I launched Highballer (named after my book) in early 2020 in anticipation of a bull run in junior mining equities that would rival previous bull cycles. Though 2020 ultimately proved to be a false start, I’m convinced we’ll witness a move that will prove epic in scale. The foundation is certainly in place. The underlying metal boasts a trajectory that has taken on an almost surreal momentum as uncertainty ripples throughout the geopolitical and economic landscape. There’s a rage in the air. The rotation into safe-haven assets continues, unabated.

There’s logic in accumulating and holding the physical metal as it continues to ratchet higher, but as Chris Parry emphasized in a recent Equity Guru piece: “You’re not chasing returns here so much—you’re preserving wealth in a manner that will survive both political revolution and zombie apocalypse.”

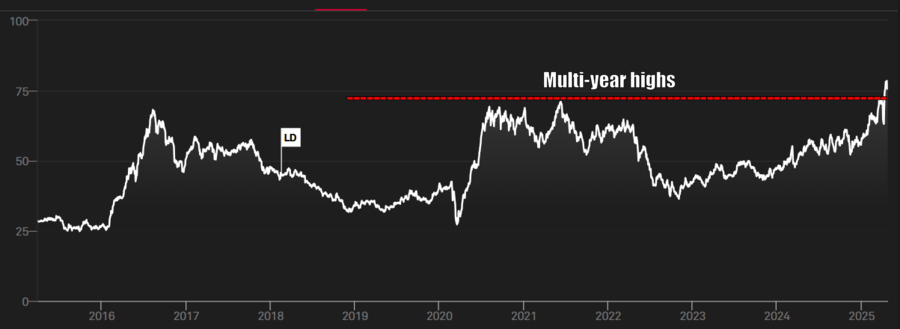

The real opportunity lies in mining stocks. Though the Senior Producers have performed well, taking out multi-year highs in recent sessions, they’re still trading at ridiculously low multiples, and well below levels witnessed back in 2011 (when gold was trading $1300 lower than it is now).

At $3300, producers are cranking out record levels of free cash flow, and their cost to produce an ounce of the metal (on average) is only $1400 all-in. Those are insanely good margins.

It’s reasonable to suggest that the senior equities—the Bigs—have some serious catching up to do and that establishing a meaningful position at current levels makes a good deal of sense.

That goes double for companies further down the food chain, from mid-sized producers to junior entities pushing their discoveries aggressively along the exploration and development curve.

Though I can appreciate a solid grassroots exploration play (what kid doesn’t like a good treasure hunt?), there is much to be said for focusing on mature juniors with significant 43-101 compliant resources on their books. These resource-rich juniors may land in the crosshairs of a resource-hungry producer whose long-term survival depends on a robust pipeline of development projects. If a producer is unable to generate its project pipeline organically (many can’t), it needs to hone its predatory instincts… it needs to hunt.

Ideally, you want to position yourself in a junior with a resource that’s open to expansion within a land package offering significant exploration upside… all in a mining-friendly jurisdiction. It’s a tall order, especially if you narrow your search to include only competent management teams boasting a combination of geological and capital market savvy. But such companies are out there, and some of the valuations are pretty damn compelling.

The here and now

With the calendar set to flip over to May, investors with significant exposure to the junior arena now must weigh the classic conundrum: ‘Sell in May and Go Away’ or ‘Be Right, Sit Tight.’ I’m leaning towards the latter.

Part of my optimism stems from the recent price action in two indexes I track for a weekly publication I ghostwrite – the S&P/TSX Venture Gold Index, where highs going back to 2016 have recently been breached…

… and the more widely followed CDNX, where 2-plus year highs are currently under siege.

The Companies

We now have a pulse in the junior exploration arena. Selective accumulation is going on in some of the higher-quality names, and money is beginning to flow into the coffers of lesser-known companies eager to probe the subsurface stratum of their flagships. Assay-related newsflow is about to find a whole new gear.

I track a fair number of companies in this sector. The following content concerns a handful I’m watching close.

Collective Mining (CNL.TO) – (CNL.NY)

- 84.85 million shares outstanding

- $1.12B market cap based on its recent $13.20 close

- Corp Presentation

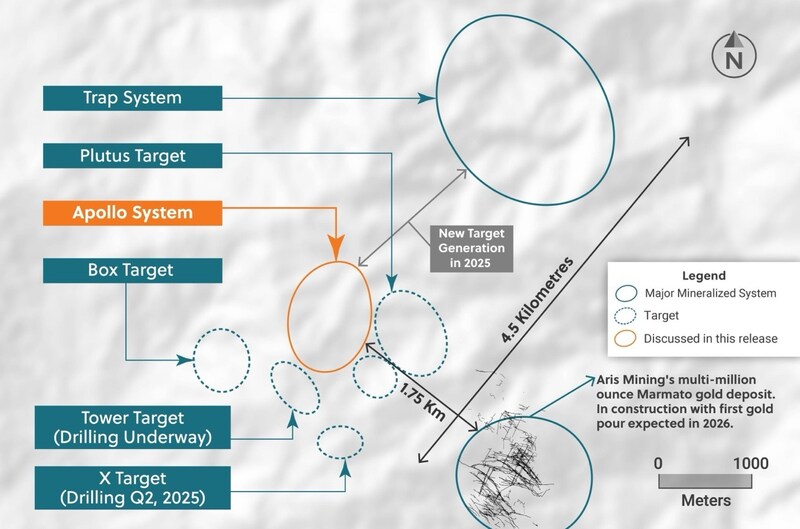

With its market cap having pushed past the $1 Billion mark in recent sessions, Collective is in an enviable position as management continues to successfully de-risk their mothership Guayabales Project with the biz end of the drill bit. The company, founded by the same team that developed and sold Continental Gold to Zijin Mining for $2 billion, appears to be onto another world-class deposit(s) at Guayabales. And its current (richly rewarded) shareholder base is betting on a repeat of that past success.

After tagging an impressive, rapid-fire sequence of bulk tonnage and high-grade intercepts that drew the attention of one of the mining sector’s Bigs, Agnico Eagle, Collective is accelerating exploration with four additional rigs, bringing the total to ten. The company is now targeting 70,000 meters of drilling across multiple targets at Guayabales (and San Antonio) in 2025.

2025 drilling objectives for the Apollo system:

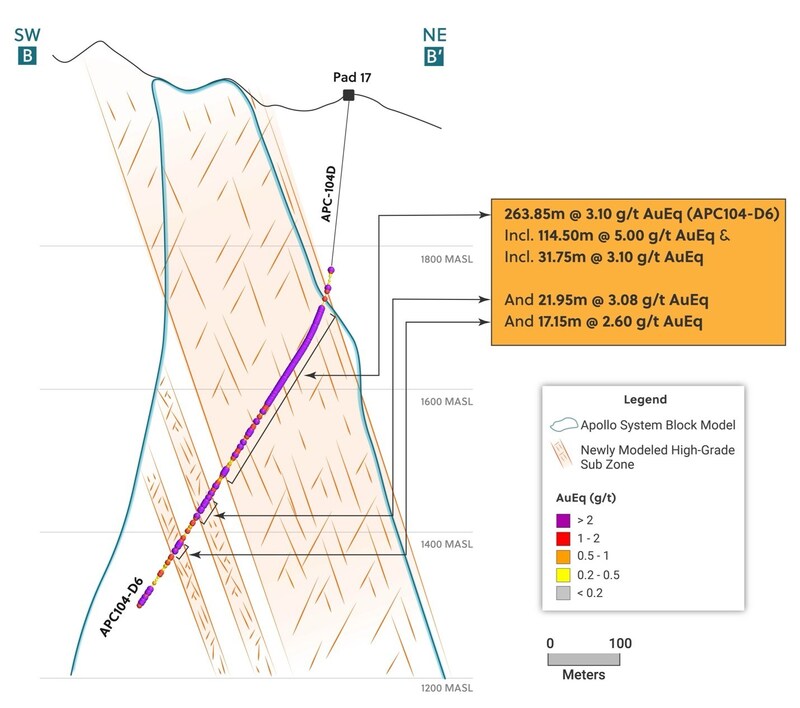

- Drill test newly modeled high-grade sub-zone targets scattered throughout the top 1,000 vertical metres from surface to improve the grade profile (and size) of the system.

- Grow the overall dimensions of the system by expanding vertically and laterally the recently discovered high-grade Ramp Zone.

- Test the northern extension potential of Apollo at shallower elevations.

- Expand and define the area of outcropping/shallow mineralization and test many drilling gaps within the internal block model from surface to a depth of 150 metres.

The latest round of drill results were released two weeks back. The highlight interval (drill hole APC104-D6) is in the text of this April 15 headline – Collective Mining Expands the Initial High-Grade Sub-Zone at Apollo by Intersecting 114.50 Metres at 5.00 g/t AuEq Within 263.85 Metres at 3.10 g/t AuEq.

Aurion Resources (AU.V) – (AIRRF.OTC)

- 149.2 million shares outstanding

- $125.33M market cap based on its recent $0.84 close

- Corp Presentation

Wanting exposure to Aurion’s district-scale land position along the Central Lapland Greenstone Belt of northern Finland, including the potential for a monetization event surrounding its Helmi project, I recently purchased shares.

To explain the rationale behind this ‘monetization’ expectation, a quote from my March 17 report:

Aurion’s Helmi project shares a common boundary with Rupert’s Ikkari deposit (Helmi is a joint venture between Aurion—30% and B2Gold—70%). A part of Rupert’s deposit (and possibly a weighty swath of mineralization) runs onto Aurion’s JV claims. Rupert will need to acquire that chunk of ground before they can proceed with open pit development of Ikkari to minimize the negative (economic) impacts of a sub-optimal pit design.

The thinking among analysts like Brent Cook is that Rupert will likely get acquired by a resource-hungry producer, but before that can happen, a deal will need to be worked out with Aurion.

Since my last update, Aurion inked a deal with KoBold Metals, granting the Gates/Bezos-backed entity the right to earn an undivided 75% interest in an area covering approximately 35 km2 in the eastern portion of the junior’s 100% owned 160 km2 Risti Property.

Deal Terms:

- Earn-in: KoBold can earn an undivided 75% interest in commodities discovered in the Project Area (other than any discoveries that are predominantly gold or silver) by incurring USD$12,000,000 in exploration expenditures on or before the fifth anniversary of the date of signing the agreement, and KoBold commits to a USD$1,000,000 minimum exploration expenditure within 18 months.

- Joint venture: Following satisfaction by KoBold of the earn-in requirements, a joint venture will be established with KoBold owning 75% and Aurion 25%.

- Net smelter returns royalty: In case an ownership interest in the joint venture is diluted to below 10%, the ownership interest will be converted to a 2% Net Smelter Returns Royalty.

- Aurion retains full ownership rights over areas within the Project Area where the predominant mineral in a discovery is gold or silver and has the right to continue exploration activities in the Project Area during the earn-in phase and the joint venture phase as long as it holds an ownership interest.

Some recent M&A

As expected, there has been a flurry of M&A since my last report. In recent sessions, China’s CMOC Group took a run at Lumina Gold (LUM.V), both parties putting signatures to paper in an all-cash deal valued at C$581 million. The other day, Australia’s Alkane Resources moved on Mandalay Resources (MND.TO) in an all-paper deal valued at almost A$560 million.

There was also an acquisition in the royalty space concerning a company highlighted in these pages in February.

Orogen Royalties (OGN.V) – (OGNRF.OTC)

- 201.78 million shares outstanding

- $363.21M market cap based on its recent $1.80 close

- Corp presentation

Orogen and Triple Flag Precious Metals (TFPM.TO) announced a ‘definitive agreement’ concerning a 1% NSR royalty the former holds on the Expanded Silicon gold project in the Beatty district of Nevada. The project, owned by AngloGold Ashanti NA, boasts a massive mineral endowment of some 16.3 million ounces of oxide gold. The deal values the royalty at roughly C$421 million.

Triple Flag only wants the 1% NSR. The rest of Orogen’s assets will be spun off into a new entity, including the Ermitaño 2.0% NSR royalty (a producing gold and silver mine operated by First Majestic Silver Corp), a portfolio of 27 exploration-stage royalties (including the La Rica porphyry target in Colombia, the MPD South copper project in British Columbia, and the Spring Peak gold project in Nevada), a pipeline of organic royalties created through exploration partnerships, and C$15 to C$20 million in working capital.

According to this April 22 press release:

Orogen and Triple Flag have also agreed to negotiate the formation of a generative exploration alliance in the western United States, whereby Triple Flag will provide funding to Orogen Spinco for generating gold and silver targets considered geologically similar to the top-tier Expanded Silicon project. The initial $435,000 budget will focus on identifying prospective exploration opportunities for incoming exploration partners.

The market appeared to be okay with the deal…

Radisson Mining (RDS.V) – (RMRDF.OTC)

- 345.91 million shares outstanding

- $103.77M market cap based on its recent $0.30 close

- Corp Presentation

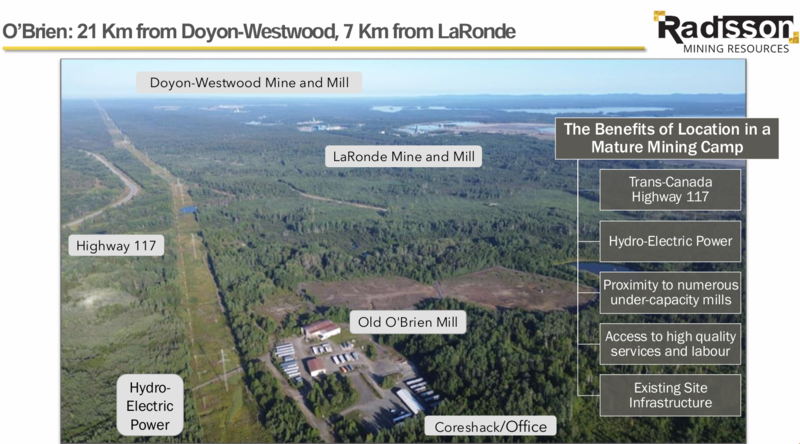

Deemed by some as one of the more obvious takeover targets in the junior arena, Radisson and its flagship O’Brien Project in the Abitibi region of northwestern Québec appear to have all the necessary attributes to draw the attention of a resource-hungry predator (producer)—a high-grade ounce count with good metallurgy, a mining-friendly jurisdiction, abundant nearby infrastructure, and a number of hungry (under-capacity) mills within trucking distance.

The company continues to deliver positive results from an ongoing 22,000-metre drill campaign. The latest round, delivered earlier this month, consists of deep step-outs below O’Brien’s existing resource block (and the historic mine workings).

Highlights:

- OB-24-337W3 intersected 29.93 g/t Au over 2.2 metres, including 53.50 g/t Au over 1.2 metres and 4.54 g/t Au over 3.0 metres, including 7.61 g/t Au over 1.5 metres;

- OB-24-337W1 intersected 4.44 g/t Au over 6.4 metres, including 18.65 g/t Au over 1.2 metres; and,

- OB-24-337W2 intersected 9.62 g/t Au over 1.4 metres.

But just when I thought the shares were about to launch an assault on fresh highs, with soaring gold prices serving as a tailwind, the company dropped news of a raise, which was subsequently upsized.

Quimbaya Gold (QIM.C) – (QIMGF.OTC)

- 41.37 million shares outstanding

- $19.86M market cap based on its recent $0.48 close

- Corp Presentation

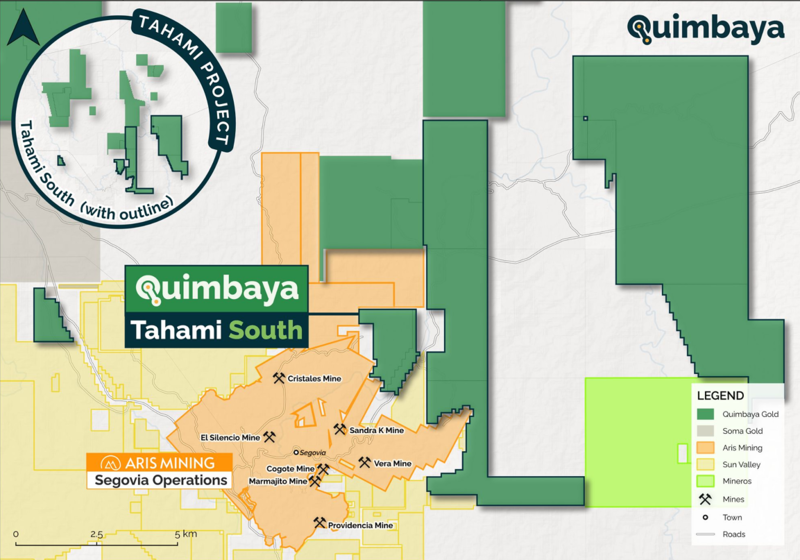

I continue to chip away at this Columbian exploreco as funds allow. As noted in a mid-March Highballer report, the company’s Tahami (South) project, on trend with Aris Mining’s high-grade Segovia project (M&I ounce count = 3.6 million ozs), is teed up for a first pass 4,000 meter drill campaign.

The company has entered into a unique partnership with Colombia’s largest drilling company, Independence Drilling, where it has secured 100k meters of drilling over five years via a share-based agreement. I can’t think of a better, more efficient way to push multiple projects along the exploration curve than teaming up with a local operator who’s intimately familiar with the terrain.

Drilling should begin shortly. According to Alexandre Boivin, the company’s CEO, the expected turnaround for assays is five to seven days (CEO Boivin is a regular on the QIM Channel over at CEO.CA).

West Point Gold (WPG.V) – (WPGCF.OTC)

- 68.11 million shares outstanding

- $40.18M market cap based on its recent $0.59 close

- Corp presentation

West Point, last mentioned here in February, recently reported an impressive round of assays from an ongoing RC drill program at its Gold Chain Project (Tyro Main Zone) in Arizona.

Highlights from this April 22 press release:

- Hole GC25-49 intersected 30.48m of 9.05 g/t Au within 62.49m of 4.73 g/t Au. This hole included 7.62m of 12.11 g/t Au, 12.19m of 12.40 g/t Au and 1.52m of 39.1 g/t Au.

- Hole GC25-47 intersected 33.52 m of 5.46 g/t Au within 50.29m of 3.76 g/t Au. This hole included 4.57m of 12.05 g/t Au and 10.67m of 8.54 g/t Au.

- Hole GC25-48 intersected 28.96 m of 6.02 g/t Au within 41.15m of 4.33 g/t Au. This hole included 4.67m of 19.04 g/t Au and 1.53m of 10.70 g/t Au.

- Based on these results and the results from GC24-34 (42.8m of 2.50 g/t – Released January 23, 2025) there appears to be a significant higher-grade zone developing at northeast part of the Tyro Main Zone

- Assays are pending for an additional 7 completed drill holes (approximately 1,533m) and the drill program is ongoing.

CEO Quentin Mai: “The results from these three holes in the northeastern portion of the Tyro Main Zone have defined a new high-grade zone with a current drilled strike extent of approximately 100m. The current results suggest that this higher-grade zone plunges to the northeast toward the Frisco Graben. These three high-grade intercepts are expected to have a significant impact on building a maiden resource at Tyro, which is on patented ground in the southwestern US.”

>>>Note that the final installment of this report is in collaboration with Forum Energy Metals (Highballer is compensated by the company for this content)<<<

Forum Energy Metals (FMC.V) – (FDCFF.OTC)

- 309.35 million shares outstanding

- $13.92M market cap based on its recent $0.045 close

- Corp Presentation

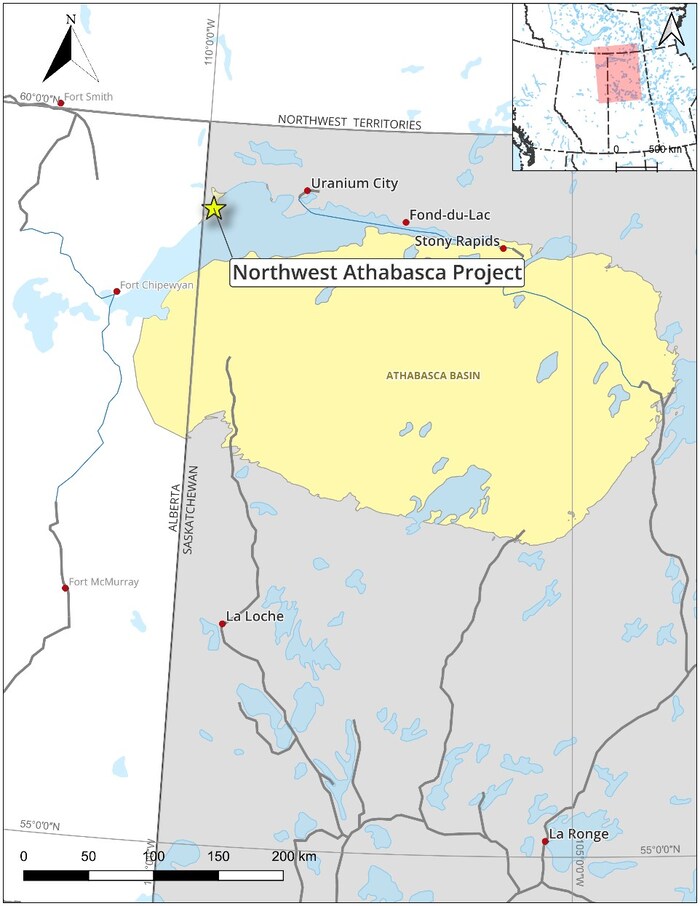

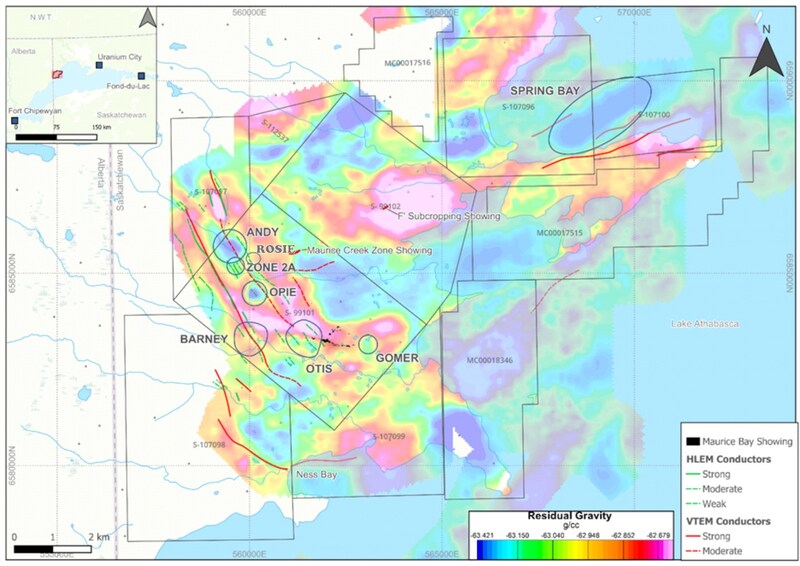

Forum and its partner, Global Uranium, recently reported having completed a diamond drilling program, as well as a round of ground geophysics, at their Northwest Athabasca (NWA) Project located along the northwest shore of Lake Athabasca in Saskatchewan – Forum Energy Metals and Global Uranium Announce the Completion of Drilling and Ground Geophysical Surveys on the Northwest Athabasca Project, Saskatchewan.

Forum reports that a total of 656 meters were drilled along two zones—2A and Rosie. Additionally, ground-based Time Domain Electromagnetic (TDEM) and Direct Current Induced Polarization (DCIP) geophysical surveys were completed over the Spring Bay grid to refine future drill targets.

The limited drill campaign, hampered by a host of logistical challenges, successfully confirmed the project’s highly prospective nature by intersecting elevated levels of radioactivity and alteration distinct to unconformity-type uranium mineralization.

NWA Program Highlights:

- Elevated radioactivity along fractures (170 to 300 cps – handheld scintillometer) intersected in both drill holes at Zone 2A;

- Bleached sandstone and elevated radioactivity (up to 120 cps) within fractures in the underlying basement gneiss at Rosie;

- Completed ground geophysical survey at Spring Bay that shows a major coincident conductor with the strong gravity anomaly.

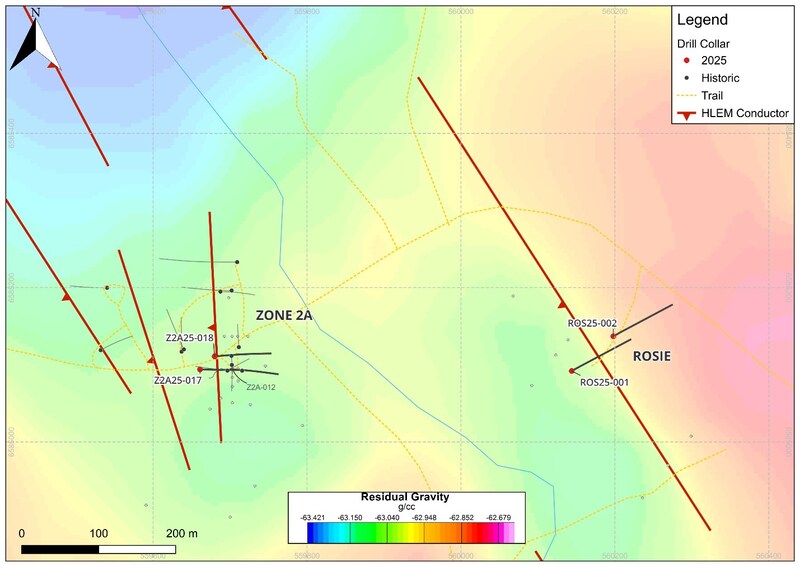

Two holes tested the Zone 2A area (image below), where previous drilling tagged a high-grade historical intercept of 5.69% over 8.5 meters in drill hole Z2A-12 (originally drilled by Uranerz). Historical EM data was remodeled here to target the mineralized zone more effectively.

At Rosie, two holes targeted a NW-trending EM conductor along a magnetic and gravity high-to-low boundary. Forum’s objective at Rosie was “to determine if a significant normal fault zone is present across the grid displaying an east up-thrown block and if there is evidence of mineralization processes in the area.”

Further details concerning Zone 2A and Rosie (as per the guts of this April 24 press release):

In Zone 2A, from DDH Z2A25-017 up to 300 cps (hand-held scintillometer) was intersected within fractures in a broader prospective fault structure with graphitic pelite, pegmatite and quart vein development. Drill hole Z2A25-018 intersected several fractures with counts ranging from 170 to 220 cps in a strongly hematized fault zone. The Zone 2A drilling successfully hit the mineralized structure and provides a better understanding on how to target this zone in the future.

At the Rosie Grid, ROS25-001 intersected 24 m of bleached pebbly sandstone and a bleached unconformity contact. Alternating moderately bleached and hematized basement intervals continue to 119 m and show that the basement rocks in this area have been affected by prospective fluid movement. Elevated counts up to 120 cps are present within silicified basement gneiss and possible dravite clay is present along fractures in the bleached intervals. Drill hole ROS25-002 intersected weakly bleached and hematite altered biotite gneiss at the top of the hole to 32 m. The Rosie drilling successfully reveals that a major fault is present between the 2 drill holes, which has up-thrown the eastern block and shows this trend is analogous to the Maurice Bay showing area. The bleaching and clay alteration at Rosie suggests that an unconformity uranium system could be present in the area.

Global can earn a 51% interest in Forum’s interest in the NWA Project by spending up to $9M over four years (complete deal terms here). Forum is the operator of the project.

Aside from the Northwest Athabasca Project and their flagship Aberdeen Project (recently updated here), Forum controls a vast pipeline of projects in the prolific Athabasca Basin of Saskatchewan, many of which are at the drill-ready stage.

END

– Greg Nolan

Full disclosure: Forum Energy Metals is a Highballer client. The author, Greg Nolan, owns stock in Forum Energy Metals (FMC.V), Quimbaya Gold (QIM.C), Aurion Resources (AU.V), and Radisson Mining (RDS.V). The author reserves the right to trade these holdings at any time without notice.

Disclaimer - Legal NoticeHighballerstocks.com (Greg Nolan) is not a licensed financial advisor and does not give investment advice.

The content of this report is for information purposes only.

Nothing contained herein should be construed as a recommendation or solicitation to buy or sell any security.

Always consult a licensed qualified investment advisor in your legal jurisdiction before making any investment decisions.

Though Highballerstocks.com (Greg Nolan) believes its sources to be credible, and the statements contained herein to be true, readers must conduct their own thorough due diligence, and or consult with a qualified investment advisor before important investment decisions are made.

Highballerstocks.com (Greg Nolan) accepts no responsibility or liability for the accuracy of the contents of this report.