While gold continues its relentless, record‑breaking tear, it’s silver that’s once again commanding the spotlight.

The last time we checked in on the white metal, it had just blown through its mid‑October high of $54.50 with explosive momentum. That was in early December. Fast‑forward only a few short weeks, and we’re sitting at $94 and change—up more than 30% since the calendar flipped to 2026.

It wasn’t that long ago that $50 was the moon. Today, the $100 line is trembling and looks ready to fall…

The white metal’s dramatic breakout is reshaping the landscape for producers and developers with significant untapped resources on their books. Deposits that were marginal at $25 silver can now boast robust economics—some may even qualify as wildly economic—under this new price regime.

Take Kootenay Silver, for example—a company whose entire project pipeline looks very different in this new light.

FULL DISCLOSURE: Highballer has an agreement with Sideways Frequency LLC for the publishing of this article on behalf of Kootenay Silver. Highballer has received compensation for this effort. The insights and views presented here should be considered biased.

Kootenay Silver (TSXV:KTN) – (OTCQX:KOOYF)

- 89.37 million shares outstanding

- $217.17 M market cap based on its recent $2.43 close

- Corp Presentation

When I highlighted Kootenay Silver in early December, it was a $1.99 stock with a $174M valuation. As of the January 19 close, it’s up 20%—but the real re‑rating may just be getting started.

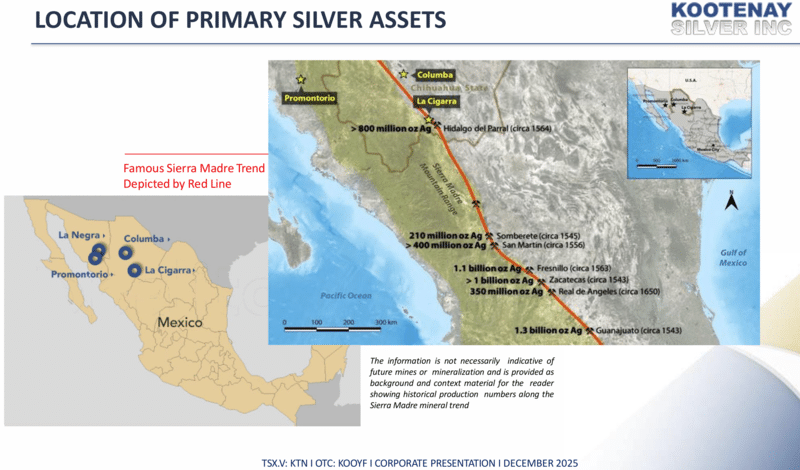

This well‑run junior strikes me as one of the more intriguing growth stories in the silver exploration arena. The company has assembled one of the largest junior‑controlled, silver‑dominant project pipelines in all of Mexico.

A brief summary from my December 3rd report:

Kootenay’s wholly-owned flagship asset, the past-producing Columba Silver Project, is located in the state of Chihuahua, Mexico, a jurisdiction known for its rich geology and mining-friendly culture.

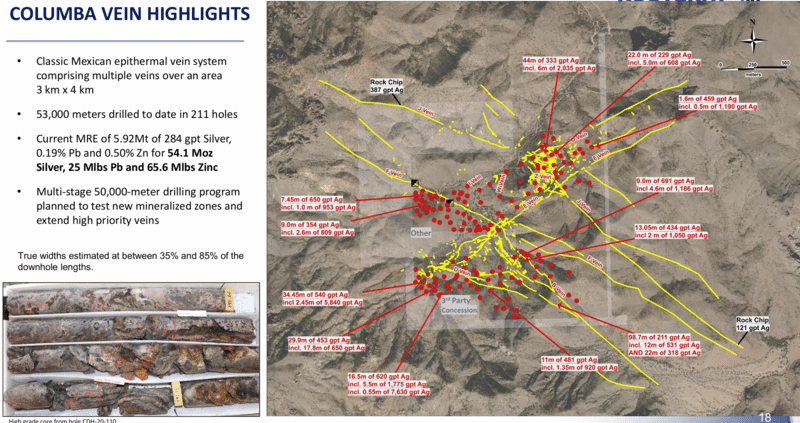

Columba, characterized as a silver-dominant intermediate sulfidation epithermal system, boasts a geological footprint measuring some 3 kilometers x 4 kilometers. In mid-June of 2025, the company tabled a maiden resource for Columba based on over 53,000 meters of drilling in over 200 holes across multiple veins. Drill targets were prioritized using good science: detailed mapping, lidar, and airborne magnetic surveys.

Columba’s maiden ounce count (MRE) = 5.92 Mt grading 284 g/t silver, 0.19% lead, and 0.50% zinc, equivalent to 54.1 million ounces silver, 25.2 million lbs of lead, and 65.6 million lbs of zinc.

The high-grade nature of this epithermal deposit is anchored in its robust vein structures, averaging five to six meters, with widths up to 20 meters—a detail that could significantly enhance the project’s underlying economics.

Quoting the mid-June press release:

The veins cut every known rock type on the project and the veins or vein structures can be traced across the highest elevations of the caldera. This indicates veins formed late in caldera history. As elevation increases vein development becomes irregular eventually being replaced by breccias at the higher elevations. Silver grades diminish with increasing elevation right down to background values. Correspondingly silver grades increase with depth from background at higher elevations to highs of kilograms per tonne at depth. It is evident from these features that the vein system has undergone almost no erosion and so whatever silver was deposited originally is largely still there.

Some of the fatter drill hits underpinning this maiden resource estimate, as per slide #18 from the company’s deck…

Chris Parry captured the essence of the story in his December 8 Equity Guru article: “Kootenay Silver is not a lifestyle explorer. They are not a one-vein wonder praying for a bull market long enough to matter. They have real resources across multiple properties, fresh discoveries with grade that makes geologists swear in a good way, and a funded plan to turn promising ounces into a meaningful district scale system.”

Ongoing Columba Drilling

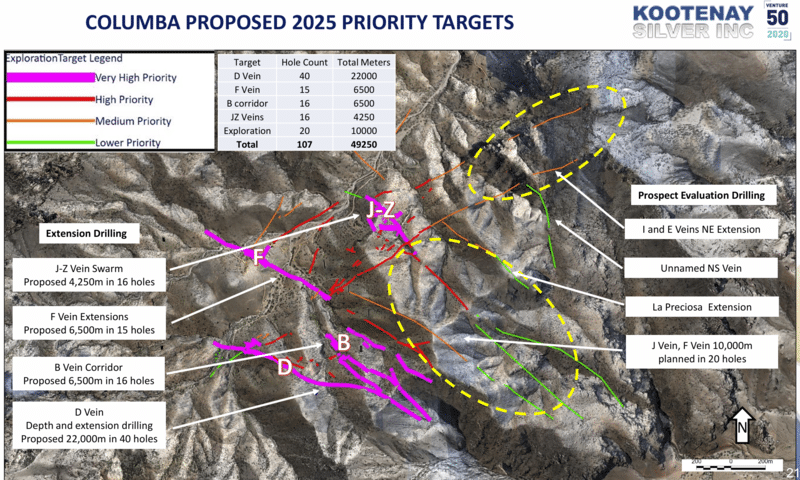

The company is currently 14,000 meters into an aggressive 50,000-meter drill campaign at its flagship project.

On January 8, the company reported results from nine holes designed to expand the known resource bodies—structures that continue to demonstrate grade, width, continuity, and scale – Kootenay Reports Results from Nine Holes in Ongoing Columba Drill Program.

Concerning these recent assay values, Kootenay’s President & CEO, James McDonald: “Drilling continues to deliver positive results at Columba. Holes CDH-25-220, 223 and 225 along with previously announced 216 are hitting good wide mineralized vein and vein stockwork breccia at some of the deepest depths tested thus far on the D Vein leaving this area wide open to depth. Also impressive is the wide-open expansion potential in the Lupe and B 2 veins. This shows well on the long sections. We are now approximately 13,000 meters into our 50,000-meter program with 7 holes awaiting assays and drill holes CDH 25-236 and 237 underway”

A Lupe Vein highlight from this recent drilling update:

- 7.6 meters (4.56 meters etw) averaging 299 gpt Ag, 0.5% Pb and 1.0% Zn from 379.4 meters downhole;

– sub interval of 0.45 meters (0.27 meters etw) of 1,830 gpt Ag, 5.0% Pb + 6.2% Zn)

Dale Brittliffe, VP Exploration adds: “The high-grade veins enveloped by the wide zones of low grade underscore the huge amount of silver in the Columba vein system and bodies well for further expansion of high-grade resources. We are extremely pleased to see continued success in expansion drilling along the B2/Lupe corridor. The intervals we are encountering are similar to those in D Vein which are often characterized by broad zones of well mineralized stockwork veining either side of the high-grade vein within the main structure”

Kootenay’s drill plan at Columba…

Today’s News: La Cigarra PEA On Deck

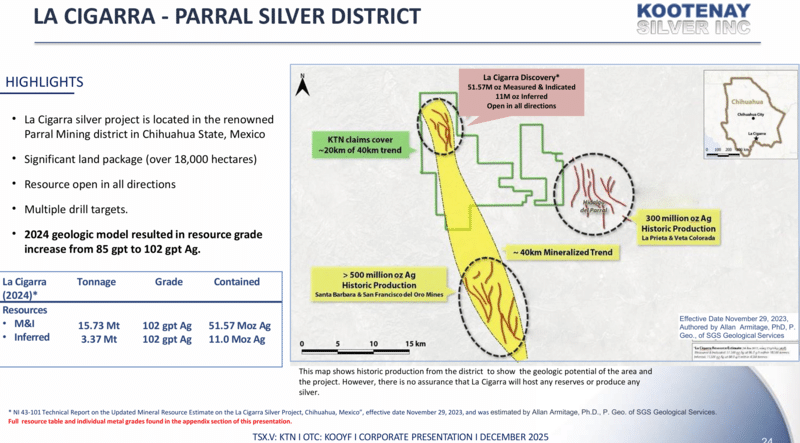

As noted above, deposits once considered marginal at $25 silver now model very differently under current metal prices. The company’s La Cigarra silver project, located in the famous Parral Mining District of Chihuahua—a prime example of this new dynamic—is the subject of today’s press release – Kootenay Commissions a Preliminary Economic Assessment on La Cigarra Silver Deposit and Continues to Aggressively Drill Columba.

The company has engaged Sacré-Davey Engineering Inc. and Canenco Consulting Corp. to conduct a PEA on La Cigarra, with results expected in Q2 of this year.

- Measured + Indicated Mineral Resources are estimated at 15.73 Mt grading 102 g/t silver, 0.07 g/t gold, 0.16% lead, and 0.21% zinc (120 g/t AgEq). The Measured MRE includes resources of 51.57 Moz of silver, 33.9 koz of gold, 54.8 Mlbs of lead, and 73.5 Mlbs of zinc (60.56 Moz AgEq).

- Inferred Mineral Resources are estimated at 3.37 Mt grading 102 g/t silver, 0.06 g/t gold, 0.20% lead, and 0.19% zinc (119 g/t AgEq). The Inferred MRE includes resources of 11.00 Moz of silver, 6.00 koz of gold, 14.8 Mlbs of lead, and 13.8 Mlbs of zinc (12.85 Moz AgEq).

James McDonald President and CEO: “In late 2023 and early 2024, in anticipation of silver decisively breaking above $30 dollars per ounce, we updated our resource estimates on the existing deposits of La Cigarra and Promontorio, and at the same time published a maiden resource on the La Negra deposit. These three deposits are well positioned to be quickly advanced with silver experiencing a nominal record high of $94.09 per ounce driven by a multi-year supply deficit and intense industrial demand. As such, we have commissioned a Preliminary Economic Study on the first of those three deposits, La Cigarra, for delivery in Q2. At the same time, we are aggressively drilling Columba to achieve our goal of increasing its maiden resource of 54 million ounces of silver to 100 million ounces followed by a PEA of its own.”

Alongside its substantial subsurface resource, La Cigarra boasts wide‑open exploration upside across its 18,000 hectares.

Promontorio & La Negra

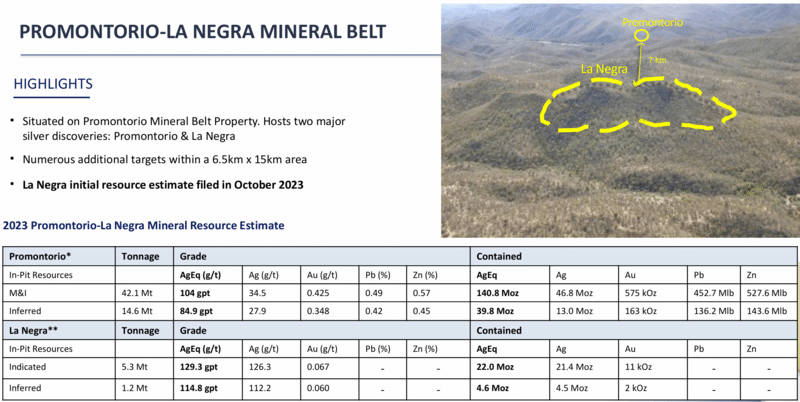

Rounding out Kootenay’s project pipeline are Promontorio & La Negra, located along another highly prospective mineral belt—the Promontorio Mineral Belt—roughly 7 kilometres south of La Negra in Sonora state.

All told, the company’s project portfolio in northern Mexico shows 214.2 million AgEq ounces in the Measured & Indicated category, plus 109 million AgEq ounces classified as Inferred.

Robust Newsflow

Aside from the La Cigarra PEA, due out this spring, expect solid assay‑related newsflow from the company’s flagship Columba project, where management has 100 million ounces in its crosshairs.

Kootenay management sees itself exiting 2026 having transitioned from an explorer—focused on discovery and resource expansion—to a project developer… a developer with meaningful exploration upside.

Should these lofty silver prices endure, producing entities will be cranking out earnings that could deliver serious shock value. Companies with substantial resources advancing along the development and economic‑assessment curve will likely re‑rate alongside the producers… perhaps dramatically so.

END

— Greg Nolan

Full disclosure: The author is not a Kootenay Silver shareholder, but may initiate purchases in the near future.

Disclaimer - Legal NoticeHighballerstocks.com (Greg Nolan) is not a licensed financial advisor and does not give investment advice.

The content of this report is for information purposes only.

Nothing contained herein should be construed as a recommendation or solicitation to buy or sell any security.

Always consult a licensed qualified investment advisor in your legal jurisdiction before making any investment decisions.

Though Highballerstocks.com (Greg Nolan) believes its sources to be credible, and the statements contained herein to be true, readers must conduct their own thorough due diligence, and or consult with a qualified investment advisor before important investment decisions are made.

Highballerstocks.com (Greg Nolan) accepts no responsibility or liability for the accuracy of the contents of this report.