With Spot Uranium testing triple-digits—currently trading at $100/lb—those in the bull camp believe the momentum witnessed over the past eight months will continue. Unabated. The fundamentals underpinning the energy-dense metal are highly supportive as the world looks to rebuild supply chains that have all but vanished.

While many of the higher-quality equities have tacked on substantial price gains and generated powerful uptrends over the past year—bellwether Cameco and advanced developers’ NexGen and Fission come to mind—many of the smaller explorer/developers are still trading at modest valuations. In this buoyant environment, these smaller entities should begin attracting a broader audience.

Companies with high-quality assets on the cusp of an aggressive push along the exploration curve—those boasting resource expansion and discovery potential—stand to generate significant positive (price chart) trajectory if they meet with success via the business end of the drill bit.

- 256.39 million shares outstanding

- $37.18M market cap based on its recent $0.145 close

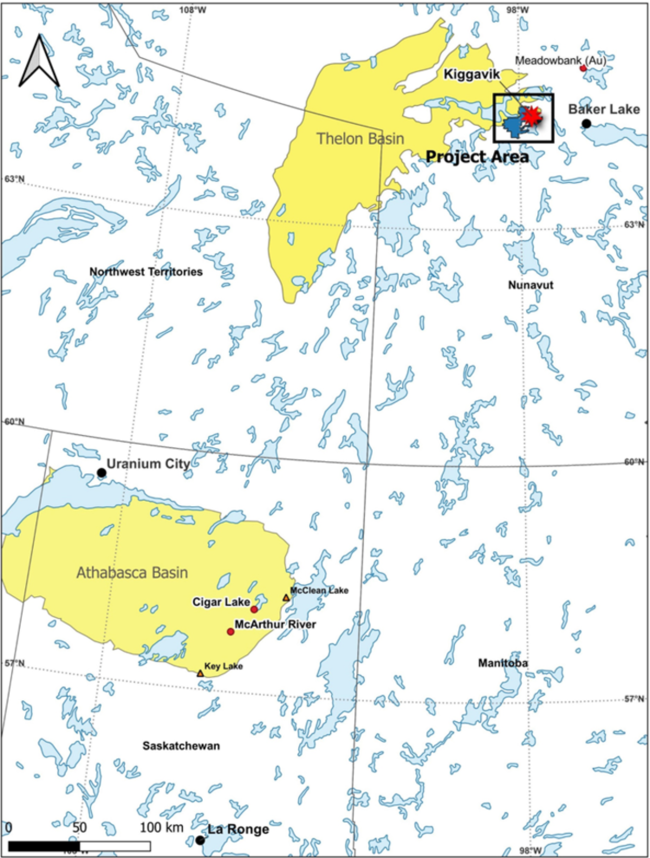

As a refresher, Forum’s Thelon Basin Project in Canada’s Nunavut Territory stands as its flagship asset. This is vastly under-explored territory. The thinking among the geological sleuths running the show here is that the Thelon Basin is the closest geological analog we have to the prolific Athabasca Basin further south. And due to a lack of systematic exploration, it may be where the Athabasca Basin was a half-century ago, before Cigar Lake and McArthur River lit up the global U3O8 map.

There are three deposits at the development stage in this Basin—the Kiggavik, Andrew Lake, and End deposits—codenamed the Kiggavik Uranium Project, pounds-in-the-ground that represent 133 million lbs of uranium controlled by Orano and Uranium Energy. Forum’s ground surrounds this impressive mineral endowment.

Forum dominates this vastly under-explored region. Its land position captures 95,518 hectares of highly prospective terrain, including claims formerly held by Uranium bellwether Cameco Corp—ground the U3O8 colossus poured $50M into when it drilled 135 holes for 36,000 meters between 2008 and 2012. Forum’s CEO, Rick Mazur, snagged these claims in a real heads-up move before anyone else noticed that Cameco allowed them to lapse. The cost to the company? $150k.

In another heads-up move, CEO Mazur hired Dr. Rebecca Hunter as his company’s VP of Exploration. Dr. Hunter guided Cameco’s exploration effort on this very ground while employed as a project geologist from 2005 to 2016. Her ability to sleuth the Basin’s subsurface layers led to the discovery of two unconformity-style uranium deposits: the Tatiggaq deposit and the Qavvik deposit (also the Ayra showing).

Forum believes the next big unconformity-type uranium discovery will emerge from its substantial land position in the Basin. Unconformity-type deposits stand out from other U3O8 deposits due to their superior grades. Where most U3O8 deposits scattered around the globe run grades less than 0.5%, unconformity deposits often run greater than 1% (a 1% U3O8 hit is roughly equivalent to a 15 g/t Au hit).

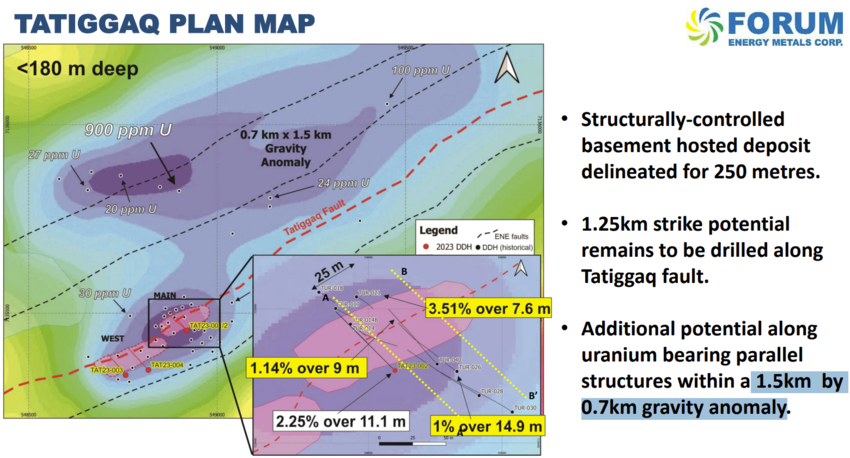

Tatiggaq

Last September, Forum lit up trading screens when they began releasing assays from a modest four-hole drill program that demonstrated high-grade, unconformity-style uranium mineralization along a 250-meter trend at the Tatiggaq zone. Intercepts included 2.25% U3O8 over 11.1 meters, 1.01% U3O8 over 6.2 meters, and 0.40% over 12.8 meters. There’s another 1.25 kilometers of untested strike potential along this high-grade zone.

Tatiggaq is 50 meters wide (so far). It’s demonstrating good mineralized continuity, and there’s (untested) potential at depth.

There’s also potential for additional discoveries—parallel structures—within this 1.5 km by 0.7 km gravity anomaly (above map).

Though it’s still early stage, Tatiggaq’s mineralization, with its multiple steep dipping lenses, bears similarities to NexGen’s Arrow and Cameco’s Eagle Point deposits.

The Drill Plan

The company is currently laying the groundwork for an aggressive 10,000 to 12,000-meter drill campaign after closing a $10.4 million private placement back in mid-December. 75% of their exploration budget will be directed at expanding the mineralization at Tatiggaq.

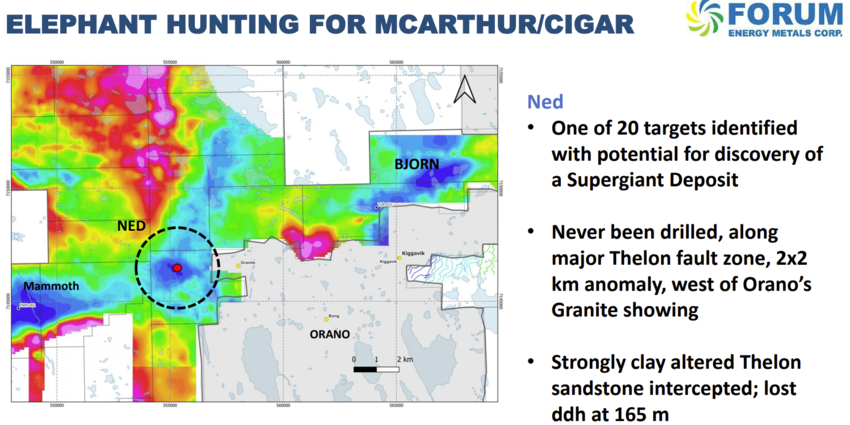

The remaining 25% will be aimed at high-priority regional targets where the company has sandstone/basement unconformity targets—McArthur/Cigar–style deposits—in its crosshairs.

One regional target the company is anxious to test—a target they deem especially fertile for unconformity-related uranium mineralization—is NED, which lies within a 2km by 2km anomaly along the major east-northeast-trending Thelon Fault, just to the west of Orano’s Granite showing.

Regarding the NED target, Dr. Hunter: “The Ned Anomaly is one of numerous targets identified on the property that could host a major uranium deposit in addition to our Tatiggaq deposit. The elevated uranium and pathfinder elements from drilling into the sandstone suggests the area is fertile for hosting unconformity-related mineralization in the vicinity of this very large anomaly. The clay alteration and bleached rock encountered in the drillhole is typical of what is observed within the sandstone column overlying unconformity-related uranium deposits in the Athabasca. I am encouraged by these results and look forward to getting back to drill this target in 2024.”

In order to further fine-tune targets for a proper probe with the drill bit, Forum ran an ANT survey (Ambient Noise Tomography)—a tool that can provide structural information along both regional and localized scales—over its Tatiggaq, Ned, and Bjorn targets. The company is currently processing the results and we might hear something on that front soon (there’s potential to line up some positive correlations with this tech).

This upcoming 10 to 12,000-meter drill campaign will utilize two rigs. Mobilization begins in March. The camp goes up in May. Drilling is scheduled to commence on June 1 and is expected to run roughly four months. We should see the first assays in early September, though Forum probes each hole with a downhole radiometric probe to detect radioactivity.

To bolster the company’s commitment to bring the local communities up to speed on all matters relating to the exploration cycle and to cultivate an atmosphere of fairness and cooperation, the company announced a new hire – Forum Announces Allison Rippin Armstrong Appointed Vice President, Nunavut Affairs.

Allison Rippin Armstrong comes on as Vice President of Nunavut Affairs. A biologist and environmental scientist, her impressive resume includes over 25 years of experience in community relations, government relations, environmental stewardship, and corporate governance in Nunavut, Northwest Territories, Yukon, British Columbia, Alaska, and Botswana.

CEO Mazur: “Forum is building its team and commitment to comprehensive exploration practice on its uranium discovery in Nunavut. We have a deep appreciation for the Inuit Qaujimajatuqangit (Traditional Knowledge) in the implementation of our drilling program. Allison has an exemplary record in the field of Environment, Social and Governance practice. Through Allison’s leadership, Forum will build relationships in the local communities of the Kivalliq region of Nunavut, indigenous organizations, territorial and federal governments and regulatory agencies.”

Allison Rippin: “Forum is a great company, I am excited to work with them again! Nunavut holds a special place in my heart, I have had the privilege to work in both the Kitikmeot and Kivalliq regions. The cold winter temperatures are offset by the warmth of the people who live there.”

This interview featuring both CEO Mazur and Allison Rippin went live earlier today …

Worth noting if you’re weighing jurisdictional risk: Canadian Prime Minister Justin Trudeau and Nunavut Premier P.J. Akeeagok recently put signatures to paper on a land transfer agreement—the largest in Canadian history—that gives Nunavut control over its subsurface mineral wealth.

The agreement will transfer all mining royalty revenue from the Fed to the coffers of this high Arctic territory – Canada to give mineral-rich Arctic region of Nunavut control over its resources. This agreement could incentivize mineral exploration and development in the territory as the Nunavut government seeks new sources of tax revenue.

To summarize

Uranium is in a powerful bull phase, and Forum is on the cusp of generating significant newsflow from its flagship asset. The Thelon Basin’s discovery cycle is in its infancy, and the company holds a commanding land position on some of its most prospective ground. With up to 12,000 meters to be drilled starting June 1, the company may be in the early innings of unlocking an entire district of significant new U3O8 discoveries. “Be bold and mighty forces will come to your aid” (we stand to watch).

One final slide from the company’s pitch deck highlighting the potential upside here…

One final (random) fundamental bolstering upward price pressure on the energy-dense metal: Twenty two countries have pledged to triple their nuclear capacity by 2050.

END

—Greg Nolan

Full disclosure: Forum Energy Metals is a Highballer client. Due your own due diligence as the author is clearly biased in his views.

Disclaimer - Legal NoticeHighballerstocks.com (Greg Nolan) is not a licensed financial advisor and does not give investment advice.

The content of this report is for information purposes only.

Nothing contained herein should be construed as a recommendation or solicitation to buy or sell any security.

Always consult a licensed qualified investment advisor in your legal jurisdiction before making any investment decisions.

Though Highballerstocks.com (Greg Nolan) believes its sources to be credible, and the statements contained herein to be true, readers must conduct their own thorough due diligence, and or consult with a qualified investment advisor before important investment decisions are made.

Highballerstocks.com (Greg Nolan) accepts no responsibility or liability for the accuracy of the contents of this report.