We’ll dispense with the usual proem on this one and cut right to the chase…

Forum Energy Metals (FMC.V)

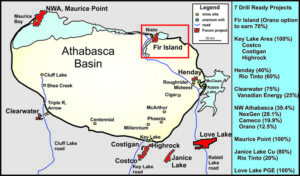

Fir Island represents only one property in the Forum’s extensive project portfolio.

The project encompasses 14,205-hectare of highly prospective ground along the northeast edge of the prolific Athabasca Basin.

Those who track uranium plays know that the Athabasca Basin is to uranium what the Carlin Trend is to gold.

Cameco’s Centennial deposit is located near the south boundary of the property. The historic Nisto uranium mine (96 tonnes mined at a grade of 1.38%) occurs in basement rocks on the northwest side of the Black Lake fault, directly adjacent to the property.

Here, senior entity Orano Canada (formerly AREVA Resources Canada Ltd) can earn a 51% interest in the project by spending $3,000,000 on or before December 31, 2021.

Orano can increase its stake in the project to 70% by spending an additional $3,000,000 (a total of $6,000,000) on or before December 31, 2023.

“The regionally important Black Lake fault, part of the major Snowbird Tectonic Zone, transects the entire Athabasca Basin, and is highly prospective for unconformity-type uranium deposits. The sandstone cover varies from 0 to 200m above the unconformity. The possibility of uranium mineralization below the unconformity at the base of the thrust fault (similar to McArthur River) or in the hanging wall of the Cathy Fault in the basement (similar to Millennium or Eagle Point) demonstrates the highly prospective nature of the Fir Island project.”

On Jan. 20th, 2021, Forum dropped the following headline:

Drill Mobilization Commences at Forum’s Fir Island Uranium Project

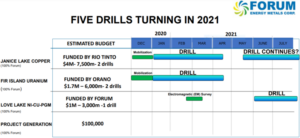

Ice road construction has commenced and two drills are being mobilized to the site for what will undoubtedly be a closely watched 6,000 meter (24 hole) drilling campaign.

This phase of drilling will be operated by Forum and funded 100% by Orano Canada.

“The program is designed to test a number of targets along two major structures associated with the Snowbird Tectonic Zone, a major lineament that transects the Athabasca Basin and is associated with Cameco’s Centennial Deposit at the south side of the basin. The targets have been developed by previous geophysical surveys (ground gravity, resistivity, and EM), a soil sampling survey, and diamond drilling in 2015 and 2020.”

Serving as a foundation for this aggressive campaign, these multiple layers of geophysics and geochemistry represent ‘data-stacking’ at its very best.

“Depth to the unconformity on this project varies from 0 meters to 250 meters, and the two previous drill campaigns have identified a 30 to 50m offset of the unconformity (the Cathy Fault) that runs under Fir Island, and extends to the north under the lake, interpreted to intersect the major Black Lake Fault near the shoreline of the mainland (map below). The 2021 drill program will further investigate this fault that exhibits strong alteration, plastic and brittle deformation, elevated geochemical indicators, and an abundance of dravite; a boron-rich clay that is present around most uranium deposits on the eastern side of the Athabasca Basin.”

To maximize efficiency—to minimize commute time to and fro (and to keep the crew and local community safe from potential C-19 exposure—a temporary camp will be established on the island to accommodate the crew.

The program is expected to run for 6 to 8 weeks and should be complete by the end of March.

Between the Company’s flagship Janice Lake property—a district-scale project that prompted mining colossus Rio Tinto (RTEC) to put its signature to a $30M JV—things are going to start heating up here PDQ, what with two major drill programs about to kick into gear.

Expect both drilling campaigns to begin pulling core by mid-February (everyone is waiting for that polar vortex to firm up access routes in the region).

Highgold Mining (HIGH.V)

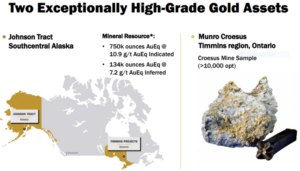

The last time we checked in with HIGH, the Company had reported the first batch of assays from its Munro-Croesus Gold Project, a past-producer that yielded some of the highest-grade gold ever mined in Canada.

If you’ve been following these pages for any length of time, you already know that the Johnson Tract Gold Project (JT) in Southcentral Alaska is where the lion’s share of the funds are being spent, taking up roughly 80% of the Company’s annual exploration budget.

Assays continue to flow out of both projects from their 2020 drilling campaigns.

Drilling at Johnson Tract is finished until next season.

Drilling at Munro-Croesus can be effectively drilled year-round.

Expect robust drilling-related newsflow over the course of 2021.

On Jan. 21st, Highgold dropped the following headline:

Here, the Company announced new assay results from this high-grade polymetallic deposit.

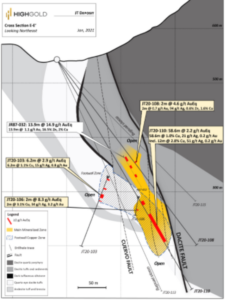

This last batch of results continue to expand the down-plunge and up-plunge extents of the JT Deposit (JT), and further demonstrate continuity in the deeper Footwall Copper-Silver Zone (FCZ).

Drill Highlights

- JT Expansion Down-Plunge – 11.0 meters at 8.6% Zn, 0.4% Cu (5.9 g/t AuEq), including 5.0 meters at 12.0% Zn, 0.3% Cu (7.9 g/t AuEq) in hole JT20-120;

- JT Expansion Up-Plunge – 18.3 meters at 5.9% Zn, 64 g/t Ag, 0.1% Cu, (5.2 g/t AuEq), including 4.0 meters at 9.5% Zn, 278 g/t Ag, 0.2% Cu (10.0 g/t AuEq) in hole JT20-121;

- Footwall Copper-Silver Zone Expansion – 12 meters at 2.8% Cu, 51 g/t Ag (5.0 g/t Au/Eq), within 58.6 meters at 1.0% Cu, 21 g/t Ag (2.2 g/t AuEq) in hole JT20-110.

Darwin Green, President, and CEO:

“We continue to be encouraged by the continuation and strength of the JT Deposit mineral system at depth and by the emergence of the Footwall Copper-Silver Zone, a new area of copper-silver rich mineralization with resource potential that contributes to the overall metal endowment at Johnson. The current batch of drill results are base-metal dominant and highlight the presence of copper and zinc-rich domains within the polymetallic gold-rich JT Deposit.”

“Drilling in 2020 significantly expanded the JT Deposit footprint with step-outs from the Indicated Mineral Resource of 750k oz AuEq (417k oz Au plus Zn, Cu, Pb, Ag) at a grade of 10.9 g/t AuEq (6.1 g/t Au) over a true thickness of 20 to 50 meters (map above). As new data is received, HighGold’s geological and structural model continues to evolve. Based on the new data, it appears that a significant portion of the mineral system is open to expansion down-plunge and is not cut-off at depth as interpreted by previous operators. With approximately C$18 million in the treasury, the Company is fully funded to further test the limits of these zones and other targets in 2021.”

‘Drill Program Discussion’ summarized

The 2020 Drill Program totaled 16,418 meters in 32 completed drill holes.

Assays remain outstanding for 12 drill holes and will be released in batches as they are received and evaluated.

The Au-Cu-Zn-Ag-Pb mineralization associated with the JT Deposit has now been intersected over a strike length of 325 meters and a down-plunge distance of 400 meters.

The JT Deposit remains open for expansion along strike to the northeast, the southwest, and at depth.

JT Deposit Targets

- Drill holes JT20-108 and JT20-110 were drilled on the same cross-section, approximately 100 meters apart, testing an area 25 meters to 50 meters along strike from the previously released step-out drill holes along the northeast, down-plunge edge of the JT Deposit.

- The results from hole JT20-110 were particularly encouraging with a broad 58.3-meter intersection of copper-silver dominant mineralization representing the Footwall Copper Zone (FCZ).

- The FCZ is a newly defined subzone of the JT Deposit and has now been intersected in six holes (See 1st map and Table-2 in the body of this press release).

- Holes JT20-115 and JT20-113—drilled as 50-meter step-outs above and below these two holes (JT20-108 and JT20-110)—are still pending receipt of assays.

- Drill hole JT20-120 was a farther 75-meter step-out to the northeast from the JT20-108/JT20-110 cross-section and intersected an upper 6-meter gold-zinc zone, and a lower 11-meter zinc-copper zone corresponding to the JT Deposit.

- Hole JT20-120 has now extended the limit of mineralization 100 meters beyond the modeled resource outline and the zone remains open along strike to the northeast and down-plunge.

- Drill hole JT20-121 was designed to test the shallow southwest strike extension of the JT Deposit, 25 meters outside the defined mineral resource and within 50 meters of surface.

- The hole intersected 18.3 meters of encouraging zinc-gold-silver mineralization and the zone remains open for expansion.

- Assays for hole JT20-122, a further 25-meter step-out to the southwest, are pending.

The resource expansion potential along these mineralized zones is considered “excellent”.

Other Targets

Assay results for an additional three drill holes, JT20-097, JT20-101, and JT20-105, have been received for the Northeast Offset Target (NEO), located 500 to 800 meters northeast of the JT Deposit. Significant results include 0.7 meters at 31.2% Zn, 0.1 g/t Au, 2 g/t Ag, <0.1% Cu (19.2 g/t AuEq) in JT20-101, and 0.8 meters at 3.0 g/t Au, 7 g/t Ag, 2.0% Cu, 3.1% Zn (7.9 g/t AuEq) in JT20-105.

Four additional holes were drilled along the NEO. Assays are pending.

The narrow intercepts reported to date at the NEO target are interpreted as distal-type mineralization similar to that found peripheral to the main JT Deposit. Taken together with historic results and geological observations of the nine holes completed this year at NEO, the Company currently interprets less offset along the Dacite Fault than was originally estimated.

Large gaps in drilling exist between the JT Deposit and the NEO zone. The 2021 drill plan will target these areas for fault displaced extensions of the JT Deposit.

At the North Trend target, results have been received for three drill holes, JT20-099, JT20-104, and JT20-107. Anomalous gold values were intersected in JT20-099, including 6.0 meters at 0.7 g/t Au, 8 g/t Ag, 0.2% Cu, 0.4% Zn (1.5 g/t AuEq). No significant mineralized intervals were intersected in holes JT20-104 or JT20-107.

Summarizing recent events

The market was obviously expecting high-grade gold in these step-outs, instead, they got base metal rich intercepts. But the fact this polymetallic deposit and its subzones remain open in multiple directions, and at depth, is a huge positive.

This is a big system.

The newly defined (copper-silver-rich) Footwall Copper Zone offers some intriguing resource expansion potential at depth.

Positioned as a stratigraphic structural footwall to the JT Deposit, as the Company continues tracking this zone along its axis (down plunge), there’s every indication that the mineralization gets stronger the deeper they go.

With a firmer grasp of JT’s geological controls—via an evolving geological model—the Company now realizes that the deposit is NOT cut-off at depth. Expect a deeper drilling campaign in 2021.

Once again, regarding a section of the main JT deposit that was displaced by a fault…

Large gaps in drilling exist between the JT Deposit and the NEO zone. The 2021 drill plan will target these areas for fault displaced extensions of the JT Deposit.

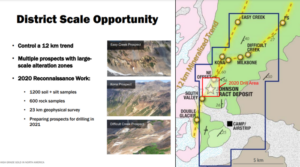

Regionally, the Johnson Tract project, with its 12 kilometers of trend (based on pervasive alteration), remains wide open for new discoveries.

The Company laid a foundation for this regional potential in 2020 via a vigorous campaign of mapping, prospecting, soil sampling… and a round of geophysics.

2021 will see multiple phases of exploration with a significant regional component.

With $18M in its coffers, the Company is fully funded as the 2021 JT exploration season draws near.

The drills were left on site after the 2020 program wound down. The Company is ready to hit the ground running as soon as the early summer window opens.

Cartier Resources (ECR.V)

Though Cartier’s Chimo Mine Project currently bears flagship status, the Benoist Property, located along the prolific Windfall belt of mining-friendly Quebec, holds significant resource expansion and discovery potential.

While waiting for an updated resource for Chimo to drop—a piece of news that could deliver 2M ounces of well defined Au—Cartier announced the commencement of drilling at Benoist.

Jan. 21st headline: Cartier Launches 30,000 m Diamond Drill Program on the Benoist Property

“Two drill rigs with directional drilling crews will be employed to complete the four-phase program for a total of roughly 30,000 meters.”

Highlights:

The Pusticamica deposit has the characteristics required for a bulk tonnage approach as evidenced, among other things, by the geometry of the deposit, polymetallic mineralization, and a maiden resource estimate on which this drilling campaign will be based.

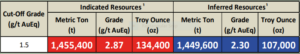

The NI 43-101 resource estimate for Pusticamica was produced using a gold price of US $1,610 per ounce and a cut-off grade of 1.5 g/t AuEq:

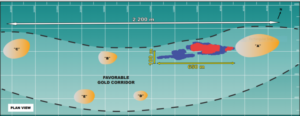

This aggressive 30,000-meter campaign is designed to expand the above resource and target new deposits—new discoveries—peripheral to the known mineralization (map below).

This multiple phase program will play out as follows:

Phase I

Determine the limits and boundaries of the Pusticamica deposit between 350 and 650 meters depth by drilling off extensions of the mineralization;

Phase II

Determine the limits and boundaries of the extensions of the mineralization beyond 650 meters—between 650 meters and 1,300 depth (these will be some deep drill holes, folks);

Phase III

Probe the areas subsurface layers in the vicinity of the Pusticamica deposit with the objective of tagging new discoveries.

A total of 5 potential targets—targets located between 150 and 450 meters consisting of “OreVision IP” type anomalies bearing geophysical signatures similar to that of the Pusticamica deposit—will be drilled.

“All of these anomalous sectors are found inside the Favorable Auriferous Corridor known over a strike length of 2,200 meters. Three of these anomalous sectors are directly located in the eastern and western extensions of the Pusticamica deposit (image below).”

Phase IV

Define the upper portion of the deposit (between 30 and 350 meters) to increase the resource and collect material for metallurgical testwork, as well as industrial sorting of the mineralization.

This press release went on to detail features of the Benoist Project:

The Benoist Property hosts the Pusticamica gold deposit, which also contains copper and silver concentrations.

This mineralization has all the typical characteristics sought by Cartier and as at the Chimo Mine Project could rapidly outline high-tonnage mineralization.

Cartier holds a 100% interest in the property for which 2.5% net smelter return (“NSR”) royalties have been awarded of which 2.0% is redeemable at any time for CAN $ 2M.

The property, which is accessible year-round via forestry road 3000, is located near the mills of the Langlois and Bachelor mines and the future mill of Osisko Mining’s Windfall Project.

Work to date on the property consists of 93 drill holes totalling 32,356 m, resulting in 14,243 samples collected over a sampled length of 14,647 m.

Cartier has entered a dynamic phase in its evolution as an advanced-stage Val-d’Or based ExplorerCo.

Philippe Cloutier, President and CEO:

“Cartier is making progress on several fronts at the moment and we anticipate positive results on the Chimo Mine project as well as the recently launched Benoist drill program. We believe this course of action will reward our shareholders in the coming months.”

The Company boasts a cash position of > $12.9 million as well as strong corporate and institutional support from the likes of Agnico Eagle Mines (AEM.T), Jupiter Asset Management, and Quebec based investment funds.

The link below will take you to a Jan. 26th interview with CEO Cloutier:

CARTIER RESOURCES – A CLOSE LOOK AT THE 30,000METER DRILL PROGRAM AT THE BENOIST PROPERTY

CEO Cloutier will also be delivering an Online Investment Conference presentation this coming Thursday, January 28, at Noon (EST). The link below will get you registered for the event…

Registration Page: Cartier Resources Presentation – Thurs., Jan. 28, 2021-12:00:00 EST

White Gold (WGO.V)

White Gold dropped an avalanche of assays on Jan. 21st covering multiple prospects along its extensive 420,000-hectare land package in the prolific White Gold District, Yukon.

For three months, nothing—nary a flake. Then all of a sudden, a blizzard… whiteout conditions.

The Jan. 21st, 2020 headline:

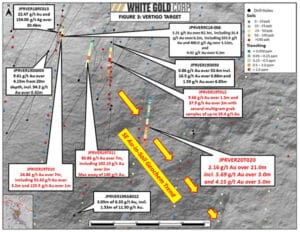

As the headline suggests, the Company announced results from surface sampling, mechanical trenching, and rotary air blast (RAB) drilling programs completed on its road accessible JP Ross (JPR) property. Here, the Company identified additional, widespread, structurally controlled gold mineralization at multiple targets.

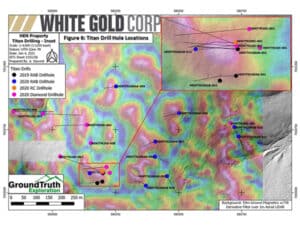

This release also reported RAB, reverse circulation (RC), and diamond drilling results from its uber high-grade Titan project.

All told, the 2020 drilling program was comprised of nine RAB holes for 832.1 meters, one RC hole for 115.8 meters, and nine diamond drill holes for 1,924.5 meters.

This work formed part of the Company’s 2020 exploration program backed by strategic partners Agnico Eagle Mines (AEM.T) and Kinross Gold (K.T).

To prevent this article from turning into War and Peace, I’m simply going to break this press release down into bite-sized pieces. The rest is up to you (draw your own conclusions).

Highlights:

(If any of the following images appear blurry, click HERE for the complete list of maps)

At the JPR property, additional gold mineralization was encountered on multiple targets hosted within a regional scale, structurally controlled mineralized system.

Trenching at the Vertigo Target identified a new mineralized zone grading 2.16 g/t Au over 21.0 meters including higher grade subzones of 5.69 g/t Au over 3.0 meters and 4.15 g/t Au over 5.0 meters—all associated with a southeast trending gold-in-soil anomaly which remains open along strike.

JPR RAB drilling encountered gold mineralization in every hole with mineralized zones ranging from 0.20-3.29 g/t Au over widths of 1.5-9.1 meters.

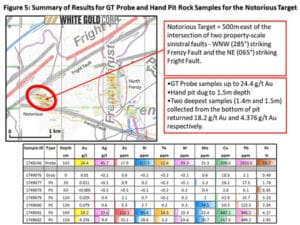

Rock samples from a hand-dug pit collected on the recently discovered Notorious Target confirmed the presence of high-grade gold mineralization. The two deepest samples at 1.4 meters and 1.5 meters returned the highest values including 18.2 g/t Au & 33.6 g/t Ag and 4.376 g/t Au & 9.8 g/t Ag, respectively;

Structural analysis (LiDAR and magnetics) on the Notorious Target confirms a favorable structural geological setting.

At the Titan Target, RC and diamond drill holes were completed in the direct vicinity of RAB hole HENTTN19RAB-002 (72.81 g/t Au over 6.09 meters) to better quantify the grade and width of mineralization.

Hole HENTTN20RC-001 intersected 105.0 g/t Au over 1.53 meters from 12.19 meters depth & HENTTN20D-003 intersected 37.40 g/t Au over 1.5 meters from 14.0 meters depth;

Titan diamond drilling intersected multiple felsic dykes up to 10 meters wide—locally with well-developed quartz veinlets with potassium feldspar haloes and trace pyrite and galena—confirming intrusive activity and the potential for buried porphyry-style alteration and mineralization.

The source of magnetic highs on the Titan Target is a magnetite-rich zone(s) with anomalous copper near the base of a mafic unit.

Significant additional results from the 2020 exploration program will be announced in the coming weeks;

All gold intersections reported herein are measured drill or trench lengths as insufficient work has been carried out to determine true widths.

David D’Onofrio, White Gold’s CEO:

“We are pleased to have encountered further additional gold mineralization across multiple recently identified zones as well as confirmed the high-grade mineralization on the newly discovered Notorious target, providing further indication that the abundant gold mineralization is part of a robust regional scale structurally controlled system on the JP Ross Property. This program has also provided valuable insight into the orientation and geometry of the mineralized systems, information that has been incorporated into our scientific and data driven methodology to define drill targets for the upcoming season. We look forward to releasing additional results from our 2020 exploration program and continuing to advance our projects in 2021.”

Further details regarding these individual target zones are laid out in the guts of this press release.

The following video is a 2021 (VRIC) interview with CEO D’Onofrio, and Shawn Ryan, Chief Technical Advisor…

Skeena Resources (SKE.T)

This headline just hit my inbox. I’ll cover it briefly before wrapping this one up…

SKEENA COMPLETES POSITIVE METALLURGICAL TESTWORK PROGRAM IN SUPPORT OF UPCOMING PFS FOR ESKAY CREEK

Here, the Company presented key findings from recently completed metallurgical testwork that will backstop the upcoming Pre-Feasibility Study (PFS) for the Company’s flagship Eskay Creek Project located in the Golden Triangle of British Columbia.

This latest campaign of testwork produced a modified plant flowsheet which resulted in improved results over the flowsheet included in the Eskay Creek Preliminary Economic Assessment (PEA).

As a reminder, this 2019 PEA delivered the following numbers:

- High-grade open-pit averaging 3.23 g/t Au, 78 g/t Ag (4.17 g/t AuEq) (diluted);

- After-tax NPV5% of C$638M (US$491M) and 51% IRR at US$1,325/oz Au and US$16/oz Ag;

- After-tax payback period of 1.2 years;

- Pre-production capital expenditures (CAPEX) of C$303M (US$233M);

- After-tax NPV: CAPEX Ratio of 2.1:1;

- Life of Mine (“LOM”) average annual production of 236,000 oz Au, 5,812,000 oz Ag (306,000 oz AuEq);

- LOM all-in sustaining costs (AISC) of C$983/oz (US$757/oz) AuEq recovered;

- LOM cash costs of C$949/oz (US$731/oz) AuEq recovered;

- 6,850 tonne per day (TPD) mill and flotation plant producing saleable concentrate.

The price assumptions applied here were conservative—$1325 gold.

Highlights from this Jan. 26th press release:

- An extensive metallurgical testing program was conducted on fresh core samples from the 21A, 21B, 21C, 21E, and HW Zones as well as samples included in the previous PEA testwork;

- The process flowsheet now includes a desliming stage to improve flotation response for coarser material, resulting in the option of producing a higher gold concentrate grade and opportunities to reduce capital costs;

- The results from this testwork further de-risk the Eskay Creek metallurgy and improve confidence in the process plant design for the upcoming PFS.

2019 PEA Testwork

As part of the 2019 PEA study, a metallurgical testwork program was conducted on samples from the 21A, 21C and 22 Zones. Flotation testwork demonstrated the ability to generate a saleable 25 g/t gold concentrate at a grind size of 60 µm with regrinding of the rougher concentrate. For the expected range of mill feed grades over the mine life, plant recovery of gold was between 80% to 90%. Leach tests (including flotation concentrate leaching) showed lower overall gold recovery due to its fine-grained nature, as well as a portion of the gold being encapsulated in sulphide minerals.

PEA testwork showed some issues with high mass pull (% of feed to concentrate), slow flotation kinetics and poor settling characteristics due to the presence of muscovite and other soft minerals. This was noted in the technical report as needing further investigation.

2020 PFS Testwork

To improve upon the PEA testwork, Skeena completed additional PFS testwork in 2020. The samples used in the PEA test program as well as fresh core intervals from the 21A, 21B, 21C, 21E and HW Zones were evaluated by Base Metallurgical Laboratories Ltd. in Kamloops BC. Composite samples representing the first three years of plant feed were also prepared. An extensive flotation testing program was completed, resulting in a modified process flowsheet.

Mineralogical studies indicated a portion of the gold was associated with non-sulphide gangue and flotation performance was negatively influenced by the presence of soft minerals. The solution was to include a desliming stage where these soft minerals were isolated and floated separately. The result was improved flotation response for the coarse material. This mill-float-mill-float circuit (“MF2”) is used in platinum processing for fine-grained precious metal recovery.

The modified flowsheet allows for separate flotation of the coarse and fine fractions, resulting in savings in regrind power requirements. A smaller flotation circuit is required due to the lower mass of material needing regrinding before cleaning to a final concentrate.

Improved Metallurgy

The MF2 flowsheet was tested on both the annual composites and variability samples to evaluate its suitability to process a range of Eskay Creek material. The result was the ability to generate a higher concentrate grade without significant loss in gold recovery – this is an improvement over the PEA flowsheet.

A 25 g/t gold concentrate is being targeted to maximise gold recovery although samples generated final concentrate grades in excess of 60 g/t Au. Concentrate silver grades are expected to be between 500 g/t and 900 g/t with arsenic and mercury penalties being incurred in the first three years of operation (when the higher gold grade feed is processed). From Year 4 onwards, arsenic in concentrate is expected to be below 0.5% and mercury below 300 ppm.

Back to me… this modified flowsheet represents an improvement over the PEA flowsheet. This should result in a lower CapEx.

The ability to generate a higher concentrate grade (without significant loss in gold recovery) is obviously a huge positive.

All in all, the economics underpinning this world-class resource should be reflected well in the upcoming PFS.

Note that Skeena will be releasing an updated Resource Estimate for Eskay Creek this spring, with the PFS study to follow later in 2021.

Shane Williams, Skeena’s Chief Operating Officer:

“The results of the metallurgical test work to support the upcoming PFS study are very positive. We were particularly pleased that the results further optimize and enhance the flowsheet for Eskay Creek, allowing flexibility on concentrate grade as well as opportunities to reduce capital costs. We now have greater confidence in the process plant design as we progress with the PFS, which remains on track to be completed in mid-2021.”

There it is.

END

—Greg Nolan

Full disclosure: Forum, Highgold, and Cartier are clients of mine. I own shares in Forum, Highgold, Cartier, Skeena, and White Gold (color me biased – do your own due diligence)

Disclaimer - Legal NoticeHighballerstocks.com (Greg Nolan) is not a licensed financial advisor and does not give investment advice.

The content of this report is for information purposes only.

Nothing contained herein should be construed as a recommendation or solicitation to buy or sell any security.

Always consult a licensed qualified investment advisor in your legal jurisdiction before making any investment decisions.

Though Highballerstocks.com (Greg Nolan) believes its sources to be credible, and the statements contained herein to be true, readers must conduct their own thorough due diligence, and or consult with a qualified investment advisor before important investment decisions are made.

Highballerstocks.com (Greg Nolan) accepts no responsibility or liability for the accuracy of the contents of this report.