I’m getting a sense that most of the companies we follow here are determined to make up for whatever time was lost during the C-19 shutdown, prepping field crews and mobilizing drill rigs to their flagship projects, if they haven’t done so already.

A number of companies on our shortlist are already active. Two—Cartier Resources and Skeena Resources—closed out last week having printed multi-year highs.

A 3-year weekly chart of Skeena…

A 2-year weekly of Cartier…

The remaining companies on our list are consolidating the upper levels of their recent trading ranges.

The balance of 2020 promises to deliver a steady flow of news into a willing market, one that is all-of-a-sudden wise to a good, high-quality exploration and development play.

I suspect the gains we’ve realized over the past few months may pale to what’s in store over the medium to long term.

Forum Energy Metals (FMC.V)

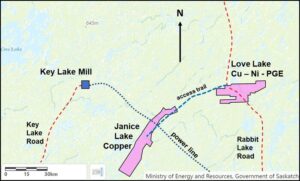

Last week I talked a little about the district-scale potential of Forum‘s Janice Lake and Love Lake projects. I also highlighted a recent interview with CEO Rick Mazur.

On the subject of Love Lake, the company dropped the following headline on June 18:

This is a modest raise: 4,000,000 units priced at $0.10 for $400,000. Each unit consists of one flow-through share and one-half of one non-flow-through common share warrant (each whole 3-year warrant is exercisable at $0.14).

CEO Mazur:

“Further compilation work has increased our understanding of the Love Lake Copper-Nickel-Palladium project, including the identification of a feeder zone with potential to host a magmatic nickel/copper/palladium deposit similar to Chalice Gold’s recent Julimar discovery. This financing will fund an airborne magnetic survey, mapping, prospecting and a ground electromagnetic survey this summer in preparation for a first pass drill program.”

In the coming weeks, we should hear more on the company’s flagship Janice Lake copper project where Rio Tinto is planning a multi-phase $7M drilling campaign—upwards of 20,000 meters.

Pure Gold Mining (PGM.V)

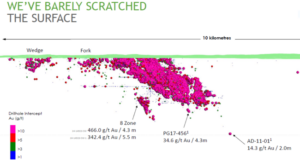

Earlier this month we updated Pure Gold after it announced a 30,000-meter diamond drilling campaign to optimize their near term mine plan, grow their current resource base, and probe the subsurface for new discoveries along their highly prospective, 47 square kilometer land position in the ‘high-grade gold capital of the world’—Red Lake Ontario.

On June 17, the company closed a previously announced PP where Canadian billionaire Eric Sprott took down the entire offering, increasing his stake in the company to 12%.

PureGold Closes $15 Million Non-Brokered Flow Through Financing

Darin Labrenz, president & CEO:

“This new capital gives us the financial flexibility to launch an aggressive exploration drilling campaign designed to accelerate our goal of resource growth and expansion. While we remain completely focused on our fully-funded mine construction and ramp-up, we strongly believe our mine plan is both scalable, and has the potential to expand. This investment allows us to begin building out our future growth today, concurrent with mine construction activities which remain on-track for first gold production in Q4 2020. We would like to thank Eric Sprott for his continued support of the Company and of our vision of becoming a high-margin, long-life producer in the Red Lake mining district”.

This is a good story, one with near term production and heaps of exploration upside.

Our initial coverage on April 6, 2020—Pure Gold Mining (PGM.V) – a high-grade Red Lake development story—has offered readers a solid double as the company has made tremendous strides in de-risking the project.

A buoyant gold price has also played a role in pushing the stock to multi-year highs in recent sessions.

30k meters is an aggressive drilling campaign. Expect strong newsflow, on multiple fronts, for the balance of 2020.

Skeena Resources (SKE.V)

Skeena is another advanced stage development story that has seen its shares soar in recent sessions, tagging multi-year highs.

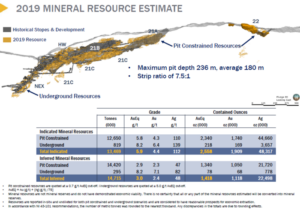

The company boasts one of the highest grade open pit development projects in the world—some four million ounces grading 4.4 g/t AuEq.

The current resource does NOT include any of the results from roughly 15,000 meters of resource upgrade and expansion drilling carried out last year.

Skeena delivered two important headlines last week:

June 15: Skeena Commences Pre-Feasibility Study For Eskay Creek

This follows a robust PEA tabled in November of last year—a PEA that shows an after-tax NPV5% of C$638M, a 51% IRR, and 1.2 year payback period (based on a $1,325 gold price).

If we plug $1,700 gold and $15 silver into this PEA, the after tax NPV rises to just north of $1B and the IRR jumps to 70%.

This is one of the reasons we’re here.

With this June 15 press release, Skeena continues its aggressive pace in de-risking Eskay Creek.

“A key work program as part of the development of the PFS will be an extensive infill drilling program to convert a large portion of the Inferred resources into the Measured & Indicated category and following completion of the PFS, declare maiden reserves for Eskay Creek.”

“Following the completion of the Eskay Creek PEA in 2019, several areas were identified that could be optimized and enhanced with further work. This includes optimizing the metallurgy and the concentrate quality and to better optimize the flow sheet. This work will further enhance the consistency and value of the final concentrate produced allowing for key concentrate offtake discussions to begin. Another focus area will be to gain a better understanding of the geotechnical characteristics in the open-pit which will allow for further pit optimization studies. Preparations and planning for these work programs are ongoing.”

Two days later, on June 17, the company dropped another material headline:

Surface-based drilling will begin in late June with two rigs. In a staged approach, additional rigs will be added to the campaign, maxing out with eight to ten drill rigs performing delineation and exploratory drilling until the end of 2020.

Initially, drilling will focus on the completion of the Phase I program of infill on the 21A, 21B and 21C Zones (24,000 metres) paralleled by resource expansion drilling in the near-mine environment. The Company is permitting 137,000 metres of exploratory drilling to test both brownfield and greenfield targets.

The exploration upside at Eskay Creek adds a weighty speculative component to this play. There are several under-explored zones, particularly at depth, where a recent drill hole tagged a new mudstone horizon outside the current resource: 314.07 AuEq over 2.21 meters. This spectacular hit will be followed up on in due course, once the infill drilling converts enough Inferred ounces to the higher confidence Indicated category.

This is another reason we’re here.

The question on everyone’s mind

Barrick has a back-in right that gives them the option to claw back a majority stake (51%) in Eskay Creek.

If they want it, they’ll have to write a cheque for three times whatever Skeena spends on the project.

Walter Coles, Skeena CEO:

“Skeena has spent almost C$25 million at Eskay Creek since we optioned the project from Barrick. Due to the exercise of warrants expiring last week, Skeena’s cash position is approaching C$50 million. The company is fully funded for an exploration budget that will total approximately C$45 million for the balance of the year as we look to aggressively advance Eskay Creek.”

That is going to be one fat cheque.

Either way, back-in or no, I see it as a win-win for Skeena.

Like Pure Gold above, Skeena is firing on all cylinders, de-risking what could evolve into a Tier-1 asset.

If you lack details, my maiden piece on the company—Skeena Resources (SKE.V) aggressively pushing Eskay Creek further along the development curve—and subsequent updates will bring you up to speed on this compelling high-grade development and exploration play.

Strategic Metals (SMD.V)

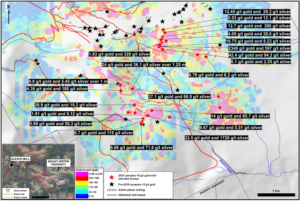

We shortlisted this Yukon prospect generator back in mid April, primarily for the high-grade potential of its wholly-owned Mount Hinton project—Strategic Metals (SMD.V) tees up Mount Hinton for high-grade gold and silver.

Mount Hinton dominated the company’s headlines in 2019.

The project’s proximity to Alexco Resources (AXU.TO) in the legendary Keno Hill Mining District—200 million ounces at a grade of 44 ounces (1,247 g/t) Ag per tonne—adds an element of intrigue to this play.

The fact that management is ditching its prospect generator business model to maintain control of this one elevates the drama.

So far, we have only two dimensions at Mt Hinton, but some of the grades tagged at surface are exceptional.

What may ultimately lie in Mount Hinton’s subsurface layers—that all important 3rd dimension—is the reason we’re here.

Earlier this month, the company announced a program consisting of excavator trenching, detailed mapping and prospecting that should be underway now.

An estimated 7,000 meters of drilling will follow this initial groundwork.

If you’ve been following Strategic over the years, you’ll know that 7k meters is an aggressive drilling campaign for the company.

To that end, the company dropped the following headline last week:

June 18: Strategic Metals Ltd. Announces Private Placement Offering of up to C$4,000,000

This $4,000,000 raise consists of up to $1,000,000 worth of hard dollar units priced at C$0.45, and up to $3,000,000 worth of flow-through units priced at $0.64. Each unit carries a full 2-year warrant exercisable at $0.65.

In a recent offering over at Chris Parry’s Equity Guru—Guru’s $20M to $80M shortlist of gold and silver ExplorerCos (those with endgame potential)—I made the following observation concerning high-quality plays in this current market:

Another indication that it’s game on in the junior arena: Nearly every private placement (PP) that crosses my screen goes into oversubscribed mode. Fast.

Those who understand the underlying dynamics—lean project pipelines, Peak Gold, Printing Presses Gone Wild—are piling into high-quality junior exploration companies in the expectation of a bull run of epic proportions.

Let’s see if this PP follows suit and gets up-sized.

That’s it for this week.

END

—Greg Nolan

Full disclosure: Forum Energy and Cartier Resources are Highballer marketing clients. The author owns shares in Strategic Metals and may initiate purchases in one or more of the remaining featured companies in the coming days.