I’ve been meaning to refresh these pages. But between final tweaks on my new book (the Highballer sequel) and ghostwriting a weekly briefing for the junior mining crowd, time’s been flying.

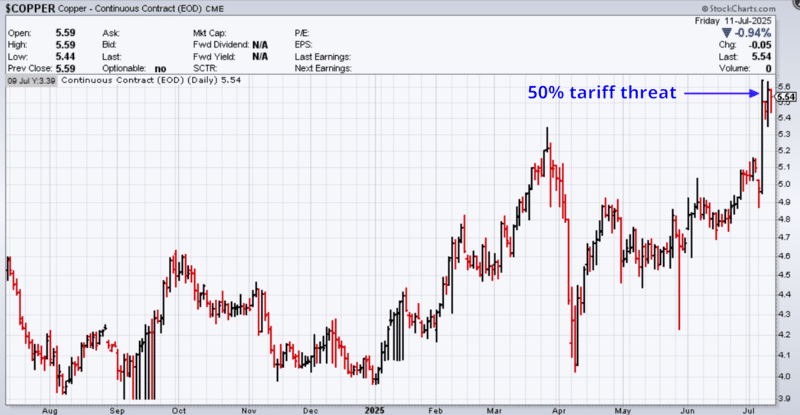

Copper

Early last week, copper stole the spotlight after Trump threatened a 50% tariff on the soft, malleable metal. The nearby U.S. futures contract pushed 13% higher in the wake of the threat, tagging highs not seen since 1968.

There’s been some intense arbitrage activity in the widening price spread between London and New York—now roughly 28%—as copper shipments accelerate westward in anticipation of the August 1st tariff trigger.

A number of juniors with significant exposure to the metal—those able to boast tier-1 porphyry potential in mining-friendly jurisdictions—are gaining traction. Two glowing examples, and what some consider obvious takeover targets, are NGEx Minerals (NGEX.TO) and Marimaca Copper (MARI.TO).

A one-year MARI, below…

Silver

Late last week, during Friday’s session, it was silver’s turn. The gray metal put on quite a show, decisively breaking out of a bull flag formation, taking out levels last seen in 2011.

Right now, there’s little standing in silver’s way until the psychologically important $40 level, viewed as a gateway to an inevitable test of $50 by the Ag party faithful.

With this recent price strength, the gold/silver ratio is now down to roughly 83 after tagging a high of 105.85 on April 22. Translation: it now takes 83 ounces of silver to buy a single oz of gold. Even after this dramatic surge, the gray metal may still be viewed as a value play as the historical average for the ratio is in the 50 to 60 range.

“Be Right, Sit Tight?”

In my last report, as we were entering the month of May, I posed the question: ‘Sell in May and Go Away?’ or… ‘Be Right, Sit Tight?’ Turns out, those who sat tight are making bank.

Silver’s breakout sets the stage for this episode of Highballer. I’ll begin by spotlighting several names covered here in recent months. I’m approaching this with the view that Friday’s breakout is for real and marks the early innings of a sustained bull run—volatility notwithstanding.

A Few Silver Cos

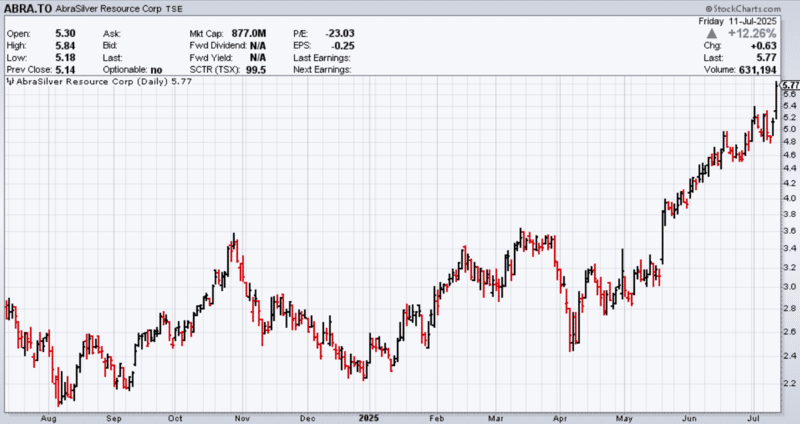

AbraSilver Resource Corp (ABRA.V) – (ABBRF.OTC)

- 152.55 million shares outstanding

- $360.04M market cap based on its recent $2.78 close

- Corp Pitch Deck

I trotted out ABRA earlier this year when it was trading with a market cap of $360M. After Friday’s massive 12% gain, it’s now valued at $880M. ABRA is a high-grade silver play in Salta Province, Argentina, where the company is aggressively pushing its wholly-owned Diablillos Project along the exploration curve.

The company lit up trading screens, triggering significant accumulation when it dropped the following headline on May 20 – AbraSilver Drills Best-Ever Gold Intercept at Diablillos; 31.0 Metres Grading 10.0 g/t Gold Including 6.0 Metres at 41.9 g/t Gold.

The grades at depth highlighted in the text of the above headline are impressive, but the same hole (DDH 25-024) also delivered high-grade silver values further up, closer to surface.

The DDH 25-024 breakdown:

- 31.0 metres grading 10.0 g/t gold and 16 g/t silver from 324 meters, including:

6.0 meters at 41.9 g/t gold and 22 g/t silver, AND… - 13.0 meters grading 307 g/t silver from 216 meters depth and within the conceptual open pit, including 8.0 meters at 446 g/t silver in the upper silver-enriched zone.

A one-year ABRA daily…

Aftermath Silver (AAG.V) – (AAGFF.OTC)

- 304.53 million shares outstanding

- $267.98M market cap based on its recent $0.88 close

- Corp Presentation

A final note in my March 3 report shed light on this one after the company reported a solid round of drill results from their Berenguela project in southern Peru… results that were initially ignored by the market. The stock was trading at $0.48 back then (now $0.88) – Aftermath Silver Reports 156m From Surface of 290g/t Ag, 1.12% Cu and 7.3% Mn In Eastern Zone Step Out.

More recently, the company dropped two assay-rich press releases:

May 26 – Aftermath Silver Reports High Grade Silver Intercepts Step Out Returns 1,174g/t Silver Over 7.1m.

Highlights:

- Hole AFD129 intercepted 12.35 meters** of 302g/t Ag, 0.66% Cu, and 10.64% Mn between 2.40 meters to 16.75 meters downhole;

- Hole AFD130 intercepted 35.55 meters** of 322g/t Ag, 0.58% Cu, and 6.88% Mn from surface to 42.25 meters, including 7.10 meters @ 1174g/t Ag, 0.80% Cu, and 11.14% Mn from 24.4 meters downhole.

**Previous underground mining resulted in some voids.

June 9 – Aftermath Silver Continues to Intersect High Grade Silver, Copper and Manganese at Berenguela, Peru.

Highlights:

- AFD144 intersected 13.8 meters @ 558g/t Ag + 3.16% Cu + 15.06% Mn from 23.2 meters down hole, including 5.6 meters @1053g/t Ag + 2.85% Cu + 15.80% Mn from 31.4 meters down hole;

- AFD139 cut 68.9 meters @ 78g/t Ag + 1.19% Cu + 6.03% Mn from 6.4 meters down hole.

A one-year AAG daily…

Apollo Silver (APGO.V) – (APGOF.OTC)

- 242.54 million shares outstanding

- $110.36M market cap based on its recent $0.455 close

- Corp Pitch Deck

Apollo boasts two weighty silver assets in its project portfolio: the Calico Silver Project in San Bernardino County, California, and the Cinco De Mayo Project in Chihuahua State, Mexico.

While recent newsflow has been relatively light, earlier this year the company announced advancements at Cinco de Mayo and unveiled its 2025 Calico work program. Management has also been busy behind the scenes, bulking up its leadership team, broadening its California footprint, and ramping up investor engagement – Apollo Silver (APGO) (APGOF); Right Assets, Right Management and Right Time.

A one-year APGO daily…

Kuya Silver (KUYA.C) – (KUYAF.OTC)

- 121.38 million shares outstanding

- $60.69M market cap based on its recent $0.50 close

- Corp Pitch Deck

Kuya first entered my radar in 2020, back when the sector was gaining momentum and the company was pushing its high-grade Bethania Silver Project in Central Peru along the development curve.

According to the company’s Overview Presentation, toll milling production at the Bethania project commenced in Q2 of 2024. This year, Q1 ramp-up saw daily production double in late April, putting the mine on track to hit 100 tpd by Q3.

Bethania’s economics as per a 2023 PEA:

- All-in-sustainable cost $9.85/oz equivalent in PEA (first 18 months);

- Average production (head) grade of 13.8 oz/t (or 429 g/t) silver eq in year 1;

- Silver revenue by percentage: 77%;

- Silver production of 1.37 Million oz eq in first full year at 350 tpd.

A one-year KUYA daily…

Prismo Metals (PRIZ.C) – (PMOMF.OTC)

- 54.18 million shares outstanding

- $3.52M market cap based on its recent $0.065 close

- Corp Pitch Deck

Not gonna lie—I haven’t done a full DD dive on this one, but it caught my eye when Chris Parry featured it over at Equity Guru. I’ve taken a cursory peek and I like what I see so far. If I start liking it more, I may establish a position in the coming days/weeks. As always, I value input from readers. If you have any insights re PRIZ, drop me a line at www.highballerstocks@gmail.com.

The following YouTube presentation covers the company’s new acquisitions in Arizona—the Silver King and Ripsey mines…

Chris Parry in his July 4 PRIZ piece: “Silver isn’t sexy—until it is. Then it’s a frenzy.”

Elsewhere in JuniorLand…

Radisson Mining Resources (RDS.V) – (RMRDF.OTC)

- 384.3 million shares outstanding

- $153.72M market cap based on its recent $0.40 close

- Corp Pitch deck

Radisson released a round of first pass economics for its mothership O’Brien Project, located roughly halfway between the towns of Rouyn-Noranda and Val-d’Or in the prolific Abitibi – Radisson Announces Positive Preliminary Economic Assessment for O’Brien Gold Project.

The numbers, which factor in a toll milling scenario with one of the nearby mills, appear very agreeable.

Details, as per the guts of this July 9 press release:

- Assumes off-site toll milling based on the results of a recent milling assessment and metallurgical study that demonstrated the potential compatibility of the nearby Doyon gold mill, part of IAMGOLD Corporation’s Westwood Mine Complex1. Off-site milling reduces capital costs, development risk, and project footprint;

- Utilizes existing Mineral Resource Estimate, re-blocked with an updated cut-off yielding more ounces in more tonnes with good continuity at a lower average grade;

- Presents a base case “snap-shot” study that excludes recent drilling successes outside the existing MRE and below historic mine workings, with a 50-60,000 meter fully funded drill program ongoing.

Value:

- After-tax Net Present Value at a 5% discount rate of $532 million, Internal Rate of Return of 48%, and payback of 2.0 years at US$2,550/oz gold;

- After-tax NPV5% of $871M, IRR of 74%, and payback of 1.1 years at US$3,300/oz Au.

Cost:

- Initial Capital Cost of $175M and Life-of-Mine Sustaining Capital of $173M;

- Cash Cost of US$861/oz and All-In Sustaining Cost of US$1,059/oz including conceptual 30% toll milling margin on processing and G&A costs;

- Extremely capital efficient with after-tax NPV5% to Initial Capital Cost ratio of 3.0 at US$2,550/oz Au and 5.0 at a spot gold price of US$3,300/oz Au.

Production Profile:

- 11-Year Mine Life with 740 koz mined and 647 koz recovered at 87% average recovery with a gravity-flotation-regrind-leach flowsheet;

- 70 koz/annum average steady-state gold production (Years 2-8) at an average annual after-tax Free Cash Flow (“FCF”) of $97M;

- Underground mining with long-hole stoping and minimal surface facilities.

A detailed webinar presentation following this July 9 press release…

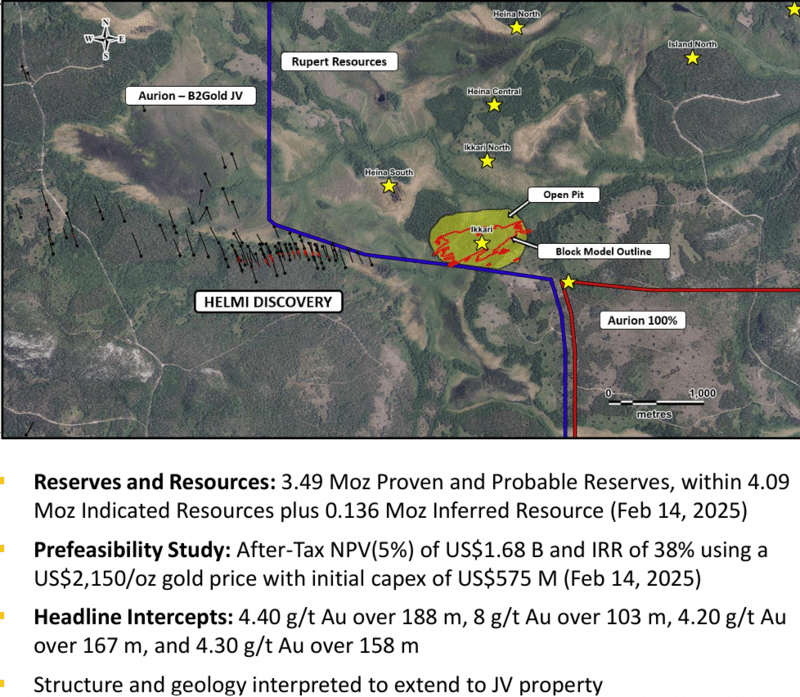

Aurion Resources (AU.V) – (AIRRF.OTC)

- 149.6 million shares outstanding

- $116.69M market cap based on its recent $0.78 close

- Corp Pitch Deck

There are multiple facets to this junior, including the potential for a monetization event tied to its Helmi Project in the Central Lapland Greenstone Belt of northern Finland. The following quote from my March 17 report sums up the potential...

Aurion’s Helmi Project shares a common boundary with Rupert’s Ikkari deposit (Helmi is a joint venture between Aurion—30% and B2Gold—70%). A part of Rupert’s deposit (and possibly a weighty swath of mineralization) runs onto Aurion’s JV claims. Rupert will need to acquire that chunk of ground before they can proceed with open pit development of Ikkari to minimize the negative (economic) impacts of a sub-optimal pit design.

We’re still waiting for Rupert to float a deal that resonates with Aurion and its shareholder base—a base that includes Chairman Dave Lotan, who’s amassed a 10%+ position via frequent open market accumulation.

Outside the Helmi JV ground, the company reported drill hole assays from its flagship Risti Property in late June – Aurion Extends Gold Mineralization at Kaaresselkä, Risti Property.

The company also has an interesting JV with Bill Gates and Jeff Bezos-backed KoBold Metals Company, granting KoBold the right to earn a 75% interest in the eastern portion of the Risti property via a $12M exploration spending commitment.

A Few More on My Radar

I have over a hundred companies on my watch list. That is to say, when news breaks, I’m in the loop. If I were to generate a shortlist from this broader group, it would include the following, which I trade from time to time…

Amarc Resources (AHR.V) – (AXREF.OTC)

- 224.33 million shares outstanding

- $170.49M market cap based on its recent $0.76 close

- AHR website

Amarc recently launched a $10M drill campaign with JV partner Boliden at its DUKE Copper-Gold Project in central British Columbia. The company is also in the advanced stage of planning a drill campaign at its JOY Project in the Toodoggone-Kemess porphyry region of north-central British Columbia with JV partner Freeport-McMoRan.

Big Ridge Gold (BRAU.V) – (ALVLF.OTC)

- 229.64 million shares outstanding

- $32.15M market cap based on its recent $0.14 close

- Corp Presentation

Big Ridge is advancing its Hope Brook Project along the southwest coast of Newfoundland where the resource base currently stands at 1.2 million ounces Indicated (16,190,000 tonnes grading 2.32 grams per tonne gold) and 231,000 ounces Inferred (2,215,000 tonnes grading 3.25 grams per tonne gold).

Collective Mining (CNL.TO) – (CNL.NY)

- 84.85 million shares outstanding

- $1.12B market cap based on its recent $13.20 close

- Corp Presentation

Collective is engaged in an aggressive 70,000 metre drill program at its multiple-target Guayabales Project in Caldas, Colombia. Results to date have been impressive, hence its steep price trajectory and $1B+ market cap.

Goliath Resources (GOT.V) – (GOTRF.OTC)

- 162.28 million shares outstanding

- $384.60M market cap based on its recent $2.37 close

- Corp Presentation

Goliath is in the midst of a 60,000-meter, 9-rig drill campaign at its high-grade Golddigger Property in the prolific Golden Triangle of northwestern BC.

Kenorland Minerals (KLD.V) – (KLDCF.OTC)

- 78.3 million shares outstanding

- $152.69M market cap based on its recent $1.95 close

- Corp Presentation

Kenorland is a hybrid prospect generator boasting C$24.3 million in working capital, a highly prospective portfolio of projects with strategic JV’s, and a fat 4% NSR covering the high-grade Frotet gold discovery.

Mayfair Gold (MFG.V) – (MFGCF.OTC)

- 109.28 million shares outstanding

- $179.22M market cap based on its recent $1.64 close

- Corp Presentation

Mayfair is pushing its wholly-owned Fenn-Gib gold project along the development curve. The project’s current ounce-count = 4.313 million ozs Indicated (181.3M tonnes grading 0.74 g/t Au) and 140k ozs Inferred (8.92M tonnes grading 0.49 g/t Au).

Northern Superior Resources (SUP.V) – (NSUPF.OTC)

- 165.19 million shares outstanding

- $82.60M market cap based on its revcent $0.50 close

- Corp Presentation

Northern Superior is executing a 20k meter drill program designed to expand the mineralized footprint of its Philibert gold project, a nine-kilometer hop from IAMGOLD’s Nelligan project in the Chibougamau Gold Camp of Quebec (SOQUEM currently owns 25% of the project).

Provenance Gold (PAU.V) – (PVGDF.OTC)

- 127.29 million shares outstanding

- $27.37M market cap based on its recent $0.215 close

- Corp Presentation

Provenance is currently engaged in an infill and step-out campaign at its flagship Eldorado Project in the state of Oregon.

Quimbaya Gold (QIM.C) – (QIMGF.OTC)

- 41.37 million shares outstanding

- $19.86M market cap based on its recent $0.48 close

- Corp Presentation

Quimbaya is teed up for a first pass 4k drill campaign at its Tahami (South) project, on trend with Aris Mining’s high-grade Segovia project (M&I ounce count = 3.6 million ozs).

Rio2 Ltd (RIO.V) – (RIOFF.OTC)

- 427.06 million shares outstanding

- $683.30M market cap based on its recent $1.60 close

- Corp Presentation

RIO is pushing its 100% owned Fenix Gold Project in Chile’s Atacama region aggressively along the construction curve. The project is on track to begin pouring gold in January of 2026.

Skeena Resources (SKE.TO, NYSE)

- 114.78 million shares outstanding

- $2.56B based on its recent $22.30 close

- Corp Presentation

First featured in these pages back in February of 2020 when it traded with a modest market cap of $125M (now $2.56B), Skeena is advancing its past producing Eskay Creek Gold-Silver Project in the Golden Triangle of northwestern British Columbia. The project is poised to rank among the highest-grade and lowest-cost open-pit Au-Ag mines in the world.

Teuton Resources (TUO.V)

- 57.75 million shares outstanding

- $48.51M market cap based on its recent $0.84 close

- Presentation Page

Teuton’s 20% carried interest in the Treaty Creek Project is currently active, with JV partner Tudor Gold leading a seven-hole, 6,000-meter drill campaign at this world-class asset in British Columbia’s prolific Golden Triangle.

West Point Gold (WPG.V) – (WPGCF.OTC)

- 87.78 million shares outstanding

- $31.60M market cap based on its recent $0.36 close

- Corp presentation

West Point is currently waiting on assays for the remaining eight holes of an RC drill program at its Gold Chain Project in Arizona. Follow-up drilling is scheduled to commence in Q4 2025.

White Gold (WGO.V) – (WHGOF.OTC)

- 197.65 million shares outstanding

- $62.26M market cap based on its recent $0.32 close

- Corp Presentation

White Gold is exploring an extensive portfolio of highly prospective projects in the emerging White Gold District of west-central Yukon. The project portfolio includes a cluster of four deposits where the (collective) ounce count currently stands at 1,152,900 ounces at 2.23 g/t Au (Indicated) and 942,400 ounces at 1.54 g/t Au (Inferred).

>>>Note that the final installment of this report is in collaboration with Forum Energy Metals (Highballer is compensated by the company for this content)<<<

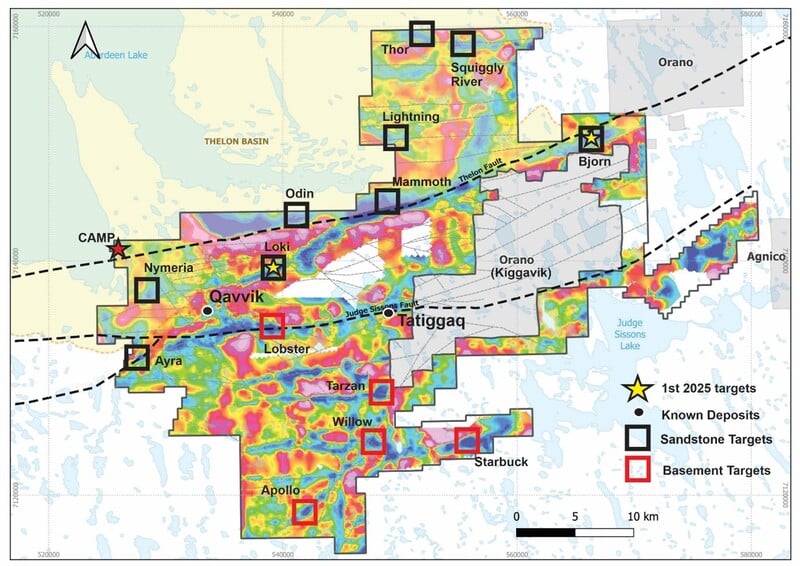

Forum Energy Metals (FMC.V) – (FDCFF.OTC)

- 309.35 million shares outstanding

- $13.92M market cap based on its recent $0.045 close

- Corp Presentation

On June 24, Forum and Baselode Energy Corp (FIND.V) announced their intention to join forces via a definitive arrangement agreement—an at-market business combination whereby Baselode will acquire all of the issued and outstanding common shares of Forum under a court-approved plan of arrangement – Baselode Energy And Forum Energy Metals Combine To Create A New Force In Canadian Uranium Exploration.

Under the terms of the arrangement, Forum shareholders will receive 0.3535 common shares of Baselode for each Forum share held.

The combined entities will continue under the name Geiger Energy Corporation under the trading symbol BEEP on the TSX Venture and BSENF south of the border.

Strategic Rationale for the business combination:

- Significant Potential: Flagship 100%-owned Aberdeen Project in the Thelon Basin, an underexplored region with district potential. A drill program to begin immediately.

- Pipeline Growth from Hook: The Hook Project remains a high-priority follow-up, with large-scale alteration systems suggestive of significant discovery potential and growth.

- One of Canada’s Largest Uranium Exploration Portfolios: 100%-owned projects across the Thelon and Athabasca basins, two of the most prolific uranium regions globally.

- Optionality Through Critical Minerals: Additional copper and critical mineral exposure adds strategic upside and future optionality.

- Strong Capital Foundation: Clean capital structure, proven capital-raising capability, and enhanced market visibility.

- Refreshed Leadership: Dr. Rebecca Hunter, a leading Thelon expert, appointed CEO. Stephen Stewart continues as Chair, with a reconstituted board drawn from both teams.

- Ore Group Platform: Strategic guidance, capital markets execution, and long-term alignment under the Ore Group umbrella.

With Nunavut’s exploration window now open, the newly formed company isn’t wasting time getting a jump on a follow-up drill campaign at Forum’s flagship Aberdeen Uranium Project – Forum-Baselode Announces Aberdeen Project Drilling Underway.

Up to 7,000 meters in 18-25 drill holes is the plan. The company has 10 high-priority targets in its crosshairs with Loki and Bjorn at the top of the hitlist.

Concerning the Loki Target: Drilling will follow up on a prospective gravity target with strong clay alteration and elevated uranium (up to 30 ppm – 30x background) in the Thelon sandstone.

The 2025 program is focused on finding additional high-grade discoveries to build scale and enhance the discovery potential in the district. Ground magnetic surveys are underway on 6 to 10 of the target areas to help refine the main fault zones within the drill areas.

Rebecca Hunter, who will serve as CEO of Geiger Energy, stated, “Our drilling is underway on the Aberdeen Project and the first target is our Loki Grid. We are excited about this target because it has all the exploration building blocks for a possible new discovery.”

Final word belongs to Forum’s Chairman, Mr. Richard Mazur (from a June 2 press release): “After three years with the Company as Vice President of Exploration, Rebecca has earned this new role as CEO.”

Okay, one more thing…

END

– Greg Nolan

Full disclosure: Forum Energy Metals is a Highballer client. The author, Greg Nolan, owns stock in Forum Energy Metals (FMC.V), Aurion Resources (AU.V) and Radisson Mining (RDS.V). The author reserves the right to trade these holdings at any time without notice.

Disclaimer - Legal NoticeHighballerstocks.com (Greg Nolan) is not a licensed financial advisor and does not give investment advice.

The content of this report is for information purposes only.

Nothing contained herein should be construed as a recommendation or solicitation to buy or sell any security.

Always consult a licensed qualified investment advisor in your legal jurisdiction before making any investment decisions.

Though Highballerstocks.com (Greg Nolan) believes its sources to be credible, and the statements contained herein to be true, readers must conduct their own thorough due diligence, and or consult with a qualified investment advisor before important investment decisions are made.

Highballerstocks.com (Greg Nolan) accepts no responsibility or liability for the accuracy of the contents of this report.