Uranium stocks have pulled out of their corrective tailspin and generated some impressive price trajectory in recent sessions.

News out of Kazakhstan is part of the reason why.

Kazakhstan unrest: Government calls for Russian help

Kazakhstan produced 41% of the world’s uranium supply in 2020. Any supply interruptions will have negative implications for an already tight market.

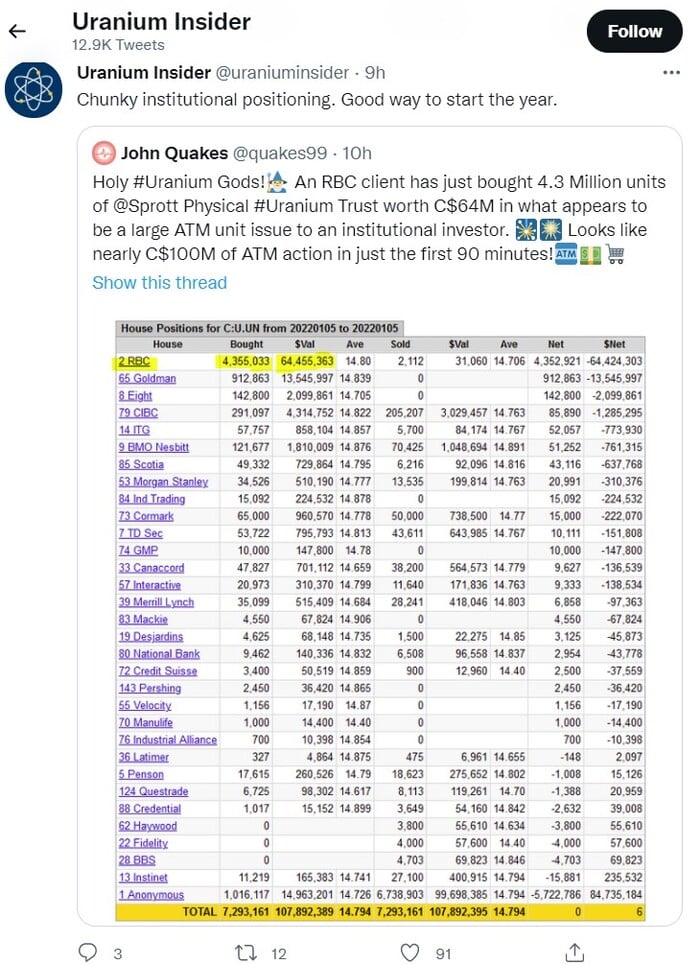

Spot U3O8 prices pushed past the $45.00 level yesterday, and it appears someone has an appetite for Sprott’s physical uranium trust units. Yesterday on Twitter…

If you bought the (across-the-board) weakness in uranium stocks over the past two months—a 30%+ correction or thereabouts—chances are you’re in the money.

If you bought Forum Energy Metals’ common shares in the waning weeks of 2021, you’re definitely in the money…

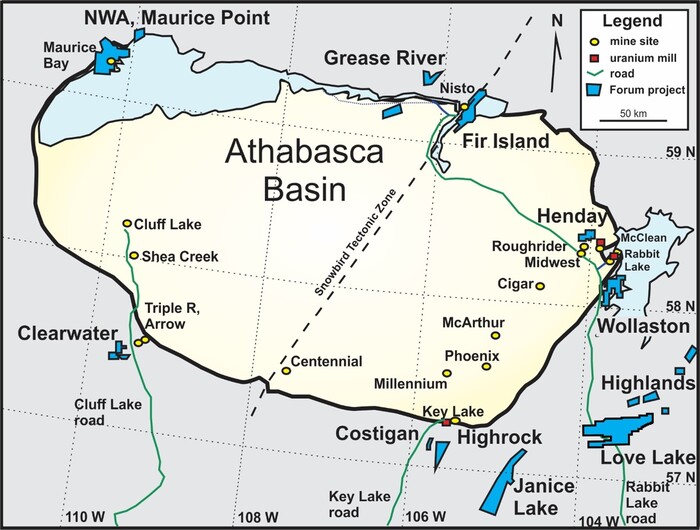

Back in late November, Forum announced that permits were submitted to drill five of its eight drill-ready uranium projects in the prolific Athabasca Basin of Saskatchewan. Included on the list were Wollaston (100% Forum), Highrock (100% Forum), Costigan (65% Forum; 35% Trafigura), Clearwater (75% Forum; 25% Vanadian) and Northwest Athabasca Joint Venture (39.5% Forum; 28% NexGen; 20% Cameco; 12.5% Orano).

The Wollaston Lake Project, located within 10 kilometers of Cameco’s Rabbit Lake uranium mill and 30 kilometers of Orano/Denison’s McClean Lake uranium mill, is about to see the business end of a drill bit in a campaign slated for at least 3,000 meters.

Having identified a number of prospective drill targets via geophysics (inc a 2021 gravity survey) and historical drill hole data, Forum is going it alone on Wollaston, maintaining 100% control of the project.

In the late November press release, management went on to state that it’s in active negotiations concerning Clearwater, Costigan, and Highrock due to third-party interest.

Those negotiations are beginning to bear fruit. Forum’s Highrock Uranium Project is about to get a solid push along the exploration curve…

Forum Options Highrock Uranium Project in the Athabasca Basin, Saskatchewan to Sassy Resources

To push projects like Highrock further along the curve, Forum wisely deploys the prospect generator business model with strategic partners who will make staged cash/share payments and commit to exploration expenditures for a controlling interest in the project.

This prospect generation model is a win-win—it puts multiple secondary projects in play while preserving capital and minimizing dilution.

Here, Forum put signatures to paper, optioning drill-ready Highrock to Sassy Resources (SASY.C).

Highrock Highlights

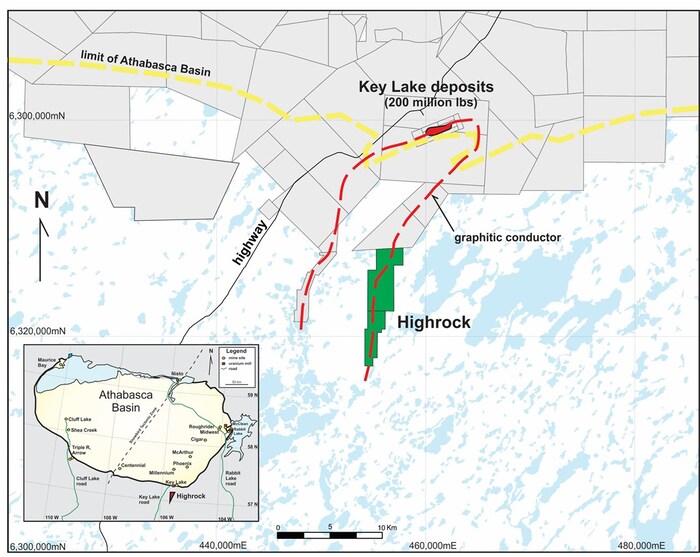

- Highrock is situated just outside the Athabasca Basin along the same interpreted conductive lithological unit that hosts the Key Lake deposits. The property consists of two claims covering 20 sq. km;

- The exploration target at Highrock is a basement-hosted deposit similar in style to NexGen Energy’s Arrow deposit and Fission Uranium’s Triple R deposit;

- Gravity surveys at Highrock have identified numerous gravity lows, some associated with zones of alteration, along a strong multi-km-long EM defined graphite conductor;

- Initial drilling by Forum in 2016 defined zones of chloritization, bleaching, elevated boron and other pathfinder elements (some associated with the gravity lows), which are in need of follow-up drilling (see Forum News Release dated June 1, 2016);

- Cameco Corporation adjoins Highrock to the east, the upper northwest and along strike to the south. Fission 3.0 has property immediately southeast of Highrock;

- A 10 to 12-hole drill program totaling approximately 3,000 meters is proposed to test the Highrock target areas in Q1/2022. Permitting, community engagement and procurement processes are underway.

Highrock presents multiple shallow (open-pit) targets with excellent discovery potential.

Cameco’s former producing Key Lake mine, which generated over 200 million pounds of uranium by open-pit methods at an average grade of 2.3% U3O8 from 1983 to 1997, is located immediately to the north of the Highrock claim boundary.

Rick Mazur, President & CEO:

“With the renewed interest in uranium as a carbon-free source of energy, Forum plans to advance its uranium portfolio by drilling some of its 100% owned projects, such as Wollaston and seeking partners for its other projects, as demonstrated by the option/joint venture with Orano on our Fir Island project and this agreement with Sassy.”

Ken Wheatley, Vice President, Exploration:

“The proximity to the Key Lake mine, the strength of the conductive trend which we interpret to be the same basal graphitic unit that hosted the 200 million pound Key Lake uranium deposit and the quality of the gravity lows make this a high priority, near surface target for exploration.”

Sassy’s technically proficient crew will compliment Ken Wheatley’s expertise in exploring this subsurface stratum (Ken boasts a four-decade-long run, an impressive track record of discoveries including eight uranium deposits, four of which became producing mines).

The Deal

In sizing up these terms, note that Sassy traded between $0.35 and $0.92 over the past 52 weeks—they last traded at $0.62 (liquidity is good).

- Sassy paid Forum $50,000 cash upon signing of the binding LOI. The LOI between Sassy and Forum describes a staged earn-in under which Sassy will initially acquire a 20% interest in Highrock by paying Forum $50,000 cash, 250,000 Sassy shares (on February 2, 2022, post-Gander Gold date of record for share distribution) and completing $1,000,000 in exploration expenditures during 2022;

- Sassy can earn an additional 31% interest (51% total) by paying $50,000 cash and 250,000 shares on or about January 2, 2023, and by providing $1,000,000 in exploration funding for 2023;

- Sassy can earn an additional 19% interest (70% total) by paying $50,000 cash, 250,000 shares on or about January 2, 2024 and providing $1,500,000 in exploration funding for 2024;

- The final 30% interest in the Property (100% total) may be acquired by Sassy by paying Forum $150,000 in cash and 3,000,000 shares on or before December 31, 2025;

- In total, to acquire 100% of Highrock, Sassy will pay $350,000 in cash, issue 3,750,000 shares and provide up to $3,500,000 in exploration funding over four years between January 3, 2022, and December 31, 2025. Should the project advance to this stage, Sassy will pay Forum $1,000,000 on delivery of a Feasibility Study and a further $3,000,000 on commencement of commercial production. Forum maintains a 1% NSR on Highrock, half of which (0.5%) can be purchased by Sassy prior to the commencement of commercial production for the sum of $1,000,000. A 1% NSR on the north claim (S-113362) is shared by third parties, half of which (0.5%) may be purchased by Sassy for the sum of $1,000,000. A 2% NSR on the south claim (MC00013262) is held by a third party and at present is not subject to a repurchase clause;

- Forum Energy Metals will act as project operator for 2022 and 2023 and may do so at Sassy’s option in 2024. Permitting and procurement processes are well underway to facilitate 2022 drilling starting as early as February. The parties have agreed to complete a Definitive Option Agreement by January 31, 2022. This Definitive Agreement is subject to customary Board, Exchange and regulatory approvals, as required.

Nice. Another iron in the fire—another (zero risk) shot at a significant U3O8 discovery.

As Operator of the project, Forum will receive a 10% management fee on all exploration expenditures—that should work out to $100k in 2022.

Should this JV go the distance on the back of a significant discovery, the cash infusions, partner equity (Sassy common shares), and NSR should generate substantial returns.

Final thought

Forum boasts a robust project pipeline of highly prospective projects in the Basin. This Highrock deal may represent only the first of many. And of course, there’s Love Lake (drill hole assays pending), Janice Lake, and Quartz Gulch (surface sampling assays pending).

We stand to watch.

END

—Greg Nolan

Full disclosure: Forum is a Highballer client. I am biased in my views so conduct your own detailed due diligence and consult a registered investment advisor before laying your hard earned money down.

Disclaimer - Legal NoticeHighballerstocks.com (Greg Nolan) is not a licensed financial advisor and does not give investment advice.

The content of this report is for information purposes only.

Nothing contained herein should be construed as a recommendation or solicitation to buy or sell any security.

Always consult a licensed qualified investment advisor in your legal jurisdiction before making any investment decisions.

Though Highballerstocks.com (Greg Nolan) believes its sources to be credible, and the statements contained herein to be true, readers must conduct their own thorough due diligence, and or consult with a qualified investment advisor before important investment decisions are made.

Highballerstocks.com (Greg Nolan) accepts no responsibility or liability for the accuracy of the contents of this report.