Gold’s recent price strength, having tested and taken out all-time highs, is making headlines, and the average guy is finally paying attention.

Gold stox

The Bigs, as measured by the GDX, are drawing most of the attention in the wake of higher metal prices, and after reporting solid Q2 earnings. This favor is expected as the producers are always the first to move (historically).

This is classic bull market behavior, as capital is slowly and steadily channeled from the sidelines to the producers. The trajectory on the GDX chart, a series of higher highs and higher lows, is precisely what the gold faithful wanna see.

Where the junior sector is concerned, we’re seeing some positive price action amongst a handful of entities, but the vast majority are still languishing near their lows. This may represent an opportunity if you believe we’re in the early stages of a bull cycle that will prove epic in scale. I’m beginning to suspect that this is it… that we’re on the cusp of a turn that will push valuations in the junior arena substantially higher. Of course, there’s always the risk of a resource-hungry predator getting in your way.

Speaking of predators, Goldfields’ acquisition of Osisko Mining, at a 50% premium, is one indication that the tide is turning in junior land.

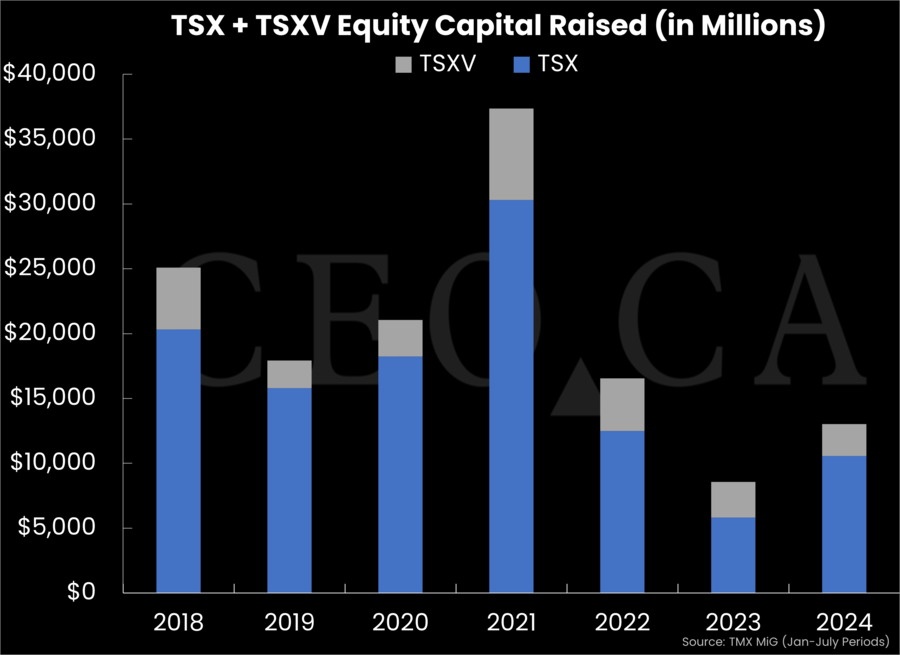

Another recent piece of supporting data suggests a turn is imminent: Total year-to-date TSX and TSXV financings are up 52% compared to the same period last year (chart courtesy of ceo.ca).

This might be an opportune time to take a closer look at well-run companies operating in mining-friendly jurisdictions—those boasting high-quality ounce counts with significant resource expansion and exploration upside. I’m currently tracking over thirty companies and chipping away at a few when funds allow. I’ll detail some of my current holdings/interests in future articles.

Bullish U3O8?

Share prices and volumes across the uranium arena got a solid boost in recent sessions as the world’s largest U3O8 producer, Kazatomprom, slashed its 2025 production guidance by 17%. In a market suffering from a severe structural deficit amidst increasing demand, this supply shock may be setting the stage for a sustainable rally in both the energy-dense metal and the equities.

Without a doubt, junior explorers tagging significant new high-grade discoveries are likely to draw heaps of interest with this bullish backdrop.

———————————————————————————————————-

Note that the following content is in collaboration with Forum Energy Metals (Highballer is compensated by the company for this effort)

————————————————————————————————————

Forum Energy Metals (FMC.V) – (FDCFF.OTC)

- 294.56 million shares outstanding

- $25.04M market cap based on its recent sub-dime close

- website link here

Forum Energy Metals, a company determined to deliver a globally significant U3O8 discovery at a time when it’s most needed, recently released a project update for its mothership Aberdeen Uranium Project where it’s in the midst of an aggressive 10,000-meter drilling campaign.

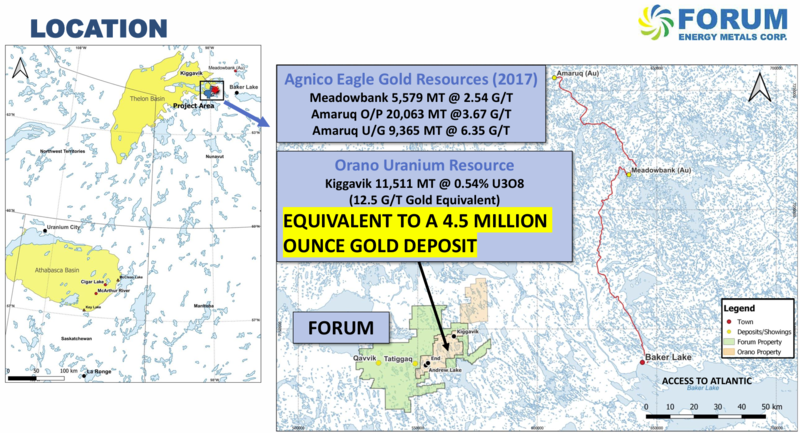

To review: The Aberdeen project is located in the Thelon Basin, believed to be the closest geological analog we have to the prolific Athabasca Basin further south. Forum believes the region holds considerable potential for unconformity-type uranium mineralization in its subsurface layers, but due to a lack of systematic exploration, its discovery cycle is still in its infancy. The thinking at Forum Central is that the Thelon Basin is where the Athabasca Basin was a half-century ago before Cigar Lake and McArthur River lit up the global U3O8 map. Forum is now poised to test that thesis with this current round of drilling.

Forum’s dominant 95,518-hectare land position in the region completely surrounds Orano’s Kiggavik Uranium Project, which hosts a significant U3O8 endowment of some 133 million pounds at a grade of 0.54% (note the gold equivalent comparison highlighted on the map below).

The following is an excerpt from the Overview page on Forum’s website:

Forum staked extensive ground with significant uranium mineralization that was discovered by Cameco in 2008-2012, but later dropped during the extended period of low uranium prices. Forum’s ground is on trend with majority owner Orano’s Kiggavik uranium deposit, and hosts two uranium discoveries made by Cameco to the west of Kiggavik. In 2022, Forum completed a review of Cameco’s historical drilling, which totaled 36,000m in 135 drill holes. Additional initiatives completed included archaeological studies, community engagment, ground geophysical surveys and establishing a drill camp location.

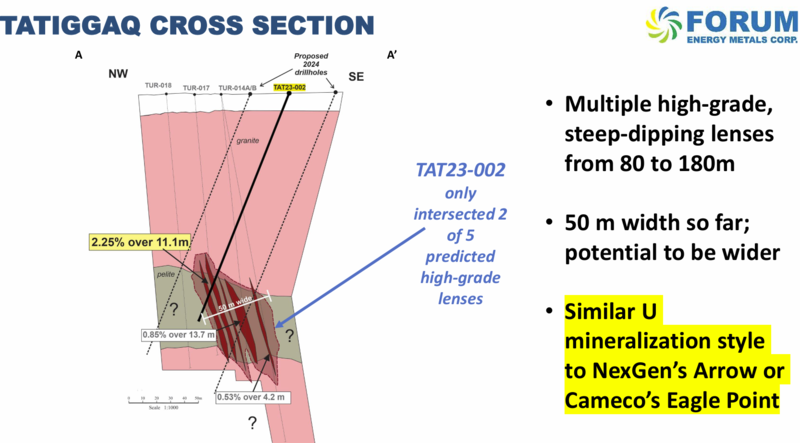

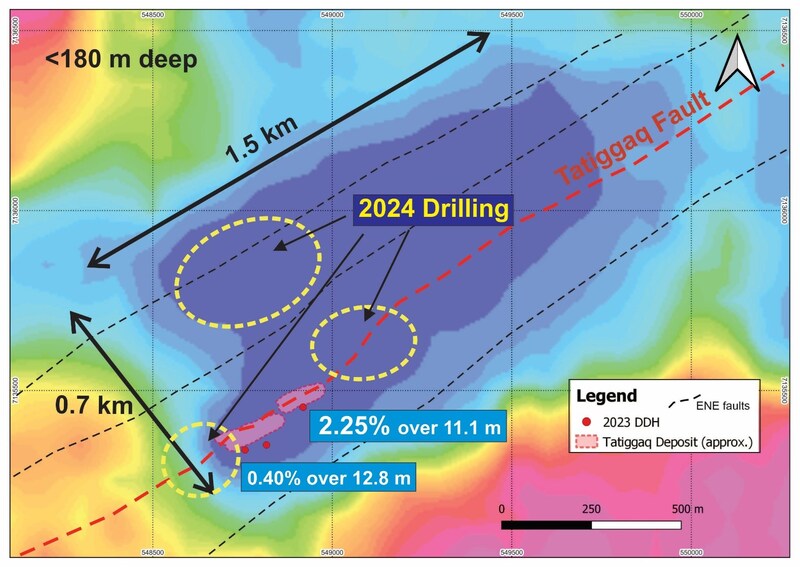

Last summer, the company launched a 1,000-meter drill program that was designed to test the shallow high-grade potential along the Tatiggaq Main and West Zones. The highlights from this modest campaign were in holes TAT23-002, which tagged an impressive 2.25% U3O8 over 11.1 meters (Main Zone), and TAT23-003, a 200-meter step out which intersected 0.28% U3O8 over 24.6 meters (West Zone).

Results to date indicate multiple high-grade, steep-dipping lenses that are beginning to demonstrate significant potential along strike. This mineralization lies within a gravity anomaly that extends 1.5 kilometers x 700 meters.

There’s also significant regional potential on Forum’s massive land package in the Basin, with multiple targets worthy of a proper probe with the biz end of the drill bit.

Good science

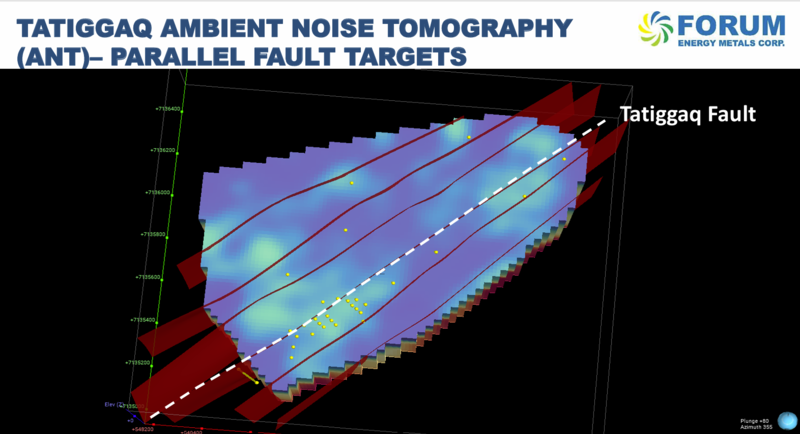

The company pulled out all the stops to prioritize drill targets for this current campaign, i.e., having conducted an Ambient Noise Tomography (ANT) survey over the property, which allowed them to model the Thelon sandstone—basement contact, as well as potential zones of fault development and hydrothermal alteration. Good, sound, innovative science, this.

The August 20 Aberdeen project update

Forum Drilling Update, Aberdeen Uranium Project, Nunavut

The company states that current drilling continues to intersect “uranium mineralization, prolific structural and lithological controls and intense alteration at the Main and West deposits along the Tatiggaq Fault.”

A recent tour of Directors to the Aberdeen project and the Kiggavik Core Storage Facility with Forum’s Geological Advisor, Dr. Peter Wollenberg, who discovered two of the largest deposits at Kiggavik, verified that the uranium mineralization processes on Forum’s property are identical to the Kiggavik uranium deposits.

From left to right, Peter Wollenberg, Forum Geological Advisor; Brian Christie, Forum Director; Rebecca Hunter, Forum Vice President, Exploration.

17 holes totaling 4,307 meters have been completed along the Tatiggaq Fault within the 1.5 kilometer by 0.7 kilometer Tatiggaq anomaly. A total of 685 samples have been shipped to the lab for analysis. Results are expected by the end of September.

Forum’s President and CEO Rick Mazur: “We thank Orano for access to their drill core storage facility for the three deposits at the 133 million pound Kiggavik deposit. Our visit to the Aberdeen project and the Kiggavik core storage area validates our view that we are in an emerging uranium district for unconformity-style uranium deposits akin to the prolific Athabasca Basin.”

This August 20 press release goes on to state: The Company has entered into Phase Two of its drill program. One drill has moved to the Qavvik deposit and Forum will now focus on a number of other high priority targets on the property for basement-hosted and sandstone-covered unconformity targets. The Company’s 30-person drill camp and crew have performed well over the summer. Drilling is expected to continue for another four to six weeks.

A new addition to the team

Earlier this summer, the company announced a key hire in a long-time Baker Lake community leader, Richard Aksawnee, who served as Baker Lake’s mayor from 2019 to 2023 – Forum Announces Senior Management Position in Baker Lake, Nunavut for the Aberdeen Uranium Project.

Allison Rippin Armstrong, VP, Nunavut Affairs: “We are excited to welcome Richard Aksawnee to the Forum team. Richard’s extensive experience and demonstrated leadership will help guide our engagement strategy, workforce development and community investment. This senior position will bring a focus to community priorities and perspectives during our exploration activities on our Aberdeen Uranium project near Baker Lake.”

If you’re new to the Forum story, the company also boasts an extensive project portfolio in Saskatchewan’s Athabasca Basin further to the south.

Conclusion

Forum is roughly halfway through a 10k-meter drill campaign, having tested the depth and lateral extent of known mineralization + a proper probe of parallel structures. They’re now in the midst of phase-2 drilling, focusing on high-priority regional targets. Assay-related news should begin flowing by the end of next month. The market is hungry for a significant new U3O8 discovery. Things could get interesting here.

END.

– Greg Nolan.

Full disclosure: Forum Energy Metals is a Highballer client. The author owns shares.

Disclaimer - Legal NoticeHighballerstocks.com (Greg Nolan) is not a licensed financial advisor and does not give investment advice.

The content of this report is for information purposes only.

Nothing contained herein should be construed as a recommendation or solicitation to buy or sell any security.

Always consult a licensed qualified investment advisor in your legal jurisdiction before making any investment decisions.

Though Highballerstocks.com (Greg Nolan) believes its sources to be credible, and the statements contained herein to be true, readers must conduct their own thorough due diligence, and or consult with a qualified investment advisor before important investment decisions are made.

Highballerstocks.com (Greg Nolan) accepts no responsibility or liability for the accuracy of the contents of this report.