Several companies on the Highballer shortlist have been generating significant assay-related newsflow over the past week or so. Let’s get right to it.

First, I should mention that I continue scouring the junior ExploreCo landscape for companies with the right combination of assets, jurisdiction, and of course…management. But it’s not an easy task—I’m not a shoot-from-the-hip sort.

When laying one’s hard-earned funds down, the probability of success needs to be greater than the risk incurred.

Having said that, I hope to trot out at least one new pick before 2020 grinds to a halt.

Companies dropping exploration results in recent sessions

I profiled Harfang Exploration (HAR.V) in a roundup piece I published over on Chris Parry’s Equity Guru yesterday. At the bottom of this roundup, I offered a summary of the Company, a review of the news released on September 22nd (already covered in these pages but worthy of a repeat), and a detailed look at the news released just a few days back, on October 22nd.

The following excerpt will bring you up to speed on Harfang…

If you perused the About link on the Highballer website, you’ll know that I was positioned in André Gaumond’s Virginia Gold prior to the world-class Eleonore discovery, and hung on for the fat takeover bid that followed.

I’m a big André Gaumond fan.

Gaumond is Chair of the Harfang Board.

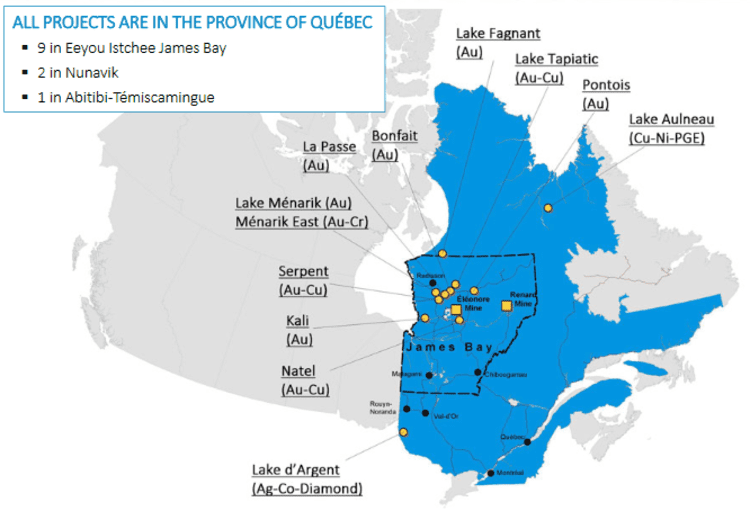

I count twelve, the number of properties in Harfang’s project portfolio.

The Company’s Serpent Project bears flagship status.

The Company’s Serpent Project bears flagship status.

Serpent appears to be evolving rapidly.

Project highlights:

- 28,565 hectares, 100% owned by Harfang;

- No underlying royalties;

- Accessible by ground, air, or by boat from lake Sakami;

- Located 80 kilometers southeast of Radisson and 60 kilometers from the La Grande airport;

- Adjacent to the paved James Bay road;

- Two powerlines run through the property;

- The eastern limit of the property is next to the Sakami Gold Project operated by Quebec Precious Metals (QPM.V);

- The project is located in an under-explored area outside the known greenstone belts, near the contact between the La Grande and Opinaca subprovinces;

- Archean basement intruded by felsic to ultramafic magmas – minor discontinuous highly-deformed and metamorphosed volcano-sedimentary horizons (including the Apple Formation);

- Elongated mafic and ultramafic dykes intruded into a major pluri-kilometric East-West deformation corridor.

The Serpent Project boasts the discovery of at least 15 orogenic gold and intrusion-related Cu-Au-Ag mineralized occurrences, 14 of which are hosted in quartz veins…

- 14 gold-rich occurrences hosted in quartz veins (up to 186 g/t Au and 200 g/t Ag—grab samples at Lawr), 79 g/t Au over 1.25 meters (channel sample at Lawr), 91.48 g/t Au over 0.45 meters (channel sample at Langelier);

- 1 Cu-Au-Ag prospect (Mista) running over at least 350 meters laterally with up to .99% Cu, 0.20 g/t Au, and 7.7 g/t Ag over 11.7 meters (channel sample);

- Very high gold grain counts in till samples (up to 324 gold grains), gold-in-till anomaly covering 4 km2 in a yet unexplored part of the property.

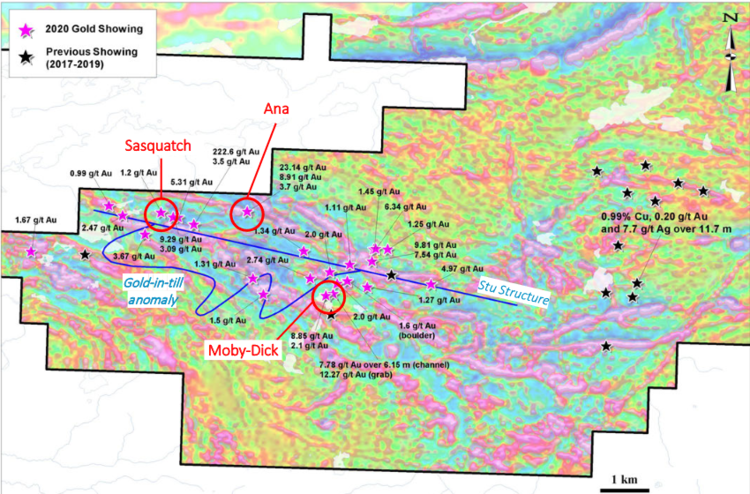

On September 22nd, the Company reported results from mechanical trenching and prospecting.

This was part of an aggressive summer field campaign focused on an unexplored area of the property (highlighted by the >4 square kilometer gold-in-till anomaly noted above).

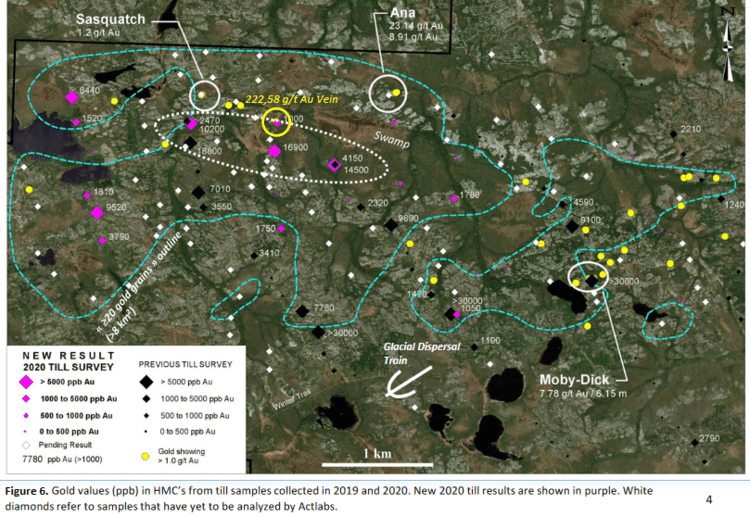

Work included an induced polarization survey (34 linear kilometers), 14 mechanical trenches in three specific areas (Moby-Dick, Ana, and Sasquatch), and the collection of 855 grab, 458 channel, 90 till, and 50 soil (B-Horizon) samples.

This recent fieldwork revealed more than 20 new gold showings (>1 g/t Au).

This recent fieldwork revealed more than 20 new gold showings (>1 g/t Au).

When combined with previously discovered showings, gold occurrences now cover an East-West strike length of at least 12 kilometers.

Quoting this September 22nd press release…

Located 100 meters from the exploration camp, the Moby-Dick structure was channelled and returned up to 7.78 g/t Au over 6.15 meters, including 24.06 g/t Au over 1.80 meters and 2.00 g/t Au over 2.25 meters (Figs. 4 and 5). Visible gold was observed in one sample along this channel (61.06 g/t Au over 0.50 meters). Trenching conducted on this structure exposed the vein over more than 350 meters. The easternmost part of the structure returned 8.95 g/t Au over 0.45 meters (TR-SER-20-005). Gold content in other channels is limited to anomalous values showing its coarse nature (nugget effect). Grab samples returned up to 12.27 g/t Au (TR-SER-20-001), and 8.85 g/t and 2.10 g/t Au (TR-SER-20-007). The Moby-Dick structure is characterized by shear zone-hosted quartz veins up to 10 meters wide. It stretches over a strike length of at least 350 m in a N250° direction, dipping moderately to abruptly to the northwest.

The Ana structure is characterized by a 4-meter wide shear zone filled with quartz veins exposed over 25 meters long (Figs. 6 and 7). The shear zone strikes into a N245° direction and dips abruptly to the northwest. It is developed in the old Archean tonalitic basement (Langelier Complex) and pyroxenite and gabbro dykes. The shear zone appears to continue to the northeast. Grab samples reached up to 23.14 g/t Au in the most mineralized part of the shear zone where visible gold was observed (Fig. 6). Channel sampling results are pending. Sulfide content (pyrite, ± pyrrhotite) reaches up to 5% locally. Calc-silicate and potassic alterations are described together with intense silicification. A parallel structure is located 25 meters to the southwest.

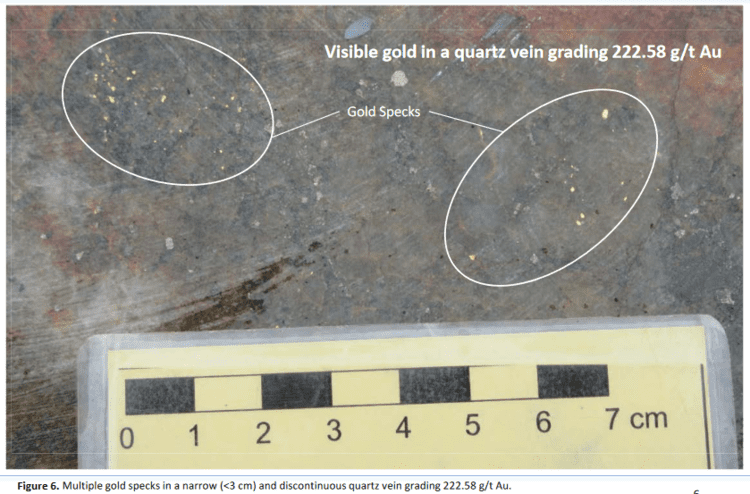

The Sasquatch structure is located 3.8 kilometers northwest of Moby-Dick. It is characterized by an 8-meter wide shear zone filled with quartz veins striking into a N245° direction, dipping abruptly to the northwest (Figs. 8 and 9). Its lateral extension is at least 80 meters and remains open at both extremities. A grab sample collected in a portion of the vein with 3-5% pyrite returned 1.20 g/t Au. Channel sampling results are pending. Sheared pyrite-bearing gabbro and several smaller quartz veins, which graded 3.50, 5.31, 9.29 and 222.58 g/t Au, were found southeast of Sasquatch along potential parallel structures.

On October 20th, adding momentum to the exploration push over the past few months, the Company dropped the following headline:

Doubling the size of a geochemical anomaly is always a good thing.

Preliminary highlights from this summer-of-2020 till survey include:

- 3 till samples containing above 100 gold grains (432, 308, 141) among which 69, 47, and 50% of the grains, respectively, bear a pristine shape;

Pristine grains are delicate pieces of free gold that are generally interpreted to have been derived from bedrock sources close to the sampling sites.

- Heavy Mineral Concentrate (HMC) from 5 samples returning gold values above 5 g/t Au (16.90, 14.50, 10.20, 9.52, 6.44 g/t Au);

Samples containing more than 100 gold grains, 47% of which are pristine, form a clear dispersal train aligned into the main glacial direction.

Partial HMC results from 2020 include 12 samples above 1 g/t Au.

“Four contiguous samples distributed over a strike length of 1.3 km returned more than 10 g/t Au (18.8, 16.9, 14.5 and 10.2 g/t Au). The high HMC and gold grain counts values are located at the proximity and down-ice of major structures and near newly-discovered gold showings. Figure 6 (below) shows many gold specks in a narrow (<3 cm) and discontinuous quartz vein located up-ice that graded 222.58 g/t Au. Visible gold was observed in quartz veins, gabbros and pyroxenites at several localities inside the anomaly.”

- 50 till samples returned 20 gold grains or more now form a gold-in-till anomaly covering an area at least 8 km2.

The high gold grain counts, high ratios of pristine gold grains, and high-grade values in the HMC’s, indicate that the bedrock source of this anomaly is close by.

Harfang is a prospect generator (PG) by design. But like Virginia Gold during the previous gold-bull-cycle (2001 to 2011), Harfang may elect to drop the PG business model if the Serpent Project continues to demonstrate world-class potential.

Real time note: I added to my Harfang position in recent sessions so color be biased.

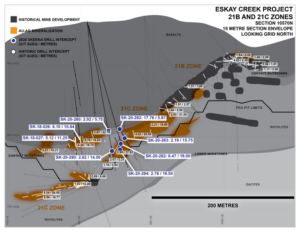

On October 14th, Skeena (SKE.T), one of our more advanced stage shortlisted Cos, released infill drill hole assays from its Eskay Creek project located in the prolific Golden Triangle of British Columbia.

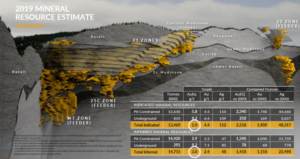

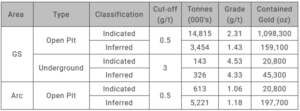

It’s important to understand that the drill holes representing the Inferred ounces in the above resource were spaced 50 to 70 meters apart versus the 10 to 15 meters spacings on the Indicated ground—the further the distance between holes, the lower the grade due to the uncertainty. Tightening up the spacings on the Inferred ground should bring the grade (currently 3.0 g/t) more in line with the grade on the Indicated ground (5.9 g/t Au). More simply put: converting Inferred material to Indicated should amplify the ounce count.

Keep in mind that open-pit mines are typically low-grade scenarios, often less than one gram per tonne. There are open-pit mines in production today—profitable open-pit mines—producing from sub 0.5 g/t material.

The Oct. 14th headline…

Skeena Intersects 7.01 g/t AuEq over 20.00 metres in 21C Zone Infill Drilling at Eskay Creek

Highlights:

The Water Tower Zone

- 4.58 g/t Au and 29 g/t Ag (4.96 g/t AuEq) over 27.60 meters (SK-20-295)

including: 8.01 g/t Au and 36 g/t Ag (8.49 g/t AuEq) over 14.40 meters.

The 21C Zone

- 6.89 g/t Au and 10 g/t Ag (7.01 g/t AuEq) over 20.00 meters (SK-20-281);

- 6.38 g/t Au and 7 g/t Ag (6.47 g/t AuEq) over 19.00 meters (SK-20-282);

- 17.61 g/t Au and 11 g/t Ag (17.76 g/t AuEq) over 5.87 meters (SK-20-283);

- 1.93 g/t Au and 39 g/t Ag (2.46 g/t AuEq) over 52.50 meters (SK-20-299);

- 1.86 g/t Au and 12 g/t Ag (2.02 g/t AuEq) over 52.09 meters (SK-20-300);

- 8.03 g/t Au and 168 g/t Ag (10.27 g/t AuEq) over 10.50 meters (SK-20-330).

According to this press release, six helicopter-supported drill rigs were active with an additional five rigs to be added in the coming weeks.

“The Phase 2 infill program is focused on Pre-Feasibility Study (“PFS”) resource category conversions for the open-pit constrained resources.”

Walter Coles Jr., Skeena’s CEO:

“These are solid results. The infill drilling continues to prove that Eskay is a deposit with excellent continuity and predictability. The addition of five more drill rigs in the coming weeks should allow us to maintain our aggressive schedule to complete the Phase 2 infill program before year end, as well as test certain high priority exploration targets.”

On October 20th, the Company released the following news with a fat headline interval:

Skeena Intersects 7.83 g/t AuEq over 42.59 m in 21C Zone Infill Drilling at Eskay Creek

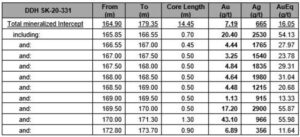

The numbers contained in this press release stand to augment Skeena’s global ounce count in a meaning way (note the silver grades in drill hole SK-20-331).

The 21C Zone

- 7.19 g/t Au and 665 g/t Ag (16.05 g/t AuEq) over 14.45 meters (SK-20-331);

- 5.59 g/t Au and 5 g/t Ag (5.66 g/t AuEq) over 25.50 meters (SK-20-341);

- 6.88 g/t Au and 71 g/t Ag (7.83 g/t AuEq) over 42.59 meters (SK-20-364).

Further 21C Zone details:

21C Zone Infill Drilling Intersects Substantial Silver Mineralization in Contact Mudstone

The Phase 1 infill drill campaign is reducing the drill spacing and upgrading the confidence of Inferred resources in a portion of the 21C Zone. Phase 1 drillhole SK-20-331 intersected significant and previously unknown high-grade Ag mineralization hosted within the Contact Mudstones. The intercept averaged 7.19 g/t Au and 665 g/t Ag (16.05 g/t AuEq) over 14.45 m, however, there is significant high-grade within this zone (table below). This intercept is closely flanked by historical drill holes 6717 and C001053, but these intersected markedly lower grades averaging 1.13 g/t AuEq over 8.69 m and 1.69 g/t AuEq over 12.78 m respectively.

This phase 2 drilling campaign now includes nine drill rigs with more on the way.

The following link takes you to a recent interview with Skeena’s VP of Exploration, Paul Geddes…

KE Report – Paul Geeds from the Eskay Creek site

Note: I added to my Skeena position in recent sessions.

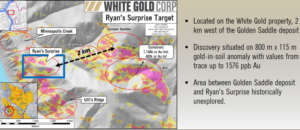

When I first profiled White Gold (WGO.V) earlier this year, I stated the following as the Company’s emphasis on geochemistry—collecting soil samples on an increasingly tight grid—is rather extraordinary:

The Dawson district has limited rock outcrop exposure (2% to 3%)—normally that’s a huge disadvantage. But the region is unglaciated.

“Unglaciated Yukon land results in soil that is undisturbed, therefore samples are indicative of the rock directly below.”

Ryan figured out that extracting, assaying, and mapping soil samples is the key to diving the district’s subsurface mineral potential. Just as importantly, he figured out that traditional soil samples—your standard six-inch-deep ‘B-Horizon’ type samples taught in geo-school—was insufficient. You need to go at least 2 1/2 feet down to get a proper response in this region.

Soil augers, on a tightly spaced grid, is how Ryan is systematically exploring this expansive land base.

Between White Gold’s property boundaries and Newmont-Goldcorp’s Coffee Gold Project boundary, Ryan and crew have mapped over 400,000 soil samples… so far. That’s dedication. That’s using good science to home in on gold, base metals, epithermal, mesothermal, mother-lode—whatever the regions subsurface layers may hold.

This soil sampling is ongoing—roughly 15,000 1 lb samples across eight projects were collected in 2019. Without a doubt, some of these samples will generate exploration targets that’ll warrant a closer look next field season.

The sampled areas are shortlisted based on assays, geophysics, and good ol fashioned geological sleuthing. But before an expensive diamond drill rig is mobilized, a lighter weight RAB drill rig is brought in for a first-pass test. If they hit with the RAB rig, a diamond drill rig is mobilized for a phase-two probe.

This intensive emphasis on geochemistry could lead to another Coffee—a deposit Ryan previously owned.

On October 14th, the Company tabled the following headline:

Ryan’s Surprise is located approx 2 kilometers west of the Company’s flagship Golden Saddle and Arc deposits (1,139,900 ounces Indicated and 402,100 ounces Inferred)…

It also lies 11 kilometers south of the VG deposit (230,000 historic Inferred ounces).

This proximity renders Ryan’s Surprise a highly strategic target, one which could augment the global ounce count in a big way.

Highlights from this press release:

- The diamond drilling program comprised 6 drill holes totalling 1,632.5 meters, with all holes encountering multiple gold intercepts, several of which are amongst the highest grade intercepts encountered to date on the White Gold property;

- High-grade gold intercepts were encountered in 5 of 6 holes including 17.40 g/t Au over 3.47 meters (WHTRS20D013), 12.80 g/t Au over 1.00 meter (WHTRS20D014), 9.10 g/t Au over 1.00 meter (WHTRS20D015), 10.96 g/t Au over 3.76 meters (WHTRS20D017) and 8.69 g/t Au over 12.30 meters in (WHTRS20D018);

- Drilling was carried out on three 50 meter spaced cross-sections to test for extensions of mineralization along strike and down dip, and to further evaluate the geological/structural interpretation;

- Gold mineralization remains open in all directions and has now been encountered over a strike length of 250 meters by 130 meters wide and to a vertical depth of 300 meters;

- Mineralization is structurally controlled in brittle fracture and breccia zones, predominately in metaquartzite and shows a strong association with anomalous arsenic;

- Ryan’s Surprise is situated on a large 11 kilometers by 5 kilometers mineralized trend which hosts several additional prospective targets.

As highlighted above, several of these Ryan’s Surprise holes represent some of the highest grade intercepts encountered to date.

The mineralized zones are open in all directions. Future probes with the drill bit will continue testing along strike and down dip.

David D’Onofrio, White Gold CEO:

“We are very pleased to have encountered additional high-grade mineralization at the Ryan’s Surprise in new zones and extensions to previously encountered mineralization in multiple directions. These results and the close proximity to our established resources provides further evidence of the growth potential of these projects. We are also further encouraged by the prospectively of the other targets in this area which share geological and other characteristics with this recent discovery.”

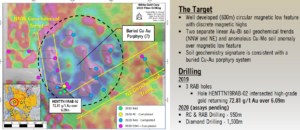

Having tagged 72.81 g/t Au over 6.09 meters (including 136.36 g/t Au over 3.05 meters) last November, a diamond drill rig was mobilized to the Titan Target this season. These are the results I’m anxiously awaiting. Assays are pending.

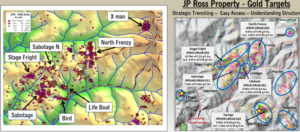

More recently, on October 22nd, the Company dropped the following headline:

Here, the Company announced positive trench, GT probe, and soil sample results that identified widespread structurally controlled gold mineralization along multiple targets at its JP Ross property. The objective is to prioritize targets for future probes with the drill bit.

Highlights:

- 29 trenches totalling 1,114 linear meters were trenched on 9 separate target areas utilizing an 8-ton tracked excavator. Results expanded known structurally controlled gold mineralization at multiple targets on the road accessible JPR property. Additional targets also to be tested in due course;

- Stage Fright target, trench JPRSF20T009 encountered a high-grade zone grading 8.88 g/t Au over 2.5 meters, and trench JPRSF20T010 exposed two separate mineralized zones grading 1.06 g/t Au over 2.5 meters, and 1.83 g/t Au over 2.5 meters;

- At the Sabotage target, five of seven trenches encountered gold mineralization including 3.40 g/t Au over 1.5 meters in trench JPRSAB20T023, 1.15 g/t Au over 8.5 meters in trench JPRSAB20T025, and 1.06 g/t Au over 2.1 meters, and 15.00 g/t Au over 0.8 meters in trench JPRSAB20T029;

- Trenching on the North Frenzy target traced a north-south striking zone of mineralized quartz vein breccias with anomalous gold over a strike length of 600 meters;

- GT Probe (top of bedrock) samples on the newly identified and previously untested Notorious target area encountered multiple anomalous gold values ranging from 0.17 g/t Au to 24.4 g/t Au;

- Significant follow-up exploration work was executed pursuant to these findings which included expanded soil geochemistry surveys, a phase 2 trenching program utilizing a CanDig mini-excavator, hand excavated soil pits on existing anomalies, and RAB drilling on several high priority targets.

You gotta love these handless—Sabotage, Frenzy, Notorious… Stage Fright. There had to be a reason.

CEO D’Onofrio again:

“We are pleased to have encountered additional gold mineralization across multiple recently identified zones as well as the high-grade gold mineralization on the newly discovered Notorious target, providing further indication that the abundant gold mineralization is part of a robust regional scale structurally controlled system. To date at least 14 gold targets have been identified on the JP Ross property across a 14km by 11km area, many within close proximity to significant current and historical placer gold operations. This program has also provided valuable insight into the orientation and geometry of the mineralized systems, information that has been incorporated into our scientific and data driven methodology to define drill targets for the current and future seasons.”

One has to wonder when the monetization cycle will begin on the Company’s more advanced stage assets (the Company enjoys strong backing from Agnico Eagle (AEM.T) and Kinross (K.T)).

I could go on, and on, but I’m going to end it here with White Gold, cept to say: I’ve added to my White Gold position in recent sessions believing this current (lowly) valuation is out of whack. Also, newsflow could be on the cusp of finding a whole new gear. I’d suggest conducting your own thorough due diligence here (consider me biased).

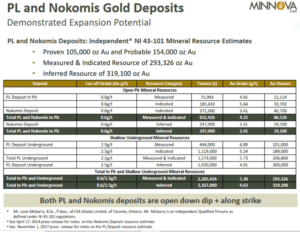

Minnova (MCI.V) is a company offering the potential for (near term) production and significant (high-grade) exploration upside at its past-producing PL Gold Mine in the prolific Flin Flon—Snow Lake Greenstone Belt of Central Manitoba.

On October 15th, the Company released stepout drill hole assays from its flagship project:

Minnova Corp. Step-Out Drilling Expands High Grade at PL Mine

Highlighted intercepts include:

- 11.7 g/t over 1.00 meters;

- 7.55 g/t over 1.00 meters;

- 6.99 g/t over 1.50 meters;

- 6.92 g/t over 1.20 meters;

- 10.7 g/t over 1.00 meter;

- 11.4 g/t over 1.00 meter.

“The purpose of the drilling program was to demonstrate the exploration and resource expansion potential of the PL Mine property. Holes M-20-01 through M-20-11 are all located outside the November 2017 mineral resource and reserve estimate resource wireframes (see news release dated November 1, 2017) and were designed to test the PL North target area to potentially expand the current PL Mine resource whereas holes M-20-12 and 13 were located within the current resource area to potentially expand and upgrade the current resource.”

This press release went on to add that drilling is scheduled to restart in mid to late November and will target further resource expansion with significant stepouts along strike. This campaign will also target new mineralized structures in the Footwall Tonalite.

The following vid is an August 28th interview with Gorden Glenn, Minnova’s CEO (good info here)…

At the top of Minnova’s (MCI.V) website, it states the following: “We’re updating our website… in the meantime check out what we’re working on.”

That message has been there since I launched my coverage back in early August. A website is normally the first place a prospective investor goes to conduct their due diligence. It would be good to see an update, soon.

A quick note on Coral Gold (CLH.V)

Coral Gold—one of Highballer’s Top Three Picks for 2020 and the object of a recent takeover bid by Nomad Royalty (NSR.T)—announced a special meeting on October 15th.

“The Interim Order authorizes, among other things, Coral to call, hold and conduct an Annual General and Special Meeting of holders of its common shares (“Coral Shareholders”) to consider, and if thought advisable, approve the proposed Arrangement (the “Meeting”). In accordance with the Interim Order, the meeting will be held on November 12, 2020 at 11:00 a.m. (local time) at 3200 – 650 West Georgia Street, Vancouver, B.C., V6B 4P7. The record date for determining the Coral Shareholders entitled to receive notice of, and to vote at, the Meeting is the close of business on September 22, 2020.”

If you believe, as I do, that this recent sideways grind in the precious metals is getting long in the tooth, Coral may represent an opportunity at current prices. There’s an arbitrage opp here too, one that will put Nomad paper (and warrants) in your account as soon as the deal is finalized.

That’s it for this episode of Highballer. Chat soon.

END

—Greg Nolan

Full disclosure: I have no marketing relationships with any of the companies featured above. The author owns shares in Harfang, Skeena, White Gold, and Minnova.