Gold continues to consolidate gains registered after a sharp push higher from its March 16 ‘crash day’ lows. We’re going into our third month of sideways chop.

No one knows for sure how this sideways channel will resolve itself, but without a doubt, if (when) gold successfully challenges $1,800 again, it’ll be watched by a universe of traders.

Updating the Highballer shortlist

Nearly all of the companies on the Highballer shortlist are holding onto their gains, despite the recent weakness in the metal. Classic bull market action, this.

Banyan Gold (BYN.V)

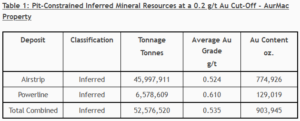

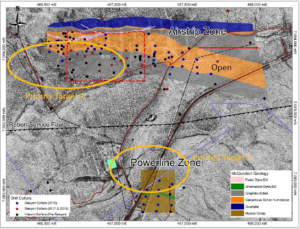

Banyan tabled a maiden resource estimate for its Aurex and McQuesten properties (aka AurMac) on May 25, a headline we covered in these pages that same day…

And since then, the company’s shares have gone on a bit of a tear…

We first featured the company back in mid-February when the shares were trading at $0.06.

The resource numbers highlighted above represent a pit constrained resource contained in two near-surface zones: Airstrip and Powerline.

A June 2 press release:

Banyan Commences 2020 Phase 1 Drill Program at Aurmac Property, Yukon, Canada

The geological model developed by the company identified a series of drill targets that could grow the above resource in a meaningful way.

We could see some high-grade core come out of this program as well.

Tara Christie, President and CEO:

“Banyan has proven its ability to efficiently and cost effectively build gold ounces through the application of clear geologic principles, and we intend to continue to do just that at AurMac this season. The Resource models that have been developed at Airstrip and Powerline both highlight the potential for expansion through systemic drilling. We feel this drill campaign will meaningfully increase gold ounces and demonstrate the higher grades that AurMac offers. Moreover, we will further the application of the AurMac Geologic model throughout this large Project, with our Banyan ‘boots on the ground’ style exploration efforts.”

Below, a very decent n detailed video version of this June 2 press release…

Between its two projects, AurMac and Hyland, the company boasts over 1.4 million ounces in the Indicated and Inferred categories (Hyland’s 524,000 ounces are AuEq).

Banyan currently has a market cap of $14.39M based on its 130.82 million shares outstanding and recent $0.11 closing price.

Cartier (ECR.V)

Cartier’s stair-stepping price pattern is textbook TA.

Note the 50 SMA (blue line) crossing over the 200 SMA (red line)—bullish price action, this.

High volume price spikes are exciting, but it’s far more constructive when a stock grinds steadily higher without that whipsaw volatility… in my view.

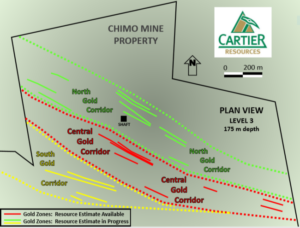

Cartier, one of my top three picks for 2020, continues tagging high-grade gold values at its Chimo Mine project in the Val-d’Or mining camp.

May 28 news: Cartier Cuts 16.5 g/t Au over 4.5 m at Chimo Mine 500 m below the New Zones 5B4-5M4-5NE

Highlights from this press release:

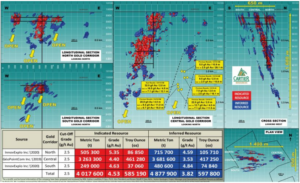

- Mineralised intersection of 32.0 g/t Au over 2.0 meters included within 16.5 g/t Au over 4.5 meters, also included within 7.1 g/t Au over 12.1 meters, located 500 meters below the new Zones 5B4-5M4-5NE in the East Sector of the Chimo Mine Property;

- The results of this press release, factored with those of the May 21 2020, April 7 2020 and February 18 2020 press releases, increase the potential for expansion of the resource estimate to date for the new Zones 5B4-5M4-5NE (image above);

- The Chimo Mine Property hosts three gold-bearing corridors (North, Central and South) that to date host the following mineral resources:

— 4,017,600 tonnes at an average grade of 4.53 g/t Au for a total of 585,190 ounces gold in the Indicated category;

— 4,877,900 tonnes at an average grade of 3.82 g/t Au for a total of 597,800 ounces gold in the Inferred category.

Philippe Cloutier, Cartier President and CEO:

″ These new results indicate that the gold mineralisation is open in all directions below Zones 5B4-5M4-5NE which have been drilled to date from surface to a depth of 1,300 meters. Growing the dimensions of the cluster of Zones 5B4-5M4-5NE is an important addition to the development potential of the project ″.

With continued success with the drill bit, we could see 2 million ounces in the not too distant future.

I’ll have more to say regarding Cartier in the coming days. Clearly, the company has endgame potential. And once Chimo is monetized, assuming a resource-hungry predator takes a shine to the project’s subsurface glimmer and ponies up a proper bid, the company has a robust portfolio of projects to set its sights on next.

Cartier has a market cap of $40.49M based on its 192.81 million shares outstanding and recent $0.21 closing price.

Pure Gold (PGM.V)

We began our coverage of this Red Lake near-term-producer-with-heaps-of-exploration-upside two months ago, when the stock was trading at $0.64.

Subscribers, spurred by that timely coverage, have registered decent price gains in recent weeks…

Pure Gold’s resource at Red Lake currently stands at 2.1 million ounces at 8.9 g/t Au in the Indicated category, and 500k ounces at 7.7 g/t Au in the Inferred category.

Just over a year ago, the company tabled a positive feasibility study based on only a portion of the above resource block—3.5 Mt at 9.0 g/t containing 1.0 million ounces.

These reserves serve as the foundation for a host of robust economics spread out over a 12-year mine life.

Two important headlines dropped since we last covered the company:

May 26 news: Pure Gold Mining Raises $12.3 Million From the Exercise of Share Purchase Warrants

All told, PureGold will have well over $100 million in cash, along with US$35M in an undrawn credit facility.

“With approximately $150 million available in funding, and $86 million remaining on capital expenditure to complete our mine construction, the Company is in a uniquely solid financial position to be able to concurrently fund an aggressive exploration program. Commencing June 3rd this program will include underground drilling focused on the expansion of mineral resources in areas targeted for early production, as well as expansion of new high-grade discoveries at surface and at depth across our 47km2 property.”

The exploration upside within the company’s 47 square kilometer patented land position—host to two significant past-producing mines—is considerable.

Still on the subject of exploration upside, the company dropped this headline last week:

“Over 30,000 meters of diamond drilling, including both underground and surface drilling, is planned to optimize the near term mine plan, expedite the growth of our mineral resources and aggressively expand new high-grade discoveries.”

30k meters is a lot drilling and will continue into 2021, generating significant newsflow in the process.

“Initial drilling will occur in areas targeted for the first two years of production as part of our ongoing detailed mine plan optimization.”

Previous drilling in this area includes:

- 232.4 g/t gold over 5.2 meters;

- 50.2 g/t gold over 4.0 meters;

- 28.2 g/t gold over 7.0 meters;

- 26.4 g/t gold over 12.7 meters;

- 19.4 g/t gold over 9.8 meters;

- 10.9 g/t gold over 9.8 meters, including 27.0 g/t gold over 3.8 meters.

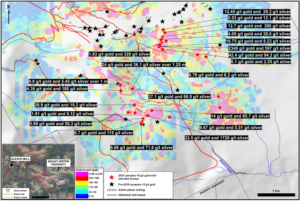

Surface diamond drilling, scheduled to begin in July with two rigs, will test for new discoveries along their 7+ kilometer mineralized corridor:

“The goal of this program is to grow mineral resources in areas where we believe strong potential exists for mineral resources to convert to future reserves and form part of an expanded mine plan.”

There will be additional focus on the growth potential of other high-grade zones, including the zone Eric Sprott has taken a particular shine to:

“… the 8 Zone reminds me a lot of the HG Zone that built Goldcorp.”

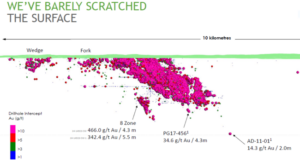

The 8 Zone has returned extraordinary drill results including 466.0 g/t gold over 4.3 meters and 342.4 g/t gold over 5.5 meters.

“Recent drilling in the area up-plunge has identified quartz veining with visible gold within a strong alteration footprint around the clearly defined structure which also hosts the 8 Zone. With the average gold grade in the 8 Zone indicated resource of 20.5 g/t, clearly the expansion of this zone, and discovery of similar zones, provide the opportunity for explosive transformative growth at the PureGold Red Lake Mine. The PureGold team is actively planning exploration drilling directed at this important component of the mine growth strategy, and further drilling is expected to commence in the coming months.”

Darin Labrenz, President and CEO:

“We believe strongly in the organic growth potential of our PureGold Red Lake Mine property. And we are confident that the mine plan outlined in our feasibility study is scalable and has the potential to expand. We are now launching an aggressive exploration program designed to realize our vision for future growth at Canada’s next gold mine. Our drill program has been designed with the goal of: increasing indicated mineral resources through infill drilling, with potential to convert to future reserves; expand our gold resources through step-out drilling and make new high-grade discoveries through regional exploration. While we remain completely focused on our fully-funded mine construction and ramp up, we strongly believe in the potential for our mineral reserves and mine production to grow, and our new program is designed to start building our future growth today.”

Pure Gold has a market cap of $519.44M based on its 373.7 million shares outstanding and recent $1.39 closing price.

Strategic Metals (SMD.V)

I began coverage of Strategic, THE dominant claim holder in the Yukon Territory, roughly seven weeks ago when the stock was trading in the $0.34 range.

Technically speaking, the stock is currently breaking out from a cup and handle pattern and could be setting up to test multi-year highs. Of course, the drill bit (fundamentals) will dictate the ultimate price trajectory here.

Strategic generates newsflow from a number of projects, but it’s Mount Hinton that has my undivided attention.

The project came to light on August 21, 2019 via the following headline:

Strategic Metals Ltd. Announces 2340 G/T Gold in a Rock Sample From its Mount Hinton Property, Yukon

Then, on September 9, the company dropped another Mt. Hinton headline (a phase two follow-up to the previous surface sampling results):

Strategic Metals Discovers More Gold-Rich Veins at Its Mount Hinton Property, Yukon

Highlights from this surface sampling campaign included:

- A two-meter wide vein, intermittently exposed along a 75 meter strike length, where four widely-spaced rock samples returned: 28.5 g/t gold; 23.5 g/t gold with 1720 g/t silver; 11.6 g/t gold; and 4.44 g/t gold;

- Another outcropping vein, found within a fault zone, graded 12.6 g/t gold and 2100 g/t silver;

- A second exposure within the same vein fault located 50 meters along strike, where chip sampling returned 30.5 g/t gold and 53.1 g/t silver over 1.2 meters and a grab sample assayed 48.5 g/t gold and 74 g/t silver;

- A third, 0.5-meter wide vein in outcrop, which is covered by talus along strike in both directions, assayed 46.9 g/t gold and 446 g/t silver.

Later on in November, building on previous success at Mt. Hinton, the company released the following results from a phase three exploration campaign that included a LIDAR survey, mechanized trenching, road building, geological mapping, and prospecting.

Phase three highlights:

- Discovery of two new veins in outcrop on the western side of Granite Creek. One where a chip sample returned 24 g/t gold over 1.25 meters, and another that is up to 1.5 meters wide, where a grab sample yielded 9.67 g/t gold;

- A sample from a large boulder of quartz vein, which assayed 42.4 g/t gold, expanded the main high-grade float train identified in phases one and two, on the east side of Granite Creek;

- A sample from a northeast striking zone of quartz vein float surrounded by oxidized breccia that is located 60 meters west of, and parallel to, the main high-grade zone on the east side of Granite Creek, yielded 12.45 g/t gold;

- A one meter wide chip sample across a quartz vein and altered quartzite wallrock exposed in a trench on the west side of Granite Creek, returned 9.9 g/t gold;

- Float samples from other new areas of mineralization yielded 28.9 g/t gold, 14 g/t gold, 9.68 g/t gold, 8.7 g/t gold with 115 g/t silver, 4.36 g/t gold with 180 g/t silver and 1.83 g/t gold with 328 g/t silver.

Being the Yukon, it’s been more than a few months since the company reported anything out of Mt. Hinton. But last week the company delivered what I was looking for—plans for an aggressive 2020 field season at their flagship project:

“The 2020 work program at the Mt. Hinton property will consist of excavator trenching and road construction along with detailed mapping and prospecting is scheduled to begin in mid-June. An estimated 7,000 meters of drilling will follow the initial work.”

7,000-meters is bigger than I was expecting. We should see significant newsflow out of Mt. Hinton over the next six months or so.

Strategic has a market cap of $50.26M based on its 96.65 million shares outstanding and recent $0.52 closing price.

END

—Greg Nolan

Full disclosure: Highballer will soon begin a marketing relationship with Cartier. The author owns shares in Strategic Metals and may initiate purchases in the remaining companies featured above in the coming days/weeks.

Disclaimer - Legal NoticeHighballerstocks.com (Greg Nolan) is not a licensed financial advisor and does not give investment advice.

The content of this report is for information purposes only.

Nothing contained herein should be construed as a recommendation or solicitation to buy or sell any security.

Always consult a licensed qualified investment advisor in your legal jurisdiction before making any investment decisions.

Though Highballerstocks.com (Greg Nolan) believes its sources to be credible, and the statements contained herein to be true, readers must conduct their own thorough due diligence, and or consult with a qualified investment advisor before important investment decisions are made.

Highballerstocks.com (Greg Nolan) accepts no responsibility or liability for the accuracy of the contents of this report.