The last few weeks have been hectic. In the wake of last week’s .75% rate hike, gold formed a higher low on the charts. But will it stick?

If the Fed’s bullying tactics towards the inflationary spiral have run their course—if they’ve exacted enough shock value via these high-handed three-quarter-point rate hikes—it could be game on where precious metals, and related equities, are concerned.

But the Greenback is still an obstacle. We’ll need it to come off these nosebleed levels for gold to establish a new uptrend.

Many of the higher-quality plays in the junior arena have been catching a bid in recent sessions. It was inevitable. The sector has been trying to bottom out for weeks.

The following content updates several of the companies on my client list. It also explores some new ideas.

Clients first.

Apollo Silver (APGO.V) – (APGOF.OTC) – (6ZF0.FRA)

- 174.46 million shares outstanding

- $36.64M market cap based on its recent $0.21 close

Apollo recently updated shareholders with another round of drill hole assays from its flagship Calico Silver Project in San Bernardino County, California. The ounce count at Calico currently stands at 166 million ounces of silver contained in 58.1 million tonnes at an average grade of 89 g/t.

All of the holes from this latest batch tagged significant (high-value) mineralization above the 50 g/t Ag cutoff. The results continue to demonstrate Calico’s (predictable) continuity of near-surface mineralization.

SILVER HIGHLIGHTS

- Hole W22-RC-011

- 137 g/t Ag over 76.5 meters from 16.0 meters depth down hole;

- including 477 g/t over 1.5 meters from 46.0 meters depth down hole;

- 137 g/t Ag over 76.5 meters from 16.0 meters depth down hole;

- Hole W22-RC-013

- 107 g/t Ag over 73.5 meters from 19.0 meters depth down hole;

- Hole W22-RC-020

- 86 g/t Ag over 107.5 meters from surface; and

- Hole W22-RC-024

- 84 g/t Ag over 89.0 meters from surface.

(Silver assays are reported at a 50 g/t silver cut-off grade with up to 4.5 m dilution and are uncapped. Lengths are down hole lengths and may not represent true widths)

GOLD HIGHLIGHTS

- Hole W22-RC-012

- 0.354 g/t Au over 27.0 meters from 94.0 meters depth down hole;

- including 1.960 g/t Au over 1.5 meters from 101.5 meters depth down hole;

- 0.354 g/t Au over 27.0 meters from 94.0 meters depth down hole;

- Hole W22-RC-013

- 0.417 g/t Au over 19.5 meters from 134.5 meters depth down hole; and

- including 1.230 g/t Au over 1.5 meters from 142.0 meters depth down hole;

- 0.417 g/t Au over 19.5 meters from 134.5 meters depth down hole; and

- Hole W22-RC-022

- 0.219 g/t Au over 27.0 meters from 79.0 meters depth down hole; and

- Hole W22-RC-023

- 0.313 g/t Au over 10.5 meters from 49.0 meters depth down hole.

(Gold assays are reported at a 0.1 g/t gold cut-off grade with up to 4.5 m dilution and are uncapped. Lengths are down hole lengths and may not represent true widths)

The Company expects to convert Calico’s Inferred ounce count into the higher confidence categories seamlessly, allowing for the initiation of engineering and economic studies. As the Company continues to de-risk the project, we should see a significant rerating in the Company’s share price.

Metallurgical studies are ongoing. We might see results on that front in Q3 of this year.

This Apollo crew is all about efficiency and the judicious allocation of capital. By optimizing the 10k meter drill plan, the Company may be able to realize its intended goal with fewer meters drilled, allowing it to deploy that (saved) capital elsewhere.

This recent YouTube interview with CEO Peregoodoff adds more color to the Apollo story:

Forum Energy Metals (FMC.V) – (FDCFF.OTC)

- 170.82 million shares outstanding

- $26.48M market cap based on its recent $0.155 close

We updated Forum’s recent progress on the exploration front via this July 11 offering—Catching up with Apollo Silver and Forum Energy Metals

More recently, John Kaiser summarized Forum’s activities in and around the Athabasca Basin via the following YouTube video (jump ahead to 28:30 to get right into it):

The Company also just updated its Slide Deck—July 27, 2022 Slide Deck

Optimum Ventures (OPV.V)

- 39.89 million shares outstanding

- $7.78M market cap based on its recent $0.195 close

We haven’t heard much from the Optimum camp in recent weeks, but the Company is busy—their flagship Harry Project is seeing activity on multiple fronts (actions speak louder than words).

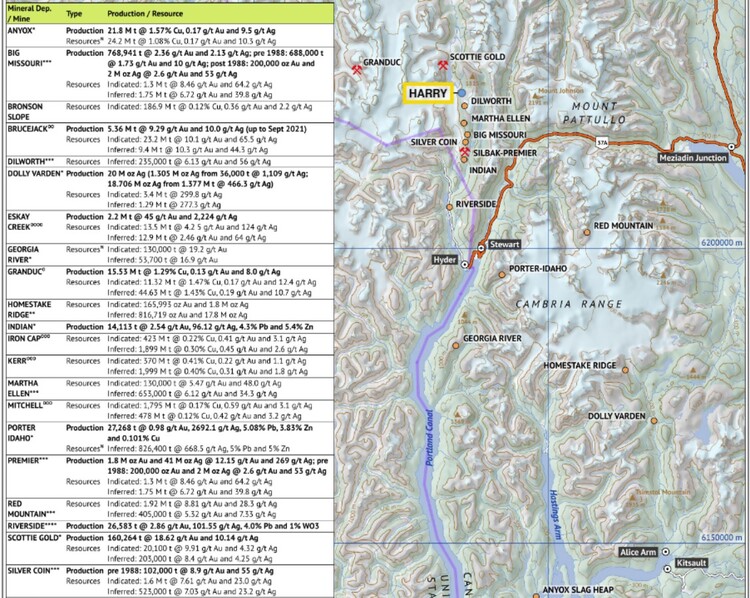

Harry is strategically located along the Granduc Access Road near the mining town of Stewart. Ascot borders Harry to the east and south, Pretium (recently taken out by Newcrest) to the north, and Scottie to the west. The project benefits from abundant mining infrastructure throughout the region.

(click on the image below to amplify)

The Company will be following up on two discovery holes tagged last year at the Swan Zone. But there are multiple high-priority targets across this 1,333-hectare property. To aid in its regional surface sampling campaign, the Company has deployed a backpack drill—the Shaw Drill Mark1 (41mm) w/swive. With the capacity to drill down five meters and produce 4.1 cm diameter core, they can expedite their geological mapping and sampling objectives.

Highlights from a (limited) 2021 Swan drill campaign include:

- Hole S21-3 intersected 15.64 meters grading 1,437 g/t AgEq (433.4 g/t Ag, 3.10 g/t Au, plus significant base metal credits);

- Hole S21.4 intersected 9.26 meters grading 1,833 g/t AgEq (690.15 g/t Ag, 1.64 g/t Au plus significant base metal credits);

- Sampling from a float boulder train produced high-grade results: the average value of 22 samples taken from the vicinity of the Swann showings is 74.22 g/t Au, 842.9 g/t Ag, 37.6 % Pb, 1.18 % Cu and 28.9 % Zn.

I’m looking forward to a good chat with the CEO, Tyler Ross, and his chief geological sleuth later this week. Details pending.

Goldseek Resources (GSK.C) – (4KG.FRA)

- 37.68 million shares outstanding

- $1.88M market cap based on its recent $0.05 close

Expertly helmed companies strategically positioned in well-established mining camps that have seen their shares settle into the low end of their trading ranges may offer the most significant upside potential as investors rediscover this battered and beaten down sector.

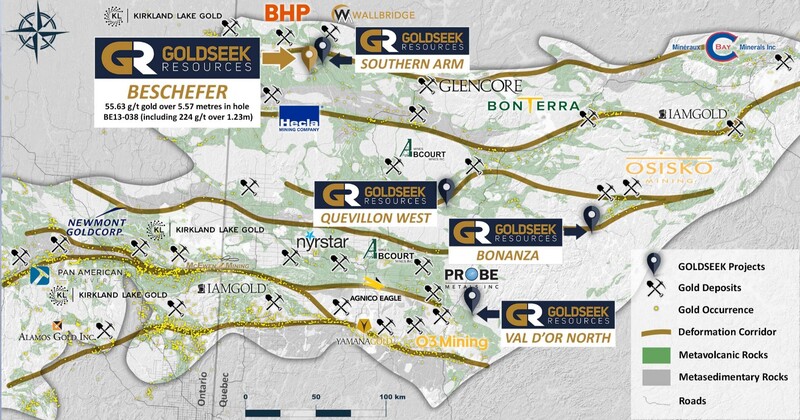

Goldseek’s flagship Beschefer Project, located along the northern Abitibi Greenstone Belt some 30 kilometers southwest of Wallbridge’s Fenelon Gold Project, is due for another proper probe with the drill bit as the Company advances the project towards a maiden resource.

Goldseek, like most others, has been relatively quiet during this sector-wide rout.

Let’s wait n see what CEO Deluce has on the agenda. News shouldn’t be too far off.

Aside from Beschefer, the Company holds an extensive project pipeline along some of Canada’s most prolific gold camps: Hemlo, Urban Barry, Quevillon, Val D’Or North, and Detour.

Teuton Resources (TUO.V) – (TEUTF.OTC) – (TFE.FRA)

- 56.22 million shares outstanding

- $93.32M market cap based on its recent $1.66 close

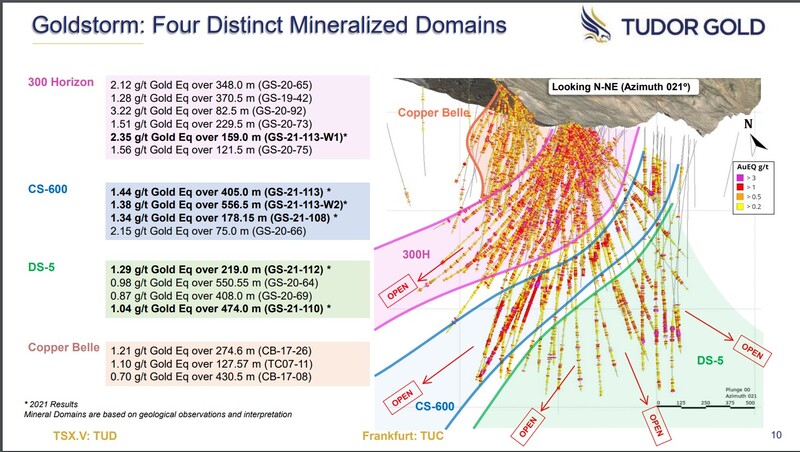

A fully funded 30k meter drill program is in full gear at Treaty Creek (TC) in the prolific Golden Triangle of northwestern British Columbia. TC is a JV with Tudor (60%) and American Creek (20%)—Teuton holds the remaining (carried) 20%. The Company is ‘carried’ until a production decision is made.

The current Measured and Indicated resource at TC currently stands at 19.4 million AuEq ounces (815.7 MT grading 0.74 g/t AuEq). The Inferred ounce count stands at 7.22 million AuEq ounces (311.7 MT grading 0.79 g/t AuEq.)

The JV partners dropped three assay-related headlines over the past few weeks.

A July 13 press release: Teuton Resources Reports Intersection of 237.3 Meters of 1.51 g/t AuEq (0.89 g/t Gold and 0.49 % Copper) in Step-out Hole GS-22-133 at the Goldstorm Deposit, Treaty Creek Property, Northwestern British Columbia

Highlights:

- GS-22-135 intersected a new zone with 5 meters grading 1.42 g/t AuEQ within 190.5 meters of 0.80 g/t AuEQ.

- GS-22-129 stepped out on the DS5 resource area and returned 5 meters of 2.33 g/t AuEQ within 89.35 meters grading 1.02 g/t AuEQ.

- GS-22-130 intersected DS5 mineralization returning 1.51 g/t AuEQ over 45.0 meters within 91.5 meters grading 1.17 g/t AuEQ.

- GS-22-131 also targeted DS5 intersecting 1.07 g/t AuEQ over 26.5 meters, within 163.0 meters of 0.61 g/t AuEQ. GS-22-131 stepped out 115 meters from the 2021 drilling.

- GS-22-133 stepped out 200 meters from the 2021 northern drilling extents of 300H and CS600 domains tagging 1.51 g/t AuEQ (0.89 g/t Au, 0.49 % Cu) over 237.3 meters within a broader mineralized zone of 0.91 g/t AuEQ over 600.0 meters. This confirms the extension of CS600 to the north and shows an increase of gold and copper grades at depth.

A July 20 press release: Teuton Resources Reports 25.5 Meters of 9.96 g/t AuEq in 500 Meter Northeast Step-out Hole GS-22-134 at the Goldstorm Deposit, Treaty Creek Property, Northwestern British Columbia

Highlights:

GOLDSTORM DEPOSIT (Section A)

- GS-22-134 stepped out on the 300H and CS600 resource area and returned 663.0 meters grading 0.97 g/t AuEQ. The hole ended 500 meters to the northeast from the 2021 drilling, well outside the existing resource estimate area. A high-grade interval of 9.96 g/t AuEQ over 25.5 meters contained an enriched zone of 20.86 g/t AuEQ over 4.5 meters.

- GS-22-136 stepped out on the DS5 resource area and returned 34.5 meters of 2.64 g/t AuEQ within 82.7 meters of 1.62 g/t AuEQ.

- GS-22-137 stepped out on the DS5 resource area and returned 232.5 meters of 1.44 g/t AuEQ within 442.5 meters of 1.02 g/t AuEQ (DS5).

SECTION 112+00 NE

- GS-22-138 tested the southern boundary of the DS5 resource area and returned 33.5 meters of 1.00 g/t AuEQ within 108.0 meters of 0.70 g/t AuEQ. This hole also provided infill drilling of CS600 which confirmed with a near surface copper-gold intersection of 241.5 m of 0.80 g/t AuEQ.

CALM BEFORE THE STORM (CBS)

SECTION CBS

- CBS-22-04 confirmed the near surface mineralization with an intersection of 8.85 meters of 1.30 g/t AuEQ. A second deeper intersection returned 42.25 meters of 1.03 g/t AuEQ within 79.5 meters of 0.77 g/t AuEQ.

- CBS-22-05 confirmed the near surface mineralization with an intersection of 9.7 meters of 1.00 g/t AuEQ. A second deeper intersection returned 12.0 meters of 1.00 g/t AuEQ within 30.0 meters of 0.67 g/t AuEQ.

- CBS-22-06 confirmed the near surface mineralization with an intersection of 7.5 meters of 1.04 g/t AuEQ.

- CBS-22-07 confirmed the near surface mineralization with an intersection of 7.5 meters of 1.56 g/t AuEQ.

A July 26 press release: Teuton Reports 70.96 g/t AuEQ Over 1.0 Meter within 39.15 g/t AuEQ Over 2.0 Meters (GS-22-143) with a 225 Meter Northeast Step-Out Hole from the 2021 Drilling at the Goldstorm Deposit, Treaty Creek Property, BC

Highlights:

GOLDSTORM DEPOSIT (Section B)

- GS-22-143 stepped out 225 meters to the northeast from the 2021 drilling targeting 300H and CS600 mineralization. A high-grade interval of 39.15 g/t AuEq over 2.0 meters was intercepted in an area that spatially lines up with the 300H mineral domain, however, is interpreted as potentially being a separate mineralization event. Visible gold was found hosted within the fabric of the host rock.

The last time I checked, eight rigs were turning on the project. Expect increasingly robust newsflow out of the Teuton camp.

Defense Metals (DEFN.V) – (DFMTF.OTC) – (35D.FSE)

- 183.37 million shares outstanding

- $32.09M market cap based on its recent $0.175 close

The last headline from Defense dropped back in mid-June when it updated progress from an ongoing drill program at its flagship Wicheeda Project in the Prince George region of British Columbia.

Defense Metals Diamond Drilling Update – Pit Slope Geotechnical Preparations Underway

The resource at Wicheeda currently stands at 5.0 million tonnes averaging 2.95% TREO (total rare earth oxide) in the Indicated category and 29.5 million tonnes averaging 1.83% TREO in the Inferred category (a 0.5% TREO cutoff binds both resource categories).

This 5,000-meter summer drill program is designed to: increase confidence in the Inferred resource block, delineate targets for additional stepout drilling, collect geotechnical and hydrogeological data to optimize the open pit slope design, and furnish core samples for continued metallurgical test work.

This interview with Luisa Moreno (President and Director), always an education, explores China’s grip on REE refinement and what it means for North America…

Additional assay-related newsflow is expected in the coming weeks.

Patriot Battery Metals (PMET.C) – (PMETF.OTC) – (R9GA.FRA)

- 86.99 million shares outstanding

- $260.97M market cap based on its recent $3.00 close

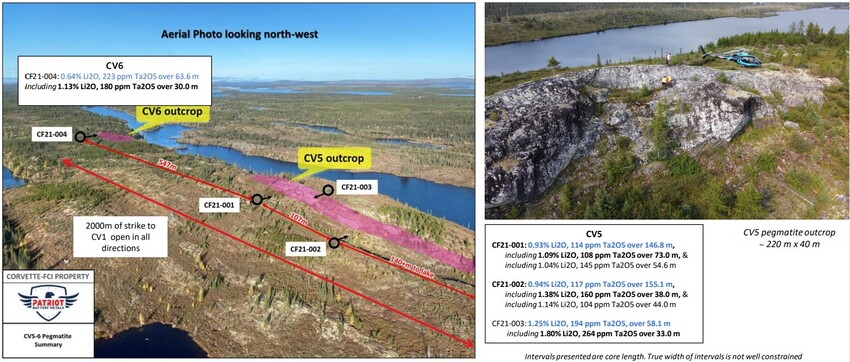

Patriot is a deftly run lithium explorer aggressively drilling off a spodumene-bearing pegmatite body at its flagship Corvette Project located in the James Bay region of mining-friendly Quebec. The project encompasses some 210 square kilometers along a 50 kilometers lithium pegmatite trend.

A total of 10,355 meters in 36 holes have been drilled thus far in 2022, 6,010 meters (16 holes) of which are part of an ongoing summer campaign.

Highlights

- Strong lithium grades over wide intervals were returned from the first two drill holes completed during the summer phase of the 2022 drill campaign:

- 1.25% Li2O and 118 ppm Ta2O5 over 96.9 meters, including 2.53% Li2O and 130 ppm Ta2O5 over 27.0 meters;

- 1.38% Li2O and 99 ppm Ta2O5 over 27.0 meters, and 2.00% Li2O and 167 ppm Ta2O5 over 7.3 meters.

- Under the summer program, the main spodumene pegmatite has now been traced an additional 500 meters westward, from the CV5 Pegmatite outcrop to the CV6 Pegmatite outcrop (image below).

- The main pegmatite body has now been traced through drilling over a strike length of approximately 1,900 meters and remains open in all directions.

- A third drill rig and barge have now been mobilized to the drill area and is expected to collar shortly.

(click on the image below to amplify)

Importantly, as noted in the above highlights, the main spodumene-bearing pegmatite structure has been traced by drilling over a distance of at least 1.9 kilometers. Strong potential exists for a series of closely spaced/stacked, sub-parallel, and sizable spodumene-bearing pegmatite structures with significant lateral and depth potential.

The Company also launched a detailed mapping campaign over the CV5-1 pegmatite corridor where field crews have identified several new spodumene-bearing outcrops located approximately 150 meters southwest of the CV5 Pegmatite outcrop and approximately 200 meters along strike of the CV3 Pegmatite outcrop.

The systematic surface geological mapping is continuing along the CV5-1 pegmatite corridor and will culminate into a detailed geological map later this summer. The surface mapping will allow for more accurate geological modelling of the drill area, as well as enable refinement to drill hole targeting. Following completion of the geological mapping over the primary drill area, surface mapping over the other known lithium pegmatite outcrops areas – principally the CV8, 9, 10, and 12 pegmatites – will be completed and assist with target ranking. Additionally, the Company intends to carry out the first documented prospecting, geological mapping, and rock sampling over the more than 25 km of prospective trend extending across the Property which has never been evaluated for lithium pegmatite.

The summer campaign was launched with two rigs testing the CV5-1 pegmatite corridor. A third drill rig is now on site and will probe the mineralized pegmatite from a barge on a shallow lake. This lake-based definition drilling will continue throughout the summer and into the fall.

The Company’s shares should soon begin trading on the ASX where lithium projects of this scale often draw a broader and more appreciative audience.

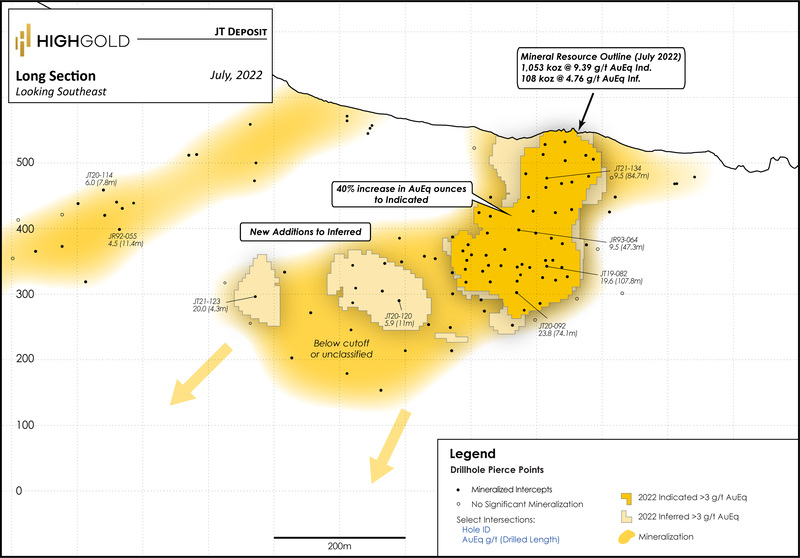

HighGold Mining (HIGH.V) – (HGGOF.OTC)

- 73.02 million shares outstanding

- $64.99M market cap based on its recent $0.89 close

Two months back, HighGold tabled exploration plans for its flagship Johnson Tract Project (JT) in Alaska—13k meters of drilling focused on multiple targets.

The 2022 JT drill plan

- A minimum of 13,000 meters of diamond drilling allocated to test the following:

- JT Deposit (Approx. 35% of meters) – focused step-out and infill drilling on the mineral resource footprint, including follow-up on successful down-plunge and on strike expansion drill holes completed in 2021 including. 4.3 meters grading 20.0 g/t AuEq (see Company press release dated September 14, 2022);

- DC Prospect Discovery in 2022 (Approx. 35% of meters) – follow-up drilling of the exceptionally high-grade, late season drill discovery, of 6.4 meters grading 577.9 g/t Au and 2,023 g/t Ag (included 1.26 meters at 2,860 g/t Au and 9,990 g/t Ag plus 1.5 meters at 60.7 g/t Au and 220 g/t Ag; see press release dated October 6, 2021);

- Milkbone Prospect, Priority Target (Approx. 20% of meters)– first time testing of high-grade soil geochemistry and boulder samples (up to 8.3 g/t Au and 184 g/t Au respectively) at the Milkbone Prospect and the 1.2 kilometer long northeast trending mineralized corridor between the Milkbone and DC prospects;

- Other Johnson District prospects (Approx. 10% of meters) – including Kona, Easy Creek and South Valley.

On July 12, the Company tabled an updated resource for JT—HighGold Reports 1.05 Moz AuEq at 9.39 g/t AuEq Indicated in Updated Mineral Resource Estimate, Johnson Tract Project, Alaska

Most of JT’s AuEq ounces landed in the higher confidence Indicated category. The Company now has a solid foundation for advancing engineering and economic studies.

On July 28, the Company updated drilling progress at JT—HighGold Mining Provides Update on Johnson Tract 2022 Exploration Program, Alaska USA

Note the strategy employed to unlock the high-grade potential at the DC prospect where last year’s drilling tagged an astounding 577.9 g/t Au and 2,023 g/t Ag over 6.40 meters. They’re drilling the zone off in a tight grid pattern. Also, note the onsite prep facility the Company built to reduce lab turnaround times (waaaay cool).

2022 Exploration Program Update

- Exploration is well underway with two drill rigs active at the DC prospect as a follow-up to the late 2021 near surface, bonanza-grade drill discovery of 6.40 meters grading 577.9 g/t Au and 2,023 g/t Ag in hole DC21-010. The first rig commenced drilling on July 4th and was joined by a second rig on July 14th. Initial drilling is being completed on a close-spaced grid pattern with the objective of determining the geometry, geological controls, and grade distribution of this promising new mineralized zone.

- Fifteen (15) drill holes, ranging from 50 to 150 meters in length, have been completed to date. Upon completion of the initial phase of close-spaced drilling, one drill rig will move to larger step-outs along trend and the other rig will move one kilometer southwest to the Milkbone prospect to test a high-grade gold-in-soil anomaly interpreted to occur within the same key host rocks and potentially be an extension of the same mineralizing system as the DC prospect.

Authors note: if they can successfully connect the dots between Milkbone and DC… Boom.

- Veining and alteration documented in the recently completed drill holes at DC is visually similar to that intersected at the main JT Deposit, located four kilometers to the southwest. Drilling has delineated zones of structurally-controlled quartz-carbonate-sulfide veining and brecciation over core intervals 2 to 15 meters or more in length, with local narrow intervals of coarse-grained semi-massive to massive sphalerite, galena, chalcopyrite, and pyrite. Surrounding alteration consists of silicification and a widespread zone of semi-massive to massive pervasive nodular anhydrite and anhydrite veining. Readers are cautioned that the significance of the visual observations of veining and sulphide mineralization will not be known until assays are received.

- An on-site sample preparation facility has been installed at the JT Camp and is now fully operational with the first batch of prepared sample material shipped out recently for analysis. Sample preparation has been a major bottleneck for North American assay laboratories, and the on-site, professional grade, drying, crushing and pulverizing facility, built under the guidance of expert third party consultant, Dr. Barry Smee, P.Geo., is anticipated to significantly reduce turn-around times for analytical results and enable follow-up of positive results during the current drill program.

- In addition to the high-priority exploration targets at DC and Milkbone, the 2022 program includes priority planned step-out and infill drilling on the JT Deposit mineral resource, including new targets identified following the recently completed mineral resource update.

- Other Johnson District targets that may be tested during the 2022 drill program include the Kona, Easy Creek and South Valley prospects.

Banyan Gold (BYN.V) – (BYAGF.OTC)

- 257.6 million shares outstanding

- $126.22M market cap based on its recent $0.49 close

Banyon is a company I featured shortly after launching Highballer in 2020. It struck me as exceptional value back then—a no-brainer—when it was trading in the $0.06 range – Banyan Gold (BYN.V) – resource expansion and discovery potential in the Yukon

After correcting along with the rest of the sector, Banyon has rebounded strongly in recent sessions, from the mid-thirties to the fifty-cent range.

The following vid features an update and interview with Tara Christie, President & CEO…

Banyon’s flagship AurMac Gold Project appears destined for Tier-1 status (a 5 million-plus ounce count). It currently boasts a global resource of some 4 Million Ounces @ 0.6 g/t Au.

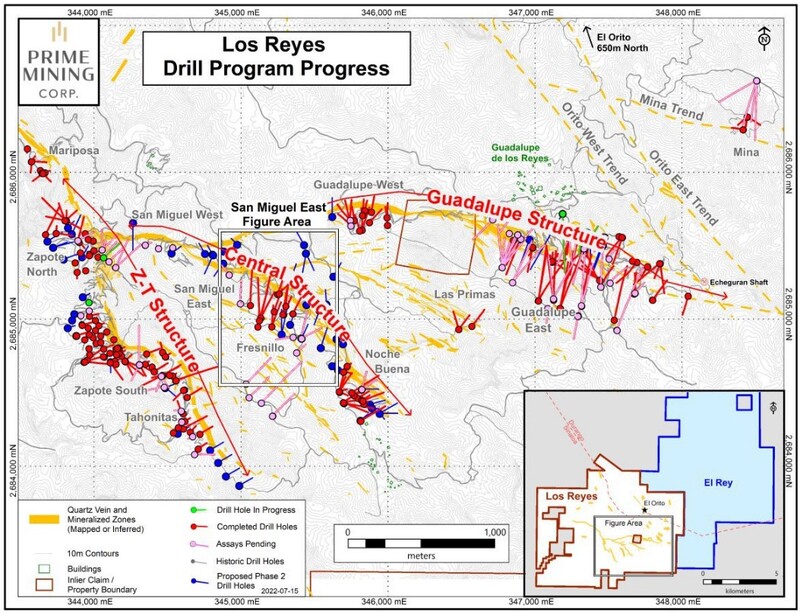

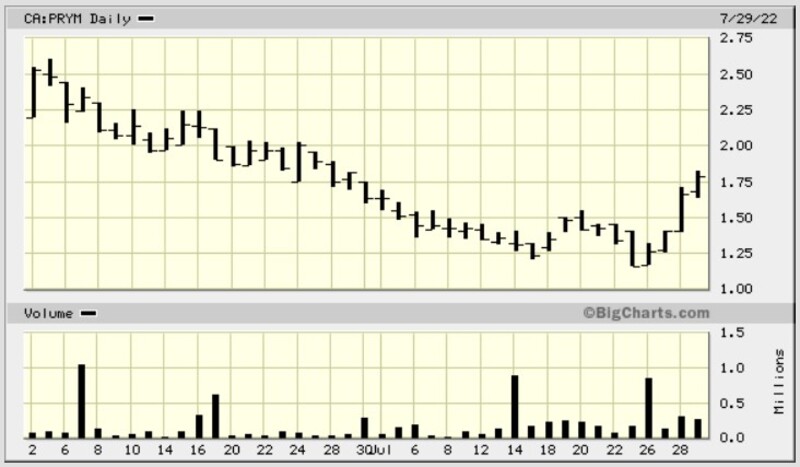

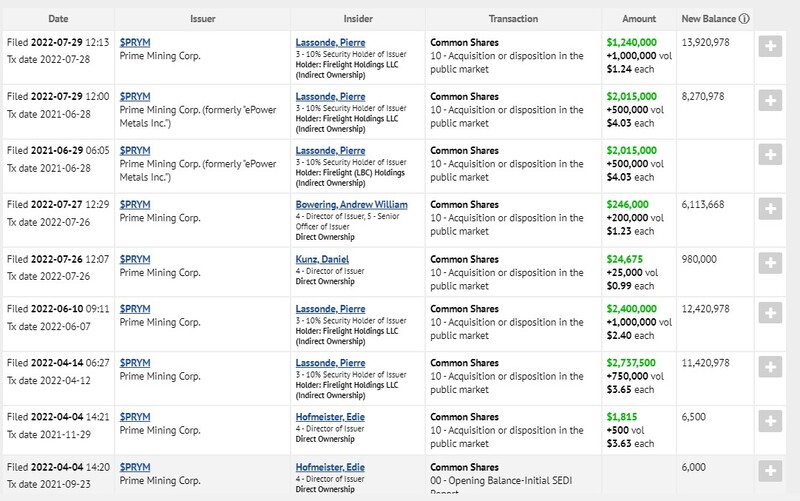

Prime Mining (PRYM.V) – (PRMNF.OTC) – (O4V3.FRA)

- 112.69 million shares outstanding

- $200.59M market cap based on its recent $1.78 close

Prime shares were pounded especially hard during this recent rout, considering its 52-week high north of $5.00. And considering the quality of the Company’s flagship asset and the pedigree of management. Some characterize the Company as a Dream Asset run by a Dream Team.

The 13,800-hectare Los Reyes Project, located in the mining-friendly jurisdiction of Sinaloa, Mexico, is the flagship. The project boasts three main corridors where exploration and development are seeing an aggressive push along the curve.

Based entirely on historic drilling by prior operators, Los Reyes hosts a pit-constrained measured and indicated resource of 0.63 million gold and 16.6 million silver ounces plus inferred resources of 0.18 million gold and 6.8 million silver ounces inferred across the west (Zapote and Tahonitas), central, and east (Guadalupe) deposits.

The most recent headline out of the Prime camp dropped on July 18—Prime Intercepts 2.7 gpt Au and 130 gpt Ag over 18 Metres in Step-Out Drilling at San Miguel East

Highlighted Drill Intercepts (San Miguel East)

- 2.72 g/t Au and 129.8 g/t Ag over 18.0 meters (16.9 meters estimated true width (“etw”)) and 1.24 g/t Au and 14.0 g/t Ag over 3.0 meters (2.6 meters etw) and 1.12 g/t Au and 4.2 g/t Ag over 3.0 meters (2.3 meters etw);

- 4.86 g/t Au and 151.5 g/t Ag over 6.1 meters and 3.96 g/t Au and 2.0 g/t Ag over 1.2 meters and 1.51 g/t Au and 5.3 g/t Ag over 1.8 meters;

- 1.88 g/t Au and 283.7 g/t Ag over 2.9 meters (2.6 meters etw);

- 1.25 g/t Au and 67.2 g/t Ag over 6.0 meters (5.4 meters etw).

Prime has drilled roughly 83,235 meters and completed 323 holes at Los Reyes thus far. 57,585 meters have been drilled during the current Phase-2 campaign. Drilling is expected to continue through to the end of October. Including the results presented in this release, 224 drill holes have been released, and 99 are pending. There are currently six rigs turning at the project.

Prime shareholders have witnessed a strong rebound in recent sessions.

The scale of recent insider buying is a tremendous vote of confidence.

(click on the image below to amplify)

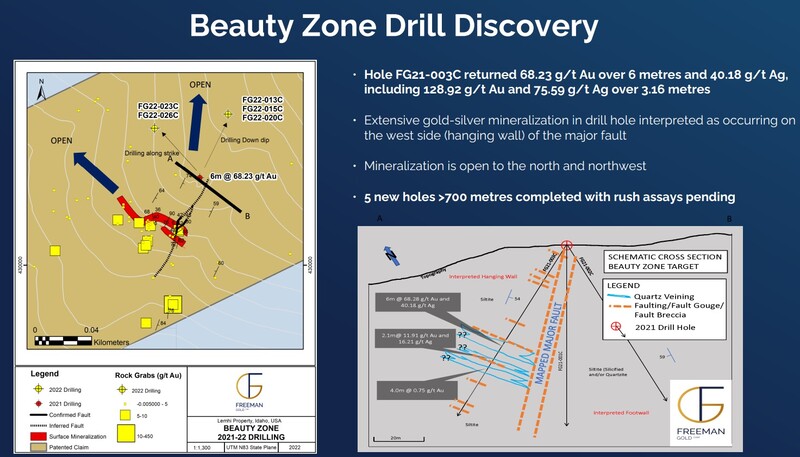

Freeman Gold (FMAN.V) – (FMANF.OTC) – (3WU.FRA)

- 131.75 million shares outstanding

- $42.16M market cap based on its recent $0.32 close

Freeman is focused on developing (and exploring) its wholly-owned Lemhi Gold Project in the mining-friendly state of Idaho.

The 30 km2 project hosts a near-surface oxide gold resource comprised of 749,800 oz gold at 1.02 g/t Au in 22.94 million tonnes (Indicated) and 250,300 oz Au at 1.01 g/t Au in 7.83 million tonnes (Inferred).

As of June 6, 2022, the Company completed 21 stepout and eight infill drill holes (7,926 meters; assays pending).

The market is wondering if they can repeat the success of a fat interval released on March 22 – 6 meters grading 68.23 g/t Au and 40.18 g/t Ag.

In a nutshell, Freeman is a development play with significant resource expansion and discovery potential.

As highlighted in the above slide, rush assays are pending for five holes totaling >700 meters.

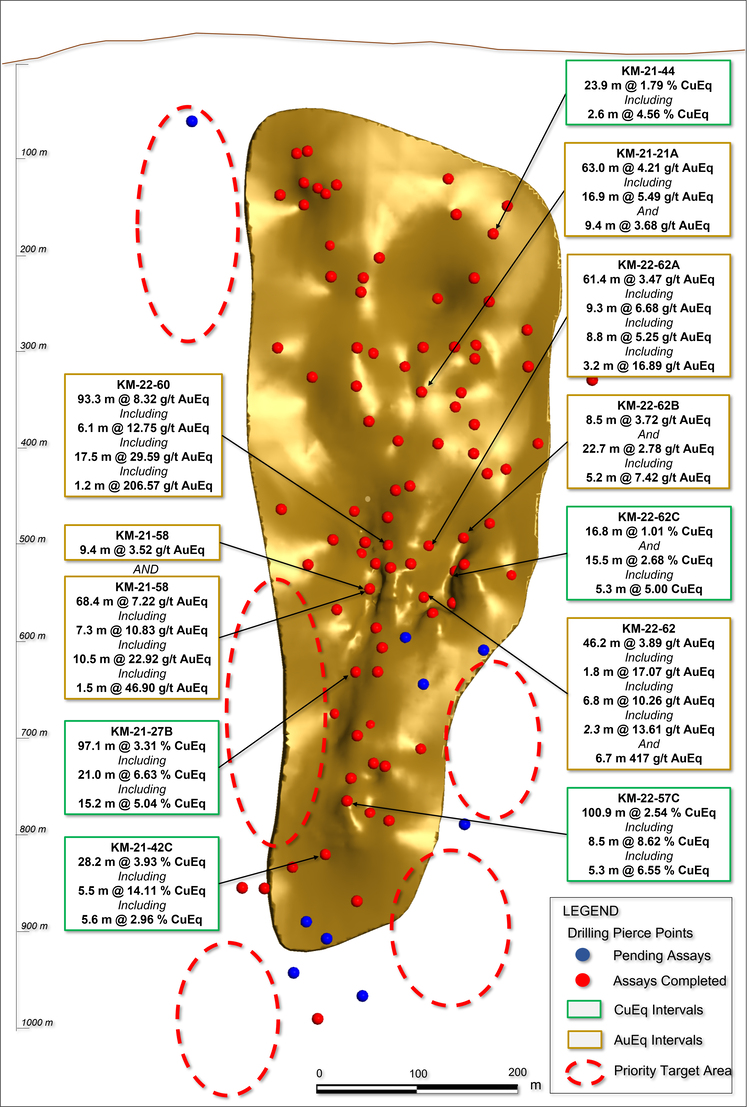

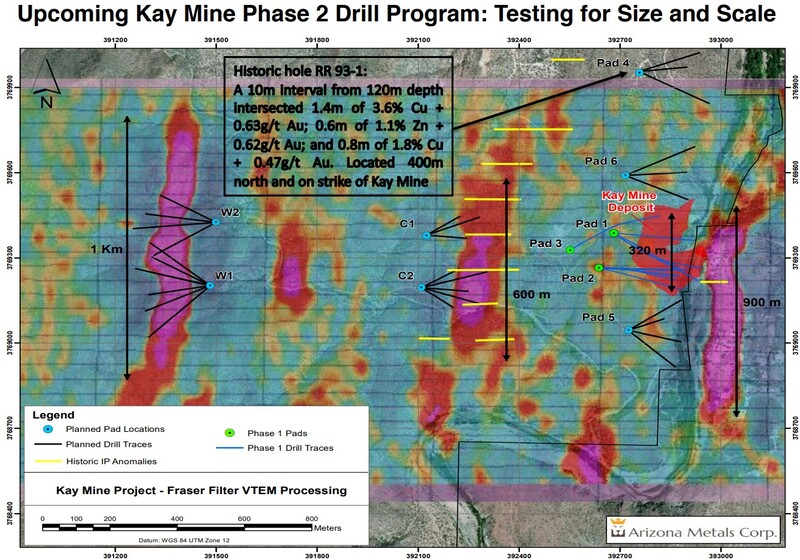

Arizona Metals (AMC.V) – (AZMCF.OTC)

- 112.17 million shares outstanding

- $491.31M market cap based on its recent $4.38 close

I began following Arizona Metals, having published several early-stage articles when it was trading in the sub-$1.00 range in October 2020.

The Company’s flagship Kay Project in Yavapai County, characterized as one of the very few large precious-metals rich VMS deposits not yet mined, is positioned along the southern end of a mineralized trend with sixty 60 past-producing Cu-Au-Zn VMS mines and nearly 4 billion pounds of historical copper production. The average grade mined = 3% Cu (plus significant gold, zinc, and silver credits).

A historic estimate by Exxon Minerals in 1982 reported a “proven and probable reserve of 6.4 million short tons at a grade of 2.2% copper, 2.8 g/t gold, 3.03% zinc, and 55 g/t silver.”***

On July 6, the Company dropped the following headline…

Highlights from this round of assays include:

- KM-22-57C – 100.9 meters at 2.5% CuEq, inc 8.5 meters at 8.6% CuEq and also 5.3 meters at 6.6% CuEq;

- KM-22-62 – 46.2 meters at 3.9 g/t AuEq, inc 1.8 meters at 17.1 g/t AuEq and 6.8 meters at 10.3 g/t AuEq;

- KM-22-62A – 61.4 meters at 3.5 g/t AuEq, inc 9.3 meters at 6.7 g/t AuEq and 8.8 meters at 5.3 g/t AuEq.

With the assayed holes released today, the Company has completed a total of 56,000 meters at the Kay Mine since inception of drilling. The Company is fully-funded to complete the remaining 19,000 meters planned for the Phase 2 program with the priority focus areas for upcoming drilling (figure below), as well as an additional 76,000 meters in the upcoming Phase 3 program which will be used to test the numerous parallel targets heading West of Kay and the Northern and Southern Extensions of the Kay Deposit.

Drilling success on any one of the high-priority targets to the west of the Kay deposit—the Central and Western targets—should trigger an acceleration in the current program via the deployment of additional rigs.

One would think that with the nature of VMS deposits in prolific camp such as this, the Kay property would be riddled with (historic) drill holes. Nope. The property has seen only two or three (historic) exploratory probes with the drill bit. This discovery potential sets up an extraordinary opportunity (IMO).

The Company is in an enviable position with roughly $63M in the till. After all the planned drilling is done, assuming there will not be an acceleration phase, they’ll still have approximately $30M in the coffers.

Lion One Metals (LIO.V) – (LOMLF.OTC) – (LLO.ASX)

- 156.42 million shares outstanding

- $215.08M market cap based on it recent $1.375 close

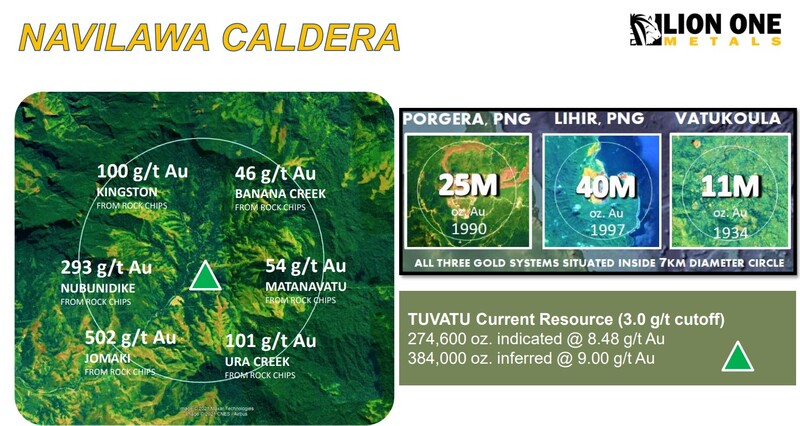

Lion One’s flagship asset is its wholly-owned Tuvatu Alkaline Gold Project located on the island of Viti Levu in Fiji. The project covers the entire Navilawa Caldera, an underexplored yet highly prospective 7-kilometer-in-diameter alkaline gold system.

If you know you’re stuff, you’re well aware that these alkaline rocks hold the potential for considerable scale.

The Tuvatu mineral resource has been estimated for each vein individually using ordinary kriging of width and grade, the latter using accumulations, into a 3D block model. The Tuvatu resource is reported at a 3 g/t Au cutoff representing a resource amenable to underground production. The June 2014 Tuvatu resource estimate reported an indicated resource of 1,101,000 tonnes at 8.46 g/t Au for 299,500 ounces of gold and an inferred resource of 1,506,000 tonnes at 9.70 g/t Au for 468,000 ounces of gold.

On June 6, Lion One halted trading to set up the release of the following headline:

There are a lot of sub intervals within TUG-141’s broader measure:

High-grade intercepts from TUG-141 include:

- 20.86 g/t Au over 75.9 meters from 443.4-519.3 meters;

- including 35.25 g/t Au over 37.5 meters from 471.3-508.8 meters;

- including 43.62 g/t Au over 30.0 meters from 477.6-507.6 meters;

- including 90.35 g/t Au over 7.2 meters from 494.4-501.6 meters.

Notable individual high-grade assay intervals include:

- 138.15 g/t Au over 0.30 meters from 450.9-451.2 meters;

- 396.16 g/t Au over 0.30 meters from 479.1-479.4 meters;

- 103.54 g/t Au over 0.30 meters from 498.6-498.9 meters;

- 340.07 g/t Au over 0.30 meters from 498.9-499.2 meters;

- 600.42 g/t Au over 0.30 meters from 499.5-499.8 meters;

- 244.37 g/t Au over 0.30 meters from 502.5- 503.1 meters;

- 230.18 g/t Au over 0.30 meters from 507.3-507.6 meters;

- 105.58 g/t Au over 0.30 meters from 518.7-519.0 meters.

Lion One CEO, Walter Berukoff:

“Like the initial discovery of the high-grade 500 Zone drilled two years ago, I believe this new robust high-grade gold feeder mineralization encountered by hole TUG-141 represents a substantial discovery for Lion One. The notable high grades and continuity of mineralization of this intercept demonstrate Tuvatu’s potential to become a large-scale, high-grade underground gold mine. I have long encouraged our team to find that “gold room” at Tuvatu, and hole TUG-141 leads me to believe they have found it. We have only to look at other notable large alkaline Au deposits as direct analogues to better understand what this latest discovery tells us, and it is clear that the discovery of a major high-grade feeder such as this should be viewed as very promising. I am confident that Tuvatu will one day fall in the ranks of notable multi-million ounce Au deposits such as Porgera and Vatukoula. I commend our team on this truly outstanding discovery and I look forward to continued successful execution of both our exploration strategy to realize growth at Tuvatu and our development strategy targeting the commencement of gold production in the second half of 2023.”

Lastly…

I track well over 100 companies in the junior arena. The following is a cross-section of those I keep regular tabs on. That is to say, when they release news, I read it:

- Aton Resources (AAN.V)

- American Creek Resources (AMK.V)

- Amex Exploration (AMX.V) – (AMXEF.OTC) – (MX0.FRA)

- Aurion Resources (AU.V) – (AIRRF.OTC)

- Azimut Exploration (AZM.V) – (AZMTF.OTC)

- Benchmark Metals (BNCH.V) (BNCHF.OTC)

- Blackwolf Copper and Gold (BWCG.V) – (BWCGF.OTC)

- Delta Resources (DLTA.V) – (DTARF.OTC) – (6G01.FRA)

- Damara Gold (DMR.V)

- Cartier Resources (ECR.V)

- Eagle Plains Resources (EPL.V)

- Filo Mining (FIL.V) – (FIL.NFNGM) – (FLMMF.OTC)

- FireFox Gold (FFOX.V)

- Globex Mining (GMX.TO) – (G1MN.FRA) – GLBXF.OTC)

- Goldshore Resources (GSHR.V) (GSHRF.OTC) (8X00.FRA)

- i-80 GOLD (IAU.TO) – (IAUX.NYSE)

- Irving Resources (IRV.C) – (IRVRF.OTC)

- Kenorland Minerals (KLD.V) – (NWRCF.OTC) – (3WQ0.FRA)

- Meridian Mining (MNO.TO) – (2MM.FRA) – (MRRDF.OTC)

- Northern Superior Resources (SUP.V) – (NSUPF.OTC)

- Pacific Ridge Exploration (PEX.V) – (PEXZF.OTC)

- Puma Exploration (PUMA.V) – (PUMXF.OTC)

- Radisson Mining Resources (RDS.V) – (RMRDF.OTC)

- Ridgeline Minerals (RDG.V) – (0GC0.FRA) – (RDGMF.OTC)

- Riley Gold (RLYG.V) – (RLYGF.OTC)

- Rio2 Limited (RIO.V) – (RIOFF.OTC) – (RIO.BVL)

- Sokoman Minerals (SIC.V) – (SICNF.OTC)

- Skeena Resources (SKE.TO) – (SKE.NYSE)

- Sitka Gold (SIG.C) – (SITKF.OTC) – (1RF.FRA)

- Skyharbour Resources (SYH.V) – (SYHBF.OTC) – (SC1P.FRA)

- Timberline Resources (TBR.V) – (TLRS.OTC)

- Tudor Gold ( TUD.V) – (TUC.FRA)

- Tower Resources (TWR.V)

- American Pacific Mining (USGD.C) – (USGDF.OTC)

- Western Alaska Minerals (WAM.V)

- Westhaven Gold (WHN.V)

- West Vault Mining (WVM.V) – (WVMDF.OTC)

- Anacortes Mining (XYZ.V) – (XYZFF.OTC)

- Zacapa Resources (ZACA.V) – (ZACAF.OTC)

Were I a rich man—if I were to suddenly fall ass-backward into heaps of cash—I’d allocate equal portions of said heap into each of the above.

END

– Greg Nolan

Full disclosure: Greg Nolan was compensated for the content concerning Apollo Silver, Forum Energy Metals, Optimum Ventures, Teuton, and Defense. Greg Nolan owns shares of Apollo, Forum, Goldseek, Optimum, Teuton, Defense, Patriot, HighGold, Arizona Metals, and Lion One.

*** The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a “qualified person” (as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects) before the historic estimate can be verified and upgraded to be a current mineral resource. A qualified person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.