Gold is on a tear, carving out fresh all-time highs as a matter of routine. Short-term (shallow) corrections aside, the metal’s momentum has been impressive, up roughly 27% since the start of the year.

Where the equities are concerned, the Bigs appear to be under steady accumulation as per the GDX (chart below). Many of the Mids are also gaining favor and are experiencing sustained buying pressure.

Lower down on the food chain, the Juniors are still languishing near their lows, though there have been a few notable exceptions (Probe beating expectations with a 10M+ oz resource at Novador, for example).

In light of the recent strength in the metals (copper included), it would seem that the conditions are ripe for an across-the-board re-rating in this high-risk/high-reward arena, at least among the better-run, higher-quality names (those with competent management teams operating geologically prospective properties in mining-friendly climes). It may only be a matter of time before these junior entities push substantially higher. And the run could be, well… epic.

Concerning Juniors with meaningful resources on their books, Goldfields’ recent acquisition of Osisko Mining is a good indication of what a resource-hungry producer is willing to pay for high-quality ounces in this current environment (Goldfields took out Osisko for its Windfall Project in the Val-d’Or-Chibougamau region of Québec for roughly $220 per oz). One can only assume that a junior entity with a large and growing resource base has a target on its back.

In a previous Highballer report, I suggested that now might be an opportune time to exercise some due diligence and begin mobilizing funds from the sidelines, if you haven’t already done so. The trick is in separating the wheat from the chaff.

The following content includes a handful of junior exploration and development cos that stand out from the hundred-plus names I follow. The summaries offer only a snapshot of the company’s underlying fundamentals, but it should be enough to get the due diligence juices flowing.

The companies

AbraSilver Resource Corp. (ABRA.V) – (ABBRF.OTC)

- 125.4 million shares outstanding

- $312.24M market cap based on its recent $2.49 close

- ABRA website

AbraSilver is a high-grade silver play in Salta Province, Argentina, where the company is aggressively drilling off its wholly-owned Diablillos Project.

Proven and Probable reserves at Diablillos currently stand at 42.3 Mt grading 91 g/t Ag and 0.81 g/t Au for roughly 124 Moz silver and 1.1 Moz gold. The potential exploration upside beyond this high confidence ounce count is considered ‘significant.’

Beyond Diablillos, the company entered into a JV with Teck on its La Coipita project, located in the San Juan province of Argentina.

Quoting a recent press release where the company reported results from a fully-funded 20k meter phase IV drill campaign: “There are several known mineral zones on the Diablillos property. Approximately 150,000 m have been drilled to date, which has outlined multiple occurrences of epithermal silver-gold mineralization at Oculto, JAC, Laderas and Fantasma. Additionally, several satellites zones of silver/gold-rich epithermal mineralization have been located within a 500 m to 1.5 km distance surrounding the Oculto/JAC epicentre.”

Abitibi Metals Corp. (AMQ.C) (AMQFF.OTC)

- 109.98 million shares outstanding

- $45.64M market cap based on its recent $0.415 close

- AMQ website

AMQ is in the process of pushing its mothership B26 Polymetallic Deposit aggressively along the exploration and development curve (AMQ is earning an 80% interest in B26 from JV partner SOQUEM, a subsidiary of Investissement Québec).

B26 hosts a historical resource of 7.0MT grading 2.94% CuEq in the Indicated category plus an additional 4.4MT grading 2.97% CuEq in the Inferred category. Further down the road, the company’s Beschefer Gold Project generated results such as 55.63 g/t gold over 5.57 metres and 13.07 g/t gold over 8.75 metres.

This well-run company (management is highly protective of its share structure) is currently in the midst of a 16,500-metre phase 2 drill program at B26 where they recently announced an extension of the deposit in step-out drilling. A 20k meter drill campaign will follow phase 2 drilling in 2025 (the company currently has roughly $15M in the till).

American Eagle Gold Corp. (AE.V) – (AMEGF.OTC)

- 133.06 million shares outstanding

- $67.86M market cap based on its recent $0.51 close

- AE website

American Eagle is drilling off multiple zones at its flagship NAK Project in the Babine Copper-Gold Porphyry district of central British Columbia.

Historical drilling, along with geophysical, geological, and geochemical work at NAK, revealed a large near-surface copper-gold system that measures at least 1.5 km x 1.5 km.

Drilling completed in 2022 and 2023 by American Eagle has returned significant intervals of high-grade copper-gold mineralization that lie beyond the extent of historical drilling, indicating that several zones of near-surface and deeper mineralization, locally with considerably higher grades, exist within the broader NAK property mineralizing system.

In a recent press release, the company reported assays for three holes drilled at NAK’s Gold Zone, along with two holes drilled across its Main Zone. The highlight interval was in drill hole NAK24-23, which tagged 40 meters of 2.01 g/t AuEq from surface, within a broader interval of 175 meters of 1.03 g/t AuEq (both of which lie within an even broader 276 meter interval grading 0.83 g/t AuEq… from surface). This current phase of drilling is expected to run through November.

Bullet Exploration Inc. (AMMO.V)

- 49.34 million shares outstanding

- $3.95M market cap based on its recent $0.08 close

- AMMO website

and

Gold79 Mines Ltd. (AUU.V) (AUSVF.OTC)

- 22.31 million shares outstanding

- $5.35M market cap based on its recent $0.24 close

- AUU website

Gold79 and Bullet Exploration recently announced a merger where the former will acquire all of the issued and outstanding common shares of the latter (Bullet shareholders will receive one common share of Gold79 for every three held).

The merged entity’s primary focus will be on delivering a maiden high-grade near-surface resource at its Gold Chain project in Arizona. Management believes Gold Chain holds multi-million oz potential in its immediate subsurface layers, and it shouldn’t take long to confirm these expectations. The project’s mineralized potential is highlighted by drill hole GC23-28, which tagged an impressive 51.09 g/t Au over 9.1 meters.

The company’s Jefferson Canyon (JC) project in Nevada has been optioned to Kinross. The senior can acquire 70% of JC for $5M (an additional US$5,000,000 bumps their stake up to 80%). JC is within a stone’s throw of the miner’s Round Mountain mine (3,361 koz M&I @ 0.9 g/t) —Kinross could certainly use JCs (potential) resource to feed its Round Mountain mill once reserves are exhausted. The partners are now in receipt of an Acceptance Letter from the United States Forest Service for its Plan of Operations to drill JC. Drilling will commence after final approvals (consultations with the public and state heritage agency) are in hand. JC’s mineralized potential is highlighted by drill hole GJ-81 which returned an impressive 41.2 meters of 6.4 g/t Au and 402 g/t Ag.

The merged entity will also generate exploration newsflow from its Jefferson North and Tip Top projects, both in Nevada.

Apollo Silver Corp. (APGO.V) – (APGOF.OTC)

- 174.69 million shares outstanding

- $41.05M market cap based on its recent $0.235 close

- APGO website

Apollo’s pure-play Calico Silver Project in San Bernardino County, California, boasts a robust Ag resource of 110 million ozs (Measured and Indicated) and 51 million ozs (Inferred). The grade on the M&I rock = 100 g/t Ag.

On Sep. 23, the company announced a new acquisition—an exploration, earn-in, and option agreement with MAG Silver to acquire its Cinco de Mayo Project located in Chihuahua State, Mexico.

The project hosts the Upper Manto Pb-Zn-Ag-Au deposit, consisting of two parallel and overlapping manto zones known as ‘Jose Manto’ and ‘Bridge.’ Four kilometers down the road lies the Pozo Seco Mo-Au deposit (both deposits host distinctly different mineralization with different commodities).

Cinco de Mayo is highly prospective for carbonate replacement (CRD) type deposits, which are known to run at depth.

Quoting this Sep. 23rd press release: As of September 1, 2012, 445 holes totaling 213,591 metres (“m”) had been drilled on the Project by the previous operators, with no work completed since. Of these, 151 holes totaling 97,610 m are located at or nearby the Upper Manto deposit and were used to model the mineralization. Roscoe Postle Associates Inc. (“RPA”) prepared a technical report on the Project, dated November 14, 2012, which includes a now historical inferred mineral resource. At an NSR cut-off of US$100 per tonne the historical inferred resource was estimated at 12.45 million tonnes of 132 g/t silver (Ag), 2.86% lead (Pb), and 6.47% zinc (Zn), 0.24 g/t gold (Au). The total contained metals in the historical resource are 52.7 million ounces of silver, 785 million pounds of lead, 1,777 million pounds of zinc, and 96,000 ounces of gold.

Amerigo Resources Ltd. (ARG.TO) – (ARREF.OTC)

- 165.97 million shares outstanding

- $288.79M market cap based on its recent $1.74 close

- ARG website

Amerigo is a miner. It produces copper and molybdenum concentrate as a by-product from processing fresh and historic tailings from Codelco’s El Teniente mine, the world’s largest underground copper mine.

If you’re looking for yield, Amerigo dividends a healthy chunk of its profits to shareholders. Highlights from the company’s Q2 reported on July 31:

- Q2-2024 Net Income of $9.8 million

- Quarterly EBITDA of $22.3 million – Free Cash Flow to Equity1 of $6.7 million

- 12th Quarterly Dividend of Cdn$0.03 per share declared, representing a 10.3% yield

- Previously declared Cdn$0.04 Performance Dividend triggered by Q2-2024 financial strength

Quoting Aurora Davidson, Amerigo’s President and CEO: “The strength of Amerigo’s business plan is now on full display. Shareholders have received the declaration of our initial performance dividend very well and are benefitting from the prompt transfer of copper price strength to their pockets. Our initial performance dividend will be paid in addition to our twelfth quarterly dividend of Cdn$0.03, announced today. Despite the present short-term price correction, we anticipate continued strength in copper prices and look forward to returning capital as quickly as possible to shareholders.”

Aurion Resources (AU.V) – (AIRRF.OTC)

- 149.89 million shares outstanding

- $89.33M market cap based on its recent $0.60 close

- AU website

Aurion currently holds (or has interests in) mineral tenements that cover roughly 75,000 hectares of the Central Lapland Greenstone Belt (CLGB) along the Fennoscandian Shield—a vastly under-explored region some say holds similar potential to the Timmins region in its subsurface layers.

The company is currently focusing attention on its wholly-owned Risti project where past drilling highlights include 789.00 g/t Au over 2.90 meters (Aamurusko zone) and 2.41 g/t Au over 56.55 meters (Kaaresselkä zone). The company is also advancing JV projects with partners B2Gold (293 km2 along the major crustal-scale Sirkka Shear Zone in the Central Lapland Greenstone Belt) and Kinross (4,300 hectares along the Sirkka Shear Zone).

Borealis Mining (BOGO.V)

- 83.22 million shares outstanding

- $66.58M market cap based on its recent $0.80 close

- BOGO website

(Newly listed) Borealis’s belief that it can go from the “drillbit to doré bars faster than 99% of our competitors” is grounded in the significant exploration upside surrounding its historically productive Borealis Mine in Nevada—a fully permitted mine site equipped with active heap leach pads, an ADR facility, and all necessary infrastructure to support a heap leach gold mining operation.

Late last month, the company reported its first gold pour after stripping 2.5 of the project’s 10 existing carbon columns loaded with residual leaching material and solution. The first pour resulted in doré bars weighing ~651 troy ounces containing 21.968 % Au and 20.169 % Ag, as determined by an independent assay of a pin sample, for approximately 143 troy ounces of gold and 131 troy ounces of silver. Please see Figure 1 for a picture of the pour.

The company’s 15,020-acre land position located along Nevada’s Walker Lane Gold Trend (mineral endowment = >50 million ozs of Au) also holds significant regional discovery potential.

Collective Mining (CNL.TO) – (CNL.NYSE)

- 68.25 million shares outstanding

- $296.20M market cap based on its recent $4.34 close

- CNL website

Collective, founded by the same team that developed and sold Continental Gold to Zijin Mining for roughly $2 billion in enterprise value, appears to be onto another world-class deposit(s) at its Guayabales Project in Caldas, Colombia.

Guayabales is anchored by Apollo, a large-scale, bulk-tonnage, and high-grade copper-silver-gold-tungsten porphyry system. The company’s current focus is expanding the Apollo system, stepping out along strike of the recently discovered Trap system, and tagging a new discovery at its Tower, X, or Plutus targets.

The company generates assay-related newsflow—long intercepts of significant mineralization— as a matter of routine. The latest results, announced on Sep. 23, expand the Apollo system to the southwest at depth beyond the boundaries of their resource model. These recent results also extend the high-grade CBM vein sub-zones within the model to depths of over 1,000 meters. This is a big system.

Five diamond drill rigs are currently turning at Guayabales as part of the company’s fully funded 40,000-meter 2024 drill campaign—two rigs at Apollo, two at the Trap system and one at the Plutus target.

Goliath Resources Limited (GOT.V) – (GOTRF.OTC)

- 132.57 million shares outstanding

- 163.06 M market cap based on its recent $1.23 close

- GOT website

Goliath is drilling off what appears to be a large high-grade gold system at its Golddigger Property in the prolific Golden Triangle of northwestern BC. The company is currently awaiting assays on a number of holes drilled to test its Surebet discovery where abundant visible gold was noted. In a September 3rd press release the company stated: The intercept from drill hole GD-24-260 intersected the Bonanza Zone between 533.90 – 547.00 meters that remains open which includes the highest concentration of visible gold to date with a vein-hosted band of semi-massive pyrrhotite, sphalerite and minor galena and suggests this structure is a principal conduit for gold-depositing fluids and is likely close to the heat engine driving this system that remains open.

Another compelling detail from this Sep 3 press release: Visible Gold has been observed in 22 out of 33 holes (66 % of holes) drilled during the ongoing 2024 drill campaign as well as 100 % hit rate with compelling base metals mineralization observed in all drill holes. As a result of the continued success of the drilling in 2024, the program has been expanded from 15,000 to 36,000 meters with 8 drill rigs currently operating. The continuity of the thick high-grade gold horizon pertaining to the Bonanza Zone is currently being drill tested with 21 new holes in an area where GD-24-197 returned 34.03 g/t AuEq (1.09 oz/t AuEq) over 9 meters (~true width) and GD-24-235 returning 35.04 g/t AuEq (1.13 oz/t AuEq) over 5.25 meters (~true width).

Significant Goliath shareholders include Crescat Capital, Mr. Eric Sprott, Mr. Rob McEwen and a Global Commodity Group based out of Singapore.

Kenorland Minerals (KLD.V) – (KLDCF.OTC)

- 75.23 million shares outstanding

- $82.75M market cap based on its recent $1.10 close

- KLD website

Kenorland is a hybrid prospect generator that successfully deploys this often underappreciated biz model. Examples…

Current Assets & Revenue (C$)

- Working Capital (approximate as of July 31, 2024) $30,931,000

- Equity Interests (including private holdings) $3,527,000

- Approximate 2024 General and Administrative Costs $3,880,000

- Estimated 2024 Cash Inflow (management fees – refundable mining tax credits): $3,589,000

2024 Preliminary Exploration Budget (C$)

- Partner-Funded Exploration (preliminary) $18,513,000

- Sole-Funded Exploration $9,062,000

- Total 2024 Exploration Expenditures $27,575,000

Earlier this year, the company converted its 20% stake in the Frotet gold discovery, a JV with Sumitomo Metal Mining, into a fat 4% NSR while Sumitomo continues to aggressively push the high-grade (Regnault) Au system further along the exploration curve. The company also holds equity stakes in a number of junior entities.

In a recent development, the company granted a wholly owned subsidiary a 2% NSR on its 100% owned South Uchi Project in the Red Lake District of northwestern Ontario where a summer (geochem) surface campaign turned up positive results.

Kenorland management runs a tight ship and is highly protective of its share structure (a rare thing in this Wild West arena).

Mayfair Gold Corp. (MFG.V) – (MFGCF.OTC)

- 105.61 million shares outstanding

- $211.22M market cap based on its recent $2.00 close

- MFG website

The dust is finally beginning to settle after a control-related brouhaha with this Timmins exploration and development play. The company can now focus on enhancing shareholder value through its wholly-owned Fenn-Gib gold project.

On September 10, the company trotted out an updated MRE on the Fenn-Gib showing an Indicated resource of some 181.3M tonnes containing 4.313M ounces at a grade of 0.74 g/t Au and an Inferred resource of 8.92M tonnes containing 0.14M ounces at a grade of 0.49 g/t Au (using a 0.30 g/t Au cut-off grade).

With its mining-friendly address and four million-plus ounce count—Fenn-Gib has a strike length of over 1.5 kilometers (widths ranging over 500 meters) and the mineralized zones remain open at depth and along strike to the east and west)—MFG might be considered one of the more obvious takeover targets in Juniorland. Enhancing its potential takeover appeal, recently completed metallurgical tests confirm that the Fenn-Gib deposit can deliver robust gold recoveries of up to 94%.

Nevada King Gold Corp. (NKG.V) – (NKGFF.OTC)

- 343.48 million shares outstanding

- $113.35M market cap based on its recent $0.33 close

- NKG website

Located along the Battle Mountain Trend near Las Vegas, Nevada, NKG distinguishes itself from the pack by delivering a steady stream of assay-related newsflow from its Atlanta Gold Project, often featuring broad intervals of oxide mineralization.

The historically producing Atlanta Mine currently has a pit-constrained resource of 460,000 ozs of Au in the Measured and Indicated category (11.0M tonnes at 1.3 g/t) plus an Inferred resource of 142,000 oz Au (5.3M tonnes at 0.83 g/t).

In a recent press release, the company highlighted two drill holes designed to infill gaps along the Atlanta Mine Fault Zone which tagged 3.59 g/t Au over 35.1 meters and 1.76 g/t Au over 24.4 meters. One week earlier, the company reported the identification of five new regional targets along this 5,166-hectare wholly-owned property.

Northern Superior Resources (SUP.V) – (NSUPF.OTC)

- 165.16 million shares outstanding

- $80.93M market cap based on its revcent $0.49 close

- SUP website

Northern Superior is currently in the early innings of a 20k meter drill program designed to expand the mineralized footprint at its Philibert gold project, a nine-kilometer hop from IAMGOLD’s Nelligan project in the Chibougamau Gold Camp of Quebec (SOQUEM currently owns 25% of the project).

At 62k hectares, the company has successfully consolidated the largest land package in the region. Its Chibougamau project portfolio includes Philibert, Lac Surprise, Chevrier and Croteau.

Philibert hosts an Inferred resource of 1,708,800 ozs Au and an Indicated resource of 278,900 ounces of Au. Chevrier hosts an Inferred resource of 652,000 ozs Au (underground and open pit) and an Indicated resource of 260,000 ozs Au. Croteau hosts an Inferred resource of 640,000 ozs Au.

The company also owns 72% of ONGold Resources, which is advancing the highly prospective, district-scale TPK Project in northern Ontario.

Back in December 2023, IAMGOLD took out Northern Superior’s neighbor, Vanstar, for its 20% stake in the Nelligan deposit for $45 million (roughly $40.00 per oz)—a 74% premium to Vanstar’s 20-day VWAP. Northern Superior shareholders anticipate a similar fate.

ONGold Resources (ONAU.V)

- 49.32 million shares outstanding

- $25.65M market cap based on its recent $0.52 close

- ONAU website

Newly listed ONGold holds a portfolio of exploration assets in Northern Ontario, including the district-scale TPK project and the October gold project.

The 47,976 of hectare TPK project boasts one of the largest unsourced gold in till anomalies in North America at 6 km x 11 kms. As I reported in a previous Highballer… It is important to bear in mind that gold grain anomalies of this scale are amalgamated responses from a cluster of gold zones. They normally indicate a large gold system or district rather than a single gold zone. The number of gold grains recovered from 10kg samples of basal till within this apron reach as high as 1258 grains, a remarkable number. Just as important, many of these samples consist of gold grains that are pristine (average 90%).

The company’s 265 square kilometer October gold project, located roughly 35 kilometers along strike from IAMGOLD’s Côté Lake Mine, is also marked by significant gold anomalies.

Management has been super tight-lipped regarding exploration progress at TPK. There’s been limited newsflow since the stock began trading in early May.

Orogen Royalties (OGN.V) – (OGNRF.OTC)

- 201.51 million shares outstanding

- $302.26M market cap based on its recent $1.50 close

- OGN website

Orogen characterizes itself as an organic royalty generator via “cost-effective royalty creation through high-quality prospect generation and exploration partnerships and the acquisition of attractive mineral royalties.” The company has a large and growing portfolio of royalties, eight active options (partners spent $20M on exploration last year), and an alliance with Altius Minerals.

The company is drawing revenue from its 2% NSR on First Majestic Silver’s Ermitaño gold and silver mine in Sonora, Mexico. Significantly, it also holds a 1% NSR covering AngloGold’s Expanded Silicon project in Nevada, where the current resource (all categories) stands at 13.3 million ounces of oxide gold. AngloGold anticipates its first production in the region in 2026 with expectations of a >500,000-ounce gold per year multi-decade mine complex.

Last month, the company reported record royalty revenue—net income before tax of $1,069,473 for the quarter ended June 30, 2024, up 713% compared to $131,616 for the same period in 2023.

Probe Gold (PRB.V) – (PROBF.OTC)

- 181.15 million shares outstanding

- $306.14M market cap based on its recent $1.69 close

- PRB website

Probe beat expectations in early September when it delivered a world-class resource from its Val-d’Or East properties in Quebec.

The global resource for all Val-d’Or East properties, along all trends and deposits, rings in at a weighty 6,728,600 ounces (M&I) and 3,277,100 ounces (Inferred). This is nearly a double from the 2023 resource update, representing a 77% increase in M&I ounces and a 131% increase in Inferred ounces.

Resources at the Novador property, which includes the Monique, Pascalis, Courvan, and Beaufor deposits, currently stand at 6,405,000 ounces (M&I) and 1,550,200 ounces (Inferred).

The updated estimates include close to 95,000 metres of new drilling completed by Probe on its 100 % owned Novador and Croinor properties, and close to 75,000 metres drilling completed by Monarch Mining Corporation prior to Probe’s acquisition of the Beaufor and McKenzie Break properties, since their last respective MRE.

Earlier this year, the company reported a PEA for Novador demonstrating a post-tax NPV of C$910 million and an IRR of 24.4% using a US$1,750 gold price input. Average annual gold production is envisaged at 255,000 ounces over the life of the mine. Project Capex is pegged at $602M.

The project is now all about development. The company is set to launch a 50,000-metre infill drill campaign. A Pre-Feasibility Study is targeted for next year.

Prime Mining (PRYM.V) – (PRMNF.OTC)

- 145.89 million shares outstanding

- 230.57M market cap based on its recent $1.58 close

- PRYM website

Prime Mining, no stranger to these pages, continues to push its wholly-owned Los Reyes Gold-Silver Project in Sinaloa, Mexico aggressively along the curve.

After doubling its resource in May of 2023—1.479 million Indicated AuEq ounces at 1.68 g/t Au and 0.734 million Inferred AuEq ounces at 1.26 g/t Au—the company continues to crank out solid drill results demonstrating significant potential to expand its resource base (the project’s multiple mineralized zones are open in all directions).

In an early September press release, the company stated: Given the results from Prime’s success-based drilling program at mid-year, the Company approved the expansion of its fiscal 2024 program to 50,000m from 40,000m. The drill program will continue to be evaluated according to this success-based approach. This evaluation will also include prioritization of targets based on probability of resource development and generative area discovery potential.

Four drill rigs are currently active on site.

Radisson Mining Resources (RDS.V) – (RMRDF.OTC)

- 321.21 million shares outstanding

- $93.15M market cap based on its recent $0.29 close

- RDS website

RDS, highlighted in these pages in the past, is focused on its wholly-owned O’Brien project in the Bousquet-Cadillac mining camp along the Larder-Lake-Cadillac Break in Abitibi, Quebec. The past-producing O’Brien Mine was once crowned as Quebec’s highest-grade gold producer.

The resource at O’Brien currently stands at 501,000 ounces Au Indicated (1,517,000 tonnes grading 10.26 Au) and 449,000 ozs Inferred ( 1,616,000 tonnes grading 8.64 g/t Au).

Last week, the company reported its first deep holes (more than a kilometer down) from an ongoing, fully funded 35,000-metre drill campaign. The highlight interval was 27.61 g/t Au over 6.0 metres, including 102.00 g/t Au over 1.1 metres (plus a separate mineralized interval averaging 6.83 g/t Au over 10.0 metres, including 40.20 g/t Au over 1.5 metres).

With its location along the Abitibi Greenstone Belt and its proximity to high-profile neighbors such as Agnico-Eagle (LaRonde, LZ5, and Lapa), IAMGOLD (Westwood), Wesdome (Kiena) and Eldorado (Lamaque), Radisson’s high-grade ounce count may represent one of the more obvious takeover targets in the junior arena.

Ridgeline Minerals Corp. (RDG.V) – (RDGMF.OTC)

- 109.68 million shares outstanding

- $14.26M market cap based on its recent $0.13 close

- RDG website

Ridgeline is a hybrid prospect generator with five key projects along the Carlin Trend, the Battle Mtn–Eureka Trend, and the ‘Emerging Porphyry/CRD Trend’ in mining-friendly Nevada.

On the JV side of its project portfolio, its Swift and Black Ridge (gold) projects have been optioned to Nevada Gold Mines* (NGM). Its Selena project has been dealt out to South32. These partner-backed ventures with NGM and South32 will see US $4.0 million spent in 2024 ($US 7.8M has already been spent at Swift & Black Ridge to date).

Its 100%-owned Big Blue project—a porphyry Cu-Au prospect located in Elko County, Nevada—generated positive results on the geophysical front two weeks back, confirming the potential for at least two porphyry targets on the property.

Michael Harp, Ridgeline’s VP of Exploration: “The big surprise for our team came from the Ohio target, where IP lines 70250N and 70900N highlight a strong chargeability anomaly under alluvial cover, less than 1 kilometer south of recently announced high-grade rock chip samples of up to 3.9% copper and 16.3 g/t gold. The consistent copper grades as well as highly elevated gold and molybdenum values compared to the nearby Delker trend suggest the mineralizing system may be increasing in strength to the west. The Ohio target represents a potential standalone porphyry system, or the faulted off portion of the Delker porphyry and our team is very excited to drill-test both targets in our maiden program.”

With a mere $15M market cap, a solid hit at Big Blue could light up this (neglected) stock in a big way.

*NGM is a JV between mining behemoths Barrick & Newmont.

Riley Gold Corp. (RLYG.V) – (RLYGF.OTC)

- 42.18 million shares outstanding

- $7.59M market cap based on its recent $0.18 close

- RYLG website

Riley Gold is another Nevada-focused exploreco with a project portfolio centered on established gold trends (Battle Mountain–Cortez–Eureka and Walker Lane).

Riley’s Pipeline West/Clipper (PWC) project, located along the Battle Mtn–Eureka Trend, was recently optioned to Kinross, the agreement granting the producer the right to earn up to a 75% interest by spending a minimum of US$20 million.

Concerning the PWC drill campaign launched by Kinross roughly 2.5 months ago, a July 10 press release stated: Drilling will target previously untested favourable lower plate carbonate host rocks of the Wenban and Roberts Mountains Formations at explorable depths. The Wenban Formation is the primary host to all the >5.0-million-ounce gold deposits in the Cortez District. Geologic work completed by Riley Gold and Kinross since the PWC acquisition includes: surface geologic mapping, soil geochemistry and controlled-source audio-frequency magnetotelluric (“CSAMT”) surveys. In addition, re-interpretation of historic drill hole, gravity, magnetic and CSAMT data has been completed and used for developing 2024 drill targets. The primary target is a large, disseminated gold deposit peripheral to the Gold Acres stock, which is the geologic setting for the NGM Pipeline gold deposit. Permitting for the initial work and drilling was submitted by Kinross to the Bureau of Land Management and approved.

Kinross also took down a 9.9% interest in Riley’s outstanding common during its last round of financing.

Teuton Resources (TUO.V)

- 57.75 million shares outstanding

- $75.07M market cap based on its recent $1.30 close

- TUO website

Treaty Creek is ranked in the world’s Top Ten (undeveloped) gold deposits. The project, with its multiple zones, boasts a resource of some 27.87 million AuEq ozs in the Indicated category (21.66 Moz of Au at 0.92 g/t, 128.73 Moz of Ag at 5.48 g/t, and 2.87 billion pounds of Cu at 0.18%) and 6.03 million AuEq ozs in the Inferred category.

As you probably already know, Teuton holds a 20% (carried) interest in Treaty Creek, along with an extensive portfolio of properties in the prolific Golden Triangle of northwestern BC. The company also holds a large portfolio of royalties on various projects throughout the Triangle (including Treaty Creek itself).

Aside from a steady stream of assay-related newsflow, there was a flurry of activity surrounding Treaty Creek in early September when privately held Cunningham Mining Ltd inked a deal with American Creek Resources for its 20% (carried) stake in the deposit. The all-cash deal was set at $0.43 per share (valued at roughly C$207 million) representing a substantial premium over American Creek’s prior trading range.

There’s obviously an appetite for these monster-sized Au-Cu-Ag deposits. One can’t help but wonder if Teuton also has a target on its back.

Other plays in the junior arena worth checking out…

Other names worth checking out include, Anton Resources (AAN.V), Aldebaran Resources (ALDE.V), Azimut Exploration (AZM.V), Hercules Metals (BIG.V), Dolly Varden Silver (DV.V), GFG Resources (GFG.V), Golden Lake Exploration (GLM.C), Kuya Silver (KUYA.C), Hannan Metals (HAN.V), Lavras Gold (LGC.V), i-80 GOLD (IAU.TO), Ramp Metals (RAMP.V), Rio2 Limited (RIO.V), Scorpio Gold (SGN.V), Skeena Resources (SKE.TO) Troubadour Resources (TR.V), Western Alaska Minerals (WAM.V), and West Vault Mining (WVM.V).

This just in…

__________________________________________________________________

Note that the following content is in collaboration with Forum Energy Metals (Highballer is compensated by the company for this effort)

__________________________________________________________________

Headline: Forum Drilling Update, Aberdeen Uranium Project, Nunavut

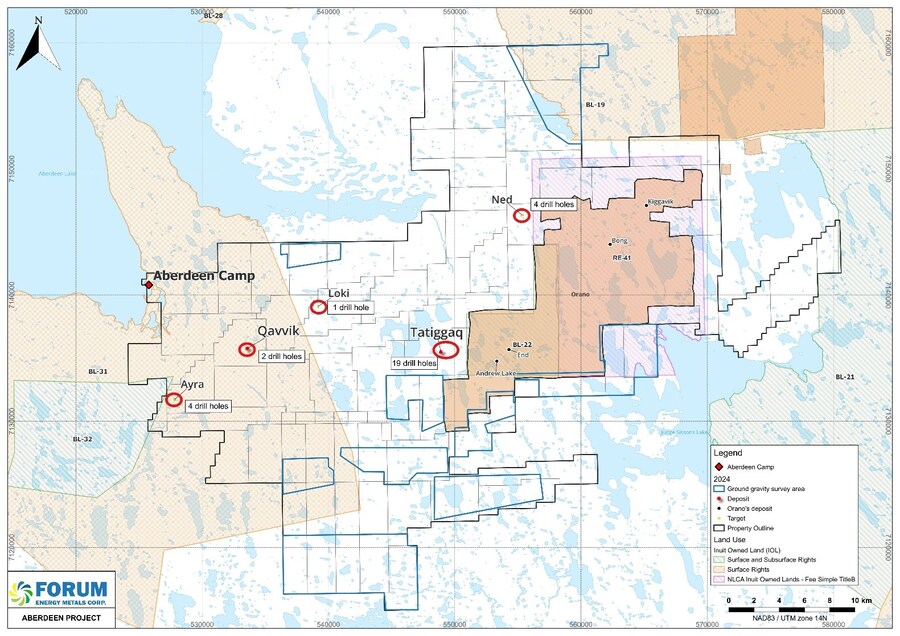

After drilling 30 holes for a total of 6,962 metres at its flagship Aberdeen Uranium Project in the Thelon Basin of Nunavut, Forum Energy Metals (FMC.V) has concluded its 2024 campaign.

According to today’s (October 1) press release, the program covered 5 of the more than 20 identified gravity targets on the 95,000-hectare property including the two existing discoveries at Tatiggaq and Qavvik.

Due to a backlog at the SRC lab in Saskatoon, Saskatchewan, initial results are now expected in two to four weeks.

Further to its news release dated August 20, 2024, Forum continues to intersect uranium mineralization and intense alteration within favourable structural and lithological corridors for unconformity-style uranium deposits in an emerging uranium district comparable to the prolific Athabasca Basin.

Rebecca Hunter, VP of Exploration,”Our 2024 program was highly successful. We constructed a 40-person exploration camp to stage our future exploration efforts in the Thelon Basin with the expertise of our exceptional logistics team and were able to begin drilling in late June with a focus on our Tatiggaq deposit. In concert with that achievement was our ability to drill four additional targets including our second discovery, Qavvik. The 2024 drilling will provide us with great knowledge to develop an even more exciting 2025 program that will include Tatiggaq and Qavvik expansion and further drilling of greenfield gravity low targets, including Loki and Ayra. The 2024 and proposed 2025 drilling at Tatiggaq and Qavvik will provide us significant data to begin the development of a preliminary resource estimate.”

Thirty drill holes have been completed on the following targets:

Tatiggaq – Nineteen drill holes were completed on this large gravity anomaly of which eleven drillholes focused on follow-up drilling from the 2023 drill program where 2.25% U3O8 over 11.1 metres, 1.01% over 6.2 metres and 0.40% U3O8 over 12.8 metres were intersected. Eight drill holes tested parallel subsidiary structures within the Tatiggaq gravity anomaly.

Qavvik – Two drill holes were completed to test an interpreted controlling structure of the uranium mineralization intersected by previous Cameco drilling.

Ayra – Four drill holes were completed on this sandstone covered target for uranium mineralization at the basement/sandstone unconformity contact. Previous drilling by Cameco intersected intense alteration and elevated uranium values within the sandstone and basement rocks.

Ned – Four drill holes were completed on this sandstone covered target for uranium mineralization at the basement/sandstone unconformity contact. Two of the holes were abandoned due to drilling conditions and two holes intersected the unconformity at approximately 200 metres.

Loki – One last drill hole was completed on this sandstone covered target for uranium mineralization at the basement/sandstone unconformity contact. Two historical holes were completed in the vicinity that intersected anomalous uranium values in the sandstone and anomalous clay alteration. The unconformity contact is at approximately 130 m and the 2024 drillhole exhibited intense clay and sooty sulphide alteration in the sandstone column but was terminated prematurely due to logistical and weather considerations in late September. Casing has been left to re-enter this drillhole next drilling season and much more of this prospective anomaly requires testing

This October 1 press release goes on to state that over 5,000 gravity stations were completed on the property resulting in near full ground gravity coverage of this district-scale property.

New favourable drill targets have been identified from the preliminary data. This survey is meaningful given that all uranium deposits on the Orano/Denison/UEC Kiggavik property were discovered within gravity low targets.

END

Greg Nolan

Full disclosure: The author has a business relationship with Forum Energy Metals. The author has no business relationship with the other companies summarized further up the page. The author owns shares of Forum Energy Metals, Northern Superior and OnGold, which he may decide to trade at any time without prior notice.

Disclaimer - Legal NoticeHighballerstocks.com (Greg Nolan) is not a licensed financial advisor and does not give investment advice.

The content of this report is for information purposes only.

Nothing contained herein should be construed as a recommendation or solicitation to buy or sell any security.

Always consult a licensed qualified investment advisor in your legal jurisdiction before making any investment decisions.

Though Highballerstocks.com (Greg Nolan) believes its sources to be credible, and the statements contained herein to be true, readers must conduct their own thorough due diligence, and or consult with a qualified investment advisor before important investment decisions are made.

Highballerstocks.com (Greg Nolan) accepts no responsibility or liability for the accuracy of the contents of this report.