ppm U), and Spring Bay (untraced uriniferous boulder field; 0.05% U3O8 over 3 m in sandstone – drill hole NWA-001).

The project consists of 11 contiguous mineral claims covering 13,876 ha. Exploration began on the Northwest Athabasca Project in the 1970s after the discovery of uraniferous boulders of Athabasca Group sandstone near Fiddler Point. Diamond drilling at the inferred apex of one of the boulder fans led to the discovery of unconformity uranium mineralization near Maurice Bay in 1976 by Uranerz Exploration and Mining Ltd. A non-43-101 historical resource estimate was documented at 1.5 million lbs at 0.6% U3O8 for the Maurice Bay Showing1,2. Uranium mineralization is hosted in 3 zones (Main, A, and B), with the Main zone associated with an east-southeast-trending fault system with approximately 30 m of normal-fault offset (south side down). The A and B zones are situated north of the Main zone within the basement rocks along reactivated normal faults and cross-cutting northeast-trending faults.

- ¹Lehnert-Thiel, K., and Kretschmar, W., 1979, The discovery of the Maurice Bay uranium deposit and exploration case history (abs.): Canadian Institute of Mining and Metallurgy District 4, Fourth Annual Meeting, Winnipeg, 1979, unpublished manuscript, 3 p.

- ²The historical resource estimate, however, was not prepared in accordance with the requirements of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). While the Company believes the historical estimate to be relevant given the extensive exploration work completed by Uranerz, a qualified person has not completed sufficient work to verify and classify the historical estimate as a current mineral resource and the Company is not treating the historical estimate as a current mineral resource. As such, the historical estimate should not be relied upon.

The 8.5 meters of 5.69% U3O8 tagged along the 2A zone was a solid hit, but it was never followed up and isn’t well understood. The zone will be a priority for Forum’s team of geological sleuths during this phase of exploration. Success in extending its high-grade mineralization could generate excitement (high-grade discoveries in the Athabasca Basin garner heaps of attention in this market).

Forum will serve as operator for this drilling campaign.

A very recent YouTube interview with Forum’s CEO Rick Mazur (‘Drilling Set To Commence In March At The Northwest Athabasca Joint Venture’)...

The current lousy sentiment in the U3O8 arena may represent a buying opp in aggressive, discovery-hungry U3O8 juniors like Forum Energy Metals. In this era of heightened geopolitical risk and increasingly tight supply chains, securing domestic sources of the energy-dense metal is taking on greater urgency. Forum, with its multiple irons in the fire, is poised to capitalize on said urgency.

This just in…

Rounding up a few of the juniors that intrigue me…

As noted at the top of the page, a pulse has been detected in the junior exploration arena…

What follows are some recent developments, along with a few observations, concerning a select few highlighted in my January 27 report:

AbraSilver Resource Corp. (ABRA.V) – (ABBRF.OTC)

AbraSilver had no problem closing its recently tabled PP as it pushes its wholly-owned (high-grade) Diablillos Project aggressively along the curve – ABRASILVER ANNOUNCES CLOSING OF $30 MILLION PUBLIC OFFERING OF COMMON SHARES.

In connection with this PP, it appears Eric Sprott still has an appetite for ABRA paper – Eric Sprott Announces Changes to His Holdings in AbraSilver Resource Corp.

The stock has seen a nice lift off its late December lows…

Abitibi Metals Corp. (AMQ.C) – (AMQFF.OTC)

On January 30, AMQ reported assays from phase-2 drilling at its flagship B26 Polymetallic Deposit in Quebec – Abitibi Metals Continues Drilling High Grade at B26, 8.72% CuEq over 3.2 Metres within 2.24% CuEq over 20.6 Metres.

Highlights included extensions of its Mid-Level and Eastern Satellite Targets:

- #343 – 1.65% CuEq over 7.4 metres beginning at 640.6 metres depth, including 4.73% CuEq over 2.0 metres;

- #347 – 1.82% CuEq over 12.5 metres beginning at 514 metres depth, including 2.8% CuEq over 7.85 metres;

- #349 – 2.2% CuEq over 4.0 metres beginning at 571 metres depth;

- #355 – 2.24% CuEq over 20.6 metres beginning at 72.3 metres depth, including 8.72% CuEq over 3.2 metres.

The company also bulked up its management team via this February 4 headline – Abitibi Metals Expands Senior Management Team.

Amarc Resources (AHR.V) – (AXREF.OTC)

Amarc hasn’t dropped any headlines since my last report, but the stock has firmed up in anticipation of the next round of JOY Project assays (JOY is a JV with mining giant Freeport-McMoRan).

Recent price action…

I spoke too soon. This headline just landed in my inbox…

American Eagle Gold Corp. (AE.V) – (AMEGF.OTC)

American Eagle recently tabled plans concerning its flagship NAK Project in the Babine Copper-Gold Porphyry district of central British Columbia – American Eagle Gold Announces Plans for 2025 Exploration at NAK.

Key Targets Due for a Proper Probe with the Drill Bit in 2025…

North Zone:

- Historically defined by near-surface vein and disseminated chalcopyrite mineralization in sedimentary rocks.

- Expanded in 2022-2023 to include deeper bornite-rich conglomerate and monzonite dykes.

- 2024 drilling extended the zone northeast, encountering broad intervals of seriate-textured dykes with disseminated bornite.

- The Northeast Expansion Zone will be an immediate and large focus to expand the North Zone, which remains open to the north, east and at depth, with step-out drilling planned to refine its orientation and extent.

Central Zone:

- The Central Zone links the historical North and South zones. It returned significant intercepts at depth in all of American Eagle’s 2022-24 drilling, but little systematic drilling has been undertaken to date at shallower depths, up-dip of those intersections.

South Zone:

- Hosts a large-scale gold-rich quartz stockwork mineralized body at surface.

- Drilling will link the mineralized conglomerate intersected in NAK24-17 and -31 with the broader South Zone.

Step-Out Targets and Emerging Zones

- The Southeast Expansion Zone, south of the Babine porphyry, returned long intervals of anomalous gold and copper in NAK22-09 and -36. Soil sampling and mineralized outcrops indicate further potential.

- The East Expansion Zone will utilize additional geophysical surveys to refine targets within and around the Babine porphyry, with scout drilling planned to test these areas.

Amerigo Resources Ltd. (ARG.TO) – (ARREF.OTC)

Amerigo, the profitable Chilean Cu producer on my list that dividends a healthy chunk of its profits to shareholders, dropped the following headline on January 29 – Amerigo’s MVC Copper Operation Attains Significant Safety Milestone.

This safety-related milestone (three consecutive years without lost-time accidents), stemming from its flagship Minera Valle Central operation, which processes fresh and historic tailings from Codelco’s giant underground El Teniente mine, shouldn’t be dismissed. It adds validity to the competence of management.

The stock has firmed up neatly since my last report two weeks back…

ATEX Resources (ATX.V)

There’s been no real news since my last report concerning ATEX, but the stock continues to push higher in this buoyant market… a buoyancy bolstering its Valeriano Copper Gold Project along an emerging copper-gold porphyry belt—a mineral belt linking the prolific El Indio High-Sulphidation Belt to the south with the Maricunga Gold Porphyry Belt to the north in mining-friendly Chile.

This ’emerging belt’ hosts several copper-gold porphyry deposits at various stages of development, including Filo del Sol (BHP / Lundin Mining), Lunahausi (NGEx Minerals), Josemaria (Lundin Mining), La Fortuna (Teck Resources/Newmont) and El Encierro (Antofagasta/Barrick Gold).

Collective Mining (CNL.TO) – (CNL.NYSE)

Collective Mining is turning into one of my better picks as it continues to deliver stellar results from its Guayabales Project in Caldas, Colombia.

The values highlighted in the text of the following February 4 headline speak for themselves – Collective Mining Expands the High-Grade Ramp Zone by Intersecting 51.95 Metres at 8.38 g/t AuEq Including 18.05 Metres at 16.32 g/t AuEq.

Drill hole highlights from the New Ramp Zone discovery, its deepest hole drilled to date along the Apollo system (the hole bottomed in mineralization at approximately 1,200 meters below surface):

- Hole APC103-D2 was drilled from mother hole APC-103D in a southwest direction to intersect the Ramp Zone, extending the vertical dimension of the zone by 150 metres where it remains open. The hole cut impressivehigh-grade gold mineralization over two zones before being stopped while in mineralization in the latter zone with assays results as follows:

- 51.95 metres @ 8.38 g/t gold equivalent from 227.10 metres including;

- 18.05 metres @ 16.32 g/t gold equivalent from 259.85 metres and;

- 18.05 metres @ 16.32 g/t gold equivalent from 259.85 metres and;

- 18.50 metres @ 3.84 g/t gold equivalent from 340.30 metres and bottoming in strong mineralization.

- 51.95 metres @ 8.38 g/t gold equivalent from 227.10 metres including;

- APC103-D1 was also drilled towards the southwest portion of Apollo and directed to laterally step-out eastwards along strike from the original discovery hole of the Ramp Zone (APC99-D5; see press release dated October 22, 2024). APC103-D1 cut a broad interval of continuous mineralization with assay results as follows:

- 48.30 metres @ 3.00 g/t gold equivalent from 396 metres including;

- 13.60 metres @ 5.16 g/t gold equivalent from 421 metres

- 48.30 metres @ 3.00 g/t gold equivalent from 396 metres including;

Personal note: I regret dumping my CNL position a few months back while growing bored with the sideways grind. I meant to restore my original position, but the market took off. There’s a lot to be said for ‘Be right… sit tight.’

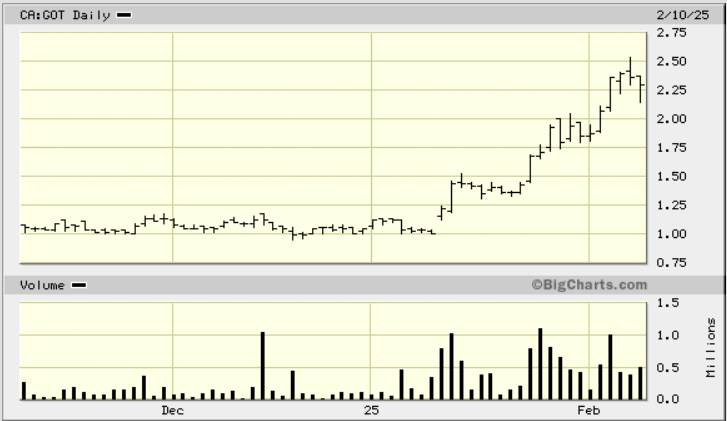

Goliath Resources Ltd (GOT.V) – (GOTRF.OTC)

On February 10 Goliath trotted out a fresh round of assays from its high-grade Golddigger Property in the prolific Golden Triangle of northwestern BC – Goliath Drills Intrusive Feeder Assaying 12.03 g/t AuEq Over 10.00 Meters Including 19.91 g/t AuEq Over 6.00 Meters And Discovers Five New Stacked Gold Veins That Remain Open Confirming An Extensive Gold Rich Source At Depth On Surebet, Golden Triangle, B.C.

The highlight interval—drill hole GD-22-58—is in the text of the headline. GD-22-58 is interpreted as ‘an intrusion-related feeder dyke that remains open, strongly indicating close proximity to a large gold-rich intrusive source at depth (Reduced Intrusion Related Gold system, RIRG).’

Though the stock saw some profit taking on this news.

Kenorland Minerals (KLD.V) – (KLDCF.OTC)

Kenorland, a hybrid prospect generator that successfully deploys this often underappreciated biz model, recently outlined plans for its Frotet Project in northern Quebec, a project joint ventured to Sumitomo Metal Mining Canada Ltd – Kenorland Commences 2025 Winter Drill Program at the Frotet Project, Quebec.

Sumitomo now owns 100% of Frotet, but Kenorland holds a fat 4% NSR on this high-grade project. Kenorland will also serve as operator for a winter drill campaign consisting of up to 23,000 meters of diamond drilling.

Quoting this Jan 30 press release:

The Winter 2025 drill program has been planned to increase confidence of the vein system geometry and grade continuity within the central portion of the Regnault gold system. Approximately 80% of the planned drilling (26 drill holes) will be targeting infill and step-outs along the R1, R5, R6, and R7 mineralised structures, optimised to step-out along known mineralisation at depth along the R2, R8 and R9 vein sets. The planned drill holes will continue to infill along the R1 vein system to 50m spacing or less, while targeting the R5, R6, R7, R8 and R9 mineralised structures with 50-100m infill and step-out spaced drill holes. Within the southern portion of the system, two deep drill holes for approximately 10% of the planned program will step-out along the R2, R9, R10 and R11 mineralised structures down to a depth of 1,000m below surface, following up on significant mineralisation returned from drill hole 23RDD172 with 41.85m at 2.56 g/t Au including 4.45m at 11.96 g/t Au along R11. The remaining 10% of drilling (six drill holes) will target additional infill and step-out targets along the R2 (west), R3 and R4 vein sets.

Mayfair Gold Corp. (MFG.V) – (MFGCF.OTC)

The day after I published my last report, Mayfair trotted out a new CEO to help push its wholly-owned Fenn-Gib gold project along the exploration and development curve – Mayfair Gold Names Nicholas Campbell as CEO.

With its modest market cap of $200M, Mayfair may represent one of the more obvious takeover candidates in the junior arena. Its mineral endowment of 4.313 million ozs Indicated and 140k ozs Inferred—a weighty ounce count with a mining-friendly address (the Timmins region of Northern Ontario)—might prove difficult for a resource-hungry producer to resist.

Orogen Royalties (OGN.V) – (OGNRF.OTC)

Orogen, with its extensive portfolio of royalties, released drill results from First Majestic’s Ermitaño gold and silver mine in Sonora, Mexico, a project where the company holds a cash-flowing 2% NSR – Orogen Royalties Announces the Expansion of the Navidad Gold-Silver Target at Ermitaño.

Drill hole highlights from expanded zones of gold and silver mineralization (Navidad and Winter veins):

- EW-24-372-A grading 13.06 grams per tonne (“g/t”) gold and 205 g/t silver over 3.24 metres (Navidad vein)

- EW-24-372-A grading 8.60 g/t gold and 77 g/t silver over 4.83 metres (Winter vein)

- EW-24-373 grading 5.64 g/t gold and 104 g/t silver over 6.06 metres (Winter vein)

- EW-24-377 grading 7.09 g/t gold Au and 125 g/t Ag over 3.30 metres (Winter vein)

- EW-24-379 grading 7.09 g/t gold and 38 g/t silver over 2.32 metres (Navidad vein)

- EW-24-382 grading 13.93 g/t gold and 99 g/t silver over 2.66 metres (Winter vein)

Probe Gold (PRB.V) – (PROBF.OTC)

Probe, currently in the midst of a 50,000-metre drill program to increase the confidence in its recently released Novador Project resource (6,728,600 ounces M&I – 3,277,100 ounces Inferred), released a large batch of assays from this infill campaign – Probe Gold Reports Infill Drilling Results with Grades Up to 3.8 g/t Au Over 17.4 Metres (Cut) at the Novador Project, Quebec.

The highlight interval is in the text of the headline.

The stock continues to consolidate at its (multi-year) all-time highs…

Prime Mining (PRYM.V) – (PRMNF.OTC)

Is it my imagination, or are Mexican-based development projects gaining favor? Mexico’s mining regulators appear to be divvying out more permits these days.

On Jan 30, Prime trotted out additional drill hole results from its mothership Los Reyes Gold-Silver Project in Sinaloa, Mexico, where the ounce count currently stands at 2.2 AuEq ozs (Indicated) and 800k AuEq ozs (Inferred) – Prime’s Central Trend Continues to Deliver Strong Grades and Continuity, Defining a 400-metre High-Grade Shoot at Noche Buena.

Highlights from this round:

- 3.48 g/t AuEq (3.12 g/t Au and 27.7 g/t Ag) over 7.6 meters estimated true width (ETW) in hole 24NB-78, including:

- 8.64 g/t AuEq (7.8 g/t Au and 64.8 g/t Ag) over 2.8 meters ETW, including:

- 16.22 g/t AuEq (15.00 g/t Au and 94.0 g/t Ag) over 1.4 meters ETW;

- 2.16 g/t AuEq (1.75 g/t Au and 31.9 g/t Ag) over 11.3 meters ETW in hole 24NB-67, including:

- 8.65 g/t AuEq (7.42 g/t Au and 95.3 g/t Ag) over 2.3 meters ETW;

- 1.65 g/t AuEq (1.03 g/t Au and 47.6 g/t Ag) over 11.2 meters ETW in hole 24NB-77, including:

- 4.24 g/t AuEq (2.40 g/t Au and 142.0 g/t Ag) over 1.8 meters ETW.

The stock has firmed up nicely over the past month…

Radisson Mining Resources (RDS.V) – (RMRDF.OTC)

Radisson, focused on advancing its wholly-owned O’Brien project, located in the heart of the Cadillac Mining Camp of the Abitibi Greenstone Belt, released positive metallurgical results, a key catalyst cited by loyal shareholders – Radisson Announces Positive Metallurgical Study at O’Brien and Provides Update on Milling Assessment at IAMGOLD’s Doyon-Westwood Complex.

Highlights from the metallurgical program undertaken at the Lakefield facilities of SGS Canada under the supervision of Ausenco Engineering Canada:

- Gold recovery of 86% based on a simple flow sheet of Gravity-Leach;

- Gold recovery of 90% based on a Gravity-Flotation-Regrind-Leach flow sheet;

- Gold recoveries of between 94% and 96% based on the sale of a flotation concentrate in a Gravity-Flotation-Concentrate Sale flow sheet after consideration for payability factors of 90% to 95% respectively; and

- Average arsenic values of 0.4% to 0.5% in whole rock and 4.6% in flotation concentrate, consistent with precedent projects in Québec’s Abitibi and offtake threshold limits for concentrates of high-grade gold projects.

The past-producing O’Brien Mine, with its current high-grade ounce-count of 501,000 ounces Au Indicated (1,517,000 tonnes grading 10.26 Au) and 449,000 ozs Inferred ( 1,616,000 tonnes grading 8.64 g/t Au), was once crowned THE highest-grade Au producer in the province of Quebec. This growing (high-grade) resource is viewed as a likely takeover target in an active mining region with hungry mills to feed.

The stock is currently trading at the upper end of its multi-year range…

Red Pine Exploration (RPX.V) – (RDEXF.OTC)

Red Pine, in the midst of a 25k meter drill campaign at its Wawa Gold Project (842k ozs Indicated and 843k ozs Inferred) along the Michipicoten Greenstone Belt of Ontario, delivered an update early last week – Red Pine Drilling Expands Gold System at Wawa Gold Project.

The company states that two rigs are currently testing a zone representing a deep extension beyond the limits of its current resource block.

Highlights:

- Three drill holes that tested the extensions of the Jubilee Shear at depth intersected quartz veins with visible gold approximately 170 m and 100 m away from the closest intersections, including in the deepest intersection ever completed in the Jubilee Shear.

- Intersected the Minto Vein with visible gold more than 100 m away from previous drilling.

- Relogged drill core found significant gold (“Au”) mineralization grading 5.81 g/t Au over 2.16 m at depth in the Jubilee Shear.

Rio2 Ltd (RIO.V) – (RIOFF.OTC)

After receiving all the required permits and securing all the necessary funds to move their Fenix Gold Project forward, Rio2 is breaking ground in the Atacama region of Chile – Rio2 Announces Official Start of Construction of Fenix Gold Mine.

The Fenix project holds an ounce count of 4.8 million ozs of gold M&I and 959,000 ozs Inferred in its subsurface layers. According to a September 2023 Feasibility Study, using a conservative $1650 Au price input, Fenix will deliver an after-tax NPV5% of $210.3 million, an IRR of 28.5%, and a payback of 2.8 years.

The projected construction capex for 2025 is estimated to be USD 122 M (excluding Chilean VAT tax which is refundable) with construction expected to be completed in November 2025. First gold production is currently guided for January 2026.

Rio2 boasts a very decent 1-year price chart……

Skeena Resources (SKE.TO) – (SKE.NYSE)

Skeena, no stranger to these pages, can also boast a very decent 1-year price chart… the upside of buoyant metal prices and a world-class (open-pit) resource in the prolific Golden Triangle of northwestern BC.

Skeena’s flagship asset is the past-producing Eskay Creek Project where the P&P reserve base currently stands at 4.6 million gold equivalent ozs. Fully funded, the company is advancing its tier-1 asset further along the development curve.

With a (precious metals) mix of roughly 65% gold and 35% silver, Skeena rebranded itself on January 31 to reflect its significant Ag endowment (88 million ozs P&P) – Skeena Gold & Silver Announces Rebrand to Reflect Significant Silver Component at the Eskay Creek Project.

Its 1-year chart…

Teuton Resources (TUO.V)

Teuton warrants attention due to the recent price action in its JV partner, Tudor Gold (TUD.V), bouncing hard off its lows, potentially setting the stage for further gains… especially if the metal continues to rip higher. Tudor is earning a 60% interest in Treaty Creek, ranked in the Top Ten (undeveloped) gold deposits globally—27.87 million AuEq ozs in the Indicated category (21.66 Moz of Au at 0.92 g/t, 128.73 Moz of Ag at 5.48 g/t, and 2.87 billion pounds of Cu at 0.18%) and 6.03 million AuEq ozs in the Inferred category.

Teuton, the original owner of Treaty Creek, enjoys a carried 20% interest in the project—Tudor must foot the entire exploration bill until such time as a production decision is made.

Significantly, Teuton also holds a 0.98% royalty covering a core portion of Treaty Creek (the Goldstorm/CB zones) and a 0.49% royalty covering the peripheral claims, neither of which are subject to a clawback (American Creek owns the remaining 20% carried interest in the project).

Teuton was good for a 14% pop yesterday (Feb. 10) as it plays catch up to Tudor’s recent price action…

Lastly…

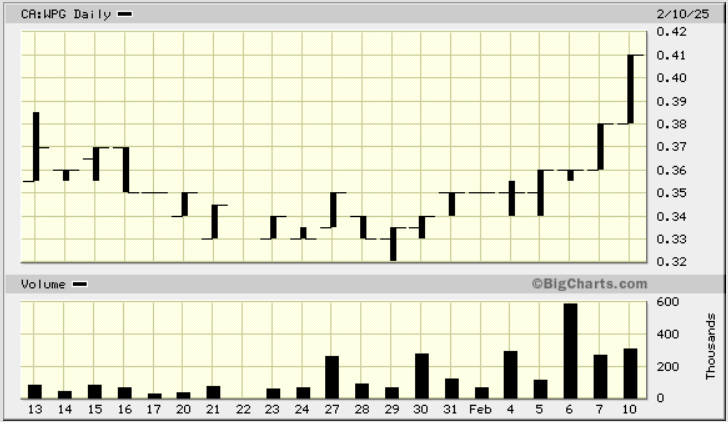

West Point Gold (WPG.V) – (WPGCF.OTC)

The shares of West Point have firmed up nicely in recent sessions. The stock tacked on an additional 8% during the Feb. 10 session after the company bulked up the advisory side of its exploration team with the serially successful Andrew Bowering – West Point Gold Names Andrew Bowering as Strategic Advisor.

Quoting this February 10 press release:

Andrew Bowering is a renowned venture capitalist with over 35 years of experience building shareholder value through mineral exploration, project development, strategic acquisitions and large-scale equity financings. He has founded, funded, and led teams in the pursuit of various metals, from initial exploration to production. Mr. Bowering has held senior management roles, overseeing asset acquisitions and sales and the raising of over $500 million in development capital. He is the founder, director and large shareholder of Prime Mining Corp and Apollo Silver. He co-founded Millennial Lithium Corp (acquired by Lithium Americas) and is actively involved in other publicly traded companies in the battery and precious metals sectors.

A 1-month snapshot of West Point’s trading action…

That’s all for now.

END

—Greg Nolan

Full disclosure: The author is a shareholder in the following companies (which may influence his perspective): Forum Energy Metals, Amarc Resources, Radisson Mining.