After testing the $1800 level earlier this week, gold backed off, rounding out the week essentially flat.

But the setup here looks compelling.

Since a double bottom that bookended the month of March (chart below), the metal is grinding out a series of higher lows- higher highs.

Having tested and broken out above the 50 period SMA, a push above the next level of resistance—the 100 period SMA at $1802 and change—appears inevitable.

If we see several convincing closes above $1800, the move to $1900 could be swift.

Supportive factors for a powerful push higher

There are several. Indulge me with the following charts.

The U.S. Dollar is showing weakness, its chart is beginning to look like a dog’s breakfast.

With U.S. President Joe Biden’s proposed plan to nearly double the capital gains tax for high net worth individuals, holding assets denominated in U.S. dollars may become too costly—less desirable—for the wealthy.

A move below 90 in the greenback should set the stage for a significant push higher in the metal. Tick-Tock.

Everett Millman, Gainesville Coins precious metals expert:

“The dollar does not seem to be liking a lot of the policies coming out of Washington, including the Biden administration’s proposed new capital-gains tax increase. Also, one of the next big initiatives is infrastructure spending. Both of those factors are hurting the dollar, and that is positive for gold.”

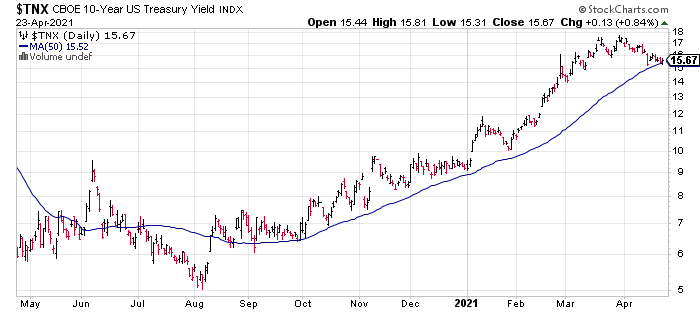

The yield on the U.S. 10 year Note, after tagging 1.75% in recent sessions, has come back down to 1.57%.

Here’s the thing: after the U.S. Labor Department announced a dramatic spike in inflation earlier this month—rooting a 2.6% annualized CPI—and with a 1.6% current yield on the 10 Year Treasury Note, we’re now back to the same negative (1%) real rates witnessed last summer—a spectacle that pushed the yellow metal to all-time highs (north of $2k).

Gold has room to move here.

However, with the Bank of Japan’s rate announcement coming up on Tuesday, the Fed’s social and subsequent press conference on Wednesday, plus U.S. Q1 GDP numbers, jobless claims, and pending home sales on Thursday… too much positive data on the macroeconomic front could put the metals hunt for $1900 on hold.

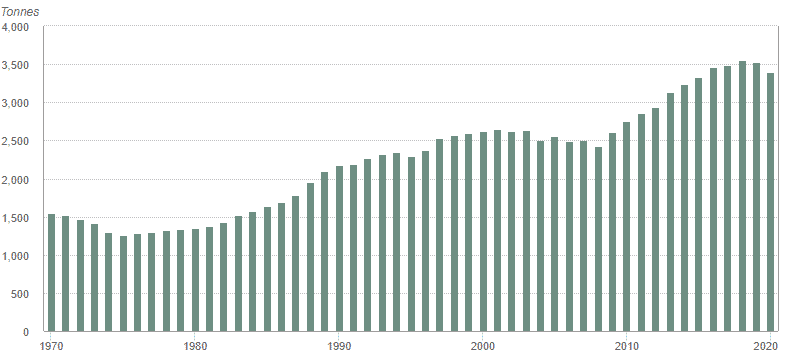

In last week’s Highballer report, we looked at the recent increase in central bank buying, stating…

Physical demand for the metal, with all of the trillions’ worth of cheap (stimulus) paper orbiting our planet, is also picking up.

Central bank buying, after a pause in 2020 as gold rallied to record highs, appears to be gaining momentum.

In February, global central banks were net buyers led by India which acquired 11.2 tons.

In March, the Polish Central Bank announced its intentions to buy at least 100 tons in the near future.

A more recent headline shows Hungary’s central bank increasing its gold reserves to 94.5 metric tons from 31.5 tons. This marks one of the most significant central bank gold purchases in decades.

The Budapest Business Journal – Hungary triples gold reserves

A choice quote from the National Bank of Hungary (MNB):

“As it carries no credit or counterparty risks, gold facilitates reinforcing trust in a country in all economic environments, which still renders it one of the most crucial reserve assets worldwide, in addition to government bonds.”

The MoneyWeek article linked below expands on this central-bank-buying theme.

China owns a lot more gold than it’s letting on – and here’s why

China isn’t just accumulating the metal via normal channels, it’s producing the metal within its borders and keeping everything it mines.

In China, exporting domestic mine production is not allowed.

China is currently the world’s largest producer—has been since 2007. Last year it produced 380 tonnes, 20% more than Australia, the world’s second-largest producer.

“With reserves in decline at home, Chinese mining companies have also been buying assets abroad, across Africa, South America and Asia. International production exceeded domestic production by about 15 tonnes last year. As well as being the world’s biggest producer, China is the world’s biggest importer. It is hard to get precise import figures, but we do know that, for example, via Hong Kong alone, over 6,000 tonnes has entered the country since 2000. Add that to cumulative gold production since 2000 and you get a figure of 13,200 tonnes.”

China has an appetite for the shiny stuff. There’s speculation that all of this accumulation is setting the stage for a gold-backed yuan. Wouldn’t that be a hoot?

REUTERS EXCLUSIVE: China opens its borders to billions of dollars of gold imports – sources

The Great Debate

My take on the outcome: Saylor was passionate regarding the validity of owning bitcoin vs gold—he was passionate but he did not persuade.

Two salient points courtesy of Giustra:

“The idea that bitcoin can go up by a factor of 10x, consume all the value of gold, and then consume all the value of bonds … I just don’t see what world that can possibly happen in.”

“Michael, you are doing your followers a disservice by telling them to sell their gold … To sell their gold is the worst thing they could be doing because they’ll need it as a portfolio diversifier because it’s inversely correlated to what I think bitcoin is and what equities are.”

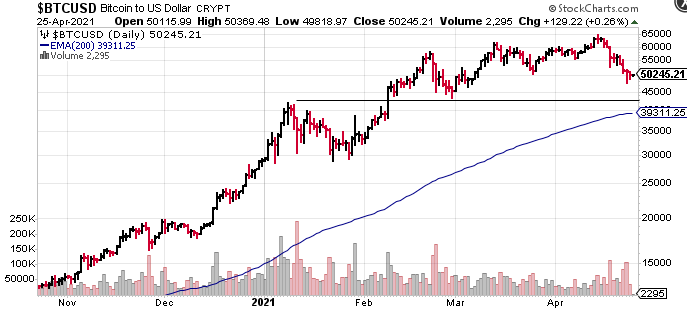

Last week, the popular cryptocurrency registered its worst (weekly) close in nearly two months.

Bitcoin vs Gold: It kinda bothers me that many view this as a zero-sum game. It isn’t. There’s logic in owning both.

Bitcoin traders will be watching the 45 and 43k levels closely. Continued weakness could represent another supportive factor for the precious metal.

Updating several of the companies on our list

On April 19th we looked at Prime Mining (PRYM.V), Defense Metals (DEFN.V) and Forum Energy Metals (FMC.V).

Today we’ll look at Cartier (ECR.V), Highgold (HIGH.V), Kuya (KUYA.V), Pure Gold (PGM.V), Skeena (SKE.T), Minnova (MCI.V), and Forum (FMC.V).

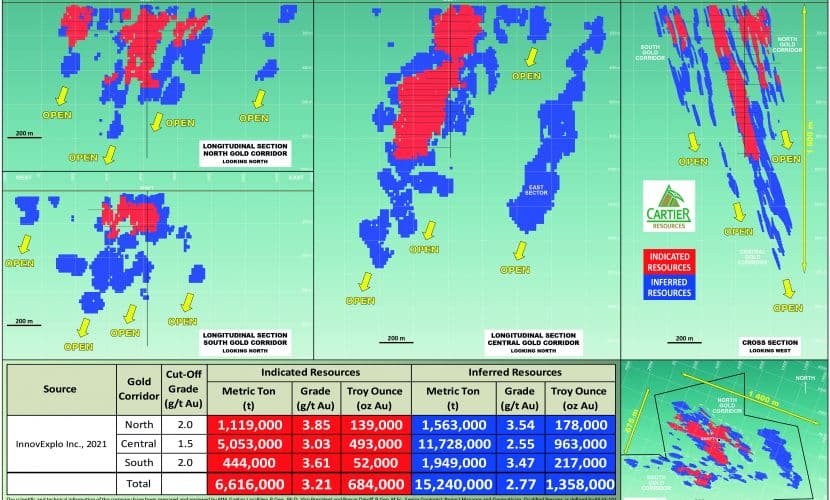

Cartier Resources (ECR.V)

After growing its flagship Chimo Project ounce count to more than 2M one month back, on April 8th the Company dropped the following headline:

Industrial sorting?

This is a hugely important development as the Company pushes the Chimo Mine Project further along the development curve. The finish line in this case would be the outright sale of the project to a resource-hungry producer. And there are a lot of those stalking the junior landscape as global production continues to fall off.

Sources: Metals Focus, Refinitiv GFMS, World Gold Council; Disclaimer

Highlights :

The industrial sorting tests of mineralisation representative of the Chimo Mine project produced a concentrate representing by mass a bit more than 50 % of the original mass of the material with a percentage increase of 170 % of the gold content compared to the feed of the sorter.

The objective of this Industrial Sorting exercise is to remove as much waste rock as possible, increasing and concentrating the grade of the material before it’s shipped off to the mill for processing.

The economic benefits:

- Increase the recovery rate at the mill;

- Reduce transport costs to the mill;

- Reduce milling costs;

- Reduce the costs of environmental restoration of mine tailings;

- Reduce the environmental footprint of mine tailings and consequently increase the social acceptability of mining project.

Efficient ore sorting ultimately increases the value of Chimo’s 2M-plus ounce count.

Corem Sorting Tests

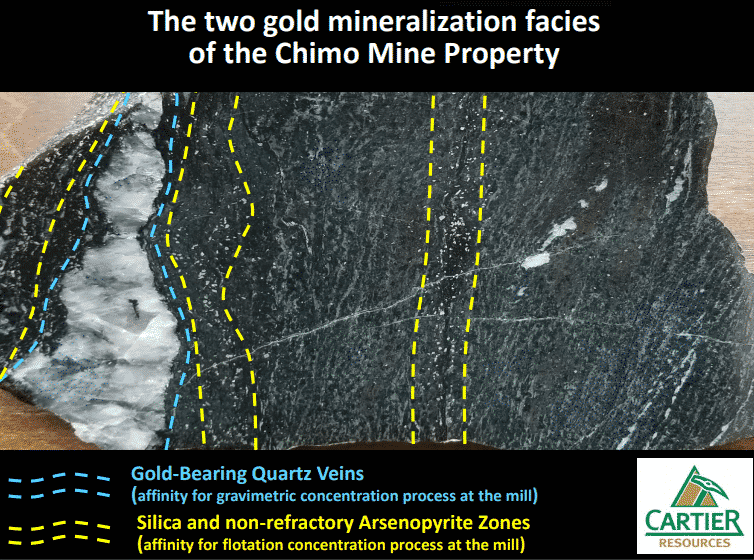

Gold from the Mine Chimo property is present in two types of mineralised facies (image below) either : i) quartz veins with coarse visible gold grains having an affinity for the gravity concentration of gold at the mill and ii) zones of silica-rich mafic rocks associated with non-refractory arsenopyrite having an affinity for the flotation of a concentrate of arsenopyrite for gold recovery at the mill. To perform the sorting tests, rocks representative of the 2 mineralised facies, made up of the following 6 mineralogical facies, were first selected for static recognition of each of the facies by the sensors of the sorter:

- Gold-bearing quartz veins;

- Gold-bearing silica;

- High-grade gold-bearing arsenopyrite;

- Medium grade gold-bearing arsenopyrite;

- Low-grade gold-bearing arsenopyrite;

- Mafic waste rock.

There’s a more thorough overview of this critical cost-saving process contained in the guts of this press release—it’s worth checking as it could serve as a model/solution for operations facing grade distribution and dilution challenges (see PGM further down the page).

I recently heard Vince Marciano (The Stateside Report) characterize Cartier as the Rodney Dangerfield of the junior arena. I’d have to agree with him on that point—this stock gets no respect, and the underlying fundamentals demand it.

Current prices, with the possibility of a future takeover bid, may represent a low-risk entry point.

Highgold Mining (HIGH.V)

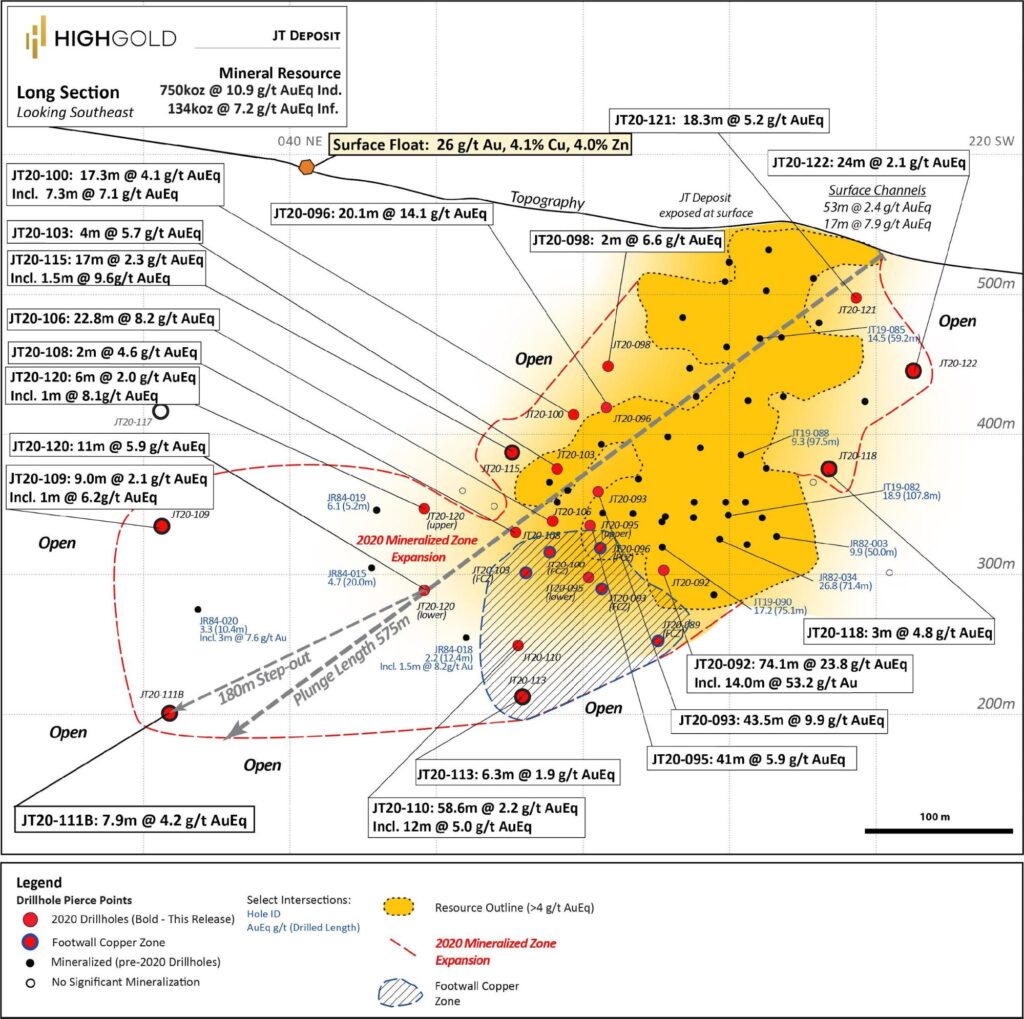

Since our last coverage roughly one month back—Highgold released assay results from the final nine holes at its flagship Johnson Tract polymetallic Gold Project in Southcentral Alaska where it’s building on a 0.75 million ounce 10.9 g/t gold equivalent resource.

Key JT Deposit 2020 Exploration Highlights:

- JT Deposit mineralization extended 180m down-plunge and on strike of earlier reported step-out intersections with 7.9m at 2.0% Cu, 1.7% Zn, and 18 g/t Ag (2.9% CuEq) in hole JT20-111B;

- The 2020 drill program successfully doubled the footprint of mineralization surrounding the JT Deposit mineral resource (map below);

Highlights continued…

- Exceptional results in previously reported step-outs on the margins of the JT Deposit mineral resource that yielded 74.1m at 23.8 g/t AuEq and 43.5m at 9.9 g/t AuEq in holes JT20-092 and JT20-093 (See HighGold press release dated September 9, 2020 for details);

- Emergence of the Footwall Copper Zone, a new zone of copper-silver rich mineralization that has now been intersected in seven (7) drill holes;

- Mineralization expanded in multiple directions and remains open for expansion along strike to the northeast and southwest, and at depth – this is a break-through as the JT Deposit was previously thought to be constrained by a fault;

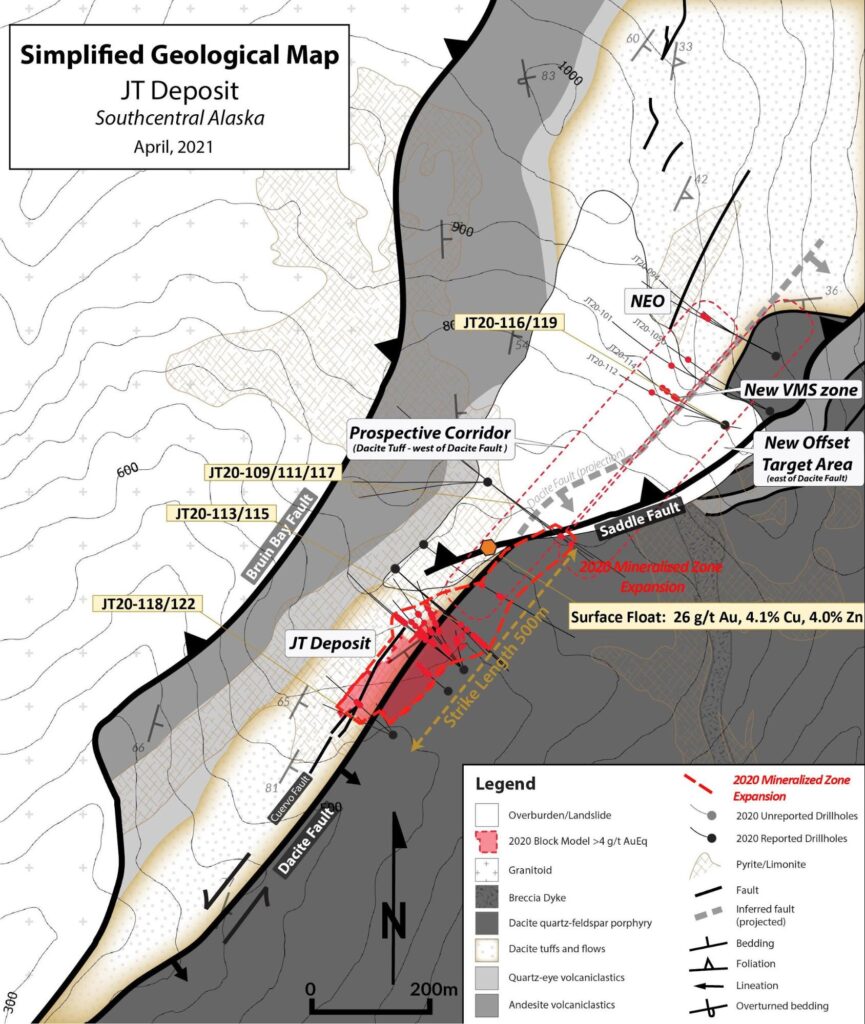

- VMS mineralization identified 600m northeast and on trend from the JT Deposit (7.8m at 9.8% ZnEq in hole JT20-114) opening up a new style of mineralization and exploration potential at JT;

- New advancements made in the understanding of Johnson Tract geology, including a revised fault offset target which has, as yet, been subject to little to no drill testing;

- The discovery of strongly mineralized Cu-Au-Zn boulders, 200m up-valley from the JT Deposit, which highlights the potential to discover JT mineralization along newly defined mineralized corridor (map below)

Darwin Green, president, and CEO:

“We are very pleased to see that the extent of the JT mineralized system is growing as we continue to step out northeast and down-plunge of the deposit. Focus will now turn to the upcoming 2021 field season in which we will be targeting both larger step-outs to the northeast and down-plunge with wide-spaced drilling for additional zones of high-grade gold and continued expansion of the JT Deposit. I am particularly encouraged by the new mineralization documented, 200 meters up-valley from the main JT Deposit, in what we call our Gap Target. Outside of the JT Deposit, we are set to drill the highly prospective DC target and rank a series of large areas of gold and silver mineralization (rock and soil geochemistry) that are prime targets for follow-up. There is much to be excited about as the 2021 drill season approaches.”

A detailed discussion of the JT Deposit Expansion results (seven holes) and the final NE Offset results (two holes) is contained within the guts of this April 13th press release.

The start of a new field season at JT is only weeks away.

Current Initiatives and the 2021 Program:

“The Company continues to refine the geology and alteration 3D model for Johnson Tract. Focus for the 2021 Drill Program, in the main JT Deposit area, will include systematic step-outs along strike and down-plunge from the current modeled resource testing the 600-meter long Gap Target, the sparsely-drilled northeast-trending ‘prospective corridor’ between the JT Deposit and the original NEO target. Our updated exploration model identifies key areas east and south of the 2020 NEO drilling for the potential fault-displaced extensions of the JT Deposit. Amongst the targets outside of the JT Deposit area, the DC target will be a key focus. The program and budget will be announced in detail in late April.”

For a detailed look at previously released JT assay results, click on the following link:

An early spring Highballer update

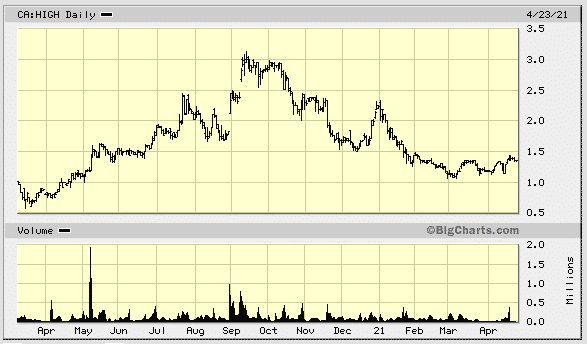

After putting on an impressive show in H1 of 2020, the shares have come off in recent months.

The price action over the past 7 weeks—a trio of higher lows and higher highs—is a good technical set-up for what could prove to be an eventful 2021 exploration campaign in Alaska.

Though JT currently bears flagship status, the Company’s assets in the prolific Timmins camp of Ontario could generate significant shareholder value in the coming weeks/months.

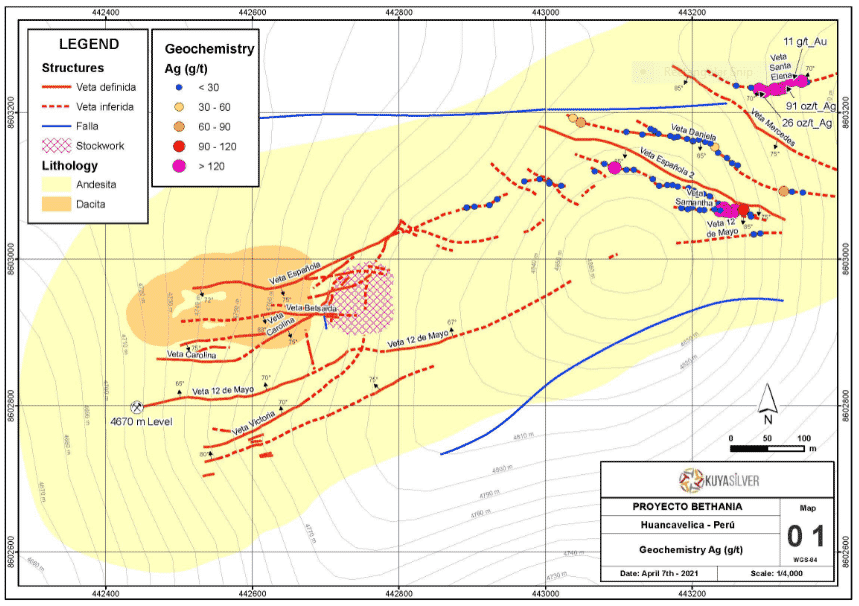

Kuya Silver (KUYA.C)

Kuya Silver, a company developing the high-grade Bethania Silver Project in Central Peru, dropped the following headline on April 8th:

Kuya Silver Extends the Strike Length of the Bethania Vein System with New Surface Sampling

Here, the Company announced results from a recent surface sampling program focused on the Bethania Extension zone and the historical Española 2 adit.

“This batch of the program consisted of 97 rock chip samples, employing a combination of trenching to expose bedrock and outcrop along visible or inferred vein zones. Of the 97 samples reported, 76 were taken from veins (observed or inferred) and 21 samples taken from altered or unmineralized host rock (hanging wall or foot wall). These sampled vein zones are located approximately 600 metres to 1000 metres from the main Bethania adit and 100 metres to 500 metres east of easternmost underground development. When mineralized, the vein zones sampled reported anomalously high silver and lead, and in some cases anomalous gold. Anomalous zinc and copper grades, which can be associated with silver mineralization in the fresh veins underground, were rarely observed on surface.”

Highlights of the Program

The easternmost zone sampled a newly identified vein at surface called the Santa Elena vein, roughly 500 meters along strike of the eastern limit of the Española underground workings. Samples were taken at 10 meters intervals along surface exposures of this vein system.

Seven consecutive samples distributed over 60 meters in length at the Santa Elena vein averaged 698 g/t (22.4 oz/t) silver, 2.79 g/t gold and 3.07% lead (30.9 oz/t silver equivalent*).

Results included:

- 2833 g/t (91.1 oz/t) silver, 5.20 g/t gold and 10.6% lead (110.7 oz/t silver equivalent);

- 300 g/t (9.6 oz/t) silver, 11.03 g/t gold and 2.17% lead (35.5 oz/t silver equivalent);

- 812 g/t (26.1 oz/t) silver, 0.32 g/t gold and 4.82% lead (30.6 oz/t silver equivalent).

Nice values.

A second zone of interest is located at the intersection between a parallel structure to the Española 2 vein and the newly identified Samantha Vein.

At the vein intersection, four consecutive samples distributed over 30 meters in length averaged 258 g/t (8.3 oz/t) silver and 2.84% lead (a 10.5 oz/t silver equivalent). Three consecutive samples along the Samantha vein—distributed over 20 meters in length—averaged 171 g/t silver (5.5 oz/t) silver and 2.33% lead (7.3 oz/t silver equivalent).

David Stein, president, and CEO:

“Kuya is very excited with this initial surface sampling program, which clearly indicates that the Bethania vein system continues along strike even further east than previously known. While we are highly confident in finding new veins in this swarm-like system, it is always a pleasant surprise to see new zones of high-grade mineralization sitting on surface up to 500 meters from the nearest underground development. The Santa Elena vein is particularly exceptional due to its high gold grades, something we have not seen to this extent in any other vein at Bethania. Kuya will use this information to help target future drilling and exploration along the strike extension of the Bethania mine.”

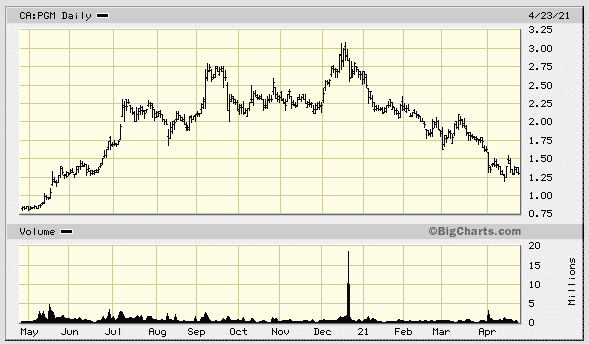

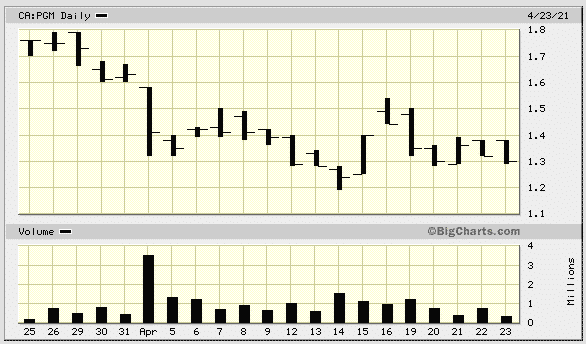

Puregold Mining (PGM.V)

We enjoyed some very positive share price trajectory in Pure Gold after initiating coverage in the $0.64 range last April.

Since having peaked at a three-dollar bill only four months back, this has been a hard one to watch.

On March 31st, Pure Gold updated progress at its PureGold Mine project as it ramps up towards commercial production.

Here, the Company states…

“Since late January, the milling facility at the PureGold Mine has been operating at greater than 75% of nameplate capacity, including multiple consecutive days at greater than 800 tpd and a peak daily throughput of 897 tpd. Gold recoveries have been exceptional and consistent throughout the ramp-up period, averaging 95%, in line with expectations. With the milling facility now fully ramped up, the Company’s focus will shift to aligning the mill throughput with the rate of ore production from underground as the mine continues to access higher grade ore and progress toward steady state production.”

But reading further down the page, there was this…

“Realized head grades for the first quarter were lower than anticipated due to ramp-up related issues including unplanned dilution in the first longhole stopes blasted by the Company and the feeding of low grade stockpile material to the mill to facilitate uninterrupted mill ramp-up during commissioning.”

And a little further down from there, this…

“In Q4 2020 the Company processed 3,535 tonnes of ore at a grade of 7.8 g/t gold to produce 860 ounces at a 96.6% recovery rate. From January 1st to March 29th 2021, the Company processed 47,182 tonnes of ore at a grade of 2.8 g/t gold to produce 4,011 ounces at a 95.0% recovery rate. As noted previously, overbreak and unmineralized dyke issues resulted in unanticipated dilution in Q1 and actions have been taken to significantly reduce these issues which are expected to result in head grades improving in the second quarter and beyond.”

The market’s reaction to the March 31st news was swift.

Too much waste rock (non-mineralized dykes being one culprit) is being sent to the mill. The Company is working to resolve these dilution issues—blasting practices have been modified to reduce overbreak going forward, for example.

The early stages of ramping up to commercial production are often fraught with these dilution challenges—it’s all part of the learning curve.

The ore sorting technology Cartier is deploying at its Chimo Mine Project might have been put to good use here.

Harte Gold is an extreme example of what can befall a new mine in the early innings of production: In November of 2019 Harte revised its guidance from 39,200 ounces at an AISC of US$1,300 to US$1,350 to a miserable 24,000 to 26,000 ounces at an AISC of US$2,000 to US$2,200.

The above is only an example of what can happen during the ramp-up phase.

The Company also went on to state that it has entered into a binding letter of agreement with Sprott Private Resource Lending II amending a prior (August 2019) agreement.

Darin Labrenz, president & CEO:

“We are pleased by the progress of the ramp-up of the PureGold Mine to date, highlighted by the milling facilities achieving design capacity prior to quarter end. With the mill ramp-up effectively complete, we can now focus our attention solely on ramping up the mine and accessing high grade ore from multiple declines where we are making great progress. The additional US$12.5 million will ensure the PureGold Mine continues its ramp-up phase with maximum financial flexibility, whilst the remaining US$7.5 million can be accessed if needed to provide additional liquidity. The term and repayment schedule matches our expected grade and production growth over the coming years as we get into the heart of the orebody and continue to execute on our organic growth strategy.”

Shoring things up further, the Company announced a $10M raise on April 8th…

Pure Gold Mining Inc. Enters Into a Bought Deal Agreement for Gross Proceeds of C$10,001,600

This bought deal raise that was upsized the very same day…

Pure Gold Mining Inc. Announces Increase to Bought Deal Financing

The terms of this flow-through “bought deal”—$1.52 per FT share—struck me as low.

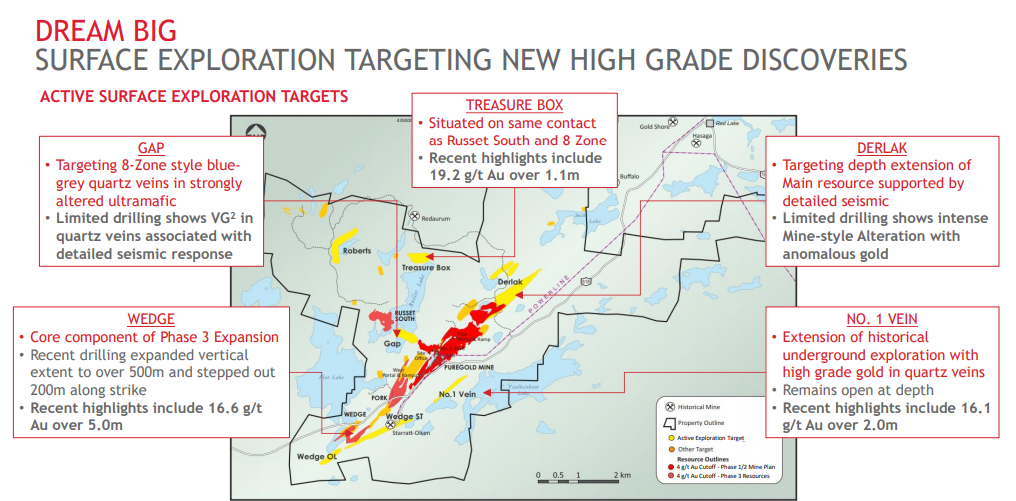

These are early days for this new mine. And this is Red Lake—the High-Grade Gold Capital of the World.

If you believe we’re in the early innings of a multi-year bull run in the metal, and if you believe Pure Gold’s flagship project will deliver the same kinda grade and scale as the Campbell and Red Lake mines, this might be considered a speed bump along the way.

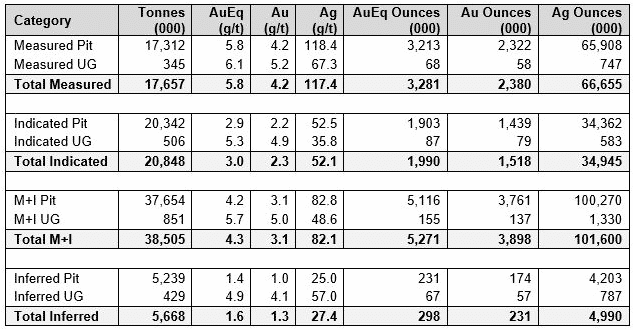

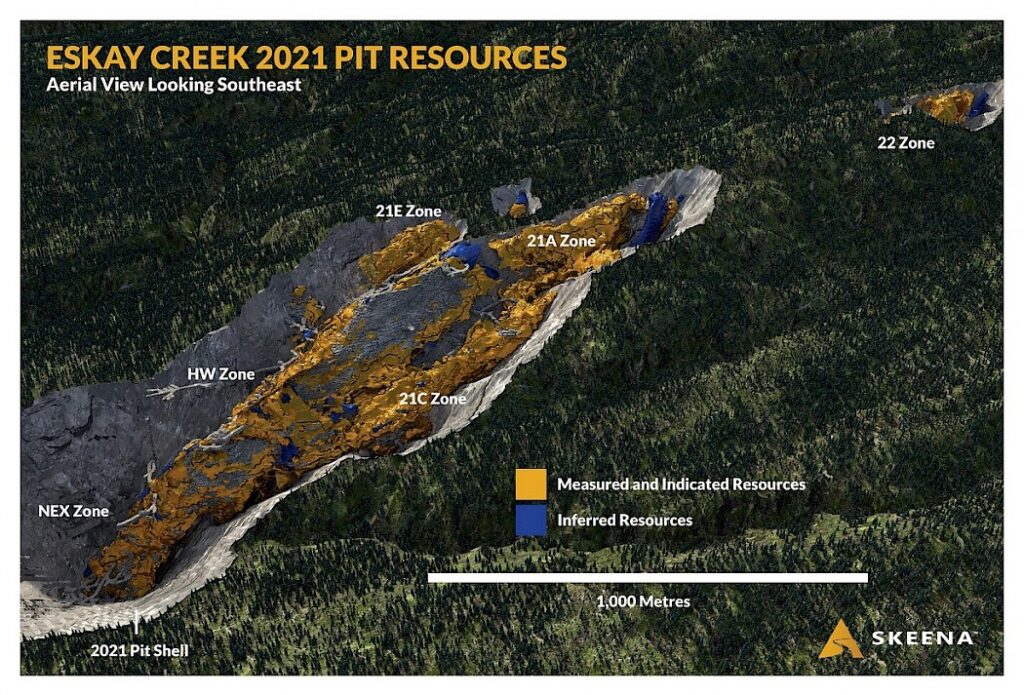

Skeena Resources (SKE.T)

After releasing a deluge of exceptional drill hole assays—both infill and stepout—Skeena released a highly anticipated resource update from its flagship Eskay Creek Project in the prolific Golden Triangle of British Columbia.

Skeena Announces 5.3 Moz at 4.3 g/t AuEq Measured and Indicated Resources at Eskay Creek

This 2021 mineral resource estimate (MRE) is the product of 7,583 historical surface and underground diamond drill holes totalling 651,332 metres, with an additional 751 surface diamond drill holes completed by Skeena between 2018-2021 totaling 104,740 metres.

Eskay Creek now qualifies as a Tier-1 deposit, of which there are only 13 on the planet.

There’s a lot of discussion surrounding both resources—pit constrained and underground—in this update. I urge you, if you haven’t already done so, to give this one a thorough read.

Accelerated 2021 Exploration Program Initiated

“With the infill drilling programs completed and the pit constrained resources having been largely converted to the Measured and Indicated categories, the Company has initiated a property scale exploration program. This accelerated program is designed to define additional near surface, bulk tonnage mineralization with the goal of expanding the current resource base and to supplement the existing mine plan. The program will involve a data compilation and interpretation period followed by judicious target ranking that will culminate in drill testing of near mine and regional targets in H2 2021. Dr. Harold Gibson, one of the world’s foremost experts in VMS systems, has been engaged by the Company to assist the program which will be spearheaded by the Company’s Director of Exploration, Adrian Newton, P.Geo.”

Very exciting.

Strengthening the bond between partners, the Company announced a new conservancy to protect the environment on Tahltan ground:

Tahltan Land to be Protected in Partnership with Conservation Organizations, Skeena and the Province

Speaking of the Tahltan, on April 16th the Company announced the closing of a C$5 million investment by the Tahltan Central Government into Skeena.

Skeena Closes Previously Announced C$5 Million Investment from Tahltan Nation

The following video explores these recent news events in greater detail…

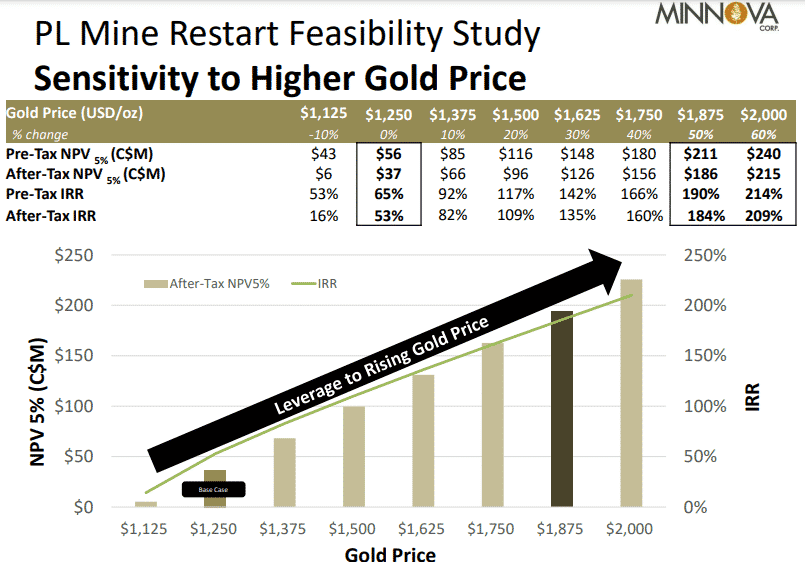

Minnova Corp (MCI.V)

It’s been a while since we last checked in with Minnova. The stock has caught a bid in recent sessions—an April 20th news event being the catalyst.

I see they’re still working on updating their website (the first place most prospective investors go when conduction early-stage due diligence).

The Company dropped two noteworthy headlines in recent weeks.

According to the Company—a discovery-stage exploration and development play—a restart plan for its wholly-owned PL Gold Mine in central Manitoba is in the works.

M & I ounces at PL currently stand at 293,326 @ 5.30 g/t Au.

Inferred ounces = 319,100 @ 4.63 g/t Au.

The PL Mine is permitted for quick restart. Discussions with qualified contractors and service providers are advancing.

Planned (upcoming) work programs include:

-

- A surface bulk sample;

- Ore sorting characterization studies and follow-on test work;

- Updated metallurgical test work with focus on gravity concentration recovery;

- The completion of a grid power connection;

- Water treatment design and implementation;

- Paste back fill design and implementation;

- New northern portal and decline plan, design and implementation;

- Camp expansion and upgrades;

- Detailed engineering;

- Equipment considerations and selection;

- Contract mining;

- Personnel/labour additions.

Project Finance Update:

“Minnova continues to advance project finance discussions with various groups in preparation for the restart of the PL Gold Mine. Discussions include project debt and equity financing alternatives. At current gold price the project is robust and fully supports a go it alone funding strategy with attractive payback and loan repayment characteristics.”

An April 20 headline: Minnova Corp. – Visible Gold in Quartz Vein Discovered in Biggest Step-Out Drill Hole in History of PL Mine and Phase 1 Restart Initiatives Update

Visible gold in the core always adds an element of intrigue… compelling speculative appeal, if you will.

Visible gold in a big stepout hole from a primary resource base heightens that level of intrigue… adding even greater speculative appeal, if you will.

“Visible Gold was logged along the margins the quartz vein is located within a broader high-strain structure measuring 1.0 meters at the target depth. This structure is interpreted to be the down dip extension of the PL North Upper Zone. M-21-048x is located approximately 350 meters northwest of the PL mill and over 500 meters beyond the limits of the 2017 PL Deposit resource model. This mineralized intercept demonstrates that the deposit is open for expansion along strike and down-dip beneath the permitted 1,000 tpd PL mill.”

Sadly, visual cues rarely live up to expectations—that’s been my (sad) experience anyway. But it’d be foolish to complain about VG in the core.

Assays are pending from this big stepout.

Forum Energy Metals (FMC.V)

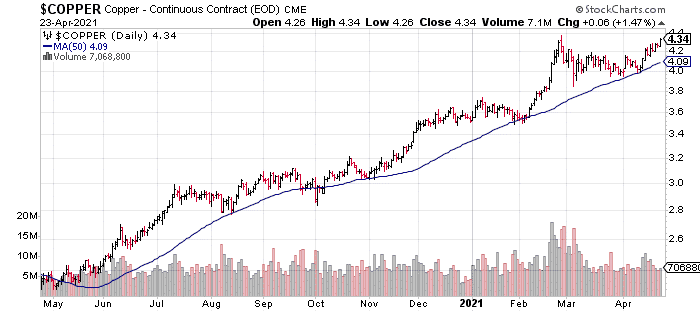

We’re currently waiting on drill hole assays from two key projects in Forum’s project pipeline—Fir Island (Uranium) and Janice Lake (Copper-Silver).

Both projects are ripe for a significant discovery, but a lot is riding on these pending Janice Lake drill results. If Forum and JV partner Rio Tinto hit at this large structure called Rafuse—a 2.8 kilometer long priority target of surface copper mineralization—things could get interesting. If they hit big—good grades over substantial widths—things could get real interesting. Fast.

Taking a look at the copper chart, with prices on the verge of challenging recent (and decade) highs, a significant new discovery in this part of the world will attract a lot of attention—Saskatchewan is a top-shelf mining destination, currently ranked #3 in the Fraser Institute’s most recent Annual Survey of Mining Companies.

If the JV comes up short at Janice Lake in this first round of diamond drilling, there are other high-priority targets to probe across this 38,250-hectare property.

The Company has a number of highly prospective irons in the fire. The 30,836-hectare Love Lake Ni-Cu-PGM Project is a good example.

On the subject of Love Lake, the Company dropped the following news on April 20th:

Forum Plans Electromagnetic Survey at Love Lake Nickel-Copper-Palladium Project, Saskatchewan

Here, the Company announced plans for a large-scale airborne electromagnetic (EM) survey on this 100%-controlled project (located only 60 kilometers northeast of the Janice Lake JV).

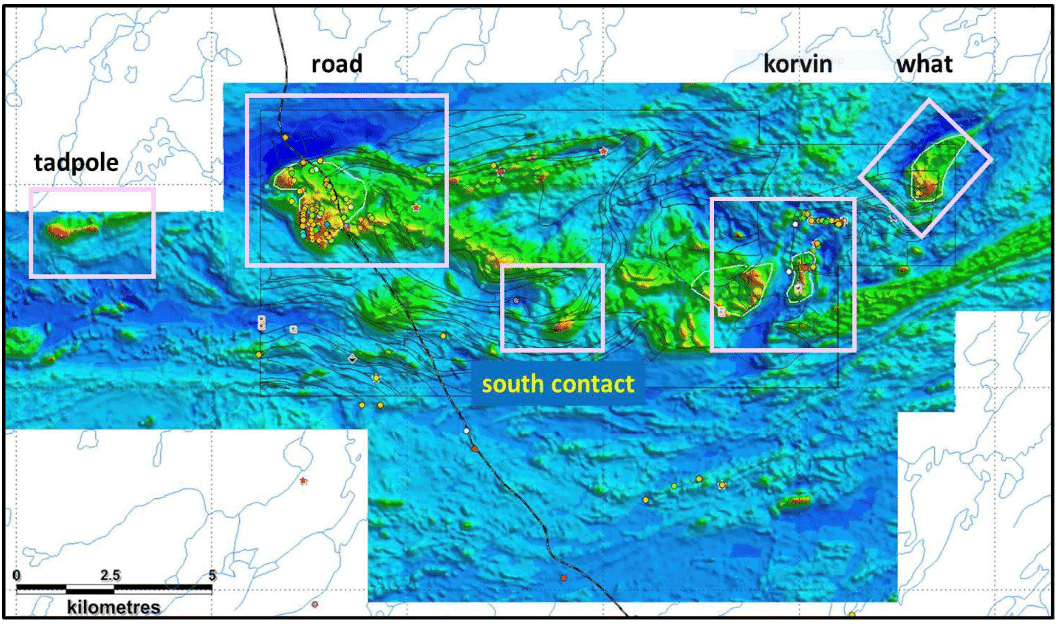

“Further processing of the airborne gradient magnetic survey and whole rock geochemical analysis of the outcrop samples collected in 2020 (see News releases dated September 9, 2020 and October 13, 2020) have identified five high priority target areas to be flown by an airborne EM survey in May (map below).”

A helicopter borne Geotech ZTEM and aeromagnetic survey flown in 2009 identified conductive anomalies within the areas scheduled to be surveyed next month. The current survey will be conducted on a tighter line spacing giving better definition of these and other potential anomalies.

Discovery International Geophysics Inc. has been contracted using the HeliSAM system (a Time Domain Electromagnetic system) on the five grids at 100m line spacings for a total of 588 line-km and 9 EM ground loops. The HeliSam survey is capable of detecting magmatic nickel-copper-PGM deposits to significant depths and will bring the project to a drill-ready state. Forum is currently making arrangements for a drill program in the late summer, the scale of which will be dependent upon the results of the EM survey.

The Love Lake drill campaign will be a highly anticipated event.

The following is a very recent interview with Forum’s CEO, Rick Mazur:

Also, this Tuesday, April 20th interview, widely distributed in the U.S. to a targeted audience, summarizes where the Company is at…

FORUM ENERGY METALS – DRILLING AT 3 PROJECTS THIS YEAR, 2 WITH LARGE PARTNERS AND 1 FULLY OWNED BY THE COMPANY

Copper price update: As I wrap up my final edit in the early morning hours of April 26th, copper is on a tear taking out its recent highs. The nearby futures contract is trading at $4.42, a chip shot from the all-time high of $4.62 tagged in 2011.

That’s it for this episode of the Highballer report.

END

—Greg Nolan

Full disclosure: Forum Energy Metals is a Highballer client (color me biased).

Disclaimer - Legal NoticeHighballerstocks.com (Greg Nolan) is not a licensed financial advisor and does not give investment advice.

The content of this report is for information purposes only.

Nothing contained herein should be construed as a recommendation or solicitation to buy or sell any security.

Always consult a licensed qualified investment advisor in your legal jurisdiction before making any investment decisions.

Though Highballerstocks.com (Greg Nolan) believes its sources to be credible, and the statements contained herein to be true, readers must conduct their own thorough due diligence, and or consult with a qualified investment advisor before important investment decisions are made.

Highballerstocks.com (Greg Nolan) accepts no responsibility or liability for the accuracy of the contents of this report.