The volatility rages on across all market sectors (Gold and Silver are off nearly 3% as I edit this piece). With the Fed set to deliver a half-point rate increase after their two-day meeting on the 3rd and 4th, expect that volatility to continue and perhaps ramp up even further. The next five days of trade should prove interesting.

No long-winded intro here. Right to it.

Catching up with Apollo.

Apollo Silver (APGO.V) – (APGOF.OTC) – (6ZF0.FRA)

- 165.72 million shares outstanding

- $77.06M market cap based on its recent $0.465 close

To refresh memories, Apollo’s ounce count (mineral resource estimate) at its flagship Calico Silver Project currently stands at 166 million ounces of silver contained in 58.1 million tonnes at an average grade of 89 g/t Ag – all in the Inferred category.

It’s important to understand that this current resource base was drilled off at an Indicated level, but additional geotechnical information is required to upgrade these ounces into the higher confidence Measured and Indicated categories – that will come from a phase of drilling that is currently underway.

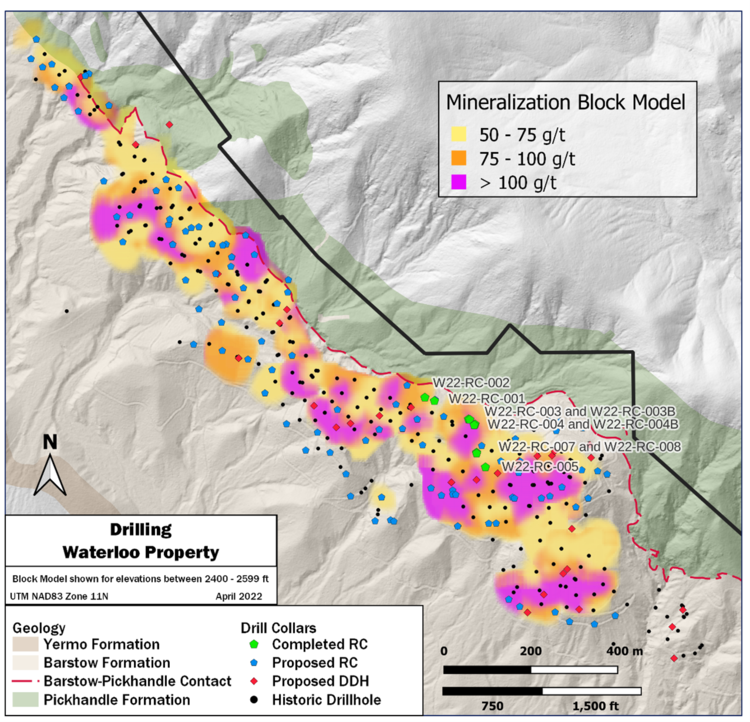

On April 26, the Company updated progress as it leans into a 15k meter drill campaign – 10k meters of reverse circulation (RC) and 5k meters of core drilling. An RC rig is currently probing the Waterloo component of Calico (116 million ounces at a grade of 93 g/t Ag).

The April 26 headline…

Calico Silver Project 2022 Drill Program Update

HIGHLIGHTS

- Drilling began on April 5, 2022, and nine RC holes have been completed to date on the Waterloo Property;

- First assay sample dispatch of 92 samples has been made;

- Sourcing of a second drill rig underway.

2022 Drilling Program Objectives (as per the guts of this press release):

- Update the confidence of the current mineral resource estimate (MRE) through:

- Acquiring high-quality geotechnical, rock properties, geochemical and lithological information.

- Geotechnical, rock properties and lithological information will be acquired using both optical televiewer surveying, traditional logging methods and detailed petrography.

- Infill drilling.

- Objective: upgrade the confidence in the MRE.

- Expand the current MRE through:

- Confirming and expanding historic bonanza grade silver intercepts (+1,000 g/t).

- Targeting shallow silver ounces by drilling untested Barstow Formation along strike and down dip.

- Objective: add additional high value silver ounces to the resource.

- Quantify MRE mineral inventory through:

- Testing the gold-mineralized Barstow-Pickhandle lithologic contact (see new release dated January 11, 2022).

- Quantifying the barite content.

- Objective: quantify the by-product credits that may be included in the resource update.

Comparing the above drill hole map with slide 15 on the Company pitch deck shows the correlation between the high-grade areas within the Waterloo resource base and the targets drilled thus far in this campaign. It wouldn’t be unreasonable to expect some high-grade hits to flow from this first round of drill hole assays (author’s speculation).

Samples from two holes (92 total samples) have been shipped to ALS-Global Geochemical Analytic Laboratory in Reno, NV (“ALS Reno”) for sample preparation, crushing and analysis for gold. Prepared pulps will then be securely transported by ALS Reno to ALS Global Geochemistry Analytical Lab in North Vancouver, BC, Canada for all other analyses.

Tom Peregoodoff, CEO:

“The 2022 drill program is advancing well. The program has very clearly defined objectives each of which is designed to add significant value to the resource we have declared at Calico. The drilling to date has confirmed the relatively simple geometry of the silver mineralization and the Barstow-Pickhandle contact which is prospective for gold mineralization. Securing a second rig will provide us with optionality to both bring forward the timing of drill results and expand the program.”

If you’re new to Apollo and its flagship Calico Silver Project located in San Bernardino County, California, the following links will help bring you up to speed:

A new addition to the Highballer list – Apollo Silver (APGO.V)

In the bottom half of my April 18 Highballer piece – A mid-April Highballer update featuring Banyan, Prime, and a few new names worthy of your due diligence – I trotted out a few new names for your consideration: Westhaven Gold (WHN.V), Goldshore Resources (GSHR.V), Anacortes Mining (XYZ.V), Freeman Gold (FMAN.V) – all with 43-101 compliant resource bases, all active on the exploration front with assay-related newsflow pending (Anacortes announced a delay in its receipt of drill permits).

Goldshore is up roughly 20% since the mention, Anacortes and Freeman are off 10%, and Westhaven is trading pretty much flat, waiting for the next round of assays.

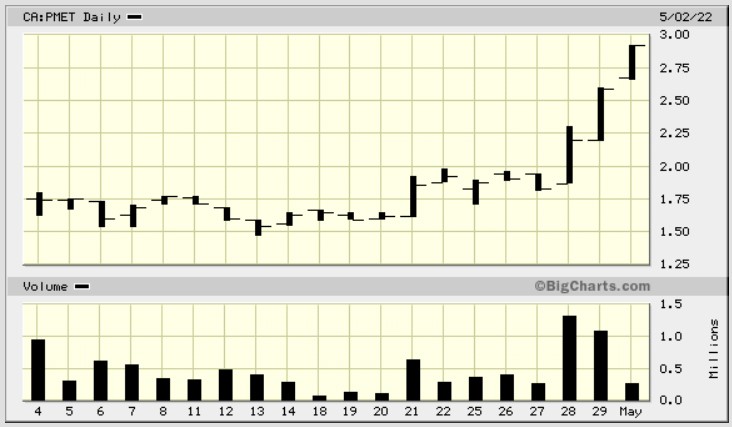

Another name I featured in that April 18 report was Patriot Battery Metals (PMET.C), a lithium explorer drill testing multiple spodumene pegmatite occurrences at its wholly-owned 210 km2-plus Corvette Lithium Property in the James Bay Region of Quebec.

The ‘Corvette Lithium Trend’ spans some 50 kilometers in length – lithium pegmatites have been identified in outcrop over a distance of 20 kilometers, with a further 30 kilometers yet to be explored.

The stock was trading in the $1.60 range when I introduced it on April 18.

Since then, the Company has updated shareholders with news that suggests its main pegmatite body is widening at depth. If true, and if the grades hold up as per previous results (i.e. 0.94% Li2O, 117ppm Ta2O5 over 155.1 meters, including 1.38% Li2O, 160ppm Ta2O5 over 38.0 meters), the Company could have a world-class deposit on its hands.

The Company, waiting on assays, is set to embark on an aggressive multi-rig drilling and (regional) surface sampling campaign.

That’s it for this episode of Highballer. Be careful out there.

END

– Greg Nolan

Full disclosure: Highballer was compensated for this Apollo Silver coverage. The author owns shares of Apollo, Westhaven, and Patriot.

Disclaimer - Legal NoticeHighballerstocks.com (Greg Nolan) is not a licensed financial advisor and does not give investment advice.

The content of this report is for information purposes only.

Nothing contained herein should be construed as a recommendation or solicitation to buy or sell any security.

Always consult a licensed qualified investment advisor in your legal jurisdiction before making any investment decisions.

Though Highballerstocks.com (Greg Nolan) believes its sources to be credible, and the statements contained herein to be true, readers must conduct their own thorough due diligence, and or consult with a qualified investment advisor before important investment decisions are made.

Highballerstocks.com (Greg Nolan) accepts no responsibility or liability for the accuracy of the contents of this report.