When I first launched Highballer stocks in January of 2020, I wanted to highlight the re-rating potential I felt existed in the junior exploration arena. The companies I first featured—those with meaningful ounces in the ground—were trading at what I considered to be absurd valuations. The timing was good. Many of the companies I introduced early in the going traded significantly higher in the months that followed—some offered multi-bagger gains in short order.

That was a fun and rewarding undertaking.

But in my commitment to introduce only those companies backstopped by 43-101 resources, I brushed aside the pure explorecos in the pre-discovery (or pre-resource) phase of their cycles.

I aim to modify that approach from here on.

The Central Newfoundland Gold Rush

Central Newfoundland is arguably THE hottest gold exploration district on the planet right now. The dominant junior in the region—Newfound Gold (NFG.V)—currently in the midst of a nine rig 200,000-meter drill program at its flagship Queensway Project, has produced drill results that might best be described as surreal.

A few examples picked randomly from the NFG pitch deck:

- 19 meters @ 92.9 g/t Au (Keats zone discovery hole);

- 25.6 meters @ 146.2 g/t Au (Keats zone);

- 17.7 meters @ 124.4 g/t Au (Keats zone);

- 7.2 meters @ 261.3 g/t Au (Keats zone);

- 2.5 meters @ 224.7 g/t Au (the aptly named “Lotto zone”);

- 11.5 meters @ 150.3 g/t Au including 2.4 meters @ 683.1 g/t Au (Lotto zone);

- 5.3 meters @ 430.2 g/t Au (Golden Joint zone).

If an early-stage, sub-$5M market cap exploreco were to suddenly drop similar high-grade values, well-positioned shareholders would wake up that day and instantly embrace a higher standard of living.

Even after a multi-month period of consolidation from the highs tagged last June at $13.50, Newfound Gold still boasts a market cap of $1.37B (w/o the benefit of a 43-101 resource estimate).

The companies in the region—Labrador Gold (LAB.V), K9 Gold (KNC.C), Exploits Discovery (NFLD.V) et al.—have been extremely volatile of late. Current valuations may represent an opportunity.

A company that entered the fray earlier in the going—a company that recognized the latent potential of the region and has been aggressive in its exploration approach for several years—is Sokoman Minerals.

For those new to the story, the following summary of this Central Newfoundland exploreco offers a perfunctory peek—just enough intel to kick-start your own due diligence process.

Sokoman Minerals (SIC.V)

- 200.23 million shares outstanding

- $85.51M market cap based on its recent $0.425 close

First previewed here last week at $0.375, Sokoman Minerals is a discovery-oriented company with a dominant land position in the region.

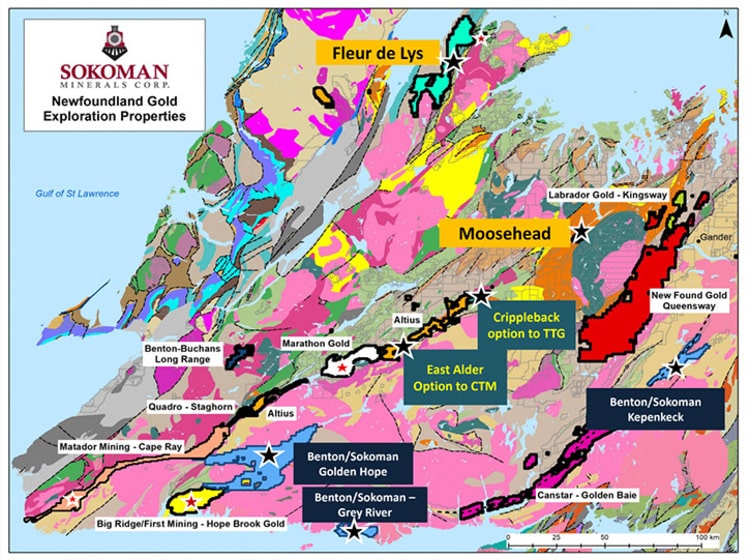

The Company’s project pipeline includes their flagship 2,450-hectare (high-grade) Moosehead Gold Project, and a trio of large-scale JV properties—Grey River, Golden Hope, and Kepenkeck—all three falling within a strategic alliance with Benton Resources (BEX.V).

Also in the project portfolio: the 3,025-hectare Crippleback Lake Project (optioned out to Trans Canada Gold – TTG.V), the 750-hectare East Alder Project (optioned out to Canterra Minerals – CTM.V), and the 1,000-hectare Startrek Project (optioned out to White Metal Resources – WHM.V).

Rounding out the Company’s project pipeline, the company’s wholly-owned district-scale Fleur de Lys Project where the target is Dalradian-Style Orogenic Gold. Regarding this 475 sq. km property, the company states:

“This exciting project will not distract us from our flagship Moosehead Project but will become a great addition to our portfolio. We are excited and proud to have seized the opportunity to acquire, largely for staking costs only, a district-scale project in one of the hottest gold exploration jurisdictions in the world.”

With its aggressive pursuit of new acquisitions in the region—with over 150,000 hectares in its project pipeline—one might safely characterize Sokoman as a Central Newfoundland land baron.

As noted above, the Company’s Moosehead property bears flagship status.

With an orogenic lode Au setting, the target is high-grade, Fosterville-type gold mineralization.

Company CEO Timothy Froude, a professional geo with over three decades under his belt, has toured Fosterville. His insights hold a great deal of validity when he compares Moosehead to Kirkland Lake’s Fosterville mine in Victoria, Australia.

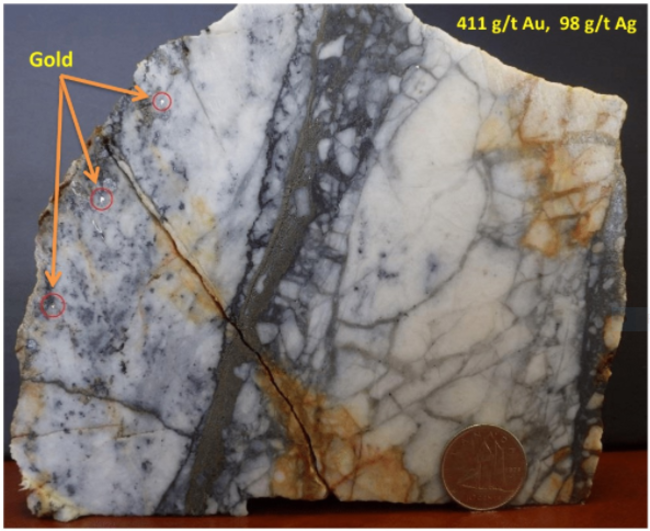

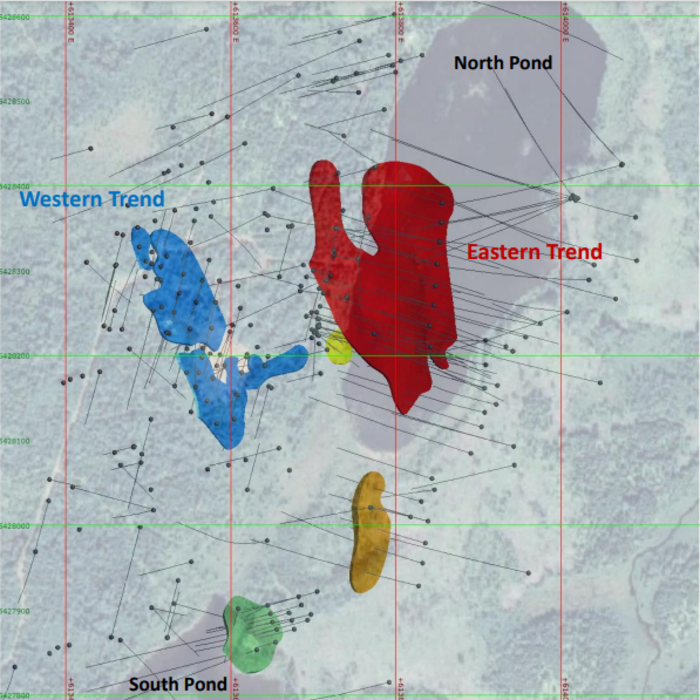

With historic high-grade boulders grading >400g/t Au setting the stage, the Company launched a Phase-1 drill campaign back in 2018—a program that tagged a high-grade discovery at the Eastern Trend zone (200 meters east of Western Trend). Discovery Hole MH-18-01 returned an impressive 44.96 g/t Au over 11.90 meters from 109 meters down-hole (historical drilling by previous operators was limited and failed to test the area’s depth potential).

Since that first 1,970.5 meter (15 hole) Phase-1 program, Sokoman has produced a steady stream of high-grade results by way of multiple drill campaigns.

Highlights from the first five campaigns

- Phase-1: Discovery Hole MH-18-01 (Eastern Trend) cut 11.90 meters of 44.96 g/t Au;

- Phase 2:MH-18-39 cut 5.10 meters of 124.20 g/t Au, including 1.10 meter of 550.30 g/t Au;

- Phase 3:MH-19-62 cut 4.8 meters of 33.59 g/t Au, including 0.90 meters of 124.15 g/t Au;

- Phase 4:MH-19-81 cut 6.4 meters of 17.34 g/t Au, including 1.45 meters of 75.50 g/t Au;

- Phase 5:MH-20-86 cut 4.70 meters of 18.60 g/t Au, including 1.85 meters of 46.99 g/t Au (from 271.80 meters downhole);

- Phase 5:MH-20-82 cut 9.50 meters of 5.70 g/t Au, including 1.70 meters of 29.19 g/t Au (from 206.50 m downhole).

With CAD$14 million in its coffers, the Company’s goal is to drill 50,000 meters across multiple zones in a Phase-6 campaign, a program that began back in Q3 of 2020 (the original Phase-6 plan was for 10k meters).

A portion of Phase-6 is designed to test the potential of the South Pond area where recent drilling produced the following highlights:

- MH-20-115 upper interval cut 4.60 meters of 47.20 g/t Au (from 64.00 meters downhole);

- MH-20-115 lower interval cut 8.10 meters of 68.70 g/t Au (from 111.20 meters downhole);

- MH-20-116 upper interval cut 1.80 meters of 11.85 g/t Au (from 54.50 meters downhole);

- MH-20-116 lower interval cut 4.30 meters of 2.94 g/t Au including 7.57 g/t Au over 1.25 meters (from 183.80 meters downhole).

Recent prospecting at South Pond, 400 meters along strike to the SW of Eastern Trend zone, produced a cluster of angular quartz float with assays ranging from 0.318 g/t Au to 157.04 g/t Au, as well as enriched silver values up to 36.2 g/t Ag.

If a float sample is ‘angular’, it likely hasn’t traveled far from its source.

The highlight drill interval from this round:

- DDH MH-20-123 cut 5.0 meters averaging 26.88 g/t Au, including 2.15 meters of 60.59 g/t Au from 47.0 meters downhole.

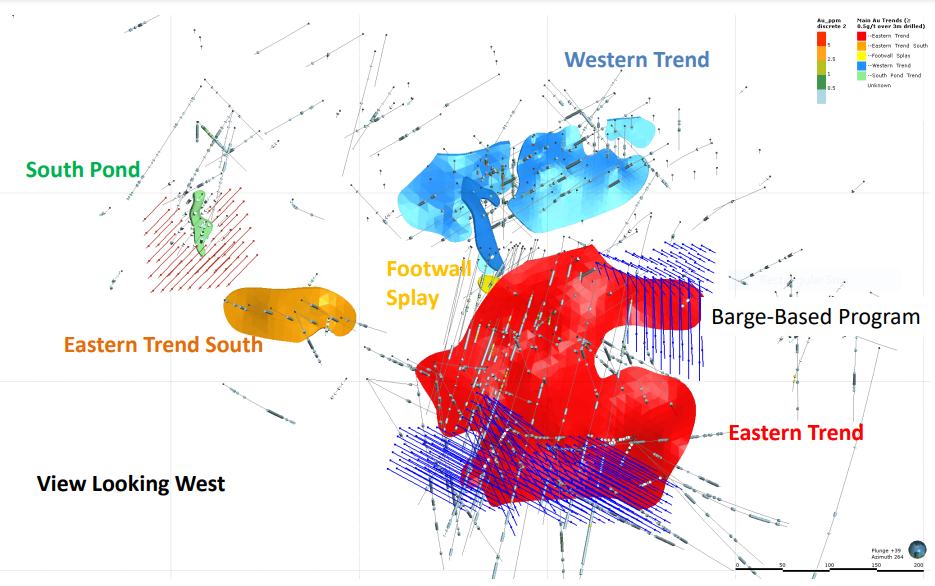

Highlights from the Eastern Trend/Footwall Splay zone reported on January 29, 2021:

- MH-20-132 cut 4.0 meters of 24.92 g/t Au, incl. 1.60 meters of 61.68 g/t Au from 70.50 meters downhole;

- MH-20-127 cut 1.30 meters of 9.23 g/t Au, incl. 0.50 meters of 22.72 g/t Au from 48.90 meters downhole;

Highlights from the South Pond zone reported on February 23, 2021:

- MH-21-141 cut 4.20 meters of 64 g/t Au, including 1.20 meters of 223.63 g/t Au from 47.90 meters downhole.

Highlights from the Footwall Splay and South Pond zones reported on April 28, 2021:

Footwall Splay

- MH-21-157 cut 3.50 meters of 12.39 g/t Au, including 1.50 meters of 28.57 g/t Au from 36.30 meters downhole;

- MH-21-163 cut 11.60 meters of 21.07 g/t Au, including 5.10 meters of 30.82 g/t Au from 44.0 meters downhole;

- MH-21-166 (collared in a visible gold-bearing quartz vein) cut 5.10 meters of 15.51 g/t Au, including 2.80 meters of 27.68 g/t Au from 9.00 meters downhole.

South Pond

- MH-21-147 cut 3.05 meters of 16.54 g/t Au, including 0.85 meters at 58.91 g/t Au from 72.40 meters downhole.

Highlights from the Footwall Splay/Eastern Trend and South Pond zones reported on May 18, 2021:

Footwall Splay

- MH-21-165 cut 4.10 meters of 21.61 g/t Au, including 2.10 meters of 41.39 g/t Au from 79.70 meters downhole;

- MH-21-164 cut 4.05 meters of 22.62 g/t Au, including 20.95 meters of 5.15 g/t Au from 79.95 meters downhole.

South Pond

- MH-21-152 cut 3.00 meters of 1.82 g/t Au, including 0.70 meters of 3.08 g/t Au from 15.00 meters downhole;

- MH-21-153 cut 3.00 meters of 1.61 g/t Au, including 1.60 meters of 2.40 g/t Au from 12.00 meters downhole.

You can see a (high-grade) trend developing across multiple zones here.

Additional high-grade results from the Footwall Splay/Eastern Trend, South Pond, and 75 zones were released on July 6th…

Sokoman Announces Additional High-Grade Results from the Moosehead Project, Central Newfoundland

And again on July 29th…

On August 18th, the Company announced that a third rig had arrived on-site and would soon be moved to a barge to test the Upper Eastern Trend and Footwall Splay targets.

That barge-based drilling should be well underway by now. A September 14th Tweet:

“The barge drill program will focus on the Upper Eastern Trend and Footwall Splay targets, estimated to constitute between 5,000 m and 10,000 m of drilling, with drill hole depths expected to be 100 m or less with a few reaching 215 m. The drill program is expected to run into the fall.”

As I stated further up the page, this report is merely a cursory look at Sokoman and its flagship project. There’s more, much more worth digging into.

One recent headline that stands out on the Golden Hope JV ground is a lithium-bearing pegmatite discovery, the first significant occurrence of lithium documented in the province and an indication of the significant geological potential underpinning this vastly under-explored region.

The Company’s website is the obvious place to begin your due diligence.

There are also a number of good interviews to be found on Youtube…

Newsflow over the balance of 2021 should be robust as the Company completes up to 50,000 meters of drilling at Moosehead, with a barge-based drill rig aggressively probing the Upper Eastern Trend and Footwall Splay targets for the remainder of the season.

Fleur de Lys will see the completion of a till sampling campaign, and the Company expects to drill several thousand meters at Grey River.

With $8 million budgeted for the balance of 2021, the Company should close out the year with roughly $6 million in its treasury (a dollar goes far in this part of the world—all-in drilling costs = approx $150 per meter).

A common theme here at Highballer is ‘endgames’—finding companies with the right asset in the right jurisdiction that stand a reasonable chance of getting taken out at a substantial premium by a resource-hungry predator. Though some may disagree, I suspect we’ll see a consolidation of some of the better-positioned plays in the region. In that regard, Sokoman stands out… especially if the Fosterville analog plays out as expected.

END

—Greg Nolan

Full disclosure: Sokoman is not a Highballer client. The author owns shares.

Disclaimer - Legal NoticeHighballerstocks.com (Greg Nolan) is not a licensed financial advisor and does not give investment advice.

The content of this report is for information purposes only.

Nothing contained herein should be construed as a recommendation or solicitation to buy or sell any security.

Always consult a licensed qualified investment advisor in your legal jurisdiction before making any investment decisions.

Though Highballerstocks.com (Greg Nolan) believes its sources to be credible, and the statements contained herein to be true, readers must conduct their own thorough due diligence, and or consult with a qualified investment advisor before important investment decisions are made.

Highballerstocks.com (Greg Nolan) accepts no responsibility or liability for the accuracy of the contents of this report.