Following a blistering late summer rally—one that bulldozed through multiple resistance levels, carving out a succession of historic highs in its wake—gold hit a wall at $4,400 and succumbed to the pull of gravity. After a period of consolidation, it now looks to be emerging from a bullish triangle pattern, bolstered by a host of compelling fundamentals that are impossible to ignore.

Silver, by contrast, is reasserting itself as the more volatile of the precious metals—the wild card—blowing through its mid-October high of $54.50 with explosive momentum. It’s now charting price levels never before recorded.

Unlike the single demand-source that triggered the move above $50 in the 1980s (the Hunt brothers’ attempt to corner the market), there are multiple industrial and commercial demand-sources underpinning this recent show of strength: EVs, solar, green energy technologies… critical pillars of the global megatrends of decarbonization and electrification.

Geopolitical/economic uncertainty, global debt, which continues to ratchet (unsustainably) higher, and the steady erosion of confidence in the greenback—a de-dollarization trend driven by central bank appetites—also represent potent catalysts driving continued across-the-board accumulation in both metals.

A Silver Co Worthy of Your DD

Disclaimer: The following content has been produced in collaboration with Kootenay Silver Inc. Highballer has received compensation from the company for this effort. The insights and views presented in this report should be considered biased.

Introducing a well-run silver explorer in the midst of an aggressive drill campaign at its flagship project—a project that boasts a substantial high-grade resource base marked by impressive silver values, including:

- 17.8 meters of 650 gpt silver;

- 6 meters of 2,035 gpt silver;

- 34.45 meters of 540 gpt silver.

Kootenay Silver (TSXV:KTN) – (OTCQX:KOOYF)

- 87.51 million shares outstanding

- $174.15 M market cap based on its recent $1.99 close

- Corp Presentation

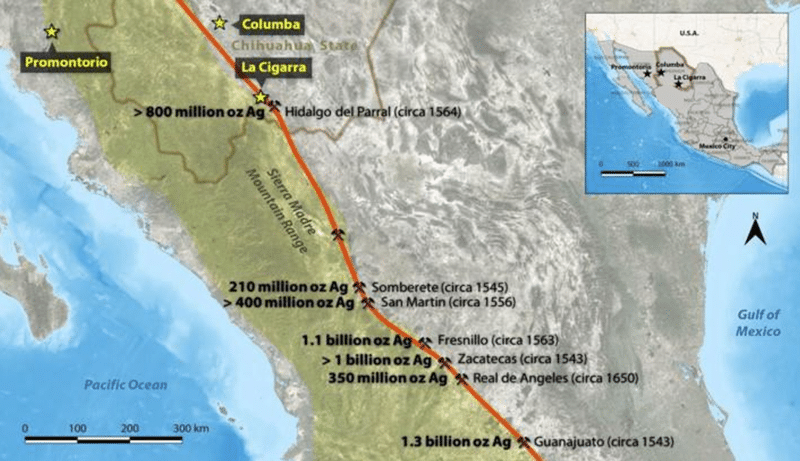

Kootenay’s wholly-owned flagship asset, the past-producing Columba Silver Project, is located in the state of Chihuahua, Mexico, a jurisdiction known for its rich geology and mining-friendly culture.

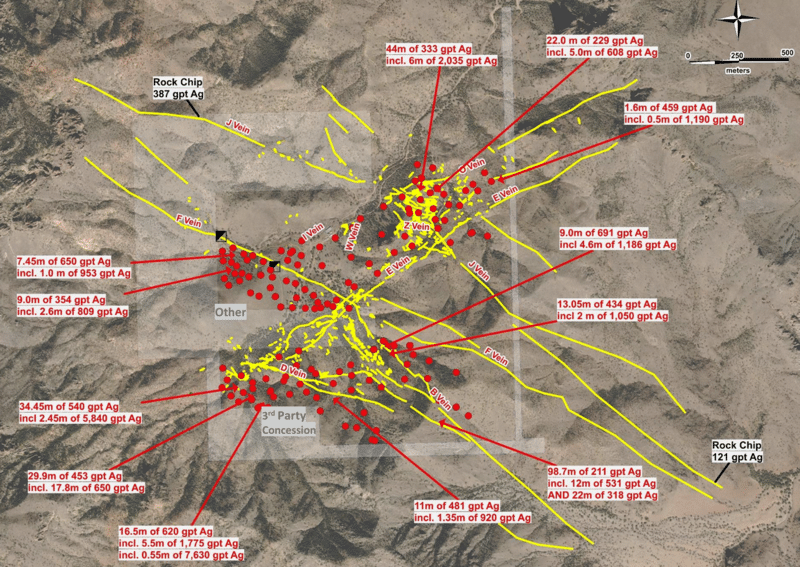

Columba, characterized as a silver-dominant intermediate sulfidation epithermal system, boasts a geological footprint measuring some 3 kilometers x 4 kilometers. In mid-June of this year, the company tabled a maiden resource for Columba based on over 53,000 meters of drilling in over 200 holes across multiple veins (drill targets were prioritized via good science: detailed mapping, lidar, and airborne magnetic surveys).

Columba’s maiden ounce count (MRE): 5.92 Mt grading 284 g/t silver, 0.19% lead, and 0.50% zinc, equivalent to 54.1 million ounces silver, 25.2 million lbs of lead, and 65.6 million lbs of zinc.

The high-grade nature of this epithermal deposit is anchored by its robust vein structures, averaging five to six meters, with widths up to 20 meters—a detail that could significantly enhance the project’s underlying economics.

Quoting the bottom of the mid-June press release:

The veins cut every known rock type on the project and the veins or vein structures can be traced across the highest elevations of the caldera. This indicates veins formed late in caldera history. As elevation increases vein development becomes irregular eventually being replaced by breccias at the higher elevations. Silver grades diminish with increasing elevation right down to background values. Correspondingly silver grades increase with depth from background at higher elevations to highs of kilograms per tonne at depth. It is evident from these features that the vein system has undergone almost no erosion and so whatever silver was deposited originally is largely still there.

The following slide highlights some of the fatter hits underpinning this maiden resource estimate…

It’s important to note that the company has a 24-year surface access agreement allowing for both exploration and exploitation on all mineralized zones drilled to date.

Aggressive Exploration – Robust (Assay-Related) Newsflow

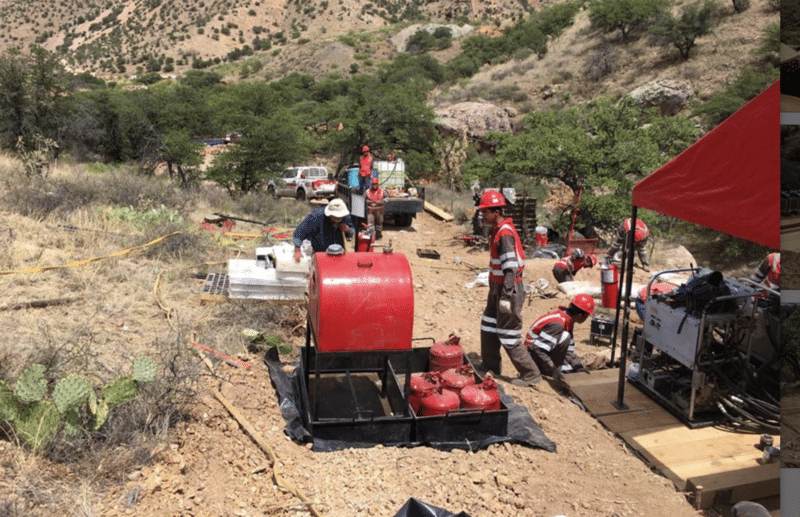

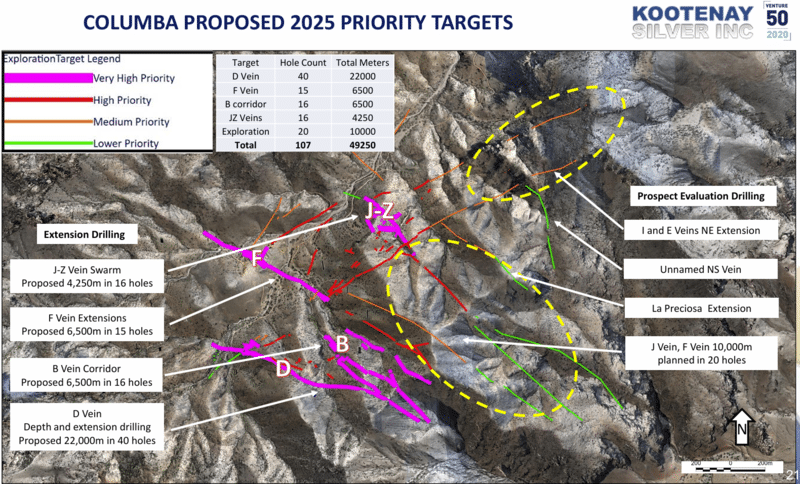

Proceeds from a recent $20M bought deal raise are being deployed to give Columba another decisive push along the exploration curve via an aggressive 50,000 meter drill campaign—a program designed to extend all mineralized zones to depth and along strike.

The drill plan? 40,000 meters in systematic step out and down plunge probes to expand defined mineralized structures, and 10,000 meters to test new regional targets. Drilling commenced in early August.

On September 8, the company reported that two rigs were in the process of testing the D vein and the “lightly tested” I Vein.

The D Vein, characterized as Columba’s low-hanging fruit, offers significant potential at depth and along strike. The plan calls for 22,000 meters in 40 holes along the D Vein alone (map below).

On November 19, the company reported results from the first seven holes of the current program—five at the I Vein and two at the D Vein. Headline: Kootenay Releases First Results from Current Drilling at Columba.

The results surprised the company’s geos. Two holes drilled along the I Vein (CDH-25-217 and 218) tagged a zone of classic gold–moly porphyry-style mineralization, a development that could materially expand the project’s scale and geological potential.

I Vein highlights (a long section view of I Vein here):

- CDH-25-217

- Two gold intervals over significant widths.

- The first is 101 meters of 0.18 gpt gold and 10 gpt silver includes 6 meters of 0.85 gpt gold and 11 gpt silver.

- The second is 26.5 meters of 0.2 gpt gold.

- And a separate silver intercept of 73 gpt silver and 0.1 % lead and 0.2% zinc over 7 meters

- CDH-25-218

- Three gold intervals over significant widths.

- The first is 27 meters of 0.22 gpt gold and 28 gpt silver.

- Includes 0.55 meters of 847 gpt silver, 0.18 gpt gold, 0.4% lead and 0.3% zinc.

- The second is12 meters of 0.21 gpt gold and 32 gpt silver.

- The third is16 meters of 0.32 gpt gold and 26 gpt silver.

- And a high grade silver interval (see photos here).

- 3.97 meters of 303 gpt silver and 2.8% Pb+Zn with 0.71 meters of 921 gpt silver, 0.12 gpt gold and 6.8% Pb+Zn.

On the significance of the discovery, Kootenay CEO James McDonald told The Watchlist in a recent interview: “… this is completely new and very exciting to us because it’s telling us that the heat engine that drove this whole silver vein system is right underneath us. It’s very close. We’re right on top of it. This opens up all kinds of geological possibilities for new types of discoveries and strengthens our belief in what the ultimate size of this project could be.”

Quoting Dale Brittliffe, VP of Exploration, from this Nov. 19 press release: “The anomalous gold zones we are seeing along the I Vein trend are testament to the complexity and thereby potential of the Columba mineral camp. While we are focused on the silver rich veins to systematically extend and expand the existing silver resource with this current drilling program, we will now also be evaluating this new and exciting gold target.”

Results from the final two holes in this November update delivered strong silver values along the D Vein.

D Vein highlights (a long section view of D Vein here):

- CDH-25-214

- 10.50 meters of 108 gpt silver and 0.1% lead and 0.2% zinc

- Includes 1.50 meters of 362 gpt silver and 0.1 % lead and 0.2% zinc.

- 10.50 meters of 108 gpt silver and 0.1% lead and 0.2% zinc

- CDH-25-216

- 3.2 meters grading 212 gpt silver and 0.2% lead and 0.6 % zinc.

- Includes 0.7 meters of 756 gpt silver 0.6% lead and 2.5% zinc.

- 3.2 meters grading 212 gpt silver and 0.2% lead and 0.6 % zinc.

At the time of this press release, seventeen holes were completed with ten holes awaiting assay results. Lab turnaround times are proving longer than usual.

The company reports that two drill rigs are currently turning on the property. Upon completion of an expanded drill core storage facility, exploration will accelerate with the mobilization of additional rigs.

Columba’s Potential

Management is targeting a 50% increase in the project’s ounce count with this phase of exploration. Ultimately, they believe Columba will host more than 100 million high-grade ounces in its subsurface layers—a milestone that could drive a ten-digit valuation (the company is currently idling in the low nine digits).

Upon completion of the 50,000‑meter drill program, and after multiple months of continuous assay-related newsflow, the company will move towards an updated MRE for Columba.

Beyond that? More drilling and a first pass view of the economics, a PEA—all potentially potent catalysts, especially with silver on a tear, and with M&A beginning to accelerate in this high-risk/high-reward arena.

The frequency of major new discoveries is in steady decline. Nearly every producing entity is predatory, looking to bulk up their project pipeline. Companies like Kootenay may well find themselves in the crosshairs of a resource-hungry predator.

A Robust Project Pipeline

Columba’s high‑grade ounce count represents just one chapter in the Kootenay story. Three additional projects also warrant attention.

The company’s La Cigarra silver project is located along a highly prospective mineral belt in Chihuahua state, 26 kilometers from the historic silver mining city of Parral. Deets below…

The company’s Promontorio & La Negra projects are located along another highly prospective mineral belt—the Promontorio Mineral Belt—roughly 7 kilometres south of La Negra in Sonora state.

All told, the company’s project portfolio comprises 214.2 million AgEq ounces in the Measured & Indicated category, plus 109 million AgEq ounces classified as Inferred—anchored in the subsurface stratum of northern Mexico.

At The Helm

Kootenay’s board and management team bring a solid mix of geological depth and capital markets savvy.

Bottom Line

Kootenay, consistent with the other higher-quality names Highballer tracks, appears well-positioned in the early innings of a rerating cycle… particularly if silver maintains its upward trajectory.

END

—Greg Nolan

Full disclosure: The author is not a shareholder in Kootenay Silver, but may initiate purchases in the near future.

Disclaimer - Legal NoticeHighballerstocks.com (Greg Nolan) is not a licensed financial advisor and does not give investment advice.

The content of this report is for information purposes only.

Nothing contained herein should be construed as a recommendation or solicitation to buy or sell any security.

Always consult a licensed qualified investment advisor in your legal jurisdiction before making any investment decisions.

Though Highballerstocks.com (Greg Nolan) believes its sources to be credible, and the statements contained herein to be true, readers must conduct their own thorough due diligence, and or consult with a qualified investment advisor before important investment decisions are made.

Highballerstocks.com (Greg Nolan) accepts no responsibility or liability for the accuracy of the contents of this report.