We’re waiting for a rising sector-wide tide here in junior land, one that’ll lift all boats, especially those we’ve singled out with significant assets on their books.

As we examined last week, we see accumulation in the Bigs – the senior producers. If history is our guide, it’s only a matter of time before the herd takes an interest in this high-risk/high-reward arena.

Quoting my April 11 report (I’m reluctant to repeat myself, but this is a potentially potent dynamic underpinning this largely ignored sector):

For those of you with exposure to the junior sector, wondering why your high-quality/undervalued positions can’t seem to catch a meaningful bid, it’s recently been suggested that precious metals (and related equities) currently account for < 0.5% of the total value of savings and investment in the U.S. The norm—the three-decade mean—is 1.5%. If investment merely reverts back to the three-decade mean, demand will triple. This dynamic represents a (potentially) powerful catalyst from the top of the precious metals food chain on down. If investment accelerates beyond that 1.5% three-decade mean, demand will outstrip supply, and this tiny sector, able to accommodate only so much buying pressure, will go on a tear of epic proportions (I’ve seen this movie before).

If you’re like me, you scour the headlines, looking for an edge – something that will lead to an undiscovered gem that’ll generate significant share price trajectory once this sector finds a gear.

Below are brief updates covering two companies we follow closely here at Highballer. Further down the page, I’ll trot out a few names followed outside of these pages (companies I’ve been holding and trading over the past few months).

We’ll start with Banyan.

Banyan Gold (BYN.V) – (BYAGF.OTC)

- 226.59 million shares outstanding

- $107.63M market cap based on its recent $0.475 close

Having singled Banyan out in a February 2020 Highballer report at $0.06, it’s been a pleasure to own. There’s a lot to be said for sitting tight when competent management has a good handle on a (sediment-hosted) structurally controlled gold deposit in a mining-friendly jurisdiction, like Canada’s Yukon Territory.

The Company’s chart is constructive, sexy too…

This recent set of assays – 21 diamond drill holes completed during a 2021 exploration campaign at the Company’s flagship 173 sq kilometer AurMac Property – was released on March 30 via the following headline:

Banyan Intersects 1.16 g/t gold over 68.9 metres at Powerline Deposit, AurMac Property, Yukon

Highlights from the Powerline zone

- 48.6 meters of 0.51 g/t Au from 36.7 meters in DDH AX-21-166;

- 69.4 meters of 0.63 g/t Au from 125.9 meters in DDH AX-21-170;

- 47.2 meters of 0.50 g/t Au from surface (10.7 meters) in AX-21-191;

- 70.0 meters of 0.65 g/t Au from surface (10.7 meters) in AX-21-194;

- 96.7 meters of 0.86 g/t Au from 73.4 meters in AX-21-197;

- 81.9 meters of 0.79 g/t Au from 32.5 meters in AX-21-199;

- 68.9 meters of 1.16 g/t Au from surface (10.7 meters) in AX-21-202.

Tara Christie, President & CEO:

“These latest assay results from our 2021 drill program continues to show the extensive nature of gold mineralization around the Powerline Deposit on the AurMac Property and importantly, continues to add to the interpreted geologic controls that will be used to update the AurMac Gold Resource estimations during the second quarter. We are looking forward to the remaining sixteen (16) holes from the 2021 program.”

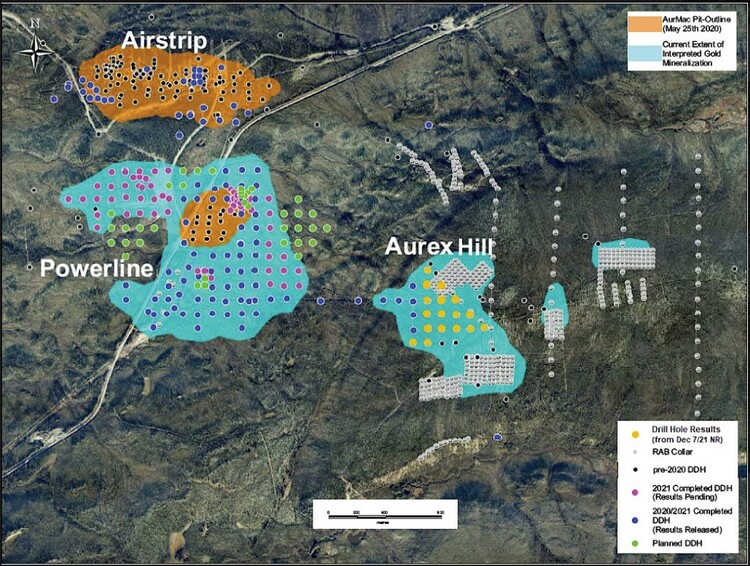

The Company has budgeted 30k meters of drilling for 2022. The aim is to expand the Powerline and Aurex Hill zones via 100 meter stepouts with a goal of establishing a link between the two zones (both zones show good mineralized continuity).

The Company is roughly 12k meters into the 30k meter campaign.

Aside from assay-related newsflow, a potentially positive short-term catalyst is an updated resource estimate, expected to drop sometime this quarter (Q2). With the crunching of approx 40k meters of additional drill hole assay values since its maiden (2020) resource estimate, the Company has a 3M+ (Inferred) ounce count in its crosshairs. With 16.5 kilometers of strike and a 10 square kilometer geochemical anomaly underpinning Aurex Hill’s subsurface stratum, we could see that number grow substantially. AurMac has legs.

According to CEO Christie, this 30k meter campaign will include a number of big stepout holes. It was that bold line of geological sleuthing – stepping out in a big way – that ultimately led to the discovery of the Powerline zone.

Here, project manager & senior geologist, James Thom, provides a Q1 2022 operational update for this flagship asset.

It’s not my place to advise you to continue holding or, for those on the sidelines, to buy this stock on weakness, but this may be a classic example of ‘be right – sit tight.’ I believe Banyan has an endgame.

Prime Mining (PRYM.V) – (PRMNF.OTC) – (04V3.FRA)

- 112.69 million shares outstanding

- $431.61M market cap based on its recent $3.83 close

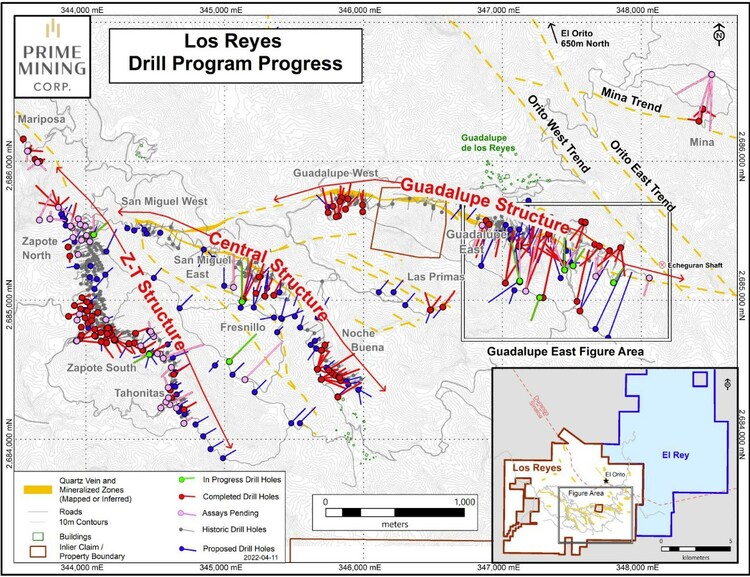

Featured back in late 2020 at $1.52, Prime continues to deliver exceptional drill hole results from its wholly-owned 13,800-hectare Los Reyes Gold-Silver Project in Sinaloa State, Mexico.

The current resource at this flagship project stands at 633,000 ounces of gold and 16,604,000 ounces of silver (Indicated) PLUS an additional 179,000 ounces of gold and 6,831,000 ounces of silver (Inferred).

The April 12 headline…

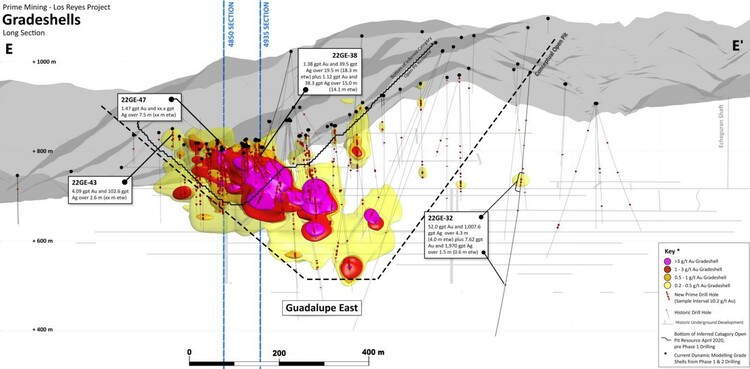

Here, the Company reported 26 drill holes from Guadalupe East, one of eight deposits at Los Reyes (the headline interval is a boomer – a massive hit).

Highlights from this round of assays include:

Estaca Vein

- 52.0 g/t Au and 1,007.6 g/t Ag over 4.3 meters (4.0 meters estimated true width (“etw”)) plus 7.62 g/t Au and 1,970 g/t Ag over 1.5 meters (0.6 meters etw);

- 1.38 g/t Au and 39.5 g/t Ag over 19.5 meters (18.3 meters etw) plus 1.12 g/t Au and 38.3 g/t Ag over 15.0 meters (14.1 meters etw);

- 4.09 g/t Au and 102.6 g/t Ag over 2.6 meters (2.5 meters etw); and

- 1.47 g/t Au and 40.4 g/t Ag over 7.5 meters (7.5 meters etw).

San Nicholas and San Manuel Veins

- 3.72 g/t Au and 370.0 g/t Ag over 3.0 meters (1.9 meters etw) plus 1.57 g/t Au and 2.5 g/t Ag over 1.5 meters (1.0 meter etw) plus 1.19 gpt Au and 9.1 gpt Ag over 1.0 meters (0.6 meters etw);

- 1.38 g/t Au and 63.1 g/t Ag over 4.9 meters (2.8 meters etw) ;

- 1.01 g/t Au and 4.7 g/t Ag over 2.8 meters (2.4 meters etw) plus 1.87 g/t Au and 6.9 g/t Ag over 1.5 meters (1.3 meters etw); and

- 1.42 g/t Au and 2.3 g/t Ag over 1.0 meters (0.9 meters etw).

Note the highlight hit – 22GE-32 – to the right, roughly 175 meters outside the conceptual pit boundary (map below). Damn fine gunnery, this 22GE-32 hit.

Notes accompanying this round of assays:

- Second high-grade ore shoot identified in Guadalupe East;

- Bonanza-grades encountered in 550 meter step out from 2020 Inferred Open Pit Boundary;

- Deepest mineralization encountered to date at Guadalupe East;

- 236 drill holes have now been completed across the entire project (122 in Phase 1 and 114 in Phase 2) with 69 pending receipt of assay data and dissemination; and

- 9 drills continue to operate at Los Reyes as part of the 50,000 meter Phase 2 program.

Daniel Kunz, CEO:

“22GE-32 is the deepest bonanza-grade mineralization ever encountered at Guadalupe East. Two weeks ago, we announced drill holes results from Zapote that increased the mineralized footprint at the western portion of Los Reyes, including 22ZAP-55R, which hit the widest-ever high-grade intercept to-date and ended in mineralization. With intercepts well below and outside the current Los Reyes resource pit boundaries at both Guadalupe and Zapote, the Phase 2 drilling is leading to resource expansion and outlining new targets requiring additional drilling.”

I believe this one, too, has an endgame.

Several companies I follow outside these pages

There are several companies I’ve been tracking and have yet to feature in these pages. A standout is Westhaven Gold (WHN.V) and its wholly-owned 17,623-hectare Shovelnose gold property located along the Spences Bridge Gold Belt of B.C.

I’ve been following Westhaven since its October 2018 discovery hole at Shovelnose (South Zone) – 24.50 g/t Au and 107.92 g/t Ag. I’ve been waiting for a high-grade follow-up discovery, had all but given up, and then out of the blue… boom – 23.03 meters of 37.24 g/t gold and 214.70 g/t silver via an April 6 headline.

Three companies boasting substantial ounce counts that are actively exploring with the business end of the drill bit – companies that also strike me as good value – include Goldshore Resources (GSHR.V), Anacortes Mining (XYZ.V), and Freeman Gold (FMAN.V). Of the three, Anacortes, operating in Peru, may have some jurisdictional risk attached to it.

Patriot Battery Metals (PMET.C) is a lithium explorer boasting multiple spodumene pegmatite occurrences along a 25-kilometer trend in the James Bay Region of Quebec. I recently purchased the stock on the back of some impressive drill hole assays. The Company’s share price trajectory has generated a fair amount of joy among those who recognized the potential early.

All of these companies are worth a look, IMO. I may feature one or more of the above in a future Highballer report.

END

— Greg Nolan

Full disclosure: I own shares of Westhaven, Patriot, and Goldshore (best to consider me especially biased regarding these three).