In early October, there was evidence that an important bottom was forming in the precious metals arena.

The following excerpts are from a (timely) article I put up on the Equity Guru website on October 4th—Unabated selling, dry powder, the upside of buying when you’re the only bidder in the room…

(click on the following charts to bring them more into focus)

… it’s important to bear in mind that these are uncharted waters, for all market sectors. In this era of difficult-to-comprehend debt, negative bond yields, over-heated monetary expansion, and the likelihood that inflation is not as “transitory” as the Fed would have us believe, the storm clouds are gathering, intensifying.

Regarding inflation, the Fed now appears to be wavering in its convictions. During a recent monetary policy meeting, chairman Powell stated: “We do think that inflation will remain elevated until supply bottlenecks are resolved. Exactly when that will happen is not possible to say.”

Some charts

The charts and attendant price patterns across multiple sectors are being surveilled by a universe of traders. The major indices—the Dow 30, the Nasdaq, the S&P 500—all appear to be forming potentially bearish Head and Shoulders patterns. Heightening the drama, a number of popular pundits are calling for an imminent crash.

So why isn’t gold screaming higher amongst all of this chaos and uncertainty?

Though the short term is impossible to call—a stock market shock will likely take everything down with it as liquidity constraints and margin calls come into play—the precious metal, as a hedge against protracted periods of uncertainty, should outperform.

Gold’s trajectory in the immediate aftermath of the March 2020 crash was nothing short of spectacular…

Don’t worry—I won’t get into the fiction that is the paper price of gold, which defies even the most basic measure of price discovery. I’d need my tinfoil hat for that one anyway (my girlfriend’s cat now occupies said hat).

Back to the present state of the junior exploration arena: Are we grinding out a bottom here?

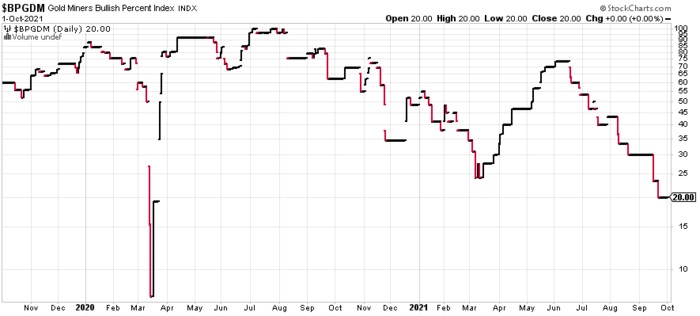

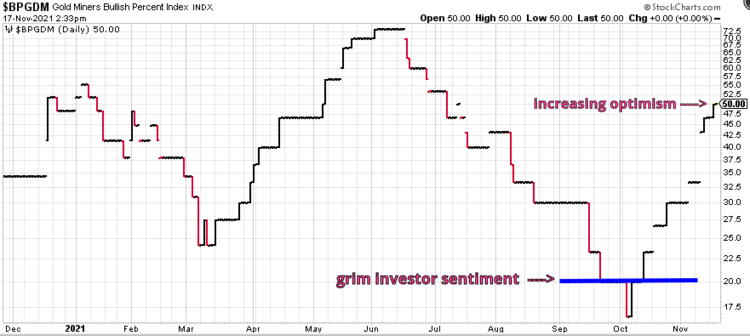

One indication that this sector-wide correction is getting long in the tooth is the current level of negative sentiment—the pervasive despair among investors as measured by the Gold Miners Bullish Percent Index. Not since the 2020 market crack has pessimism sucked thus and so.

Bottoms have a way of forming when negative emotions run this deep.

Psychologically, it’s effortless buying during an uptrend, especially when the online message boards abound with bullish I-can’t-believe-how-freakin-great-this-company-is type commentary.

But when sentiment is this bad—when fund managers and hapless retail investors toss their positions with little regard for intrinsic value—it’s difficult, painful even, stepping up to the plate and initiating purchases.

Buying severely depressed stocks is a counterintuitive process—an exercise that should trigger a host of negative emotions on a gut level.

In cycles past, my biggest wins in this arena stemmed from overriding my reluctance and apprehension, holding my nose, and willing myself to pull the trigger on my trading platform. This is the act of a true contrarian: Standing alone. Buying when you’re the only bidder in the room.

Though charting is a largely subjective exercise—surety depends on how sharp your pencil is—it can be a valuable tool. At the very least, it can help structure your thinking where entry and exit points are concerned.

This chart of the VanEck Junior Gold Miners ETF (GDXJ), augmented by my support/trendlines, tells me that the sector may be in the process of bottoming out.

A disciplined chartist always looks for more evidence.

Back in my rookie days, my trading mentor stressed the importance of Divergences (positive and negative). A Positive Divergence occurs when the price of a commodity, index, or stock prints a new low while a momentum indicator (Money Flow, for example) registers a higher low.

This next image zooms in on the GDXJ and shows a classic Positive Divergence in the making.

The new lows in the GDXJ versus the higher lows in the MFI is an indication that the downtrend is losing momentum.

The correlation between the negative sentiment readings, the various support/trendlines, and this Positive Divergence lends validity to the notion that a bottom may be near.

Back to the here and now

The GDXJ was trading at $38.35 when I published that piece in early October—it’s currently trading north of $47.00 having broken out from the downtrend line presented above…

The GDX? It has a similar price pattern and breakout.

The other chart I featured in early October—the Gold Miners Bullish Percent Index (BPGDM)—now depicts greatly improved sentiment in the gold arena.

Bottom line: it could be game on for the precious metals sector. Gold is currently trading at $1869 as I edit this piece. The next stop is resistance at $1900.

(Update pre-open on November 22nd: Scrolling back up to the GDXJ chart, we want to see a higher low printed here if this current consolidation turns south. $42.00 needs to hold. If we get a close below $42.00 on significant volume, all bets are off)

Companies on our list generating headlines

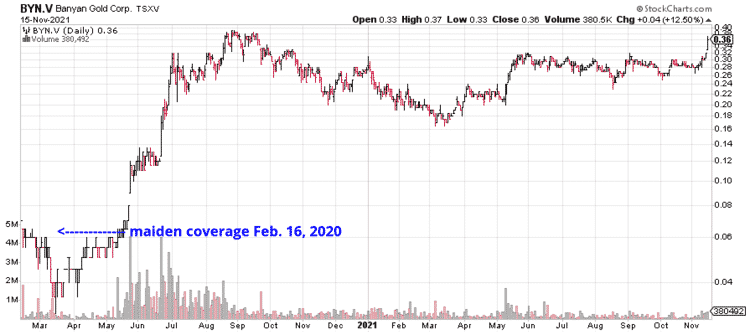

Banyan Gold (BYN.V)

- 225.17 million shares outstanding

- $81.06M market cap based on its recent $0.36 close

I’m a big fan of Banyan, its flagship asset, and its CEO, Terra Christie.

While many companies in the junior arena are under pressure with year-end tax-loss selling exacting a toll, Banyan appears on the verge of testing its all-time highs.

Banyan was first featured in these pages on February 16, 2020, in a piece titled Banyan Gold (BYN.V) – resource expansion and discovery potential in the Yukon. The price of admission back then: a mere six pennies ($0.06). Early investors who took advantage of those bargain-basement prices are sitting on a potential 500% gain.

For those playing the long game—those who view Banyan as a potential M&A candidate for its high-quality ounce-count—more price appreciation could be in the offing as there’s multi-million-ounce potential here.

A November 9th headline:

Banyan Gold Provides Q3 Exploration Update, Aurmac Project, Yukon

Here, Banyan reported an acceleration in drilling at their flagship AurMac Gold Project. There are now three rigs turning.

The Phase II 2021 AurMac exploration program continues to follow up on successful 2021 Phase I drilling at the Project which, since February of this year, has culminated in approximately 25,000 metres (“m”) and over 120 diamond drill holes completed to date. With planned drilling of over 30,000 m, there will be assay results for well over 90 drill holes in the coming months.

The remainder of this calendar year will see a two-fold exploration focus at AurMac:

- Two diamond drill rigs targeted on continued growth of the Powerline Deposit through expansion of the on-going 100 m step-out grid-based drilling resulting in the definition of a much larger overall mineralized footprint of the Powerline deposit; which remains open in all directions, and

- One diamond drill concentrated on tighter spaced drilling towards refinement of the gold continuity modeling of the Powerline Deposit – towards an updated AurMac Gold Resource statement in 2022.

Diamond drilling at AurMac since the Q1 2020 maiden resource announcement stands at approximately 35,000 m – which has been targeted on potential resource expansion of the Airstrip Deposit (2020 drilling); and throughout 2021, the focus has been the rapid expansion of the mineralization footprint at the Powerline Deposit. It is anticipated that this season’s exploration campaign will continue into December and will recommence in early 2022.

The Company is rapidly defining a large, near-surface, (potentially) bulk-tonnage resource—a resource likely watched closely by resource-hungry predators (producers looking to bulk up their lean project pipelines).

It’s important to keep in mind that every day a producer digs ore out of the ground—every day they’re open for business—their mineral inventory dwindles.

Whether we’re talking about a Senior, a Mid, or a Small Producer, the key to long-term survival is a robust pipeline of development projects.

The brutal bear market of the past decade forced many of these companies to dramatically scale back exploration spending.

Since many of these miners were unable to grow their project pipeline organically, through exploration, they’ll need to take on the role of acquirer… predator.

In recent weeks we’ve seen M&A activity in the gold sector begin to pick up. Late last September Agnico Eagle and Kirkland Lake announced their intention to combine in a deal valued at $13.4 billion.

More recently, Australian-based Newcrest took out Pretium in a deal valued at $3.5 billion.

If the pace of M&A is indeed beginning to accelerate, companies like Banyan likely have a target on their back.

Significant results from Banyan’s 2021 drill campaign

- 0.88 g/t Au over 54.6 meters from 80.0 meters in AX-21-66;

- 0.56 g/t Au over 67.5 meters from 60.5 meters in AX-21-68;

- 0.75 g/t Au over 46.6 meters from 52.5 meters in AX-21-70;

- 0.55 g/t Au over 81.2 meters from 86.5 meters in AX-21-73;

- 0.73 g/t Au over 56.6 meters from 38.1 meters in AX-21-75;

- 0.50 g/t Au over 76.2 meters from surface in AX-21-79;

- 0.56 g/t Au over 50.3 meters from 15.2 meters in AX-21-86;

- 1.03 g/t Au over 81.4 meters from 32.0 meters in AX-21-88;

- 0.70 g/t Au over 50.3 meters from 85.1 meters in AX-21-91;

- 0.69 g/t Au over 45.7 meters from surface in AX-21-93;

- 0.70 g/t Au over 52.3 meters from 119.9 meters in AX-21-95;

- 0.42 g/t Au over 186.1 meters from surface in AX-21-97;

- 0.62 g/t Au over 110.7 meters from 96.6 meters in AX-21-99;

- 0.54 g/t Au over 195.9 meters from surface in AX-21-100;

- 0.74 g/t Au over 144.8 meters from surface in AX-21-101;

- 0.50 g/t Au over 89.6 meters from surface in AX-21-111;

- 1.28 g/t Au over 28.2 meters from surface in AX-21-113

Tara Christie, President and CEO:

“The execution of an efficient drill program designed to deliver maximum value for shareholders, by increasing ounces, will continue to be the focus of Banyan’s 2021 AurMac exploration season. At current drilling rates, we will exceed the 30,000 m drill target we have set for ourselves this year and anticipate we will be well positioned for a meaningful AurMac resource update by Q2 2022.”

The Company states that assays from 2021 drilling at Aurex Hill, a near-surface bulk tonnage target that was the focus of an 18 hole 4,400-meter campaign, are pending. You might have guessed that these delays are a lab issue (so what else is new?).

CEO Christie’s presentation at last weekends Metals Investor Forum (Nov. 12-13, 2021):

Important to note that Banyan is cash-rich with roughly fifteen mill in the till ($15,000,000).

Defense Metals (DEFN.V) – (DFMTF.OTC) – (35D.FSE)

- 80.58 million shares outstanding

- $22.96M market cap based on its recent $0.285 close

A November 9th headline:

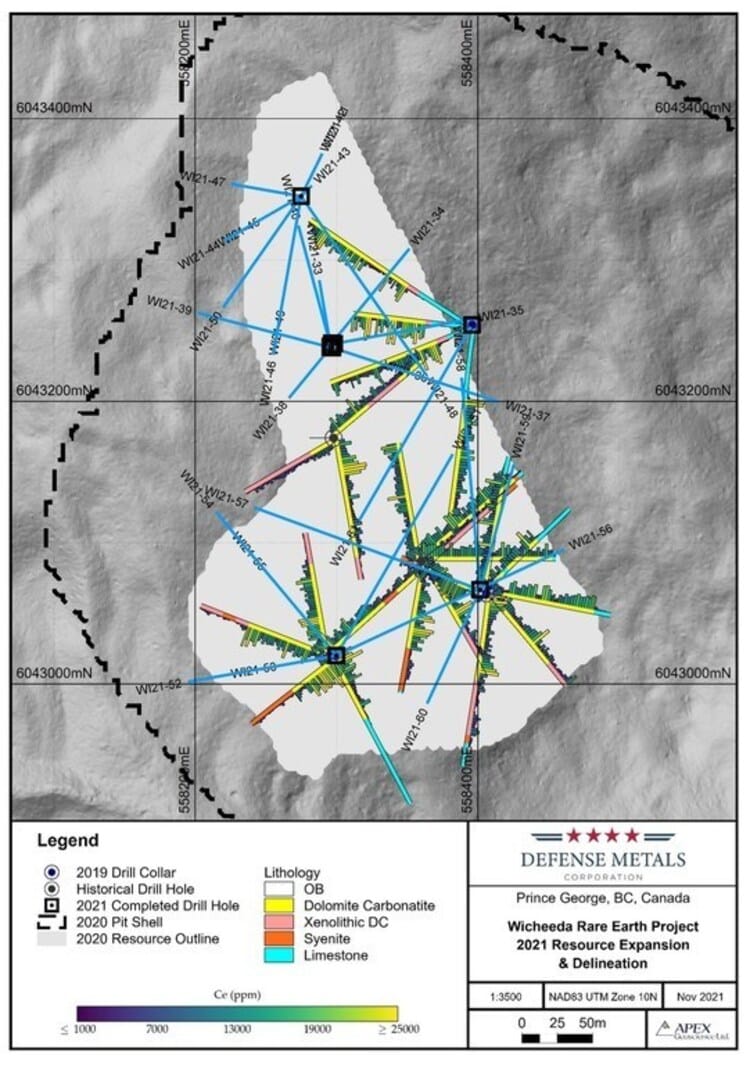

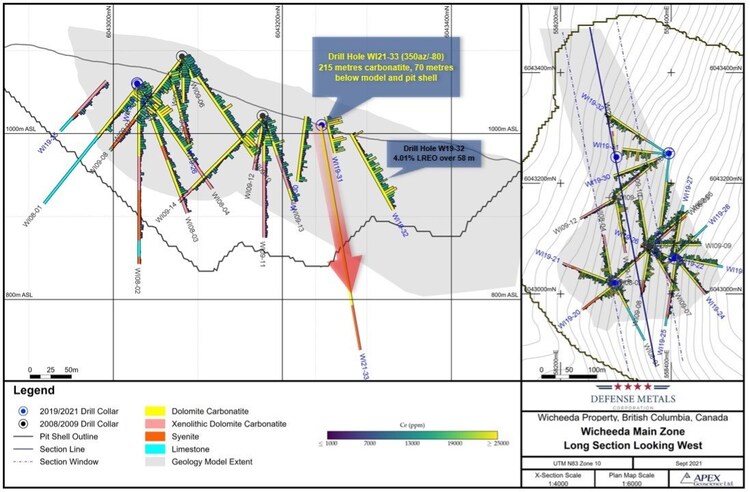

Defense Metals Completes Resource Expansion Drilling Program

Here, Defense announced the completion of a 2021 drill program at its Wicheeda Rare Earth Element (REE) Project. This efficiently run campaign, designed to expand the mineralized envelope and upgrade the existing resource to higher confidence categories, saw 5,349 meters drilled in 29 holes.

As it currently stands, the Wicheeda deposit has an Indicated resource of 4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Elements) and an Inferred resource of some 12,100,000 tonnes averaging 2.90% LREO.

A previous campaign in 2019 generated a 49% increase in tonnage and a 30% increase in overall grade (Defense Metals press release dated May 13, 2020).

The now complete 2021 drilling program successfully accomplished the Company’s goal of identifying the expansion of the REE mineralized dolomite-carbonatite zone to the north, in addition to further delineating existing resources mineralization zones within the central and northwestern areas of the deposit.

Drilling within the northern sector of the Deposit occurred over an area of approximately 200 x 100 metres where multiple drill holes intersected visually mineralized dolomite carbonatite beyond depths predicted in the geological model, both laterally and vertically (Defense Metals news release dated September 21, 2021). Drilling within the southern area of the deposit, primarily designed to upgrade existing inferred and indicated resources, has also confirmed and in some cases expanded the mineralized dolomite carbonatite zone.

The longest hole during this recent campaign was 301.5 meters, in the southern section of the deposit. The deepest hole ran roughly 270 meters (vertically) below surface. As the deposit is on a hill, it was drilled to a maximum vertical extent of 400 meters.

Clearly, the primary goal with this 2021 campaign was to upgrade the resource to the Measured and Indicated categories.

Once the results are in hand, a process of re-modeling and updating the current resource will unfold. Once complete, plans for a 2022 drill program will take shape—plans that will include some geotechnical drilling to meet the needs of a future PFS.

Results from this 2021 campaign will begin to flow in Q1 of 2022.

Craig Taylor, CEO:

“We are pleased to have completed our 2021 drilling campaign. Our expectation is of expanding and upgrading the current Wicheeda REE Deposit mineral resource. We believe the 2021 drilling results, once released, will firmly place the Wicheeda REE Deposit among the most significant rare earth deposits in North America.”

A Whicheeda PEA is on deck. It could drop any day now.

Defense has roughly one mill in the till ($1,000,000).

Cartier Resources (ECR.V)

- 218.15 million shares outstanding

- $38.18M market cap based on its recent $0.175 close

Newsflow out of the Cartier camp has been fairly subdued over much of the past year. And its price-performance over that same period of time has been a disappointment. With the precious metals seeing some nice upward trajectory over the past few weeks, I was hoping the stock would find a new gear.

But there is progress here.

A November 4th headline:

Cartier Awards Chimo Mine Project PEA to InnovExplo

After a good deal of groundwork—a resource update, internal engineering studies, and a successful ore-sorting campaign—this first pass economic study will shed some light on the Company’s Chimo Mine Project, and its current ounce-count.

- 6,616,000 tonnes at an average grade of 3.21 g/t Au for a total of 684,000 ounces of gold in the Indicated category and;

- 15,240,000 tonnes at an average grade of 2.77 g/t Au for a total of 1,358,000 ounces of gold in the Inferred category.

Some question the overall resource grade/depth at Chimo. That’s what the ore-sorting tests were designed to address.

The initiation of a PEA is the scratch line. It’s where the rubber meets the road.

Philippe Cloutier, President and CEO:

“We are pleased that our Chimo Mine Project has reached this important milestone and believe it will demonstrate the significant potential of this key asset in the rich Val-d’Or mining district”.

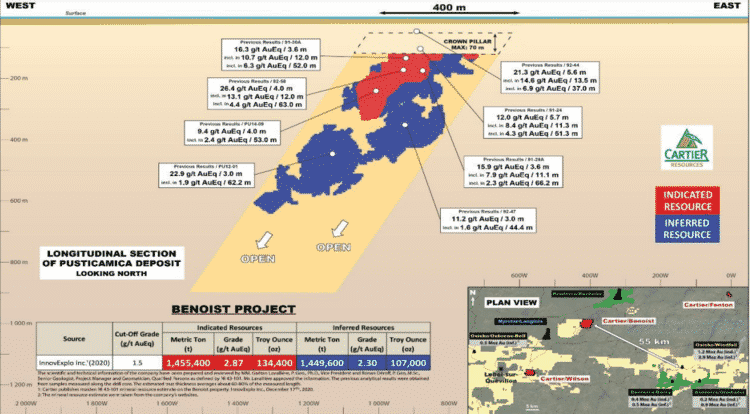

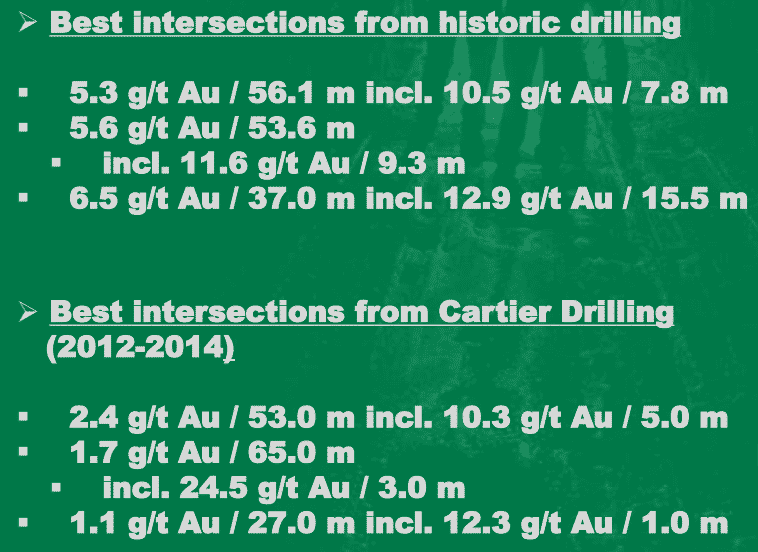

Earlier this year, Cartier launched an aggressive drill campaign at its highly prospective Benoist Project located just up the road from Chimo, roughly 65 kilometers northeast of Lebel-sur-Quévillon Québec.

We haven’t seen assays flow from this project yet—the first batch of results can’t be too far off.

Benoist may represent a major catalyst for the stock.

The following resource estimate for the Pusticamica Gold Deposit underpinning the Benoist Project was generated using a gold price of US$ 1,610 and a cut-off grade of 1.5 g/t AuEq:

- 1,455,400 tonnes at an average grade of 2.87 g/t AuEq for a total of 134,400 ounces of gold in the Indicated resource category;

- 1,449,600 tonnes at an average grade of 2.30 g/t AuEq for a total of 107,000 ounces of gold in the Inferred resource category.

- Drilling aims to expand the resource of the Pusticamica deposit and discover new deposits peripheral to the known mineralization

Benoist holds the potential to generate very decent grades over substantial widths.

The Company also has drills turning at the Wilson Property with JV partner Hawkmoon Resources. This is a fairly aggressive campaign that should see 5,000 meters drilled in 29 holes.

Cartier could surrender additional market cap to year-end tax-loss selling, but the current valuation—<$40M—could represent an opportunity. Bring on Benoist.

At last count (as per their September pitch deck) the Company had roughly eight-point-five mill in the till ($8,500,000).

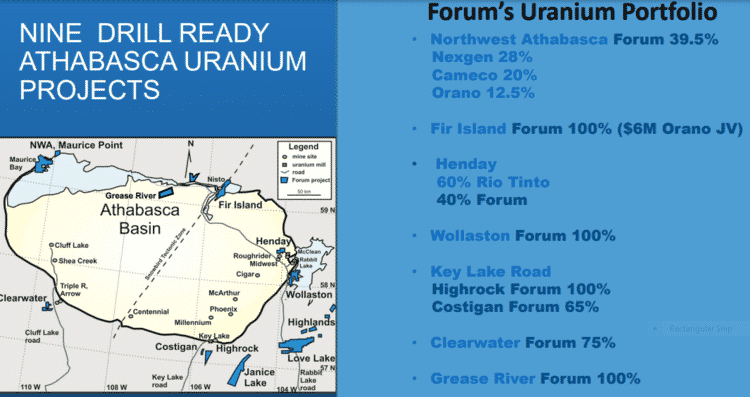

Forum Energy Metals (FMC.V) – (FDCFF.OTC)

- 166.19 million shares outstanding

- $63.98M market cap based on its recent $0.385 close

On November 8th, Forum laid out its (revised) plans for 2022 via the following headline:

Forum Provides Update and Plans for 2022

URANIUM PROJECTS

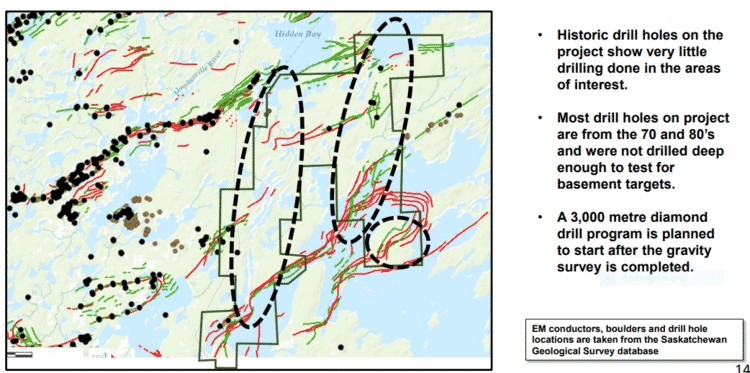

Wollaston (100% Forum)

Permits have been submitted for a 3,000-meter drill campaign—a program slated to commence in mid-January of 2022.

The Wollaston project is located within 10 kilometers of Cameco’s Rabbit Lake uranium mill and 30 kilometers of Orano/Denison’s McClean Lake uranium mill.

Staked in April, 2020, the Company conducted a gravity survey in the spring of 2021.

Having compiled historical geophysical + drill data, Forum has identified a number of prospective drill targets that will see the business end of the drill bit during this upcoming campaign. Additional gravity surveys will be conducted in January as part of this proposed campaign.

At the MIF conference, Rick Mazur, Forum’s CEO, talks about his uranium project pipeline, as well as a fascinating new (environmentally friendly) extraction technology—Surface Access Borehole Resource Extraction (SABER)—that would benefit projects like Wollaston, should the Company tag a new discovery (the SABER discussion begins at the 6:00 mark).

Northwest Athabasca Joint Venture (39.5% Forum; 28% NexGen; 20% Cameco; 12.5% Orano)

Permits have been submitted for a 3,500-meter drill program at the Northwest Athabasca JV. In deference to good environmental stewardship, Forum spent the past two months decommissioning the old camp as part of their Phase-1 program.

Drilling at the project has been postponed until the winter of 2023 as a new camp facility could not be delivered in a timely manner due to the barge season closure. In the meantime, the Company will be conducting a cost-benefit analysis to mobilize camp, fuel, and equipment, to fine-tune a future exploration campaign.

The historical 1.5 million pound Maurice Bay uranium deposit* is a perched deposit in the sandstone based on 600,000 tonnes grading 0.6% U3O8 to a depth of 50 metres in the Western Athabasca Basin (Source: Saskatchewan Industry and Resources, Miscellaneous Report 2003-7). Forum is focused on the discovery of a larger uranium deposit hosted at the unconformity between the sandstone and basement rocks and/or within the basement rocks.

Fir Island (Orano Canada Option to Earn 70%)

As operator of the Fir Island project, Forum is currently reviewing tenders for a resistivity survey to be conducted in an area north of the drilling completed this past winter. The survey is slated to commence in March of 2022.

Strong indications of potential uranium mineralization have been identified along the Cathy Fault. Results from the resistivity survey will be used to identify new anomalies. We should see a winter-of-2023 drill campaign here.

Other Uranium Projects

Forum has identified a number of drill targets from past drilling by Forum at the 100% owned Highrock and the 65% owned Costigan projects located 5 km south of Cameco’s Key Lake uranium mill. In the Western Athabasca Basin, Forum’s 75% owned Clearwater project, on trend from Fission’s Triple R and NexGen’s Arrow development projects has drill targets identified by previous Forum drilling. Expressions of interest have been received for these projects by potential joint venture partners and permits have been submitted for drilling.

There are a lot of companies vying for a position in the prolific Athabasca Basin of northern Saskatchewan. There’s potential for significant newsflow with these projects as Forum entertains various offers.

ENERGY METAL PROJECTS

Janice Lake Copper/Silver (Rio Tinto Option to Earn 80%)

The final five holes from a summer-of-2021 drill program are expected within the next two weeks. Forum and Rio Tinto will be meeting to review results from their recently concluded 2021 exploration campaign later this month—plans for 2022 will also be discussed during this meeting.

Love Lake Nickel/Copper/Palladium (100% Forum)

Forum completed eleven drill holes totaling 2,844 meters on three targets identified over the Love Lake mafic/ultramafic complex (see press release dated September 20, 2021). Results are expected later this month or early December.

Quartz Gulch Cobalt/Copper (100% Forum)

A prospecting, mapping, and sampling program was completed in early October (see news release dated October 13, 2021). Results are expected in late December/early January. The Company will decide how to push the project forward after said results are received and analyzed.

The Quartz Gulch property consists of 127 claims totaling 10.65 square kilometres, located approximately five kilometres to the southeast of the past producing Blackbird cobalt mine and Jervois Global Limited (“Jervois”) Idaho Cobalt Operation, the only permitted cobalt mine under construction in North America. Jervois reports that development activities at the Idaho Cobalt Operation on trend from Quartz Gulch are on track for commissioning of the mine in mid-2022 (Source: Jervois Global Limited News Release dated September 27, 2021).

There’s an informative Market Musings Podcast dated November 15th featuring CEO Mazur and Forum’s VP of Exploration, Ken Wheatley—Wheatley is a Professional Geoscientist with eight uranium deposits under his belt, four of which became producing mines in the Athabasca Basin.

If you’re interested in U3O8 and the Athabasca Basin, you’ll appreciate the detail in this podcast.

Homing back in on the Wollaston project that will see a 3,000-meter drill campaign in mid-January, this next map further highlights the potential.

The red lines on this map represent the conductors these geological sleuths follow to prioritize drill targets in The Basin. The black dots are historic drill holes. Clearly, this project is vastly under-explored.

If there’s a uranium deposit lurking in Wollaston’s subsurface layers, Wheatley will tap it.

Forum currently has five mill in the till ($5,000,000).

The Company’s recently updated slide deck can be found here.

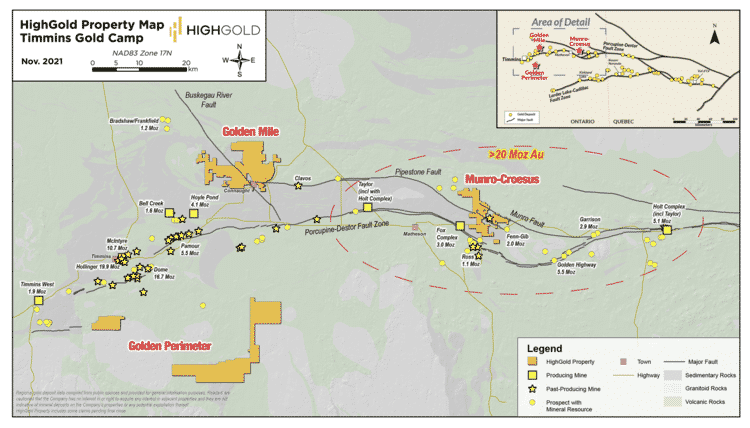

HighGold Mining (HIGH.V) – (HGGOF.OTC)

- 72.86 million shares outstanding

- $118.04M market cap based on its recent $1.62 close

While we wait on additional assay-flow from their flagship Johnson Tract Project in Southcentral Alaska (resource = 750k ounces AuEq @ 10.9 g/t AuEq Indicated plus 134k ounces AuEq @ 7.2 g/t AuEq Inferred), HighGold is stepping up activity around its assets in the Timmins camp of Ontario.

A November 4th headline:

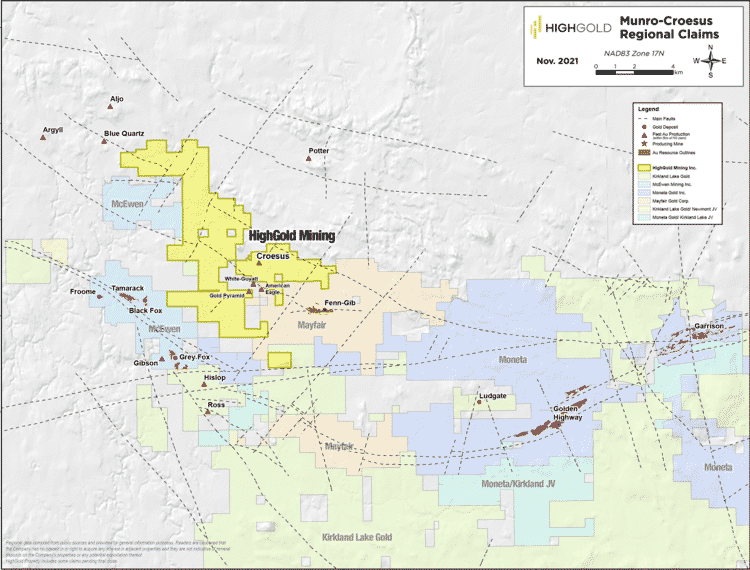

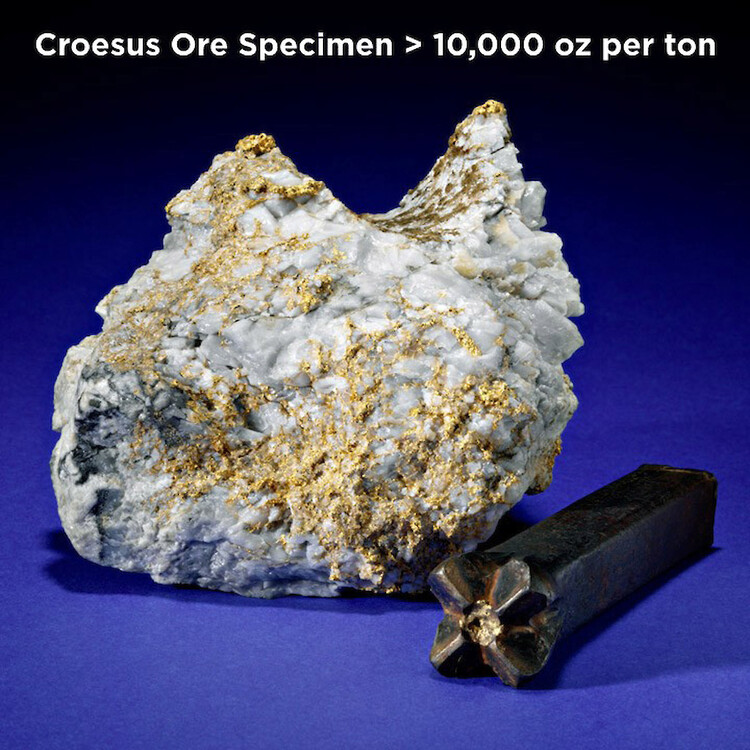

The Munro-Croesus Project is located along Highway 101 in the heart of the Abitibi greenstone belt, Canada’s premier gold mining jurisdiction (map above). The Project covers 36 km2 of highly prospective geology situated between the Black Fox Mine Complex operated by McEwen Mining Inc. and the Fenn-Gib Project being developed by Mayfair Gold Corp (map below). Recent consolidation has been part of an ongoing strategy by the Company to tie-up the patchwork of patented and unpatented mining claims surrounding the historic Croesus Gold Mine into one contiguous package and enhances the exploration potential of the Project.

A 3,000-meter Phase-1 drill program is now underway at Munro-Croesus. This campaign is designed to follow up on encouraging results encountered peripheral to the historic Croesus Gold Mine.

This current phase of drilling is part of a multi-phase effort that should deliver consistent assay-related newsflow through H2 of 2022. Phase-1 is expected to run into mid-December. A larger Phase-2 drill campaign is slated to commence in January 2022.

Darwin Green, President and CEO:

“Following nearly two years of land consolidation and targeting work by HighGold, we are excited to commence what is anticipated to be a significant and sustained exploration campaign at the Munro Croesus Project. The Munro-Croesus project is the jewel in our Ontario portfolio with its location in the +100Moz Timmins Gold Camp, proximity to major gold-bearing breaks and neighboring multi-million-ounce gold deposits, and an average grade of 95.3 g/t Au from the historic Croesus Gold Mine. Most of the Project area has gone unexplored since the 1930s due to a legacy of fragmented mining claims which, until now, had never been unified under single ownership.”

2021 Exploration Work to Date

The Company has taken a systematic approach to exploration following its land consolidation efforts in order to:

- better understand the regional setting in the context of the Porcupine-Destor, Pipestone, and Munro Faults;

- refine and prioritize drill targets, and;

- develop new conceptual models for controls on the historic bonanza grade gold mineralization.

This region has yielded some of the highest-grade gold ever mined in the province.

Work on the property in 2021 included:

- Property-wide airborne magnetic and electromagnetic (VTEM) survey and LIDAR;

- Geological, geochemical and historic diamond drill hole data compilation;

- Detailed structural study on fault and vein kinematics by SRK Consulting;

- Geological mapping, sampling, and mechanical trenching of known quartz vein prospects and identification of other potential target types and host environments including shear-hosted gold in variolitic basalts, ultramafic rocks (green carbonate zones) and sediments, and intrusive-hosted gold adjacent to the major faults.

2021 Fall Drill Program

The Program is designed to systematically test the strike and down-dip/down-plunge potential of two vein structures, the #2 Vein and #4 Vein targets, which yielded encouraging results from surface sampling and reconnaissance drilling completed in the fall of 2020.

The #2 Vein target is a northeast trending vein structure that has been traced by surface mapping for several hundred meters along strike to the southwest of the historic Croesus Gold Mine. Surface channel sampling by the Company in 2020 returned values up to 8.4 g/t Au over 0.9 meters.

The #4 Vein Target area is located one kilometer west-southwest from the Croesus Gold Mine and was developed during the 1916-1919 era with an inclined shaft (“#4 Shaft”) to a reported depth of 100 feet. Channel sampling by the Company in 2020 returned 11.24 g/t Au over 1.85 meters, 17.05 g/t Au over 0.8 meters, and 8.42 g/t Au over 1.5 meters (see Company press release dated September 22, 2020). Drilling in the Fall of 2020 returned values up to 3.16 g/t Au over 4.2 meters, including 11.01 g/t Au over 1.10 meters in drill hole MC20-46 (See Company press release dated December 22, 2020).

Additional planned 2021 Fall programs include ground DCIP geophysical surveys.

The regional consolidation effort continues.

“HighGold, through its wholly-owned subsidiary, has entered an agreement with arm’s length vendors (the “Vendors”) to acquire an aggregate of 10 single-cell mining claims and 14 boundary cell mining claims totaling approximately 2.7 km2 (269 ha) in the Timmins region, Ontario (collectively, the “Acquired Property”) that are contiguous with the Company’s existing Munro Croesus property package. In consideration of the Acquisition and subject to TSX Venture Exchange (the “TSXV”) acceptance, as applicable, the Company has made, or agreed to make, a cash payment in the amount of C$50,000 and will issue 100,000 common shares of the Company to the Vendors. Pursuant to the Agreements, the Acquired Properties are subject to certain net smelter returns royalties, a portion of which royalties may be purchased back by the Company.”

The Difficult Creek (DC) discovery hole the Company dropped on October 6th—577.9 g/t Au, 2,023 g/t Ag, 2.15% Zn, 0.30% Cu over 6.40 meters—is still fresh in my young/impressionable mind (K, I’m not that young). That was a FAT hit. Additional DC drill hole assays are on deck.

With twenty-seven mill in the till ($27,000,000), color the Co cash-rich.

Skyharbour Resources (SYH.V) – (SYHBF.OTC) – (SC1P.FRA)

- 127.07 million shares outstanding

- $81.32M market cap based on its recent $0.64 close

Skyharbour continues to make significant progress on multiple fronts.

A November 2nd headline:

Skyharbour Signs Option Agreement with Medaro Mining Corp to Option the Yurchison Uranium Project

A November 10th headline:

I covered these events in two very articles over at Equity Guru.

A November 10th EG piece…

An excerpt:

Aside from an additional 12 or 13 holes due in the coming weeks from their 100% owned Moore Uranium Project, where we saw an impressive 2.54% U3O8 over 6.0 meters (including 6.80% U3O8 over 2.0 meters) released in mid-September, there’s plenty of news to flow from these JV projects.

Come January/February of 2022, we should see four active drill campaigns.

The market has an appetite for high-grade U3O8 plays, especially in top-shelf jurisdictions like the Athabasca Basin.

Moore Lake assays are on deck.

A November 12th EG piece…

News round-up: Gold Mountain (GMTN.V) and Skyharbour (SYH.V)

An excerpt:

This 0.994% U3O8 over 5.7 meter hit further demonstrates the high-grade nature of the East Maverick Zone… mineralization that is entirely basement-hosted.

“Holes ML21-16 through -19 were drilled in the eastern end of the Maverick East Zone and at the eastern end of the Maverick Main Zone in order to establish linkages and extensions of the mineralization in the intervening interval between these two mineralized zones. The drilling successfully established the relationships and complexity of the geology and structure within this area, with geochemical results also pending for these holes.”

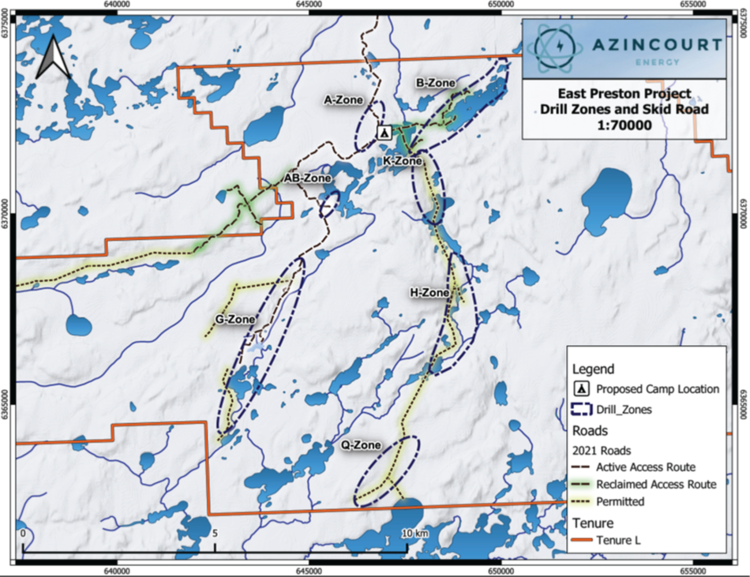

As noted in my November 10th piece, it’s shaping up to be a busy winter in The Basin. Come January/February of 2022, we’ll see drill rigs mobilized to several projects—another campaign at the flagship (drill plan details pending), a 7,000-meter program at East Preston with partner Azincourt, and an aggressive first-pass campaign at Hook Lake(up to 4,500 meters) with partner Valor. We may also see a rig mobilized to Preston, Mann Lake, or Yurchison (pure speculation on my part).

With China’s intent to build 150 nuclear reactors over the next 15 years, the fundamentals underpinning the uranium market are compelling. As CEO Trimble stated in a recent interview with Resource Stock Digest, China’s timelines can be relied upon—if they say 150 new reactors are on deck, we’ll see those 150 come into play.

This just in:

Azincourt Energy Updates Upcoming Drill Program at the East Preston Uranium Project, Saskatchewan

An East Preston Project winter-of-2022 exploration update:

TerraLogic Exploration Inc. has been contracted to facilitate and execute a planned diamond drilling program, which will consist of a minimum of 6,000 meters of drilling in 30-35 drill holes. Drilling will focus on the A-G and K-Q trends, commencing in the G-Zone where the 2021 drill program ended. The program will continue to test the G-zone to the south and then move to test the K-Q trend. The program may be modified as results warrant.

Preparations are well underway and contractors for drilling, camp services and roadwork have been selected. Opening of the 60 km winter road to access the property and campsite is expected to commence by the end of November, with camp construction in late December and into early January. Drilling is anticipated to commence in early January utilizing two diamond drill rigs to complete the program.

Trevor Perkins, Azincourt’s VP of Exploration:

“We are excited to return to the property and continue drilling where our 2021 program left off. This will be the largest program to date on the East Preston project. The A-G and K-Q Trends are at the point now where drilling is the best way to test our ideas, focus in on the most responsive areas, and confirm what these trends have to offer.”

Looking at Skyharbour’s recent price action, it’s consolidated back to a level that may represent a good/logical entry point.

With roughly Ten Mill in ($10,000,000) in cash and partner-company equity, Skyharbour is a cash-rich Athabasca Basin land baron.

Sokoman Minerals (SIC.V) – (SICNF.OTC)

- 200.04 million shares outstanding

- $75.01M market cap based on its recent $0.375 close

Sokoman recently released additional results from its flagship Moosehead Gold Project in north-central Newfoundland.

These results emerged from a barge-based drill program referenced in my October 27th Highballer report…

Highly anticipated results from a barge-based program shouldn’t be too far off. Here, at least 5,000 meters of drilling is planned to test the Upper Eastern Trend and Footwall Splay targets where previous drilling tagged some of the best grades/widths encountered to date—47 g/t Au over 4.6 meters (Footwall Splay) and 68 g/t Au over 8 meters (Upper Eastern Trend).

The November 10th headline:

Sokoman Reports First Barge-Based Drill Results, Moosehead Gold Project, Central Newfoundland

Barge-based highlights:

- MH-21-291: 4.95 meters of 27.70 g/t Au from 41.55 meters downhole;

- MH-21-283: 4.20 meters of 14.72 g/t Au within 9.80 meters of 6.65 g/t Au from 53.00 meters downhole.

Nice high-grade hits. Shallow too.

The Company appears to have thwarted any further carnage with this very decent batch of assays, and right around key chart support…

As per their June pitch deck, the Company had roughly fifteen mill in the till ($15,000,000).

White Gold (WGC.V) – (WHGOF.OTC) – (29W.FRA)

- 137.25 million shares outstanding

- $107.05M market cap based on its recent $0.78 close

To the shock and elation of many a fatigued shareholder, White Gold has come back to life in recent sessions.

A barrage of assay-related headlines were released earlier this month.

On November 1st:

Highlights:

- 3 RAB holes drilled at the Ulli’s Ridge target intersected significant gold mineralization including:

- RAB006: 4.67 g/t Au over 6.10 meters;

- RAB005: 1.35 g/t Au over 21.33 meters;

- RAB009: 4.43 g/t Au over 1.52m, 1.53 g/t Au over 4.57m & 2.26 g/t Au over 9.14 meters.

- Gold mineralization encountered extends over a 500m strike length which remains open along strike to the southeast and northwest and makes up part of a 6.5km long x 1km wide gold in soils trend.

- Encouraging results were followed up with diamond drilling at the Ulli’s Ridge, with all assays pending.

Then, on November 8th:

Highlights:

- Drilling at Ryan’s Surprise has now encountered gold mineralization over an area measuring approximately 400m E-W by 400m N-S, and to a vertical depth of 450m and remains open along strike to the west and downdip.

- 2021 drilling tested mineralized zones an additional 150m along strike to the west and 100m downdip.

- All holes intersected gold mineralization with significant mineralization including:

-

- D026: 10.36 g/t over 3.25 meters, 2.07 g/t Au over 3.40 meters, and 2.09 g/t Au over 5.05 meters;

- D020: 3.66 g/t Au over 6.00 meters and 1.66 g/t Au over 25.50 meters;

- D019: 1.88 g/t Au over 15.00 meters and 1.57 g/t Au over 4.90 meters;

- D021: 1.84 g/t Au over 6.50 meters, 3.35 g/t Au over 6.05 meters, 1.38 g/t Au over 7.78 meters and 2.14 g/t Au over 5.85 meters;

- D024: 0.48 g/t Au over 43.75 meters;

- D023: 2.58 g/t Au over 6.65 meters.

- Gold mineralization is structurally controlled and has been preliminarily interpreted as multiple mineralized structures which display two dominant orientations – steeply SW dipping and moderately SE dipping, with the intersection of the two representing a possible fault, and remains along strike and down-dip.

- A video overview from management discussing these results and preliminary interpretations can be found at: https://www.youtube.com/watch?v=mZOYCxsUQbw

- Results from diamond drilling on the Betty and Ulli’s Ridge Targets and other exploration activities will be forthcoming in due course.

Just over the ridge from its primary resource base, at its VG Deposit, this next headline from November 11th:

Here, the Company reported an updated resource estimate – a near-surface Inferred ounce count of 267,600 ounces of gold (5,264,000 tonnes at an average grade of 1.62 g/t gold). This represents a 16% increase compared to a historical 2014 resource estimate. The VG deposit remains open in multiple directions.

And this just in…

There are some impressive values in this press release—50.0 meters of 3.46 g/t Au is a solid hit. Super solid.

Highlights:

- 6 diamond drill holes totaling 1,364m tested the Betty Ford target along an approximately 500m strike length, with hole lengths ranging from 190 to 278m.

- 2 of 6 diamond drill holes intersected significant broad zones of near-surface gold mineralization across a 100m strike length, including:

-

- Hole D003 intersected 50.0 meters of 3.46 g/t Au from 33.0 meters including a higher-grade core of 5.25 g/t Au over 19.0 meters downhole and an upper zone of 1.14 g/t Au over 6.1 meters from 15.9 meters;

- Hole D001 intersected 48.0 meters of 1.17 g/t Au from 19.0 meters including a higher-grade core of 2.38 g/t Au over 10.0 meters and an upper zone of 9.03 g/t Au over 1.0 meter from 6.0 meters.

- Gold mineralization is hosted within a newly identified east-west striking subvertical polylithic breccia unit that is 40m to 60m thick.

- The soil geochemical anomaly indicates that the shallow zone of gold mineralization remains open along strike to the east and 200m to the west.

- Drilling encountered 2 styles of mineralization: 1) broad zones (50m) of gold-silver mineralization within the polylithic breccia in holes BETFD21D001 and 003; and 2) narrower zones (1-5m) of silver-zinc-lead mineralization which was intersected in all holes.

- The Betty property is located on the eastern extension of the Coffee Creek Fault, which hosts Newmont’s Coffee deposit.

- The 2021 maiden diamond drill program focused on 2 of 5 targets identified on the Betty property, with drill testing of the other targets planned for next year’s program.

There are numerous maps and images associated with all of the above press releases—dig into them as they augment what the Company is encountering along this highly prospective, vastly under-explored White Gold District ground.

The Company’s current valuation is backstopped by a significant resource, buttressed by the likes of Agnico Eagle and Kinross.

I don’t have their current cash position, but this is a Company that will likely never want or need—Kinross and Agnico Eagle are both in for a weighty 17.1% of the outstanding common.

Prime Mining (PRYM.V) – (PRMNF.OTC) – (04V3.FRA)

- 112.41 million shares outstanding

- $564.31M market cap based on its recent $5.02 close

Prime is another classic example of a Be Right, Sit Tight scenario as the stock continues to generate very decent price trajectory (PRYM was first featured in these pages < 12 months ago at $1.52).

Today’s headline:

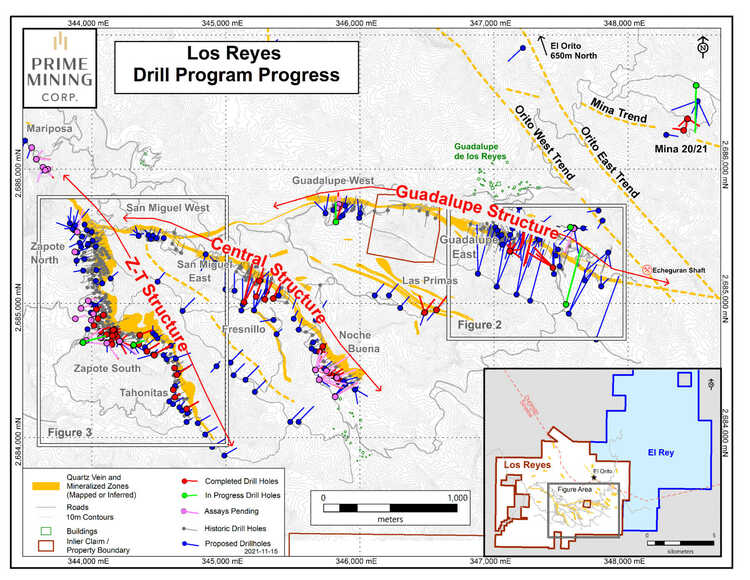

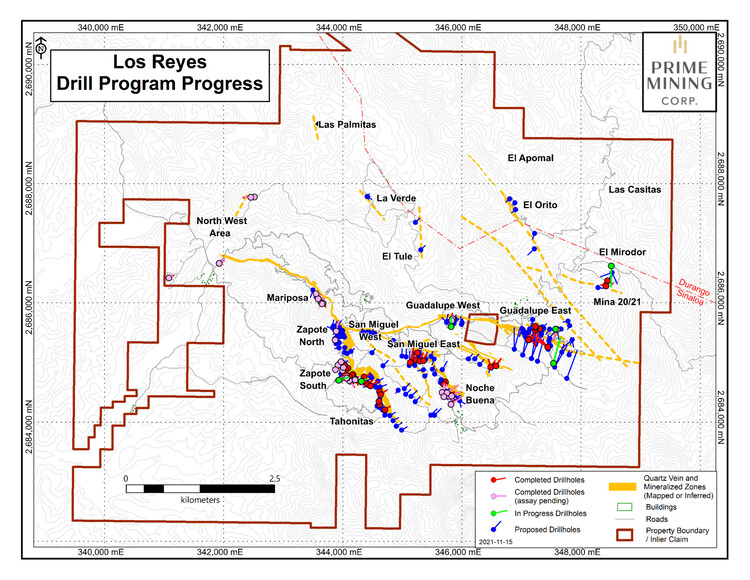

Prime Announces Commencement of Phase 2 Drilling at Los Reyes

Phase-2 drilling is now underway at their wholly-owned Los Reyes Gold-Silver Project in Sinaloa State, Mexico.

This current phase represents the Company’s second year of drilling at Los Reyes.

Phase-2 is an aggressive push along the exploration and development curve—eight diamond drill rigs, three reverse circulation rigs… over 250 drill holes for a minimum of 50,000 meters.

The Company has identified three main corridors of mineralization—additional higher-mill-grade gold-silver are in the crosshairs.

In addition to the three main structural corridors, several adjacent targets will see the business end of the drill bit for the first time.

Phase 2 – Principal Objectives

1) Expanding resources along the three main corridors of known open-pit mineralization, following up on previously reported high-grade areas in Phase 1:

- Guadalupe Structure – drilling will target new areas of bonanza-grade mineralization, including significant step-out drill holes to the south east;

- Zapote-Tahonitas (“Z-T”) Structure – will be drilled to connect deposits and to expand higher-grade areas to depth; and,

- Central Zone Structure – including San Miguel West, San Miguel East, and Noche Buena, will test the individual deposits to expand them to collectively form larger pits as well as to assess the depth potential in this under-explored area.

2) Complete first pass testing of newly developed targets:

- Last year’s technical program led to the development of several high potential targets within an approximate 5 kilometer (“km”) radius of the main mineralized corridors at Los Reyes;

- Drill testing will include high priority targets Mina 20/21, Mariposa, Las Primas, Fresnillo, El Tule, and others on the two parallel El Orito trends: and,

3) Resume surface mapping and sampling:

- Phase 1 prospecting, mapping, and sampling that led to the development of new targets will continue in Phase 2.

Daniel Kunz, Prime’s CEO:

“We are extremely pleased with not only the results from Phase 1, but also the progress we have made in our geological understanding, in only our first season of drilling at Los Reyes. With the rainy season now behind us, we are in the process of gaining full access to all areas of Los Reyes and already have six drills operating. This Phase 2 drilling will continue to advance the new discoveries made during Phase 1 at Guadalupe East, Zapote–Tahonitas, and Mina 20/21. Our team is excited to aggressively test our new geological understanding and exploration models we developed to target additional higher-grade mineralization.”

Kerry Sparkes, Prime’s Technical Advisor:

“This strategy favors wider-spaced drilling over closer-spaced infill drilling to test the full potential of Los Reyes. Phase 1 results provided key information regarding the optimum deposit elevations of high-grade gold-silver mineralization creating a rich target environment for discovery in Phase 2.”

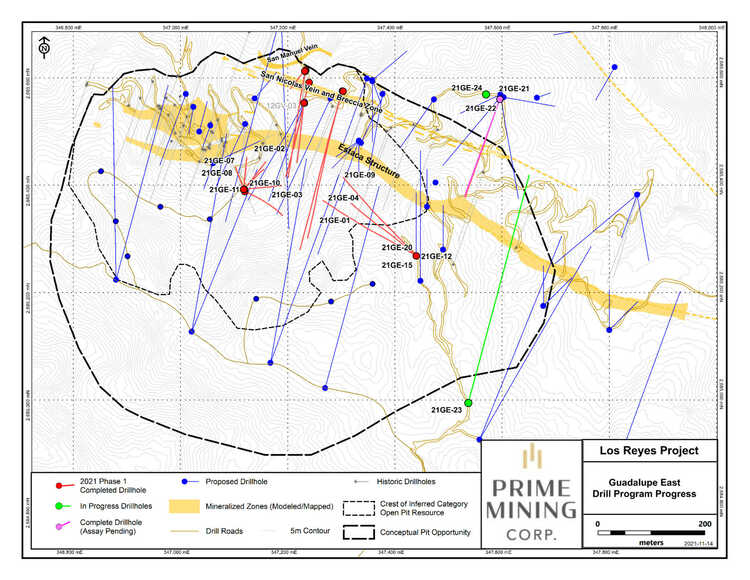

The following details, as per the guts of this press release (click on the following maps to bring them more into focus):

Guadalupe Structure (Guadalupe West through Guadalupe East)

The Guadalupe deposits comprise multiple veins within a 5 km long structural corridor (see Figure 1 (map above): Los Reyes Drill Program Progress, Figure 2 (map below) Guadalupe East Drill Program Progress). To the southeast of Guadalupe East, there is approximately 900 m of strike length that remains open. Phase 2 drilling includes 75 planned core holes for approximately 23,000 m targeting the Estaca, San Nicolas and San Manuel veins along strike in both directions (to the west and to the southeast), and down-dip with step outs between 100 m and 280 m spacings. Surface mapping, sampling, and modelling is confirming the existence of more veins in the east and southeast parts of the deposit than previously recognized. Combined, these veins have the potential to significantly reduce the quantity of waste associated with the Guadalupe East open pit resource.

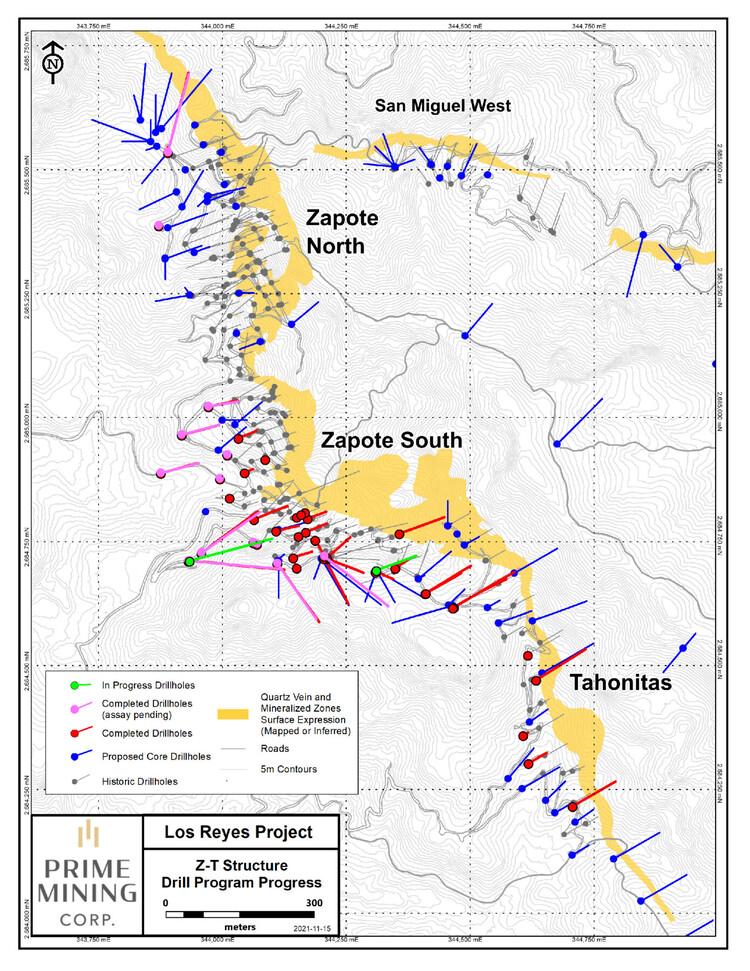

Zapote – Tahonitas (Z-T) Structure

Z-T, with a strike length of over 1.8 km, remains open along strike and at depth (see Figure 3 (map below): Z-T Structure Drill Program Progress). Phase 2 includes 79 core holes for approximately 13,800 m to expand and link the Zapote North, South and Tahonitas deposits. Phase 2 drilling will follow-up on high-grade mineralization previously identified at depth ‘below pit’ at Zapote. Drilling will also follow-up on near-surface mineralization at Tahonitas encountered in Phase 1. This mineralization is at relatively shallow depth compared to the higher-grade mineralization in the adjacent Zapote deposit. Phase 2 at Tahonitas will test both the depth potential of the system and to the south-east, where the system remains open. Additionally, current mapping and sampling work shows that the Z-T structure has the potential to be extended northwest and potentially connecting with the Mariposa target.

Central Zone Structure

This area contains San Miguel West, San Miguel East and Noche Buena and represents a 2.3 km structure that is relatively under-explored. Historical resources in the Central zone are relatively small-to-moderate in size but they remain open to further discovery and there are additional splays off the main structures including Las Primas, Fresnillo, San Miguel East north-arm, and a new emerging structure between Noche Buena and Las Primas that need to be tested. Phase 2 will include 54 core holes and will provide the first meaningful test of the potential of the Central Zone.

New Property Targets

The new targets are each located within newly identified structures some of which have the potential to develop into new mineralized corridors. They are all within 4 km of the known gold-silver deposits. The Phase 2 budget includes 8,875 m to test Mina 20/21, Mariposa, Las Primas, Fresnillo, El Orito, and El Tule (see Figure 4 (map below): Los Reyes Property Drill Program Progress).

Phase 1 included six drill holes at Mina 20/21 that identified the potential for bonanza high-grade mineralization [see June 28, 2021 news release]. Follow-up drilling at Mina 20/21 is currently underway.

Mariposa is an area of historic small-scale mining. Phase 1 work included adit and drift sampling and detailed surface mapping that showed a strongly mineralized structure. Mariposa is likely an extension of the Z-T structure. Since the commencement of Phase 2, 1,785 m in 9 holes have been drilled.

The Fresnillo structure was encountered in two core holes during Phase 1 drilling in the Central Zone near San Miguel East. Additional drilling is required to assess this structure’s extent and potential. The aerial magnetic survey completed in Phase 1 identified another parallel structure in this region which the Company plans to follow up and drill test.

Phase 1 Accomplishments

Phase-1 drilling saw over 25,650 meters drilled, pushing well past the original 15,000 meter drill plan. The accelerated program resulted in several new discoveries including bonanza grade mineralization below previous drilling, extending resources down-dip and along strike.

The program also recovered silver values that were not included in past resource calculations.

While on the subject of silver, some of the Ag values encountered in Phase-1 were impressive. Take the Tahonitas step out drilling for example:

- 14.51 g/t Au and 82.1 g/t Ag over 4.9 meters (3.8 m etw) at 16.5 meters, and 3.96 gpt Au and 9.2 gpt Ag over 2.9 meters (2.2 m etw) at 37.5 meters (21TA-08);

- 5.55 g/t Au and 163.8 g/t Ag over 2.8 meters (2.1m etw) at 13.5 meters (21TA-10);

- 2.07 g/t Au and 247.8 g/t Ag over 3.8 meters (2.90 m etw) at 113.0 meters, including 7.32 g/t Au and 840.0 g/t Ag over 0.9 meters (0.7 m etw) (21TA-05);

- 1.90 g/t Au and 78.3 g/t Ag over 6.0 meters (3.9 m etw) at 72.0 meters (21TA-09);

- 3.86 g/t Au and 448.0 g/t Ag over 1.0 meter (0.9 m etw) at 48.2 meters and 1.55 g/t Au and 230.2 g/t Ag over 4.4 meters (4.0 m etw) at 58.4 meters (21TA-11).

I’m looking forward to the next resource estimate, which will factor in the silver values dismissed by previous operators.

Phase-1 exploration at Los Reyes also included:

- the acquisition of 1,056 line km of high resolution aeromagnetic-radiometric data;

extensive regional and detailed geological mapping; - initiation of an alteration mineral study; and

- identification of alteration styles and multiple pulses of mineralization, all of which will helped vector the exploration program to a focus on higher mill-grade gold-silver mineralization within reach of open pits.

The Company’s September deck shows a cash balance of thirty-two mill in the till ($32,000,000).

END

Greg Nolan

Full disclosure: of the companies featured above, Forum Energy Metals and Defense Metals are Highballer clients. The author owns shares in Defense, HighGold, Sokoman, and Skyharbour. I am obviously biased in my views so do your own due diligence, and consult a registered investment advisor before making any investment decisions in this high-risk/high-reward arena.