The allure of the discovery cycle… There’s nothing like establishing and holding a position in an early-stage junior exploration company that goes on to tag a significant discovery. It’s akin to picking a winning set of lotto numbers.

The allure is especially amplified today in this era of depleted ore reserves and a discovery cycle that has ground to a (near) halt. If your junior’s labors meet with success, the reward can be nothing short of spectacular, life-changing even.

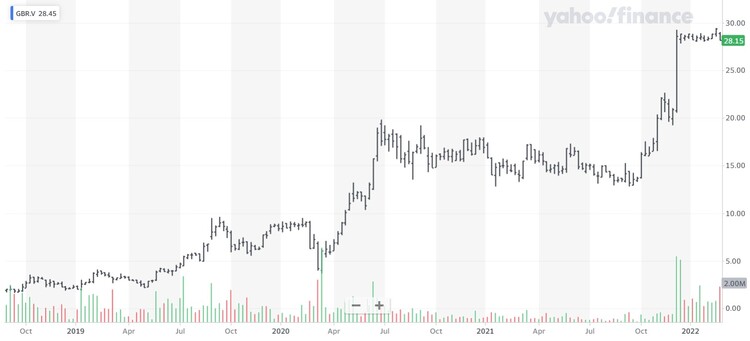

A recent example of this phenomenon is Great Bear Resources, a Vancouver-based exploreco that set its sights on Dixie, a project in the Red Lake district of northwestern Ontario.

Great Bear began its discovery cycle story as a lowly junior—a penny stock—but with high hopes.

After repeated success with the business end of the drill bit, it attracted the attention of a resource-hungry predator looking to bulk up its mineral inventory. Said predator, one Kinross Gold, tabled a takeover offer of $29 per share (plus a contingent value right worth an extra dollar).

The positive share price trajectory demonstrated above is the reason we’re here. A modest investment in Great Bear pre (Dixie) discovery can now be swapped for that Whistler condo you could only dream of a few years back.

The Peak?

It’s possible that we’ve reached ‘Peak Gold.’ There’s fear that the sector’s most productive years are in the rearview mirror.

The Peak Gold hypothesis, considered lazy thinking by some, is supported by the likes of Ian Telfer, mining legend and the former chair of Goldcorp. In a conversation with Kitco’s David Lin, Telfer opined:

“I think we have [reached peak gold]. I think that anything below $3,000 [an ounce] we have found most of the gold we’re going to find, maybe all the gold we’re going to find. If you look at the exploration successes over the last 20 years, they’ve been declining steadily for that period of time and it’s not because people haven’t spent money or they don’t want to find gold, it’s because, I think, all the deposits that can make money below $3,000 have been found.”

New discoveries drive the gold market. While new discoveries ARE being made, I’d wager that the vast majority are not economic at current gold prices. It would appear that the low-hanging fruit—ore bodies that outcrop at surface—have already been discovered.

We’re now forced to drill blind targets deep below the surface where the odds of success are limited. These deeper (blind) targets are also expensive drill, straining exploration budgets already under stress due to spiraling inflationary price pressure.

Many of these sub-par orebodies are technically challenging to build or contain refractory ore… or are so deeply buried in the wilderness/jungle that new infrastructure will need to be pushed in at great expense.

We’re also forced to explore in jurisdictions that are not exactly mining-friendly. Twitchy governments, those without a clear and fair set of values where mining interests are concerned, can wreak all kinds of havoc on your company’s journey along the exploration, development, and permitting curve. Even in the most mining-friendly of jurisdictions, permitting a project to production is turning into an increasingly bumpy ride.

This next photo speaks volumes, as we’re forced to push boundaries in our hunt for new (economic) reserves in mining-friendly climes.

Where discovery potential still exists

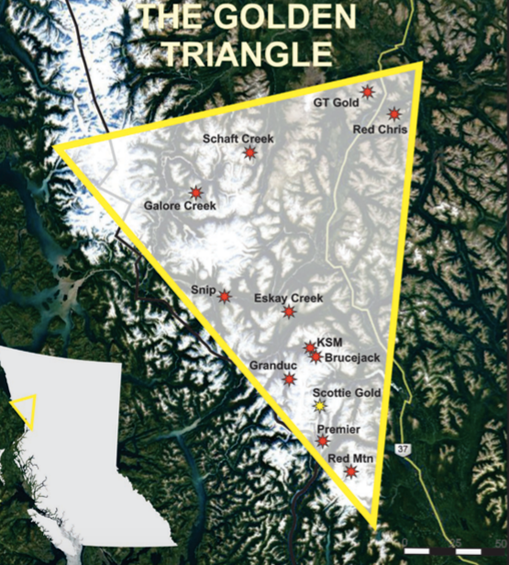

The remainder of this piece will focus on a junior exploreco that has a good shot at tagging a significant new discovery in a region tucked in along the rugged coastal mountains of northwestern British Columbia—an area known as the Golden Triangle.

If you’re a speculative resource investor, you’re going to want to keep an eye on the Triangle as it’s one of the few remaining (mining-friendly) regions left on Earth where significant discovery potential remains.

The Triangle boasts some truly epic deposits in a broad range of geological settings and deposit types (gold-copper porphyry deposits, epithermal vein deposits, volcanogenic massive sulphide deposits, and intrusion-related deposits).

One example that stands out:

KSM (Kerr-Sulphurets-Mitchell) represents one of the largest (undeveloped) polymetallic deposits on the planet where current M&I resources stand at 76.4 million ounces of gold and > 17.1 billion pounds of copper. 65.9 million ounces of gold and >33.2 billion pounds of copper round out the Inferred category. That works out to 142.3 million ounces of gold and 50.3 billion pounds of copper in all resource categories. KSM also boasts 728 million ounces of silver and substantial moly credits.

This extraordinary mineral endowment is a consequence of the same geological processes that generated mineral deposits along the Pacific Ring of Fire—Grasberg, Lihir, Cadia, to name a few.

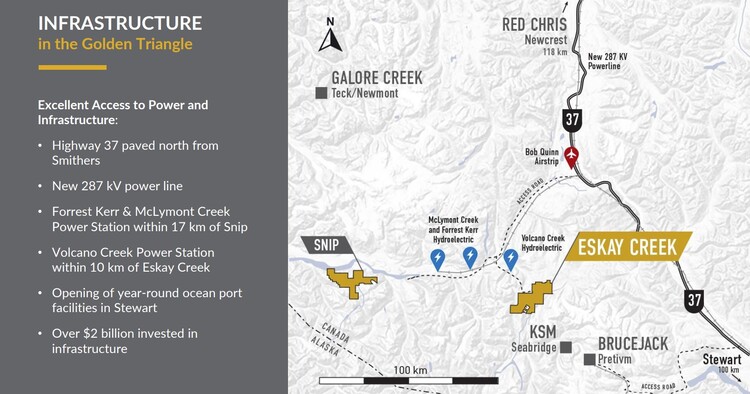

The Triangle’s remote and rugged landscapes have hindered exploration over decades, but recent infrastructure upgrades—high-voltage transmission lines, ice-free deep-water ports, the recently paved Stewart-Cassiar highway, a vast network of gravel roads crisscrossing the region—have blown the gates wide open.

The pace of exploration and development is accelerating dramatically.

In a well-written Golden Triangle piece published last fall, Lawrence Roulston stated, “The Golden Triangle is evolving so quickly that investors and even people deeply involved in the region are not up-to-date.”

M&A activity in the region

A mine’s impermanence is what makes investing in this sector so damn compelling. If a Junior tags a significant new discovery, you can bet a pack of resource-hungry predators’ll stalk it.

Producers facing depleting assets and lean project pipelines are now forced to tap the balance sheets of smaller exploration and development companies further down the food chain—they’re forced to take on of acquirer (predator).

Producers and well-heeled investors—those with an appetite for the precious metal—are piling in.

M&A activity in the Triangle began to pick up speed roughly three years back when Australian-based Newcrest Mining paid $804 million for a majority stake in Imperial Metals‘ Red Chris Mine. In early 2021, Newcrest announced its intention to invest an additional C$135M in the project.

In the same area, in Q1 of 2021, Newmont acquired GT Gold’s Tatogga Project, a copper-gold porphyry deposit, for a cool $393 mill.

More recently (on Nov. 9th, 2021), Newcrest Mining, still on the hunt for Golden Triangle assets, took out Pretium Resources in a deal valued at $3.5 billion.

Newcrest’s total investment in the Golden Triangle is closing in on $4.5 billion.

Moving along…

In Dec. of 2020, Seabridge’s acquired Pretium’s Snowfield property for US$100M.

In April of 2021, Yamana Gold took a $20.6M equity position in Ascot Resources.

In December of 2021, Franco-Nevada took a $31M equity position in Skeena Resources.

Canadian billionaire Eric Sprott has taken significant equity positions in the 27.3 million oz Treaty Creek via multiple private placements in joint venture partners Tudor, Teuton, and American Creek.

Sprott also took down a weighty position in Dolly Varden which operates the Dolly Varden silver project and the nearby Big Bulk copper-gold project.

Late last year, Dolly Varden acquired Fury Gold‘s Homestake Ridge project for roughly C$50M.

Hecla Mining recently purchased an 11% stake in Dolly Varden and acquired a massive 590 km2 project right next door.

The pace of M&A in the Golden Triangle appears to be accelerating. Golden Triangle companies with significant discoveries/resources on their books may have a target on their back.

Optimum Ventures (OPV.V)

- 39.69 million shares outstanding

- $24.61M market cap based on its recent $0.62 close

Optimum is the new kid on the block, having secured a strategic land position in an area buzzing with exploration and development activity.

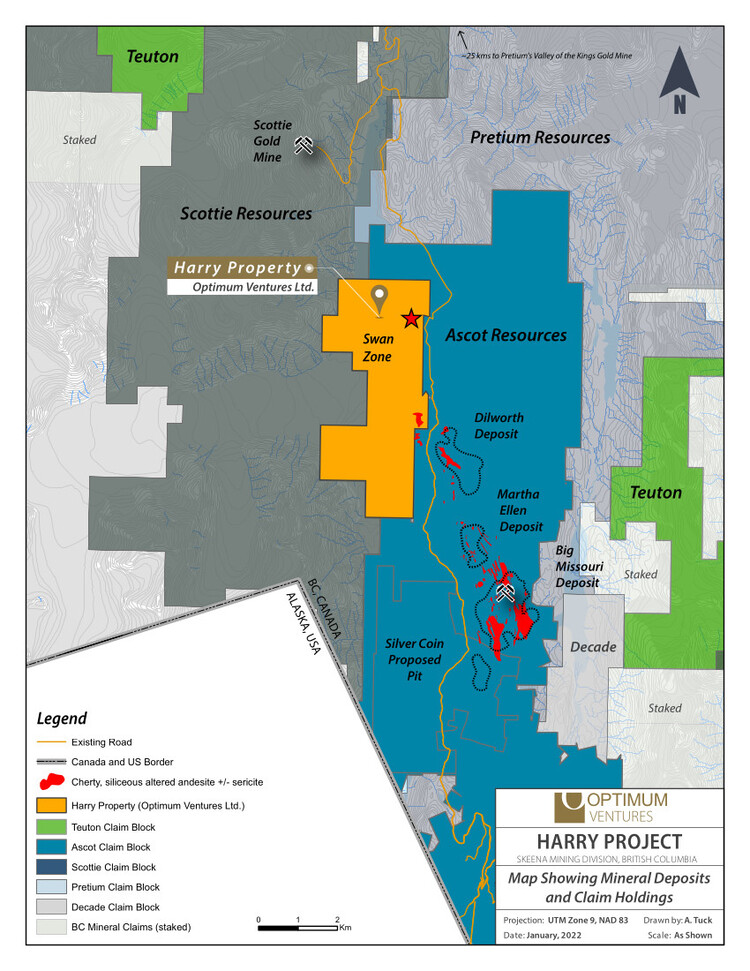

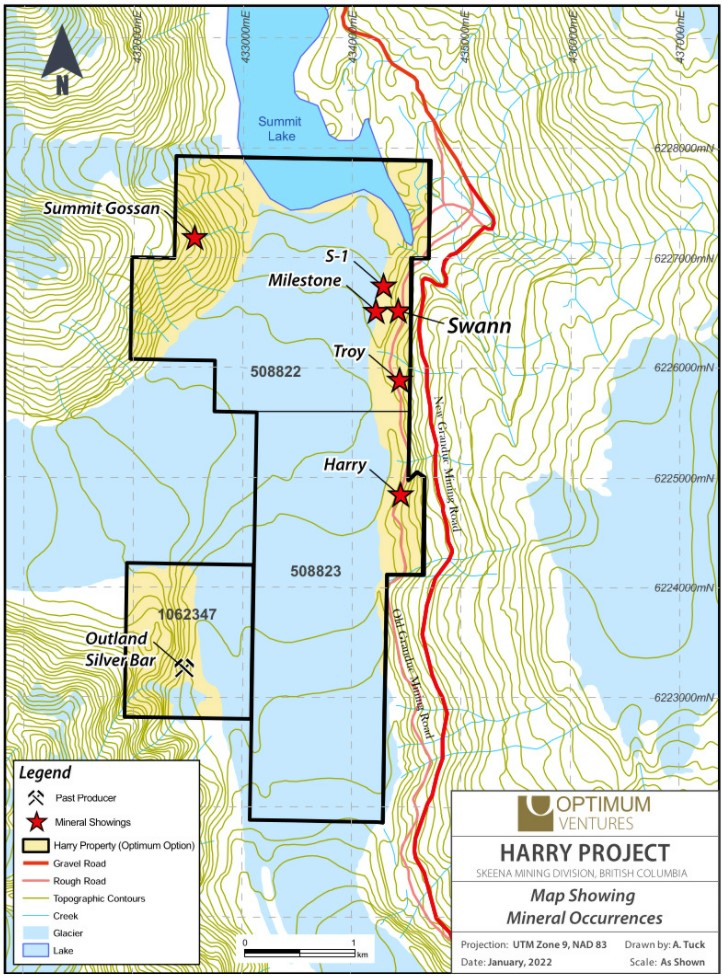

The Company’s flagship Harry Project is a 1,333-hectare stretch of highly prospective terra firma located along the Granduc Access Road near Stewart, British Columbia. Ascot Resources border the project to the east and south, Pretium Resources to the north, and Scottie Gold to the west.

Optimum is earning up to an 80% interest in the project from Teuton Resources by spending $9 million on exploration plus staged cash and share payments ($1.5 million in cash and 4,000,000 shares) over the five-year option period. Teuton also retains a 2.0% NSR on the project.

The property lies along the northwestern portion of a geological corridor prospective for gold-silver mineralization. This corridor is 3 kilometers wide and at least 15 kilometers long.

The target at Harry is high-grade gold-silver mineralization, large-scale bulk-tonnage Au-Ag zones, and VMS-type mineralization.

Importantly, Harry is in close proximity to Ascot’s high-grade Premier Gold Project, which is currently under construction and slated for its first gold pour in Q1 of 2023. Ascot is the major player in the area.

Looking at the map above, the Premier, Big Missouri, Silver Coin, and Martha Ellen deposits are all located along the same structure that continues on to the Harry property. These deposits (3M+ ounces of Au and 11.49M ounces of Ag) are all part of Ascot’s mine plan.

Ascot is targeting 150k-plus ounces per year at an average grade of ~8 g/t AuEq. The Premier Project represents the highest-grade (undeveloped) underground project in Canada not owned by a producer (a feasibility study tabled in May 2020 study demonstrates robust economics including an after-tax NPV5% of C$341 million and an IRR of 51% (price inputs = US$1400/oz gold, $17/oz silver).

A bit of history: The Premier Gold Mine, a landmark mine in its own right, went into production in 1918, hitting its peak during the Great Depression. Premier produced roughly 2 million ounces of gold and 45 million ounces of silver during its 34-year run.

Positioning itself as a consolidator of the southern Golden Triangle, Ascot took out Rob McLeod’s IDM Mining for its high-grade Red Mountain project back in January of 2019 “to create the leading high-grade gold development and exploration company in northwestern British Columbia’s Golden Triangle.”

Without a doubt, any significant discoveries made by Optimum in the region will NOT go unnoticed by Ascot.

A closer look at Harry:

The property lies along the northwestern portion of a geological corridor prospective for gold-silver mineralization that host several former and operating mines. The property hosts several 500 metre wide zones of intense alteration that trend northwest along the claim length. Within this intense alteration, sericite with abundant pyrite is prevalent. Quartz veins, Quartz breccias and semi-massive sulphides occur within these alteration zones. This type of alteration and mineralization is found at the nearby gold deposits currently being developed by Ascot Resources.

Harry is largely unexplored—less than 10% of the property has been prospected.

At the top of the page, we talked about how most of the low-hanging fruit—ore bodies that outcrop at surface—have already been discovered. That doesn’t necessarily hold true for many areas within the Golden Triangle.

Receding glaciers, a scenario brought on by climate change, is opening up vast stretches of ground, exposing outcrop that previously lay buried.

The recession of the Treaty Glaciers in the mid-90s exposed mineralization that eventually led to the Treaty Creek discoveries by joint venture partners Teuton, Tudor, and American Creek. Pretium’s Valley of Kings was buried in ice until roughly 2010.

The above pic, furnished by Ed Kruchkowski, Optimum’s director and CFO, shows the Salmon Glacier receding on Optimum’s ground.

The Zones

Milestone

According to Ed Kruchkowski, the Milestone showing was under ice until only a few years back.

In 2020, a new zone of mineralization in quartz breccias, called the “Milestone” was discovered on the Harry Property. The previous operator reported a trench sample averaging 7.86 ounces per ton gold (269.5 g/t) across a 2 meter width. The full width of this new zone has not been defined due to overburden cover.

Work in 2021 was restricted to the Milestone showing.

Outland Silver Bar

Several mineralized quartz veins and gossans occur on the Outland claim. The veins consist of quartz with scattered galena, sphalerite, tetrahedrite and pyrite with minor chalcopyrite.

Lenses of sulphide mineralization, that may be replacement-type, occur in pyrite-rich siltstones and mudstones, on the Outland claim. These mineralized lenses contain pyrite, pyrrhotite, arsenopyrite, and scattered chalcopyrite, galena, tetrahedrite, argentite, sphalerite and an unidentified tungsten mineral.

Harry

The zone is defined by a zone of mineralization consisting of fine-grained arsenopyrite, galena, and sphalerite blebs within quartz floods, hosted by sericitized felsic rock, resemblant of. Mineralization in this showing is similar to epithermal-type mineralization observed in the Big Missouri and Dilworth deposits (Ascot Resources).

Summit Gossan

Northeast trending quartz veins occur immediately north of this alkaline stock and contain sphalerite, galena, and tetrahedrite mineralization. Northwest trending fault zones with associated pyrite-chalcopyrite-arsenopyrite-sphalerite-galena and related chlorite-carbonate alteration occur several hundred metres east of a potassium feldspar porphyry. A 1 metre sample with 3% galena, 3 to 5% sphalerite, 2% tetrahedrite in quartz calcite gangue assayed 1% copper, 1.24% lead, 4.33% zinc, 400.8 g/t silver and 1.01 g/t gold (Assessment Report 25677).

Troy 6

A quartz-sericite structure with banding in the quartz forms this showing. Zones of massive pyrite lie between the quartz bands. A band of darkish quartz has a blackish look to it from disseminated dark sulphides, mainly galena and sphalerite. The gold and silver values appear to be directly related to the dark sulphide bearing quartz. A composite sample over 1 metre assayed 15.63 grams per tonne gold, 44.0 grams per tonne silver, 0.05 per cent copper, 0.24 per cent lead and 0.58 per cent zinc (Assessment Report 23220)

S-1

The S-1 is a 10 metres wide vein swarm comprised of numerous parallel quartz veins which contain up to 10 % of combined pyrite, galena and sphalerite. Locally the veins have dark gray to black colour from dispersed carbonaceous mater and/or very fine grained galena and sphalerite. Four grab samples collected from S-1 showing returned up to 1.34 g/t gold and 32 g/t silver.

Elsewhere in Optimum’s project pipeline, the Riverside Property—a past producer located in the Hyder Mining District in southeastern Alaska—will also see exploration activity in 2022. We’ll take a closer look at Riverside when Optimum mobilizes a ground crew to the project later this year.

Hitting the ground running

Just the other day, Optimum dropped the following headline, which included an unexpected development.

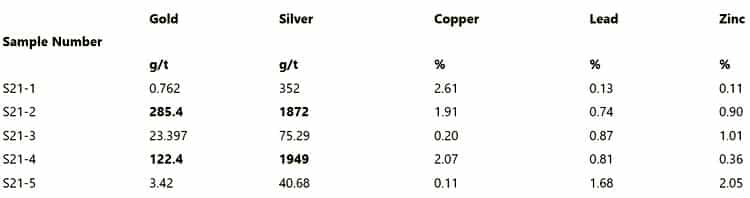

Here, Optimum reported encouraging results from a late 2021 (limited) surface exploration campaign at Harry. The sampling program was conducted along the Swann zone (above map). Swan is exposed over a small area of quartz and semi massive to massive mineralization within an intensely altered zone. Visible gold is present along this showing. Follow-up exploration is required to determine Swan’s true width and strike length.

Swann Zone surface sampling highlights***

Work completed in late 2021, while only on about 10% of the property, indicates that sulphide zones occur within quartz bearing structures trending both east-west (south dip). Where these structures are crosscut by northwest trending structures (dipping east), semi-massive to massive sulphides occur. Within these sulphides, sphalerite, galena, tetrahedrite, chalcopyrite and pyrite are present. Fine visible gold is occasionally present within the massive mineralization. The Swann zone is several hundred meters east of the Milestone, where 2020 trench sampling returned 7.86 oz/ton gold (269.5 g/t) across a 2 metre width.

This next detail is the unexpected development hinted at above…

Following the surface sampling program, Optimum completed four short diamond drill holes on the Swann zone as a requirement under the option agreement on the property. Due to a quick onset of winter and Covid complications, these four drill holes were boxed and put in locked storage prior to being logged. Optimum geologists have now retrieved the drill core from storage and have logged, split and sent it for assay. Logging of the core has indicated up to 6 m of semi-massive to massive mineralization associated with highly altered sericitic rocks and quartz veining. Cut core showed silvery galena, indicative of silver in the Stewart area, green sphalerite and dull black stringers of tetrahedrite. In cut surface samples, fine visible gold is observed in the sphalerite, galena and tetrahedrite.

“Optimum completed four short diamond drill holes on the Swann zone” – Shareholders now have drill results to look forward to (and the core looks interesting).

Optimum management

Management is everything in the junior exploration arena… nearly everything. You can have a world-class deposit in the friendliest jurisdiction on earth, but without the right team in place—a combination of gifted rock kickers and enterprising business types—things can fly apart at the seams. Operational inefficiencies often create a processional effect that can lead to an erosion in shareholder value via reckless spending and an endless cycle of heavily dilutive raises.

Optimum has assembled an experienced and technically proficient team with a solid track record of running a tight show and creating shareholder value.

Final thoughts

It’s only been a few months since Optimum closed the deal on Harry. The quality of this flagship asset coupled with the pedigree of this management team has put Optimum on the radar of those looking for (potentially) high-impact exploration scenarios in the Golden Triangle.

The latent discovery potential of the Golden Triangle is highlighted by a new high-grade discovery at Pretium’s Golden Marmot Zone, 3.5 kilometers north of its Valley of Kings deposit, where it tagged an impressive 72.5 g/t gold over 53.5 Meters, including 6,700 g/t gold over 0.5 Meters.

Expect an aggressive push along the exploration curve from the Optimum crew in 2022.

END

—Greg Nolan

Full disclosure: Optimum Ventures is a Highballer client.

*** Grab samples are solely designed to show the presence or absence of any mineralization and to characterize the metal tenor in this mineralization. Grab samples are by definition selective and not intended to provide nor should be construed as a representative indication of grade or mineralization at the property; and the grab samples analysed from the property reflect a broad range in grade from below detection limit to the grades highlighted herein.

Disclaimer - Legal NoticeHighballerstocks.com (Greg Nolan) is not a licensed financial advisor and does not give investment advice.

The content of this report is for information purposes only.

Nothing contained herein should be construed as a recommendation or solicitation to buy or sell any security.

Always consult a licensed qualified investment advisor in your legal jurisdiction before making any investment decisions.

Though Highballerstocks.com (Greg Nolan) believes its sources to be credible, and the statements contained herein to be true, readers must conduct their own thorough due diligence, and or consult with a qualified investment advisor before important investment decisions are made.

Highballerstocks.com (Greg Nolan) accepts no responsibility or liability for the accuracy of the contents of this report.

Hi Gregg

I read your news letter every time its in my inbox

Etruscus Resources is another company in the Golden Triangle that doesn’t get much Press

They have low share count and low market cap and a share price that I think is a bargain for being in the location of the Golden Triangle. Check them out and see what you think.

Respectfully

Jim

Thanks Jim. I’ve looked at the Rock and Roll in the past, but it’s been a while. I’ll take another look.