The launch of Highballer back in early 2020 sprung from the belief that we’re in the early stages of a bull market in precious metals, base metals, battery metals, and all things mining—a bull run that will prove epic in scale.

I’ve seen this movie before. It has a riveting plot.

Bolstering that belief, central banks around the globe, in maintaining extremely accommodative monetary policies, are debasing their currencies at a rate that is difficult to fathom.

On this side of the pond, Biden is intent on injecting $1.9 trillion worth of additional stimulus into the US economy… for starters. That’s welcome news to those who desperately need the support, but this accelerating (greenback) debasement will open the door to higher inflation and a dramatic loss in purchasing power.

Last week, cognisant of the currency risk they’re exposed to, Tesla announced having bought $1.5 billion worth of Bitcoin.

According to its recent SEC filing, Tesla stated:

“As part of the policy, which was duly approved by the Audit Committee of our Board of Directors, we may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds, and other assets as specified in the future. Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy and may acquire and hold digital assets from time to time or long-term.”

Note the reference to gold.

Has Tesla lost faith in the US Dollar? I suspect they’re not alone. Large companies all around the globe are sitting on piles of cash. How many see the risk? Well, if they weren’t thinking about it leading up to Elon Musk’s move, they surely are now.

Not to diss crypto, but if a conservatively run company is looking for an alternative to paper currency, gold’s long-standing role as a safe haven asset should hold greater appeal.

This could be the catalyst that pushes gold to new highs.

John Hathaway—portfolio manager at Sprott Hathaway Special Situations Strategy and co-portfolio manager of the Sprott Gold Equity Fund— has some good, well-considered insights regarding the metal and where it may be headed.

Hathaway believes that interest rates will need to stay low—that much is clear, considering the state of the global economy. He believes bonds—widely used as a hedge against stock market uncertainty—can no longer be relied upon. This will force large pools of capital to seek a more effective hedge against equity risk, and gold is the only asset that will offer such protection.

Hathaway estimates there’s roughly $100 trillion worth of assets currently under management—pension funds, mutual funds, sovereign wealth, private wealth—and gold does NOT factor into the equation in any meaningful way.

If a mere 1% of that total—$1 trillion—were to move into gold over the next few years, that would represent six years of new mine supply. That’s how under-owned gold is.

$1 trillion entering the gold space would push prices to levels difficult to imagine, to perhaps five times the metal’s current trading range.

The mining stocks we follow

As I stated at the top of the page, I believe we’re in the early stages of what will evolve into an epic bull market in all things mining.

In my opinion, the argument for buying strength right now is as strong as the argument for buying weakness.

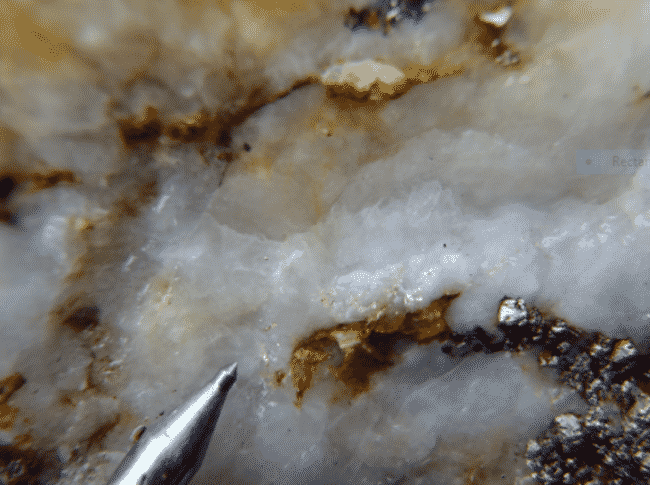

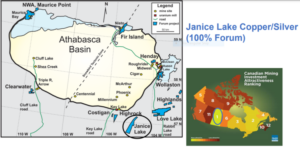

Forum Energy Metals (FMC.V) is a good example of what I’m talking about. When I first featured this copper-uranium ExploreCo at $0.09 last summer, the price of copper was $2.40 per lb.

In recent sessions Forum breached its all-time high, settling out the week at $0.33. That may appear expensive compared to our sub-dime entry point, but the price of copper is now pushing $4.00 per lb.

I have no doubt that a significant copper discovery at the Company’s flagship project—Janice Lake— will generate significant gains from current levels, unless the price of the underlying metal collapses.

Buying strength might be the right course of action here.

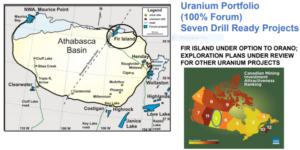

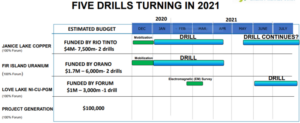

This positive price trajectory is also due to growing anticipation that drill rigs have been mobilized to two key projects (Forum also has a potential uranium discovery in its crosshairs).

On January 20th, we received word that ice road construction was underway at the Company’s Fir Island Project and that two drill rigs were being mobilized to this area of the (prolific) Athabasca Basin for what will undoubtedly be a closely watched 6,000 meter (24 hole) drilling campaign.

Janice Lake is the main show. The project encompasses some 38,250 hectares in north-central Saskatchewan, within the Wollaston Domain—a northeasterly-trending belt of metamorphosed lower Proterozoic supracrustal rocks deposited upon Archean granitoid basement.

The property has over 20 sediment-hosted copper showings that hold the potential for multiple layers of copper mineralization.

Mining behemoth, Rio Tinto (RIO) is earning up to 80% in Janice Lake and as you may already know, RIO doesn’t mess around with the small stuff—they’re only interested in projects that hold world-class potential.

The terms of Forum’s deal with RIO are aggressive.

“Forum entered into an agreement granting Rio Tinto Canada a four-year option to acquire a 51% interest in the Janice Lake Project by spending $10 million in exploration, making $490,000 in cash payments, and servicing the remaining $200,000 in underlying cash payments to Transition Metals Corp. Rio can earn a further 29% interest (total 80%) by spending a further $20 million in exploration over three years (total $30 million) and making further cash payments of $150,000 to Forum (total $640,000).”

In early February, the Company announced that RIO had commenced the mobilization of two drills, fuel, and other supplies to the Janice Lake site and that drilling would soon follow.

Today, the Company dropped the following headline:

Rio Tinto Commences Drilling at Forum’s Janice Lake Copper/Silver Project, Saskatchewan

The drills are turning at Janice Lake.

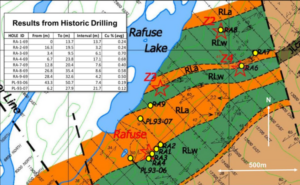

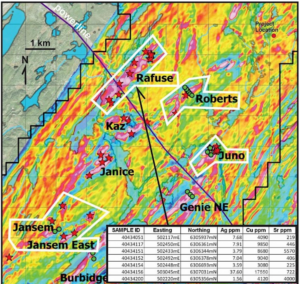

Two drill rigs are initially testing the Rafuse target, a 2.8-kilometer-long (priority) target of surface copper mineralization that was developed during a mapping, prospecting, and geophysical campaign last summer.

The Company believes that historical drilling did NOT adequately test the target’s depth and strike potential.

“Drilling of nine holes at Rafuse in 1969 to a maximum depth of 62 metres returned up to 17 metres of 0.68% copper and two holes drilled in 1993 by Noranda to a maximum depth of 128 metres returned 21.7 metres of 0.19% copper (see Figure 1 and news release dated November 11, 2020). Two, one-kilometre lines of an Induced Polarization (IP) survey conducted by RTEC over the Rafuse target this summer identified a strong chargeability anomaly starting at a depth of 130 metres. The first two holes are planned to test this IP chargeability anomaly.“

lines are shown in yellow, the first two drill holes for 2021 are shown as purple dots with arrows.

After Rafuse receives a proper probe with the drill bit, RIO will test the Jansem, Juno, and Roberts targets.

“Drilling at Jansem would follow up on thick intervals of surface copper mineralization outlined by drilling in 2019 (up to 51.8 meters grading 0.57% copper). Drilling at Juno and Roberts are follow-up targets from positive rotary air blast (RAB) drill results encountered during the past summer RAB drill program (up to 1.5m of 0.62% copper and 9.3 g/t silver at Juno). For further details, see news releases dated December 3, 2019, November 11, 2020 and November 18, 2020.”

The Company has two rigs turning now, possibly four.

Forum will be generating significant assay-related newsflow over the coming months.

Defense Metals (DEFN.V) is another company on our shortlist that has generated its fair share of joy in recent weeks. An increasingly volatile political backdrop threatening the supply chain and recent corporate initiatives have elevated the Company’s REE resource to a significantly higher standing.

Kudos to the Defense team.

It’s about time the market woke up to this highly strategic REE play.

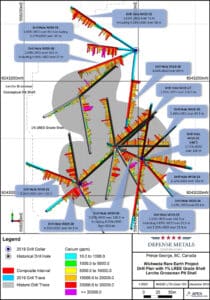

The Company’s flagship Wicheeda Project has a current indicated resource of 4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Elements) and an inferred resource of 12,100,000 tonnes averaging 2.90%.

That’s some rich rock.

Flotation pilot-plant processing of a 26-tonne Wicheeda bulk sample yielded a mineral concentrate averaging 7.4% NdPr oxide (neodymium-praseodymium). These are critical magnet metals.

Last month, the Company announced its role as a founding member of the recently launched Canadian Critical Minerals and Materials Alliance:

“Defense Metals and nine other C2M2A founders reflect a broad knowledge base across the suite of critical material supply chains; including current & prospective producers and processors, commercial & national laboratories, academia and innovation hubs, and engineering & business experts.”

More recently, on February 11th, the Company dropped the following headline:

Here, Defense engaged Welsbach Holdings to assist in building awareness for its flagship asset, providing market research, introductions to supply chain partners, and assistance in commercial negotiation.

The market liked this piece of news, for obvious reasons.

Craig Taylor, CEO:

“The engagement of Welsbach will enable Defense Metals to leverage their extensive experience and relationships in the Asia-Pacific region (Australia, Singapore, China, Japan, and South Korea), Continental Europe, and the United States towards engaging in one-on-one discussions with REE refiners and separators. The goal is the successful negotiation of one or more binding commercial REE offtake and/or other supply chain agreements with respect to the Wicheeda REE Deposit. Welsbach will immediately commence its work aiding with respect to strategic partner identification, business introductions, and ultimately commercial negotiations.”

This just in…

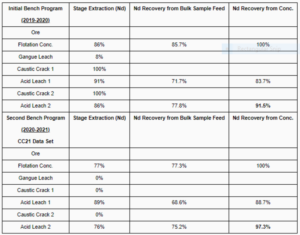

Here, the Company announced receipt of additional infill hydrometallurgical test results from SGS Canada’s Lakefield Site.

Highlights:

- Increased REE extraction from 91.5% to 97.3% from flotation concentrate (~75% from bulk sample feed) into a chloride-based leach solution compared to initial testing (CC-21, table below);

- Decreased REE losses via milder gangue leach compared to the base-case flowsheet;

- Simplification of flowsheet by removing re-grind step and reducing caustic dosage on re-crack (CC-20) yielded comparable REE extraction of 95.8% from flotation concentrate (~74% from bulk sample feed).

CEO Taylor again:

“Our decision to conduct additional infill hydrometallurgical test-work has yielded significant REE recovery gains approaching 100% REE extraction from the flotation concentrate. Perhaps more importantly, this additional testing has advanced the Wicheeda REE separation flowsheet such that we able to “tune” process variables (chiefly: grind size, acid, and caustic concentrations) to achieve a balance of minimizing REE leach losses and maximizing impurity removal. This level of process control will de-risk our planned hydrometallurgical pilot plant and contribute to greater flexibility in design of a future commercial-scale hydrometallurgical plant.”

Clearly, Defense is firing on all cylinders.

And for those champing at the bit, it shouldn’t be too long before we learn more about the Company’s 2021 exploration plans for Wicheeda.

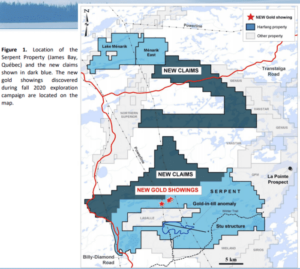

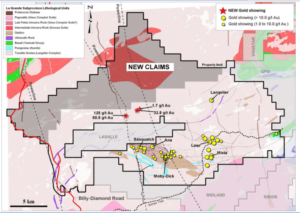

Though Harfang Exploration (HAR.V) is still at the pre-discovery stage, the Company is giving its flagship Serpent Project a proper probe with the drill bit as I type this piece.

Early-stage results at Serpent suggest we’re onto a large mineralized system.

Four weeks back the Company updated the project’s status with the announcement of three new high-grade showings along the northern limits of the property.

The Company also announced having increased its land position in the region to 43,452 hectares…

“The newly-discovered high-grade gold occurrences open up a totally new prospective area at Serpent that has never been prospected, immediately west and north of LaSalle Exploration’s Radisson Property. Harfang believes that these findings are linked to multiple regional East-West structural breaks among which the parallel Stu structure could be one of the dominant features. Harfang now controls most of the auriferous structural breaks extending over more than 20 km in an East-West direction.”

“Geological mapping and surface prospecting along structural breaks parallel and north to the Stu structure reveal gold showings corresponding to quartz veins hosted into sheared, foliated and gneissic tonalite and granodiorite considered to be part of the old Archean basement (Langelier Complex). The gold-bearing veins contain disseminated pyrite locally and resemble other gold occurrences found on the Property since 2017. The Stu structure, oriented into a N290° direction, is spatially associated with a >8 km2 gold-in-till anomaly and abundant gold occurrences on the Property (see press release dated on October 20, 2020).”

On February 9th, Harfang dropped the following headline:

Harfang reports gold-rich soil samples and commenced drilling at Serpent (James Bay, Québec)

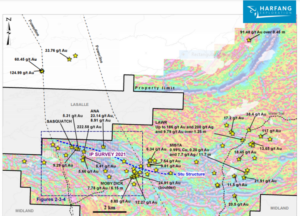

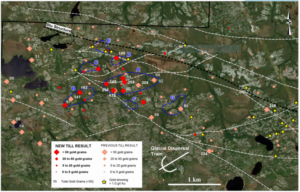

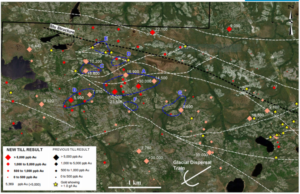

Here, the Company announced new results from soil and infill till surveys, stating, “these highly encouraging results further reinforce gold potential in the bedrock in the vicinity of the previously disclosed gold-in-till anomaly.”

The Company is performing an Induced Polarization survey over the area.

And a highly anticipated (maiden) drilling campaign is currently underway.

Highlights from this press release

Soil survey defines priority targets:

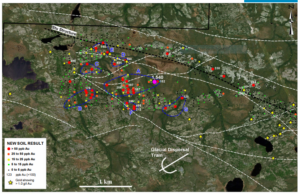

- 35 samples (among 560 fine fraction, B-horizon samples) returned over 50 ppb Au and 17 returned more than 100 ppb Au. One soil sample graded up to 1.54 g/t Au in the vicinity of the interpreted Stu structure;

- Soil anomalies are distributed in 7 clusters (A to G) scattered over a 2.5 km by 1 km area along major structural corridors and at their intersections;

- With the exception of clusters E and F, all other clusters are coupled with gold-rich till samples.

Infill till survey strengthens the existing gold-in-till anomaly:

- 19 out of 23 infill tills collected during the fall contained > 20 gold grains, mainly in clusters A and B;

- 5 till samples contained over 100 gold grains (140, 145, 162, 258, 294);

- 37 Heavy Mineral Concentrates from till samples graded above 1 g/t Au (among 82 new results), including 2 samples above 30 g/t Au;

- Tourmaline and abundant scheelite grains are locally found inside the gold-in-till anomaly; tourmaline and scheelite are indicator minerals for orogenic gold deposits, among others.

IP Survey

“A 69 line-kilometer IP survey covering the gold-in-till anomaly area with lines spaced 100 m apart has begun in early January. The main objective of this survey, located over multiple gold occurrences in bedrock and gold-rich soils, is to identify geophysical targets and some of them will be drilled-tested this winter.”

Drilling Campaign

Drilling began on February 1.

The Company plans to drill 4,000 meters to test selected areas underneath gold-rich tills, soils, and surface showings associated with (IP) geophysical anomalies and structural corridors (including the Stu structure and the associated shear zones).

“Our strategy for this first phase of drilling is to aim at specific targets under clusters A to G and to drill along a fence across the Stu structure according to our conceptual geological model.”

I like this part…

“Harfang is thrilled by the actual winter exploration program which will test new well-defined targets along kilometric scale structures as part of the first-ever drilling campaign of the Corporation. The actual program is expected to evolve into subsequent drilling phases due to the extensive area (>8 km2) to be investigated.”

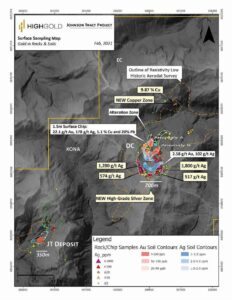

On February 11th, Highgold Mining (HIGH.V) released surface rock and soil sampling results for its Difficult Creek Prospect (DC).

The DC Prospect, located four kilometers northeast of its high-grade JT Deposit, is one of nine known mineral prospects located along the Company’s district-scale Johnson Tract Project in coastal Southcentral Alaska, USA.

The JT Deposit hosts an Indicated Resource of 2.14 Mt grading 10.93 g/t AuEq comprised of 6.07 g/t Au, 5.8 g/t Ag, 0.57% Cu, 0.80% Pb and 5.85% Zn. The Inferred Resource of 0.58 Mt grading 7.16 g/t AuEq is comprised of 2.05 g/t Au, 8.7 g/t Ag, 0.54% Cu, 0.33% Pb, and 6.67% Zn.

The Feb. 11th headline:

Concurrent with its 2020 JT drilling campaign, HighGold completed an extensive field program designed to evaluate regional targets along its district-scale 21,000-acre property.

Work at the DC Prospect consisted of reconnaissance level geological mapping, prospecting, and geochemical sampling to evaluate historic showings and to explore for new zones of mineralization.

Rock sampling and contour soil sample lines were collected in addition to the completion of an IP survey—inversion and modeling of the geophysical data are currently ongoing.

The results from this surface sampling campaign are plotted in the image below.

Assay results from additional regional prospects are pending.

“A new high-grade silver-gold-zinc vein field was discovered through rock sampling over a 250m x 700m area, located on trend and south of the historic DC Prospect gold showing. The 2020 exploration field program also significantly expanded a ‘gold-in-soil’ anomaly previously defined by the Company in 2019, including delineation of a new sub-parallel 320m long ‘gold-in-soil’ anomaly. At the northern end of the DC Prospect and at lower elevation, rock sampling has also identified an area of high-grade copper mineralization. Collectively, these results map out a large, zoned mineralizing system over a 1.5km x 3km area (above map).”

DC Prospect Assay Highlights

New Silver-Gold-Zinc Vein Field

- 1,800 g/t Ag, 0.4 g/t Au, 0.5% Zn, in rock grab sample;

- 1,280 g/t Ag, 1.9 g/t Au, 0.9% Zn, in rock grab sample;

- 574 g/t Ag, 0.5 g/t Au, in rock grab sample;

- 517 g/t Ag, 1.1 g/t Au, 2.8% Zn, in rock grab sample;

- 211 g/t Ag, 1.5% Zn, in rock grab sample;

- 201 g/t Ag, 0.8 g/t Au, 0.6% Zn, in rock grab sample.

Gold-in-Soil Anomalies

- 180 m x 50 m of greater than 100 ppb Au, Anomaly A;

- 320 m x 50 m of greater than 50 ppb Au, Anomaly B.

New Copper Zone

- 9.87% Cu, in rock grab sample;

- 3.98% Cu, in rock grab sample.

The Company was careful to note that grabs are often biased samples and not necessarily representative of the area’s subsurface mineralization.

Discussion of DC Prospect Results

The DC Prospect is located four kilometers northeast of the JT Deposit and is characterized by a series of large gossan alteration zones similar in style to the JT Deposit that collectively extend over a 1.5 km x 3 km area. Gold mineralization and pervasive clay/anhydrite alteration appear to be preferentially developed within dacitic to rhyolitic tuffaceous rocks that underly a shallowly-dipping, capping sequence of lesser altered andesite. The widespread extent of mineralization exposed in erosional ‘windows’ through the andesite supports potential for a large and partially blind mineralized system linking the various DC Prospect zones together.

The new Ag-rich vein field was discovered through follow-up of positive results generated during a short reconnaissance program in late 2019. The new discovery consists of multiple sets of low-sulphidation epithermal crustiform quartz veins, vein swarms, and siliceous breccias. The vein field has been sampled across an area measuring 250m x 700m (Figure 1) that is centered approximately 1 km south of the main DC Prospect showing area and 200-300m higher in elevation. Individual quartz veins typically range from 20 cm to 1.0 m in width, are steeply dipping, and have been traced on surface for up to 250 m along strike with several vein structures interpreted to project beyond their current mapped extent beneath talus and scree cover. Dominant vein orientations are north-northwest, east-west, and north-south.

Veins within the new vein field have significantly higher silver to gold ratios than the main DC Prospect gold showing area, with multiple samples in excess of 100 g/t Ag (ranging from 30 g/t to 1800 g/t). The veins are at higher elevation and higher in the stratigraphic sequence than the main DC Prospect, which has returned grab samples up to 50.1 g/t Au. It is interpreted that the veins represent the high-level silver rich uppermost part of a large epithermal mineral system at the DC Prospect. In addition to their potential for high-grade silver, these veins are important targets at depth where they project into underlying dacite tuffs that host most of the high-grade gold mineralization elsewhere on the Property.

Two gold-in-soil anomalies have also been identified, referred to as Anomaly A and B. Anomaly A is an expansion of the 100-meter long zone of +100 ppb Au reported from 2019 sampling. New 2020 sampling has extended this zone to 180-meters long and 50-meters wide. This anomaly correlates to 2019 rock sampling that reported anomalous Au, Ag, Pb, Cu and Au, highlighted by a 1.5 meter chip channel sample grading 22.2 g/t Au, 178 g/t Ag, 1.1% Cu and 20% Pb. Anomaly B, located 200-meters to the southwest, is defined by a 320-meter long zone of +50 ppb Au. Both anomalies represent compelling drill targets for testing during the 2021 drill season.

New rock samples collected 1.5 km north of the main DC Prospect gold showing identified a zone of copper mineralization in a silicified gossan over a 45m x 20m area. Six (6) samples collected ranged from 0.1% to 9.9% Cu. Follow-up exploration work is planned for this and other areas of at DC Prospect in the 2021 field season.

Results from 12 drill holes are still pending from the 2020 JT campaign.

Final drill results are also pending from the late 2020 drill program completed at the Company’s Timmins projects.

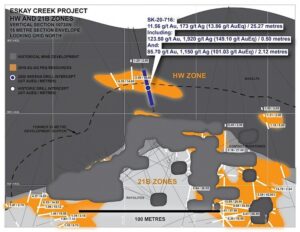

Skeena Resources (SKE.T) is trading exceedingly well, tagging new highs as it continues rolling out exceptional infill (resource conversion) drill results from its flagship Eskay Creek Project located in the prolific Golden Triangle of British Columbia.

A February 10th headline:

Skeena Intersects 13.86 g/t AuEq over 25.27 metres in Hanging Wall Zone at Eskay Creek

Here, the Company reported additional diamond drill results from its Phase-2 infill campaign.

This Phase-2 program, focused on (PFS) resource category conversions for its open-pit constrained resources, is now complete.

The Company states that it has also completed 5,000 meters of (near-mine) exploration drilling. Results from this stepout drilling are pending.

Eskay Creek Infill Drilling Highlights:

Hanging Wall (HW) Zone:

- 11.56 g/t Au, 173 g/t Ag (13.86 g/t AuEq) over 25.27 meters including: 123.50 g/t Au, 1,920 g/t Ag (149.10 g/t AuEq) over 0.50 meters AND 85.70 g/t Au, 1,150 g/t Ag (101.03 g/t AuEq) over 2.12 meters.

21B Zone:

- 15.30 g/t Au, 80 g/t Ag (16.37 g/t AuEq) over 14.00 meters.

21C Zone:

- 4.41 g/t Au, 5 g/t Ag (4.48 g/t AuEq) over 22.50 meters;

- 3.20 g/t Au, 242 g/t Ag (6.42 g/t AuEq) over 19.00 meters, including: 41.60 g/t Au, 4,390 g/t Ag (100.13 g/t AuEq) over 1.00 meter.

Shallow HW Zone Drilling Intersects Impressive Gold and Silver Grades

Infill drilling in the HW Zone has delivered above-average thickness and grades as demonstrated by 11.56 g/t Au, 173 g/t Ag (13.86 g/t AuEq) over 25.27 m (SK-20-716). This intercept occurs only 25 m vertically below surface and is highlighted by exceptional subintervals grading 123.50 g/t Au, 1,920 g/t Ag (149.10 g/t AuEq) over 0.50 m and 85.70 g/t Au, 1,150 g/t Ag (101.03 g/t AuEq) over 2.12 m. This new intercept exceeds the tenor and width of the widely spaced historical drill holes (which were only selectively sampled) which informed the current Mineral Resource Estimate (MRE) for the HW Zone. Nearby historic drilling intersected 2.49 g/t AuEq over 16.00 m and 6.30 g/t AuEq over 14.00 m only 10 and 20 m to the west (CA89-176 and CA90-567). The HW Zone is interpreted as discordant, replacement-style gold-silver mineralization hosted by mafic volcanics with minor interbeds of sediments in the stratigraphic hanging wall to the historically mined Contact Mudstone.

21C Zone Drilling Exemplifies Silver Endowment of Eskay Creek Deposits

The 2020 infill drilling campaign targeted an area of Inferred resources within the 21C Zone and confirmed the high silver grades which characterize this zone. A 19.00 m intercept within the Contact Mudstone and underlying footwall Rhyolite averaged 3.20 g/t Au, 242 g/t Ag (6.42 g/t AuEq) with an impressive subinterval grading 41.60 g/t Au, 4,390 g/t Ag (100.13 g/t AuEq) over 1.00 m (SK-20-699). Nearby, 15 m to the west, infill drilling intercepted 1.43 g/t Au, 224 g/t Ag (4.42 g/t AuEq) over 5.48 m including 4.31 g/t Au, 1,150 g/t Ag (19.64 g/t AuEq) over 1.00 m (SK-20-700) within rhyolite breccias.

Skeena is on tap for an updated Eskay Creek resource estimate this spring—the PFS will follow.

Pure Gold Mining (PGM.V)

We haven’t heard much out of PGM in recent weeks, but I did come across this recent interview with Darin Labrenz, Pure Gold’s CEO:

As you’re likely aware, the Company poured its first gold back in December, on budget, and on schedule. The Company is now ramping up towards commercial production—a milestone they should reach before Q1 is done.

From a technical POV, Pure Gold is trading down to what should be solid support. For those technically inclined, there are positive divergences on the RSI and (3, 10, 16) MACD…

Final thoughts

Returning to the topic of Alternative Reserve Assets, the Idaho state gov’t just approved legislation that will allow it to add gold and silver to its treasury.

Republican Rep. Ron Nate:

“With new concerns about financial instability, it makes sense for investors, and it makes sense for states, to turn to real assets, especially in terms of precious metals, to protect investments of their funds.”

This bill now heads to the state Senate for debate.

END

—Greg Nolan

Full disclosure: Of the companies featured above, Forum and Highgold are Highballer clients. The author owns shares of Forum, Highgold, Defense, Harfang, Pure Gold, and Skeena. Color me biased (do your own due diligence).

Disclaimer - Legal NoticeHighballerstocks.com (Greg Nolan) is not a licensed financial advisor and does not give investment advice.

The content of this report is for information purposes only.

Nothing contained herein should be construed as a recommendation or solicitation to buy or sell any security.

Always consult a licensed qualified investment advisor in your legal jurisdiction before making any investment decisions.

Though Highballerstocks.com (Greg Nolan) believes its sources to be credible, and the statements contained herein to be true, readers must conduct their own thorough due diligence, and or consult with a qualified investment advisor before important investment decisions are made.

Highballerstocks.com (Greg Nolan) accepts no responsibility or liability for the accuracy of the contents of this report.