The past two weeks have been particularly brutal for investors in the junior exploration arena. High-quality stocks are being tossed with little regard for their underlying intrinsic value.

At this conjuncture, year-end tax-loss selling season looms large—it seems more outrageous this year than last. If you correctly predicted this rout, and have dry powder, some of these current valuations look pretty damn compelling.

There are exceptions: Prime Mining, a company first featured here roughly 12 months back, is holding onto the lion’s share of its gains. Banyan, too—it’s weathering this storm exceptionally well, holding onto its multi-bagger gains since it was first featured here in February of 2020.

A company I took a shine to and began following closely over at Equity Guru in early October of 2020—Arizona Metals—is up a solid 650% in only 14 months, trading within 10% of its all-time highs.

So yeah, there are some noteworthy exceptions. And yeah, it’s possible to make serious coin in this arena, even when sentiment is in the dumper.

But some high-quality cos have REALLY taken it on the chin, giving up much of their hard-fought-for gains. Forum Energy Metals is one example…

We’re still up 100% since I first featured the company in mid-2020, but the pounding the stock has endured over the past few sessions is way overdone IMO. We’ll take a closer look closer at Forum a little further down the page.

Defense Metals (DEFN.V)

- 80.34 million shares outstanding

- $19.28M market cap based on its recent $0.24 close

Defense recently completed a 5,349 meter, 29 hole drill program at its Wicheeda Rare Earth Element (REE) Project—a campaign designed to upgrade the existing resource to the higher confidence categories (M&I). Due to Wicheeda’s robust mineralization, the Company almost certainly added tonnage to the deposit, and as a consequence, increased the (potential) mine life.

Defense Metals Completes Resource Expansion Drilling Program

As it currently stands, the Wicheeda deposit has an Indicated resource of 4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Elements) and an Inferred resource of some 12,100,000 tonnes averaging 2.90% LREO.

On November 24th, Defense released a highly anticipated PEA via the following headline:

A cursory look at the study’s metrics:

- The project has a pre-tax net present value (NPV) of $765 million1, and after-tax NPV of $512 million, at 8% discount rate;

- The pre-tax internal rate of return (IRR) is 20%, and the after-tax IRR is 16%;

- The capital payback is 5 years from start of production, and assumes partial self-funding of construction of hydrometallurgical plant from concentrate sales;

- Revenues average $397 million per year from sale of REE mineral concentrate (years 1-4) and mixed REE hydrometallurgical precipitate (years 5-16).

Operating margin of 65.2%; - Production of a saleable high-grade flotation-concentrate, with average 43% total rare earth oxide (TREO) for the life of the mine. It will be sold to market directly for years 1-4 and will then feed a project hydrometallurgical plant starting in year 5;

- Project near to key infrastructure;

- Base case economics were calculated using rare earth oxide (REO) prices of US$5.76/kg TREO in flotation concentrate and US$14.04/kg TREO in mixed REE carbonate precipitates.

The PEA boasts some solid numbers. The selling that ensued was triggered, presumably, by the modest after tax IRR of 16%.

A few points worth considering…

The PEA was prepared by SRK Consulting. Quoting Defense’s CEO, Craig Taylor, “We chose SRK due to its world-class experience and reputation in the mining industry and in particular its ability to assemble a team with highly specialized knowledge of Rare Earth Elements projects.”

SRK employed a conservative approach with this first pass economic study. The neodymium and praseodymium prices used were a three-year average. Quoting CEO Taylor again, “If we use today’s spot pricing for neodymium and praseodymium — our numbers would be staggering.”

Fair enough, and that’s what I thought when I first saw that 16% after-tax IRR. With this PEA, I was hoping to see a table demonstrating the after-tax NPV8% and IRR sensitivities to a broader (higher) range of neodymium and praseodymium prices. That would’ve fleshed out the (potential) “numbers” CEO Taylor referenced above.

SRK chose not to furnish us with a commodity price sensitivity table, and that’s all part of sticking to a conservative approach.

The REE universe will likely view this PEA as a highly reliable study—the numbers are conservative, SRK is top-shelf (respected world wide), and the metrics will improve markedly using current commodity price inputs. There’s a lot to build on here.

The following interview with CEO Taylor fills in the blanks…

Quoting Defense director, Dr. Luisa Moreno:

“The Wicheeda project has the three main aspects for a successful rare earth project, favorable minerology dominated by coarse grained bastnasite family minerals, a metallurgical process that yielded high grade flotation concentrate and great infrastructure in a friendly jurisdiction. With the positive PEA, the project is undoubtedly a step closer to production.”

The West needs Wicheeda in the biggest way.

With the compelling supply/demand dynamics likely to maintain its prevailing tension, current shareholders, those playing the long game, might be considered ‘smart money.’

Goldseek Resources (GSK.C)

- 32.96 million shares outstanding

- $4.28M market cap based on its recent $0.13 close

I’ve covered Goldseek in some detail over the past seven weeks.

A quick review of recent developments at the Company’s flagship Beschefer Project:

Historical drill hole highlights:

- 55.63 g/t gold over 5.57 meters in hole BE13-038 (including 224 g/t over 1.23m);

- 13.07 g/t gold over 8.75 meters in hole B12-014 (including 58.5 g/t over 1.5m);

- 3.56 g/t gold over 28.4 meters in hole B14-006 (including 7.42 g/t over 5.5m);

- 10.28 g/t gold over 8.00 meters in hole B14-35 (including 86.74 g/t over 0.60m);

- 12.40 g/t gold over 3.78 meters in hole B11-003.

The highlight interval from the first seven holes of a 5,000-meter campaign—4.92 g/t Gold over 28.65 meters, including 11.39 g/t Au over 9.1 meters (Central Shallow Zone)—was released on Oct. 6th.

The second batch of drill hole assays released on Nov. 23rd was highlighted by an interval of 2.17 g/t gold over 13.2 meters, including 3.9 g/t gold over 5.6 meters (Central Shallow Zone).

Another good interval from that 2nd batch—2.01 g/t gold over 13 meters—extends the largely untested East Zone to the northeast.

The final round of assays from this 5k meter program was released on Nov. 25th via the following headline:

Goldseek Intersects 0.96 g/t Gold over 19.9 Metres in East Zone Extension at Beschefer

Highlights from this press release:

- 0.96 g/t gold over 19.9 meters, including 1.56 g/t gold over 7.0 meters, in a 90-metre north-east step-out hole;

- Finely disseminated chalcopyrite observed between 30 and 200 meters—the three step-out holes carry copper potential (base metal results are pending);

- 15 of 17 holes returned gold values highlighted by 4.92 g/t gold over 28.65 meters (141 Metal Factor), including 11.39 g/t gold over 9.1 meters, the 2nd best intercept on the Property to date in terms of grade and thickness (BE-21-02);

- A follow-up drill program is being planned, and commencement is targeted for late January.

The drill grid was designed to validate and extend the modelled Central Shallow Zone and East Zone, covering approximately 700 metres of strike length following a general north-east trend. The mineralization extends from the bedrock interface down to a vertical depth of about 200 metres. The target structure dips at 40° to the southeast.

Holes reported aimed at finding the extension to the northeast at an average distance of 100 metres using three holes, BES-21-12 to BES-21-14, totalling 1,050 metres and forming a staggered fence. The program has successfully identified a possible robust extension to the mineralized system following a trend that can be evaluated at N060 degrees based on gold grade and lithological correlations. The historical drill coverage going eastward is nearly absent, possibly due to the lack of clear geophysical signals.

As the Company establishes continuity between the four main zones at Beschefer, the upcoming maiden resource could yield some interesting numbers.

Expect aggressive stepouts into and beyond the East Zone during the upcoming winter program.

As highlighted above, a significant copper component could come into play as the drills are pushed further east.

With a Phase-2 campaign expected to commence in late January, the geo-sleuths at Goldseek will be fine-tuning their geological model. To more accurately vector in on possible extensions of the higher grade areas, the Company is looking at doing some downhole geophysics.

Jon Deluce, President & CEO:

“We are very excited to announce these final extension holes from our maiden 5,000-metre program at Beschefer. BE-21-14 extends the East Zone to the northeast by 90 metres and supports the expansion potential of the Project. This hole encountered strong chalcopyrite over varied metric lengths. With all chalcopyrite occurrences combined, it results in a large envelope reaching 100 metres of core length. We look forward to receiving the base metals results, which are still outstanding.”

Harfang Exploration (HAR.V)

- 69.53 million shares outstanding

- $16.69M market cap based on its recent $0.24 close

Harfang’s 28,565-hectare Serpent Project (James Bay region, Quebec) boasts multiple property-wide orogenic gold and intrusion-related Cu-Au-Ag mineralized occurrences.

On August 31st, the Company commenced a Phase-2, 3,500-meter drill campaign at Serpent—a program designed to test a series of high priority targets up-ice from a gold-in-till anomaly where surface gold showings and auriferous shear zones were encountered during a previous campaign. Additional (newly defined) targets were also due for a test during this second phase of drilling.

Recent highlights from this summer campaign include:

- Grab samples up to 345 g/t Au from Trench TR-21-26;

- Channel samples up to 208 g/t Au over 0.75 m (Powerline showing);

- Quartz-tourmaline boulders (up to 45.5 g/t Au) up-ice of the Moby-Dick gold structure;

- Metallic sieve analyses up to 3,710 g/t Au for the coarse fraction (>106 microns) confirming the abundance of coarse-grained gold grains.

Regarding these September 28th results, the Company went on to state:

Our summer exploration program included excavating of 26 mechanical trenching, detailed geological mapping and prospecting. A total of 599 channel samples and more than 560 grab samples were collected so far. Trenching was carried out in specific areas around the marshland where earlier prospecting had revealed large gold-bearing quartz veins and shear zones. Recent prospecting was focused on selected areas around the marshland and in the northern part of the Property. A soil survey (B-horizon) with more than 800 samples was completed. Results from these soil samples and approximately 250 grab samples are pending.

On December 1st, Harfang dropped the following headline:

Here, Harfang released the first round of results from its Phase-2 summer drill campaign.

Highlights:

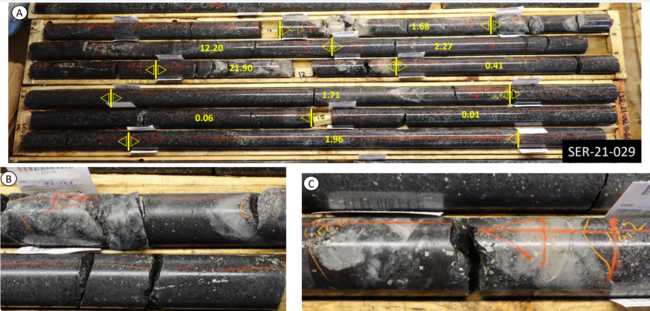

- Drillhole SER-21-029 returned 4.09 g/t Au over 8.00 meters;

- Drillhole SER-21-035 returned 4.33 g/t Au over 7.00 meters and additional gold intervals (most mineralized drillhole so far);

- Main gold-bearing Stu structure extended for at least 425 meters;

- A large gold footprint (10 km2, >50 ppb Au) defined at surface and at depth;

- WNW-ESE gold structures outlined on Serpent extend into LaSalle Exploration’s Radisson property totaling at least 10 kilometers in length.

This second drill program at Serpent, completed in early October, included 19 drillholes for a total of 3,759 metres. Five holes (SER-21-028 to 032) tested the main interpreted Stu structure immediately east and west of the gold interval hit in SER-21-013 (3.47 g/t Au over 7.50 m) during the maiden campaign. A North-South fence of 6 holes (SER-21-033 to 038) was strategically positioned to test several sets of magnetic discontinuities (structural lineaments?) underneath the marshland, 425 m east of the first fence completed during winter 2021. Two holes (SER-21-039 and 040) were added on both sides of that fence following gold observations in holes 035, 036 and 037. Finally, the remaining holes (SER-21-041 to 046) tested specific targets, including the southeastern extension of LaSalle’s Goldhawk trend.

Developing a District-Scale Gold Play

The Serpent Project is underpinned by one of the most significant gold-in-till anomalies in Canada, covering an area in excess of eight square kilometers.

To date, more than 40 gold showings have been discovered across a regional gold-bearing corridor extending over 10 kilometers.

“Recent drilling demonstrates that gold structures, still barely tested, exist underneath the marshland.”

Newly-Defined Regional Gold Footprint

This newly-detected gold footprint, which is spatially associated with diorite and gabbro and appears to be structurally-controlled, is another strong evidence supporting the hypothesis of district-scale gold potential.

Figure 5 illustrates the gold footprint defined by all surface grab samples with more than 50 ppb Au. This threshold value truly represents an atypical gold content for dioritic and gabbroic host rocks. The footprint spans over at least 10 km2 at Serpent solely, and is known to extend into the Radisson property. Approximately 25% of the grab samples collected in and around the diorite intrusion contain >50 ppb Au.

Figure 6 shows that non-magnetic zones correspond to anomalous gold content in drillholes. These zones include a higher proportion of samples >50 ppb Au intermixed with intervals in which values range between 10 and 50 ppb Au. The footprint in drillholes appears to follow the non-magnetic WNW and ENE discontinuities. It is also associated with very low magnetic susceptibility in rocks.

These linear features and their intersections are prime targets for additional drilling.

A Phase-3 drill campaign is slated to begin in January.

“Main targets include follow-ups on gold structures drilled so far in the marshland and any other gold intervals that will emerge from drillholes for which results are pending. Other targets, developed from our most recent prospecting and interpretation, will be drill-tested.”

Results from the remaining 11 drillholes from Phase-2 are pending.

All maps and images accompanying this Dec. 1st press release can be accessed here.

Forum Energy Metals (FMC.V) – (FDCFF.OTC)

- 166.19 million shares outstanding

- $29.91M market cap based on its recent $0.18close

On November 26th, Forum updated progress at it Janice Lake Project.

RTEC reports that it has spent $14 million in exploration expenditures to date, which exceeds the $10 million required to earn a 51% interest in the Janice Lake project. Rio Tinto does not plan an exploration program for the 2022 budget year. A $100,000 cash payment to Forum is due on or before May, 2022 to complete its 51% earn-in obligation.

Rick Mazur, President & CEO:

“Rio Tinto’s $14 million in drilling and regional exploration has added tremendous value to the Janice Lake project, most notably at the Janice and Jansem targets where drilling has significantly expanded high grade copper mineralization. Forum’s diversified energy metals portfolio will focus on our extensive uranium property portfolio in Q1 2022, including plans to begin drilling at our 100% owned Wollaston uranium property nearby the Orano and Cameco uranium mills in the eastern Athabasca Basin.”

Since RTEC has no intentions of drilling the property in 2022, it’s fair to assume they’ll walk. RTEC is looking for Tier-1 type deposits—they want scale, and Janice Lake isn’t (currently) meeting that minimum threshold. But this is a massive property—some 39,943 hectares encompassing the entire 52 kilometers long Wollaston Copperbelt District.

A first pass 447 meter drill program conducted by Forum in August of 2018 tagged copper mineralization in the four holes drilled at the Janice and Jansem targets. All mineralization encountered was within 80 meters of surface.

Hole FEM-01 intersected 18.5 meters (59.0 to 77.5 meters downhole depth) grading 0.94% Cu and 6.7 g/t Ag including 5.2 meters grading 2.22% Cu and 16.5 g/t Ag. The true thickness of the mineralization is 18.0 meters. Rio Tinto has since drilled 39 holes totalling 10,033 meters on four drill targets: Janice, Jansem, Kaz , and Rafuse.

If Rio walks, Forum assumes full control of the project. With $14M poured into the project, Forum has a much better understanding of the subsurface geology than before RTEC entered the fray. Janice Lake may not appeal to a mining colossus like RTEC, but it may appeal to a mid-size producer.

Btw, the following values represent RTEC’s final five holes at the Rafuse target:

- JANL0035 – Nil;

- JANL0036 – Nil;

- JANL0037 –0.15% Cu and 1.63 g/t Ag and 0.41% Pb over 42.25 metres from 221.25m to 263.5m, including 0.19% Cu and 1.94 g/t Ag and 0.51% Pb over 30.9 metres from 232.6m to 263.5m;

- JANL0038 – 0.16% Cu and 2.77 g/t Ag and 0.18% Pb over 15.4 metres from 95.6m to 111m, including 0.25% Cu and 4.93 g/t Ag and 0.34% Pb over 7.5m from 95.6m to 103.1m, 0.19% Pb over 1.37 metres from 134.8m to 135.75m, 1.09 g/t Ag and 0.43% Pb over 1.2 metres from 157.8m to 159m;

- JANL0039 – 1.28 g/t Ag and 0.14% Pb over 2.6 metres from 154.2m to 156.8m.

Hole JANL0028 drilled in the winter program intersected 0.86% copper and 8.02 g/t silver over 14 metres from 246m to 260m, including 6m of 1.67% copper and 13.6 g/t silver from 254.1 to 260.1m (see news release dated June 9, 2021). Hole JANL0028, JANL0032 and JANL0037 have intersected structurally controlled mineralization that is oxidized at depth.

A November 30th press release:

Forum Uranium and Energy Metal Project Review

Here, Forum updates shareholders with a review of its exploration plans for its uranium, copper, nickel, and palladium projects in Saskatchewan (and its cobalt project in Idaho).

URANIUM PROJECTS

Permits have been submitted to drill five of its nine drill-ready uranium projects in the prolific Athabasca Basin of Saskatchewan—Wollaston (100% Forum), Highrock (100% Forum), Costigan (65% Forum; 35% Trafigura), Clearwater (75% Forum; 25% Vanadian) and Northwest Athabasca Joint Venture (39.5% Forum; 28% NexGen; 20% Cameco; 12.5% Orano).

The Company is in active negotiations regarding Clearwater, Costigan, and Highrock due to third-party interest.

The plan is to drill 3,000 meters at the Wollaston Project in mid-January 2022. Wollaston is located roughly ten kilometers from Cameco’s Rabbit Lake uranium mill and 30 kilometers from Orano/Denison’s McClean Lake uranium mill.

Forum will start organizing the mobilization of camp and equipment in the New Year for a winter 2023 drilling campaign at the Northwest Athabasca Basin Joint Venture project, host to the historical 1.5 million pound Maurice Bay uranium deposit*, based on 600,000 tonnes grading 0.6% U3O8 to a depth of 50 metres in the Western Athabasca Basin (Source: Saskatchewan Industry and Resources, Miscellaneous Report 2003-7). A drill is currently located on the property.

Forum’s Fir Island project is under option to Orano who can earn a 70% interest in the property by spending $6 million in exploration. To date $2.5 million has been spent by Orano on two drill campaigns and Orano is reviewing Forum’s contract tenders for a resistivity survey to be conducted in March, 2022.

ENERGY METAL PROJECTS

In reference to the News Release dated November 26, 2021, Forum wishes to disclose that, contrary to certain reports in the media, Forum continues to hold a 100% interest in the Janice Lake copper/silver project in Saskatchewan as Rio Tinto Exploration Canada has not yet elected to vest a 51% interest in the project in accordance with the terms of the May, 2019 option agreement between the parties.

At Forum’s 100% owned Love Lake Project, Forum completed eleven drill holes totaling 2,844 meters on three targets identified along the Love Lake mafic/ultramafic complex (see news release dated September 20, 2021). Results are expected in late December or early January.

The Company is also awaiting results from a recent prospecting, mapping, and sampling program at its Quartz Gulch Project located along the Idaho Cobalt Belt. The project is positioned on-trend with the past-producing Blackbird cobalt mine and Jervois Global’s Idaho Cobalt Operation—the only permitted cobalt mine under construction in North America.

Over on the Forum channel at ceo.ca, there was talk that a uranium newsletter caused much of the recent downdraft, having issued a sell recommendation. If true, this selling pressure is likely overdone, especially with tax-loss selling in full gear. Current price levels may represent a good entry point.

Lastly, I’d like to draw attention to two roundup pieces I recently put up over at Equity Guru. These roundups include roughly three dozen sub-$20M ExploreCos I currently follow. They’re all high-risk propositions, but I’m betting there are a few (potential) multi-bagger gems in there.

and…

END

—Greg Nolan

Full disclosure: Goldseek, Defense and Forum are Highballer clients. The author owns shares of Goldseek and Defense. Color me biased, especially where my clients are concerned. Do your own due diligence, and consult a registered investment advisor before making any investment decisions in this high-risk/high-reward arena.

Disclaimer - Legal NoticeHighballerstocks.com (Greg Nolan) is not a licensed financial advisor and does not give investment advice.

The content of this report is for information purposes only.

Nothing contained herein should be construed as a recommendation or solicitation to buy or sell any security.

Always consult a licensed qualified investment advisor in your legal jurisdiction before making any investment decisions.

Though Highballerstocks.com (Greg Nolan) believes its sources to be credible, and the statements contained herein to be true, readers must conduct their own thorough due diligence, and or consult with a qualified investment advisor before important investment decisions are made.

Highballerstocks.com (Greg Nolan) accepts no responsibility or liability for the accuracy of the contents of this report.